Where are the inflationary pressures?

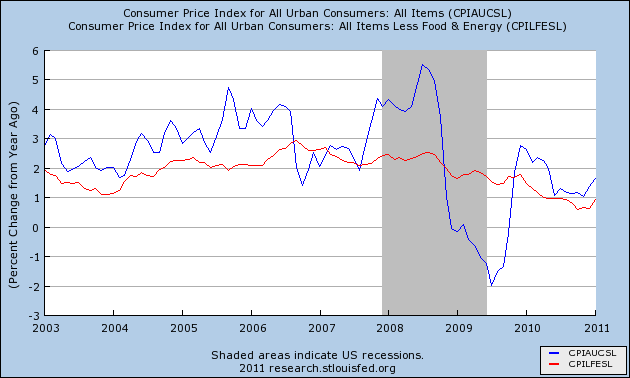

The BLS reported on Thursday that the inflation rate as measured by the headline CPI has been 1.6% over the last year. Excluding food and energy, the inflation rate would be 1.0%.

|

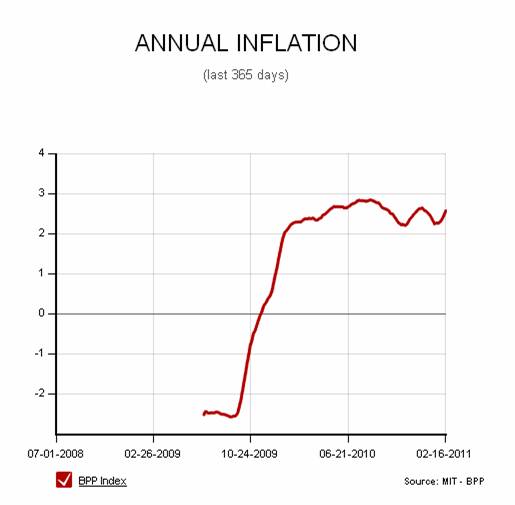

The MIT Billion Prices Project is recording a slightly higher inflation rate for the U.S. of about 2.5%. As Paul Krugman explains, the discrepancy between the indexes arises from the fact that the BPP excludes the cost of services, which have been experiencing more modest price increases than goods. The Wall Street Journal has more on the different inflation rates for goods and services.

|

The BLS CPI does register a modest tick up from recent values. If the increase in the CPI for the months of December and January alone were to be repeated for the next year, we’d be looking at annual inflation rate of 5% for the headline CPI and 1.4% for core CPI. Should we be concerned that this is the first move toward a higher inflation environment?

The biggest factor in most firms’ costs is their wage bill. The unemployment rate is still at an extremely high 9%, and I don’t expect it to come down quickly. We’re also seeing solid gains in productivity. In those circumstances, telling a story of inflation driven by wage costs seems more than a little far-fetched.

There’s also much discussion of inflation pressures arising from all the money that the Federal Reserve is supposedly printing. But as noted here last week, currency in circulation has actually been growing at a 5.2% rate over the last two years, which is lower than the historical average, and, given real output growth in excess of 3%, is consistent with the very low rates of inflation confirmed in the latest observed annual inflation rates.

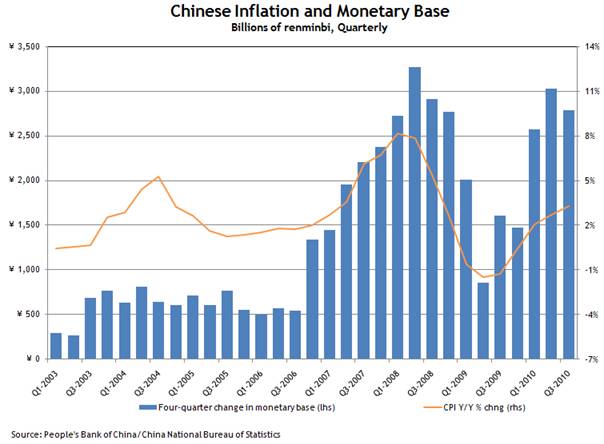

The main source of inflationary pressure today is coming from outside the United States. There are two factors in this. First, real economic growth at the moment is much stronger in emerging markets than here. Second, countries such as China have kept their exchange rates artificially low relative to the dollar.

Macroblog has a nice discussion of this issue. If a country tries to keep its nominal exchange rate from appreciating by using monetary policy to buy up foreign reserves, the predicted outcome is inflation in their own country.

|

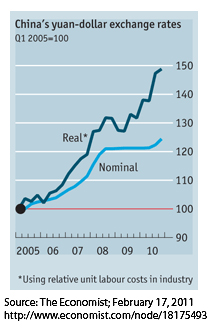

If the nominal exchange rate is prevented from doing the adjusting, the real exchange rate must.

|

For these reasons, I see the principal inflationary pressures in the U.S. at the moment coming from the prices of internationally traded commodities and imported goods. Given the huge volume of U.S. imports from China, I think the impact from the latter channel could be noticeable.

Does this mean I can’t buy synthetic Chinese rice from Wal-Mart now??? Screw it. I’ll just boil my rice together with a shredded Glad trash bag from now on. I have to get my daily recommended allowance of plastic somehow damnit.

This discussion, and many others out there, seems to conflate measures of the two conceptual categories of (1) monetary inflation and (2) consumer-price-index/cost of living. (I know our hosts are clear on the distinctions.)

Certainly these two measures speak to similar phenomena and often travel together, but they are distinct. However, the systematic divergence we see nowadays seems to be telling an important story.

We apparently don’t see wage driven monetary inflation, nor significant monetary inflation driven by any other mechanism: core is around one percent. But cost of living is increasing by perhaps three to five percent.

Does this divergence largely represent other economies outbidding us for resources?

If so, when we hit our monetary inflation target, of say three percent, does that then mean the cost of living increase rate goes up proportionally, to a range between nine and fifteen percent?

Finally a proof that QE2 works in a way it should have ( or was intended to?) ! Inflation “back to sender”- the USA , UK, and Eurozone.

After reading the Economist link I’m still confused about real vs. nominal exchange rates and how to “personalize” it. For example, I know I’m getting a negative “real” rate of interest on my savings account (inflation is higher than interest paid).

Interpreting the “real” fx rate is what I’ll be paying for Chinese goods, notwithstanding what nominal rate is? Doesn’t that imply there is a black market for Yuan (or how else is the real rate effected on us)?

Bob: “Real” means adjusted for purchasing power. You can trade dollars for yuan (the nominal exchange rate) or U.S. goods for Chinese goods (the real exchange rate).

Great analysis as always. It seems at some point in the not too distant future this inflationary pressure will register with us here in some palpable way as cheap labor from emerging economies, specifically China, and to a lesser extent countries such as India, becomes more scant and as those laborers demand higher wages as we are seeing now. Perhaps we may see what was once felt like a seemingly endless supply of this off-shored cheap labor giving way, something that appears to have exerted at least modest downward pressure in U.S. inflation for many years.

It is worth keeping JDH’s analysis in mind in coming months when we are sure to hear the bond vigilantes saying, in effect if not in so many words, that we need to keep people unemployed because the cost of gas for their SUVs is getting too expensive.

Professor, this article treats currency as the only form of Fed ‘printing.’

There is also a form of printing known as ‘typing,’ as when the FED types up a larger number of bank reserves in order to pay for QE and other FED obligations.

Printing via typing has now generated over $1.2 trillion in bank reserves, at an escalating rate if the past two weeks are any guide.

Until someone addresses potential ‘leakage’ from the supposedly inert bank reserves into things like stock and commodity speculation (eg, thru the Fed Funds markets), how can one dismiss ‘typing’ as an additional source of the price inflation that anyone who writes the checks to pay their bills can see right in front of their face.

My point of reference is 2005/late 2004. Inflation is ok, the relative price changes are horrible. Food and energy prices create deflation.

aaron –

To complete your comment: Higher….“Food and energy prices create deflation”…. in other goods and services.

“There’s also much discussion of inflation pressures arising from all the money that the Federal Reserve is supposedly printing. But as noted here last week, currency in circulation has actually been growing at a 5.2% rate over the last two years, which is lower than the historical average, and, given real output growth in excess of 3%, is consistent with the very low rates of inflation confirmed in the latest observed annual inflation rates.”

Shouldn’t you be using the amount of medium of exchange (currency in circulation plus the demand deposits created from debt)?

“Where are the inflationary pressures?

The BLS reported on Thursday that the inflation rate as measured by the headline CPI has been 1.6% over the last year. Excluding food and energy, the inflation rate would be 1.0%.”

I believe it would be better to use a lower/middle class person’s budget. I doubt if 1.0% or 1.6% is true then. Here is an example. The budget for the electric bill in my family is now about 50% higher than about 5 years ago with about the same amount of usage. Volatile on the way up and staying there.

Plus, do the inflation stats take into account things like rising sales taxes?

“The biggest factor in most firms’ costs is their wage bill. The unemployment rate is still at an extremely high 9%, and I don’t expect it to come down quickly. We’re also seeing solid gains in productivity. In those circumstances, telling a story of inflation driven by wage costs seems more than a little far-fetched.”

What if the excess supply is overseas and someday gets get off?

So if positive productivity growth and cheap labor produce price deflation, what should happen to the amount and composition of the medium of exchange?

“For these reasons, I see the principal inflationary pressures in the U.S. at the moment coming from the prices of internationally traded commodities and imported goods. Given the huge volume of U.S. imports from China, I think the impact from the latter channel could be noticeable.”

Oops! Should have read the whole article first. However, is free trade, legal immigration, and illegal immigration leading to a lower standard of living for most people in the high wage countries?

I thought the bit here on the contribution of shelter to inflation was interesting.

http://www.investmentpostcards.com/2011/02/09/us-cpi-inflation-expect-2-5-jump-in-march/

MarkS said: “To complete your comment: Higher….”Food and energy prices create deflation”…. in other goods and services.”

How about Higher….”Food and energy prices create deflation”…. in other goods and services if wages don’t rise, some people don’t go into debt, and/or some people don’t spend their past savings?

“We apparently don’t see wage driven monetary inflation, nor significant monetary inflation driven by any other mechanism: core is around one percent. But cost of living is increasing by perhaps three to five percent.”

1% vs. 3% to 5%. What kind of problems would there be in that scenario? Could the wage share of GDP (especially for the lower and middle class) be falling?

Exactly as we’ve been predicting. Plenty of food and energy inflation, little to no wage inflation.

Zimbabwe Ben is not a friend of the working or middle classes.

What affect will external inflation pressures have on internal disinflation pressures???

Contrary to economic theory, monetary lags are not “long & variable”. The inflection points have already passed. Price rises will accelerate if QE2 is not interrupted, and or, if rising interest rates don’t choke off the expansion.

flow5,

How do we get rising interest rates with Bernanke short-circuiting the bond market and monetizing all the debt?

Professor-

I think the problem that some have with economists is the unequivocal and absolute terms that they tend to speak in. It’s as if they are talking about the law of gravity when they are describing there “models”.

Well modern finance has moved past any realm that can be decribed in these arcaic terms. We now live in a world where physists not only create the financial products that are sold at the speed of light, but also the algorithms that decide when and how much to trade. While economists are saying look over here everything is fine, a massive dislocation of capital is taking place in another.

So the dollar is cheaper when QE takes place could you concede that? If so, then investors will seek to run carry trades through our banks’ investment arms. The banks will then leverage up those trades using the Feds cheap money and procede to dump them in emerging markets, commodity ect., ect.

Would you please reconsider this condenceding language about how things work?

The PPI in europe, including food and energy is an the upwards.A time when inflation expectation (CPI 2.2 %) is no longer the adequate standard and may succomb to the sacramental second round effect (ECB monthly bulletin P44)

Bloomberg

ECB Doesn’t Exclude Possibility of Euro-Zone Inflation Risk, Trichet Says

The central banks existing money supply is more weighed by the preservation of the payment system.The monetary system is now operating in reverse, risks assets are nurtured but not assessed. May this situation be explained in term of exchange rate?

Assuming a two countries, two products universe. Country one is producing goods deliverable and consumable now,the other is producing evidences of financial debts ,liens on the underlying assets but no market prices for those assets.The term of trade is materialized by financial debts against consumable goods.Assuming that financial debts are prices inflated,which country is overvaluing the exchange?

Professor,

This is a very good post. If read logically it explains why the US is responsible for the blow-up in the ME.

As you note: If a country tries to keep its nominal exchange rate from appreciating by using monetary policy to buy up foreign reserves, the predicted outcome is inflation in their own country. Most people only read this in relation to China but it is much more devastating when it is applied to smaller countries.

For years the US dollar has been the reserve currency. In the Bretton Woods agreement this was codified. But in 1971 and 1973 Richard Nixon ended the illusion that the US would maintain a stable currency and so the fiction of Bretton Woods was finally made manifest.

With the dissolution of Bretton Woods many countries in the world attempted to go it alone but found that the economic power of the US dollar made it king of the currencies and so, finally facing reality, they submitted to the power of the US dollar.

During the 1970s the US monetary authorities pushed their advantage through chronic inflation, but other smaller economies in an effort to keep their currencies on a par with the dollar ended up importing hyper-inflation through the mechanism you describe above. The economies of these smaller countries simply could not absorb the inflation resulting from their efforts to match the dollar.

These small countries faced a Sophie’s Choice. They could let their currencies appreciate against the dollar allowing the US to essentially buy their countries for pennies, or they could engage in massive inflation in an attempt to keep up with the dollar. Either alternative was a disaster.

Today we are seeing a repeat of the early 1970s. Because the US is going through a massive real estate deleveraging prices are being driven down by the resulting contraction, but the US dollar has continued to decline in the FOREX markets, gold has risen to a level never imagined even 10 years ago, and the FED dollar expansions have flowed into hugely excessive bank reserves (not to mention foreign dollar reserves increasing at double digits).

But as countries face the same dilemma as they faced in the 1970s every move they make to protect their domestic currencies results in inflation and that inflation has been manifest primarily in food.

When we look at the unrest in Egypt we see at its core is available food and food prices. Around the world the US has been forcing up the price of food, whether ethanol depleting corn supplies or inflation pushing up other products.

So essentially it is US monetary policy that is creating havoc in the world today and by continuing these destructive policies the unrest will simply grow unless the dollar is stabilized.

For those who might be students of monetary history, in the years between WWI and WWII you can see the UK essentially doing the same thing that the US is currently doing culminating in the UK defaulting on the pound commitment to be exchangeable for gold and the destruction of the world’s monetary system.

Mr Ricardo

“…They could let their currencies appreciate against the dollar allowing the US to essentially buy their countries for pennies…”

Huh? If my currency appreciates against yours, how does that allow you to buy my assets for pennies of your currency?

@Rob “If my currency appreciates against yours, how does that allow you to buy my assets for pennies of your currency?”——

By killing their export markets, and thus the economic value of their assets.

A couple of questions based on things I’ve seen today, in case they interest you.

1. You said that inflationary pressures might come from China. But there doesn’t seem to be much evidence of that yet, and if you look at recent import price inflation from the US’s other two big trading partners, Canada and the EU, it looks like import price inflation from them has recently been quite high but nobody has been worried. Why is China a special case? See here:http://research.stlouisfed.org/fred2/graph/?&chart_type=line&graph_id=&category_id=&recession_bars=On&width=630&height=378&bgcolor=%23B3CDE7&graph_bgcolor=%23FFFFFF&txtcolor=%23000000&ts=8&preserve_ratio=true&fo=ve&id=CHNTOT,CANTOT,EECTOT&transformation=pc1,pc1,pc1&scale=Left,Left,Left&range=Custom,Custom,Custom&cosd=2004-12-01,2004-12-01,2004-12-01&coed=2011-01-01,2011-01-01,2011-01-01&line_color=%230000FF,%23FF0000,%23006600&link_values=,,&mark_type=NONE,NONE,NONE&mw=4,4,4&line_style=Solid,Solid,Solid&lw=1,1,1&vintage_date=2011-02-21,2011-02-21,2011-02-21&revision_date=2011-02-21,2011-02-21,2011-02-21&mma=0,0,0&nd=,,&ost=,,&oet=,,&fml=a,a,a&fq=Monthly,Monthly,Monthly&fam=avg,avg,avg&fgst=lin,lin,lin

2. A friend pointed me to a site that looks like a bears’ paradise. In particular, I said this chart was nonsense: http://www.shadowstats.com/alternate_data/inflation-charts

Dave,

Thanks. Maybe I’m interpreting the statement wrong. For example, the Euro has appreciated against the $ — under the above logic, this allows the US to buy EU assets cheaper? Over time???

I get that at a certain FX point US customers will switch, e.g. from BMW’s / Mercedes to cheaper US cars, that the southern EU countries would dearly love to devalue their way out their ongoing crisis and that freely floating currencies are supposed to adjust trade imbalances. But I just don’t see, e.g., the US picking up a German stock exchange on the cheap right now. Au contraire.

What am I missing?

JDH,

I think it would be right in this discussion to acknowledge that the efforts at pegging by Asian & petro-state central banks over the last decade has been made more difficult–therefore requiring more inflating on their part to accomplish–by the loose money policies of the Fed

Rob-

Ricardo is not talking about EU countries, but emerging market countries that have very limited internal demand.

John Butters: I’m with you on Shadowstats, as discussed here.

Bryce:I’d grant that, except that I wouldn’t characterize 1.5% headline inflation as “loose money”. I really believe that the core of the situation is that the monetary policy that is appropriate for the U.S. is different at the moment from the monetary policy that is appropriate for China, in light of which it makes no sense for China to try to maintain a nominal peg to the dollar.

W.C. Varones: “How do we get rising interest rates with Bernanke short-circuiting the bond market and monetizing all the debt?”

How? – with M1 SMOKIN @ Seasonally adj annual rates (WSJ), % CHANGE

3-mth = 15.6%, 6-mth = 14.2% & 12-mth = 10.3%, that’s how.

Rates bottomed on 8/31/2010. The monetary transmission mechanism is not QE2, it is via interest rates. Thus the degree of ease or restraint is related to the changing portion of the yield curve covered under the remuneration rate’s umbrella. The higher rates become, the looser policy becomes (as the portion of the yield curve which is lower than the remuneration rate @.25% continues to shrink).

US oil consumption is at 7% of private GDP and 6% of PCE, which is the same level as prior to the recessions in ’08 and ’80-’82, the worst recessions since the Great Depression.

And this time the oil shock is occurring with a 9-9.5% U rate, 16-20% U-6, falling labor participation, a multi-front imperial war, growing fiscal constraints, increasing global social and political instability, and China importing oil at more than 50% of consumption and consuming nearly as much as we import.

The payroll tax holiday giveback has already been spent in the form of higher price of gasoline and ongoing debt service; no stimulus here, folks.

Coming to a theater near you: Oil and Financial Shock Global Great Recession II. This time it’s serious times two . . .

JDH,

M1 growing for more than 2 years at average annual rates exceeding 10%–& its current rate of growth. Negative real interest rates for most of that period. I characterize that as loose money.

Having said that, let me admit that when money is forever the provence of a gov’t bureaucrat rather than the market, it is impossible to know what the natural rate of interest should be. That is, the rate that would arise from the supply of real savings & the demand to borrow.

Recent BPP Inflation:

On 1/20/11, 101.5881

On 2/20/11, 102.4034

31 days, ratio = 1.0080255

1.0080255^(365/31) = 1.098688

which is a 9.87% annual goods inflation rate

There is lots of talk in the financial press and in academia about inflationary pressures on businesses. No one talks about the impact of inflationary pressures on the families of America.

I participate in a national voluntary grass roots effort to track inflation where it hits families hardest – at the grocery store and the gas pump. Our group consists of hundreds of people all over the country who conduct weekly price surveys. We gather retail prices on a list of family essentials – regular gasoline, and household grocery and personal needs products you would find in a typical American family grocery cart.

We began gathering data last fall. For the 12 weeks ending February 2, 2011 our effort reveals an annualized inflation rate for family essentials of 13.9%.

Core inflation doesn’t really mean much to those of us who are gritting our teeth every month as we watch the cost of family essentials continue to rise.

JDH: Many thanks — a more thorough debunking than I could manage!

Fine, may I suggest reading of the following Econbrowser posts and comments:

Inflation Fears and Measures of Expected Inflation

Core, and More, Near Zero

To add an additional inflation indicator to the tooth fairy,may I draw your attention

A long time ago one could be a brother for a dime

Remember “Hey brother do you have a dime to spare”

Nowadays even for a dollar you are no longer a brother.

Dave,

Thanks for understanding.

It is interesting that there are countries such as Panama and Ecuador who have actually dumped their currencies and stopped attempting to run the race with the dollar. They have adopted the dollar as their currency. That protects their markets from US currency attacks.

I was fantasizing with a friend a few day ago and asked the question, “What would happen if China dumped the renminbi and moved to the dollar as its currency?” Would the US still complain that the Chinese “dollar” was overvalued? If you think about this question you see the foolishness of the argument that a Chinese renminbi linked to the dollar creates an overvalued renminbi.

Ecuador and Panama have officially made the dollar their currency of exchange but they are not alone in practice. Most of the countries in South America allow the dollar to circulate with their domestic currency and businessmen (try a taxi cab driver in Colombia) can calculate the exchange rate between the domestic currency and the dollar instantly, based on the current rate printed on the front page of the newspaper every day. You give a Colombian taxi cab driver dollars and he will almost instantly give you the correct change in pesos.