Just a quick note on a couple of new data releases today.

The Chicago Fed National Activity Index aims to summarize in a single number 85 separate measures of real economic activity that are now available for the month of June. The CFNAI fell from +0.31 in May to -0.63 in June. Berge and Jorda found the CFNAI to be one of the most useful indicators for summarizing the state of the economy, with a value for the 3-month average below -0.72 often reliably signaling an economic recession. The good news is that the current 3-month average still stands at -0.05. But two more months like June would definitely be worrisome.

|

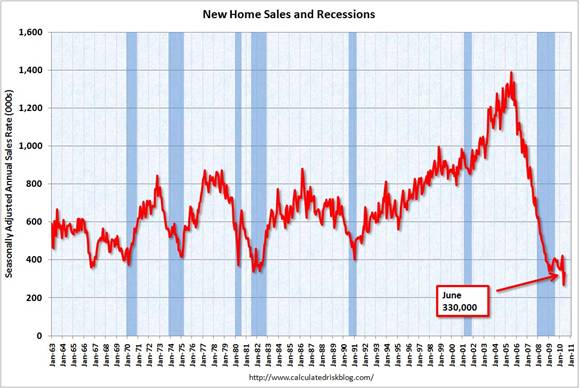

Today we also learned that last month was the worst June on record for new home sales. Part of my optimism (at least relative to some observers) had been based on the idea that sectors like housing and autos really couldn’t get much worse than they had been.

|

Seemed like a nice idea at the time.

My brother is an intermediary in the garment business. He matches orders from US retailers with Asian factories. He told me that his US clients are starting to cancel and delay orders again, like they did in 2008.

Housing prices are well above revenues (rental value) and private incomes in Europe(except Germany)

Astronomical prices,when knowing that only 1% of the European population is having 1 Million euros (all assets inclusive)

On the other hand by strangling the real estates markets through higher prices,liquidities remain available in cash and are maintained in the banking system.

A continuity in the last 10 years wealth transfer from private sector to banks and to states public debts.

“Today we also learned that last month was the worst June on record for new home sales. Part of my optimism (at least relative to some observers) had been based on the idea that sectors like housing and autos really couldn’t get much worse than they had been.”

Really? Aren’t these two sectors the most dependent on debt for purchases? Go check out some lower and middle class people’s budgets and see what they are like (as in negative real earnings growth based on their budgets and not on CPI).

Im not sure why anyone is surprised

Heh, funny, “seemed like a nice idea at the time”.

Don’t feel to bad Professor Hamilton, I’m wondering what the stock market players excuse will be for the rise here in late July. Other than some sparse individual companies’ earnings reports, none of the data is explaining the Dow rising. And this garbage with the bogus stress tests in Europe making everyone breath a sigh of relief seems like something out of a Bizarro World dream when at the same time interbank loan rates between European banks are rising.

We already pretty much knew before the report came out that new home sales would have the worst June on record. In fact, the figure for June was higher than expected, and it was still an increase from the original May figure. The downward revision for May is troubling, but it’s not clear that new home sales are still getting worse.

If you liked June’s numbers you will be absolutely ecstatic in 2011.

If you want an unhappy chart, go over the Calculated Risk: Q2 2010: Homeownership Rate Lowest Since 1999

Just eyeballing the associated chart suggests we have a good 5-7 years to go until real estate is back on a more customary footing.

We are headed for 3 years of 2002-2003 type environment, which followed Sept 11 stock market scare. Nothing to be happy about, especially as such protracted periods of uncertainty usually ends in US involvment in wars, most likely Iran and Central Asia, most likely 2013-2014.

Then stocks and economy recovers as spending is forced by war time mobilization of wills. And a strong leader is expected and welcomed.

Housing has shrunk so much that residential construction is unlikely to be a big swing factor (to the downside) for gdp.

House prices are another story. New home sales of around 300k indicate depressed demand and an inability for the market to clear near-peak TOTAL inventory. As such, prices will likely resume their decline. This has much broader implications for gdp, both via the wealth effect and through credit losses in the banking system.

David Pearson: …prices will likely resume their decline.

When you say “resume their decline” I assume you mean reverse the small turnaround in the April and May 3 month moving average prices. According to the WSJ:

The S&P Case-Shiller 10-city and 20-city home-price indexes increased 1.2% and 1.3%, respectively, in May on a non-seasonally adjusted basis. Compared with a year earlier, the 10-city index rose 5.4% and the 20-city reading climbed 4.6%.

http://online.wsj.com/article/SB10001424052748703977004575392933078292008.html?mod=WSJ_hpp_LEFTWhatsNewsCollection

The housing market looks one way in one region of the country and quite another way in another region. The boom areas of the Sun Belt (Las Vegas) are still in the doldrums, but the housing market in the midwest and along the coasts is looking a little better. Maybe global warming is causing people to think twice about Minneapolis.

When people, such as myself, who have always paid their bills, run and owned business’s and met their obligations, can not even get a sniff of business capital from banks with 20 year relationships, there is a problem. I went from being able to borrow on my word, to being denied very viable loans. It is as if the banks have had a higher power, I believe the U.S. Government, tell them they will not be lending any money. It really looks from this vantage point that all future capital for private, small business will be raised not from banks, but from private pockets. It has taken me two years to handle having been cut off at the knees financially and to begin to raise my own savings level to fund my future projects. I will however, not form any companies nor seek to employ others until Barak Obama has been removed from office along with the current Congress. It is quite accurate to say the middle class is hunkered down, paying off debt, forming it’s own pools of capital and that it fully understands the rules have changed. If this causes deflation, so be it. The middle class has suffered a holocaust and is chanting “NEVER AGAIN”. Oh, and we will get our pound of flesh at the ballot box.

It seems to me likely that the June house sale slump would have something to do with the expiration of tax credits at the end of May. Since those credits could have been used directly toward the down payment of FHA loans, their expiration affected both the comfort level of people buying a house and their ability to raise the funds needed to close on financing.

I expect that those incentives drove a number of sales into May. Also, with the expiration of the tax credits, there was a lot of chatter about reintroducing them. As such, if I were a perspective homebuyer, I’d probably be taking a wait-and-see approach to make sure I don’t buy before the credits come back.

CBO respectfully disagrees with former Enron adviser Paul Krugman.

link

W.C Varones: The CBO report is mainly about the long term deficit, which just about everyone (excepting Dick “Deficits Don’t Matter” Cheney) agrees is a problem. CBO is talking about the structural deficit and they are looking out over the long term (2020-2035). Krugman is only talking about increasing the deficit over the short term…as in ~2 years and only cutting back spending, increasing taxes and adopting a small VAT after the NAIRU interest rate moves into positive territory and the Fed is able to take over management of the recovery. See the difference between a short term cyclical policy and a long term structural solution?

The CBO report also references the Irish experience with austerity announcement. The CBO noted (in a rather understated way) that the market’s reaction to Ireland’s austerity program wasn’t exactly warmly embraced by the bond markets.

I’ve noticed that a lot of the austerity hawks have been retreating a bit from their earlier hardline positions. For example, this weekend Niall Ferguson (on Fareed Zakaria’s show) backed off from some of his earlier statements and said that he was not recommending austerity for the US “right now,” although strangely he did support Britain’s planned suicide.

The evidence in JDH’s post on weak housing prices just reinforces the case for additional stimulus. No aggregate demand. We have a magneto problem. The economy is, if not teetering on the verge of a technical double dip, at least in danger of something that will smell and feel and awful lot like a double dip.

Steve,

Why would banks lend to businesses when they can borrow from the Fed at 0% and buy Treasuries at 2% – 3%?

The government doesn’t have to tell banks not to lend. It just gives them an immensely profitable alternative to lending.

“It is as if the banks have had a higher power, I believe the U.S. Government, tell them they will not be lending any money.”

No, that higher power is the market (i.e. the bank’s customers and stakeholders). Banks have been forced to deleverage to reduce their risk, which means they can’t lend out every dollar they get 40 times at once like they used to. This deleveraging has to happen quickly, as at some point the banks will be forced to come clean about the actual value of their bad assets (when mark-to-market resumes). This will move up their leverage again (by reducing their reserves), if they remain solvent at all. It’s a race against time.

If a transparent free market is restored too soon, the banking system will collapse. Explicit and implicit guarantees by the government, and the temporary suspension of important transparency rules by the government regulators are the only things that allow the system to survive right now.

So Steve, by all means, get your pound of flesh at the ballot box. Vote out all the Republicans that are being so stubbornly ideological that they are willing to kick the economy in its teeth while it is down. As an added bonus, most of these chaps are indirectly responsible for creating this mess in the first place, so it will be very nice to see the last of them. Thanks!

The Pareto distribution of 80/20 (20% of the causes produce 80% of the effects) has been successfully tested on the US mortgages loans. I firmly believe that the same extrapolation may apply to Europe based banks (It was easier to make an estimate in the USA,as data are available through the Fed).

The Banks deleveraging process will take decades but that does not mean that as a whole banks have no capacity left, as the world is over banked.

Applying the historic norm’s for rate of home-ownership based on age of head of household to the current distribution of household’s gives a rate of ownership slightly higher than we are at right now. Aging the distribution a couple of years leads to an ownership rate slightly lower than we are at right now. Demographically speaking there is no reason for the housing market to “recover” for 5 more years. Within the segments, starter homes should start to recover in 3 to 4 years. Boomers should be driving the second home market, but they don’t seem to want to/banks won’t take on any mortgage debt. The Gen-X birth dirth has made us Japanese (too many oldster capital producers, not enough youngster capital consumers, etc) for some time to come.

endorendil,

Please read this article. I think it will be clear where the problem lies. It is not the Republicans nor the Democrats, it is too much money influencing elected officials. The result has been a Government of the banker, by the banker and for the banker. I do agree corrective action is happening! The free market will always prevail! I object to the damage done to those who are least responsible for the carnage. The vote is the only tool left and it must be applied now or it will be stolen as well.

http://spectator.org/archives/2010/07/28/the-timeless-principles-of-ame

2slugbaits: Maybe global warming is causing people to think twice about Minneapolis.

2slugbaits must be thinking of this: http://minnesotansforglobalwarming.com/m4gw/videos/

Steve, supply side economics has been a resounding failure, in particular for the poor and middle classes, which have been shafted in the last 25 years by ill-advised economic policies based on it.

The problem of oversized influence of corporations is real, as it has pushed government out of its role as moderator in the economy, defanged its regulatory powers and undid some of the hard-won social support that are essential for a modern economy to remain competitive. It has led to the disastrous developments in US society over the past 25 years, eroding US competitiveness by wasting the human capital it is based on.

Your vote means nothing unless the two-party stranglehold is broken, and corporations are muzzled in stead of being endowed with human rights. I’m personally very skeptical that this can be done in the US. I think it will continue on the long downwards slope that Reagan set it on. Articles such as that one in the Spectator just confirm that Americans continue to prefer ideology over common sense.

endorendil:

I certainly agree on the influence of Corporations, especially the money exchangers, they have caused the crash by corupting the Government and using our money for their gain. Supply Side economics has worked, everytime it has been brought to bear, every time! Keyensian economis has failed, every time it has been brought to bear! I have prospered under supply side, when I have been allowed to keep my money and have trouble when the Government trys to redistribute it. I am back to my roots, because that is what works! Self reliance! All future financial endeavors will not include financial institutions, NEVER AGAIN! We are working with family and friends to build a better Country. No to the corps and no to the moneychangers.

I guess we have the answer to the great “Alphabet question” from a year or two ago. It’s an L-shaped recession. Now it’s just a question of how many consecutive underscores we have to endure.

Anonymous (a.k.a. Steve?): I’m not quite sure what you mean by supply side economics. In economics pretty much everything usually gets boiled down to two curves…a supply curve and a demand curve. I assume that you are trying to say that lower taxes and less regulation allows you to be more productive…you can produce more, which pushes out the aggregate supply curve. Normally this is a good thing because it increases potential GDP. And notice here that I’m setting aside the issue of whether or not tax cuts pay for themselves (they don’t!) and even whether or not supply side economics ala Ronald Reagan actually worked as advertised. Here I’m simply taking the most sympathetic case possible for supply side economics. But given all that why would you think that supply side economics is the cure for what ails today’s economy? Unlike 1978 today’s problem is not an overheated aggregate demand curve pushing up against the limits of potential GDP. Look at JDH’s graph on new home sales. Look at one of JDH’s Ward.com graphs on auto sales. The problem is weak demand, not constrained entrepreneurs struggling to get out from under the yoke of heavy handed government. This is not 1978. Worse yet, supply side solutions would almost certainly make today’s macroeconomic problem even worse because it is very likely that the aggregate demand curve is locally upward sloping because of a negative NAIRU interest rate…it’s geeky, but that’s just what the math implies. If that’s the case, then the last thing you want is to increase potential GDP. That just widens the output gap and further feeds deflation. In fact, one way that an economy recovers from recession is that the capital stock becomes so depreciated that businesses have to reinvest. That was sort of the intuition behind the cash-for-clunkers idea. Today’s problem is weak aggregate demand and some flavor of Keynesian economics is ideally suited to answer that problem.

2slugbaits

Hi Slugs — been awhile, a long while. Reading the comments is kinda discourging. Why is it so hard to get the point across that slack demand is the problem, and what should be done about it.

wogie: Well bust my britches, it’s good to hear from you. Really good. I don’t know why it’s so hard to get the point across. A case in point. In 2008 I was briefing the Army leadership on the results of our econometric stochastic frontier analysis study of the cost functions of Army’s repair and overhaul operations. This got a lot of attention because it focused on economic efficiency. Note: the study was started before the recession hit us. A few days after Obama’s inauguration I was invited to be part of a 2 week crash project to see how DoD spending could contribute to the recovery. I turned down the offer because it was clear from the outset that folks just didn’t get it. The emphasis seemed to be on finding ways to save money by leaning operations…and the new spending that was being proposed was of exactly the wrong kind. People just get frozen with this idea that the right way for government to react to a severe recession is to hunker down, get leaner, and just ride things out until better days come. The idea that government should be countercyclical so that you expand during a recession and contract during a boom is just too counterintuitive for people. And you see the same thing in the general public. But at least the general public has an excuse; they weren’t formally trained in economics. What’s really maddening is seeing people who should know better still make the same bad arguments.

Like I said, really good to hear from you. Hope you stick around.

The largest slack since many years is the truth, numbers, structural deficits, employment, inflation, solvency,government costs,financial markets, balance sheets, incomes revenues,financial products.

Nothing is stronger than an idea when its time has arrived,the time is there but the idea is still expected.