Do recently rising oil prices signal a resurgence of economic growth?

In the WSJ Blog Environmental Capital, Russell Gold writes of

a growing belief that the economy could be regaining its footing and oil prices will climb to the price that OPEC is willing and able to defend…. “[T]here would be no reason why the current price rally could not extend to $75 within a fairly rapid timeframe,” [Paul] Horsnell wrote in his weekly overview of oil-market conditions.

Believers in oil-market fundamentals are left scratching their heads. Exxon Mobil Corp. chairman and chief executive Rex Tillerson told reporters earlier this week that he couldn’t see any reasons involving supply and demand to push up oil prices. He attributed the recent oil rally to fluctuations in the U.S. dollar and people trying to get in front of a perceived economic recovery.

The first point I’d emphasize about this hypothesis is that the recovery people are talking about isn’t necessarily in the U.S., Europe, or Japan. Developments in those countries are not what have been driving the oil market in recent years. These regions reduced their consumption of oil by almost 800,000 barrels per day between 2005 and 2007, a time when the price of oil was booming. The increases in demand over that period came instead from places like China, India, and the Middle East.

|

And, as Dave Cohen notes, the additional drops in consumption from the major industrialized countries since the start of 2008 have been quite remarkable. U.S. oil consumption in the first three months of this year averaged 18.8 million barrels per day, almost 2 mb/d below the value for 2007:Q1. Japan’s real GDP fell at a 15% annual rate in the first quarter, and its

overall oil product output for April was 14% below year-earlier values, though the April measure of Japan’s industrial production showed a sharp gain. GDP declines in Europe also exceed those in the United States.

So to the extent that oil speculators see any green shoots, perhaps they’re in the nature of Asian bamboo rather than American prairie grass.

Chinese oil consumption was up 4% in

April, though that was the first year-on-year gain for them in 6 months.

India’s oil consumption also seems to be growing. But so far those gains are well below the drops seen in the U.S. and elsewhere.

Whatever recent developments in Asia may mean for the future, there is a physical product being produced and consumed in the here and now at a price that Friday moved above $66/barrel. If that price is such that the current quantity produced exceeds the current quantity demanded, it would have to show up as an addition to storage, either as inventory build-up, or, as Dave Cohen emphasizes, held in tankers at sea. The graph below plots the behavior of U.S. crude oil inventories over a typical year, along with what actually happened in 2008 and so far in 2009. The fact that inventories were significantly below average in the first half of 2008 is one of the indicators to me that you can’t attribute the whole run-up at the time to speculation.

|

By contrast, so far this year inventories have been well above average. Futures prices had exceeded spot prices by enough until recently that there was a risk-free profit to be had from buying at spot, storing the product physically, and hedging by selling futures. Had it not been for the added demand for oil coming from inventory accumulation, the price would have fallen further. Nevertheless, it is interesting that U.S. inventories have been coming down significantly during May, the same month when oil prices started to rise significantly, although inventory levels remain above average. Here’s Dave Cohen’s conclusion:

Physical traders storing oil will start dumping it back on the market. They will need to dump it all or pile up losses leasing supertankers. The ensuing snowball will cause the oil price to crash. Oil may fall below its February low as today’s distorted $62 price becomes tomorrow’s distorted $25 price.

China’s demand may or may not be about to resume its spectacular growth, but if not now, in a few years surely. Anyone who sells oil now at $25 rather than wait a few years would in my opinion be throwing their money away.

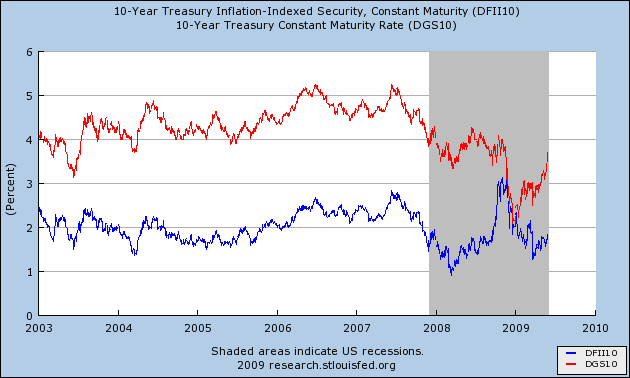

Then there’s that question of inflation. If you think that current U.S. budget deficits raise a significant

risk of future inflation— and I do– a long position in commodities is one way you might want to hedge against that. Granted, oil’s price is rising in every currency, not just dollars, though the inflation risk is not by any stretch confined to the United States. It seems unlikely to be a coincidence that these moves in commodity prices coincided with a surge in long-term U.S. nominal yields, a surge that is not matched by TIPS, though the gap between the two (the implied expected inflation rate) is still smaller than I can explain.

|

Maybe prospects for near-term real growth, particularly in Asia, have improved. Maybe expectations of inflation have been creeping up. Or maybe, as Dave argues, speculators have gotten ahead of the reality of the first two. But oil stores for quite a while, particularly if you just leave it in the ground. Anyone with oil to sell should be looking not months but years ahead.

Perhaps those crazy speculators are doing just that.

Technorati Tags: oil,

oil prices

I’m reminded of a wag’s comment; “The markets can remain irrational a lot longer than you can remain solvent.”

Then again, it more like a game of chicken. Traders can count. They see 300 million vehicles thirsting for gas. If prices decline – to $35 a barrel – massive US demand will increase and probably quickly.

The $35 oil price mirage is what prompted the ‘Green shoots, BTW.

The increase in demand will strip inventories and the price will zoom up. Why should traders endure the inevitable whipsawing when it is easy to bid up prices in the futures market – using Fed money – and keep prices stable?

After all, traders afe just people, too!

– I don’t have the figures in front of me but the current price is in line with yearly averages and less than last years average price.

– The market can be held by a few traders because only a few traders make up the market. The market itself is very small relative to the bond market, for instance.

– The Chinese can keep energy prices high by not buying Treasuries and buying commodities futures instead.

– All the oil in storage will eventually get used up. It will not go to waste.

Personally, I believe all the fundamentals are in place for another spike up to + $100 a barrel. There is a lot of Fed liquidity w/ no place to go. It’s in a liquidity trap. Too bad it can’t stay there … generalized inflation is nonexistent. There is no public borrowing and spending. Nevertheless, as someone whose name escapes me at the moment suggests, petroleum demand is highly inelastic. People will buy gas. Added to the inelastic demand and liquid market there is the fundamental of Peak Oil Availability taking place in 1998 – look at prices.

There is a basic misunderstanding that the world’s economy can stand $80 – $90 oil. This is insane, the world’s economy cannot withstand $45 oil. Am I right? Why is manufacturing relocating to China? High wages plus massively increasing energy prices plus capital costs plus management and marketing costs against diminishing purchasing power equals no profits for business.

No profits means no business.

Looks like inflation expectations. Silver is up 25% since April 1st. Prices are recovering quicker on oil than I had expected. On the other hand, crude overshot on the way down. Future supply prospects are dimmer now than they had been in the beginning of 08.

We have a positive yield curve with a 3.5% spread. This is a good thing.

However, it is time for the FF rate to rise at at least back up to 2%. That will not derail the recovery, but will correct the ridiculous 0% rate we have now, and may soften the threat of high inflation.

Start raising the FF rate back up to 2%.

The global economy can handle $100 oil, no problem. More and more new dollars of GDP growth is derived from information technology, that is not tied to the price of oil.

The central banks of the world, led by the Fed, are ‘printing’ money with abandon to deny any return at all to low risk savers. CDs yielding less than 1% before you pay taxes on the 1%, for instance. (& then Bernanke complains about Americans not saving)

The money has to flow into something. It isn’t unusual for commodities to be the 1st thing it flows into.

Dave is probably right. There are about 300 million excess barrels (crude and refined product) beyond normal inventory levels, so that should affect the market.

Overall, we might expect some transient pricing weakness, not down to $25, but perhaps into the $40’s and for longer periods (weeks, maybe) into the $50’s.

At the same time, indicators suggest that US oil consumption (and the GDP cycle) troughed around May 15, so I would anticipate demand should begin to increase going forward.

Not really clear whether supply or demand is running ahead (thank you for the disconcerting Q1 revision, EIA), but I would think demand might be running ahead of supply within the next 60 days or so.

At that time, pricing power will tend to revert to OPEC. Consider: the North Sea and Mexico’s Cantarell are both down a solid 11% since the beginning of the recession. The US rig count has fallen by more than half over the last year, so expect US output to decline as well. Overall, then, non-OPEC supply is looking fragile. Meanwhile, OPEC, in concerted action, has reduced supply by some 4 mbpd. A simple reading of the situation looks like OPEC will emerge from this recession with pricing power similar to that of 1979: strong control over incremental production and practice in concerted action.

If OPEC opens the tap, then prices could remain in the $60-75 range for a while. If not, prices could surge quite a bit by year end.

By the way, the max sustainable price for oil for the US appears to be around $80. The current oil price is $66.

And Secretary Chu has been off in London telling people that the way forward is to paint their roofs white.

I’d like to see an oil supply curve.In my imagination its very steep over the last 20% of oil demand making the price sensitive to small shifts in demand.

Even accepting that there is a speculative element to oil and that inventories are up to 20% below a (rising) average its still difficult to see where the new supply is coming from to meet field declines as well as increased demand.

Fundamentally its easy to be an oil bull and I venture to suggest that just about every oil company out there remains optimistic about the long term price of oil.

Gas may be another matter. Its much easier to see the supply increase.

“By the way, the max sustainable price for oil for the US appears to be around $80. The current oil price is $66.”

Define sustainable. With no habit adjustments at all, perhaps $80 is correct.

There are a number of relatively painless adjustments that people could, and should, make, however. A 10% reduction in consumption is easy.

The innovations that reduce oil dependence are also slowing inching forward. Another 10% reduction in consumption from here.

Innovations in efficiency are also emerging. Yet another 10%.

So a 30% reduction in demand is possible through a combination of habit changes and innovation.

I am in the inflation/dollar weakness camp. I think the signs are that the world is very concerned about Washington’s inability to rein in spending, and the concomitant necessity of borrowing.

I wonder if the continued increase in the price of oil will choke off any possible recovery.

Sustainable: When crude oil expenditure has hit 4% of GDP, the US economy has gone into recession every time since 1972. 4% of GDP equates to $80 / barrel at 18.6 mbpd, the EIA’s projected number for May (or it is June).

For the record, US consumption peaked at 20.7 mbpd and will have troughed, if I recall correctly, at 18.1 mbod for this cycle.

U.S. economic policy? LOL Benefits from high oil, as we transition over the next two decades out of the fossil fuel sources and into much cleaner sources. Only the high price pressure of fossil fuels can bring about the change required. I would rather have $60 to $90 a barrel oil than to have it spike and crash!

In anticipation of the question, “What cleaner sources?”, I readily admit I do not know, but necessity is the mother of …..well you get it!

Oil is at $68/bbl and gold is testing the 12 month high set in February 2008.

Professor, if your analysis is correct, and I have no reason to doubt your numbers, we should see a return of the decline this summer as oil prices climb.

From Bloomberg today —

Technical momentum! Don’t step in front this train! Will wonders never cease?

JDH: “though the gap between the two (the implied expected inflation rate) is still smaller than I can explain.”

The TIPS will give the same returns as ordinary bonds when prices decline, as they are not adjusted for deflation. So, if deflation is a possibility, TIPS become a hybrid of nominal and real bonds and the gap between will tend to overstate true expected inflation.

You must be expecting considerably more inflation than the market.

I thoroughly enjoy Prof. Hamilton’s posts on oil prices. The links are most interesting. Thank you Sir.

Question: Can anybody recommend a piece of writing that examines in detail how benchmark oil prices declined to US$10/b in the late 1990s on the heels of the Asian financial crisis?

Many of you will recall that a handful of emerging Asian Tiger economies suffered sharp economic contractions while both China and the USA continued to exhibit positive real rates of growth.

If the American market was isolated, which of course it is not, but just for illustration, what is the marginal cost per barrel for the oil people to increase oil production from 18 million to 19 million. The last number I heard on that was somewhere around $60, so prices about $60 would make sense. If it goes to $100, that would tell me that trillion dollars that has been sitting on the sideline for the last nine months is speculating on oil prices.

And… let’s clearly define our terms. Someone who buys oil to stockpile it for his own use is a USER. Somebody who buys it with no intent of ever refining it is a SPECULATOR.

Dave,

When the cash price of oil dropped to $35, the Dec 2011 price for crude was priced at $60 . The 2011 price never got below $60. Even if you are correct and the price drops to $25, the long term futures prices will probably stay above $50.

Back in 2004, the long term futures prices tracked the cash price. Those days are over and the market has finally acknowledged the peak in production.

Sink or swim, the chips are down. We have a handful of years to make a transition. I’m bullish on oil and hope to wake up the slothful energy hogs.

I feel that the price of oil and gas is still so high due to the greedinedd of wall street and the oil companies. While the world was going into turmoil and the economics of the world were falling apart the oil companies were recording records profits without thinking about the everyday normal person who has to buy or not buy the gas.

Peak oil theorists are truly ahead of their time. So are the Greens. I mean that earnestly. But as of today there is no supply constraint in sight. The Arab producers have taken a lot of production offline, and delayed bringing their next fields online. It would take years of strong consumption growth to run up against capacity limitations.

The recent bidding up of oil assumes that Arab producers will maintain reduced output for at least the next several months. It also assumes a near-term pick-up in demand globally. As for China, it’s the stockpiling, not the consumption, that needs to be watched most closely. Believe it or not, China was stockpiling at $120. When they stopped, the market tipped. Recently they’ve been stockpiling again.

What could make oil producers sell at $35, or lower? Not stupidity. They need to bring in money, and it’s tough to agree and implement cuts on the scale required to affect the price. The Arab producers are getting better at it, but they’re annoyed at having to carry the cuts themselves while giving the rest of Opec and non-Opec producers a free ride.

Interesting Commentary by the wealthy and Speculators here. As a consumer, I believe strict financial requirements need to be put in place so Speculators can not control vast amounts of futures with small amounts down. Another thing not mentioned by most is the largest oil find in 49 years on the South East Coast of China. That was two years ago, yet is being ignored by media and supposedly smart speculators. Just two weeks ago, Exxon Mobile & Texaco joint ventured with China to build the Worlds largest refinery over this huge oil find. Bet nobody heard much of that huh? If this were all public, then the price of oil, if truly speculative, would plummet to the near-term price of $35bbl. This new field is said to be larger than the Saudi Fields and make China self sufficient in 8 years. Wonder why nobody talks about this? Could it be it would destroy the false builds in the futures market? But then, I am just a lowly consumer, what do I know?

There was a time in our history that the government could build dams that would supply a cheap source of power for our industries. Sad to say but those times have come and gone. But I believe that even if we had a cheap source of power we could not compete with the Chinese in the manufacturing field. At first I thought they were dumping there goods on us at a lose in order to put the American companies out of business. It has been going on to long for that. So what are we left with? We are the innovators right? The people that do the manufacturing are the ones that are exposed to the technology. That is not us. Even if you were brilliant and came up with an ideal like slicing bread what would you do with it if you live somewhere that does not make bread? Go to the place where they make bread and sell it to them right? The Chinese do not even respect the rights of there own citizens why would they respect our patent rights? We have nobody to blame but ourselves. As a country we were given the best start possible. We blew it. I just hat the fact that my children will end up paying the bill.