A couple of weeks ago we received the encouraging news that retail sales for both January and February were 1.8% above December. On Monday the National Association of Realtors reported that February sales of existing homes were 5.1% above January levels on a seasonally adjusted basis. Today the Census Bureau reported that new orders for manufactured durable goods rose 3.4% in February, with new orders for nondefense capital goods up 7.4%. And also today the Census Bureau reported that new home sales in February were up 4.7% (on a seasonally adjusted basis) relative to January. Is the tide starting to turn?

|

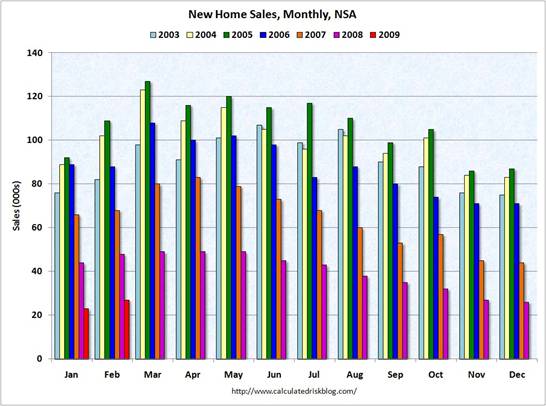

The new home sales figure is particularly relevant. Calculated Risk has been emphasizing the discrepancy between the possible turnaround in sales of existing homes and what had up until today been an ongoing slide in new home sales. Much of the strength in existing home sales has come from foreclosure resales. Large numbers of foreclosures coupled with falling sales of new homes do not paint a picture of a healthy housing market. Although the February bump in seasonally adjusted new home sales is encouraging, on a seasonally unadjusted basis, we’d usually expect February sales to be 25% above the seasonal low in December. But the seasonally unadjusted February 2009 number was about the same as was reported for a very weak December and 44% below February 2008.

|

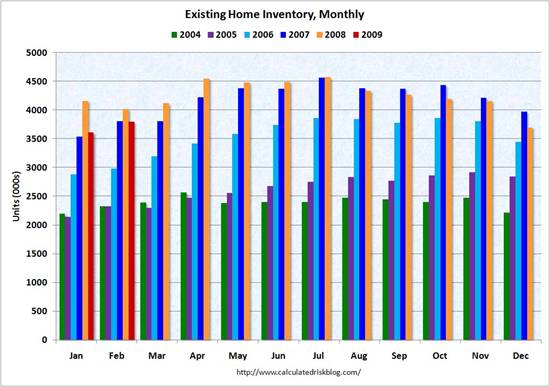

Despite the increase in sales of existing homes, the inventory of unsold existing homes unfortunately also increased in February. But the good news is that this inventory remains below the levels seen for most of 2008.

|

Here is Calculated Risk’s take on the earlier existing home sales report:

Inventory levels increased sharply in 2006 and 2007, but have been below the year ago level for the last seven months. This might indicate that inventory levels are close to the peak for this cycle. Note: there is probably a substantial shadow inventory– homeowners wanting to sell, but waiting for a better market– so existing home inventory levels will probably stay elevated for some time. There is also the possibility of some REOs [real estate owned] being held off the market.

It is important to watch inventory levels very carefully. If you look at the 2005 inventory data, instead of staying flat for most of the year (like the previous bubble years), inventory continued to increase all year. That was one of the key signs that led me to call the top in the housing market!

If the trend of declining year-over-year inventory levels continues in 2009 that will be a positive for the housing market. Prices will probably continue to fall until the months of supply reaches more normal levels (in the 6 to 8 month range), and that might take some time.

As long as house prices continue to fall, concerns about the true value of mortgage-backed securities and financial instruments constructed from them will still be with us. But a lower bound on how much farther house prices will fall would help significantly to resolve the status of trillions of dollars in these “troubled assets”.

On Monday CR wrote:

I think the keys to watch for the housing market are declining inventory levels, a bottom in new home sales, and the gap between new and existing home sales closing.

CR was right on target about the housing peak, so I trust his judgment in calling the bottom. But I take some encouragement in the news of the last two weeks.

Technorati Tags: macroeconomics,

economics,

housing,

recession

“Is the worst behind us?”

This question and your use of the word ‘turnaround’ make me wonder what you think lies ahead. It seems quite obvious to me that we cannot return to the unstable regime of 2005-2007 based on excess borrowing. In addition, the basic soending capacity of a huge number of persons has been reduced even beyond their inability to borrow – because any investments or pension they might have had has been crushed.

I think that before you use the word ‘turnaround’ you have to establish not just inflection of some lines but also some economic basis for expecting an increase of activity. Otherwise, all that the graphs establish is indication of possible leveling-off.

IIRC there was an FRB-Boston study not that long ago which concluded that mortgage defaults were more closely related to the level of unemployment than to house prices (“underwater mortgagors”).

In evaluating bank solvency (“legacy,” “troubled,” or “toxic” assets) should the dominant metric be a bottoming of house prices or a bottoming of unemployment rates?

The whole idea of a turnaround is based on a fales premise. Our current economic crisis is not due to some natural business cycle that will magically turn around when it has run its course. Our current economic crisis has been specifically created and as long as the policies that caused the crisis are inplace and expanding there can be no “turnaround.” Turnaround will only come from a change in decisions not because housing has “recovered.” Housing purchases are a function of a strong economy; a strong economy is not a function of housing purchases.

The new home sales explanatory notes indicate that nearly every number in the new home sales release is statistically insignificant. This means that “it is uncertain whether there was an increase or decrease” in that number. For example, new home sales increased 4.7% in February “plus-or-minus 18.3%”

The NAR’s inventory estimate underestimates inventory because of “phantom inventories” . A significant proportion of foreclosed homes are not listed by the multiple listing service, so tthey are not included in the NAR’s database. A better measure of slack is the Census Bureau’s homeowner vacancy rate, which measures the proportion of homes that are vacant and for sale—and which stood at an all time high at the end of the fourth quarter of 2008.

One key statistic pointing to “better-times-ahead,” however, bears watching. Last week, the Census reported that single-family housing permits (which has a beautiful 90% confidence interval of 2.1%) increased 11.0% in February, but today, it revised this increase to 16.1%.

This isn’t the only evidence that the worst might be behind us.

One of the NBER’s economic measures (real income after transfer payments) made a low in September 2008 that it hasn’t returned to (yet?). Today’s durable goods numbers suggest that another NBER measure (industrial production) will be up from its February 2009 low.

A turnaround isn’t all that far-fetched.

And I’m still scratching my head over the reluctance of some (allegedly endangered, with their downfall threatening the entire global financial system) banks to accept bailout money. Things must not be as serious now as they seemed to be last Fall.

Sebastian

Can the worst be behind us, and yet, at the same time the bottom is still in front of us?

I believe the risk of system-wide collapse is behind us. We came awfully close. Might still take a while for all the lemmings to scurry home and get on with the day-to-day.

Define “worst”. Certainly the most rapid decline in activity is behind us, but slower decline still means worsening conditions. Surely, you aren’t relying on a single month’s housing and durables data, or two months nominal consumer spending – right after a dreadful holiday period – to call a trough in overall activity. So what, exactly, is the question you mean to put before us?

While we are at it, does asking if the worst is behind us, right after Fed officials have explained that a deterioration in the outlook prompted them to accelerate the expansion in the Fed’s balance sheet, mean that you think the Fed has missed the turn and is over-stimulating?

OK, I’m going to try again.

Define “worst”. Are you suggesting that the pace of decline will slow, or that we are about to commence an expansion? I think a slowing in the pace of decline is a near certainty, given the recent pace of decline. I can’t believe you really mean to use one or two month’s data from a time of year that is prone to wobbles of all kinds as evidence for a turn.

If you do, does that also mean you think the Fed is committing a policy error? Fed officials have explained their decision to expand the Fed balance sheet more rapidly by saying that the outlook had deteriorated. Is that mistaken?

Oops.

Rebound indeed. We are squinting for improvement during a period of an ongoing bubble in long-term interest rates, thanks in large part to central banks’ ‘quantitative easing’. When the market eventually reasserts itself in the area of long-term interest rates, what will be the demand for housing?

When 10 yr Tres require 7%+ to entice takers, as they will in 2 or 3 years, mortgage rates will be the other shoe that is yet to drop.

I think we’ve passed the inflection point — we’re not falling as fast as we were a few months ago. That’s not the same as finding the bottom, and it’s certainly not the same as starting upwards again. But it’s better than continuing the freefall of Nov-Dec-Jan.

Ellen1910 asks a good question. Traditionally, unemployment is seen as a lagging indicator. So will housing be more forward looking?

Real manufacturing and trade sales in Jan & Feb followed the same pattern of retail sales–up about 1% in Jan & 0.1% in Feb.

Moreover, the real manufacturing & trade I/S ratio appears to have peaked in December although it did not improve much in Jan & FEB it did fall.

This implies that in the goods sector — manufacturing, wholesale and retail trade — the economy is shifting from involuntary inventory accumulation to inventory liquidation. Consequently, for firms in this sector they are going from building and/or buying goods they are not selling to selling goods they have already paid for. This is a key factor in a bottoming of profits in the goods sector and an end to large scale lay-offs.

Even if housing and cap spending has not bottomed, the shift from inventory accumulation to inventory liquidation is an important change in the “phase” of the business cycle. To me it implies that the economy is in the process of bottoming.

P.S. The available data on inventories implies to me that the standard assumption built into most first quarter forecast that inventories will be a big negative for first quarter growth are way too pessimistic.

Is the worst behind us? That depends on which sector/data you think is important :

CA, NV, AZ, FL Housing : No

Rest of US Housing : Yes

Job losses : No

GDP : After Q1 data is out, Yes

Inventories in Tech Sector : Yes

Inventories in Automobiles : No

Threat of Deflation : Yes

Threat of ‘Great Depression II’ : Yes

Threat of Japan-style weak decade : No

Threat of double-dip recession in 2011-12 : No

Stock Market : Almost. One more re-testing.

So depending which indicator matters to you, your answer will vary on whether the worst is behind us or not.

We are moving from the housing-collapse explanation for the decline in aggregate demand to the attempt-to-buildup-savings explanation for the decline in aggregate the demand. The role of the trade deficit will become clearer now, I think.

That was January sales, but they report them in February. Pending sales, reported in March are February sales. Guess what? They tanked.

Retail sales and durable goods are declining in March(I have my sources).

Don’t be fooled by month to month jibes.

Housing affordability is at a 50 year high. Don’t underestimate the power of affordability.

Its just about as cheap to buy as rent. Housing starts are at 1/3 of underlying demand.

Inventories of unsold new homes are down 40% from their peak.

All of these are quite positive indicators. However caution is still desirable because:

1. The inventory of vacant homes for sale is still at a peak although only up 2% year on year at last count.

2. Foreclosures are about 40% of existing home sales. However Govt. action will slow foreclosures while the cram down details are being finalised.

3. House prices are still falling (2% a month).

What does this add up to? In my view a stabilising market but not one that is about to turn around in a real hurry.

What is wrong with building up savings? Sure, it is at the expense of short-term consumption, but savings have to be built up eventually anyway.

Furthermore, regarding the crash in both housing and the stock market, this is bad for people who are 55+ and had lofty retirement goals.

But this is very good for people under 35, as they can now make their 401K contributions to buy up equities at lower prices, thus getting a higher 30-year return than they previously might have. They will get an impressively low cost-basis on their 401K assets.

The same goes for housing. Baby boomers have bestowed the post-1980-born set with discounted first-time homes for them to buy. A generation that thought they could not buy homes now can.

kharris: Given the conventional wisdom on monetary policy lags, the fed either anticipates worsening conditions or has clearly ‘over-stimulated’. I’ll reiterate that I believe the fed reacted in a panic mode. Not good.

lilnev: Was musing that shrinking is OK as long as the economy is not contracting too quickly. A decelerating rate of negative growth carries the glimmer of hope of near-term positive growth.

This housing data calls for the skills of a time series econometrician. Anybody up to the task? Jim, do you have an eager grad student? Here is my observation. I think the seasonal pattern has changed because different climates are coming in with different weights. Where has the housing market collapsed most completely? — California, Nevada, and Florida. What all these states have in common is mild winter weather. So housing starts in January would have been disproportionately depressed by the fact that the usual housing starts would have been disproportionately in mild weather states. However, coming off the unnaturally depressed January, the most recent figures would look like an unexpected rebound. The proof of the conjecture would be to disaggregate housing starts by state or climate and evaluate recent housing data in the disaggregated data.

just looking at the case/shiller plot, it seems to me that we will have a few years of flatness in prices, and then a very slow recovery.

all assuming we already hit the bottom, and credit environment will be the same as 2002-2005, of course (something i wouldn’t dream about too much)

This is question for those who understand these things. Last week the Fed announced they were going to buy $1.3 trillion in long term treasuries. This, I understand is printing new money. This also caused me to worry about inflation.

Here is the question: since the US stock market has lost tens of trillions of dollars over the last 12 months it is my understanding that the m3 money supply has declined by that much. If so it seems that printing another trillion dollars in money should not be inflationary because it is only replacing a fraction of the money that dissappeared. Does this make sense?

The numbers always rise in February versus January, especially when it comes to home sales. You need to look at Year on Year changes to make an honest assessment.

Housing will bottom when the median price is 2.5 times median income. Median income is still falling, but let’s call median household income something like 48k. Median house price should fall to $120-125K. Until then, no bottom.

As far as claiming that a housing bottom will resolve the status of “troubled assets”, that depends entirely on where they are being marked. Most of what is going on and being said leads me to believe they are massively over-marked right now. So even if this is the housing bottom, the derivative bottom is still many trillions away.

Let the stock market have its fun. Gosh, all those investors and analysts must be right, right? After all, they did such a good job over the past ten years.

As per usual on otherwise serious econ blog comments: there is no news that can be good news, else it is wrong news. One would think people would be much more cautious about adopting their own conventional wisdom so fervently given what has transpired.

Carlo, you are confusing money and wealth. The value of stock market shares is not part of M3. Whether the Fed’s reckless action(IMHO)will fuel much inflation depends on people’s willingness to hold more cash at current prices. If people are willing to walk around with 50% more cash in their wallets, checking accounts (and bank vaults) without spending any of it (or in the case of banks, loaning it) then the policy won’t effect the price level. But if people have no desire to hold additional cash (or reserves) except insofar as higher prices dictate it, the result will be inflation. Inflation usually takes 6-18 months to fully appear, so don’t assume I am wrong if nothing happens this April.

I find the “good news” grasping at straws interpretations of some of these numbers rather distressing.

We need to unwind a 30-year private debt/credit bubble and get this economy on a sound basis where finance plays a lesser role and manufacturing plays a greater role. Yet people are willing to accept any number which appears to signal that the deleterious trends of the last 3 decades did not happen. In other words, we’re OK after all! We didn’t mess up! No political corruption here! Insolvent Too Big To Fail Banks are just fine with me!

I’m not talking about Econbrowser. It’s all the happy talk on NPR, CNBC, CNN, etc. when durable goods orders go up a bit.

Give me a break.

The Fed anticipating worsening conditions and overstimulating are not two different options. One is the cause of the other, if the Fed is in fact overstimulating.

I had two initial questions. One is, what is meant by “worst is over”? I agree with lilnev and, apparently, with spencer (which is always reassuring), that we are no longer going to fall as fast as we have. That means only that the worst decline is over, but not that decline is over. The worst in the most common understanding of the word lies ahead, even as early indications of improvement are seen.

Fuzzy numbers and bad reporting on both durables and housing. Rather than repeat it all here, I’ll recommend that these links (not my web site and no affiliation with it in anyw way) be evaluated.

First on the “rise” in housing numbers (where the reported 4.7% increase is subject to a margin of error of plus or minus 18.3 percent), see here: Fuzzy Reporting – Press Helps to Distort Housing Data

And here: More Fuzzy Reporting: New Home Sales Misrepresented

And on durables (the other supposed bright spot), see here: More Fuzzy Numbers – Durables

Don’t misunderstand me here. I am not rooting for bad news or failure. But I am rooting for better reporting and real (as opposed to fuzzy) numbers.

People should be aware (if not just flat wary) when it comes to things like housing numbers coming from industry groups that these groups are…well…not disinterested or necessarily objective.

(If anyone following those links has some issue with the deconstruction which renders the analysis I am using as a basis for taking issue with the idea that the “worst may be behind us” open to question, well, please let me know what it is as Dr. Martenson, at least on most issues, makes quite a bit of sense to me.)

Sorry, got that post wrong. I’m not GNP. I was answering GNP.

The second question I meant to repeat when I was so rudely interrupted by GDP revisions was whether we want to hang our hats on a month or two of volatile data. I think there is a reasonable case to be made that the pace of decline in economic activity is slowing, but waving around a few favorable data points seems a weak way to argue that point. Look back over recent quarters and you’ll see equally large bounces in housing activity, retail spending and the like, all on the way to even more disastrous declines.

What we have going for us now is that, whatever level of activity the US economy can sustain under current conditions, we are nearer that level now than a few months back. That is what more stable inventories would imply. The GDP revisions today, by the way, show inventories a net drag on output in Q4, not a net add, which supports the notion that they will be less of a drag in the future.

Housing data is awful if you compare Year-to-year data.(media is stupid in saying housing is faring well)

http://www.ritholtz.com/blog/2009/03/new-home-sales-fell-41-in-february-2009/

banks are better only because their holes has been filled by the government else they would have been all bankrupt by now.

in other words all the risk from the banks has been/is being transferred to the government balance sheet.

private sectors losses has been/is bening socialised to the tune of 3-4 trillions.

now the big question: will the USA credit suffer? if the answer is yes….then look out below.

if USA can withstand couple more trillions in debt/deficits….then i guess we have distributed our ills to rest of the world in the form of USD dilution.

The composition of the profits collapse in the last quarter is interesting. Non- financials fell by $89bn (saar) or by 11% whereas financials fell $179bn (saar) or by 59%.

Even if there is an ongoing increase in write offs/bad debts it seems unlikely that it will continue at this rate. In which case a recovery of financial profits seems likely and with it a recovery of profits overall.

As profits provide both the spur and the incentive to accumulate, a rebound seems inevitable from here on in.

bill:

what profit in financials are you talking about??

couple of trillions gifted to them and of course they will be profitable.

but what about the government which is taking all the bad assets off these financials onto themselves?

I wasn’t making a moral point. I agree with you they’re out of order. As for the government – a trillion of quantitative easing will do wonders for their balance sheet.

But the rate of write downs simply won’t continue at the pace seen at the tail end of last year. The FDIC noted in their December quarterly report;

“Loss provisions represented 50.4 percent of the industrys net operating revenue (net interest income plus total noninterest income), the highest proportion since the second quarter of 1987 when provisions absorbed 53.2 percent of net operating revenue.”

Certainly there will be more losses, but the rate of losses will almost certainly slow down. Citi and Bank of America have already claimed to be profitable this quarter – sure without reference to write downs – but provided the rate of write downs slows they will return to profitability.

Given that the bulk of the drop in profits has consisted of financials, all things being equal, (big if to be sure) this will lead to a recovery of profits, as non-financials have maintained high profit rates even during the crisis.

you seems to me missing my point.

profits in financials are a moot point right now, since their losses are getting subsidised beyond their bankruptcy point(without the 100s of billion AIG, Citigroup, BofA, Wells Fargo etc… would have been bankrupt by now)

you think QE is great….it would have been put to better use if they have used that money for constructive purpose like stimulating the economy….rather than subsidizing losses of those financials.

i agree with you that we may not see any more writedowns in financials (simply because they are getting absorbed by the FED) but there is still a small probability that their balance sheet is so out of whack that government may decide to nationalize(by diluting existing shareholders and maybe bond holders) them after they are able to unwind the huge derivatives that have made the system unstable.

For what its worth I would nationalise the banks without compensation and use the money to reflate the economy too.

That way you could guarantee lending, wouldn’t need to waste money on bonuses and the recession would be over in a jiffy.

For what its worth, Goldman Sachs make the same point;

“The Bureau of Economic Analysis (BEA) reported the sharpest quarterly decline in pretax “economic” profits since 1953. However, some of this probably reflects asset write-downs in the financial sector, which accounted for about 70% of the total decline reported. Although such write-downs are normally excluded from the GDP data, the BEA notes that quarterly reports from firms often make it difficult to extract these losses. Accordingly, we would downweight the steepness of the decline while recognizing that the economic environment was obviously not conducive to profit growth. Outside the nonfinancial sector, declines were pervasive but less sharp.”

Serious macro good news? All i see is consumer spending, roughly flat for several months and with a savings rate that reached 5% in Jan. This looks like enough to account for wealth effect bad news. Suggests that if govt keeps real DPI flat then real spending could hold. This too much to expect but much lower rate of consumer spending decline likly near term. News slightly revised with this mornings data with the savings rate at 4.4 and 4.2% Jan/Feb

Nice summary GK. For Bill J on profits, check out the S&P reporting of 4Q S&P 500 “profits” where the LOSS exceeded the largest plus side quarterly earnings ever.

http://www2.standardandpoors.com/spf/xls/index/SP500EPSEST.XLS

Operating profits similar to BEA were also at a slight loss. Goldman didnt see that coming.

This year seems to playing out like last year did. Numbers were better than expected and the economy found itself in a period of optimism over the stimulus plan. However, even though it is likely that the market is preparing for gdp growth to turn positive in the second half of the year, economists and investors are likely to be disappointed in the growth and numbers leading to the way down as happened last fall. Until debt is restructured (either defaulted or terms changed) the cash flows are insufficient to service the debt.

“The whole idea of a turnaround is based on a fales premise. Our current economic crisis is not due to some natural business cycle that will magically turn around when it has run its course. Our current economic crisis has been specifically created and as long as the policies that caused the crisis are inplace and expanding there can be no “turnaround.” Turnaround will only come from a change in decisions not because housing has “recovered.” Housing purchases are a function of a strong economy; a strong economy is not a function of housing purchases.”

This is exactly right. Promising that the economy WILL ‘turn around’ is just an empty promise. A ‘politician’s promise’.