We’re pleased to feature another post from Steven Kopits of Douglas-Westwood, this time on the EIA’s oil demand outlook.

EIA: The China Syndrome

by Steven R. Kopits

Last time out, we looked at the supply of oil in the EIA’s recently released International Energy Outlook (IEO), which many consider the EIA’s definitive annual forecast. This time, we look at the demand side, specifically China.

Oil demand does not grow linearly with GDP. Rather, the bulk of oil demand growth occurs in the two decades during which societies typically acquire motor vehicles, after which per capita oil demand flattens. For example, per capita oil consumption in the United States is today lower than it was in 1979, even though per capita income has increased substantially since.

Demand levels attained in emerging economies are relatively comparable regionally. For example, per capita consumption in both Korea and Japan peaked at 1.9 U.S. gallons per day. Korean levels are unchanged; Japanese consumption has declined to 1.4 U.S. gal per person in the last decade. (For purposes of comparison, US consumption will be about 2.5 gal / day per capita in 2010, down from 2.9 gal in 2005.)

Both Japan and Korea are effectively islands (Korea due to its closed northern border), and both are densely populated, mountainous Asian countries. In fact, South Korea’s population density is three times that of China. As a result, Japan and Korea’s per capita oil consumption is comparatively low next to that of countries with large land masses like the United States, Canada and Australia. China has a land mass equal to that of the United States. On the flip side, China has a one-child policy, which may reduce the need for suburban housing.

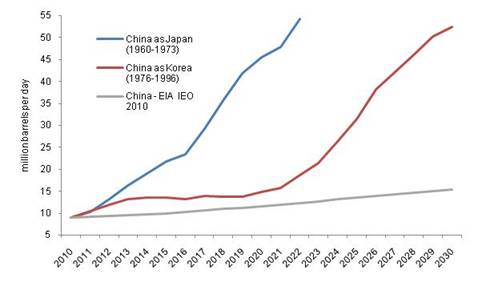

In any event, without delving deeper, we might expect China’s steady state demand for oil could prove not less than that of more advanced Asian nations. Based on the experience of Korea and Japan, China’s current population would be expected to consume approximately 55 mbpd at steady state (when per capita consumption plateaus), or nearly 2/3 of current global oil production, were the supply available.

This increase in demand can arise quite quickly. Japan’s oil demand increased six fold in the twelve years prior to leveling out. Demand can also develop more slowly. In the case of Korea, a six-fold increase in consumption required twenty years, with much of the delay owing to OPEC pricing strategy following the second oil shock of 1979. Korea’s model of development is potentially relevant for China, as China faces an oil price environment not entirely different from Korea’s after 1979. Importantly, high oil prices from 1979 to 1985 did not destroy Korea’s demand for oil. It only deferred it. Thus, we might expect that, were oil prices to fall substantially and durably, China’s demand for oil could surge fairly quickly. Indeed, were the oil supply available, China’s consumption could increase by more than 40 million barrels per day by 2022.

|

By contrast, the EIA sees China’s oil consumption at only 10 mbpd for 2015, a growth rate of approximately 2.7% from current levels, and at only 16 mbpd by 2030. Is this consistent with a country whose vehicle sales are up 56% in the first five months of the year? Where sales of Audi’s are up 77% and those of BMW have doubled compared to the first five months of last year? Is China truly going to be satisfied, as the EIA would have it, with less than 1/5th of the per capita oil consumption of Korea in 2030, even though they should be similar by that time?

The differences in views about China’s oil demand outlook have enormous policy implications. If the EIA is right, and China will forget how to grow, then pressures on the oil supply will be modest. On the other hand, if China is to develop like other countries in Asia, the pressure on the oil supply will be crushing, with oil shocks, recessions, and war all conceivable outcomes. The energy–as well as the economic and security–policy differences between the two scenarios are like night and day.

Is the EIA sure it has the numbers right?

Thanks. Very important to point out the EIA sticking its head in the sand on this one.

It seems useful to mention that both Japanese and Korean oil consumption booms took place in cheap oil periods. It seems unlikely that we will be seeing cheap oil ever again.

This takes nothing away from the fact that it seems nonesensical to project that China will have less than 1/5th the per capita oil consumption of Korea in 2030.

It does seem to indicate a likely tempering of the Chinese consumption growth rate from the path taken by Japan and Korea.

Another limiting factor, of course, as you allude to, is the relative size of the countries with respect to the world oil market. For this reason, China’s growth will be marked by significantly greater self-imposed price pressure than were these former ascents.

Assuming that long-run equilibrium is per capita oil usage roughly equal in Japan, Korea, and China, the question is about how much will the price need to go up and how much will per capita consumption go down.

I figure prices will go up enough that U.S. consumption is cut in half. That’s about double the decline from 1979 to 1983. This will go a lot smoother if we start working on reducing our structural dependence NOW, instead of waiting for oil shocks and recessions to move us in that direction.

How do we get there?

Here’s a repeat of a pertinent post I made here a couple weeks ago, after the thread died.

How to reduce oil use by 50% in the U.S. almost overnight (3 years):

I don’t guarantee any of the data below (most of it was generated off-the-cuff), please correct if in error, serious criticism is welcome (defeatist pooh-poohing, not so much). This is kitchen table (and sink) talk for one path alternative and is focused on oil rather than energy overall.

Basically eliminate (90% reduction) residential and commercial use (fuel oil and propane primarily for space heating) by using natural gas, wood/pellets, and electricity (heat pumps). It’s amazing how many houses/neighborhoods with gas are still using fuel oil. This is about a 5% reduction in overall oil use. How? Pay for conversions (~$70B at $5K a pop, would more than cover it). Offset increased natural gas and electricity use by installing 60M programmable thermostats (all residences with an existing non-programmable). Longer term (10 years), offset electricity and natural gas use by weatherizing homes and adding solar water heat to homes in southern climes.

Industrial: If we successfully reduce oil consumption by half, refinery energy use will drop by half. Since this sector consumes almost half of U.S. industrial petroleum energy, this will reduce industrial oil use by about 25%. This would likely creep back up or be partially offset immediately, as we imported crude and exported refined products to better use existing infrastructure. I have not considered this as increased U.S. consumption.

Efficiency gains (industrial audit program) of another 15 percentage points would increase this to a 40% (industrial oil) reduction. Fuel switching from LPG to natural gas would allow another 10 percentage point reduction (in industrial use). Use the LPG saved on residential and industrial to fuel converted fleet vehicles (displacing gasoline, conversion/fueling is easier than CNG/LNG in short term), or export it (longer term there is higher value for this fuel type in less developed economies). Industrial reduction totals about an 11% reduction in oil use.

Transportation: Raise gas/diesel tax by $1/gal, peg to inflation with an adjustment for consumption. This should reduce transportation usage (71% of total) by about 20% long-run (14 percentage points of total). Add minimum liability auto insurance coverage to the gas price. Drivers with points/accidents would be required to purchase a supplemental policy or pay an increased fine. Drivers could purchase comp/collision or additional liability coverage as now. This would raise the price of gas by about 10% (but reduce insurance premiums) and reduce transportation consumption by about 5% (3.5 percentage points).

Mandate and 100% subsidize (ala CARB/Smartway) 20% fuel efficiency (primarily aerodynamic, but nitrogen and lightweight rims and super-singles, etc too) retrofits for heavy trucks … (3 percentage points).

Tax truck diesel another 25% to keep per mile fuel cost constant.

Pay to make road diesel B20. (2.5 percentage points).

Mandate 20% jet fuel displacement by biodiesel (1.5 percentage points). Foregoing two items will require substantial increase in biodiesel production.

Invest in rail signaling and trackage and update regulations. Divert 20% of tractor-mile truck traffic to rail over three years. (2 percentage points)

Drop import tariff on ethanol. Increase proportion of gasoline displaced by ethanol from 4% to 10%. (4 percentage points). Import roughly 0.5mbpd ethanol from Brazil and Caribbean — guarantee price floor for 10 years to allow 150% capacity expansion (takes 3 years).

Require addition of real time mileage displays to all 1996 or later registered vehicles (license fee raised, with deduction for compliance). Research proceeding on behavioral effect on consumption but believed to be non-trivial. (Ill take credit for 0.5%)

Drop speed limit by 5-10mph temporarily (while longer term measures kick-in) on freeways/highways which exceed 55mph (3% of transportation).

Longer term:

Assess Property Tax on employee free parking at best, highest use.

Create carpool information infrastructure to include: Database of fixed destination pairs and times; Algorithm matching of partial routes, partial schedule, different employers, different partners; Free emergency car-sharing and taxi service (up to a quota) for missed connections.

Expand subsidized metro transit significantly.

Invest in improved FAA infrastructure to reduce jet fuel consumption.

Invest in high-speed rail to displace jetliner and individual auto traffic.

Keep raising CAF.

Index fuel taxes to inflation and efficiency.

Reduce oil and gas tax subsidies, increase royalties, severance tax for the #3 oil state.

Real free fast air service at the pump and car wash. Slow air compressors requiring tokens and located away from the pump discourage consistent tire inflation habits. Oregon-style full-service at the pump required everywhere with a mandatory checklist and windshield smartchip? Free air filters and fluid top-off included? Waived by drivers in a hurry, but repeated waivers would generate fees.

After-market tire rolling resistance standard and feebate (CAF style).

This makes sense. The questions remain:

1)under what scenario would the EIA be correct (ex-exogenous)? i.e. something like, if China’s relative degree of urbanization would be less than that of S. Korea or Japan.

2)What’s been the experience of others (i.e. Russia’s experience post Gorbachev)?

Steven,

your last post was about EIA joining the peak oil camp.

If supply IS constrained -as suggested there-, China will NOT be able to consume more than implied by the low-growth trajectory.

So I think the 2 pieces of the EIA view are consistent with each other. They would not be consistent if they forecasted a very high Chinese demand growth.

The only question is: at what prices will China only consume so ‘little’ oil? Your insight on possible Chinese demand growth suggests a VERY high price.

Well, let’s see here. China’s current light vehicle fleet it between 50 and 60 million, and it built 13 million last year, and it continues to build at a growing rate.

Simple math: – if the average Chinese car lasts 15 years and even if production rates plateaued at around 15 million a year – that would yield an equilibrium fleet of around 225 million (around the size of the US fleet and about four times today’s level) – and furthermore, this level would be achieved by 2020.

Assuming constant fuel use per vehicle – that would mean a quadrupling of demand for refined motor fuels in a demand.

So, let’s say that’s too optimistic, and we’re off by 100% – and demand for oil “only” doubles – that’s STILL *far* above what the EIA has to say about it. It’ll probably end up somewhere between the Korea and Japan scenarios.

Why would a poor Chinese citizen purchase a car only to almost never buy any fuel for it and get any use out of it? No – they’re going to need and use that gasoline for all those new cars being built.

I expect Chinese and US oil consumption and net oil imports to be about the same in 2020. As for prices – that’s a tougher one…

Steve,

Great article!

One insignificant, small quibble. You wrote,”Korea’s model of development is potentially relevant for China, as China faces an oil price environment not entirely different from Korea’s after 1979. Importantly, high oil prices from 1979 to 1985 did not destroy Korea’s demand for oil. It only deferred it. Thus, we might expect that, were oil prices to fall substantially and durably, China’s demand for oil could surge fairly quickly. Indeed, were the oil supply available, China’s consumption could increase by more than 40 million barrels per day by 2022.”

While price is determined by supply and demand it is also determined by inflation/deflation. Supply and demand in units rather than in currency value is a much better indicator.

That said CB monetary errors can cause consumption variations but with China tracking to the dollar monetary effects will be smaller.

Like I said that is a small quibble. The article is great.

OK, lets think about making money from this. What oil company would benefit the most from trying to supply this chinese demand? Petrochina?

Alternatively, what if the oil/gasoline is simply not there, and the chinese are forced to turn to electric cars. Who would benefit?

China will have one of the newest vehicle fleets in the world. If a majority are Chinese made, can we assume better gas mileage than the Japan and Korea cases? If so, that would lower China’s per capita demand trajectory relative to Korea and Japan.

Japan and Korea are more decentralized and the market played a larger role in determining demand. China’s more centralized system will reduce the rate of increase in fuel demand.

For example, if China can enforce a 1 child policy I am certain they can enforce a 1 car policy or other measures that will reduce the rate of increase in fuel demand.

Greater efficiency, higher fuel prices and a central planner should create significant differences between China’s future demand for fuel and the historical record for Japan/Korea.

Thanks Steve! I’m adding to my basket of Colombian oil plays and your input is confirming my own prior beliefs though the risk manager in me is telling me to buy something I dislike (and that in theory moves orthogonally to the oil basket).

Three questions follow.

What exactly do you mean by deferred demand for oil? Are you trying to say ‘deferred consumption’? If so, I still do not understand what this means. Deferred consumption of luxury goods or assets like a 2nd or 3rd family automobile makes intuitive sense. Not oil.

Current technology is much more fuel efficient than it was in the latter part of the 20th century. How does that figure into your calculations?

(In passing, I find it interesting that nobody assumes the Chinese will give up current lifestyles and adopt an American lifestyle of minimal physical exercise and daily commuting over great distances.)

Is there not some potential for natural gas and other energy sources to substitute for oil as a transportation fuel over the next 3 decades? I would personally assume that China would have full access to new technologies as well as inexpensive, abundant natural gas.

Indy wrote: Why would a poor Chinese citizen purchase a car only to almost never buy any fuel for it and get any use out of it? No – they’re going to need and use that gasoline for all those new cars being built.

Good question. One answer is either flexibility or social status (or both). Owning a car may be a significant status symbol even if it is driven relatively few kilometres. Some North Americans own a vehicle but use it as little as possible while they bike, walk, take public transportation to most daily destinations.

You may recall that the Governor of that Banana Republic called California owns a fleet of Hummers and other cool, macho vehicles that he never drives.

Just a thought on two things that MIGHT support EIA numbers.

1. China is highly population dense in the east coast where 80% of the population live, thus the land mass itself is somewhat misleading. The availability of railroad and bus system make China incomparable to US. In China, car is a luxury goods for status, not a necessity goods like in the U.S.

2. The rapid introduction and adoption of electronic cars might reduce oil damand.

Lee

A sensible and efficient way to help cut oil consumption is to meter road use. The reduction in driving would reduce oil demand and at the same time increase welfare by bringing social and private costs of driving into line.

Well I guess this answers the question, “How does China rebalance its current account?” If they import 12 mbd at $150/barrel, that’s $54b/month.

So China exports manufactured goods and imports oil. The US imports both, exporting financial claims (and military protection). The oil exporters become the world’s savers, piling up financial assets that they don’t really need (and gaining military protection that they might). Or, they recycle those dollars into Western equity shares and real estate, and set themselves up as trust-fund babies for the next several generations. That works for a while, I suppose.

Are we really sure that smiley should be green?

I’m afraid even the Japan line may understate the potential growth. For many reasons too complex to go into here. Suffice to say that prosperity has only begun to spread through the Chinese cities and into the countryside. There are about 50 cities in China with over 1 million people in their metro areas. We hear about a few, mostly the really huge places. Beyond the cities is a countryside that lags way behind but which has many more people than our countryside. These places need transport.

Maybe it is a bit misleading to account for China to be a relatively homogeneous country and having a homogeneous growth.

Good points, but there are other reasons why China’s demand is likely to grow more slowly, besides the possibility that it will “forget how to grow”. China is developing as more elitist than Korea or Japan, and with greater regional variation. It remains unclear how widespread car ownership will become in China.

I really enjoy the guest posts from SteveK (this one and the last). I echo comments above pointing out that constrained supply will necessarily mean constrained demand. In a future post, can Steve put the demand and supply sides together, and give us a forecast of equilibrium price? Or, what would the price have to be for the EIA to be right about future Chinese oil demand? And what would this price imply for the rest of the world?

Great article, Steven Kopits. Thanks.

Cheap oil and antiquated technology. That’s why Japan and South Korea used that much oil to grow. With expensive oil and better technology, China will not follow the same path.

In addition, of course, there’s the supply argument, but that is largely irrelevant. China’s percentage of world-wide oil consumption will grow, as it has the cash, and the willingness to strike deals with any regime able to provide resources.

Always though, technology. Technology and price.

The passenger cars available now double the fuel economy of the ones of the late 70s.

Even the Koreans in 1979-1985 were probably buying cars that got 25-30mpg. Over 40mpg (US gallon) is now widely available (the new BMW technology, plus diesel cars, plus hybrids).

The price of oil will rise, and the Chinese, and the rest of the world, will adopt more efficient vehicles. Those technologies already exist and better ones are in development.

Recent Chinese efforts to bring the price of gasoline closer to oil prices (ie to market levels) are very important in this. So would India if it follows suit.

I’ve seen graphs that show the ASEAN countries have not, now, 2009, surpassed their oil consumption of 1997 before the East Asia crisis.

Michael Levi argues here that this Japan/Korea analogy is in error because it neglects the fact that transportation is a much smaller fraction of oil usage than in the US. I think he’s right. At the same time, recent Chinese oil consumption growth suggests that the EIA is definitely underestimating how much China will grow in their reference oil price case, an argument I make here.

Anonymous,

I can’t comment on most of your ideas. However, you may believe that the industrial sector uses significant quantities of oil. Industrial oil use (in liquid form) is surprisingly close to zero.

Residential and commercial oil consumption at 0.980 MBD in 2008. This is roughly 5% of total oil (which matches your estimate). For electrical power I have 0.207 MBD for 2008 of which a large fraction is petroleum coke (0.070 MBD). This is roughly 1% of total oil if you include petroleum coke and considerably less if you don’t.

The issue here is industrial use of oil. The 2002 manufacturing survey has 66 KBD for industrial distillate consumption, 93 KBD for industrial residual fuel consumption, and 71 KBD of LPG.

How much petroleum coke is burned is not clear. Clearly the power industry burns some. Several sources indicate that most petroleum coke is not burned. http://tonto.eia.doe.gov/dnav/pet/PET_SUM_SND_A_EPPC_MBBLPD_A_CUR.htm shows that roughly half of all petroleum coke is exported. A better source is http://www.eia.doe.gov/cneaf/electricity/epm/table2_3_c.html which shows 6.314 million tons of petroleum coke being burned for power in 2008. That number matches what the EIA shows for petroleum coke.

Still gas does appear to be a large source of fuel for refineries and it comes from crude oil processing. (See http://www.transportation.anl.gov/modeling_simulation/GREET/pdfs/energy_eff_petroleum_refineries-03-08.pdf for some data on this point). However, it is not a liquid fuel by any means. The standard definition of still gas lists many possible components including higher hydrocarbons such as propane, butane, etc. I originally assumed that still gas was mostly higher hydrocarbons, and the propane, butane, etc. were cycled back into liquid product manufacturing.

This does not appear to be true. One source (http://omrpublic.iea.org/glossary_sec.asp?G_FLOW=Individual%20Products) defines still gas as

“Includes a mixture of non-condensable gases mainly consisting of hydrogen, methane and ethane obtained during distillation of crude oil or conversion of oil products (e.g. cracking) in refineries. This also includes gases that are returned from the petrochemical industry.”

Note the use of the words “non-condensable”. This point is substantially verified by cta.ornl.gov/…/Lower-Higher_Heating_Values_for_Various_Fuels.xls which gives the fuel value of still gas as 1458 BTUs per cubic foot (versus 983 BTUs per cubic foot for natural gas).

I think the best way of looking at this is that still gas is essentially “natural gas” produced from crude oil as part of refinery processing. Of course, refineries burn it just as they burn purchased natural gas to run their operations.

Overall, I calculate 2008 R+C oil consumption of 0.980 MBD, electric power oil consumption at 0.137 MBD (excluding petroleum coke), and industrial oil consumption of 230 KBD.

By oil consumption I mean the burning of liquid fuel for heat. Of course, still gas is burned to run refineries (671 KBD equivalent in 2008). However, it is not a liquid fuel. Petroleum coke is burned in limited quantities for power (and to regenerate FCC catalysts). However, it is not a liquid fuel either.

Thank you

Peter Schaeffer

P.S. A few more details on petroleum coke. The EIA shows that U.S. refineries produced 299.253 million barrels of petroleum coke in 2008. However, only 217.804 million barrels was marketable. The rest was catalyst coke burned off to regenerate the catalyst (FCC processing). Exports were 138.125 million barrels and imports were 8.037 million barrels. That puts net exports at 130.088 million barrels. Subtraction suggests that 87.716 million barrels were consumed domestically. At 5 barrels per ton, that is 17.543 million tons. Only around 6 million tons were used for electric power. Where the rest went isn’t clear. To be, sure some went into Aluminum production (perhaps 1.2 million tons) and other metallurgical uses. Some was used to produce cement. However, the amount isn’t clear.

China coal consumption: increased as much as total US consumption in the four years to 2007.

China natural gas consumption: Set to triple by 2020; first four month’s data suggest it might make that goal by 2018-ish.

Given that we see such dramatic growth in other energy commodities consumption in China, why would we think oil is special (unless we’re struggling on the supply side)? And why would our baseline expectation for China be a fraction of that for Japan or Korea?

It shouldn’t. Our default expectation for China should be that it develops like Korea or Japan. The onus is on the skeptics to make the dissenting case, to explain why and how China will be different from Korea or Japan in 2030 for oil consumption, be that in transportation, industry or other applications.

Peter Schaeffer: The AER (by EIA) shows about 1.6mbpd of LPG use (2quads/yr) in mfg, about 0.6mbpd of DFO, etc. It shows 3.1 Quads/yr of NGL/LPG used in mfg.

This is primarily used in the chemical sector and does not include the large quantities of still gas consumed in refineries. However, most of this is used as feedstock (only about 0.4mbpd of liquids outside of the 6 quads of ‘other’ petroleum category is burned for process heat in mfg). I am uncertain of how much difficulty/energy would be involved in mass feedstock switching, probably a great deal.

With respect to still gas: EIA defines this as “Any form or mixture of gases produced in refineries by distillation, cracking, reforming, and other processes. The principal constituents are methane, ethane, ethylene, normal butane, butylene, propane, propylene, etc. ” At higher price points, one assumes that liquid fuel value of the propane and butane will lead to separation rather than on-site combustion. At a high enough pricepoint, of course, even gas to liquids becomes financially attractive.

Based on the value of LHV you found (which I will assume is average though I suspect composition varies widely), and very roughly, if still gas were entirely methane and propane, it would be about 1/3rd by volume propane. The energy content would be about 54% propane. Ethane could replace this mix roughly 1 for 1. If the mix were entirely butane and methane, the mix would be about 1/5th by volume butane. The energy content would be around half butane.

I think this is sufficient to demonstrate that there are non-trivial fractions of propane/butane in still gas IF there are non-trivial fractions of methane. Given the presence of lower energy gases, as hydrogen, this is even more true.

If emerging economy consumption of natural gas grows sufficiently quickly, I could see the global price of LNG-shipped natural gas rising high enough to create lucrative infra-marginal rents for many (not all) producers. Forecast supply-constrained oil production will make natural gas look increasingly attractive and worthy of expensive infrastructure investments.

If these same economies move along the Environmental Kuznets Curve like more mature western economies have, then I could readily imagine significant substitution out of oil into natural gas. I would also expect increasing volumes of bio-waste and coal to be transformed into natural gas.

benamery21,

I have seen and used the AER data on many occasions. However, as you know it fails to distinguish between hydrocarbon use for heat versus feedstocks. Fortunately, the 2002 manufacturing survey does break this down. See http://www.eia.doe.gov/emeu/mecs/ and http://www.eia.doe.gov/emeu/mecs/mecs2006/2006tables.html for the actual data. Table 3.1 gives fuel use in physical units. The numbers are 34 MB of residual fuel, 24 MB of distillate, and 26 MB of LPG. That’s a total of 84 MB or 230 KBD.

The 2006 manufacturing survey data is now available from the same source. The numbers are 40 MB of residual fuel, 22 MB of distillate, and 21 MB of LPG. That’s a total of 83 MB or 227 KBD.

Your comment that

“I am uncertain of how much difficulty/energy would be involved in mass feedstock switching, probably a great deal”

is generally correct depending on what the alternative might be. Carbon chemicals can be produced from coal. Indeed, a major coal chemical industry has arisen in China (see http://tinyurl.com/2crmblt). However, some chemicals are easier to produce from coal (via gasification) than others. Notably oxycarbons (methanol, acetic acid, etc.) and ammonia are well suited to using coal as a raw material. By contrat, traditional polymers (ethylene, proplyene, etc.) are not.

Ethanol from corn would actually be a good feedstock for ethylene production (industrial ethanol is made from ethylene). However, many issues beyond the scope of this discussion are associated with corn-based ethanol.

Your definition of still gas is the same as mine. However, the actual composition appears to be methane and ethane. Note that ethane has 1773 BTUs per cubic foot versus 2522 for propane (see http://www.documentation.emersonprocess.com/groups/public/documents/application_notes-tech._briefs/d301334x012.pdf?&xBusinessUnit=Remote%20Automation%20Solutions).

It does not appear likely that still gas, as it is burned, contains large quantities of propane or higher hydrocarbons. Propane has traded at a substantial premium to natural gas for years and separating propane by distillation is relatively easy. By contrast, ethane is harder to separate from methane and has generally been worth less.

A quick read of the FCC (fluid catalytic cracking) literature strongly suggests that propane is recovered, not burned. The same holds for coking units, hydrocracking, etc.

It is very conceivable for China to plateau at 1/5th of the oil consumption of its Asian neighbors.

China is not and never will be Japan nor South Korea. To make the comparison is to show total lack of understanding of China. 1.4 billion people cannot and will never rise to the socio-economic status of either of the smaller neighbors. China has a vast number of people who will never be able to earn enough to buy many of the things that are now considered essential consumer items in developed countries — cars, computers, big TVs, refrigerators, showers, etc. Many of my neighbors now do not have their own toilet and must share the public one down the street. Forget in home showers. They save their jiao (1/10th RMB) and go to the public bath once or twice a month. (Chinese tend to have a great deal less BO than westerners — me.)

The Chinese are planning for the long-term future. That is clear by the massive shopping/contract-signing spree they have gone on to secure future resources and their response to the economic down-turn by subsidizing farmers. The western Chinese farmers are the migrant workers and they returned home to western China instead of becoming a problem in the industrialized east. Creating jobs in their home areas was an extremely smart move.

China is currently the world’s number one producer of solar cells. Granted, most of those are going overseas right now, but once the need exists in-country, they have everything they need right here and in place.

Not to mention that Warren Buffet has invested in a smaller Chinese auto manufacturer that is making electric cars. Some major cities in China already ban gasoline-powered motorcycles so there are tens of thousands of electric bikes everywhere. It is conceivable that if oil consumption becomes a problem, they’ll just ban future sales of gasoline-powered vehicles or decide that everybody WILL use LP gas.

The sweet position that the Chinese are in is that, other than ancient coal-fired power plants, they just don’t HAVE the earlier investment now in obsolete technologies because their development is so recent and they can make smart choices for their future that don’t require massive REinvestment in new technologies.

Any discussion about oil prices over the next decade must include an attempt to quantify emerging economy demand as an important driver at the margin. Here is a simple thought experiment using Chinese demand:

– China moves from 3 bbls/person/year to the South Korean per capita consumption level of 17 bbls/person/year over the next 30 years

– No peak in global production

In next 10 years we must find 44 million BOPD:

– 26 million BOPD to maintain supply – 30% of current production, almost 3 times Saudi Arabias output

– 18 million BOPD to keep up with demand – 22% of current production, almost 2 times Saudi Arabias output

If you superimpose peak production on top of this demand profile using the following parameters oil prices would increase approximately 250% in real terms over next 10 years:

– Oil demand elasticity of -0.3

– Current production 84 million BOPD, current price US$ 80

– Peak production 100 million BOPD

– Post peak decline rate of 3-4%

If you want to try the model for yourself using your own assumptions it can be found at Petrocapita Income Trust: http://www.petrocapita.com/index.php?option=com_content&view=article&id=128&Itemid=86

Schaeffer: While we are agreed that outside of refineries, there are few liquids burned in industry, we have differing numbers on that quantity (a difference of about 76% of your lower number, but still a low number overall). I’m pretty sure the AER source explicitly states that this small quantity is combusted.

On the liquids content of still gas:

In your earlier cite you gave the LOWER heating value of ‘still gas’ but in the later cite you gave the HIGHER heating value of ethane and propane. My point in the last three paragraphs of my last post was that the LHV of still gas and ethane appear to be about the same, therefore to the extent there is (lower BTU) methane in still gas (there is), and to the extent the LHV’s of still gas and ethane are near equal (perhaps less true), some higher BTU gas (propane/butane) must be present.

The fact that the propane market IS higher than the natural gas market does not mean that introducing additional supply (and separation cost and small volume liquids transportation cost) is profit maximizing to the extent that ALL propane is separated. Introducing additional supply would lower the price point. If the marginal value of the propane minus the additional separation/transportation cost and minus the natural gas cost is less than the reduction in value of the rest of the propane market, an oligopoly might well burn part of the propane. After all the quantity of propane produced is largely incidental, but natural gas production is controlled and stored.

benamery21,

I have typically used the Manufacturing Survey data (2002 and 2006). However, the AER numbers are the same as the Manufacturing Survey. See http://www.eia.doe.gov/aer/consump.html for a list of tables. Table 2.3 gives numbers for residual fuel, distillate fuel, and LPG in barrels and trillions of BTUs. Table 2.2 has total manufacturing fuel consumption data (feedstock and heat). The residual fuel and distillate fuel numbers are close. The LPG number in table 2.2 is vastly greater (as one would expect).

Yes, you are correct about the LHV and HHV values. The ORNL number is an LHV and the other numbers are based on HHV.

It is not easy to get a useful grip on the composition of still gas. The numbers are all over the map. The EPA is using a set of four very different still gas samples in its calculations. See Reference Number 56 (page 27) of “Petroleum Products and Natural Gas Liquids: Definitions, Emission Factors, Methods and Assumptions” (http://www.epa.gov/climatechange/emissions/downloads09/documents/SubpartMMProductDefinitions.pdf).

Also see http://bit.ly/aBFpWf. Note that the same four samples are used here as well. The samples average 6.2% propane. However, the percentages appear to be volumetric rather than mass based. As a consequence, propane would account for a higher percentage of the fuel value.

The notes indicate that the first sample is from the Gas Engineers Handbook, probably Table 2-21 on pages 66 and 67. See http://amzn.to/bTESI2. Page 2/20 has a discussion of Refinery Oil Gas where it is noted that 75% of all propane is recovered from refinery oil gas. The book is from the 1960s. Presumably propane recovery has increased since then.

Of course it is not true that all propane is recovered from still gas. That is a thermodynamic impossibility. However, the economics favor a reasonably intense effort to do so. Since propane is traded as a commodity both nationally and internationally, each refiner has incentives at the margin to maximize propane recovery and sale as long as propane trades over natural gas.

Refining is a classically competitive commodity business with very high volatility. See http://omrpublic.iea.org/refinerysp.asp and http://www.bp.com/productlanding.do?categoryId=6929&contentId=7044622 for some data on refining margins.

Schaeffer: Thanks!

My bad on the mfg liquid combustion, I apparently misread/typed 0.4mbpd for 0.4 quads per year, and missed it on the overly-cursory re-check as well.

It appears from the provided sample data that still gas varies widely in composition and is something of a grab-bag. I think this is an area where EIA needs to provide greater reporting/transparency requirements. That said, it seems likely that the amount of hydrogen is higher and amount of propane/butane lower than I initially assumed. This point affects less than 2 percentage points of the 50 percentage points of reduction I originally offered up.

We’ll have to differ on the degree to which the oil and gas business operates as an oligopoly.

Schaeffer: The seasonality of propane and natural gas pricing appears to differ markedly. Propane is still highly seasonal as a winter heating fuel. Natural gas price is bimodal. This may mean that refiners separate a higher fraction of propane seasonally, since additional propane production would go to storage in July. While propane stocks are seasonal as well, a mild winter might mean that it’s cheaper to burn propane in April than separate, transport, and store it.

benamery21,

I agree about the highly variable composition of still gas. 4 samples isn’t nearly enough. A comprehensive census of still gas as it is actually burned (versus produced before C3/C4/C5+ stripping) would be needed. However, still gas chemistry isn’t a constant. Refinery operations evolve over time (as new process units are added or removed) and in response to changing prices.

With Google, I found references to refineries burning propane by intent at some points in the past. Sure enough, those were periods when propane prices fell below natural gas. Obviously in such a period, refineries have less incentive to strip propane from still gas. Conversely, the machinery would mostly do it automatically. The refinery would then just burn the stripped propane.

I looked up propane and natural gas prices and volumes. As you would expect, propane volumes are deeply seasonal. However, prices are not. A very extensive propane storage system exists, leveling out prices. Occasional price spikes show up. Some are clearly tied to severe winters, others are not. I don’t think the propane price data would pass a statistical test of seasonality. Nor would the natural gas price data.

The data also shows that the propane has traded over natural gas for a long time. The ratio of propane prices to natural gas prices has been high. Perhaps more relevantly, in recent years (since 2000) the ratio has been huge. Predictably you can find online articles about enhancing refinery propane recovery.

The spreadsheet with all of the data is at http://bit.ly/dqANY2