New York Attorney General Andrew Cuomo (hat tip: LA Times) asserted that on Friday insurance company AIG, recipient so far of perhaps $170 billion in bailout assistance, distributed over $160 million in “retention payments to members of its Financial Products Subsidiary.” These payments apparently included “retention” payments of over $1 million each to eleven individuals who are no longer working at AIG.

One of the reasons this is so outrageous is that the promise of such bonuses was in fact one of the very factors that caused our current problems, creating incentives for managers of AIG to get out of solid insurance underwriting and into hedge fund gambling. If anyone had supposed that AIG had “learned its lesson”, this report seemed to dash that hope against the wall like a plate of china.

Some may argue that AIG’s hands were tied by contracts the company offered employees in the spring of 2008 promising that 2008 bonuses would be 100% of 2007 bonuses. Or that the inability of the Treasury Secretary to override these bonuses was cemented by the following clause in the American Recovery and Reinvestment Act signed into law on February 17:

The prohibition required under clause (i) shall not be construed to prohibit any bonus payment required to be paid pursuant to a written employment contract executed on or before February 11, 2009, as such valid employment contracts are determined by the Secretary or the designee of the Secretary.

Fox News blamed the above de facto AIG exemption on Senator Christopher Dodd (D-CT), suggesting a possible connection to the fact that Dodd was the largest single recipient of 2008 campaign donations from AIG. But Jane Hamsher documents that the words above were inserted after the bill left the senate and went to conference committee. Hamsher proposes instead that pressure from Treasury Secretary Timothy Geithner and National Economic Council Head Larry Summers played a role in those words’ appearance in the final bill.

I have yet to find a clear account with actual names of the representatives and senators who thought prohibiting restrictions on bonuses promised before February 11 was a good idea. But somebody put that clause in, and the claim that the legislators all are shocked– shocked– to find this is part of what they voted for is, if nothing else, Exhibit 9,247 for the case that legislation needs to be sufficiently short that everyone can be expected to read it.

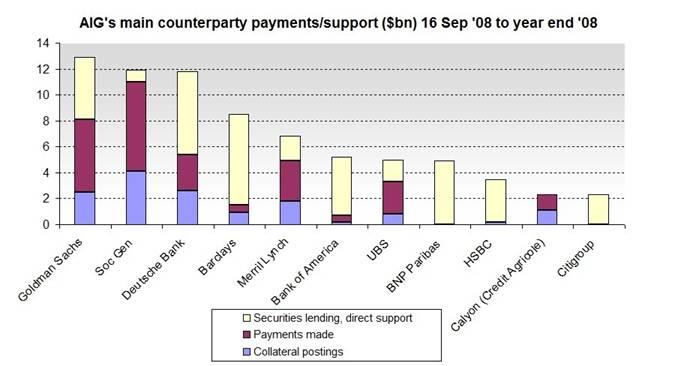

But more shocking yet, at least if we measure these things in dollars and cents, is the amount of taxpayer funds that have gone to compensate AIG’s counterparties for bets those counterparties never should have been allowed to make.

|

On Sunday Larry Summers offered this explanation for the bonuses:

We are a country of law. There are contracts…. Binding contracts were entered into long before the government put any money into AIG. We’re not a country where contracts just get abrogated willy-nilly.

But here’s the point. AIG may have entered into contracts with its managers and its counterparties, but the U.S. taxpayers did not. A precondition for infusion of taxpayer funds has to be sufficient restructuring of pre-existing commitments to ensure that any new funds delivered achieve their purpose rather than simply prolong the problem.

If Geithner and Summers feel they lack the legal authority to ensure that kind of constructive receivership status for recipients of bailout dollars, then they should have delivered proposed legislation to Congress providing such authority on day one.

Or, given that we missed that deadline, maybe they’d consider giving us a plan that works tomorrow.

Technorati Tags: macroeconomics,

economics,

credit default swaps

bailouts,

AIG

This entire process has struck me as a management failure from day one. Not bailing out the banking sector; that very likely was necessary. I certainly thought so at the time, and I support that decision now. But bailing out management as if CEOs of blown-up corporations and divisions aren’t entirely fungible eludes me, and not forcing the various bailed-out counterparties getting a handout to give up either a haircut, an equity stake or some sort of concession seems a missed opportunity.

Why the government has been so shy about using its leverage here eludes me.

My outrage has passed the point of outrage and has entered the realm of incandescence. I don’t think I’ll ever vote for an incumbent again as long as I live. And if there’s ever a riot, why, I think I’d like to join right in.

Well, I am happy that Congress woke up and smelled the coffee. But let’s face it, whatever AIG gave to its employees is chump change compared to the Trillions that Congress is proposing to blast into outer space.

So, unless Congress is prepared to repeal the porkulus bill, and the G$410 budget buster supplement, I don’t want to hear another word from those misbegotten fools.

Obama has made outstanding picks for his cabinet with the exception of Geithner and Summers. Those two might be considered safe picks since they have the background and experience, but they aren’t necessarily smart picks if you want to make bold changes. These guys represent the status quo with excessive deference to Wall Street.

They claim they can’t “abrogate contracts willy-nilly” — unless they happen to be the contracts of blue collar automotive workers. They managed to rewrite union contracts affecting hundreds of thousands of past and present workers without all this hand-wringing and angst.

Why not use the same threats they made to auto workers — comply immediately or you are out of a job? Why do they need retention bonuses when there are no other jobs to be had right now? If they want to sue, let them sue. Meanwhile they have no job and they can spend the next five years waiting on a long, complicated court case.

This impotence and grovelling displayed by Geithner is really embarrassing. He really doesn’t want to hurt Wall Street’s feelings.

The latest excuse from Larry Summers:

Larry Summers suggested that if Treasury Secretary Timothy Geithner had pushed the insurance giant too hard on the bonuses, AIG could have collapsed just like Lehman Brothers and sparked an even bigger crisis.

“Secretary Geithner has used all the legal authorities that are open to him to contain and limit the payment of bonuses,” said Summers, chairman of the National Economic Council. “What he did not do, and what would have been irresponsible to do, as outrageous as these payments are, would have been to put at risk the stability of the financial system.

“To have courted the kind of disaster that followed the decision to let Lehman Brothers simply collapse might have felt good briefly, but it would have touched the lives of a huge number of Americans who would have unnecessarily become unemployed or seen destruction of their lifetime savings.”

In other words, the AIG execs strapped on a vest of explosives, walked into the Treasury building and announced “Give us the money or we blow up the economy” and Geithner opened up the cash drawers and said take what you want. It seems that “too big to fail” is a license for blackmail.

Maybe we should start a pool on how long Geithner will last. Hopefully Obama, like Lincoln, will eventually find his General Grant.

The AIG story should be about how “the best and brightest” missed this contract provision when offering up the money to AIG.

All of this AIG dust up is a distraction from a greater injustice:

http://www.cnn.com/2009/POLITICS/03/17/obama.veterans/

Re: Joseph’s comments

Obama has his General Grant but hasn’t seen fit to give him the reins: Paul Volker. Volker wrung inflationary expectations out of the economy in the early ’80s. The pain was awful but the disease had festered to crisis proportions. What we need now is a well-announced policy to end bail-outs [1] and a credible, stern hand to implement it and to thus wring bail-out expectations out of the system completely. [2] Volker is the man to do it. But Obama is not (yet?) the president to do it–which is not to suggest that McCain would have been any better at grasping this especially pernicious bull by the horns. The political issue is vastly different from the one facing Carter-Reagan on inflationary expectations. Then the Volker-led Fed could be blamed for the policy, deflecting ire away from the president. Now, any policy shift away from increasing bail-outs and the consequences of such a shift are fully owned by the president.

Notes:

[1] Re: current bail-out monies

Instead of reducing the seniority status of Federal money from preferred to common, the preferred shares should be promoted to the same seniority level as debtor-in-possession financing: senior to all deferred compensation/bonus pools and to all unsecured debt. Treasury/Fed guarantees on dodgy assets can be phased out by increasing the coinsurance percentage of the bailee to the 100% level over the course of, say, a year.

[2] Re: bail-out expectations and a most odious feedback loop:

Those expectations, if not met as with Lehman, make for disorderliness in the bankruptcy process. The disorderliness itself then feeds political demands for more bail-outs, reinforcing the expectations and thus increasing the pain from any bankruptcy. The bail-out itself underwrites increased risk taking, institutionalizes “TBTF” status, and transforms corporatism and cronyism into fully-ratified lemon socialism for a special class. That class is then fully justified in touting its special entitlement status—welfare queen writ very large—and in parading its disdain for those underwriting their privilege: The beggars are not the financial institutions except in pro forma sense, but the taxpayers expecting economic salvation from them.

The abrogation of contracts is as American as apple pie (and nationalisation). It’s why we have such thing as a CDS and bankruptcy procedures.

It’s time to let AIG go bankrupt now as punishment. This would be good news because it would mean the shareholders of other companies would know what happens to lazy shareholders that do not rein in the board.

Professor,

This is the best article I have seen on this issue. Truth is a hard taskmaster. Thank you for doing the due diligence that our lawmakers did not do and thank you for not pulling any punches.

Now to my two cents. What gives such uninformed and uneducated people as Senator Christopher Dodd, Timothy Geithner, Larry Summers, and a host of others including George Bush and Henry Paulson the gaul to spend $trillions of our money. Any self-respecting CEO would be fired if he made such a bone-headed move, but these guys just keep taking more and more power and responsibility on themselves to make the next bone-headed move.

We are so doomed if we don’t figure out a way to keep power out of the hands of such people.

As Simon Johnson has written, the Obama administration is more and more indistinguishable from Wall Street. Now we learn that Lewis Alexander, Citi’s chief economist, is leaving the bank to serve as a counselor to Geithner.

What kind of treatment can we expert for AIG — they are a conduit to the counterparties — when the banks are counseling the Treasury on what should be done with the banks?

We need an overtly national bank, if for no other reason than that if these TBTF banks are really systemically important and they do collapse, then we will have a stable, national bank to step into the breach.

As for our morals and ethics. Obviously they were tossed overboard a long time ago, even though we now know they were systemically important.

Wasn’t the recovery act of February suppose to be a blue print for how the government would deal with future bailouts and had nothing to do with the AIG bailout that was done by Team Bush?

“But here’s the point. AIG may have entered into contracts with its managers and its counterparties, but the U.S. taxpayers did not.”

That’s completely irrelevant. Believe it or not, purchasing a majority stake in a publicly-traded company does not entitle you to breach contracts that are binding on the company.

“A precondition for infusion of taxpayer funds has to be sufficient restructuring of pre-existing commitments to ensure that any new funds delivered achieve their purpose rather than simply prolong the problem.”

Complaining that we didn’t insist on rescinding the bonuses as a condition of the bailout is about as unhelpful as it gets. In hindsight, yes, we should have insisted that AIG rescind the bonus contracts before it received government funds. But we didn’t. Pointing out that we should have done this in no way rebuts Summers’ point: the contracts are binding, and we have no legal authority to simply abrogate them.

And receivership for AIG is almost exactly what we’ve been trying to avoid all this time. Like bankruptcy, receivership constitutes a “credit event” under standard derivatives contracts. Where have you been for the past 6 months?

The government should mandate a minimum and maximum wage for everyone. Problem solved.

Others have expressed the outrage we all feel toward the bonuses going to AIG execs.

My question is, Why are people surprised that the much of the AIG bailout was passed on to counter parties? Wasn’t that the justification of the AIG bailout? The precise reason that a AIG failure would result in destabilization of the financial system was the losses it would impose on counter parties.

“”But here’s the point. AIG may have entered into contracts with its managers and its counterparties, but the U.S. taxpayers did not.”

That’s completely irrelevant. Believe it or not, purchasing a majority stake in a publicly-traded company does not entitle you to breach contracts that are binding on the company.”

Well well well, but it DID work that way for the auto workers right? Or maybe a union contract is different from a management contract? Or maybe the auto workers were grossly overpaid?

“Treasury gives AIG break, but not GM

By PETER MORICI

Tuesday, March 17, 2009

Washington and the nation are enraged that AIG is paying millions in bonuses to retain financial wizards who sold insurance on mortgage-backed securities with few assets to back up their promises.

AIG is telling us that it must pay those bonuses, because they are required by employment contracts necessary to retain its financial engineers.

Treasury Secretary Timothy Geithner has expressed outrage. Instead, he should be embarrassed.

When the Bush administration agreed to bail out General Motors and Chrysler, it required those companies to renegotiate their labor contracts — that’s right, contracts — and they are doing just that to keep their federal largess.

The Obama Treasury, headed by Geithner, is forcing the terms of that deal on the United Autoworkers.

Why did Henry Paulson and Geithner not require the same at AIG? Remember, Geithner was president of the New York Federal Reserve Bank and a key player when financial giants like Citigroup and AIG were being bailed with the taxpayers’ cash.

Those bailouts continue, with easy terms for the bankers and their contracts, on Geithner’s watch.

The threat was the same with AIG and GM. If either shut down, the economy would plummet into chaos and depression, we were told.

So Mr. Geithner, instead of being outraged at AIG’s last revelations, perhaps you can explain to all of us why a UAW worker earning $29 dollars an hour must give back wages and benefits to keep their company alive, while the architects of the biggest financial disaster in history get to keep their gold-plated contracts?

We are waiting for your answer.”

http://www.ajc.com/opinion/content/opinion/stories/2009/03/17/moricied_0317.html

“But Jane Hamsher documents that the words above were inserted after the bill left the senate and went to conference committee.”

I’m sure that these giant bills are written with computers, not with quill pens. I’m equally sure there must be at least a few people in Congress aware that there is software that allows tracking changes to shared documents, including who made each change. So I can only conclude that they want deniability for these shenanigans.

The people strain at the gnats of bonuses and swallow the camel of bailouts.

On the question of industry versus banking, re: government required UAW contracts to be renegotiated, the answer is; when a facist wants to take over the economy it needs the banks. I’m sure you all know how Hitler and Mussolini came to power. It was with the consent of the bankers, who thought they could control both the government and thus industry or the “private economy”. Wake up people, the old rules of law and morality no longer apply. We as a Country have about 18 months to get rid of the current incumbents or it is over. I suggest some very good reading can be had in the book, The Fall of The Roman Empire”, by Peter Heather. To save the Empire from a perceived external threat, all local and regional tax money was taken by the Roman State, our Federal Gov., now. From that time on, only those who were friends of the Emperors, got any of it back. Families out of favor had land taken and the “Libertas”, that is “Freedom under Law” which made Rome great, disappeared. We are in really big time trouble here and we had better stand up!!

Don’t make me laugh. Congress gets its panties in a bunch over the bonuses and then does next to nothing about them but screech and scream…to no avail. When Wall Street meets Congress, you can be sure it is Congress that will fold…like a crumpled piece of paper. Congress has no guts and no willpower. Wall Street rules Washington and always will, whatever happens. So sit back and laugh at our silly hypocritical Congress with a big bark and no bite.

Don’t make me laugh. Congress gets its panties in a bunch over the bonuses and then does next to nothing about them but screech and scream…to no avail. When Wall Street meets Congress, you can be sure it is Congress that will fold…like a crumpled piece of paper. Congress has no guts and no willpower. Wall Street rules Washington and always will, whatever happens. So sit back and laugh at our silly hypocritical Congress with a big bark and no bite.

That’s completely irrelevant. Believe it or not, purchasing a majority stake in a publicly-traded company does not entitle you to breach contracts that are binding on the company.

spencer, stop being an apologist. I’m an upper-level executive. I would have done what was suggested here. I would have called all of those people together and given them an option: you will sign this agreement on the disposition of your bonuses (which, btw, I would have DIFFERED into the future pending turn-around) or you won’t. Then I would have terminated anyone who didn’t. Simple isn’t it? That’s what a CEO is supposed to do when trying to gain trust of all stakeholders. But hey, maybe I went to b-school somewhere where greed wasn’t a part of the curriculum.

And, really now, what did you expect from Obama’s crew? Take a look at where they are all alums of, and take a look at where they worked. Is that change? I think not. Outrage by all classes, even the executive one, is warranted. This idiocy affects what people think of me too when the use terms like “CEOs” as a blanket.

me:

The AIG employees got a median bonus of $3,000. That is three thousand.

The UAW retirees got buyouts on the order of $50,000.

Frankly I think it’s a smoke screen at this point and probably was planned that way by the Admin from the get go.

When it comes down to it the amount is a tiny percentage of the bailout monies sent to AIG. I think this is just pseudo outrage in an attempt to get the American people to shift their anger from D.C. in general because of all the bailouts to another party.

There’s a swell across the land that I imagine DC is finding disconcerting and my feeling is that we can see more of this blame game in DC.

It’s either that or it’s proof that the government really is clueless when it comes to running a company.

Take your pick. It’s bad news for us either way.

me:

The AIG employees got a median bonus of $3,000. That is three thousand.

The UAW retirees got buyouts on the order of $50,000.

It is pretty clear from your article that the corruption of the democratic system runs extremely deep.

Senators are “shocked”? Ya sure they are – that was for the “press” – that was the politically correct position to take.

Meanwhile behind the scenes just remember who these Senators are: political elite who receive funding donations and hobnob with the kind of privileged people who receive $1 million+ annual bonuses (and I don’t mean just AIG here – I mean AIG is the canary in the mine, like teh Merril Lynch bones saga – it simply exposes the tru enature of the system)

Clearly our system has become a revolving door (between the private system and public government) where the priveleged few abuse the system for maximum profit.

this may be what’s on the news but there’s a ton of other shady stuff going on inside AIG that hasn’t yet been exposed.

The employee benefits industry is giant. And all insurers, starting with AIG, should be providing a premium break-down when presenting rates to the end customers—ALL CUSTOMERS, not just the broker. THere are millions of dollars being paid between insurer and broker the customer has no idea what they are paying for—they only see a lump sum premium not knowing how their money is being distributed, like 20% or 30% of premium going to their broker, in addition the SHARE THE INSURER KEEPS also includes ADDITIONAL bonus money on top of the 20% and 30%, PLUS, additional allocations for expensive dinners and gifts.

Here’s an interesting post from someone who worked at AIG.

http://www.vdare.com/miano/081014_aig.htm

I agree with most all that JDH has so clearly written, but there is one point that, to me, seems too strong.

JDH says:

But what if the counterparties were just entering CDS to hedge the default risk in their MBS/CDO portfolios? Should these transactions have been prohibited? I have not seen firm data, but it seems likely that many (but not all) counterparties were primarily hedging.

The root issue may be whether the CDS market should be eliminated, or whether it should be regulated like other exchanged traded derivatives — with a clearinghouse, standardized contracts, position limits, margins, mark-to market and transparency.

I wonder if anyone has ever really looked at and exposed the average “Entertainment and expense” MONTHLY budget of an AIG Sales Executive. I mean really;

or if anyone has ever really looked at the activity of AIG Sales Executives………..like any personal campaign contributions for local labor union elects……….ones who would make

a decision or influence purchasing certain policies.

No wonder the annual increases of insurance and healthcare are outrageous.

Professor, it sounds like you are near to joining our torches and pitchforks brigade to supply the brains behind the brawn!

…

Are people here really unaware that time flows in one direction?

The Feds required GM and Chrysler to renegotiate. And the UAW agreed. (Well, not really. The UAW promised to “look into it,” but that’s irrelevant here.) Should they have done this with AIG? Oh most definitely. The moral hazard this whole fiasco causes is horrendous.

But wishing really bad that you had done something isn’t the same as actually having done it. These bonuses are bad, but the various bloviating by Congress to Do Something About It scares me. Apparently if the US is your employer you are now their little bitch. Do what your boss says, or else. This should remind everyone of the days of “the company store.”

I haven’t seen the contracts, and neither have you. But if this strategy would work, it should definitely be followed for a significant portion of these employees.

WRT Joseph’s 12:59 comment, you need to remember that one of Bernanke’s theories about the Great Depression was that it was a loss of information about credit intermediation that made the Depression worse. As more and more bankers lost their jobs, fewer people knew how to decide who was credit-worthy and how to make loans. There was a loss of the relationships that had allowed loan managers to know who was a safe credit risk. This is covered in Bernanke’s 1983 paper “NON-MONETARY EFFECTS OF THE FINANCIAL

CRISIS IN THE PROPAGATION OF THE GREAT DEPRESSION”

From that perspective, one thing to be very concerned about would be to make sure that the people who understand the business stick around. The pandering to Wall Street makes a bit more sense from that perspective.

Of course, what’s clear now is that they are probably far too late. The managers they should want to keep around were fired in the early part of this decade for being too conservative. The ones that remained are those who really don’t know their business, but rather *thought* they were good a speculating and managing risk. They were really just gamblers playing with other people’s money at a lucky time. But they may be the best we now have available, since the real knowledge of credit evaluation has been lost, and at least these people know how the current system works.

I am totally against mortgage bailout. I believe it penalizes people like me who live in a 900 sq. ft. house and unnecessarily distributes my taxes to folks who live in 3000 sq ft homes. That being said when I heard Summers real time on Sunday my heart sank and I was sad for the rest of the day. Can someone explain? How is it that the administration can’t break AIG bonus contracts, but they think they can modify existing mortgage contracts with the housing bailout?

Since all financial bailouts are politically directed then the recent pubic fallout regarding these bonus payments points to a change in public perception which Congress and the President got a strong whiff this weekend. Been easy so far for Obama to point fingers at the Republicans for the mess but now he and the Democrats have been caught with their fingers in the cookie jar and the little white lies about not knowing this and that about these bonus payments will be thoroughly hashed out in the media and creating a less then boy scout image for Obama and company. The financial sector must be nervous that main street will get its revenge and that Democrats will leave them hanging sooner or later.

The political landscape is changing and with it will be the bailouts not only by Obama and the Democrats but also the FED.

John Elder: I do not say it was wrong for the counterparties to want to hedge. The reason I believe that these transactions should have been prohibited is because AIG lacked the resources to honor the contracts, making them implicit bets against the U.S. taxpayers, as I elaborated here.

MikeR

The UAW retirees got buyouts on the order of $50,000.

And now they have no job, no health care and no retirement. What a bargain.

As far as median income, what is the “median” income when Bill Gates walks into the room. Nice straw man.

Professor,

During the S&L bust, the same style of “contracts with employees” were abrogated by the US courts because the bankrupt institution had no standing. AIG would not be able to make those payments today without taxpayer intervention; thus, contracts are null and void.

This is historical precedent. Summers is a liar.

JDH, thanks for raising my blood pressure. I didn’t know about the legislation part. The obvious solution is to let AIG fail. Wouldn’t the bonuses then suffer the same fate as other worker contracts? It would be a foolish idea to let such a small consideration drive such a big policy move, if it weren’t the right thing to do anyway. But it is. It is also time to stop the attempts at wealth maintenance. The Treasury can’t afford it. Look at what BB’s recent antics are doing to the dollar. What infuriates me even more is the misguided notion that we have to placate foreign lenders. A reduction in their loans would provide a welcomed fiscal stimulus through the current account.

JDH: I do not say it was wrong for the counterparties to want to hedge. The reason I believe that these transactions should have been prohibited is because AIG lacked the resources to honor the contracts, making them implicit bets against the U.S. taxpayers, as I elaborated here.

Some hedge funds weren’t hedging anything. They were simply making naked short bets that CDOs they didn’t even own would fail. Should taxpayers be on the hook for paying off for fire insurance someone bought on their neighbor’s house? These kinds of bets serve no risk management purpose. They are pure speculative plays. Why not just hand them their premiums back and cancel the contract?

@kjmclark:

“The managers they should want to keep around were fired in the early part of this decade for being too conservative.”

Those guys are still around. Time for a promotion?

In defense of the 160M paid out in retention bonuses and which had been agreed to prior to the current management, ie., Liddy, et al, had the contracts been abrogated isn’t it possible that AIG’s FPS execs. who received these bonuses would most likely have initiated lawsuits thereby causing more financial harm to this company? A major burden and distraction keeping AIG from making substantial progress towards paying back the American taxpayer and becoming profitable again?

Is it not in our interest to keep this company afloat, not of course because of its credit default swap operations which have been substantially flushed from the books, but because of its commercial insurance operations which allow many public infrastructure projects some guarantee of achieving completion(If AIG goes down, our half-completed science building on our campus may not be finished thereby causing a major disruption to our, ie., students, science educations).

So, of 170B of TARP money invested already, why make 160M a major distraction? People are certainly angry about this but shouldn’t they be made to understand that there a better chance of making the taxpaper whole by just sucking up the loss and keeping this company going forward.

Wouldn’t the alternative be much worse? In just one instance wouldn’t the rug be pulled out from under capital improvement projects already under percentage of completion contracts throughout the U.S.?

MikeR: The AIG employees got a median bonus of $3,000. That is three thousand.

As usual, when you want to deceive, use median numbers.

From the NYTimes: Of the 418 employees who received bonuses, 298 received more than $100,000, according to the New York attorney general, Andrew M. Cuomo. The highest bonus was $6.4 million, and 6 other employees received more than $4 million. Fifteen other people received bonuses of more than $2 million and 51 received $1 million to $2 million.

An earlier post said:

“And receivership for AIG is almost exactly what we’ve been trying to avoid all this time. Like bankruptcy, receivership constitutes a “credit event” under standard derivatives contracts”.

I smell an opportunity. Does a “credit event” mean all derivatives contracts are null and void?

If so, receivership for AIG is exactlay what I have been seeking all this time.

The important point made by JDH is that these contracts should never have been permitted to be made. Legally they exist. But the Federal government is making a big mistake to provide any money to prevent the failure of AIG. We have no business supporting the activities of AIG.

Who in his right mind thinks that failure of AIG today will cause the kind of credit freeze that was experienced 6 months ago following the shock of Lehman’s failure?? Lehmans was a new event. Failure of AIG will merely be the end of a period of being propted up by the Federal government.

Obama needs to make a public declaration that no more federal money that he controls will be paid to AIG.

TH,

One has to wonder if the AIG board had not been distracted by the Greenberg vs. Spitzer situation, would the financial products division been managed differently. We will never know.

Certainly, Greenberg incentives were better aligned as he had more skin in the game than anyone else.

JDH says:

But more shocking yet, at least if we measure these things in dollars and cents, is the amount of taxpayer funds that have gone to compensate AIG’s counterparties for bets those counterparties never should have been allowed to make.

But what if the counterparties were just entering CDS to hedge the default risk in their MBS/CDO portfolios? Should these transactions have been prohibited? I have not seen firm data, but it seems likely that many (but not all) counterparties were primarily hedging.

The root issue may be whether the CDS market should be eliminated, or whether it should be regulated like other exchanged traded derivatives — with a clearinghouse, standardized contracts, position limits, margins, mark-to market and transparency”

Geithner is now in serious trouble. He did not see that he was the new CEO of a bank holding company, for AIG, Citi, BOA, Freddie, with the public as his Board, and thought he was still a Fed policy wonk. His credibility is so damaged that he may not be able to get anything meaningful through Congress. My own (Democratic) Representative has gone on public record to say he will not vote for any future bail-out because Treasury has shown they cannot manage it. For better or for worse, the character of Federal involvement in this economic crisis seems to have hit a brick wall, and will have to change in fundamental ways.

AIG has a ton of business that is doing just fine. If the derivative contracts they signed were abrogated, the rest of the company would survive.

Best way to cleanse the company is to allow it to fail. Whether receivership or some other arrangement, these derivative contracts could then be negated.

I haven’t seen the contracts, and neither have you.

Very true I haven’t. But I also haven’t seen a contract written that can’t be broken in some manner if you put your mind to it. There is also the idea of willingly amending the contract, which is why what I said I’d do would work. Here is an amendment to the original bonus contract that puts it out 5 years IF the company attains x in profit by that time. I suggest you sign it.

Those that did would stay. Those that didn’t I’d dismiss and find a legal way to twist out. Very simple. It’s just that these CEO’s are more interested in collecting money and keeping the old boys network than having balls and solving problems.

This is a very simple solution. The other one is for congress to have some balls and write a retroactive tax that is levied on all bonuses of any company that took any US money starting in the year of the transfer. Tax everything at 100% above 100k full stop. If these people want to leave their jobs because the money isn’t good enough, let them. Those that want to stay for future rewards and actually solve the problems will stay. The rest we should push off-shore in a raft.

I don’t even understand what the debate is about here.

Reformer Ray: AIG has a ton of business that is doing just fine. If the derivative contracts they signed were abrogated, the rest of the company would survive.

Don’t be so sure about that. From Newsweek:

“Most of this as-yet-undiscovered problem, Gober says, lies in the area of reinsurance, whereby one insurance company insures the liabilities of another so that the latter doesn’t have to carry all the risk on its books. Most major insurance companies use outside firms to reinsure, but the vast majority of AIG’s reinsurance contracts are negotiated internally among its affiliates, Gober says, and these internal balance sheets don’t add up. The annual report of one major AIG subsidiary, American Home Assurance, shows that it owes $25 billion to another AIG affiliate, National Union Fire, Gober maintains. But American has only $22 billion of total invested assets on its balance sheet, he says, and it has issued another $22 billion in guarantees to the other companies. “The American Home assets and liquidity raise serious questions about their ability to make good on their promise to National Union Fire,” says Gober, who has a consulting business devoted to protecting policyholders. Gober says there are numerous other examples of “cooked books” between AIG subsidiaries. Based on the state insurance regulators’ own reports detailing unanswered questions, the tally in losses could be hundreds of billions of dollars more than AIG is now acknowledging.”

link

I certainly hope Mr. Mike Laird is right:

“For better or for worse, the character of Federal involvement in this economic crisis seems to have hit a brick wall, and will have to change in fundamental ways”.

The fundamental change needed is to refuse to provide any more money to the system that created the problem.

Second, face the issue of what to do about derivatives. Derivatives are at the root of AIG’s problems.

My suggestion is to follow through on the desire of the financial community to allow derivatives to be written outside federal regulation, as was legislated in the 2000Act _Commodities Futures Modernization Act. By follow through I mean keep ALL relations to derivatives outside the regulated system. Specifically, make it illegal for banks and insurance companies (regulated too insure safety of deposits) to participate in derivatives in any form, including providing money to fund the activity.

I realize this objective will have enforcement problems. Any treatment of derivatives which will allow them to exist and which will try to prevent the kind of disaster that developed in the U.S. is going to have enforcement problems.

Derivatives are part and parcel of a desire to gamble. Such activities cannot be regulated like activities aimed at preserving wealth. The two are incompatable. So separate them. Create a wall between the regulated system and the unreg ulated system where derivatives flourish.

Obama is one lucky politician. Maybe his luck will carry him (and us) through this problem.

Examples of luck. 1. Primary opponent in race for Illinois legislature disqualitifed because she did not fill out forms correctly. 2. Primary opponent in race for U.S. Senator from Illinois dropped out because of personal scandal. 3. Lehman failure on Sept. 17th shifted voters to Obama.

If his luck hold, here is what will happen:

1. Furor over AIG bonuses will force him to declare that no more money will go from his administration to AIG.

2. AIG fails. 3. Disaster predicted by Bernanke, Summers and Geithner does not happen. Instead, many toxic assets destroyed. Obama likes this outcome.

4. Obama refuses to act to rescue any additional business firms (no policy announcement – just refusal to act).

4. Stock market sharks target the big bank they think is most vulnerable. It collapses. Nothing much else happens. Except more toxic assets destroyed.

5. Stock market sharks target the next big bank on the list. This one is not an easy target because it has fewer toxic assets. But it finally falls.

6. Stock market sharks traget the next big bank on the list. This effort fails. This bank is supported by all the other banks. After the remaining banks form a defensive front, Obama relents and supplies additional money to the surviving banks.

7. Credit begins flowing freely among the remaining banks who now trust each other.

8. Larry Summers and Geithner are forced to tear up their plan to pump an additional 750 billion into the banking system.

9. All live happily every after. (This is a fairy tale, of course. But one I hope to see come true).

The federal government simply can’t afford to make up the bad real estate loans, even if they limit it to those that were insured.

Paulson should return most of his gains. It would set a good example. It is money he has no moral right to, almost as obvious as Hilarious’s ill-gotten profitsin cattle futures.

WHO KILLED AIG?

(Who Killed Davey Moore, Bob Dylan)

WilliamBanzai7 Blog

Sing along: http://www.youtube.com/watch?v=62daicHQ9as

Who killed A-I-G,

Why an’ what’s the reason for?

“Not we,” say Greenburg, Sullivan and Willumstead

“Don’t point your finger at we feckless CEO three.

We could’ve stopped it in the early days

An’ maybe kept it from this fate,

But the markets would’ve booed, we’re sure,

At not gettin’ its money’s worth.

It’s too bad we three had to to go,

But there was a pressure on we too, you know.

It wasn’t we three that made AIG fall.

No, you can’t blame we three for incompetence, lyin or financial thievery at all.”

Who killed AIG,

Why an’ what’s the reason for?

“Not we,” cry AIG’s derivative traders,

Whose screams filled the trading floors loud.

“It’s too bad AIG died alright

But we just like to write hedges all night.

We didn’t mean AIG t’ meet its death,

We just meant to plunder it with bonuses n obscene bets,

There ain’t nothing wrong in that.

It wasn’t us that made AIG fall.

No, you can’t blame us at all.”

Who killed AIG,

Why an’ what’s the reason for?

“Not we,” say the politicians and regulators,

Puffing on big Goldman private label cigars.

“It’s hard to say, it’s hard to tell,

We always thought that AIG was well.

It’s too bad for the taxpayers and shareholders AIG’s walking dead,

But if it was sick, someone should’ve said.

It wasn’t we that made AIG fall.

No, you can’t blame we at all.”

Who killed AIG,

Why an’ what’s the reason for?

“Not we,” say the gambling institutional shareholders,

With their unmailed proxy ballots still in their hands.

“It wasn’t we that knocked AIG down,

Wh never dreamt AIG’s Board was so dumb.

We didn’t commit no ugly sin,

Anyway, we put money on AIG to win.

It wasn’t we that made AIG fall.

No, you can’t blame we at all.”

Who killed AIG,

Why an’ what’s the reason for?

“Not we,” says the rating agencies,

Spewing useless drivel using their useless models,

Sayin’, “the Ratings ain’t to blame,

There’s just as much danger in

the subprime dating game.”

Sayin’, “Financial innovation is here to stay,

It’s just the old American way.

It wasn’t we that made AIG fall.

No, you can’t blame we at all.”

Who killed AIG,

Why an’ what’s the reason for?

“Not we,” says Goldman Sachs whose derivative trades

Laid AIG low in a cloud of counterparty risk haze,

Whose CEO led them through AIG’s mega billion bailout back door

Even though they say they were hedged from the ground t the top floor.

“We hit em, we hit em, yes, it’s true,

But that’s what we Wall Street bankers n traders are paid to do.

Don’t say ‘murder,’ don’t say ‘kill.’

It was destiny, it was the market God’s will.”

Who killed AIG,

Why an’ what’s the reason for?

http://blogs.tnr.com/tnr/blogs/the_plank/archive/2009/03/18/they-were-against-it-before-they-were-for-it.aspx

Republicans are Men of Principle?

I jest.

Was Paulson not the Chairman of Goldman Sachs when that firm conducted most of the business with AIG that eventually led to the US government funneling almost 13 billion dollars (that we know about so far) via AIG to Goldman Sachs, a move that as Treasury Secretary Paulson tried to enable without any possibility of Congressional review, let alone contemporaneous oversight?

Stalin had show trials. Paulson should be the first to whom this courtesy ought to be extended. Maybe Professor Yoo could be engaged to draft whatever legal memo might justify charges of treason, sabotage, and conspiracy to wreck national finances. Aggressive interrogations of Paulson could be televised live, aimed at having Paulson cough up name after name of his co-conspirators. These names would be provided to Paulson in the form of a list referring, inter alia, to veritable swathes of Bush-era appointees. Once named, these individuals would be arrested. Their perp walks would be primetime eye candy for a nation crazed with vengeful emotions. Among those frogmarched for the cameras would be Hiatt and Marcus, not to mention Limbaugh, Beck, Hannity, Coulter, Rove, Murdoch, and in due course Cheney and Bush.

Paulson would eventually confess to how the Iraq War being financed by government borrowing was really just a scheme to enrich Wall Street and defense contractors, and that there existed a traitorous conspiracy to surrender effective sovereignty over the United States to the Chinese dictatorship in exchange for its support for the government bond market.

Executions would take place in public before cheering crowds of indignant workers and be televised live. Wall Street would become a row of gallows. The cathartic effect would be immense.

Local workers’ soviets would organize courts of summary justice to be meted out to members of the economics profession.

What else?

Dear Jim:

I wonder what your thoughts are on the following. Why did the $55 billion AIG paid in the form of ‘retention bonuses’ this past December to its Financial Products unit generate no reaction remotely similar to the outrage in response to last weekend’s AIG bonus news? This is more of a political than economic question, but I’d be interested to know what you think about this apparent lack of proportionality.

Back to American milestone, where people building the country with courage and self esteem, with eyes open I belief that A.I.G CEO will returning back all those bonuses.

Re median bonuses: If the NYT is right that well over half of the bonuses paid were over $100k, then the median bonus was at least $100k.

IMO we should not be outraged that AIG paid the bonuses (old dog, new tricks…) We should be outraged that the guarantee of bonuses was written into law. I think it was Molly Ivins who I first heard call our govt. a “corporate oligarchy.” I used to think she was a whiner. No longer.

I think I was wrong on the median bonus numbers. The NY Times reported that $165 million went to 400 employees. I used the number 4,000 because I read in the WSJ that $600 million in retention payments went to over 4,000 employees.

My opinion is that the government grandstanding over a few million, when TRILLIONS are on the line with TARP and the budget. Lets get the finance system working, then look for scapegoats.

MikeR: The outrage at bonuses may actually serve a useful purpose. The financial corporations need to go into receivership, before they push the U.S. Treasury into that position. Note the run from the dollar in response to Ben’s recent misguided wealth maintenance policies. The possible side effect (the fiscal stimulus from the current account improvement) may help, unless Asian currency policies push the whole thing onto Europe, which is not big enough to hold up our considerable bulk.

I watched a lot of Edward Liddy’s (CEO of AIG for last 6 months or so) testimony to congress yesterday, and I was impressed. He took a LOT of abuse, but stayed calm and explained things well. I was not very impressed by how the congressmen did not understand what he was saying! Liddy took the job for a salary of $1, and he seems to have a genuine interest in the public good. People are asking for AIG to be liquidated, and that is essentially Liddy’s plan–just not through formal bankruptcy. His plan is to wind down risky positions ($1.6 trillion in derivatives–not the CDOs and several other risky instruments) in a fairly orderly way and then break up the conglomerate by selling off the healthy pieces in order to pay back all the Fed funds supplied to AIG. He says they cannot sell off the pieces at this time because there are no buyers with sufficient capital. Thus, his plan hinges on the economy turning around within the next year or two. To avoid losing business because the brand name AIG has become so tarnished, the healthiest parts will be rebranded. His plan makes sense to me.

As for the bonuses, it seems that people are misunderstanding this entirely. While the bonuses being paid to employees of the Financial Products division, they are not being paid to the people who ran the CDO business–the latter are all gone! They are being paid to the people winding down other derivative contracts. (Most congressmen seemed miss the point that two kinds of contracts were being discussed: bonus contracts and derivative contracts.) Congressmen also seemed to misunderstand the term retention bonus—they kept asking why people left right after receiving the bonus. Liddy explained that the way the derivative wind down process was structured was to give each manager a chunk of contracts to unwind in the most profitable or least unprofitable way. They had some leeway as to how long they could take. Some finished late last year, others earlier this year. If more senior people judged that a manager had done a good job of unwinding his contracts, he was eligible for the bonus. The retention part was to retain these people until their chunk had been wound down: their goals were effectively to put themselves out of a job. Under these conditions, it does not seem unreasonable that these people received some form of bonus—but probably not the levels guaranteed to them.

The possibility that the administration orchestrated this bonus outrage frenzy for the purposes of political cover for subsequent actions is intriguing.

…AIG, recipient so far of perhaps $170 billion in bailout assistance, distributed over $160 million in “retention payments to members of its Financial Products Subsidiary.”… absolutely shocking indeed. And look at all the fuss this has stirred up, on less than 0.1 percent of the total package. Boyoboyoboy is it going to be fun once we start getting into the rest of it!

The U.S. Taxpayer did enter into the contract scenario when Treasury Secretary Tim Geither and US Senator (“I admit I lied”) Dodd cobbled together the TARP Ponzi Scheme. Both knew, or should have known, that employee bonuses were part of the AIG’s employment contractural obligations. Geither’s and Dodd’s actions tied the American people to these onerous bonuses. Now we have to pass Bill of Attainder style laws to correct the law, and these laws will be challenged in Court when most likely they will be declared unconstitutional. Thank Mr. Geither (“What me pay taxes?) and self-confessed liar Dodd for all you do for the American people.

JDH, the more I look at the timeline of events, the more this looks like a well-planned fraud to me.

The decision to provide the bonuses was made at the end of 2007. The AIG argument is that not all of their businesses had deteriorated. However, thanks to your efforts and those of Menzie (and CR and Roubini), we know that they should have known that a major event was on the horizon. After all, predicting the future and costing out the associated risk was their job.

“Despite criticism this week about its relationship with American International Group Inc., Goldman Sachs Group Inc. says it would not have lost money from its contracts with the insurance giant – even if AIG failed rather than be rescued by the federal government.

The New York-based investment bank said it was fully hedged with credit default swaps or collateral, and it rejected offers to settle trades with AIG (nyse: AIG – news – people ) at a discount” (Associated Press, March 20, 2009).

The company that got the most money from AIG via taxpayers could have survived just fine if AIG had gone under.

Where is the evidence that the financial system will collapse if AIG fails? Bernanke has never provided a shred of evidence that his fear of massive bank failures is realistic.

IT IS PAST TIME TO STOP TRYING TO KEEP AIG ALIVE.

What Nationality are the folks in the Group over in England that got the Bonuses and Started this…

Were they Americans working abroad or other Nationals just looting an American company for there gain without regard?

I mean seriously why is no one discussing this???

Everyone forget an important factor: who initiated original bail out of $85B? Hank Paulson. Who is Hank Paulson? Former Goldman Sachs chairman. Who is the biggest beneficiary of the bail out? Goldman Sachs. There was report that there was only one private sector CEO attended the government meeting which they were debating whether to bail out AIG, after they let Lehman gone under. Who was that person? Current Goldman Sachs chairman. Hmmmmmm, sometime I am wondering who was actually running Treasury Department? Goldman Sachs, or we the people?

its not just this money, but a lot of the bail out money seems to have gone towards bonuses. its like saddam hussein running out of his palace and grabbing all the gold he can

http://www.ritholtz.com/blog/2009/03/where-aig-bailout-money-went/

and the big winner is : Goldman Sachs.

Is anyone surprised ?

Huge success, greetings from the GS money club and Tim G.

Dear SHEEP…..bahhh…bahhh. You are ALL getting what you asked for…quit crying! I left the USA 10 years ago and have not looked back, or had ANY regret. Keep on and you will ALL be in a bread line…except the executives and politicians. You live in a Reverse Robin Hood State…rob from the poor and give to the rich. YOU CANNOT DO ANYTHING EXCEPT///////go there and make things right! But you will not, your all sheep………..bahhh…..bahhhh.bahhhh

A lot of anger but very little value in these commonts.

The internet has become the place to go for people who think that emotion is a good substitute for rationality.

If the good professor *feels* Tim Geithner and Larry Summer need an argument for voiding contracts then let him provide a legal argument that would overcome the legal opinion of the government staff attorney whose opinion says they cannot.