On a seasonally adjusted basis, U.S. light vehicle sales remained deeply depressed in December. But at least things don’t seem to be any worse than they had been the previous month.

U.S. light vehicle sales usually get a lift in December, and 2008 was no exception. Sales of cars (excluding SUVs) manufactured in North America were 22.7% higher in December than in November, which is even a little stronger than the usual seasonal increase. But it was a modest bump up from a frighteningly low level, with November 2008 39.9% below November 2007 levels, and December 2008 still down 33.9% from December 2007.

|

| Category | Nov 2008 | Dec 2008 |

|---|---|---|

| domestic cars | -39.9% | -33.9% |

| domestic trucks | -36.9% | -38.8% |

| imported cars | -29.5% | -31.9% |

| imported trucks | -35.8% | -31.4% |

| all vehicles | -36.7% | -35.6% |

Domestically manufactured light trucks (which includes the SUV category) also saw a bump up in December, though this could not be said to be any bigger than the usual December upswing. The same is true of imported cars and trucks.

|

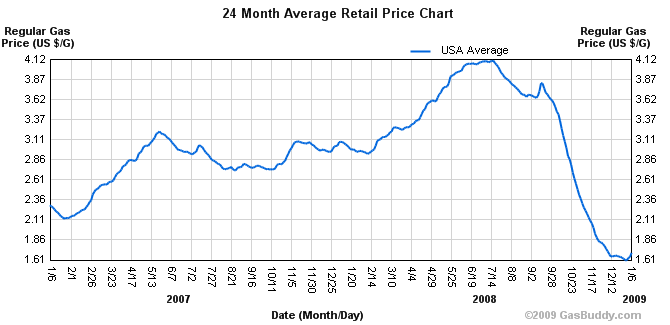

Overall, in the fall of 2008 we saw a big decline in all categories– cars and SUVs, imports and domestics. That is very different from the problems last spring and summer, when SUVs were clobbered, but domestic cars were not hit too badly and sales of imported cars were actually up slightly. That difference is one of the reasons that I have characterized the problems facing the auto sector in the fall of 2008 as very different from what happened in the spring and summer. In early 2008, the primary problem for U.S. auto manufacturers was the sharp hike in gasoline prices, which explains the collapse of sales of SUVs at the same time that imports of smaller cars were on the way up.

|

|

By contrast, the current problems for the auto sector resulted from the broad collapse in overall consumer spending. With the aggregate picture as bleak as it is, consumers seem reluctant to buy any kind of car, regardless of the price of gasoline.

|

Technorati Tags: macroeconomics,

autos,

auto sales,

economics,

recession

Probably impossible to answer, but could the effect of “keeping up with the Jonses” evaporate during downturns, as brand-new cars in fewer neighbors’ driveways make it easier to keep the family lemon for another year or two?

Jim,

Did you actually look at Toyota’s pathetic sales figures by model for December ’08? And have you followed up, noting Toyota’s corporate decisions on production shutdowns as a result of global sales declines?

It’s good to cite Wards summary data, but that doesn’t begin to tell the sales and future short-term production story by manufacturer. When I told friends and associates about Toyota’s lousy sales numbers, some simply didn’t believe it.

This is an exceedingly serious downturn. I doubt that auto manufacturers will sell 10 million light duty units in CY 09.

These are really bad numbers. I see that Toyota announced an 11-day shutdown for February, but with a 30% decline in sales, doesn’t that imply they really need more like a 4-month shutdown this year?

Guess no one is going to start saving money, as

the hero Greenspan has told us other myths for a decade.

Everyone is probably buying the Barack Obama Presidential Coin set which is selling for only 179.95.

Agree with this:

With the aggregate picture as bleak as it is, consumers seem reluctant to buy any kind of car, regardless of the price of gasoline.

And others here who think the view of a new car is not the same as it was a year ago…you aren’t buyin the new GM now because it is a status symbol, but more likely as a patriotic gesture. It seems to me we have to go back decades to buy it for some New Improved Feature that you just must have…or am I missing something?

It might be nice to look at the turnover rate to discover how long the new buyers are holding onto them. Do the depreciation rates..the trends tell us anything? What about those buyers who have been turned away from the declining housing market –are they renting as economically as they can and saving for that cheaper house down the road when house prices start to increase, or splurging on the new truck to compensate for the indignity of slumming with the renters?

Agree the sales numbers look terrible, but I wonder if the number of vehicles and their age is still out of line with other industrialized countries? Is part of that re-balancing in our consumption (the 70% of GDP) habits, turning down the car sales?

If you had shares in Honda or Toyota would you be a little angry at being left out of this bailout?

If aggregate demand is so low, wouldn’t the best solution be to suspend the payroll tax and make SS payments with the TARP money. Some people will use the tax break to keep up with mortgage payments, hopefully stabilizing housing. Some will pay down other debt or save it which could stabilize banks. And others will spend some to improve aggregate demand, not to mention after other households improve their balance sheets they will start spending. I do not understand giving money to banks to lend if everyone is already over leveraged. And giving money to auto companies for what; to build more cars that no one is buying. Instead of giving money to all the screw-ups, give it to honest hard working people and let the business chips fall where they may!

These sales also need to be viewed in light of the deals that the automakers where throwing at people in December. I saw some simply insane deals from GM.

Very tempting, but ultimately I, like evidently most people, didn’t bite.

Instead, I just put new tires and a battery in my existing 7 year old vehicle (original battery and tires! Way to go GM). Discount Tire was quite busy.

US auto sales are running at about 60% of trend.

If you factor in inventories and excess foreign capacity this implies that the US auto industry is operating at about 50% of capacity — in the industrial production data auto and auto parts capacity utilization is at 57%.

Given the big 3 labor contracts means that labor costs are largely a fixed cost this implies that

even the best managed firms could not survive long in this type of environment. The auto companies are supporting a cost structure designed for revenues from sales of 16 million light vehicles. But they are only selling some

10 million units.

With new foreign nameplate capacity coming on line in the south and large scale excess capacity abroad it is hard to see how even a government bailout can keep the big 3 from a massive elimination of auto capacity.

The December year over year sales declines by manufacturer and full year declines are below (from last Monday’s WSJ). While Toyota did have a bad month, they had a better year than the Big 3. These numbers are just US sales so they exclude international.

I would bet that heavy discounting by GM and Ford boosted their sales toward the end of the month. Since Toyota typically does not discount as aggresively, their sales suffered. It is hard to imagine how an industry with such high fixed costs and long product cycles could handle a 30% sales drop. At least JDH’s earlier post on oil prices and auto sales suggest to me that the fall in oil prices my be a boost to sales down the road.

Dec 08 / Dec 07 Full Year 2008 / 2007

GM -31.0% -22.6%

Ford -31.6% -20.1%

Chrysler -53.1% -30.0%

Toyota -36.7% -15.4%

Honda -34.7% -7.9%

Nissan -30.7% -10.9%

For a long time, you’ve been able to buy a slightly used car and get some 80% of its life for 50% of the price.

Rephrasing, new cars were overpriced.

I’ve got over 200,000 miles on my car, and while it’s accumulating minor defects and injuries, I very much doubt I would replace it with a new car, unless the deal was very VERY good.

If the market has corrected the overpricing of new cars, the automakers are in for a world of hurt.

Toyota can probably recover, especially since they have flexible labor contracts that makes layoffs possible.

Congratulations on 200,000 miles. I just traded my old Ford Explorer at 166,000 miles in late November 2008. Doing my part for the US economy (and because I liked it best), I bought a 2009 Ford Taurus Limited. It gets good gas mileage and drives extremely well. We paid cash, but that may have been a mistake. I reasoned that new car depreciation may be less than our currency depreciation in 2009.

Yes, it is still pretty frightening down here in the trenches of auto sales. Used cars are not any better then new. People are scared and waiting it seems.

I see where Nuvell faxed dealers yesterday that they are no longer buying any paper due to increasing cost of funds and high delinquencies. GMAC apparently back pedaled from their initial intention to stop buying sub 700 fico score paper and now will consider down to 620. Of the big players, only Chase seems to have had the discipline in the sub prime market to still be a player. Their standards were always too high for me to use them much for my typical borderline buy here pay here customer. I have had a couple of sources dry up but, my main lender is fine and going strong so that I can also. I just need more lot traffic.

Thanks for the clear read from the front lines, H-. No fun.

My recommendation: hope and pray for more lot traffic, and hedge your bets by saving every cent possible and buying UNWPX, GDX, and gold.

Wow, DocJim:

“I reasoned that new car depreciation may be less than our currency depreciation in 2009.”

Izat because there might be some Collector value on the 2009 model…the last of the Carrier Pigeons?

Maybe…

I would say that if you are not in marketing, you should be.

While the numbers, in general, didn’t seem worse than other months I think the Chrysler numbers were horrific! Frankly, I don’t see how they will manage to survive.

I have an eight year old Ford Ranger (with over 150,000 miles) that I would not mind trading in. The deals are pretty good. Still, what good is a good deal if you loose your job?