The latest auto and employment numbers paint a picture of an economic recovery that remains tepid and potentially fragile.

September was the worst month for U.S. auto sales since February, down 23% from September 2008 and down 41% from the August 2009 outlier.

|

Many of us had wondered whether the cash-for-clunkers program would simply cause people who would have bought cars in September or October to buy instead in July and August. Now we seem to have an answer, though General Motors Sales Chief Mark LaNeve believes that low inventories also lost the industry 300,000 potential sales for September. If you average the three months of July, August, and September together, the impression is one of improvement since the terrible first quarter that’s still left us below 2008:Q3. Inventory rebuilding should give a cyclical boost at some point, but at the moment this is not looking at all like the sharp recovery some had been hoping for.

|

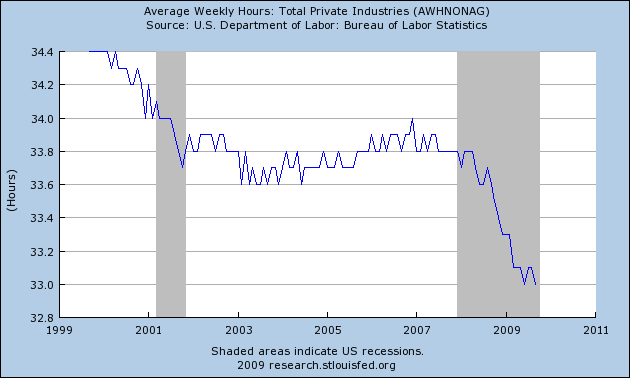

But the biggest worry remains employment. Initial claims for unemployment insurance and number of hours worked are often viewed as leading economic indicators. Initial claims peaked in March, but have improved little since August.

|

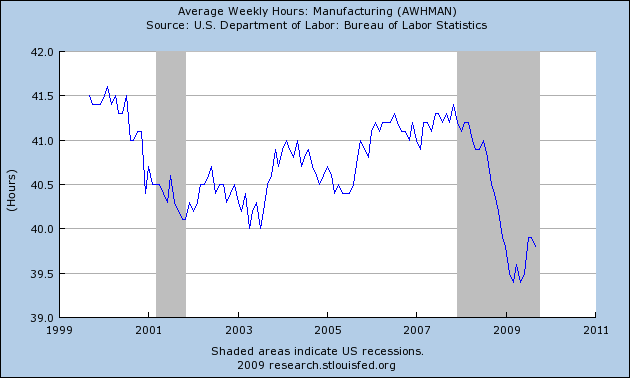

Average hours per week in manufacturing fell back a bit last month, undoing some of the earlier rebound.

|

Hours worked for the broader economy remain at the low point for this cycle.

|

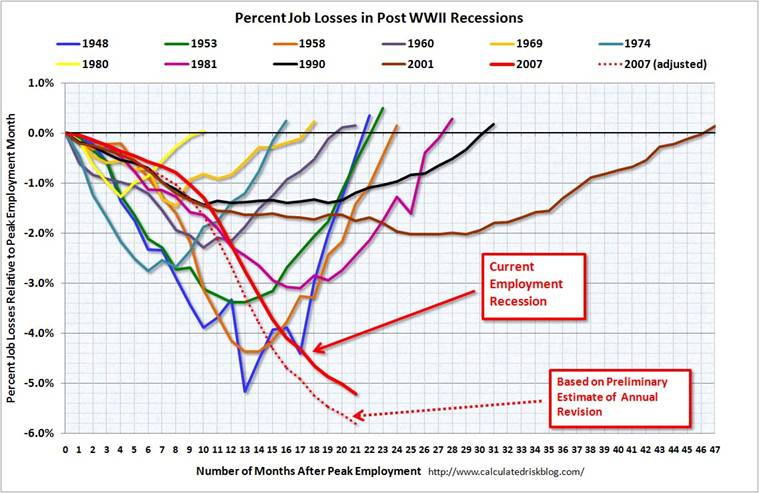

And total employment, generally regarded as a coincident economic indicator, continues to plummet, with a quarter million fewer Americans on payrolls in September compared with August (seasonally adjusted). That this is not as rapid a decline as we saw at the start of the year can no longer provide much comfort to anyone.

|

The Aruoba-Diebold-Scotti Business Conditions Index also doesn’t care much for the latest numbers, having moved back into significant negative readings.

|

Although I expect the GDP numbers later this month to show positive growth for the quarter, further deterioration on jobs is bad news for critical factors like loan defaults and total spending.

Carpe Diem has his usual optimistic take on this. Wish I felt the same way.

Professor Hamilton. Does the retracement of oil to about $70 a barrel have an impact on the stagnation in recovery through the demand side mechanisms you have championed?

Professor Hamilton,

Both Calculated Risk and yourself have referred to weekly claims (and other negatives) having peaked in March. The downward spike in March was clearly the culmination of the Lehman liquidity shock. So if this has been liquidity crisis, it’s reasonable to assume that was the bottom.

But what if what we are experiencing is a medium-to-long term solvency/delevergaing episode, within which there was a short term liquidity shock caused by last fall’s Lehman collapse? Has any meaningful amount of deleveraging occurred?

What if we were extend the downward trend that was occurring from during the first eight months of 2008 through September 2009? Might the present situation fit nicely with that steady downward decline extended another 13 months?

The effects of the liquidity shock have been handled with seeming adroitness, but, if anything, the longer term solvency problems have been exacerbated. The essentially 0% down FHA mortgages (counting the tax credit) and the cash-for-clunkers (where more than 90% of the new cars were bought with loans) have subsidized a further deterioration of household balance sheets. The too-big-to-fail institutions have grown in size as their assets continue to deteriorate. CDOs have dismantled and resurfaced as Re-Remics.

A lot of cans have been kicked down the road, and an awful lot of sovereign wealth has been spent. But does anyone seriously think household debt will resume its rise? Or would anyone be surprised if another Lehman-sized shock appeared on the horizon within the next six months?

Professor,

I wouldn’t worry about unemployment. Our President has gone to Copenhagen to tend to the more important matters of our nation, bringing the Olympics to Chicago. That should give a huge boost to employment… What?… Oh, Chicago didn’t get the Olympics? Never mind.

I think reflation is the only way out unless we let deleveraging to occur at a rapid un-regulated rate like in 2008, which can lead to unemployment as high as 30-40% for a short amount of time when many businesses and consumers will go bankrupt…and all non-essential consumption will fall by almost 50-70%

If USA owes the world 60 trillion and it has reached a saturation point where the natural path is destruction of this debt due to insolvency(all the savers will have to eat the loss due to their bad investment). But this will be painful period…for lets say 2-3 years of huge unemployment (vicious cycle of unemployment->falling wages->lower consumption->unemployment …..

also insolvency->shrinking credit marketts->lower consumption->unemployment->insolvency…)

It will lead end of the world as we know it.(I think similar to great depression of 1930s….but this time there is no world war to lead us out of this shock)

I am not even sure if the society will be able to handle this and we have to wonder if it will lead to law and order problems. (demand for trained armed security personnel will be huge since every billionaire will like to hire atleast 10-30 of them 🙂

I am sure most people who work for a living and who need a job will agree that maybe we should not experiment to see if above scenario will happen.

(But all those idealogues who say “Free Market”, “Save the Environment”, “Small governement in any situation”, “Oppose this govt because it is Liberal” etc will be always whining).

Lets say if the above happens how will it affect ROW(rest of the world).

I am sure it will lead to vicious cycle of falling exports to USA->falling consumption worldwide->falling employment worldwide….

And also since most people/companies who owe the world 60 trillion will declare bankruptcy….ROW will lose money big time. Not to mention that they will lose their export market since USD may fall to such level that local manufacturing will be again feasible in USA.

Looks like nobody will be interested in letting the natural deflation to level the imbalance created between savers and debtors.

In other words, ROW will be interested in a slow pace of balancing so that they can find other forms of employment for their population or their society adjusts to live with high unemployment (lower exports)….or maybe china and india’s huge population can be encouraged to replace the US consumers.

which means that reflation will be attempted by USG(us gov) and it will not be completely opposed by ROW (yes they will not be happy that all their savings is going up in thin air due to USD printing that is taking place, hence there will be consistant whining).

but this is a fine balancing act by all players, if anyone makes a wrong step the other can take drastic measures(trade wars, currency wars etc) leading to rapid price rise in commodities, or shortage of commodites or huge fluctuations in currency exchange value….leading to instable global markets.

so far FED has directly/indirectly created around 10 trillion and there is not much of a noise from USD holders.

I think we will see bigger budgets in all areas, more stimulus bills, more increase in the balance sheet of the FED to absorb all kinds of junk assets….the goal is to inflate the money supply to fight the deleveraging that is going on which was started by housing crisis and now the vicious cycle has started in the “employment/credit->consumption area”.(Paragraph two).

Please comment on my above assumptions/guesses/hypothesis?

Professor, I second Bob’s request that you humor us and look at the lay of the land from a ‘Wow, that household debt-to-GDP ratio IS at an all time high. Is such a debt overhang important? If yes, what is the most likely path to bring that ratio back to normal, and what does that imply for the U.S. economy?’

I have penciled my own calculations on such, but mine are top-down and unsophisticated. I’d love to see how better minds with better tools approach this.

Any idea why the recovery and then re-lapse?

Are we seeing different drivers?

That second-last chart of job losses as colored lines is scary. Of course, combining the 1980-82 recession as one big one would give a more accurate picture of that situation.

While it is not impossible that we could get back to 0.0% breakeven by Month 48, I don’t think anyone is betting on it. We are being faced with the retirement of baby boomers, for the first time ever.

So from an asset management point of view, I am betting on a weak dollar + much higher GDP growth in emerging markets vs. the US.

Hence, my money is in emerging market ETFs, including income ETFs with high dividends.

Not to be overlooked is the Rutgers reemployment study. 2017 is not looking good…

Although the recovery is “…tepid and potentially fragile…” to say the least, our business cycle model is still high in positve territory. We do not see a another recession for at least the next year, possibly two. However, the Fed talk of raising interest rates rapidly “when needed” should scare the stoutest of investors: It won’t take a lot to tip our economy into a tailspin which will make the current recession seem mild.

It is just a normal signal passing through a linear system with exponential tail ( if pictures are inverted around horizontal axis). It can not be V since initial drop was exceptionally fast.

The signal front in stocks took only 5 months

(Oct-Feb) to reach minimum. The tail will go up at least 3 times longer – 15 months, so it seems from parts of signal observable today- until May-June 2010, if nothing else with negative panic component happens ( e.g inflation in the USA with devaluation of USD).

The spike was so deep that it will cause some ringing in the tail ( stock fluctuations from June 2010 onwards, at least 1-2 periods of 20 months each). In June they will go down, then up again in Spring 2011. Of course, other events may overlay this as its impact weakens.

This is the strongest recovery in ECRI’s history.

————–

Economic Recovery Far From Fragile

Reuters

October 02, 2009

(Reuters) – An index of future U.S. economic growth slipped in the latest week, but its yearly growth rate climbed to a new record high, indicating a smooth recovery in the near-term, a research group said on Friday.

The Economic Cycle Research Institute, a New York-based independent forecasting group, said its Weekly Leading Index slipped to 127.1 in the week to Sept. 25 from an upwardly revised 127.9 the prior week, which was originally reported as 127.8.

Last week’s figure marked a 60-week high.

The index’s yearly growth rate rose to a new all-time high of 25.1 percent in the latest reading from 24.3 percent the prior week.

“With WLI growth rising to yet another record high, the economic recovery is highly unlikely to falter in the next few months,” said ECRI Managing Director Lakshman Achuthan.

Achuthan recently told Reuters that unease over rising unemployment, debt-laden consumers, and fears of a dip in economic growth are typical of recessionary times, and do not necessarily signal roadblocks to recovery.

Last week, Achuthan said current data shows that economic recovery is “far from fragile.”

Steve Kopits, I’ll take a shot at your question of recovery, relapse, and the different drivers. The recovery has been largely driven by Federal stimulus. Individuals and corporations are cutting spending and rebuilding savings, while the Federals increase debt and sponsor spending. This works for a while and sparked a jobless recovery. State and local governments are now in large budget and job cutting exercises because lost jobs means lost tax revenue. Meanwhile, other lagging drivers like commercial real estate and credit card default are also driving the relapse forces. I see a turn – timing is the only question. IMO, the crux of the problem is that when individuals suffer large losses in asset values (pensions, investments, houses), they will aggressively rebuild savings to “become safe” – by cutting consumption. No government actions have been taken to help individual savers, so they will proceed to “become safe” at the expense of their neighbors and even their own job loss as these large forces play out. Informed estimates suggest the “become safe” saving effort is less than one quarter of the way towards desired goal levels. This force will be the driver for the next 3 to 4 years, at least.

So now the professional economists can have at the discussion. Enjoy.

Mike Laird, isn’t what you describe commonly referred to as “the paradox of thrift?”

Dave Dittman: The paradox of thrift is a name for one of the forces. But I also mentioned other lagging forces that come from the initial down draft last fall – for example, state and local governments forced into severe cutbacks, commercial real estate defaults which are always lagged because of the structure of large commercial loans, and banks which are still distressed and not making commercial loans. Several wheels are in motion. None of them were directly addressed by the ARRA stimulus package. It was and is a stimulus for an inventory correction recession, which we do not have.

> If USA owes the world 60 trillion

It doesn’t.

The US owes $13.6T to the rest of the world, and that only if you count all the stocks and bonds foreigners own. If you do that, though, you should also note the $7.2T of foreign securities that Americans own, resulting in a rather less alarming net of $6.4T owed.

Why is this even an issue, though? Why is it considered bad that foreigners are investing money in American companies?