Tuesday’s stock market rally was pretty impressive. But can the mere words of the Federal Reserve Chair actually produce a 4% increase in the value of the U.S. capital stock?

“Stocks up as Bernanke says recession to end in ’09”, declared the AP headline. But Andrew Leonard

(hat tip: Mark Thoma) read the fine print:

the actual text of [Bernanke’s] prepared remarks reveals further qualification: (Italics mine.)

If actions taken by the Administration, the Congress, and the Federal Reserve are successful in restoring some measure of financial stability– and only if that is the case, in my view— there is a reasonable prospect that the current recession will end in 2009 and that 2010 will be a year of recovery.

That’s not just a big “if.” That’s a giant, honking, humongous, get-down-on-your-knees-and-pray-for-salvation “if.” Ben Bernanke predicts that we can hope for an economic recovery next year, only if government action is effective — and that includes, in his view, Treasury Secretary Tim Geithner’s plan to bring stability to the banking system, the details of which are still unknown.

In the full context of his remarks, Bernanke doesn’t sound all that optimistic.

Or maybe, opined the Wall Street Journal, stocks rallied because the Fed Chair

“made the strongest comments yet against nationalizing major Wall Street firms.” But

Paul Krugman isn’t buying that line, either. Krugman writes:

Here’s my stylized picture of the situation:

At the top are a bank’s assets. Below are its obligations to various parties, with decreasing seniority from left to right. I’ve drawn it to embody a pessimistic assumption about the bank’s finances, because those are the cases we’re interested in: the bank’s assets aren’t enough to cover its debts. Nonetheless, the stock, both preferred and common, has a positive market value. Why? Because of the Geithner put: the bank is protected from collapse, keeping the creditors appeased, but stockholders will get the gains if somehow things turn up.

What we want to do is clean up the bank’s balance sheet, so that it no longer has to be a ward of the state. When the FDIC confronts a bank like this, it seizes the thing, cleans out the stockholders, pays off some of the debt, and reprivatizes.

What Treasury now seems to be proposing is converting some of the green equity to blue equity– converting preferred to common. It’s true that preferred stock has some debt-like qualities– there are required dividend payments, etc.. But does anyone think that the reason banks are crippled is that they are tied down by their obligations to preferred stockholders, as opposed to having too much plain vanilla debt?

I felt that Simon Johnson hit the nationalization nail on the head on Monday when he wrote:

In some important and not good ways, we have already nationalized the financial system….

[M]ost importantly perhaps, we have the expansion of the Fed’s balance sheet as it seeks to step in to replace the weakening banks and the drying up of credit markets. In effect, the Fed is becoming a commercial bank as well as a central bank.The government is essentially taking over the role of intermediation– take funds in and lend them out– for the US economy. This is a form of nationalization, and it will lead to all the lobbying and politically directed credits we have seen in other nationalized financial systems; taking away this credit once the economy starts to recover will not be easy. We have state control of finance without, well, much control over banks or anything else– we can limit executive compensation (maybe) but we don’t get to appoint directors (or replace entire boards) and we have no say in who really runs anything. Responsibility without power sounds accurate.

Why have we de facto nationalized? Because the private credit system– particularly large banks– is weakened and not getting any better. Attempts to deal with the problem banks are apparently blocked by the political power of influential bankers.

How then do we really privatize? By exercising leadership: take over insolvent banks and immediately reprivatize them. The new controlling owners can replace the boards of directors (tell me: why haven’t they resigned already?), and these boards can decide who to keep and who to let go from existing management. The taxpayer retains a significant number of shares (or the option to buy common stock) as a way to ensure upside participation– the economy will one day recover, and that will be a very good day for owners of the remaining banks.

Above all, we need to encourage or, most likely, force the large insolvent banks to break up. Their political power needs to be broken, and the only way to do that is to pull apart their economic empires. It doesn’t have to be done immediately, but it needs to be a clearly stated goal and metric for the entire reprivatization process.

OK, so if it wasn’t reassurances from Bernanke, do I have a better explanation for what could have produced such a big move in stock prices? No I don’t, other than to suggest that perhaps we were in pretty much the same situation Tuesday afternoon as we had been on Friday morning.

|

Technorati Tags: macroeconomics,

economics,

bank nationalization,

stock market,

credit crunch

Here’s an explanation: people sold a lot on Monday, making some people think stocks were too cheap, so those people bought on Tuesday.

Time will tell who made the better decision.

Or perhaps we are all still being manipulated, if not by a small group of individuals then collectively by each other.

Are we still trying to explain away patterns we can’t possibly explain after all Taleb has shown us?

We have learned the lessons of Japan. Unlike them, we are determined to implement bad policies without delay.

The most likely explanation :

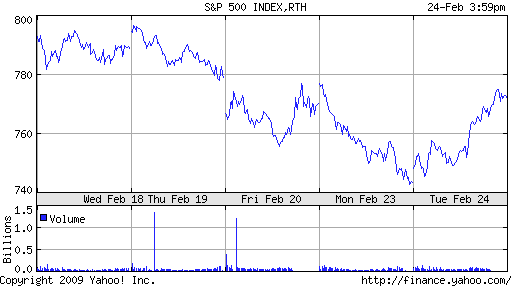

We re-tested the Nov. 20 lows (which are also the 2002 lows) on Monday on the S&P500 (the 740 level). This was a classical technical re-test.

If we break this level, we are in serious trouble, heading down to 660. But the 2002 lows have now been tested twice.

“In the short run, the market is a voting machine, but in the long run it is a weighing machine.”

attributed to Ben Graham

(Interestingly, I briefly checked to find this oft-quoted statement before posting in comments and couldn’t locate it, neither in Security Analysis (both 1934 and 1951 eds.) nor in Intelligent Investor (1973 ed.)… anyone here care to refer me to the source or could it be that it is apocryphal?!)

Rather than examining the reaction in the S&P 500, the financial services ETF (XLF) may be a better proxy for real progress in the crisis. XLF also had had the two most heavily traded March 2009 options yesterday (according to Yahoo’s data provider).

It’s sort of odd to see economists try to micro-rationalize in economic terms a stock market that at that resolution is completely irrational.

People didn’t look at specifics of a plan or sitaution, they repriced a recovery based on the expectations of their leaders….time to get in or stay out.

The recent downward pressure was brought on by Obama et al. saying things like “if spending this trillion doesn’t work, then we’ll do it again”…paraphrasing but that is what people heard. Those comments do not instill confidence and suggest that our leaders expect more problems and no recovery. All Bernanke did was reverse those negative expectations by saying a recovery is possible, essentially repricing the likelihood of a recovery upwards.

It’s now clear that the Obama economic team can not think outside the “finance box” that got us into this mess to begin with. If a bank if too big to fail (TBTF), it needs to be seized, broken up and the remaining parts re-privatized on a sound basis. But Geithner, Summers, et. al. are still stuck in the TBTF paradigm and are thus no different from Paulson’s (understandably) bumbling attempts to set things right.

Thus this is not change we can believe in. Obama said he “gets it” last night in the State of the Union. No, I don’t think he does. And until he starts thinking outside the box, we’re going remain paralyzed for some time to come. Bernanke’s qualification says it all.

The stock market move just shows the power of wishful thinking.

Is the lending system weakened or is it the borrowing system? Is the pattern of weak lending because the banking system does not have enough capital or be because consumers do not have enough income to support their former levels of consumption?

The Federal government can fix the 20 largest banks; but can it fix the millions of individuals that, either through over borrowing or job loss, can no longer pay their debts?

What if we are spending all our time trying to fix the banking system, when it is other parts of our economy that are broken?

Dave, do you figure that Tim and Ben –figures that have been prominent players in the financial world for more than a decade, (and Larry even longer) are “stuck” (with those pair of dimes), or exemplary defenders of vested interests, TBTF?

Well, I listened to the President speak and I wish to report what a joy it is to hear a capable orator, a person with a brain…and, yeah, expressing the views of his rather conservative economic advisors.

Why is the volatility that we witness recently, not correlated to the number of large players?…are we supposed to believe that the small investor has returned?

Does Obama get it?

Do we “get it”? One key asset price needs to fall further…or wages need to align with it.

I am beyond entertaining Bernanke’s remarks. I think his next job might be auctioneering if he does not overcome his anxieties and moderate his pant-wetting speed.

Rajesh: “The Federal government can fix the 20 largest banks; but can it fix the millions of individuals that, either through over borrowing or job loss, can no longer pay their debts?

What if we are spending all our time trying to fix the banking system, when it is other parts of our economy that are broken?”

Excellent summary. For 30 years, the few got all benefits of productivity increases and growth, and the many got stagnation, and the pressure to pile up debt just to slow down the sinking.

If you want the many to buy, you will have to give them money. If the few got all the money, you will have to take it from them. You can argue about the best way to take it (a 100% gift/inheritance tax above a 1 million threshold would be agood entry into a meritocracy), and the best way to spend it (free education for everybody, gated only by aptitude testing, would be a good complement to removing inherited power), and in times of crisis you could do worse then e.g. taxing later to build a national smart power grid combined with free-for-all broadband now, but the core of the equation – where the money is, and where it has to – does not change.

Or you can dither.

– b.

Glad to see this issue raised. People are in the stock market to make money. The only way players are making money today is in response to what the government is likely to do – which, of course, no one knows, especially not Obama. I am waiting for him to realize Larry Summers is no better than Bernanke or Geithner in being able to look at the problem from the perspective of the taxpayer – or the future health of the total economy.

Missing from all the discussion of nationalization or not nationalization is the issue of whether or not traditional practice will be followed when CTIgroup either fails or is nationalizaed. I certainly hope not. Follow the example of Lehman Brothers rather than banks. Because Lehman Brothers was not a bank, the Federal government had no responsibility for the debts that Lehman’s assets did not cover.

Under current practice, FDIC will be responsible for Citigroup’s debts that their assets do not cover.

First order of business for a rational Obama administration is to declare that the banks are strong enough to succeed on their own – and by the way, Lehman Brothers will be the model for how mega banks will be treated if they fail – or if they are nationalized.

That would remove the uncertainity over whether of not the federal govenment is determined to be responsible for all the debts contracted by this shadow banking system.

Bankers hate this uncertainity. Let’s make it clear that their debts will not be honored – beyond what they can get from the private sector.

I believe Mr krugman’s picture of the large banks’ balance sheet is incorrect. Assets equal liabilities in standard accounting and unless Krugman has some special insight into these assets, which I doubt, this is pure guess work. Does he think the auditors are facing lawsuits for putting out false financial statements?

Should AIG and Citigroup be allowed to fail?

YES. Why? Because their failure, if treated as Lehman Brothers was treated, will remove many toxic assets from the balance sheets of U.S. finance firms. In this instance, being a huge firms with many debts to counterparties is an advantage. Not only will toxic assets be removed from their balance sheet, but toxic assets will be removed from all the finance firms with which they are intertwined. Second, only those counterparties that were playing the game with AIG and Citigroup will be caught in the contagion. Plenty of other finance firms will remain standing after these firms are destroyed. Third, the size of the U.S. finance industry needs to be cut – drastically. ]

Failure of these large firms will move the U.S. economy in the right direction – IF THEIR TOXIC ASSETS DIE WITH THEM.

“In effect, the Fed is becoming a commercial bank as well as a central bank.”

Is this the case or is the Fed simply becoming an off balance sheet vehicle (SIV) for the toxic assets of a group of zombie banks? The new TALF program with its non-recourse loans collateralized with garbage seems to be the most recent, blatent example of this.

http://www.creditwritedowns.com/2009/02/talf-a-bailout-if-one-reads-the-the-fine-print.html

timberwolf: Items on the left side of the balance sheet can be determined from mark-to-market, mark-to-model, replacement value, at cost, must be marked up or down, depreciated, and what have you, compliant with US GAAP for one calculation, compliant with tax rules for another calculation, with another set of assumptions for internal management assessments, and maybe some other purposes. Krugman keeps the right side fixed (schematically) where it is today. This is just for illustration of US gov’s dilemma, not a “correct” representation of balance sheets.

dead cat bounce + ignoring Bernanke’s IF

+ Geithner tea leaves on unlimited $ for banks [1]

= “big” rally to recover 1 day losses on Friday

Note:

[1] If Citi & AIG can be “negotiating” w/ Treasury (what do they have to negotiate with?), everybody is covered.

As an Investor and not an economist. I have not bought any Real Estate since 2005. That means I have created no additional jobs. I have moved in and out of the Stock Market many times in the last 18 months and have made every effort to give the new President a chance to perform.

At this point I give up. My friends have moved their own investments to places like Communist China over the United States of America. I am soon to do the same.

JFK, Reagan, Bush, Clinton and Bush have solved past recessions with very simple formulas. This new President wants to re-invent the wheel.

I see a Stock Market trying to move up and a President walk out in front of cameras and kill it almost every day.

Even if this President were to break me though spending and taxes. I would just go out and make more money. My problem is what about the old folks who can not go out and make money? A Government who seems to need these retired folks money worse then they do?

Why does an American President want to kill an economy? Could it be the wealthy contributors like Soros are getting the inside stuff? That would not only allow DNC coffers to be filled in time for a 2010 election cycle where the DNC will be crushed after the display put on by Obama and the dems. It would also crush RNC contributors at the same time before the 2010 election cycle.

This is the only reason I can see for Obama to behave in the manner he has to date.

Go ahead and blast away!

Dave Johnson

Sacramento CA

GOPsavers

timberwolf: Assets and liabilities balance because there is a phantom liability called “stockholder’s equity” which is not directly related to the actual market value of common or preferred stock outstanding.

Krugman is describing a bank where stockholder’s equity is negative under mark-to-market (or some other valuation scheme), but looking at market (or said other valuation scheme) values of their assets and liabilities.

He’s not preparing a balance sheet, so there is no requirement for anything to balance. Just because he’s talking about assets and liabilities doesn’t mean that he must go through the same gyrations as accountants do.

The reason we force balance sheets to balance is a technical one to do with checking of calculations. As long as everything you do must balance, then whenever it doesn’t, you have an immediate red flag that there’s been a mistake in your bookkeeping.

There is nothing inherent in the structure of a company that causes assets and liabilities to balance. In accounting, we merely create a category whose essential *meaning* is “assets minus senior liabilities” and call it a liability in order to make the balance sheet zero out for tracking purposes.

@ Michael E Sullivan:

“we merely create a category whose essential *meaning* is “assets minus senior liabilities” and call it a liability in order to make the balance sheet zero out”

Spoken like a true corporate speak person. Some of us think that a business has a liability to maintain and grow stockholder’s equity, and that responsibility is stronger than tracking to see if it has been “zeroed out”.

Mr. Dave Johnson: Go to the blackboard and write this sentence 10 times: The stock market is not the U.S. economy.

Mr. Mike Laird: Some of us think that enhancing stockholder value by actions that produce a global recession should not be tolerated and that the debts contracted in the process are not the responsiblity of the Federal government.

O Mike…wazzat a wise crack or a wiser crack?

…without a precarious record of liabilities then, there is no chance of your business becoming a holding company or receiver of TARP funds.

You figure that stockholders are united with upper management in the pursuit of “equity growth” and, a distant second (possibly non-finisher, if the DoJ gets its foot in the door before the SEC) impeccable accounting standards?

Ummm, what Michael E. Sullivan said is just plain vanilla double-entry accounting.

Go check the bankruptcy filings and you’ll see. Just last week, we had the Journal Register go under: “The Journal Register Co. filed Saturday for bankruptcy protection from its creditors . . . . . The Yardley, PA newspaper publisher reported $596 million in assets as of Nov. 30 and $692 million in debt, including unpaid interest. Revenue has fallen more than 20 percent since 2006, the company said in the court filing.”

With $596 in assets and $692 million in debt (exclusive of other liabilities, regardless of what label one puts on Shareholder’s Equity), I guarantee you that’s one funky-chicken balance sheet.

A bit off topic, but where GAAP and Sarbox really let the world down in this go-round was in policing of Special Purpose Entities. We’d been told after Enron that Sarbox had put an end to the off balance sheet gamesmanship (or at least had put teeth in the penalties for corporate earnings manipulation using things like SIV’s and Conduits), but we were obviously told a big ugly untruth on that one. Charles Prince really should have been charged with some level of accounting fraud by now.

Of course, it makes matters that much worse that the Fed and Treasury are playing the same SIV-like games with their alphabet soup of badly accounted for acronymic programs, but that’s even further off topic.

Comments by a number of economists (e.g. Roubini,Krugman) and a number of commentators with vested interest in favor of nationalization

have been instrumental in the cratering of the banks in the last couple of weeks.Why should the commnents of the most powerful economic voice not move the market.

Spoken like a true corporate speak person. Some of us think that a business has a liability to maintain and grow stockholder’s equity, and that responsibility is stronger than tracking to see if it has been “zeroed out”.

That’s pretty funny. I’m not actually an accountant, though as a small business owner who has studied some finance and economics, I am quite familiar with accounting practices.

It’s very much in my interest to increase the value of my business, since I own 60% of it and I’m related to the people with the minority interests.

“Stockholder’s equity” on a balance sheet is an accounting term of art. It is not like equity in a house. It does not mean what you seem to think it means.

If you’ve ever actually run a company, or understood how to read a balance sheet as an investor, you would know that this number has only a very weak relationship to the actual value of the stock in a going concern.

Stockholder’s equity is very nearly irrelevant to valuation outside of vulture/insolvency situations (where a company has a fair chance of being liquidated), or unproductive companies (which are hoarding assets out of proportion to their earning capacity). Even in those cases, if the organization has assets and liabilities that are not or cannot reasonably be marked to market, the stockholder’s equity value represents, at best, nothing more than a guess at orderly liquidation value. At worst, it can be a complete fiction.

“It’s now clear that the Obama economic team can not think outside the “finance box” that got us into this mess to begin with. If a bank if too big to fail (TBTF), it needs to be seized, broken up and the remaining parts re-privatized on a sound basis.”

This is exactly right. Sinking so much money into these failing ventures is simply going to make the problem worse in the long run. It’s already gotten to the point that many companies now have their hand out to the government. If one company is “too big to fail”, what about all the others? Where do we draw the line?

So, academics seem to favor nationalization (Krugman, Fama), but perhpas Timmy and Larry are worried about what happened when Lehman failed. The question, it seems to me, is how fooled are lenders? Would owning up to the real situation make them more skitterish, or do they already know the truth? (I hope Timmy and Larry aren’t worried about the stock market values, which will tank when the “Timmy put’ evaporates.)

Timberwolf, I think he drew it that way to represent projected market values, not book values and to highlight the notion that they equity is essentially worthless. I may be wrong.

MikeR, that’s exactly right, and in the quoted text, Krugman even tells us why he has drawn the picture this way:

“I’ve drawn it to embody a pessimistic assumption about the bank’s finances, because those are the cases we’re interested in: the bank’s assets aren’t enough to cover its debts.”

Hi Dr. Hamilton:

I hope that you remain well. Watch for at least a 10 percent gain in 2009 for composite US stock indices. Markets are way oversold and the past week finally marked the week of when some policymakers began to talk about what all of their past stimulative actions will mean going forward.

Equity prices are anything but linear and higher growth expectations can strengthen sentiment and equity prices very quickly.

Take care,

Kirby