Recent economic indicators tell more of the same story– disappointingly weak growth.

U.S. auto sales for September repeated the same kind of numbers we’ve been seeing since March. The last 7 months have averaged 10% above the corresponding values for the same months last year, but well below what had been typical in previous years.

|

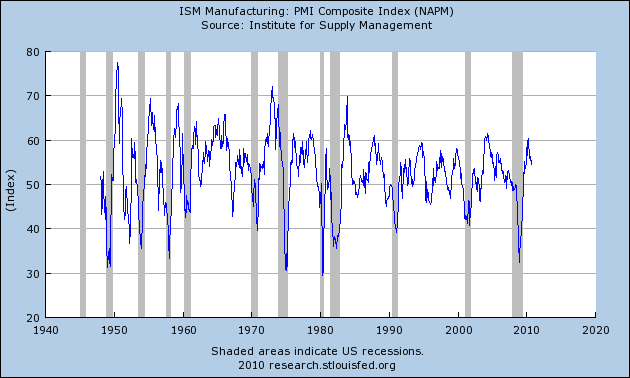

The ISM manufacturing PMI continues to slide, now standing at 54.4 for September. That still signals a growing economy, but at a slightly slower rate than we’ve been seeing. And the rate we’ve been seeing wasn’t nearly fast enough.

|

More troubling was last week’s Chicago Fed National Activity Index, whose 3-month moving average for August stood at -0.42, suggesting quite weak growth. A value below -0.72 would be the sort of number that could signal the beginning of another recession.

|

The economy overall is still growing. But we seem as far from where we’d like to be as ever.

May be, these charts will supplement the global economy outlook.In essence they picture, the on going struggle to keep trends above the lowest trends lines.

Tracking the global economy

http://research.stlouisfed.org/economy/indicators/summary.pdf

Yes, Virginia, Presidents Bush and Obama have brought us a new reality. As long as investors and entrepreneurs have no idea what the future will hold for health care costs, cap and tax, organized labor corporate ownership, environmental restrictions, government price controls on such things as credit cards, and the list could go on and on. Until leadership changes this is our new reality. We have a new “equilibrium.” How do you like it?

The question, given the tendency of Congress and the Administration to eschew fiscal policy stimulus, seems to be “can the Fed do more to help on its own?” Krugman is hopeful but skeptical. I am much more pessimistic – I don’t think they will even be able to stop deflation. The test will come when Ben’s policies put stress on the euro and other currencies that “play by the rules.” Chimerica is just too big a beast to pull itself up on the backs of these other countries.

To stimulate innovation and jobs, should long-term capital gains tax be zero? My understanding is that a considerable number of new jobs are created by start-ups. My understanding is also that angel investors and high net worth folks are the ones who supply much of the capital needed to fund start-ups either through direct investment or through venture capital firms. It seems if we want to create an incentive for high net worth folks to invest in start-ups we could consider dropping LTCG tax to zero.

Didn’t we already have a post on this past month or so ago that says it is sales that is messed up. Why do you guys (economists) not mention that over and over and over again.

Instead we get two posts above, one calling it “future uncertainty” and the other calling it “capital gains taxes too high”.

Bogus. Sales are too low. In other words, it is about Aggregate Demand.

Adam, I believe it is because economists assume there is unlimited aggregate demand. I don’t!!!!

Economists don’t believe budgets matter in the macroeconomy. I do!!!

Even in a wealth/income inequality economy, macroeconomists don’t understand why low interest rates don’t “trick” people into going into debt.

Adam,

I realize that demand is low, but innovation may activate demand for a new service or product.

AS said: “To stimulate innovation and jobs, should long-term capital gains tax be zero?”

What if businesses fire people to raise the stock price generating a capital gain?

Also, a zero long-term capital gains tax does not magically allow new businesses/ideas to appear out of nowhere.

Get Rid,

Ideas always exist; the magic is to get them into the economy. Activation of ideas often requires capital; Investors are reluctant to invest if there is not a reasonable chance of after tax returns. Those folks with “excess” capital are often the ones who invest in new ideas, so why not create incentives for them to invest in new ideas? Have any of you “movie” critics ever been involved with creating a movie rather than being a critic? Having been involved with several start-ups, I could not have been successful unless I had high net worth investors. One company involved home IV therapy, which dropped the cost of IV therapy from what was charged on an inpatient basis to what we charged for out patient. Innovation can increase efficiency and improve a product and increase demand due to lower cost.

Ricardo As long as investors and entrepreneurs have no idea what the future will hold…

Are investors too stupid to read the papers or watch the news? The healthcare provisions are now a matter of public law, so investors shouldn’t have any doubt about what the future holds…unless of course they allow themselves to be fooled into thinking that the GOP is going to reverse the healthcare provisions already enacted. Ditto with the tax laws. The law says the tax cuts will expire, so what’s not definite about that? Once again, it appears that some people in the investor class are allowing themselves to be lulled by FoxNews fantasies of a fresh new round of upcoming tax cuts. As to cap and trade…here again the long run picture is pretty clear. Nothing signficant in cap and trade will happen until it’s crisis time, and that will be long after most in the investor class are long dead and buried. So where’s this confusion about what will happen politically?

The problem isn’t investors sitting on the sidelines because they don’t know what to expect 10 or 20 years from now. There’s no more confusion today than there was in the past. The reason companies aren’t expanding is very simple: they’re already sitting on excess capacity and they see very little demand for their products. We have a magneto problem. This isn’t difficult.

Well, I guess slow growth is better than no growth. Honestly, it’s hard for me to complain when the word “growth” is there. In other news, the dollar is weak. And apparently these days that’s a good thing….? Check out my URL, read about it.

Yes governments they are,and hereunder chart testifies for most of them!

Government Current Expenditures 1950

http://research.stlouisfed.org/fred2/series/GEXPND

Governments have always been !

Business Booms and Depressions since 1775 [Chart] : 1943

http://fraser.stlouisfed.org/publications/bb/issue/5069/download/85250/1943chart_busibooms.pdf

Did they spend better whilst the public sector was getting more and more affluent?

Gold bubble has crashed.

AS said: “Ideas always exist; the magic is to get them into the economy.”

I don’t see any big ideas that will dent unemployment from cheap labor and outsourcing. People might try and blow an alternative energy bubble, but I am not sure that will work either.

And, “Having been involved with several start-ups, I could not have been successful unless I had high net worth investors.”

There is another problem. Most people should be saving more, and the few should be saving less because they should be earning less.

Also, why didn’t you save enough yourself for your startups?

Get Rid,

The fact that you do not see any ideas that will dent unemployment, does not mean they do not exist.

Regarding saving enough for start-ups, most folks do not have the millions it takes for a substantial roll-out past proof of concept. Venture capital is usually required at the roll-out stage prior to a public offering. Many high-tech successful companies required venture funds prior to a public offering. Have you ever done anything substantial to contribute to unemployement or to grow the economy, or do you just pontificate?

Your comments seem to indicate you have no idea how a capitalist economy operates and how start-ups are financed.

Neo-liberalism has nothing to say about aggregate demand. We are just reaping the logical conclusion of a 30 year obsession with slashing wages and benefits to drive up next quarter’s profit. There simply aren’t enough people able to buy all the crap that is being churned out. The US elite has no solution but to yell at China to open their market.

AS, I think you should have a backup plan in case they don’t exist or don’t exist soon enough.

I don’t know for sure, but it seems to me that most of the venture capital is savings/excess savings of the few.

I hope I haven’t contributed to unemployment. I haven’t outsourced anybody’s job, hired a legal immigrant, or hired an illegal immigrant just to lower wages.

I want to grow supply and demand at about the same rate, not more supply than demand.

I didn’t own the business but helped with a lot to most of the details for one that grew quantities about 60% to 90% in 2 years or so.

IMO, the USA has a crony capitalist economy where the labor market gets oversupplied so it can exploited by the few.

AS: Investors are reluctant to invest if there is not a reasonable chance of after tax returns.

This seems like faulty reasoning. Capital Gains taxes don’t increase the risk of a venture. That is, you’ll never make a loss on your investment because you have to pay capital gains. If there’s a return to be had there will be an after-cap-gains return to be had, too.

2slugsbait:

“The healthcare provisions are now a matter of public law, so investors shouldn’t have any doubt about what the future holds…”

Can you point to a summary of the law and the implications–from a non-partisian source? (I’m not an economist, do not wish to discuss politics, and am here to learn)

Rob

Here’s a “just the facts” kind of summary:

http://www.cbsnews.com/8301-503544_162-20000846-503544.html