Recent indictors continue to support the impression that we’re in the midst of a weak economic recovery.

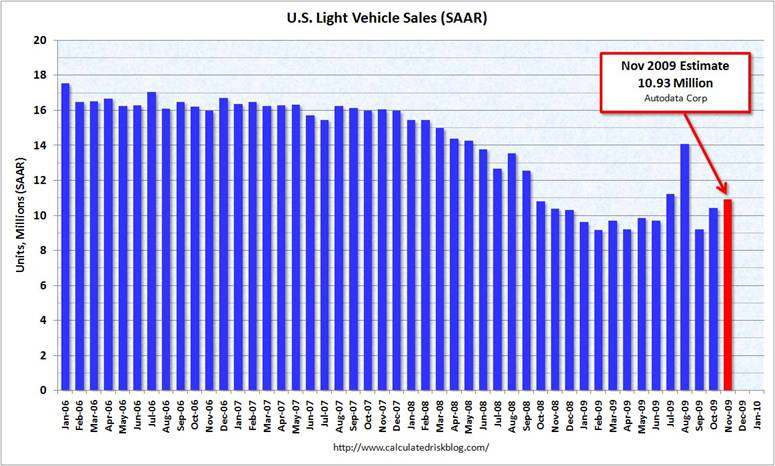

Americans bought about the same number of light vehicles in November 2009 as they had in November 2008. That’s the second month in a row with flat year-on-year comparisons. Admittedly, flat is better than the declining year-on-year comparisons to which we’d become accustomed. But remember that by November of 2008, auto sales had really fallen off the cliff.

|

The number of cars sold last month was lower than observed for March through June. But the spring-to-fall decline was more moderate than the usual seasonal softness, meaning you could read the latest numbers as a modest improvement on a seasonally adjusted basis.

|

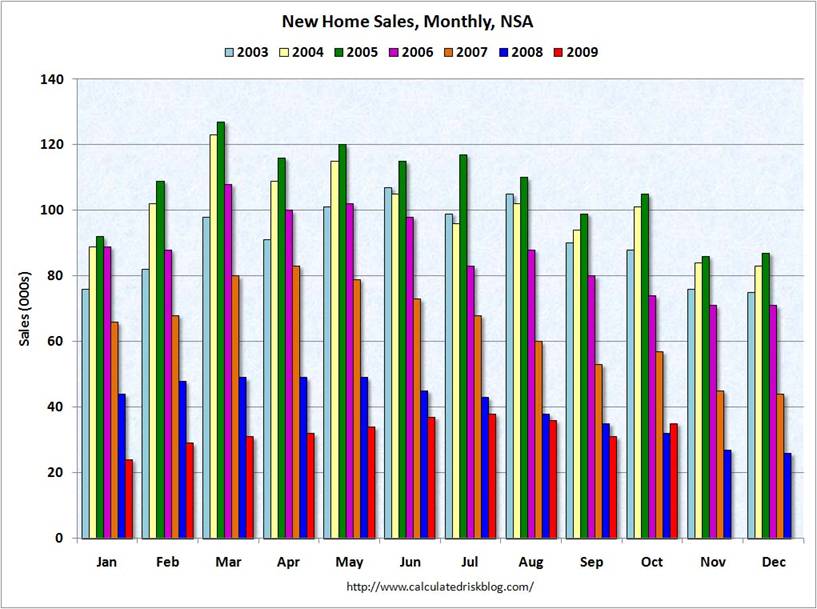

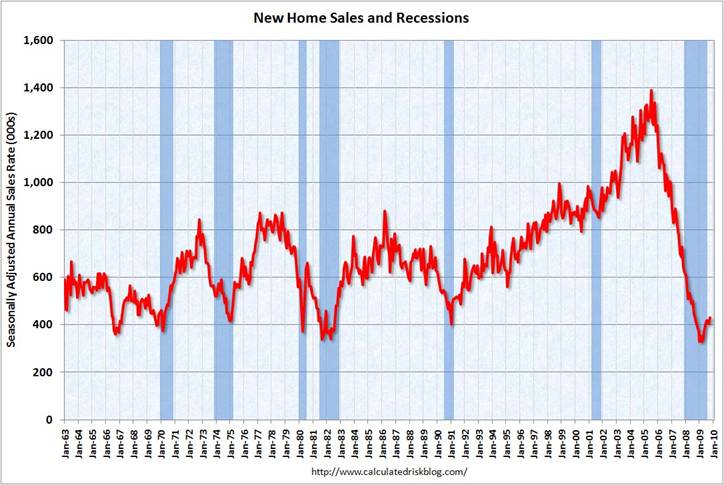

I’m seeing the same story in new home sales. These are up on a seasonally adjusted basis mostly because they had previously been so very low, not because the market is remotely back to normal.

|

|

Another worrisome indicator: ADP estimates that U.S. nonfarm private employment decreased 169,000 from October to November 2009 on a seasonally adjusted basis. Nobody can seriously claim that things are back on track until employment begins to improve. And I don’t count “smaller declines” as “improvement”.

There was one bright spot of sorts in the auto sales.

GM dealers in the U.S. delivered 151,427 vehicles in November. But

GM with its joint ventures sold 177,339 vehicles in China in November.

It seems if you want to sell something today, the place to do it is China.

Even if what you’re selling are American cars.

Every business person I talk to, from sales people, printers, design engineers, contractors say the same thing. They see zero growth ahead. Sales have flat lined at a very low level. I believe it was Soros who predicted a backwards sq. root symbol to describe the economy going forward.

Selling to China looks like its working well for the commodities markets, too.

I have to disagree with this at least partially.

While you are certainly correct about home sales and payrolls, the historical auto data actually contradicts you. You’ve only posted data from this recession. In fact car sales have rebounded more strongly from their bottom earlier this year in both raw numbers and percentages than in virtually any other post-WW2 recession. (Source: ATLSALES, St. Louis Fred)

Additionally, the ISM Manufacturing index has rebounded to faster expansion than was recorded in either of the past two “jobless” recoveries.

Initial jobless claims have also dropped more steeply both in raw numbers and percentages than in either of the past two “jobless” recoveries.

Since we had the biggest housing bubble since the 1920’s, I’m not sure I would expect a stronger rebound there until excess supply is mopped up.

In any event, what has barely rebounded at all is consumer spending, and until it does, the jobs situation will be anemic as you say.

What could be happening is that policies to head off or mitigate a crash, and policies to recover from a crash once its happened, are too different things. US policymakers might know how to do one but not the other.

Nice post. The situation is what it is. Improving modestly, but still anemic, as you indicate.

My forecast for the November 2009 growth rate of US industrial productions is -0.1% (http://core.ecu.edu/econ/rothmanp/bci_forecasts.htm).

Is the economic glass half empty or half full? Your stats are true, but here are some other true economic stats (thanks to David Rosenberg).

15.7 million American households, or a third of those with a mortgage, have negative net equity (see page A16 Housing Weighs on the Economy of the Saturday NYT).

17.5%, or 1 in 6 Americans, are either unemployed or underemployed.

A mere 3.2% of respondents to the latest Conference Boards Consumer Confidence Survey believe jobs are plentiful this is amazing considering that we have a 0% funds rate, a $1.4 trillion budget deficit, a super-weak exchange rate, and a $2.2 trillion Fed balance sheet. What should be done for an encore?

1 in 7 Americans with a mortgage are now either in arrears or in the foreclosure process. In a recession, you dont see, already two years after the recession began, articles like this make it to the front page of the Sunday NYT U.S. to Pressure Mortgage Firms For Loan Relief: Official Faults Banks Karl Marx would be proud.

Small business failures are up 44% year-over-year as was the case in Q3 this far into a Fed easing cycle.

1 in 8 Americans is now on food stamps and there are 239 counties where at least 25% of the population is on the program (again, see the front page of the Sunday NYT).

A 35% slide in home prices; a 50% plunge in commercial real estate values; and a 20% mall vacancy rate nationwide (see page M6 of Barrons) between 250 and 300 million square feet of retail space has to vanish just to bring the vacancy rate down to 12%.

Some food for thought for those that think

Isn’t it more the case that its the beginning of the recovery – not necessarily an anaemic one? As NDD pointed out the fall in jobless claims is similar to that of 1983 and 1974, i.e. strong recoveries from very great job losses.

Profits remain very high on historical comparisons and world demand has held up better than most would have expected.

Hey, CR! Your graphs look even better over here!

So why is it that ECRI’s Laxman Achuthan has an indicator that has been steeply rising for several weeks?

Or does the transition to ‘smaller declines’ fully account for that?

ECRI’s series hasn’t been through a period like this one, so we don’t actually know what it means for that index to rise as rapidly as it has. Achuthan confidently tells us what his indices mean because he is in the business of selling his confidence (comfort to his clients), but there is no reason to think he has a better handle on what his indices mean than the rest of us.

the gm stats tell me

multi nationals if faced with a zero sum choice between sales in china and sales in norte amigo

at the margin — today at least–

might choose china

where international import gaps

if not closed are not further increased

the implication

if the present forex structure is optimal for MNCs

then stag here boom there makes good sense

maybe our stag is a contrived for MNC

mid term

global earnings max

of course one would need to believe both

all we hear about the why’s of the job stag are knowingly bogus

and that macro policy is dictated

from wall street

i wouldn’t want anyone to assume that

without a careful review of their Weltanschauung

The following reports support Jim’s conclusion.

November 2009 Non-Manufacturing ISM Report on Business

http://www.ism.ws/ISMReport/NonMfgROB.cfm?navItemNumber=12943

November 2009 Manufacturing ISM Report On Business

http://www.ism.ws/ISMReport/MfgROB.cfm?navItemNumber=12942

Ok, we have a poor recovery.

What should be done about it?

I advocate a gradual increase in tariffs on all manufacturing goods entering the U.S. that is produced in any of the 5 countries that created 70% of the U.S. trade deficit in 2008.

Stop throwing money at the problem. Go to the source – consumption has exceeded production for too long.

The U.S. has the power to move the world trading system back towards a more balanced system that everyone agrees is needed. But everyone but me seems afraid to say how to get there.

Nice to see jobs come in at -11K instead of the MMS survey expectation of -114K. Plus October’s number is revised to -111K from -190K and September’s number is -139K instead of the first report of -263K.

Less anemic?

— Signed, the optimist

The economic recovery is still a distant dream for many businesses around the world. There does not seems to be any new business deals signed across the world.

US was at the centerstage of the recession with the falling auto sales, steep decline in home sales and the mammoth increase in unemployment. All these factors made the Fed bank to mull severe change in its strategies and actions going forward.

Euro zone and Japan were no exception in the backdrop of the recession, as the exports were effected severly and the decline in the demand made the situation more worse. Emerging economies such as China and India handled the situation to some extent due to the demand from next generation tech-savvy people.