Most observers now seem convinced that the Federal Reserve will shortly implement QE2, a second round of quantitative easing. It’s worth taking a look at what QE2 is and is not expected to accomplish.

The ability of the Federal Reserve to influence what happens in the economy is fundamentally limited. The ultimate power of the Federal Reserve is the ability to create money, and how much money the Fed creates is a key determinant of the purchasing power of an individual dollar bill. A very minimalist position on what the Fed should be doing is that it should aim for a rate of inflation that does not disrupt the economy’s ability to use real resources in the most efficient manner possible.

I think there would be broad agreement that a high and volatile inflation rate does not accomplish that objective. One reason why most of us can agree with that statement is that we have lived through times of high and volatile inflation and know first-hand the kinds of problems that environment can create.

It is also quite clear to me that deflation– an increase in the number of goods you can buy with an individual dollar– can be even more destructive. Since this may be less obvious to many readers, let me review some of the reasons why I say that.

For people struggling under debt burdens, deflation makes repaying the loan more difficult and less likely to happen. If that leads to a wave of bankruptcies, everyone, including creditors, can end up losing out. Debt burdens and delinquencies remain a significant problem holding back the economic recovery today. These problems would magnify enormously if a serious deflation were to get underway.

Deflation also means you can earn a positive rate of return just by stuffing money in your mattress. That creates an incentive for consumers, firms and banks simply to hoard cash rather than invest it productively. Even very sound investments can have a hard time competing for lenders’ dollars when the alternative of hoarding becomes sufficiently lucrative.

I’m personally persuaded that the 25% drop in the overall price level in the U.S. between 1929 and 1933 was one factor contributing to the depth and severity of the Great Depression. Our recovery began pretty dramatically when the U.S. reflated by dropping parity of the dollar with gold in 1933. Other countries had a similar experience– things began to improve only after prices began rising.

|

But even if you agree that significant deflation can be a problem, we’re not seeing deflation in the U.S. at the moment. We had 1% inflation, not deflation, over the last year. What’s the harm in that?

One danger of low inflation is that, if it turns into deflation, the chain reaction can be difficult to stop before significant damage gets done. We’re already at a point where, because of the very low inflation rates, the traditional tool that monetary policy would use to stimulate the economy, lowering the overnight interest rate, has no potency whatever, making it much more difficult for the Fed to arrest a significant deflationary turn should it arise at the moment. And with inflation this low, we’re still seeing some of the problems with debt service and cash hoarding noted above. Many analysts point to Japan’s experience of the 1990s as an illustration of the problems that this kind of low inflation or modest deflationary environment can cultivate.

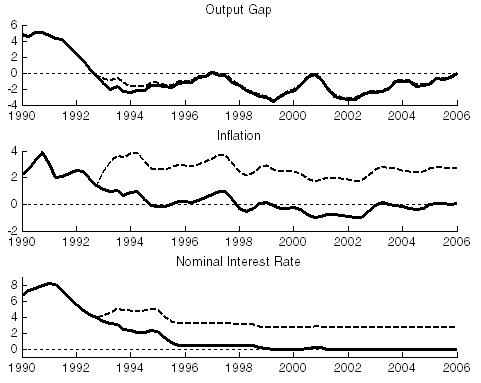

Actual path (solid line) of output gap, inflation, and interest rate, and simulated counterfactual path (dashes) for Japan,1990-2006. Source: Daniel Leigh (2010).

And even if you don’t agree with me that, given our current economic situation, a 1% inflation rate for the U.S. is destructive, maybe you’d at least agree that, if our inflation rate were to rise to 3%, it wouldn’t be that harmful. On the other hand, there should be no question about the damage being done to people’s lives by the continuing high rates of unemployment and wasted economic capacity. In normal times, we worry about trying to stimulate the economy too much out of concern about the negative consequences of a higher inflation rate. But if the downside for the latter is not that great, why not try to do a little more?

I grant that this is a little like the philosophy of driving your car into the garage until you bump up against the wall. Not generally a good guide for how to drive your car, but at least it is one very reliable way to know that you’ve done all you can. At the moment, I have a great deal of uncertainty, as I think other reasonable observers should as well, as to just how much we could stimulate the economy without producing inflation. I personally believe that we might reach that point sooner than many other analysts seem to be assuming. But the only way to know for sure is to try and see.

I emphasize that more expansion from the Federal Reserve may be of only limited help, and nobody should hope for too much from QE2. I urge the Fed to be carefully watching commodity prices as one indicator of just how far away the wall of the garage may still be.

I do not believe that the Fed can solve our economic problems. But I do believe that excessively low or negative inflation rates will make them worse, and that this is something the Fed can and should prevent.

I presume in your view, people like Dean Baker are wrong about what printing money can achieve. Are you able to easily summarize why?

I would be very interested to hear your thoughts about other ‘channels’ through which QE may effect the economy – either positively or negatively. I’m thinking here of things like the effect on asset prices, such as shares, and perhaps also with regard to theories like “the banks aren’t lending because they are trying to rebuild shareholder capital” – does QE have a role there?

Here is part of what Michael Hudson had to say from an article on Oct. 11, 2010 :

“The problem for all countries today is that as presently structured, the global financial system rewards speculation and makes it difficult for central banks to maintain stability without recycling dollar inflows to the U.S. Government, which enjoys a near monopoly in providing the world’s central bank reserves by running budget and balance-of-payments deficits. As noted earlier, arbitrageurs obtain a twofold gain: the margin between Brazil’s nearly 12% yield on its long-term government bonds and the cost of U.S. credit (1%), plus the foreign-exchange gain resulting from the fact that the outflow from dollars into reals has pushed up the real’s exchange rate some 30% – from R$2.50 at the start of 2009 to $1.75 last week. Taking into account the ability to leverage $1 million of one’s own equity investment to buy $100 million of foreign securities, the rate of return is 3000% since January 2009.”

“Brazil has been more a victim than a beneficiary of what is euphemized as a “capital inflow.” The inflow of foreign money has pushed up the real by 4% in just over a month (from September 1 through early October), and the past year’s run-up has eroded the competitiveness of Brazilian exports. To deter the currency’s rise, the government imposed a 4% tax on foreign purchases of its bonds on October 4.”

““It’s not only a currency war,” Finance Minister Guido Mantega explained. “It tends to become a trade war and this is our concern.”[7] Thailand’s central bank director Wongwatoo Potirat warned that his country was considering similar taxes and currency trade restrictions to stem the baht’s rise. Subir Gokarn, deputy governor of the Reserve Bank of India, announced that his country also was reviewing defenses against the “potential threat” of inward capital flows.”[8]”

——————

This is a must read article for anyone who is seriously interested in this subject. Dr. Hudson continues to get it right when most economists continue to get it wrong.

http://michael-hudson.com/2010/10/why-the-imf-meetings-failed/

Shouldn’t a distinction be made between CPI and wage inflation?

If the Fed creates CPI inflation through a fall in dollar/rise in commodities, and only much milder wage inflation, won’t we be worse off?

And while a fall in mortgage rates will be inflationary, won’t the loss to savers (including retirees, pensions, endowments, insurers) be deflationary? State pension funds have been lowering their expected returns for the last couple years, meaning more savings by the states, or lower benefits to pensioners, both are deflationary.

Frankly, I think it’s rather obvious that absolutely no one can make a convincing case that they can predict what the net positive effects of this will be.

The effect of revaluing to the gold standard is thoroughly as anachronistic as the gold standard itself. We didn’t have the burden of being tied to a fixed rate, and we can’t expect to create the benefit leaving it.

Tim Duy’s recent post on the collapse of Bretton Woods 2 is also an important contribution to the subject at hand:

http://economistsview.typepad.com/timduy/2010/10/the-final-end-of-bretton-woods-2.html#comments

But Professor Hamilton, why would they do more of something (QE2) that didn’t work to generate inflation the first time (QE)? The only thing I can think of is that the Fed thinks it can raise inflation expectations by promising to “act irresponsibly” … and that QE2 is irresponsible since the consequences of misjudging the wall will be far greater

Dr. Hamilton –

America’s economic problems are directly related to price levels caused by inflation. Its impossible right now for an American manufacturer to compete against a Chinese competitor paying $1/hour for labor and operating at a 3% gross margin. Supporting existing price levels and adding to them with QE2 does not solve the problem.

Japan saw the handwriting on the wall ten years ago, and abandoned quantitative easing for deflation because they knew that they were in direct competition with China and Korea. 1000 Yen apples were not going to lead to prosperity. America on the other hand is addicted to the cheap fix… For forty years, we’ve relied on negative foreign trade, negative fiscal accounts, and geometric credit expansion. Now that we’ve crashed the economy due to credit excess and corrupt financial and industrial policy, we’re playing the last card in a losing hand: Buying back impaired securities at inflated prices to keep the banking system from realizing its actual losses.

That’s the rub- In order for the banking system to safely extend credit and the economy to again grow, we need to REDUCE the debt level in America. That necessarily means that non-performing loans have to be PURGED and impaired financial institutions have to be CLOSED.

I am beyond frustration that the FED board and academic economists believe that they can defy gravity. Safe banking and credit expansion can only occur with honest asset valuations, adequate capital ratios, and a capacity of the customer to service their debt. TIME FOR SOME TOUGH LOVE!

Professor,

If you believe that inflation and deflation are always and everywhere monetary phenomenon then you must not confuse deflation with contraction. If government intervention creates a harsh economic environment where there is massive unemployment and lack of business investment you can have a decline in demand for goods and a crash in prices as happened during the Great Depression.

We are facing a similar event today and that is why QE1 had virtually no effect on the real economy, only on the stock market and the price of commodities and excess bank reserves. QE2 will also have no impact on the real economy even though it might temporarily spike the stock market. Once the stock market has to face reality even the market will not react to QE. Until demand side economists understand that we are beyond monetary events and into actual destruction of goods production we will continue in stagnation and perhaps even gretaer decline.

Trough several previous posts, Econbrowser and comments addressed the benefits of QE and possible causes and consequences.

Banks have ample reserves and do not lend, as they may not see a clear risk rewards through the actual imbalanced economies.

Banks are much more found of the “aggiotage” on the interest yield curve.States bonds are rewarding this strategy,as long as they buy there is no default.

Interbanks lending and borrowing is in autarky.

Instead of driving bonds prices and interest rates through Interest rates swaps,futures,options, physical assets are performing the same function and remain under the Fed control.

The OOCC derivatives report is clearly showing the profit attrition at the IRS chapter,the unwinding of the IRS swaps and the rising activities in the forex components attached to the swaps.

Intended consequences could be the clearing up of the derivatives in the banks books and the recognition of the proprietary trading by their shadow(s) owners.

QE may not not create full employment its 10 years track record is poor.

QE will not cure insolvency,the three last years of practice and the actual banks assets are a testifying for it.

The most important idea missing from your view of deflation which seems all to common is whether deflation is actually beneficial to the economy longer term. Especially when you consider deflation is the result of lax central government fiat paper management, not some magical process morphed out of thin air.

Furthermore, deflation has a natural limit/floor (the amount of fiat paper circulating) and cannot continue forever. However, the opposite is true of inflation and money printing. It can go on for eternity or until society collapses.

The biggest problem with fighting balance sheet recessions with more fiat money is you never clear the bad assets and mismanaged corporations from the landscape and thus prolong the necessary adjustment.

Americans are too weak to endure the re-alignment of capital and resources our grandparents went through so we create new acronyms for the same old story of throwing good money after bad.

Thanks Raylove

Michael Hudson’s Why the IMF Meetings Failed was a wonderfully concise and thorough description of US financial policy and its unintended consequences.

there is a lot of decent literature on this and it focusses on measuring the long rates rates reduction. Via observed rate declines on announcements, that were big, and the shrinkeage of the privately held bonds, estimated by one down 22% with QE 1

http://research.stlouisfed.org/wp/2010/2010-018.pdf

good findings and summarizes others.

a lot of folks never liked QE or stimulus, but its clear to me they both did work. the only one who says no is John taylor. that figures. But they may well be right eventually. QE and stim effects will eventually weaken and exhaust,side effects multiply, spend some time on that?

Framing this debate about deflation is pointless, the fed is nowhere near a pure deflation avoider, they are targetting jobs and functioning finance.

The rhetoric is mostly confidence building fluff.in my view its disinflation that hurts debtors, and there is nothing magic about the zero line.

As for the Fed. Its quite possible they are just jawboning about deflation/ QE2 now. if this gets rates down, they need not actually do it?

Jim: Remember that the inflation rate is an average. If the non-linear negative effects of deflation are family – by – family, then what we care about is not whether or not the average rate of change of prices less than 0, but what share of the population has experienced wage & income change less than 0. Surely there can be a not-insignificant share of the population experiencing wage deflation when the overall average rate of price inflation = 1. Just ask all the CA state workers, UC and CSU employees. . .

deflation is bad only for an economy where expansion is entirely debt induced. debt levels sooner or later reach the point of exhaustion: there is only so much debt that could be serviced with the present income.

at this point what is better: inflation or deflation? whatever leaves more disposable money to service the debt. through inflation you inflict even greater immediate pain, only after years of suffering and given a tight labor market, you can get a reprieve. inflation is not a quick fix.

http://research.stlouisfed.org/fred2/data/CPIAUCNS_Max_630_378.png

I wouldn’t worry too much about QE2. I don’t think the Fed could cause inflation right now any reasonable amount of QE. Here is my reasoning.

1. In an economy that is 70% consumer spending inflation cannot get very far without corresponding increases in nominal household income. If prices rise without corresponding increases in household income aggregate real demand will fall in proportion to price increases and quickly snuff inflation.

2. Thus, for QE2 to cause significant inflation there has to be some mechanism by which the additional money pouring out of the Fed turns into an increase in household income.

3. One possible mechanism would be that freshly printed money is used for real investment, that creates jobs and thereby creates increases in household income. However, interest rates are already at near record lows and companies are still not embracing real investment, so it seems unlikely that a few more tenths of a percent drop in the interest rate will stimulate significant increases in real investment.

4. The additional money being used to bid up commodity prices is not likely to result in increases in household income as long as there is excess capacity and high unemployment. Commodity sellers will simply tend to pocket the extra profits from the higher prices.

5. Higher commodity prices could result in increased commodity production, which could result in increases in household income. However, the increased commodity supply from increased production will tend to moderate the price increases at the same time that the higher household income is providing income to pay higher prices, so once again inflation will tend to be blunted over time.

Isn’t it likely that the countries who went off gold bought it at the expense of those who were still on it? i.e the beggar my neighbour policy?

“The ultimate power of the Federal Reserve is the ability to create money, and how much money the Fed creates is a key determinant of the purchasing power of an individual dollar bill. ”

This is simply false. First off, “money” is a slippery concept in these discussions. The Fed can create reserves at will, but it cannot, under normal circumstances, “create money”. It can only swap one financial asset – one form of “money” – for another. All such monetary operations leave the total amount of financial assets – “money” – in the private economy unchanged, no matter how many reserves are created. For the Fed, it is always a matter of price, not quantity. The only effect of QE is to alter the term structure of interest rates.

The amount of reserves the Fed creates simply has no effect on inflation or deflation (except in the very marginal effect that different interest rates have, and those are most likely the opposite of what the fed intends – e.g. lower interest rates are deflationary). Both require a change in purchasing power, which requires a change in the amount of assets the private sector holds. This is fundamentally a fiscal operation – the treasury spending more than it taxes – which is not in the purview of the Fed.

The FED can’t really create “inflation” now since Asia(and its partners) basically gobble it all up as economic activity. I am also not convinced it can defeat Asia’s games. Especially if Europe doesn’t follow and the Euro hyper-surges, thus bringing down the whole continent and then again the global economy.

When you are in debt deflation and you have more debt than savings, inflation is desired because of its ability to provide structural investment while the debt loads are reorganized. Deflation literally will destroy your country. The “Great Depression” was only a moderate “spiral” and you saw the damage it did. This “spiral” would probably destroy 60-75% of the productive US economy.

Note the end of the post-war boom saw more inflation than we wanted with our high savings levels. People confuse inflation all the time with what they see at the grocery. They don’t understand that there won’t be many groceries or foods available in a deflationary spiral. It is the confusion that leads towards anti-capitalism when realization occurs.

“I grant that this is a little like the philosophy of driving your car into the garage until you bump up against the wall.”

Actually, it’s more like the philosophy of seeing just how slowly you can accelerate and still get on the freeway without being rear ended.

Or at least it would be if you had ever “lived through” long-term unemployment, and knew “first-hand the kinds of problems that environment can create”.

Jim,

From Wiki:

A central bank implements QE by first crediting its own account with money it creates ex nihilo (“out of nothing”).[1] It then purchases financial assets, including government bonds, agency debt, mortgage-backed securities and corporate bonds, from banks and other financial institutions in a process referred to as open market operations. The purchases, by way of account deposits, give banks the excess reserves required for them to create new money, and thus hopefully induce a stimulation of the economy, by the process of deposit multiplication from increased lending in the fractional reserve banking system.

Two things:

1) We have a jobs and wage problem here not a money supply problem, there is plenty of money, it just happens to be sitting idle.

2) Tax policy is not being used properly to create jobs, which will stimulate spending and turn the money flow back on.

Couple suggestions, let’s agree to extend the tax cuts for all. However, for those above say $250K, let’s make it a tax credit that can be taken if the money earned above $250,000 is put into active play in funds for entrepreneurs to build businesses and jobs in America only. No foreign investments would be allowed by this fund.

Corps would need to do the same with profits. No more giving out huge bonuses to avoid the double taxation issues. Instead, if you want lower taxes, invest in the U.S.

There is much to be done and our leaders are failing to work for the common good of the Country.

There is a blow out coming on Nov. 2. Those elected had better get awful damn serious about the U.S. economy.

On the debt side: Let’s have a tax holiday for those under $250,000, from fed, SS and MC. Of course, the holiday would only be good for those who use the resulting tax savings to first pay down existing unsecured debt, then secured other than your home and then mortgage payments. Let’s make a one year holiday.

We need to get money moving again. Does anyone remember the disney film on how money works from the 30’s or 40’s? It should be mandatory for our schools today!

Ow and BTW if these things are done, revenues to the feds would go up.

JDH

How much should the Fed trust the recent commodity price growth given that a lot of it seems to have a perfectly good explanation that does not require expected inflation as an explanatory variable. For example, the spike in metals prices may be due to recent attempts by China to corner the market in precious metals. China’s motivation for doing so appears to be purely a political strategic one not at all related to economic fundamentals. And the recent volatility in grain prices could be explained by the severe droughts in Russia, Ukraine, Australia and this year’s extreme heat & rainfall in the grainbelt region of the US. [Note: the disappointing crop forecast from USDA should settle the debate about global warming being good for corn yields!] So grain prices could be going up due to supply shocks rather than Fed induced inflation.

slugs,

Australia tempers view of commodities demand

By Peter Smith in Sydney and Leslie Hook in Beijing

Published: September 21 2010

Australia, the world’s largest exporter of commodities such as iron ore and coking coal, has tempered its outlook for global commodities demand in 2011, painting a more bearish picture than its previous report in June.

“Over the past few months, world steel consumption growth has moderated, and economic growth in 2011 is assumed to be weaker in China and major OECD economies,” the Australian Bureau of Agricultural and Resource Economics said in its latest quarterly report, published Tuesday.

==============

In short, demand for hard commodities should be tailing off as stimulus moneys tail off around the globe. Hard commodities are at the same price levels as in Oct. of 2007, global economic activity though is well short of that if deficit spending is seen as unsustainable, as it should be.

“I am beyond frustration that the FED board and academic economists believe that they can defy gravity.”

Me too. And I haven’t forgotten that Ben voted with Greenspan on every one of his short-sighted actions.

“Surely there can be a not-insignificant share of the population experiencing wage deflation when the overall average rate of price inflation = 1. Just ask all the CA state workers, UC and CSU employees. . .”

I wonder if inflation of the type we are likely to experience (stagnant wages with increasing costs of natural resources) will be all that helpful to debtors. An increase in gas prices will not help them pay the mortgage.

“2. Thus, for QE2 to cause significant inflation there has to be some mechanism by which the additional money pouring out of the Fed turns into an increase in household income.”

It seems to me that inflation under conditions of excess capacity and high unemployment can only come from fears for the value of the currency. And it seems to me quite dangerous to foster such fears, as they may easily become unhinged. My fear is that in order to mollify an unhappy public, the Fed may lead us into truly disastrous straits. I think acceptance of foreign currency mercantilism, stupid and short-sighted Fed actions under Greenspan after the dotcom bust, and a public too spoiled to pay for its government’s spending led, more or less in equal parts, to our current malaise. Ben can’t do much to fix it, but he can make it much worse if he isn’t careful.

rayllove

Thanks, and I’m sure that’s right. But supposedly the Chinese have been buying up precious metals for strategic purposes unrelated to any kind of demand driven by economic activity. My point is that the Fed may not want to put too much faith in a commodity price that may be fundamentally driven by geostrategic political interests rather than anything based in economic fundamentals. Too much political noise in the signal.

The irony of the recent IMF meeting is that while US officials were busy trying to gain support for a united front to condemn China’s currency manipulations, it was US currency manipulation that wound-up being condemned in the most significant ways. Brazil’s 4% tax on foreign purchases of its bonds, and the other nations, India, Thailand, also announcing that they were also considering a tax on foreign purchases of their bonds, was pretty much what the meeting was intended to accomplish, but with the condemning aimed at China instead of at speculators from the US and etc. I wonder if President Obama chewed-out Sec. Geithner after the dust settled.

Here is more from the Hudson article:

“Indeed, the standoff between the United States and other countries at the IMF meetings in Washington this weekend threatens to cause the most serious rupture since the breakdown of the London Monetary Conference in 1933. The global financial system threatens once again to break apart, deranging the world’s trade and investment relationships – or to take a new form that will leave the United States isolated in the face of its structural long-term balance-of-payments deficit.”

Slugs,

You may have seen the following on another thread here? It adds an interesting dimension.

Oct. 11–RIYADH — NCB Capital,(Saudi Arabia’s largest investment bank)

… the rising presence of institutional investors highlights the growing appeal of commodities in portfolio diversification and yield enhancement, all of which has prompted growing liquidity inflows into the commodity markets. This is causing considerable short-term volatility in prices as speculative investing amplifies the traditional cyclical movements.

Dr Kotilaine continued, “The economic profile of the GCC region leaves it heavily exposed to commodity price fluctuations. While the region stands to benefit from strong oil prices, the arid climate and limited non-hydrocarbons endowments leave it heavily dependent on imports. Although diversification policies are seeking to address these constraints, strategic acquisitions to control price volatility are likely to become increasingly important.”

There are a growing number of efforts to build up strategic reserves in the region, especially in agricultural commodities. Oman has already built up a buffer of between three and four months and both Saudi Arabia and the UAE are in the process of setting up similar systems. GCC public and private sector players have also increasingly developed an international profile in their efforts to secure key commodity supply lines, most obviously in the case of agricultural products. This echoes similar developments in China and India and is likely to grow in importance.

——————————

It seems very likely that the rise in commodity prices is due to a combination of speculation and speculation about further speculation. This of course also requires a moderate level of demand but as the report from the Australian Bureau of Agricultural and Resource Economics makes fairly plain, it is unlikely that demand for commodities will rise as stimulus funds wane on a worldwide basis. The report only mentions China specifically but it is safe to assume that stimulus funds are widely reaching their ends in most all of the nations that consumed large amounts of commodities for infrastructure projects and etc. It is also conceivable that, as the article from Riyadh hints at, there may be some stockpiling taking place to prepare for a trade war, and, as stated more overtly, some middle eastern nations are trying to stay one step ahead of the speculators. If you haven’t read Dr. Hudson’s latest article regarding the recent IMF meeting, and about speculators etc., It is a must read. Not much about commodities but it all connects!

The FED isn’t trying to inflate, they are trying to raise inflation expectations. If the current expectation is inflation of 0% to 1%, then HHs and Firms can safely sit on cash as a hedge against deflation and double dip.

The incentive to sit on cash is greatly reduced if QE2 is successful at raising inflation exectations given the choice is to earn ~0% nominal return when inflation is expected to rise.

Unfortunately, and as many have pointed out above, the addition of FED money simply increases the excess reserves of primary lenders. This will do litle to alter inflation expectations.

Thus, QE2 will fail to raise inflation expectations and will fail to ignite HH spending and business spending.

“The irony of the recent IMF meeting is that while US officials were busy trying to gain support for a united front to condemn China’s currency manipulations, it was US currency manipulation that wound-up being condemned in the most significant ways.”

And it’s too bad that Ben is no more likely to listen to these complaints than China and other Asian currency manipulators.

There is, however, an important distinction between monetary easing and currency manipulation. Namely, the former reduces interest rates at home, which tends to discourage domestic saving and encourage domestic consumption and investment, as well as cause the local currency to depreciate. Pure currency intervention, in contrast, encourages savings and discourages consuption in the home country, at the same time that it causes the local currency to depreciate. In other words, one can characterize monetary easing as a policy to spur domestic AD with a side effect of transferring AD from trade partners to the home country, whereas currency intervention is a policy to transfer AD from trade partners to the home country with a side effect of encouraging saving and discouraging consumption in the home country(and thus reducing total global AD). This is egregious behavior in our current world of deficient AD and that is why Krugman decries it. Hudson fails to note this important distinction.

And what exactly is wrong with “cash hoarding” when there’s so much overcapacity already that there’s nothing worth investing in? And why should we spend the stuff on toys when we already have everything?

What’s the worst that could happen when the Federal Reserve implements QE2?

A serious question…

don,

The important distinction that you accuse Hudson of not making would be illogical for him to make considering that he explains that:

“U.S. officials demonize foreign countries as aggressive “currency manipulators” for keeping their currencies weak. But these countries simply are trying to protect their currencies from arbitrageurs and speculators flooding their financial markets with dollars. Foreign central banks must choose between passively letting these inflows push up their exchange rates – thereby pricing their exports out of global markets – or recycling these inflows into U.S. Treasury bills yielding only 1% and whose exchange value is declining. (Longer-term bonds risk a domestic dollar-price decline if U.S interest rates should rise.)”

“The euphemism for flooding economies with credit is “quantitative easing.” The Federal Reserve is pumping liquidity and reserves into the financial system to reduce interest rates, ostensibly to enable banks to “earn their way” out of negative equity resulting from the bad loans made during the real estate bubble. This liquidity is spilling over to foreign economies, increasing their exchange rates. Joseph Stiglitz recently acknowledged that instead of helping the global recovery, the “flood of liquidity” from the Fed and the European Central Bank is causing “chaos” in foreign exchange markets. “The irony is that the Fed is creating all this liquidity with the hope that it will revive the American economy. … It’s doing nothing for the American economy, but it’s causing chaos over the rest of the world.”[1]”

So… why would Hudson make the “distinction” that you claim to be so critical when he is not saying ‘anything’ about one being more or less harmful than the other, but instead, that one causes the other? Did you read his article? Your claim regarding the ‘distinction’ makes me think that your mind is cluttered with bias to the point that you resort to counter-factual and deceitful comparisons, such as the one involving Krugman and Hudson, based on your ever unsupported and unsupportable claims regarding global AD, as if you have undeniable proof that China is solely at fault here, when that is clearly not axiomatic, as if the US has 700+ military bases and 17 intelligence agencies for altruistic purposes. Your worldview is playing tricks on your reasoning. Had Hudson made the comparison that you assigned to him, or suggested anything of the sort, your ‘distinction’ assertion would have had merit. But you simply distorted the context of his argument, to suit your argument.

We know already that if the Fed buys a trillion in treasuries next year, the banks won’t have any treasuries to buy.

This will cause the banks to buy 1 trillion dollars of China Mobile stock.

Consequently, the PBoC will print a trillion dollars of RMB and sell it for dollars in FX to keep the RMB pegged to the buck. The Yollar tanks against all other currencies. The BRICs and small Asian countries eliminate taxes on residents because taxes on foreign inflows from the rest of the US support their governments.

Meanwhile, inflation rises in China and the US. The PBoC raises reserve requirements to fight inflation. The Fed will patiently wait for data confirming that import inflation creates jobs in America.

We all know the drill.

Launching QE2?

Does Queen elizabeth have to turn up with a bottle of champagne?

So the good professor thinks:

deflation bad because

1) People can buy more things per nominal money How is this a bad thing? If you ask the average people, what would they prefer, I can say with upmost confidence, they prefer price to be low than high.

2)Investment opportunity need to compete for genuine capital formation (again, how is this a bad thing? This is the very capital market mechanism which makes the whole thing work.)

3) Cash hoarding – leaving companies and individuals to decide for themselves to see whether to spend/invest or not, again how is this a bad thing? Why should people be pushed to spend, and not be allow to be in control of their finance? Self control on finance is a great thing. What this depression has clearly shown US has no control, after being pushed on by the Fed to spend/consume to the limit (coupled with tight money shock).

inflation good because:

1) debt worths less in real terms, no doubt good for debtors, getting a free-ride (why allow debtor a free-ride and not savers? This sort of debt biase is another reason for the heavy indebtness of average citizen and the country. No wonder balance sheet is horrible).

2) People can buy less things with nominal dollar (this is a good thing?).

3) Investment opportunity doesn’t have to compete hard for capital. However the corollory also goes like this, easy capital = low value capital, never mind the fact decision to invest gets skewed by inflation, rather than solely by the risk/reward itself.

Don: on QE, the current evidents is contrary to the theory you put down – QE has shown to create excessive savings, as shown in form of bank reserve at fed, and the huge amount of hot money going into gov bonds (beyond the amount Fed monetized). The low fed fund rate/yield is acting as a magnet. This also happened during the dotcom bust, when fed fund rate is low, there was a huge amount of money in bonds. That money exited once fed fund started to go up. Practically zilch result demonstrated so far that it does anything meaningful for the real economy (or AD in real economy).

I have to say, I’m either surprised to see so many fans of the bizarrely anti-American Hudson in one thread, or I’m not at all surprised that the tenor of this blog over the past several years has left mostly only agenda-obsessed angsters.

But it is absolutely fascinating to watch Hudson continue to fellate the Chinese. It’s been lucrative for him.

I think 1% inflation is suitable for economy with high unemployment rate because imagine if we have 3% inflation with 10% unemployment rate, meaning the next six years, people will have to pay 10% higher cost of living than 1% inflation and imiagine if we come back to normal employyment level how high inflation is, it could be 10%.

Furthermore, under Plosser view, the best inflation level is zero to create the best price stability, but I think 0.5-1% would be suitable because it can ensure the low risk of deflation.

Furthermore, I think QE will have negative effect on economy because the monetary limitation. The money injection cannot create jobs like we have seen the lase QE because the money never goes into people and credit system because people are full of debts and this is why Bernake fails on his Keynesian model. He forgets the limitation of debt level, once people cannot expand thier borrowing, the money will go into price of asset like commodities especially Gold. That’s why we see QE1 cause negative effect on growth becuase it causes higher than true value of commodities or we are not facing gold bubbles and higher inflation causes lower real income. We can see US is only one country that used QE and only one country that is facing higher unployment.

What would be the real solution. I think FED should set up employment fund maybe 300-500bn and inject it into real economy to improve employment. Fed also should absorb excess liquidity at the same time to control inflation to improve real income.

Surely, the higher real income is only way to help American to pay back thier debts and increase saving. Because now saving is only tool to increase investment that is the only way to bring Us back to normal.

Everyone is taking new normal but I think US ia unnormal and Bernanke ‘s QE will create unusaul failure with lower real income and higher unemployment rate.

MPO,

Is it the economists who continue to be wrong that are “bizarrely anti-American”, or is it Hudson, who just keeps providing accurate and detailed warnings about the imminent failures of economic policies?

“Hudson’s April 2006 Harper’s cover story, “The $4.7 Trillion Pyramid: Why Social Security Won’t Be Enough to Save Wall Street,” helped defeat the Bush administration’s attempt to privatize Social Security by showing its aim of steering wage withholding into the stock market to reflate stock market prices for the benefit of insiders and speculators – and to sell to the pension funds. His May 2006 Harper’s cover story, “The New Road to Serfdom: An illustrated guide to the coming real estate collapse,” was the first major national article forecasting – in precise chart form – the bursting of the real estate bubble and its consequences for homeowners and state and local government solvency.[1] The November 2008 “How to Save Capitalism” issue of Harper’s includes an article by Hudson on the inevitability of a large write-off of debts and the savings they back.”

~Wiki

==================

And as for this: “It’s been lucrative for him,” why is so hard to understand that unsupported claims say more about those who make them, than they do about the person or issue being targeted? To me, your claim suggests that people of low integrity are so threatened by Hudson that they resort to dishonorable tactics to debase his reputation. But… as this comment should be making perfectly clear, your attempt at disparagement is so easily reversed and directed at you, that its lack of foresight also suggests that at least one person who fails to appreciate Hudson’s contribution is not very bright.

Consequently, your comment just tells me what I already knew: that some people have less than adequate critical thinking skills. But it is good to know that at least one of those people is on the opposing side of things.

Rayllove –

That article makes the common assumption that banks are reserved constrained, and excess reserves allow them to make more loans than they would otherwise. This assumption is false. Reserves are irrelevant to banking operations, as they can always be obtained, either on the FF market or directly at the discount window. Banks are only constrained by their capital and their ability to find creditworthy borrowers – never by their reserve position.

Jim,

Michael Hudson is very probably the most respected economist among the MMT faithful. I think you are just not quite understanding his positions, he is in fact complicated.

Notice that he recognizes, throughout all of his writing, the importance of what he often calls ‘keyboard capital’. I am by no means an expert on his work, I have not in fact read one of his books since the early 1980s (Super Imperialism). But if I had to guess I would suppose that Hudson was probably the first to explain that banks are not ‘reserve constrained’. But that is of course only in theory and in his most recent article he is addressing the obvious reality that if QE did not enable banks to lend more… then what is point of QE? It is important too that his position regarding QE is part of a broader concern that has to do with flooding global markets with artificially cheap capital.

It seems too that you are unaware of the fact that Hudson is a research professor at the University of Missouri at Kansas City. UMKC is of course a hotbed for MMTers although whether Dr. Hudson subscribes to the theory is something of a mystery for me. I have not seen him mention any affiliation thereof but he is easily the best known professor at that school so I suspect that his being there has had a substantial influence on the MMT folks.

He is also affiliated with The Berlin School of Economics, and also very involved with the rebuilding efforts regarding some of the ex-soviet states, as a consultant etc., so just how involved he is at UMKC is most certainly diluted by many other involvements.

Interesting posts by AndyfromTucson at October 13, 2010 12:38 PM and don at October 13, 2010 02:14 PM.

Another relevant argument about inflation and global trade flows is Andy Xie’s at this link:

http://english.caing.com/2010-08-16/100171139.html

Xie makes the argument that monetary accommodation exports inflation to faster-growing markets rather than causing inflation in the aging developed world.

Professor Hamilton,

I agree that deflation is a threat to society in many ways, including to the political order in extreme situations. But I believe it is important to distinguish between good deflation and bad deflation. Good deflation is the result of technological invention and increased know-how and skills: for example, the internet has drastically reduced prices for all communications and many forms of distribution. Society is as a whole better off in economic terms, though there is no doubt a transfer of wealth within society as a result of the shift. Bad deflation most often comes from a mis-allocation of capital; for example, a credit boom results in the building of excess capacity, which is not shuttered in the ensuing credit bust and is allowed to operate at losses, which keeps prices low. I believe most people in the USA, certainly on the coasts are experiencing the following: goods deflation in (driven by excess capacity in most industries globally); commodity inflation (gas, food) which is to small in totality to drastically change living patterns; and dramatic local services inflation (education, both private and public; healthcare and municipal services in the form of taxes). I do not believe the CPI properly captures the cost of living increases most people are experiencing, and the upper and upper middle classes are experiencing a greater cost of living increase than the poorer classes; the CPI doesnt capture taxes, real estate prices, the price of good education (not bad public schools), first class healthcare, etc etc. So if by deflation, you mean cost of living going down, I dont believe CPI is anywhere near accurate. If you mean a more economic definition of deflation, aggregate demand being less than aggregate supply, maybe you are right, but who really knows.

It is important to realize the difference between good and bad deflation, because bad deflation will not respond to money printing; money printing will only prolong excess capacity, as the cost of money appears artificially cheap. I believe the deflation in this country (in the official statistics) is being caused by flat to declining wages due to 1) unemployment in industries suffering from the credit bust like real estate, 2) increased regulatory hiring costs and 3)increases in taxes and other mandatory deductions. As this country has no net savings, there is nothing to fall back on except asset prices. The government is fighting this situation with money printing, which will never cause CPI to rise (because wages wont rise), but will cause dollar denominated assets to rise, provided they have a global demand component like corn or oil or top Manhattan or SanFran real estate.

I agree with you (you are clearly in the Martin Wolf camp) that a stimulus plan is needed right now; problem is the first stimulus plan was nothing but a blank check to keep overpaid government workers from being fired. There is no return on that money, especially in an over-levered world. The stimulus needed is money that earns a return for society — better roads, better cellphone coverage (Pakistani villages with no running water have better reception than New York City).

Unfortunately there is no political trust between the parties and within society for this to occur. What will happen in my eyes is continued money printing and debasement of the dollar, and a knife fight amongst lobbyists for federal and municipal budget dollars which will not be growing in overall size. Healthcare and pension and interest expense will take “market share” from social programs, defense, education, etc. at every level of government.

However we are not Japan. The Japanese are a docile people; the American electorate is anything but docile. When you divide the total amount of contributions into the last Pres election cycle by the maximum individual amounts allowed under campaign finance laws, you get to a number less than 150,000. That’s the number of people it takes to “buy” an election and change government. America is not destined to become Japan, and the only question is what the value of the dollar will be when real change occurs.

Shorthand for the above discussion: inflation punishes savers and rewards both debtors and their lenders, i.e., the purveyors and consumers of debt. Deflation has the opposite effect.

IMHO, the policy question should be: what behavior should our government reward: prudence or penury? Remember, the “burden” that debtors and their lenders suffer from a fall in home prices is a burden they voluntarily accepted because they chose to gamble on rising prices. As prices rose, those debtors and their creditors made billions, savers not so much. Now the tables are turned — an entirely natural and very predictable state of affairs — and our leaders are claiming that these natural and predicable consequences are a “burden” that must now be placed onto the shoulders of savers by purposely devaluing their savings.

I’d like you to address this point directly, as I’ve yet to see a single argument for why government policy should do such a ludicrous thing.

Comment by A. Gundlach that the first stimulus package and TARP was to preserve public sector workers was not correct. TARP funds went to the TBTF Wall St banks…may I suggest that many public jobs serve as much or more to society’s well being as do private jobs however I do understand the inability for Americans to think constructively.

Theoretical benefits of marinating the CPI at 2 to 3% must be weighed against costs, such as:

1) Inflation is not even across all sectors. Commodities are going up faster than the prices small businesses can charge for their end product. Very high inflation in health care is taxing business, consumers, and public budgets. Most health care inflation is not tracked by the CPI, because consumers don’t directly pay for most of it.

2) The aging of the population makes maintaining the purchasing power of the elderly more important for the economy than in the past, which makes losing even 3% of their purchasing power per year problematical.

3) Leveraged asset bubbles are encouraged to form by printing, which creates problems when they pop. The effort to “clean up” after the Y2K bubble popped created the housing bubble, which was even more costly to fix. What is going to be the cost of cleaning up an even bigger bubble in response to QE?

4) The total public/private debt to GDP level has been steadily rising over the decades in response to printing credit. At some point, excessive debt can no longer be serviced.

So… why would Hudson make the “distinction” that you claim to be so critical when he is not saying ‘anything’ about one being more or less harmful than the other, but instead, that one causes the other? Did you read his article?

Yeah, I wasted some time reading his stuff. You do realize that China has been intervening in currency markets for some time, well before the onset of the housing collapse, and indeed built up the bulk of their $2.6 trillion in reserves before that collapse happened? Based on that fact, it is hard for me to agree that QE is now the cause of their continued intervention. The distinction I drew is important for understanding why there is a difference between China’s currency intervention and Japan’s zero interest rate policy.

goodrich4bk — you are correct that public sector jobs serve enormous purpose and are noble professions (ie police and fire) — you are incorrect that stimulus money was wasted on TBTF banks, because every dollar put in was eanred back with interest and great returns — in fact, only the nonbanks will prove money losers: GM, Chrysler and AIG — my point is not to belittle noble public workers, though Americans with increasingly worrisome job security do start to resent the excessive job security given to municipal workers — my point is to belittle the stimulus plan, which was not only to little, but also poorly spent: take highway spending, every state took the cash and cut their own highway budgets (there was no match requirement) and diverted the money to municipal salaries and benefits, such that there was no increase in highway spending (so called pick and shovel job creation) … so Obama’s stimulus was nothing but a bailout to poorly managed, over-levered states and it did nothing to revive jobs and consumer confidence (though it did prevent a much worse decline) … hope this helps clarify my point

Don,

Hudson is exclusively only talking about flows from QE in the second paragraph of the two paragraphs that I posted. The first paragraph is more general which is implied by:”…demonize foreign countries as aggressive “currency manipulators”…”, this because Hudson of course knows that these accusations have been around since long before QE flows were leaving the US.

The following is a repeat of the first paragraph that I quoted:

“U.S. officials demonize foreign countries as aggressive “currency manipulators” for keeping their currencies weak. But these countries simply are trying to protect their currencies from arbitrageurs and speculators flooding their financial markets with dollars. Foreign central banks must choose between passively letting these inflows push up their exchange rates – thereby pricing their exports out of global markets – or recycling these inflows into U.S. Treasury bills yielding only 1% and whose exchange value is declining. (Longer-term bonds risk a domestic dollar-price decline if U.S interest rates should rise.)”

Then, in the second paragraph he begins to bring in QE.

Where your argument went astray is with your claim that Hudson failed to make a ‘distinction’ regarding China’s currency manipulating. Your inescapable distortion is made obvious by the fact that Hudson said nothing about China, you did, but yet you accused him of not making a distinction that would not fit or belong anywhere in his argument. To further your flawed assertion, your claim assumes that he has failed to make the distinction elsewhere in a context where it might belong, but, of course, I know that only a week or so past you knew almost nothing about him or his work so you could not possibly know what he has, or has not said regarding currency manipulation, the man wrote his first book on economics in the 1960s and has been prolific ever since, which, makes it very, very, unlikely that you could possibly know what you claimed to know. So, essentially, you slighted Hudson ‘again’… based on distortions.

And in this most recent comment it seems that your reading skills are being demoralized by an unwillingness to conceptualize the distortion that I have now explained–‘twice’. Obvious.

Ray –

I was referring to the wiki article you linked to in your first response to me, not to Hudson’s article.

For the benefit of those who may not have the time or inclination to research Hudson’s work, here is a recent sample:

“U.S. ‘quantitative easing’ is coming to be perceived as a euphemism for a predatory financial attack on the rest of the world. Trade and currency stability are part of the ‘collateral damage’ caused by the Federal Reserve and Treasury flooding the economy with liquidity to re-inflate U.S. asset prices. Faced with this quantitative easing flooding the economy with reserves to ‘save the banks’ from negative equity, all countries are obliged to act as ‘currency manipulators.’ So much money is made by purely financial speculation that ‘real’ economies are being destroyed.”

Hudson also says that “Malaysia used capital controls during the 1997 Asian Crisis to prevent short-sellers from covering their bets. This confronted speculators with a short squeeze that George Soros says made him lose money on the attempted raid. Other countries are now reviewing how to impose capital controls to protect themselves from the tsunami of credit flowing into their currencies and buying up their assets” and “If other nations take this route, it will reverse the policy of open and unprotected capital markets adopted after World War II.”

He fails to remark, however, that China has always had capital controls in place and that the controls are quite effective, which is rather inconvenient for his arguments.

“Your inescapable distortion is made obvious by the fact that Hudson said nothing about China, you did, but yet you accused him of not making a distinction that would not fit or belong anywhere in his argument.”

Hudson: “U.S. officials demonize foreign countries as aggressive ‘currency manipulators’ for keeping their currencies weak.”

I’d say it’s pretty clear he’s talking primarily about China, wouldn’t you?

don,

No, Hudson is not “talking primarily about China”. He uses Brazil and Thailand as the most recent examples of problems caused by purchases of bonds by foreigners in this article:

“Brazil has been more a victim than a beneficiary of what is euphemized as a “capital inflow.” The inflow of foreign money has pushed up the real by 4% in just over a month (from September 1 through early October), and the past year’s run-up has eroded the competitiveness of Brazilian exports. To deter the currency’s rise, the government imposed a 4% tax on foreign purchases of its bonds on October 4.”

““It’s not only a currency war,” Finance Minister Guido Mantega explained. “It tends to become a trade war and this is our concern.”[7] Thailand’s central bank director Wongwatoo Potirat warned that his country was considering similar taxes and currency trade restrictions to stem the baht’s rise. Subir Gokarn, deputy governor of the Reserve Bank of India, announced that his country also was reviewing defenses against the “potential threat” of inward capital flows.”[8]

I don’t have time to re-read the entire piece to see if he mentions China, he probably does? But the articles subtitle has to do with capital controls as taxes on bond purchases by foreigners, which, is currently an issue in India, Brazil, Thailand, and a couple of others, but it is not an issue in China. You ‘jumped to a conclusion’ which is part of what made your “distinction” claim so disingenuous.

I think right now the Fed would be much smarter to exercise their regulatory powers, than their monetary powers. To restore confidence and promote future investment, we need a legal cleanup of the fraud far more than a fresh printing of money to paper over the mess.

See my post at 5:46 and Krugman’s article today (“We’re Not China,” at http://krugman.blogs.nytimes.com/2010/10/18/were-not-china/).

We disagree with Hudson on almost identical grounds.