More on the possible contribution of index fund investment to recent commodity price moves.

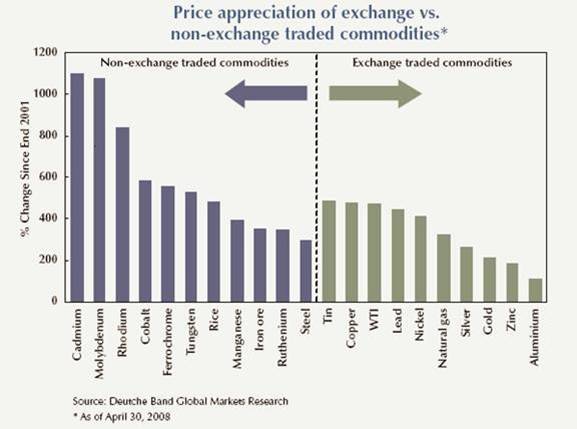

We and many others have been discussing whether the surge in investment fund purchases of long positions in commodity futures contracts may have been a factor contributing to the spot prices of those commodities beyond what would be warranted by considerations of physical supply and demand. John Mauldin shares an interesting graphic from Deutsche Bank researchers, showing that the prices of a number of commodities in which no futures market exists have increased even more dramatically than those traded on major exchanges.

|

I have long been maintaining that the broad run-up in commodity prices generally and oil prices in particular over the last five years has primarily been driven by the fundamentals of production having a hard time keeping up with surging global demand. I have nevertheless also suggested that there are additional factors contributing to the increases we’ve seen since January of this year. So I was curious to see how some of the “niche metals” featured in the graphic above been doing over the most recent months.

Rhodium and manganese, like the other commodities we’ve been following, indeed surged dramatically beginning in February:

|

|

|

On the other hand, while cadmium and molybdenum have had a spectacular 5-year run, they have not been doing much in 2008. Cobalt’s strong performance has also recently stalled:

|

|

|

|

|

|

All of which leaves me still believing that fundamentals are the most important part of the 5-year story, but that the falling dollar, negative real interest rates, and quite possibly fund purchases of commodity futures contracts have also made an important contribution during 2008.

Technorati Tags: commodity prices,

commodity speculation,

commodity futures

Industrial users of raw materials are driven by momentum just as much as purely financial players.

Professor,

Do you consider inflation as a fundamental?

Could you more clearly define what you mean by “important contribution” of the falling dollar, negative real interest rates, and fund purchases of commodity futures contracts during 2008?

Are you suggesting that over the past several months oil prices have been driven as much, or possibly more, by these other factors as oppose to the demand/supply story?

Thanks for the ongoing in-depth analysis! Always appreciated.

Could somebody explain to me why rice is listed as non-exchange traded commodity? Isn’t rough rice listed at CBOT and doesn’t that influence the price of other types of rice as well?

Speculation can, and often has, taken place in non-exchange traded metals, something Johnsen Matthey made note of a few years ago: “Other PGM: Speculators fuel rhodium rally to $1,525 before offers of metal emerge.”

mxq:

Inflation is a measure of price change not a fundamental driver.

Fundamentals include supply, demand, weather, geopolitical events, etc; for futures of commodities fundamentals begin encompassing action by the Fed and various economic reports.