Over the last month, a consensus seems to have emerged that (1) the Fed has the ability to depress long-term yields further, and (2) the Fed has the intention to implement such measures. That raises the possibility that recent market moves represent a bet already placed by market participants on the basis of the logical implications of (1) and (2).

In the good old days of Fed watching, namely, back when the Fed actually had something obvious it could do, market participants became extremely skilled at anticipating the target that the Fed would choose for the fed funds rate well in advance of the FOMC decision and public announcement. When the actual FOMC announcement came, very little happened, because it had all been already priced into the market.

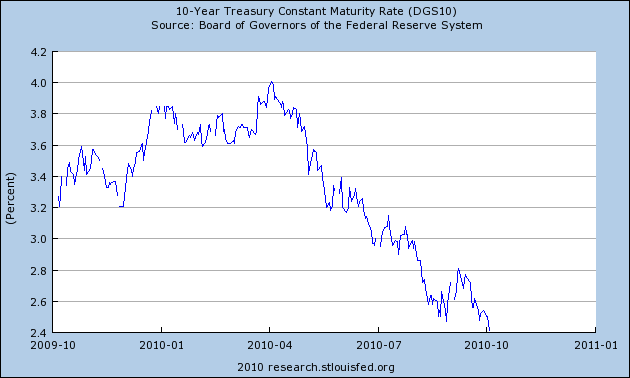

That game has been up since the end of 2008, when the Fed drove the fed funds rate essentially to zero. But if the Fed is now using very large-scale asset purchases to push around longer-term yields, should those operations warrant a new venue for Fed-guessing by bond markets? It’s certainly striking how much yields have declined as the conviction of a second round of quantitative easing (referred to by some as “QE2”) has grown. Over the last month, the 10-year yield has fallen 40 basis points. If you wanted to attribute all of this to expectations of QE2, and if you were assuming that $400 billion in long-term bond purchases could lower the rate about 13 basis points, you might think the market has already discounted some $1.2 trillion in additional large-scale asset purchases. All of which raises the interesting possibility that if the Fed were to announce in November another trillion in purchases, nothing would happen, because the market has already discounted it.

|

Another aspect of those “good old days” of monetary policy was that the Fed never needed to know the value of multipliers like this one in order to be able to implement the policy. The Fed would simply announce its target for the fed funds rate, and the market would jump there instantly, because it knew that the Trading Desk of the Federal Reserve Bank of New York stood ready to add or remove reserves as needed to maintain the target. The Fed had a big enough stick that all it had to do was to say what it wanted, and so it would be. Indeed, in the years before the Fed started publicly announcing its target in 1994, something very similar happened. If the Fed added reserves at a time when fed funds were trading a little below a new target, savvy market participants would figure out that the Fed was aiming for a lower target than before, and that in itself was enough to bring the rate down.

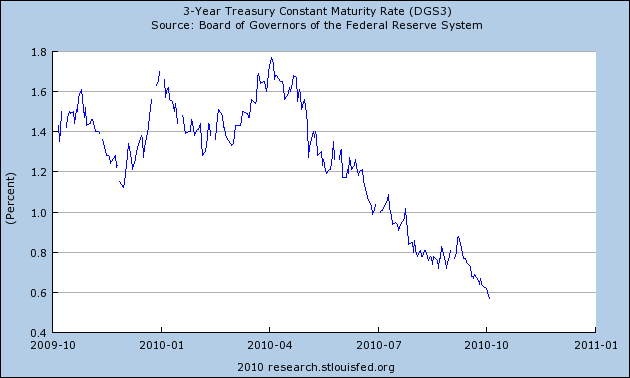

If the Fed were to aim, explicitly or implicitly, for a target for a longer-term interest rate, what would it pick? Presumably it wouldn’t be a 10-year rate, but something more intermediate like a 2- or 3-year rate. These of course are already quite low, and have plunged along with longer yields the last month. Joseph Gagnon suggests that the Fed aim for 25 basis points on the 3-year yield, as one way of being very precise (and aggressive) about what it means by keeping rates low for an extended period.

|

Of course, the growing market belief that QE2 is coming is itself a response to growing evidence of economic weakness. That economic weakness would also by itself be a factor that could lower bond yields, regardless of what the Fed is planning to do. But it’s curious that we’ve also seen commodity prices taking off at the same time interest rates are coming down. While a weakening economy makes sense as an explanation for falling bond yields, it does not make sense as an explanation for rising commodity prices. But a growing market conviction that QE2 is coming could be consistent with both.

Even so, I have a hard time fully reconciling the recent behavior of bond and commodity markets. It’s true that while the 10-year yield is down 40 basis points since September 10, 10-year TIPS are down 50 basis points, consistent with the view that there may have been a modest decrease in real rates and increase in inflationary expectations. That of course is exactly what QE2 is supposed to accomplish. But I’m doubtful that such a modest effect could be reconciled with the 10% moves in commodity prices we’ve seen over the same period. The people who think that 10-year nominal bonds paying 2.4% are a good buy, and who think that copper at $3.80 a pound is a good inflation hedge, can’t both be right.

I continue to believe that the Fed needs to watch commodity prices carefully as an indicator of how far to push on its new-found accelerator pedal. It may be that, as far as the market is concerned, QE2 has already happened, and it’s already accomplished all it could.

Great post James, think you are right. Exactly.

QE2 has already happened, even before it will be announced as the cure for the patient (at around election time).

But as I know the game, Ben will not care about commodity prices. No, don’t think this will ever happen.

When will QE3 happen ? I have an idea !

Indeed. Now the Fed has to follow through on its telegraphed QE2 or the stock market will start sliding, which is the last thing Bernanke wants.

I agree that the Fed ought to pay more attention to commodities and food and energy inflation, but they clearly care more about keeping stocks and houses afloat right now.

JDH,

The bond/commodities dilemma has a solution.

Assume that markets believe the Fed will start to target the unemployment rate (implicitly). Also assume that markets believe QE will be effective in stimulating commodities speculation and “pull-forward” buying, but not real growth. In that case, commodities would rise while bond rates kept falling (as unemployment remains stubbornly high). In fact, you yourself are a proponent of the view that higher oil prices — at some level — hinder real growth. This market’s anticipation of QE impacts is consistent with this view.

The counter-argument to the above view is that equities are rallying, at least in part, on the prospect that QE will be “successful”. That is, that the Fed’s intervention will produce high real growth and moderate inflation (high inflation is typically bad for equity P/E’s). This is something to watch closely. If the equity rally stalls while commodities continue higher and bond yields lower, this might deliver a signal consistent with a market view that QE risks producing high inflation without delivering a sustainable recovery. Ultimately, this market view would be highly damaging to the Fed’s credibility.

I know the Fed has implied that it is targeting (“too low”) inflation. But the possibility remains that it will allow an inflation overshoot if the unemployment rate remains near current levels. In effect, it would be targeting unemployment at that point. IMO, this is a likely outcome if inflation can occur even under a large output gap.

The people who think that 10-year nominal bonds paying 2.4% are a good buy, and who think that copper at $3.80 a pound is a good inflation hedge, can’t both be right.

But what if the “people” buying 10-year bonds are not investors seeking return but Fedsters seeking to depress yields or foreign central bankers seeking to devalue their own currencies relative to the dollar? That would resolve the enigma.

It seems that higher commodity prices will lead to some price inflation and that in turn will leave the dollar depreciated. This would therefore cheapen US exports and supposedly that would create jobs.

The rub though, if I understand all of this correctly, is that an increase in exports means an increase in competition between the US workforce, and the global workforce, which, consequently, leads to the seemingly obvious conclusion that the US economy, and the global economy, will have price inflation without any potential for wage inflation, especiall in nations like the US where wages are relatively high already and where trade imbalances are in the worst state . Plus, as if that downward pull on global purchasing-power were not enough to offset any perceived gains regarding job creation in the US, there will be additional downward pressure on global AD from the loss in value of global savings that are held in dollar related assets as these depreciate in value.

So, the objective of QE, (that of protecting the financial system [creditors] from deflation via the lowering of long-term interest rates), seems suspect and even more-so considering the liquidity trap conditions that currently exist. With banks now having more than ample time to strengthen their balance sheets, and considering the extensive government aid received, the US financial system is in a better position to make sacrifices than what the national and global economies are in.

Perhaps, QE2 is actually about ‘harvesting’ global market share in the nationalistic sense. This ‘is’ after-all the underlying objective that explains much about economic policy in the US and typically with an ‘end-justifies-the-means mindset’, but the gains from that ‘harvesting’ will come at the expense of global purchasing-power due to a lack of wage inflation and this will cause an even more distorted distribution of wealth between the rich and the poor, as measured by national wealth and also by individual wealth.

In other words, Wall St. traders do not relish QE because it is good for the working-class.

‘Globalization’ has allowed for a detrimental dynamic because global workers have so little disposable income that the global investment-class is not dependent on workers having disposable income. QE therefore, would seem to only worsen the wealth distribution inequities that are exacerbating the very global AD shortfalls that are causing the excess capacity shortfalls in the first place. This would suggest that a proverbial monkey (investment-class) has its hand stuck in the global jar which holds the demographic dividend. It is worth remembering that in 1929, before the crash, the poverty rate in the US was 71% (BLS).

Ray L-Love

Heard in the market that the TBTF banks are borrowing from Fed at .5& to buy Treasury to lock in the easy and low risk profits. This one way to rebuild BS of the banks. There could be another group of investors wanting to hedge against the perceived diminishing value of dollars by buying commodities and gold. Markets has many participants and who almost always have different views or needs.

Prof. Hamilton,

Did you notice that the 5 year TIPS has turned decidedly negative in yield (-0.34% as of Friday)? This seems highly abnormal. While holding a regular 5 year note at 1% can arguably make economic sense — it is possible we have deflation and the 1% nominal yield could turn out to be quite good, what is the reason to hold an instrument (negative yield TIPS) when you are guaranteed to lose economically?

Either the Treasury is not calculating the rate correctly (TIPS have features that could make calculation tricky) or someone is acting rather irrationally.

“That raises the possibility that recent market moves represent a bet already placed by market participants on the basis of the logical implications of (1) and (2).”

Is it just me or is there some level of moral hazard here? If the market really has priced in QE2 but the Fed *doesn’t* act will that through markets into a tailspin just as the economy weakens, so that the Fed will be increasingly forced to act?

The great danger in this strategy is that it does not ignite employment growth. How does the world react when it becomes clear that the FED is powerless to increase growth?

Traditional policy suggests we must rely on fiscal policy in that scenario. However, the new congress will be controlled by fiscal conservatives who ran on the claim that the first stimulus was not necessary. Will they vote for a second?

I think it might have to do with the dollar. Not just the recent fall of 6-7%, but the idea that the dollar becomes a funding currency for the emerging markets, etc., fueling a boom elsewhere. A lot of people see that as likely, not me though.

But the combination of rising monetary easing and decreasing fiscal stimulus and local/state government cutbacks could definitely lead to situation similar to that of October 2007-July 2008 when stocks began sliding and commodities continued to rise.

tj,

At the end of WW2, savings rates were high. Now, savings rates are low. After WW2, demand for houses, loans, and most all things, was very high, now, demand for these is not only low, but demand is saturated with supply to a point of excess and foreign goods are cheaper. So it is unlikely that fiscal policy would be an apt solution in these conditions even if the conservatives were not an obstacle.

“It seems that higher commodity prices will lead to some price inflation and that in turn will leave the dollar depreciated. This would therefore cheapen US exports and supposedly that would create jobs. The rub though, if I understand all of this correctly, is that an increase in exports means an increase in competition between the US workforce, and the global workforce, which, consequently, leads to the seemingly obvious conclusion that the US economy, and the global economy, will have price inflation without any potential for wage inflation, especiall in nations like the US where wages are relatively high already and where trade imbalances are in the worst state.”

Ray, good points and I would agree that US domestic purchasing power will drop first. However, I suspect the positive end effects of this (if it is successful) will be a domestic import substitution effect. IOW, we start producing more of our own consumption and end up employing people to do that. Bottom line… our total domestic demand will not increase much, but production, employment, and savings will go up, while consumption will go down. More people will end up being employed, but real wages will fall at first. That’s my take anyhow.

Doc,

I agree. Plus, to a certain extent, consumption in the US needed to abate anyhow.

What is worrisome is that the QE efforts are not likely to work. It is difficult to guess at what happens as global purchasing-power wanes but there is already talk of a global race downward between a long list of currencies. Something of a scramble I suppose to not be one of the nations with too few exports in a world with not enough global AD and austerity exacerbating things.

Plus, I don’t see a way to reconcile the US being the largest beneficiary of MNCs while having its home markets in partial isolation. The US ‘brand’ is losing favor as it is.

It is worth noting too that a depreciating dollar will lead to a rise in energy costs, which could be a good thing eventually, but it is likely to be a very bumpy ride for a time. With a result that leaves us with wealth distribution not seen since feudal times. The investment-class has too much power. But… sometimes it needs to get worse before it can get better.

Nice post. I think there were two stories in September. Anticipated Fed easing drove nominal rates lower and inflation expectations slightly higher.

The strong output numbers from China in the past month probably contributed to the strong commodity prices. In addition, commodity prices generally rise faster than the CPI during a cyclical upswing.

And yes, the weaker dollar also played a role.

I think W.C. Varones probably provides most of the answer.

But one should keep in mind that creating & lending a trillion $s of money that no one has ever saved is certain to lead to significant mispricing. It damages the micro-economic co-ordination process long before it is reflected in the CPI–or even if it never is reflected in that average.

It could also be Asia doing the deed for the FED so they DON’T have QEII. The FED would like to QE to Asia gives up his economic model IMO. Could lead toward war.

Commodity inflation will happen in any recovery piece and it just something you have to handle. Be more efficient, drive less, walk your butt into shape. Beats 20% unemployment.

QE2 has little to do with employment and is about puffing up the asset souffle that is the US economy.

Unemployment must be kept high – forget fiscal stimulus or direct hiring – so that washed up tool and die workers can be made grateful for their new careers flipping burgers.

Oh yeah, and China is going to open its capital markets to Wall Street because they are scared of Geithner, and a new debt market will bloom.

—I agree. Plus, to a certain extent, consumption in the US needed to abate anyhow. —

2nd derivative consumption has been in decline since the 1970’s. Consumption share has been increasing because of weak investment. The economy needs Americans to buy more, they just need to buy without credit which means they need wage gains.

People are muddled on the consumption meme, and confusing credit debt with overconsumption as measured historically.

We will always be ‘overconsuming’ if workers continue receiving a smaller and smaller slice of the pie.

In mt opinion, QE2 is an overloaded charge in the barrel of the FED’s artillery. It carries with it the real possibility that political winds will blow with a gale, and the FED’s governors may find themselves in jail for fraud. Make no mistake, QE2 will amount to little more than theft if it is exercised.

Maybe QE2 is an urban myth, concocted as a way to jack up the equity markets so the elites can lighten their positions prior to the inevitable 2011 recession.

Reading the footprint of the shadow economy (OOCC derivatives report) is always educative when it comes to confirm a converging trend in an asset category.

http://www.occ.treas.gov/ftp/release/2010-113a.pdf

Subdued in the interest rates (P3),one may assume that physical assets holdings are now more prominent than derivatives, in prices and interest rates anchoring.

The “hedges” on the foreign exchange side of the banks ledgers are not showing disappointing results,”markets are still extremely skilled at anticipating targets”

Is the universal quantitative easing Q+n more focused on nurturing assets and their prices than interest rates? (WC Varones comments)

PS As rates are trending towards zero we should notice the melting in profit amount of the IRS contracts coming to maturity (P18).

Perhaps I’m missing something, but why would the primary driver of commodity prices be expectations of US interest rates? Where I live (Australia) all the commentary about commodity prices refers to the surge in demand for commodities from China and attempts by the Chinese government to manage their growth rate.

Prices are the fundamental means by which we communicate to each other how much things are really worth to us — how we really want economic resources to be used.

Interest rates are prices that communicate the time value of money — perhaps the most fundamental and precious prices of all.

When prices are falsified by any means — exchange rate manipulation, central bank ZIRP policies (e.g. quantitative easing) — the resulting pattern of economic activity will be fundamentally distorted, and distorted in ways over which we lack direct control.

Unnaturally low interest rates make unprofitable activities appear profitable as if by magic, directing activity into ventures that are fundamentally unsound and that will founder if rates are ever raised back to honest levels.

It is far more honest, and far more effective, to stimulate by direct fiscal expenditure, so that we know exactly what it is we are causing to be done.

Bryce. I don’t quite follow your comment ‘no one has ever saved…..damages the micro-economic co-ordination process…’

Monetary expansion could represent potential investment, right? That it’s stuck right now doesn’t eliminate that possibility.

Also, savings rates are climbing. But investment obviously isn’t. Net job creation is difficult to engender because most spending flows through our distribution system to stimulate a foreign manufacturer. Which is why we have idle capacity.

I think QEII is aimed at this problem. It’s an escalation of a currency war that we’ve been non-fighting for almost 30 years. It’s about time we did something IMO.

“The people who think that 10-year nominal bonds paying 2.4% are a good buy, and who think that copper at $3.80 a pound is a good inflation hedge, can’t both be right.”

By now it should be crystal clear that people chase the trend. You can’t blame them since govt & finance(particullary CBs) have done everything possible to encourage short-term casino like speculation/gambling. Since in the long term we’re all dead anyway……nobody gives a rats ass about the long-term results…..screw the kids, grandkids and thebwhole planet. Narcissism @ it’s absolute finest………..

“I continue to believe that the Fed needs to watch commodity prices carefully as an indicator of how far to push on its new-found accelerator pedal.”

It is an accelerator pedal? sounds similar to the accelerator pedal on a Toyota, but then again, QE was Made in Japan.

The past QE already proved that Bernake was wrong to help the job creation and QE cannot do anything on economy except the speculative in financial markets that drive oil and food prices to the roof and jump the cost of living for the American unemployed people.

I think QE is useless to solve the employment problem and if Bernanke use the flagship to promote the job growht, we should know he is going to lie us.

QE is the major reason of unemployment because it creates the higher prices without fundamental supports. Imaginethepast QE support speculation in oil and foodbut American still have no jobs. It is not justified the oil price at 80 usd/barrel with nearly ten unemployment rate. Oil should be 40 rather than 80 if we have no QE.

QE isbroad base policy andfocus only liquidity support in financialmarket to drive the asset price to go beyond the fundamental value. Now Wall street wants to speculate more on oil price and food price, they also tell on CNBC and bloomberg that we need another QE to stimulate economy. It is nonsense.

The next QE will fail to create j obs but I am confident that the oil will jump to 120-150 with more than ten unemployment rate.

Bernanke shouldcome up with the need policy that directly solve unemployment problem without stroking another commodities price hike. Bernanke should build SME fund or SME banks to create the American jobs, American competitive markets and absorb the excess liquidity in financial markets to control jump in oil and food prices to create the higher real purchasing power. I think it is unfair that big corporate can access very cheap funding from Fed but small companies cannot access any thing and cost of funding is uncompetitive. We live in unfair policy and every economist talk on free market. If it is free, why Bernankesupport big corporation, support Wall street, support bigbanks but no support theunemployed people.

H.Z.,

Re the TIPs turning negative yield, people are either betting that inflation – 0.34% will be greater than the rate on the 5-year note (at 1.1%, inflation of 1.5% would do it) or they want a hedge.)

I have a ten-year TIP with 7 years until maturity. The coupon rate is 2.63% and I could sell it at a slightly negative yield and invest in a 7-year note that pays 2.3%. But if inflation averages more than 2.1%, I should have kept it.

I’m keeping it as a hedge.

JDH ~

“While a weakening economy makes sense as an explanation for falling bond yields, it does not make sense as an explanation for rising commodity prices. But a growing market conviction that QE2 is coming could be consistent with both.”

Commodity prices are where they were in Oct. of 2007, just before the downturn (including both Fuel and Non-Fuel Price Indices). So, considering that untold trillion$ have vanished from the global economy, some 17 trillion lost from the US alone in net assets, it seems that more than just QE is artificially driving up the prices of commodities. My guess, is that all monetary policy (global) is fueling what still exists as an excess of misguided investment capital. If someone who admits to an inability to recognize bubbles is the chairman of the Fed, it should come as no surprise that his policy recommendations fail to consider bubbles in any meaningful way.

If a trend-line of GDP growth going back 15 years is overlaid on a chart showing growth in net US assets, the difference in these two growth rates shows that asset values are still about 10 trillion $ above the GDP growth trend. This alone should be signaling that there is still too much investment capital in the system. But, of course, there are still those fuzzy thinkers who cite a lack of investment as if all types of investment are the same, as if that is all there is to it. But… what should have been the most important lesson of the recent downturn was that of just how out-of-balance, and misguided, capital allocation has become. Bubbles are not possible without too much speculative investment, how hard is that to grasp?

Intellectually, the problem stems from a multi-century long brainwashing effort by financiers endeavoring to convince all others of just how valuable their contribution to progress has been. Now though, the very nations showing unprecedented growth are the same nations that have put limits on short-term capital inflows. China now has the world’s 3 largest banks, and, unprecedented growth rates and poverty reduction rates. What this should be telling us is that fiat currencies are nothing more than keyboard capital that have minimized the demand for foreign investment. This understanding should be debunking the importance of financiers although they have instead managed to convince citizens of the western powers that their worth is actually more now than it has ever been, which should be alarming considering how their contribution was originally justified by the risk they took with ‘their’ money. A contribution which has been minimized almost out existence.

So what we should be seeing now, in an historical context, is increasing efficiency regarding capital formation and allocation. But the 10% rise in commodities over the past 60 days, like so many other factors, says otherwise. There has not been a ‘genuine’ “upswing” over the past 60 days, nor did the future look increasingly positive as those 60 days unfolded. The financiers simply received a reaffirmation that the value of their deceitful contribution to society will continue to be protected. But of course financiers have incomparable influence over who, from their own ranks, will protect their status from alleged positions of oversight. So, the imbalances continue and if billions of people are left unable to afford enough food etc., well… the wealth will trickle down eventually. As if, the financial ‘system’, and especially the ‘crucial contribution’ of the financiers, must always come first!

I don’t think there is much to be worried about commodity prices. They are in short supply and need higher prices to justify increased investment. We need a growing economy and this is an area that needs to grow. Even if this leads to increased inflation in the short term, this is just what the economy needs to adapt.

The US is still stuck in a slow-growth/no-growth situation that should persist for a while, while the rest of the world is not. Brazil, Asia, Europe, all are surprising with stronger than expected growth rates. Their material demands easily explain the commodities price increases, while the US letargic strugle explains QE2.

Exactly what positive influence can QE2 be expected to have on the economy? It seems to me the main possibilites are:

1) Depreciate the dollar and improve the current account balance.

2) Support asset prices and thereby support consumer demand (through the wealth effect).

3) Help promote inflation (prevent deflation), thereby ameliorating the debt overhang that discourages consumption.

4) Encourage investment by reducing the interest cost.

1) will help only if foreign response is not forthcoming. Asia is pegging to the dollar, leaving Europe and some other emerging markets to carry the load. Even if those don’t respond with competitive depreciation measures, the adverse effects on their economies may feed back to the U.S. For example, a collapse of the highly indebted euro members could be catastrophic. (It has been estimated that each one percent euro appreciation reduces the euro area growth by 0.1%. The euro has recently appreciated by about 15% vs. the dollar.)

2) will postpone needed adjustments and is not a long term solution. The effect is also likely to be small.

3) may not be achievable under conditions of high unemployment and excess capacity – even the measures needed to prevent deflation may prove unpalatable, involving an unacceptable risk of unhinged inflationary expectations.

4) is unlikely to be much help – business investment is mostly level-determined and housing seems unlikely to respond significantly anymore.

My guess is that QE2 won’t have a noticeable effect on unemployment – but we will never know how much worse things could have been without it.

Monitoring commodity prices is right. $150 per barrel oil would help tank the economy, just like it did a couple of years ago. Asset prices should also be monitored. Another housing bubble is just asking for trouble. Of course, non CPI inflation is also pertinent. For example, the portion of health care inflation not monitored by the BLS (because consumers don’t directly pay for it) is stressing public budgets, and making manufacturing uncompetitive on the world market.

The unintended consequences of printing can’t simply be ignored. Especially when they repeat so consistently.

Australia tempers view of commodities demand

By Peter Smith in Sydney and Leslie Hook in Beijing

Published: September 21 2010

Australia, the world’s largest exporter of commodities such as iron ore and coking coal, has tempered its outlook for global commodities demand in 2011, painting a more bearish picture than its previous report in June.

“Over the past few months, world steel consumption growth has moderated, and economic growth in 2011 is assumed to be weaker in China and major OECD economies,” the Australian Bureau of Agricultural and Resource Economics said in its latest quarterly report, published Tuesday.

—————

Oct. 11–RIYADH — NCB Capital,(Saudi Arabia’s largest investment bank)

… the rising presence of institutional investors highlights the growing appeal of commodities in portfolio diversification and yield enhancement, all of which has prompted growing liquidity inflows into the commodity markets. This is causing considerable short-term volatility in prices as speculative investing amplifies the traditional cyclical movements.

Dr Kotilaine continued, “The economic profile of the GCC region leaves it heavily exposed to commodity price fluctuations. While the region stands to benefit from strong oil prices, the arid climate and limited non-hydrocarbons endowments leave it heavily dependent on imports. Although diversification policies are seeking to address these constraints, strategic acquisitions to control price volatility are likely to become increasingly important.”

There are a growing number of efforts to build up strategic reserves in the region, especially in agricultural commodities. Oman has already built up a buffer of between three and four months and both Saudi Arabia and the UAE are in the process of setting up similar systems. GCC public and private sector players have also increasingly developed an international profile in their efforts to secure key commodity supply lines, most obviously in the case of agricultural products. This echoes similar developments in China and India and is likely to grow in importance.

——————————

It seems very likely that the rise in commodity prices is due to a combination of speculation and speculation about further speculation. This of course also requires a moderate level of demand but as the report from the Australian Bureau of Agricultural and Resource Economics makes fairly plain, it is unlikely that demand for commodities will rise as stimulus funds wane on a worldwide basis. The report only mentions China specifically but it is safe to assume that stimulus funds are widely reaching their ends in most all of the nations that consumed large amounts of commodities for infrastructure projects and etc. It is also conceivable that, as the article from Riyadh hints at, there may be some stockpiling taking place to prepare for a trade war, and, as stated more overtly, some middle eastern nations are trying to stay one step ahead of the speculators.

But, demand for commodities has been artificially supported by deficit spending worldwide and so future prices should not be rising at this time based on supply/demand. As I said in a previous comment, commodity prices are at the same levels as just before the down turn. The current price trends would only seem sustainable if deficit spending were to be sustained or if consumption factors were back to where they were, but commodity price trends are not only sustained they are rising rather quickly.

Beezer,

Why we have idle capacity is because a lot of bad investments were made, guided by the interest rates artificially depressed by central banks. “Artificial” in that the money these central banks lent out [buying bonds] was never saved [except to the extent PBoC sterilized].

It is crucial to a sustainable structure of production that avoids boom/bust to be guided by an interest rate arising from the interplay of savings & the demand to borrow those savings. An interest rate arising from the manipulation of a gov’t bureaucracy–especially one led by Helicopter Ben–distorts this crucial price in the extreme.

jm, also in this post, captures some of what I’m talking about:

Prices are the fundamental means by which we communicate to each other how much things are really worth to us — how we really want economic resources to be used.

Interest rates are prices that communicate the time value of money — perhaps the most fundamental and precious prices of all.

When prices are falsified by any means — exchange rate manipulation, central bank ZIRP policies (e.g. quantitative easing) — the resulting pattern of economic activity will be fundamentally distorted, and distorted in ways over which we lack direct control.

Unnaturally low interest rates make unprofitable activities appear profitable as if by magic, directing activity into ventures that are fundamentally unsound and that will founder if rates are ever raised back to honest levels.

I wish Hoenig would give me advance warning when he is about to speak against QE. His speeches seem effective enough to cast doubt on the strength of the anticipated Fed move and are followed by a clear dip in the DOW and by dollar appreciation. Provides separate evidence that the market is anticipating the Fed’s move. Apparently, the fools still think Bernanke can save them.

Professor,

With your work on oil prices and economic contraction where do you believe we are headed as oil prices surge?

It is good to see you connect the rise in oil pirces with inflation. If you want to know what the price of oil is going to do just watch the price of gold. Oil is still under priced. The market may be reacting to QE2 but soon it will be reacting to EXXON 2 as a combination of inflation and tax increases squeeze profits even more.

There have been several money managers, after the 2008 and early 2009 experience, to emphasize the use of US Treasuries as the ultimate diversifier against equity-like risk for a global portfolio. They might be the ones who currently like copper and 10-year notes.

Great post! I call the QE II cheap talk, the Bernanke put. How long will the Bernanke put last? Will he eventually replace cheap talk with balance sheet entries and keep them for a couple of years? I ask because of the heavy portfolio weighting in base metals and oil explorecos.

Wouldn’t it be fascinating if some economist 20 years from now concluded that all this monetary stimulus had largely helped non-American economies?