A couple of disappointments in this week’s data.

New claims for unemployment insurance have peaked just before the end of each of the last half-dozen recessions.

|

Unfortunately, the Labor Department reported today that seasonally adjusted new claims for unemployment insurance rose by 32,000 for the most recent available week. That bumps the 4-week average to 630,000, up 6,000 from its value the previous week, though the average is still below its peak of 659,000 reported April 9. That the downward trajectory will resume next week is far from clear.

|

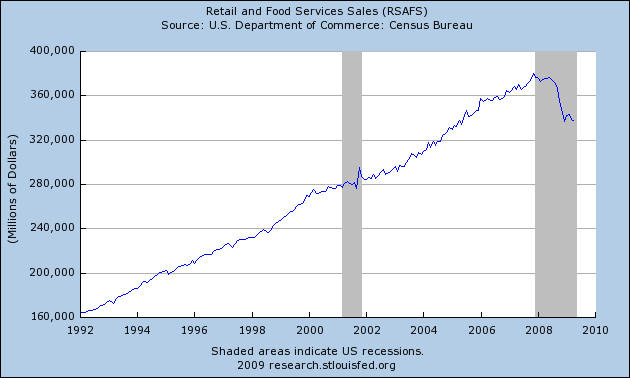

We also received the news yesterday that monthly sales for retail and food services fell 0.4% in April, the second consecutive monthly drop. That, too, is a disappointment for those who are waiting for increased consumption spending to lift us out of recession.

|

Technorati Tags: employment,

recession,

macroeconomics,

economics

Dude,

What happens when “good” Chrysler comes out of BK in 60 days, do these 60K employees get back their jobs?

Not till Q3, as I have been saying :

1) NBER recession trough in Q309

2) 131M jobs at the jobs bottom

3) UE rate exceeds 10%

There is one more leg of false hope that has to be worked through.

If claims in any week do not go above 675 000 in next 3 weeks the fact that April 9 was peak will become obvious (not that I doubt it, but for those who do).

How fast the jobless claim speed will decline, is another question- historically, it can have a plato at around 550 000 for almost a year as economy keeps restructuring or drop to 350 000 by the end of 2009 if there was no real need for such a big scare.

When GM shuts down its factories for 9 weeks, we will see another spike in new claims. I do not see how we can pretend the recovery is started when two major manufacturers are moving through bankruptcy with ripple effects on suppliers, dealers and the communities where the plants are located. American Axle is closing three plants and laying off 600 workers because they are not getting new orders from GM and Chrysler.

These claims data are too early to reflect the C layoffs.

Claims in Michigan actually fell– because auto layoff moderated according to the Michigan unemployment office.

But we know large C & GM layoffs are on the horizon as GM shuts down for 9 weeks rather than the normal 2 weeks for summer vacation and C shuts down while in bankruptcy –to eliminate inventories.

The character of job losses is different this time, so the “peak analysis” is suspect.

This recession job loss has two characteristics:

1) As a % of the employed base jobless claims are far lower than previous recession peaks. One any given month, one could think of this as a “mild” recession.

2) Obviously, its not mild, and the duration of jobloss reflects this. From the household employment survey, one can see that the ratio of long term (greater than 27wks) to short term (less than 5wks) unemployed is at 1.1, far above the previous 1983 peak of .8.

So obviously, this is not a steep cyclical decline in jobs used to cure excess inventory. Instead, it is likely a slow, consistent structural decline in labor capacity, one in which the “peak” may mean little, because its the DURATION that determines how much capacity we will eventually shed.

We have just begun to see the employment effects of the bankruptcies on the carmakers–Chrysler & soon GM. Besides those laid off at least for the summer at both manufacturers, we are already seeing some 2,000 dealerships told they are being cut off now or in the months ahead. And with production cut through the summer, we can expect layoffs at suppliers as well–and they are less likely to bounce back later than the manufacturers.

And with those 10s if not 100s of thousands of workers out of work, why would anyone expect the consumption engine to drive near-term economic stability, much less recovery.

We’ll see a bump in the economy in 4Q as fed stimulus jobs & holiday sales kick in, then it will be back to negativity through at least the first half of next year.

While there is focus on initial claims, continuing claims have exploded for 15 straight months to over 6 1/2 million, an all time record. It would seem creative destruction is destroying without creating anything.

Note, though, that industrial production got revised upwards today: from -1.5 to -1 in february; -1.7 to -1.5 in march; and only -0.5 in april. positive revisions are a good sign. The ADS index now looks much better than before.

“New claims for unemployment insurance have peaked just before the end of each of the last half-dozen recessions”

How convenient that 1970 is not in the last six out of seven recessions.

One in seven datapoints, for such a limited sample, is pretty significant.

And that’s before we account for the lengthened recession averages when coupled with banking crises, as Rogoff-Reinhardt have shown, and for the global slump.

I think any bump we see in GPD we’ll see will be only nominal. Not that “real” GPD won’t increase, just that the CPI will increase more.

I strongly suspect that monetary policy and goverment spending is pulling money away from investment in actual productivity and inflating costs. That’s even before the regulatory uncertainty.

On a lighter note, since the auto companies have less people working and the interchange near my office is under construction, there are a lot less slow-pokes in the way during my commute. My commute is shorter and I’m getting better gas milage.

Going beyond our fiscal problem, I think the economy has suffered much more than we realize from a decrease in our transit efficiency. I think transit is being mis-mananged, our aging population has slowed down and increased congestion despite less driving, and cell-phone use while driving has had similar effects.

I recommend these 2 articles.

http://www.itulip.com/forums/showthread.php?p=86995

“A depression, unlike a recession, is not induced by government raising interest rates to combat inflation. On the contrary, a depression occurs in spite of all efforts by government to expand credit; interest rates are cut to zero yet the debt deflation goes on.

Debt deflation cannot be stopped by government credit expansion because that effort only increases debt levels that are already excessive as a result of decades of previous interventions to re-start the already over-indebted economy. As the economy shrinks, there is even less income available to repay debt, and a vicious cycle sets in. The wheel not only stops, it begins to run backwards and pumps money out of the economy.”

http://www.calculatedriskblog.com/2009/04/gdp-report-good-news.html

“Note: Any recovery will probably be sluggish, because household balance sheets still need repair (more savings), and any rebound in residential investment will probably be small because of the huge overhang of existing inventory. As I noted in Temporal Order, at least we know what to watch: Residential Investment (RI) and PCE. The increasingly severe slump in CRE / non-residential investment in structures will be interesting, but that is a lagging indicator for the economy.”

There were some “blips” in the ’80 recession on the way up as well. I think the modes of this recession are in many ways different from past ones. If growth stagnates well below trend a “recession” is over but there is nothing in the way of a recovery. That is only instructive to claim we have avoided a depression but not for when the economy has “recovered”.

If most consumers FINALLY have too much debt (which I believe is true), it is not valid to look at how recessions were ended for the last 50 or 60 years, imo.

How about “dude, where’s my next cheap debt bubble?”

Would the gov’t love to have an alternative energy bubble now?

BLS did report that much of the rise in new claims was associated with the auto sector, but provided no detail. It is entirely possible, and likely, I think, that suppliers account for the rise, rather than Chrysler. As spencer points out, it may be a bit early for Chrysler numbers. A smart pipeline shuts down from the input end before it gets cranked off at the output end. Even if Chrysler hadn’t cut back on orders in anticipation of its shutdown, suppliers can read the paper.

Odds are, then, that we are seeing the impact of both Chrysler and GM cutting back on parts orders. GM’s cut back will be spread out, so we should see more suppliers layoffs sprinkled in with automaker layoffs in coming weeks.

“Note, though, that industrial production got revised upwards today: from -1.5 to -1 in february; -1.7 to -1.5 in march; and only -0.5 in april. positive revisions are a good sign. The ADS index now looks much better than before.”

That will be snuffed out as well. May-Augest may not be kind.

your charts will confirm that initial claims have to “collapse” not just turn. get them below 500k or 450 and you can talk more reliable green shoot. i am also watching the monthly gain in continuing claims. This had been criticized here because of too many erratically falling off. True but its a good minimum. if its montly gain is 5-600k, like the last two months, there is not a major slowing of decline

some related google trends research