I’m still looking for, and still not seeing, the economic recovery that everybody is talking about.

|

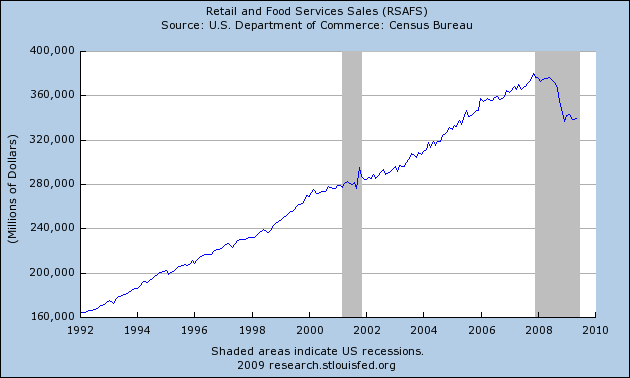

One bit of good news this week was the Census Bureau report that nominal seasonally adjusted U.S. retail and food services sales rose 0.5% in May. But of the $1.57 billion increase in total spending, almost $1 billion of it came from extra spending at gasoline stations. An optimist might read that as an indication that consumers are now prepared to spend more, and just happened to devote most of that extra spending to gas. A pessimist might worry that it portends further cuts in spending on other items ahead. But then, pessimists always find something to worry about, don’t they?

|

Or perhaps we can take some cheer from the Labor Department report that new claims for unemployment insurance fell again this week. In principle that could be quite a promising signal. But this week’s number puts the 4-week moving average barely below the value we saw May 7.

|

Count Jeff Frankel among the skeptics who see no hint of recovery in total hours worked.

|

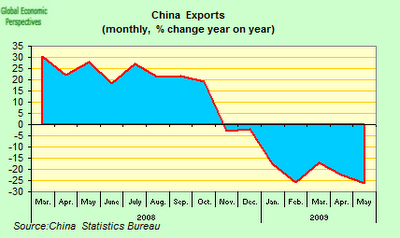

So maybe all the optimism is inspired by favorable developments elsewhere on this globe. Some point to a resumption of strong economic growth from China. But Edward Hugh (via Brad DeLong) notes that any growth in China is not coming from their ability to sell more products to the rest of us.

|

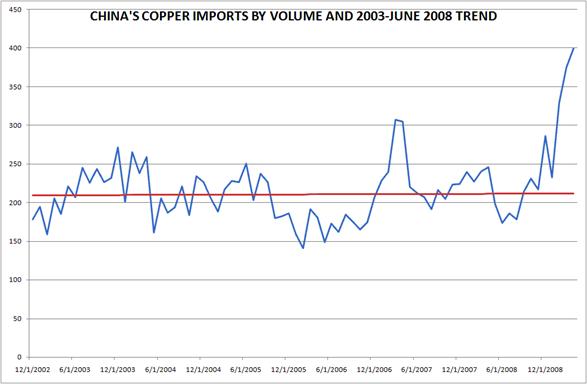

Is China’s domestic expansion so strong that it can carry this all by itself? Hugh steers us to Macro Man, who thinks that a big part of what’s happening is the Chinese are simply buying raw commodities to stockpile. Their copper imports, for example, far exceed what could plausibly be attributed to increased domestic production.

|

The above graph, by the way, appears to just go through April, and China’s copper imports were up another 6% from those sky-high April values in May. Macro Man has similar graphs for China’s imports of coal and iron, and a slightly less dramatic picture for oil. All of which may have something to do with the fact that, despite what looks to me to still be a very weak world economy, the average commodity price in the graph below has increased by over 25% in the last three months.

|

Technorati Tags: macroeconomics,

China,

commodities,

economics,

recession

I think people too often see stock prices as a proxy for economic conditions. While sometimes the two may correlate, more often the two aren’t correlated at all.

The current rise from the March lows is not an indication of future earning gains by US companies considering that there haven’t yet been enough quarterly periods to fully reflect the contraction in the economy going on now. The old saying may apply : if it’s obvious it’s obviously wrong.

I agree professor.

I’m still looking for, and still not seeing, the economic recovery that everybody is talking about.

You are just looking in the wrong place. It is printed on your quarterly bonus report from MS, GS, JPM, or some other gov’t subsidized financial co.

Once you adopt the proper perspective, the only dark cloud in the economy today is that the IRS has been pressuring the Swiss banks to reveal info about accounts held there by US residents and citizens. It is so annoying when the help snoops.

Some good leading indicators coming this week. We’ll see how they turn out.

Basic (possibly stupid) question: How importing commodities for the purpose of stock-piling affect domestic growth? I mean, yeah, their buying up commodities, but I just don’t see how does this affect chinese GDP: its a “+” for inventory investment and a “-” for imports, a total of zero.

It’s hard not to notice the increasse in crude prices and then realize these prices embed themselves in every link of every good or service supply chain. The effects of the increase since April have yet to be felt but certainly will if the past be any guide at all. Add enough cumulative price increases in any product and profits disappear. Increase the price of the product to capture costs and customers disappear.

The next surge in foreclosures accompanying a large bankruptcy crisis (California defaulting?) will provide the smokescreen behind which the damage done to the economy by +$45 oil will be hidden.

Make no mistake about it, our crises orbit around energy, energy price constraints and strategies (failed) to work around those constraints. The problem is prices, not the ‘spike price’, but the price runup leading to the spike. The current price is probably far too high to support any sort of economic ‘growth’.

Unfortunately, the time to act has long since passed.

Well, if you look only at lagging indicators like labor, you’re surely going to be one of the last people to recognize any recovery.

Here’s what The Conference Board said on May 21 about their leading indicators:

It will happen unexpectedly, not visible, i.e. fast because the whole bank mistrust story is a fad-informational phenomena in the age of Internet.

The moment is gathering behind a fast swing in economic mood and that is all what matters, at least to get to pre Lehman levels.

Stocks will obviously be the first ones to swing to pre Lehman teritory, somewhere between August-October. Economy may follow as confidence is regained.

I was reading some links at FT Alphaville and one of them referenced this interesting piece:

http://gregor.us/oil/overhead-crush/

Visually, we can think of demand in this phenomenon as being in a kind of contracting triangle. Every time consumption resumes after a previous demand crash, it hits the ceiling at a lower level. This is the point where, if you find yourself living in the age of biomass and wood, you get rescued by coal. For example. This is also the point where, if you are living in the age of oil, its less likely you get rescued.

I am curious Dr. Hamilton of what your views are about this hypothesis. It appears to fit with your hypothesis of oil price shocks triggering recession.

Below is a post I posted in the discussion section of Slope of Hope ( a trading blog that everyone who is interested in trading should read everyday ). Want to share with readers here.

Where the market goes in the future will mostly depends on where the dollar goes and where the dollar goes will be determined by the policies made in DC. So the Capital Hill and the White house will dictate over any chart reading on the path of the market direction. I don’t know how high or how low $spx will go in the next few months or next few years but I am pretty much sure about one thing that is if the current policies (both fiscal and monetary) are not the right cure the prices of all kind of assets will respond accordingly and the market forces eventually will push politicians and American people to make the right decisions no matter they like it or not.

The fundamental root cause of the current problem as we all agree is overspending in governmental. corporational and personal levels. The correct cure is to control spending within its means. The Consumer is doing it (by foreclosure, default on credit card debt and spending less while saving more) and corporations are doing it accordingly (by layoffs and cutting capital investment) but the government is doing the opposite due to political considerations. The market will respond to the government policies in different stages which could be treated as a scoreboard for the outcome between the forces of government and the forces of the market:

Stage 1. from Oct. 2008 to March 6 2009: The market forces won. Market’s primary concern was deflation: therefore we saw equity , commodity drop sharply while bond and dollar rallied even though Fed injected tremendous amount of liquidity into the system and Government is bailing out everybody.

Stage 2: from march 6 to a near future (most likely to Sept. 2009): The Government wins. Market’s primary concern is government spending when the financial system is seemingly stabilized ( which is not and we will see the financial system collapses again in stage three) therefore dollar weakened, bond yield jumped, equity rallied. Although the government policies win so far the market is giving warning signals to the government by testing the limit of how weak the dollar can go and how much weak dollar induced inflation the US economy can withstand. The yield of 10 year treasury note and crude oil will keep climb (my guess is 10 year yield around 5 to 5.5% and 30 year mortgage around 7.25 to 7.75%. as for oil little bit hard to project but it could go to 105 to 110 level) until the economy turns into a nose dive mood again. I don’t know the exact time frame but I suspect b4 Labor Day we will see oil peaked by then and all the economic indicators pointing to deteriozation in a fast pace.

Stage 3: market forces win again. $SPX down another 50% or so from its peak in stage 2 (probably around 1050 as its peak). Commodities tank again. Dollar and bond rally again. Unemployment rise above 12% and heading to 15%. The second wave of foreclosures(mostly prime loans) and credit card defaults and commercial real estate defaults will hit the banks harder once again. Now what the government will do will once again determines the outcome of next stage.

If by this time the government could adopt the correct policies and let those should fail fail then the healing process will start from here and we will see a start of a bull market pretty soon or at least the market low reached in this stage will be the LOW.

If the government instead does not learn the lessons and increase the magnitude of the wrong polices implemented in the stage 2 (more spending and more bailout), we will see a repeat of stage 2 with hyperinflation this time. The dollar could lose its reserve status and there will be large scale social and political unrests until American people really wake up and decide to take bitter medicines that they should take at the first place. I was so mad at the politicians at DC and their stupid policies that I was too biased to think the American Century is gone and this country will end up falling apart. However I strongly believe we human beings are able to learn from our own mistakes and are adaptive to the new challenges. The American people may not be able to convince themselves now that less government spending and live a simpler life is the best solution but they will realize they have to to do so when they see otherwise their country will be falling apart and they will have no life instead of a simpler life. The market dynamics will force American people to adopt the correct policies in the end and will rebuild the great American experience. It’s just too sad to foresee the Americans could go through this tough period with less cost and pain instead the luck of the will of both its citizen and their leaders will cause them to go through much bigger ordeal.

Watch California. What happens in California will indicate what will happen to the whole country.

For short term, just watch dollar, bond yields, commodities and be ready to short the stocks.

Just remember there is no green shoots. Also remember the run on oil, bond yields and commodities will not be sustainable because their own rise will lead to their own free fall. They are used as a pressure by the market dynamics to force government to revert back to correct policy making. Buy them when government issues wrong policies and sell them when the bad outcomes from these policies become obvious to everybody.

I believe a large part of the slopers will share the same view as I described above and hope this could make you feel better about the big picture and will not be confused or frustrated by the daily market fluctuations.

We do see some stabilization in the manufacturing diffusion indices, but we need to see some confirming movements in “hard” data as well. Industrial production comes out this week. We shall see.

The demise of the housing market and tightening of credit card lending have disable the mechanisms through which Asian trade surplus income was recycled back to those US consumers willing to take on ever-higher debt. On top of that, the ranks of those willing to take on ever-higher debt have been greatly thinned, and will continue to be thinned by ongoing job losses, working-hour-cuts, and the collapse of pension funds.

The leading edge of the baby boom is nearing retirement (in the case of public-sector employees with their amazing defined-benefit pensions, already retiring) while staring at the realities that they’re not going to become “accidental millionaires” by down-sizing out of their current homes, that the Fed’s zero-interest-rate policies are going to ensure they never make a penny of real after-tax income on any safe investment of their savings, that if they have a defined-benefit pension (even a public one) its promises may not be kept, and that “buy-and-hold” may not be the sure-fire stock investment strategy they’d been sold on for the last few decades.

The evidence is clear all around that this is leading to a very serious hunkering down and increase in saving.

The conventional economic wisdom is that people will save more if interest rates are high, and less if they’re low. But I clearly remember that the high interest rates of the early Volcker years did not increase the savings rate as expected — because people felt confident that with those high rates (of course assumed to be permanent) they could get the retirement income they’d need with far less saving. And in Japan we can see that when people know they’ll get zero income on their savings, they know that means they’ll need to save more for retirement.

So the conventional wisdom that the Fed’s zero-interest-rate policy is going to revive economic activity — and in particular that it will revive the housing market — is utterly wrong. This is especially so because Asia’s vendor-financing-fraud mercantilists remain poised to snatch up any manufacturing order that can practically be filled by an overseas source.

The only way to get the economy out of this will be for the government to employ in national projects that component of the labor force that’s been put out of work by Asian mercantilism, and — as in WWII — to employ it in ways that will create infrastructure that will pay a real economic return in the future, while simultaneously suppressing wasteful luxury consumption. If that’s not done, there’ll be no recovery.

“If by this time the government could adopt the correct policies and let those should fail fail then the healing process will start from here and we will see a start of a bull market pretty soon or at least the market low reached in this stage will be the LOW”

Incorrect if you “let fail” which should fail, the economy will crash as all credit freezes leading toward 20% unemployment and higher. Doesn’t matter if the economy “roars” back either, the gap would be so deep, it would take years for anybody to feel it and we don’t know how much the structural problems may inhibit. The economy roared back from 33-37 as well.

I also suspect Dow 1000 would be likely.

Laxman Achuthan, who has yet to ever be wrong, is quite certain that a recovery is very soon :

http://businesscycle.com/news/press/1457/

But he is not claiming it will be robust. No one is.

I will stick with my earlier May 15 call for the trough.

If you’re looking at April, or even May monthly numbers, you won’t see it, so looking there won’t help. And, if I understand correctly, unemployment levels are a lagging indicator, so they’re not helpful in calling the trough.

On the other hand, new jobless claims have a perfect record in the last six recessions, so I’ll stay with those. Also, we have net petro liquids draws for 4 or the 5 last weeks in the US. Oil consumption tends to be a coincident indicator for economic activity, so that supports my view.

Auto sales are up, retail sales up, employment news less bad. I have no reason right now to revise my earlier call.

That does not, however, mean that I have a strong view on the strength of the recovery. The US remains vulnerable to resurgent oil prices (I should have a piece on that in Oil and Gas Investor in the middle of this week), latent inflationary pressures are not clear to me (M1, M2 up about 17% since the beginning of the recession–is that a tragedy?), path of deleveraging still foggy to me.

I am sticking with my consistent call since December :

1) NBER trough in Q309

2) 131M jobs at lowest point

3) UE rate crosses 10%

4) Jobless recovery into 2010

I’ll go on record with a call that we’re nowhere near the trough — that we’re just momentarily bouncing along a talus slope above a resistant rock layer part way down into the canyon, and that we’ll soon be plunging vertically again.

Here in the northwest suburbs of Chicago, stores and offices are going vacant at an amazing pace, and the residential real estate market is moribund except at the low end. In Arlington Heights, only 164 homes sales had been recorded as of May 20, compared to 459 in 2007, and only six of those sales were at or above $600k, with only another nine at or above $500k. Moreover, the highest sales price recorded this year is a mere $825k. In 2007, of the 1245 sales recorded 101 were at or above $600k, with another 96 at or above $500k, and a full 45 were above $825k, with nine at or above $1 million (and 2006 was similar).

Meanwhile, in the real estate listings, nearly a thousand homes are for sale, with 116 at asking prices of $599k or above, and 68 more above $499k. As this is 60 months of inventory at the current sales pace, and it’s safe to assume that in this market nearly every listing is a home that’s seriously for sale, the market is in a state of extreme glut. And since one of the factors in the housing bubble was pulling forward of housing demand in the younger age cohorts, boosting the home ownership rates of the 25-29 and 30-34 age cohorts to remarkable levels, we have a saturated market to boot.

What this means is that home-building and home sales are not going to play their traditional role of leading the economy out of recession.

It also means that people who become unemployed in this recession are not going to be able to use cash-out refinancings to keep afloat while searching for new jobs.

When it becomes obvious at the end of the summer that most of the high-priced homes up for sale aren’t going to sell this year, and probably not next year either, there is going to be a massive flood of properties going into the initial stage of foreclosure, and the shock waves from that are going to have very negative effects. As that is also the time at which recasts of option ARM begin to accelerate, the economy will enter a new phase of decline.

I think people cant really see IT.

They just have felt IT since the beginning of March. Are their “animal” spirits at work ?

@frankzhao : cit. “Watch California. What happens in California will indicate what will happen to the whole country.”

No, cant say that. Do you also like SFO that much …

Congress and the administration are gearing up to tackle the problem of unemployment. With “green” jobs costing 2.2 jobs for every “green” job created it appears to be double digit unemployment as far as the eye can see, that is of course if it doesn’t become triple digit.

Take lots of pictures of your coworkers. You will need the pictures to remember them.

Until consumer credit frees up there will be no recovery in the service and retail industry. Since this represents at the very least 70% of the economy, a recovery is not possible. I repeat an earlier statement. We are in a sea change, not until the indebted middle class pays down it’s debt will the economy turn. Raising interest rates will not have the effect it once had because people are not able ro borrow at the current rates and will continue to pay down debt. When a person is paying off credit at usury rates of 15% to 30% on their credit cards, then they are in fact getting a huge return on their money as they pay off the debt. I repeat no recovery until the consumer debt is paid down!! We have 48 to 54 months to go, based on the recession start of 4th qtr. 2007. Flatline with small upticks and downticks until 2013. We are also in generational change and I have a warning for Keynesians. The babyboomlet generation is very conservative from a financial perspective. I have three of them, all sons, and they have learned about money the hard way. They are now all employed, but tighter than the bark on a tree with their money! LOL

I did a little extra spending this month, but it was all credit (0% though)and will require extra savings for a couple months.

“Until consumer credit frees up there will be no recovery in the service and retail industry. Since this represents at the very least 70% of the economy, a recovery is not possible. I repeat an earlier statement. We are in a sea change, not until the indebted middle class pays down it’s debt will the economy turn. Raising interest rates will not have the effect it once had because people are not able ro borrow at the current rates and will continue to pay down debt. When a person is paying off credit at usury rates of 15% to 30% on their credit cards, then they are in fact getting a huge return on their money as they pay off the debt. I repeat no recovery until the consumer debt is paid down!! We have 48 to 54 months to go, based on the recession start of 4th qtr. 2007. Flatline with small upticks and downticks until 2013. We are also in generational change and I have a warning for Keynesians. The babyboomlet generation is very conservative from a financial perspective. I have three of them, all sons, and they have learned about money the hard way. They are now all employed, but tighter than the bark on a tree with their money! LOL”

LOL. You don’t know how wrong you are. The economy is not made up of 70% consumption anymore. That is what you don’t get. The last expansion it was, but the coming one it won’t be. The inability of people like Steve to understand the changes areas of growth during the cycle amazes me.

Hence, your generational change is for the better, especially as the Asian Neo-Mercs subsidies lose effect.

I’m with DickF. This particular political economy has become much more dependent on government over time. Our current crop of leaders are pushing us to European statism at an alarming rate. I think we can safely predict a similar outcome. Two policies currently being rammed down our throats contain the seeds for double digit unemployment as far as the eye can see. Cap and trade and health care reform (nationalization). Our economy is now dependent on the whims of a handful of powerful congress critters and economic growth is not even on their list of priorities. I believe saving our planet from an overabundance of plant food rates pretty high.

I share your concern, Professor.

Until household debt gets chopped by at least one third, any upward momentum will be short-lived.

We have a long way to go to the trough in GDP, unfortunately.

“With “green” jobs costing 2.2 jobs for every “green” job created…”

Wow! Who’d have guessed that job gains are job losses, that growth is shrinkage. Oh, yeah, the same people who think that Oceana is always at war with… c’mon Dick. At least pretend to provide evidence.

johnson: “The economy roared back from 33-37 as well.” Um. No. It didn’t roar back at all. Unemployment didn’t go down and industrial activity went up only after the government started building to enter the war. Unemployment was still around 19% when the US entered.

Look, we have a country where people want it all but they don’t want to pay for it. They want a big, expensive military that can fight two wars at once, threaten countries on the other side of the globe with nuclear annihilation, and have 780 military bases around the world, but they aren’t willing to pay a nickel to do it. Oh yeah, while still waving the flag and crowing about what great patriots they are. It is the military machine we are supporting that is the 800 pound gorilla that is bankrupting us and no one, Democrat or Republican, dares to suggest we slash it at least in half.

Until we all start acting like adults and recognize that everything government provides (including defense) costs money, America is going to be in a downward spiral.

The new acronym for 2010 and well beyond SGM,Slow Growth Mode, the forecast from H&P Capital Partners

Well, JH, sounds like you’re coming around to what a lot of us have been saying: (1) that “green shoots” was always an inappropriate term to describe the economic improvements we’ve been seeing since March, which mainly reflect that US production and inventory cuts generally somewhat overshot the demand decline, and so now we can hope for some re-employment of recently idled capacity (aka “jobless recovery”), if consumer spending bottoms out, (2) that China is driving up commodity prices with stockpiling and political infrastructure investments, and (3) that there is still no visibility as to when we might begin a sustainable recovery.

As to the discussion of the ’30s and WWII, I sometimes get the impression that many people don’t understand the seemingly obvious fact that fighting a war is pure economic cost. Of course winning a war does bring economic benefits, which can outweigh the costs. Also, it can be very lucrative to not be at war when most of the rest of the world is. During WWII, the US went from the latter situation to the former in quick enough order that in retrospect the whole of WWII seems like one big economic gain.

“Um. No. It didn’t roar back at all. Unemployment didn’t go down and industrial activity went up only after the government started building to enter the war. Unemployment was still around 19% when the US entered”

Uh, yes it did roar back, but as my point said the trough was so deep it was only able to make poor.

The full recovery didn’t get going to 1939 as the war production started then 1941 when full recovery was reached.

People that can’t get that, amaze me.

I agree with the post by Stephen Kriz. Where are the adults?

Any country that permits its financial system to post tremendous profits from gambling in a system that is supposed to be rigged to so that all bets pay off has lost control of its economy. Furthermore, the willingness of the Congress and the Presidents and leaders of both political parties to continue to provide governmental funds to make good on those bets that turned sour is —— (I am at a loss for words).

Do we still look at unemployment as a lagging indicator? I think not. Although there are positive signs on paper, we need to clearly see the dust settle in the housing/labor market. I agree with whoever mentioned “green jobs”. SOunds good to the layman, but economists know that every green job will eliminate 2 jobs elsewhere. Crazy

China will lead the world out of the NEXT global crisis, not this one.