Calculated Risk observes that we already know the values for a significant chunk of 2008:Q3 GDP. And it doesn’t look good.

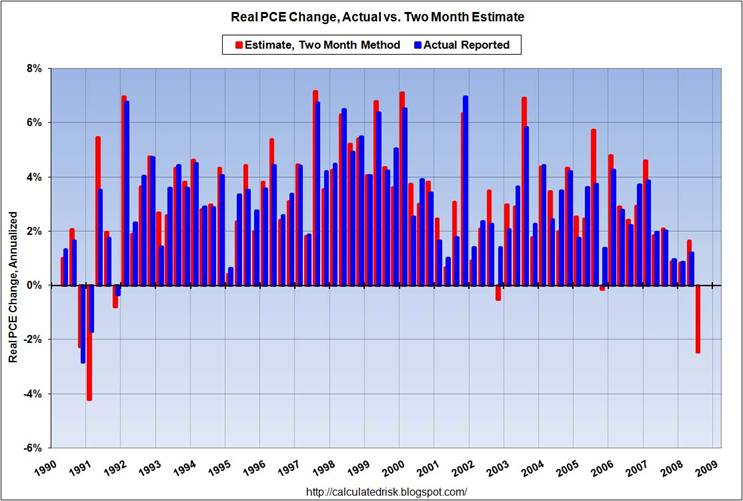

CR notes that personal consumption expenditures, the biggest single item in GDP, is released by the BEA monthly, so we now know two of the three monthly values that will make up this item for 2008:Q3 GDP. The graph below shows the inference you’d make using the first two months’ release of PCE to estimate the actual quarterly consumption component of GDP. The inference from two months alone looks pretty useful, though as Simon van Norden reminds us, it would be interesting to construct this graph using real-time vintages for the two-month estimates rather than the revised data shown here.

|

in general, the two month estimate is pretty accurate. Maybe September was exceptionally strong (very unlikely from anecdotal evidence), or maybe July and August will be revised upwards, but the two month estimate suggests real PCE will decline in Q3 by about 2.4% (annual rate).

Since PCE accounts for about 71% of GDP, this also suggests the change in real GDP in Q3 might be negative. This depends on exports and changes in inventories (investment will be weak).

If accurate, this will be the first decline in PCE since Q4 1991. This is strong evidence that the indefatigable U.S. consumer is finally throwing in the towel.

As I wrote last weekend, the purpose of the bailout proposal still being debated in Congress is not to prevent a U.S. recession– the recession is a done deal. The purpose is to try to prevent the recession we’re already in from being transformed into a severe contraction.

Technorati Tags: PCE,

recession,

macroeconomics,

economics

But maybe a severe contraction is exactly what we need.

Get home prices, financial sector employment, the dollar, etc. etc. etc. to sustainable levels as fast as possible.

Look, what did Jeffery Sachs recommend to the former Soviet economies back in the early ninetees? “Shock Therapy”. Call it that and get it overwith.

To Buzzcut: Shock-therapy did not mean “throw the economy into recession and see if it drowns”. Shock-therapy simply meant opening up the borders and releasing prices into an UPWARD spiral. All post-Soviet economies experienced hyperinflation due to shock-therapy. The economies were in deep recessions before shock-therapy was adopted and shock-therapy cured them because capital immediatly went into the most needed areas and output grew, bringing inflation down.

Also note that although we only have one month of trade data that month actually fell so that trade is starting out to be a negative rather than a big positive. But it is way too early for this to be meaningful.

However, capital goods shipments are negative implying bad capital spending in the gdp release.

It is looking more and more like the third quarter will be a negative.

Mark this down folks, this is one of the few times Buzzcut and I agree.

Who Pays?

The taxpayer pays. The taxpayer always pays. No. Matter. What.

Everyone pays taxes and everyone is the taxpayer. When a blowup happens, it’s the taxpayer who will pay. When there is economic destruction, the taxpayer pays. (And, conversely, when we pay taxes there is economic destruction… generally.)

Now that we’ve dealt that, who should they pay?

Should they pay borrowers, who didn’t realize that living expenses might go up but their wages wouldn’t, so they might want to default?

Or lenders who didn’t expect the borrowers? wages to stay low and prices to go up, leaving them less to make payments with?

Should we pay the flipper, who bought houses, hopefully with the intention of improving them and quickly selling? He didn?t know costs would go up and home values would go down, decreasing the return on his now costly improvements.

Or should we pay the lenders, who loaned to flippers at low rates, but put a ballooning interest rate on the loan so that the flipper would sell to someone else if he didn?t improve the property fast enough? He didn?t know that improvement costs would go up and tightening budgets would cause home prices to go down.

Or should we pay the banks, who bet that they would not see default risk go up, bet that they would receive sub-prime principal in lump sums, bet that they would not see sub-prime principal payments in installments after 2 years, bet that they would not see interest payments at ballooned rates, then borrowed on those bets and bet bigger?

Ok, so it doesn’t really matter why we where we are. We need to get out of here. But I don’t think adding liquidity will help. I think it will actually increase our risks. Perhaps we can guarantee inter bank lending. But dumping money into the markets could spell disaster.

Here’s my Best Case:

Nothing is done. Banks, afraid to lend to eachother and faced with watching their assets depreciate, loan to good borrowers with higher down payments or collateral and lower interest rates. Portions of loans with 6% or higher interest rates are refinanced at a lower rate, probably around 4%, on the existing value of the house or other collateral, the owner must pay the portion of the principal not covered by the current value of the house at existing terms, but the current rate is locked in. Owners deemed too risky at the new low rates default. Some banks holding mortgage backed securities that are dependant on the cash flows on the portion of the loan refinanced and on defaulted loans go bust. The assets of failed banks are sold off and the debts are nationalized. Inflation is kept in check, so costs of living do not increase relative to income, so default risk goes down. Commodity production increases to take advantage of recent rises in prices, continuously rolled over long positions on commodities are seen as untenable long term investments. Money is moved away from commodities, and prices of consumables fall. Default risk further decreases and some risky assets become valuable again.

And now the Worst Case:

Bailout happens. Inflation increases, but home values continue to decline and wages remain flat. Home owners, with budgets already crunched beyond expectations, are burdened with even higher costs of living and default risk increases greatly. Defaults increase and home prices fall more. The bailout causes the interest rate the government borrows at to go up, moving money away from businesses and causes banks to expect higher interest rates from home buyers, putting further downward pressure on home prices. Scared money also goes from home and business loan to continuously rolled over long positions on commodities, which people expect production not to increase for but demand to remain. Prices go up relative to income, and default risk goes up…

“Credit markets freeze up within the next week and many businesses cannot meet their payrolls. Margin calls cannot be met and the NYSE shuts down for a week. Hardly anyone can get a mortgage so most home prices end up undefined rather than low. There is an emergency de facto nationalization of banks to keep the payments system moving… There is no one to buy up the busted hedge funds, so government and the taxpayer end up holding the bag. The quasi-nationalized banks are asked to serve political ends and it proves hard to recapitalize them in private hands. In the very worst case scenario, the Chinese bubble bursts too.”(Tyler Cowen)

Both seem fantastically risky to me. I think we need a more cautious move forward that targets the specific bad assets without increasing the risk of the assets. Buying them will likely increase the cost of living for borrowers and therefore the default risk, making the assets much riskier.

Unless you address the $14 trillion in household debt, you are ignoring the elephant in the room.

That level of debt, compared to GDP, is without precedent in U.S. history.

That is what is choking off economic activity.

This recession will naturally proceed to a depression, as well it should. That household debt must be written down, and the holders of assets must accept the corresponding hit.

The bailout bill merely postpones such unavoidable ‘medicine.’

The only bright spot in 2008 looks to be the same qtr the stimulus checks went out. Makes the Bush cheerleader crowd (Kudlow, Laffer, etc) look stupid when they said the stimulus would have no effect. Agreed it had no lasting effect, but the demand side Post Keynesian crowd say the economy requires continuous stimulation. A payroll tax holiday would go a long way in solving the problems in the real and financial economy (although a higher energy tax may be required to partially offset the tax cut in order to promote conservation to keep inflation in check).

Shock-therapy simply meant opening up the borders and releasing prices into an UPWARD spiral. All post-Soviet economies experienced hyperinflation due to shock-therapy. The economies were in deep recessions before shock-therapy was adopted and shock-therapy cured them because capital immediatly went into the most needed areas and output grew, bringing inflation down.

It seems to me that we need to become a nation that saves more, consumes less, and is better at real engineering than financial engineering.

The bailout is just prolonging the transition to this new nation.

We need a cheaper dollar, higher interest rates, higher energy and commodity prices, more exports, and much, much less imports. The bailout is just preventing people from making the transition to this new world.

It also hurts renters who would like to buy a home but can’t afford it, savers, and export oriented manufacturers, or even just manufacturers who have to compete with imports.

Here’s another idea to lesses the impact of foreclosures and write downs.

Handling the Housing Default Side of the Crisis

Part of the problem is that when default risk went up, buying slowed and so values on homes went down. This means that for many people, if they sell they are still stuck with a sizeable debt and no asset to lose if they default on it.

Here’s a way to mitigate some of the problem.

The bank gives the borrower foreclosed properties on it’s books for the value, or partial-value, of the existing debt.

JDH wrote:

As I wrote last weekend, the purpose of the bailout proposal still being debated in Congress is not to prevent a U.S. recession– the recession is a done deal. The purpose is to try to prevent the recession we’re already in from being transformed into a severe contraction.

Professor,

If this is true, and I do not believe it is, then their methods are all wrong. There will still be a severe contraction and if this passes it will be worse not better than if the market solves the problem. You cannot treat poisoning by taking more poison.

A question was presented to me. If the government can get us out of this mess then why dont we let the government run all of the economy?

Can you tell me how many economic PhDs there are in congress? Can you tell me how many investment bankers are in congress? Can you tell me who, constitutionally, has the responsibility for federal finances? (I hope you can say the House) The economy is screwed up and it is without question the fault of congress primarily the House. That being the case, how can we trust them to solve the problem?

Paulsons plan was 3 pages, the House bill was 100+, and the Senate bill is 401 and growing, yet the bills presented so far are dealing with a symptom not the problem. And most are saying this is not the time for blame. Listen, if you dont know why it broke I can guarantee you that you cant fix it.

This whole thing is a huge rip off of taxpayers. Even if congress makes money on the bailout everyone knows that not one dime will be given back to the taxpayers. Congress is not protecting taxpayers. Congress is protecting their slush funds.

We go for the simplest tricks. “The government is going to spend X dollars in a sudden emergency. How should it be spent?”

So everyone runs around planning the best way to spend X dollars instead of negotiating the value of X or whether it should be spent at all. Greedy gnomes already have their skim spent before the tally.

Furthermore, I keep hearing the $700b buys assets which will retain value and “pay for themselves” at some later point.

Ignoring the obvious (time value of money, cost of capital) consider this:

The 2007 federal budget was less than $3trillion, borrowing from social security was $180billion and other borrowing was $300billion. Before the crisis, federal deficit spending was near 20%.

So when proceeds from the bailout arrive should we expect:

A) Budget cuts and retiring of debt.

B) Spending stays the same, consuming any returns.

c) Spending grows proportionately with revenue.

Honestly.