Federal Reserve Chair Ben Bernanke last week dismissed the suggestion that the recent surge in gold prices signals some kind of inflationary pressures:

So gold is out there, doing something different from the rest of the commodity group. I don’t fully understand the movements in the gold price, but I do think that there is a great deal of uncertainty and anxiety in financial markets right now and some people believe that holding gold will be a hedge against the fact that they view many other investments as being risky and hard to predict at this point.

I think Bernanke has this exactly right.

|

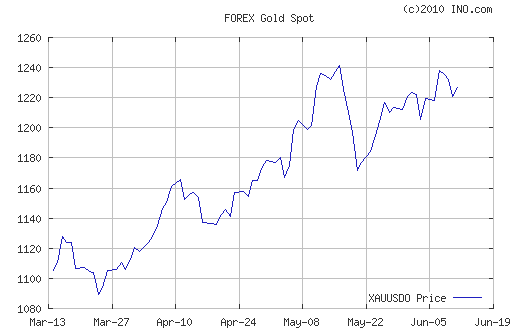

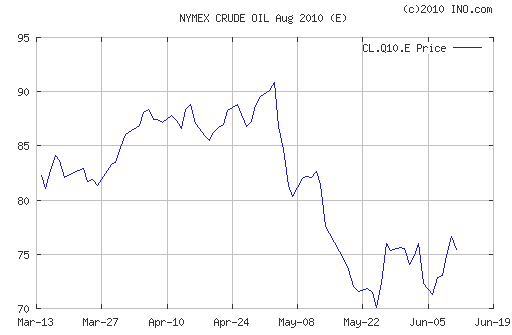

During the last two months, gold prices have surged while prices of most other commodities fell like a rock.

|

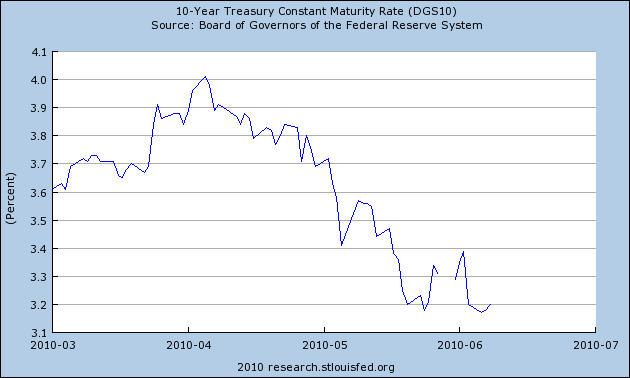

At the same time, we’ve seen yields on 10-year U.S. Treasuries coming down impressively as well.

|

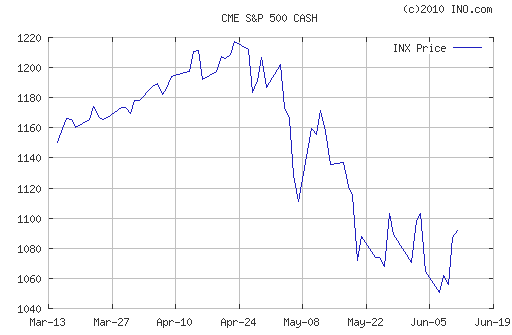

But those lower interest rates have brought no cheer to equity markets.

|

There’s a common thread to all the above figures, and it’s not fears about inflation. Instead it’s worries about the level of real economic activity, showing up in a flight to safety. U.S. Treasuries remain the instrument of choice for investors who think nothing looks safe.

But with the long-run fiscal challenges facing the United States, are 10-year Treasuries really the safest place to put your money? The yellow metal seems to be one way some people are hedging that bet.

Monetization of the debt seems inevitable.

We are running deficits of 10% of GDP and getting only 3% – 4% GDP growth. Private sector jobs aren’t coming back and we still have huge excess capacity. Revenues simply are not going to grow fast enough to get the debt/GDP ratio under control. Trying to raise taxes will only depress the economy further.

Additionally, the government has to create inflation to keep the housing bubble going, because the government now backstops virtually the entire mortgage market via Fannie, Freddie, and FHA. If the government allows housing prices to deflate, it will have not only reduced revenue from the economic downturn but also direct losses from a huge new wave of mortgage foreclosures.

As a proxy to historical events gold is for the least a conspiscuous passive witness

Gold chart since 1883 1998

http://66.38.218.33/scripts/hist_charts/yearly_graphs.plx

or show no correlation with the commodities

http://www.sharelynx.com/chartsfixed/dowgoldratiooil.gif

And those who were long gold during the religious wars in France 1560 have been able to square their positions at even prices………in 1998

http://www.sharelynx.com/chartsfixed/600yeargold.gif

As a protest against CBs monetary policies gold is a late starter.

The link is more useful through this thread

http://www.chartsrus.com/

Then 650 Year Historic Gold Price

The yellow metal seems to be one way some people are hedging that bet.

With the emphasis on hedging their bets. Hedging your bet is very different than betting on inflation as the most likely outcome.

JDH,

The confusion on gold arises from its role in discounting all FUTURE inflation (gold is the longest duration asset available — it is permanent and has no yield).

So when deflation risk exists, additional data signaling economic weakness should make the gold price rise. The likely response to a double-dip would be further significant deflation-fighting commitments by the Fed. This might include additional QE or price-level targeting.

If the Fed formally adopts an inflation target that they will meet “at all costs”, the tail risk of high or hyper inflation rises. Therefore gold should rise as the best hedge against this risk.

The enemy of gold is self-sustaining, organic (not produced by stimulus) real growth. We had that from 1983 to 2000, during which time the gold price collapsed. Since 2001, we have made repeated, global attempts at stimulating the economy. Gold and equities both worked as earnings rose, but the stimulus commitment implied higher future inflation risk. What we face now is a possible commitment to reduce leverage by reducing the real value of debt. If that occurs, then gold could go materially higher.

Gold is nothing but the longest-duration financial asset that is also not a financial liability. All of its characteristics and behavior, over the long term, stem from this fact.

Interesting post professor. So is it time to talk about a bubble in the gold market?

I think the smart people, like Soros, are riding a bubble they will be able to bail out of faster than the dumb people following them.

I’m sure their were lots of condo flippers in Florida who sold out near the peak, there were just even more who followed them.

Gold production is increasing rapidly and the cost of production is about half the current price. When this falls, it will fall just like the 1980s. But without the 5-12% inflation they had then, it will likely fall even faster.

But I don’t doubt it could hit $2,000 before then.

Gold has become a religion so it will be a bit longer before reality sets in and pushes it back down where it belongs. Once people realize how much deleveraging lies ahead–gold will slide back to $750 per ounce.

Teabaggers love gold. They think the world will return to gold coins and loin cloths after Armageddon.

Teabaggers love gold. They think the world will return to gold coins and loin cloths after Armageddon.

No, we just note that the dollar has lost 90-something percent of its value since the Federal Reserve was created, and current debt, deficit, and bailout policies appear highly likely to accelerate that trend.

Almost all of gold’s supposed sensible relationships have really broken down lately. I had always heard its primary purpose was as an inflation hedge and that gold’s relationship to other commodities prices was constant…. for some reason. Well, that’s fallen apart. In 2008 we learned that it wasn’t much of a hedge against a financial crisis. It’s some kind of irrational hoarding and I suspect that gold will enter a sustained decline at some point.

Horsefeathers. Completely muddled thinking. Gold is as volatile as other asset classes, and people are as uncertain about the future of gold prices as they are about the future of other asset class prices. Gold is being bought as an alternative store of value to currencies, because of expanding money supply.

When one starts to hear people like some here giving arguments for why gold (or any other asset) “can only go up,” (at least for some extended future period), one knows one is in a bubble, although as Paul Samuelson wisely observed in a paper in the Weltwirtschaftliches Archiv back in 1957, we do not know for how long the irrationality can run before it ends, but end it must.

Regarding the bizarre claim that gold is forever or the longest lived asset out there, what about land? When there are land bubbles we often hear similar arguments about it, you know, “they ain’t makin’ no more of it,” (except that they are in places like Holland). Having just gotten through the crash of a real estate bubble, we are not hearing much of that talk now, although there are families and institutions (think the Roman Catholic Church) that have owned certain pieces of land for far longer than anybody has held any paarticularly serious piles of gold.

One thing that may be propping gold up, and may continue to do so for awhile at least, are the reports that the Chinese have been buying it. However, I last heard those reports some time ago and do not know if that is still going on or not. Part of that was probably associated with their unloading of euros, without wanting particularly to replace them with USDs.

No, we just note that the dollar has lost 90-something percent of its value since the Federal Reserve was created, and current debt, deficit, and bailout policies appear highly likely to accelerate that trend.

Posted by: W.C. Varones at June 13, 2010 04:39 PM

The inflation bug’s mind works on the basis of fear; specifically the fear that rising prices deter and ultimately destroy savings and investment.

And the inflation bug is 100 percent correct.

To see this, all we need to do is to compare the price level for consumer goods and services today with the level prevailing in 1933. Yes, that’s right; prices today are much higher than they were in 1933.

And what has been the effect? Yes, just as the inflation bugs predicted, investment has plunged dramatically in the last 75 years, rendering the U.S. a byword for staggering economic decline.

And those living on fixed incomes or from savings have, en masse, been forced to beg whatever crumbs they can garner from illegal immigrants working as crop pickers or car washers. The creation of Social Security merely exacerbated the pauperism that our decades-long monetary inflation has wrought.

The only exceptions are those wise and fortunate souls who have hoarded gold.

If only we as a nation had not inflated our currency starting in 1933, our children and grandchildren would have all the marvellous pre-1933 era blessings afforded by Sound Money policies.

But the inflation bug at least can be consoled by the KNOWLEDGE that he was RIGHT, and that the inflationists were wrong.

Now, there are some who will say the right-wing inflation haters are merely absurd cranks, or absolutely whacko crackpots, or indescribably moronic simpletons, who are fed these stupendously erroneous ideas about monetary economics by the propaganda machine that serves the interests of the ruling plutocracy. But as the simple, clear, and dramatic analysis of the facts which I have provided above PROVES BEYOND ALL DOUBT, these idiotic douchebags actually have the facts on their side. Not, to be sure, the liberal-socialist-collectivist so-called facts, but the facts as derived from the ridiculous, off-the-wall, fruitloop worldview of the inflation bug.

QED

Mr. Hamilton,

I see you share the commonly held, but mistaken, belief that gold is a hedge against inflation, or that it’s a primary hedge against inflation. However, this is not why most investors accumulate gold (as the media so often misunderstands; and you can see from the above posts how common gold’s investment aspects are misunderstood).

The price of gold is not going up due to deflationary expectations, because in a deflationary situation counter party risk is very great–this is why we’re seeing deflation in the other commodities, and yet gold is still rising (which it will continue to do). If I expected inflation, then I could very well buy many other commodities as a hedge (sugar is a much better performer than gold). Further, many might either fear a geopolitical upheaval or that wealthy investors are looking for somewhere to store their money, and gold at times can and does trade as a currency (we are seeing inflation in art prices and diamonds, another well known hiding place for the wealthy).

For the price of gold to be making a ten year trend with still showing a solid trend upward, more would have to be going on than the simple belief that sometime five to ten years down the road the government will monetize its debt.

Barkley,

I don’t hear people here saying gold “can only go up.”

I hear people saying global fiscal policy is out of control to an unprecedented degree, and gold seems a pretty common-sense response to that circumstance.

I’m not advocating a huge allocation to gold. I’m spread across equities, real estate, equities, gold, cash, and AUD. And gold is a small minority position in that group.

But to dismiss gold out of hand simply because it’s starting to capture mass attention seems a mistake. Competitive devaluation of fiat currencies is a non-zero probability.

Varones,

When something captures the mass attention it is time to be very careful.

Barkley,

My point was not to say that the hold price was not volatile, that it could not be in a bubble, or that there were not other long-duration assets out there. By “duration”, I meant that its present price captures the value of ALL future inflation (discounted, of course). Land is different. First, it has some yield when used for agriculture or when it supports a structure. Secondly, land follows cycles that have to do with the REAL and nominal demand for agricultural commodities and structures.

The gold price is somewhat sensitive to real growth in the form of jewelry demand, but the long-term impact on the price is minor compared to currency debasement. This is because the bulk of the gold ever mined is put in storage as an inflation hedge, or can be easily converted from jewelry to that use.

So if deflation forces more mortgage defaults and drives the Fed into reckless monetary experiments that are difficult to exit from in the future, then its natural that land prices should fall while the gold price goes up. Same goes for commodities. As their duration is lower, they will start to rise once inflation is closer to occurring.

Difference #1 between the recent real estate bubble and the supposed gold bubble: Leverage.

The downpayment on a bar of gold is 100% and the monthly payment is zero.

Difference #1 between the recent tech stock bubble and the supposed gold bubble: ROI.

It might be delusional, but I think most gold holders are looking for insurance more than ROI.

The best place to look for a comparison for this gold bubble is the last gold bubble.

1. Real gold price has not crossed the peak of the last financial crisis yet.

2. This financial crisis is clearly worse than the last one.

Would anyone her like to argue that 2009 is not as bad as 1979, or that the 1980 inflation adjusted gold peak is lower than today’s?

Gold has no counter party risk. All fiat instruments, including cash and treasury bonds, are someone else liabilities and might not be paid. Gold will never default. In deflation you should expect it to rise in value against other goods and possibly but not necessarily dollars and in inflation expect it to rise in dollar price along with everything else.

The fact that gold is going up while most other commodities (especially metals) are going down is a serious reason to view it as a bubble. Back at the end of the 70s, the other commodities were going up, especially oil.

The mass attention thing becomes more noticeable as one sees public buying being pushed by the likes of Glenn Beck, who both pushes doomsday stories on the show part and hawks gold sellers openly on the commercial part. Something about shoeshine boys giving advice on stocks in September, 1929…

Why do I buy gold?

Has Obama and the democrats done anything to inspire confidence? No, they are protecting the drug industry, health insurance industry and of course wall street. Why have foreclosures slowed down? Because the insolvent banks would have to recognize their losses instead of extend and pretend.

The only thing worse in returning republicans to power in November.

Gold mining and recycling should be used as the example for microeconomic supply-demand-price theory as it so clearly demonstrates the capital barrier to entry, marginal price, supply shifts, not to mention the various substitution effects on demand and the emotional and irrational behavior of demanders.

My guess is the marginal cost of gold production is $200 an ounce for the lowest cost supply, recycling, while the cost of adding new supply through mining requires a price of $750 an ounce for a decade for a three decade total cost of $500 an ounce, at which point the marginal cost takes over at $300 an ounce.

If investment in mining gold were to respond to the current price on the basis the price would remain above $750 forever, mining capacity would easily double.

The point that economists are failing to impress on students is the role of fixed and marginal costs in the price of everything. People fail to connect the costs of producing gold to the market price just as they failed to connect the cost of producing homes or shopping malls with their prices. And then we have the economists who argue that the minimum wage is the cause of the high unemployment as if the cost of working can fall to zero because a worker has no capital cost nor marginal cost.

Economists seem to live in this fantasy world of no costs for anything. Labor has no cost, gold mining has no cost, pollution has no cost, with the factors driving the supply of those three things being defined as “externalities.”

“just as they failed to connect the cost of producing homes or shopping malls with their prices”

Housing prices has never been about wood, paint, granite and steel. It’s about location.

The prices ha have changed according to the cost and availability of debt, but the premium between Santa Rosa and San Mateo is not about shower heads and countertops.

me,

You can buy gold for whatever reason you want. However, if you are still doing so, why rather than to buy something that has gone down already and is a better deal, like sugar or land, rather than gold, which is in danger of having a really huge crash?

If investors today tie up their capital in gold and other non productive assets wouldn’t that increase the risk of future inflation as necessary investments to expand capacity are not being made? Uncertainty produces the flight to gold and the flight to gold produces the inflation? Just a thought….

I don’t understand why any experienced investor would choose gold over TIPS. There are only two reasons why a good investor would invest in gold over TIPS: (1) if he expects the government to default soon, or (2) if he expects that there’s a gold bubble and wants to capitalize on it before it crashes.

(There are a few other reasons why someone would invest in gold, but they’re mostly conspiracy theories and are not worth my time scrutinizing.)

I sincerely believe we are in the midst of a gold bubble. I expect the price of gold to eventually come crashing down quite a bit.

Want to hedge against inflation? Buy TIPS.

Actually, there is a rational reason for buying gold, although I have not seen it stated yet by anyone commenting here. It is that money can be made in a bubble on the way up. So, one can buy gold now, but not any sort of hedge against anything. One should buy it now with the intention of selling it quickly and immediately once it is clear that the bubble has ended and the price is beginning to crash.

Lots of money can be made in speculative bubbles, if one plays them right. But one has to know that one is in a bubble and needs to get the heck out at the right time.

Watching academics try to understand gold is like watching Spock try to understand human emotions — “But it’s not logical!”

I get that you can’t value it because there are no cash flows, but how do you ignore the fact that every fiat currency in the history of humankind has gone asymptotically toward zero?

And if gold is overvalued relative to its cost of production, what is the cost of production of a dollar?

I just don’t understand why gold haters have such blind faith in central banks when central banks have always and everywhere debased currency over time.

More thoughts here:

http://www.wcvarones.com/2010/05/richard-wiggins-trashes-gold-in-barrons.html

David Pearson wrote:

The enemy of gold is self-sustaining, organic (not produced by stimulus) real growth. We had that from 1983 to 2000, during which time the gold price collapsed.

David,

I normally agree with you but here you make a mistake. Look at a graph of the price of gold, you can find one here http://www.kitco.com/charts/historicalgold.html at KITCO showing a Multi Year Gold chart from 1975-2010. You will notice that gold was out of control befor 1983, but from 1983 until about 1995 the price of gold was virtually flat. This does correspond to the greatest sustained period of growth our economy has seen in 100 years. The price of gold reflected a stable currency, just on element in economic prosperity.

But you are right that in 1995 Greenspan abandoned gold as an indicator moving to his “Greenspan standard.” The result was a serious deflation where gold fell to almost $250/oz in 1999.

It was this deflation that brought us the Greespan recession of 2000. (No, it wasn’t Bush because the decline started before he took office. No, it wasn’t Clinto because he was not in control of the currency.)

Barkley,

You cannot compare gold to other commodities. Gold is not consummed and has very limited use. Gold is primarily a monetry commodity while others are industrial commodities. Gold reflects the quality of the currency that may or may not be reflected in the price level. Consider the Cantillon effect.

To all of those that say that fiat money is inherently inflationary, I agree completely. This is why I insist on interest on all of the bonds that I buy, and the yields are considerably higher then the inflation rate. I really don’t care how much each individual dollar will buy 100 years down the road. I do, however, care about how much my entire balance will buy 100 years down the road.

Real interest rates are much higher on bonds (2.5% today on TIPS treasury bonds) then they are on gold.

Agree with RicardoZ that gold cannot be compared with other commodities, whose values will fall if manufacturing falls. The price of gold may be in a bubble now, but its fundamental value in terms of a particular currency rests ultimately on what happens to the value of that currency with respect to other goods and other currencies. During GD1, competitive devaluations meant everyone devaluing relative to gold. Today, universal attempts to monetize national debts would lead to a similar result in terms of the value of gold. To the extent markets are rational, the rise in the price of gold implies that people expect the value of the currency to fall.

Oh, I really should not debate gold bugs, but it is just so tempting, like shooting fish in a barrel and all that.

Varones,

How can I ignore “the fact” that every fiat currency in history has gone asymptotically to zero? Well, the dollar is not obviously doing so, and it has been around for a couple of hundred years. Is the Chinese yuan doing so? How about the Japanese yen, where they have been having deflation off and on for several years, meaning that the currency is rising in value against goods and services? Sheesh.

RicardoZ,

Oh, and why can’t I compare gold to other commodities? Most peopel do most of the time, except when it is in a bubble like now and gets all disconnected from other commodities. It has jewelry and industrial uses, as well as a cost of production, and its current price is far above any of those. So, why is it so different? Are we going to start hearing mumbo-jumbo such as how it is the only yellow metal and is inert and looks like the sun thereby reflecting the eternal divine majesty of the Egyptian Pharoahs? Yeah, that makes sense.

Liye,

30-year TIPS yields are 1.8% according to the Treasury:

http://www.ustreas.gov/offices/domestic-finance/debt-management/interest-rate/real_yield.shtml

And that yield is on top of CPI, which has a lot of problems (biases, hedonic adjustments, etc.). See http://www.shadowstats.com for more detail.

Even if you’re happy with the government’s CPI calculations, monetization is causing asset inflation but not yet CPI inflation. Maybe someday CPI will catch up, but in the meantime, TIPS aren’t keeping up.

I do not think the recent spate of gold fever is based simply on the axiom “gold will always go up” rather it is that the dollar will always go down. I do not think anyone will disagree. Or at least the plan (of our system) is for steady inflation, right?

During the past 10 yrs., equities burned plenty of investors, and honestly, growth prospects are not great. Bonds are in bubble territory. There is a lot of cash in the system looking for yield, where else to go other than gold.

However this too shall pass.

Barkley,

Dollar: http://www.minneapolisfed.org/community_education/teacher/calc/hist1800.cfm

Plot that out in constant 1913 (Fed Reserve Act) or 1971 (Nixon closes the gold window) dollars. That asymptotic enough for you?

Yen: http://www.rateinflation.com/inflation-rate/japan-historical-inflation-rate.php?form=jpnir

Take a look at the double-digit inflation in the 70’s. I don’t see any current double-digit deflation undoing that.

Yuan: http://www.china-embassy.org/eng/xw/t464830.htm

It’s early days for the yuan on the world stage, but it’s already had periods of 7-8% inflation.

“You cannot compare gold to other commodities. Gold is not consummed and has very limited use. Gold is primarily a monetry commodity while others are industrial commodities. Gold reflects the quality of the currency that may or may not be reflected in the price level. Consider the Cantillon effect.”

Huh??? How did you post that statement without gold? Are you using smoke signals?

Only 20% of all existing gold and of newly mined gold goes into monetary or speculator stockpiles, 80% is consumed in consumer and industrial uses.

A substantial amount of gold is used for jewelry and art, but the price paid is always significantly higher than it will fetch when sold.

What you are confusing is the size of the speculative hoards relative to mining and consumption – those hoards are more than ten times annual consumption.

Gold was the only asset since 2000 offering substantial gains. The suggesting to BSB that gold is indicating inflation was most likely a red herring. Everyone who can operate a pocket calculator and is able to calculate percentages must come to the conclusion that the US will default on its debt. Whether its going to be a debt moratorium or very high inflation nobody knows. Since the average maturity of US Federal debt outstanding is only about 5 years, inflation wont to the trick imo.

And to find out whether gold might be in a bubble or not I would suggest to ask friends and relatives whether they own some gold ….

A significant portion of the move in gold price may be explained by demand generated by inflation in the BRIC & other countries.

Varones,

If you want to argue that inflation is more common than deflation, this is correct. But that does not mean that it is asymptotically heading to zero, even if it is heading in that general direction, and, to be technical, something that is asymptotically going somewhere never gets there because it only “gets there” in infinite time, meaning, never. Heck, when it was introduced in about 1150, the farthing (fourth of a British penny, only formally discontinued in 1961) could buy a whole chicken. Big deal.

So, the issue is gold versus alternative assets. For any asset one can pick time periods or dates that make it look good or not so good. Gold since 2000 looks better than most. Pick other time periods, such as starting in 1979, after which it looks pretty awful for quite a spell. That it has done so well since 2000 compared to others is a reminder that it has become disconnected from other commodities, relative to which it usually links pretty well. This should be a serious warning sign to anybody who is not into Pharoahnic divinity or otherwise gaga (and, yes, the Pharoahs did make these arguments about gold).

mulp wrote:

Only 20% of all existing gold and of newly mined gold goes into monetary or speculator stockpiles, 80% is consumed in consumer and industrial uses.

Sorry but you are wrong. The World Gold Council estimates that the total amount of gold ever mined totals 165,000 tons as of the end of 2009 and that the total world supply was 165,000 tons.

Barkley wrote:

RicardoZ,

Oh, and why can’t I compare gold to other commodities? Most peopel do most of the time, except when it is in a bubble like now and gets all disconnected from other commodities. It has jewelry and industrial uses, as well as a cost of production, and its current price is far above any of those. So, why is it so different? Are we going to start hearing mumbo-jumbo such as how it is the only yellow metal and is inert and looks like the sun thereby reflecting the eternal divine majesty of the Egyptian Pharoahs? Yeah, that makes sense.

Barkley,

Appparently you do not believe in the subjective theory of value. From your post you seem to believe that value comes from production costs. Since you believe in an out-dated theory of value I doubt I can respond to your post, but I will try.

Only 12% of gold is used for industry most being recovered for reuse. 51% is used in jewelry but most of this is actually for investment purposes. 17% is held directly for investment and 18% is held by CBs.

The supply of gold is significantly stable so any changes in price are due to changes in currency supplies which are only dependent on how fast the FED can punch computer keys.

Because jewelry is held rather than traded and CBs hold gold as potential support for their currencies, the price of gold is determined by those holding gold for investment. This means that gold price changes are significantly determined by market transactions. Demand for gold has a much smaller impact on the price than that of other commodities because gold is neither destroyed nor consumed.

Because of this the price of gold is the best indicator of the ratio of the supply of commodities to currency. Other commodities compare to gold because gold reflects the monetary component of the other commodities but because other commodities are consumed demand has a significant impact on these other commodities.

I realize that you do not understand this relationship preferring to believe in bubbles and mumbo-jumbo about how the supply of currency doesn’t effect the value of the currency but at least I tried.

@Barkeley

“You can buy gold for whatever reason you want. However, if you are still doing so, why rather than to buy something that has gone down already and is a better deal, like sugar or land, rather than gold, which is in danger of having a really huge crash?”

I began my position at $418 and added at 690 and 820. Don’t worry, if it goes back down to $1000 I will be buying again.

Rather than watch TV you need to watch central banks. When Russia and China and India central banks start selling, so will I. Remember George Soros saying sell gold while he was buying?

Barkley,

What did you think I meant when I said all fiat currencies go asymptotically toward zero? Exactly that! The fact that the dollar has lost only 95%, not 100%, of its value in the last century is cheerful news for you?

You trivialize the global debasement trend when you downplay it as “inflation is more common than deflation.” It’s not just “more common;” it’s the overwhelming trend across time and geographies. Show me a fiat currency that hasn’t lost the bulk of its purchasing power in the last thirty years, or in the thirty years before that.

And this is not a matter of cherry-picking starting points. Gold has consistently held its purchasing power over centuries while paper currencies have not.

RZ,

While there have been reports of the Bank of China buying gold, the main central banks owning gold, US, UK, France, and Russia, have it because it is left over from the gold standard past. If anything, they have been selling some of it off and on rather than buying more, although they do not wish to disrupt the market particularly. The idea that central banks are buying or selling gold “to support their currencies” is nonsense.

Demand is determined by subjectivity, but not the supply side. Takes both to determine prices. And, if you want to argue that the supply of gold and subjectivity determines its price, this is a recipe for greater volatility of the price of gold, not less.

Varones,

Land has held its value better over the long run than gold. Unlike gold, the old line about land that “they ain’t makin’ any more of it” is a lot closer to being true than most of the fantasies that gold bugs indulge themselves in. More gold is being dug up out of the ground on a regular basis, certainly far more in percentage terms than the minor increases in land due to the Dutch or others building dikes.

Central banks have had 29 years to sell their gold hoards. Why haven’t they?

@TT: “… Why haven’t they? ”

because its in the cellar, and they guys have Alzheimer’s disease and have forgotten it.

TT,

They have done so gradually. They do not wish to disrupt markets by dumping large amounts. Gold bugs would howl bloody murder. The CBs tend to be pretty conservative about playing with their assets, in case you had not noticed. Apparently they officially price gold at something far below the current market price, btw.

Barkley,

That seems like a rather weak argument. US dollar came off the Gold standard in 1971. There must be a more persuasive argument to hold on to such vast gold hoards. Gold is making all-time nominal highs. Why aren’t they selling? Why have the Euro CBs stopped selling?

TT,

Because they might burst the bubble and get blamed for it by all the angry gold bugs who will be losing their shirts.

I thought you had a serious point of view – nevermind.

I second TT’s emotion.

It was surprising to get Barkley to concede that fiat currencies always go asymptotically toward zero.

Now that he’s claiming that central banks set policy based on what goldbugs think, his credibility is so lost that there’s no point debating him.

TT,

Oh, and what is your point? What is the significance of the central banks not selling lots of gold right now? Is this proof that gold will keep on going up up up, and that gold is the greatest hedge against inflation or general systemic collapse, or, well, what exactly?

“That seems like a rather weak argument. US dollar came off the Gold standard in 1971. There must be a more persuasive argument to hold on to such vast gold hoards. Gold is making all-time nominal highs. Why aren’t they selling? Why have the Euro CBs stopped selling? ”

There is an international agreement limiting central bank sales of gold stocks. The reasons are multiple, but one nation has nuclear weapons they could use against central banks that dumped their gold and destroyed the fiscal balance of the government.

Ie., two nations rely heavily on selling their mined gold for national and government income, Russia and South Africa.

Pretty much everyone agrees their is no upside to central banks trying to manipulate the gold market. In fact, evidence central banks were selling gold would likely trigger a financial crisis and a flight to gold, so a central bank sale intended to drive gold to $1000 would cause it to hit $1500.

“Sorry but you are wrong. The World Gold Council estimates that the total amount of gold ever mined totals 165,000 tons as of the end of 2009 and that the total world supply was 165,000 tons.”

Gold that is in jewelry or electronics or catalysts et al is consumed.

If it isn’t, then their is no consumption because food merely changes its form and who or what eats it.

Everything is recycled, some profitable, and others not. Platinum is recovered at a high rate as well, but as you seldom find platinum or rhodium et al bugs, less of them is mined and no one tallies how much exists. People steal catalytic converts for their platinum or other platinum group metal; many are worth $100 for scrape.

Just sold my half ounce Krugerrand I had since I was a kid. Really wanted the 1 oz coin when I was a kid, but couldn’t save up that much money. Maybe I will luck out, and be able to take the proceeds and finally get my 1 oz coin later :).

mulp,

After you eat your strawberries, I sure hope you don’t put the “recovered” strawberrys on your new bowl of ice cream.

Platinum is a companion of gold, but does not have the same quality or quantity of monetary characteristics as gold. Neither do strawberries, BTW.

@W.C. Varones

You do realize that the early 1500’s were the discovery of the new world and a massive, massive supply increase in gold?

I don’t see anything similar happening again, in the near future.

Re: platinum

Platinum is primarily an industrial metal and tends to follow industrial metal price movements. Gold is primarily a form of money (mostly for international reserves, although it is used in the middle east as actual currency).

Attempts to make platinum like gold is, have been fought fiercely by the platinum industry, which wants to keep the prices low enough so people don’t research and use alternatives for industrial uses.

What do you folks think of gold as a hedge against regional nuclear war?

GNP,

Probably not a good hedge if you or your gold is in the region.