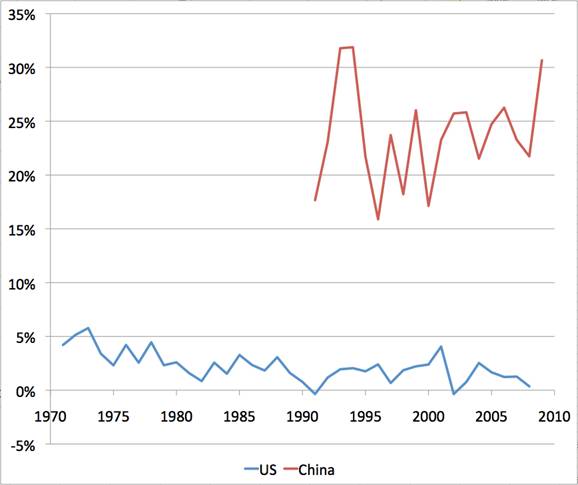

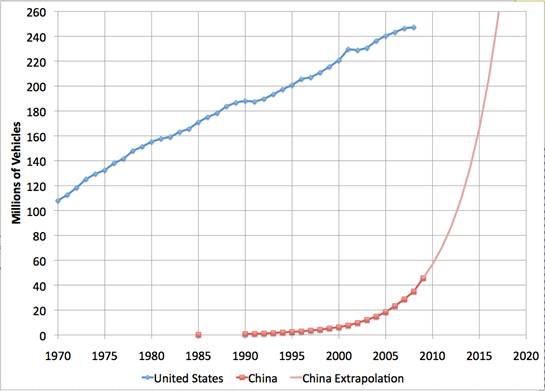

Stuart Staniford notes that the number of trucks and passenger vehicles in China has been growing at about 23% each year.

|

You don’t have to extrapolate that too far into the future to come up with a pretty scary picture.

|

Is that a silly extrapolation? Stuart notes that the plot for 2015 would still leave the U.S. with 7 times as many vehicles per person as China. And the level of oil consumption per person in China today is 1/3 the current oil consumption per person in Mexico ([1], [2]). No question, there’s potential for a lot more growth in demand from China

What’s substantially less clear is where the oil to fuel those cars could come from.

The “SCARY PICTURE” of exponential Chinese oil consumption strikes fear only into the hearts of people too lazy and complacent to change their reckless consumptive lifestyles. To people concerned about the future and about supporting life-form diversity on this planet, cultural change to sustainable energy and resource utilization can not come fast enough. I see the future as bright.

“…What’s substantially less clear is where the oil to fuel those cars could come from.”

Build dams, divert lots of water to farmland (make sure there are no droughts!), grow lots of soy, convert to biodiesel? What could go wrong?

Lots of questions.

I note the graph shows about 100 million additional vehicles for China alone between 2015 and 2017 (as compared to less than 30 million between 2005 and 2009). Where does the steel, the tires, the manufacturing plants, the time and labor come from? Before worrying about what fuels the trucks perhaps you should consider where all those trucks are coming from. Prediction can be quite difficult, especially about the future.

McKinsey sees steady state auto sales in China at around 50 million per year. I think mid-30s is more likely.

But Stuart’s analysis is not at odds with my post here last year.

The source of the incremental fuel is painfully clear: the US consumer. And then the question is, how will that consumption be transferred? Will it be a smooth line consistent with “get used to is”, or will it be an oil shock, which appears more consistent with the historical record? If the latter, it would seem more likely that the US falls back into recession, and relatively soon.

And that, in turn, becomes the defining theme of the 2012 election.

JDH wrote:

What’s substantially less clear is where the oil to fuel those cars could come from.

Consider this; Russia has the largest land area of any country in the world. Russia is the world’s largest oil producer at 9.5mbd. The third largest country by land area is the United States and is the third largest oil producer in the world 4.5mbd. China is virtually the same size as the United States and yet they only produce 3.8mbd.

There are about 880,000 oil wells in the world. China has about 80,000 wells. Do you believe that China has so few wells because the nation does not have underground oil resources? In truth the exploration for oil is a huge gamble and so if the payoff is not huge speculators will not explore. China is a country where political conditions make exploration for oil an economic loss. If China ever opened up its country to wildcatters its oil production would soar.

Today China is making deals with foreign sources of oil because the structure of the country discourages risk taking. The US has 510,000, almost 60% of all the oil wells drilled in the world.

Competition for oil in the world is not because of “peak” oil. Competition is totally political. The first country to figure this out will become rich on the production of energy resources. It is doubtful that China will be that country.

World oil exploration has barely scratched the surface, no pun intended.

Plastic bags is the solution.

My latest fashion are very large plastic transparent bags the size of a football field. Float them along the shore in southern coasts where it is warm. Fill them with water in which the micro-organisms have been filtered out. Under these clean conditions, the bags can grow genetically engineered algae. The wave action on the bags churns the algae and get maximum sunlight. Use continuous flow. Result, 100,000 gallons per acre per year, pure biodiesel.

Louisiana becomes the energy capital of the world.

China’s oil fields onshore are mature. They have been produced, in some cases, for more than half a century. Most of these have seen not only primary, but secondary and tertiary recovery.

China’s oil production has averaged around 4 mbpd for a number of years, with pretty good incremental growth last year. Still, no one expects China to materially change its production profile. We expect it to hold steady, but I don’t think many analysts would see production increasing by much more than 0.2-0.4 mbpd.

If you extrapolate from Stuart’s numbers–or ours for that matter–you might anticipate China could increase consumption by more than 2 mbpd / year during several of the years in this decade. China won’t be able to meet domestic demand from domestic supply.

Of course, this does not consider China’s shale oil resources. It’s still very early days here, so we’ll have to see how they unfold.

Even if the production of autos in China doesn’t continue to accelerate (and it will for a while), there is no particular reason to believe that it will slow down, number of vehicles per year is unlikely to decrease. That should be a lower bound to the extrapolation, IMO.

“The source of the incremental fuel is painfully clear: the US consumer. And then the question is, how will that consumption be transferred? Will it be a smooth line consistent with “get used to is”, or will it be an oil shock, which appears more consistent with the historical record? If the latter, it would seem more likely that the US falls back into recession, and relatively soon.”

The only way this happens smoothly is if we plan to reduce our structural dependence, and soon.

Chinas economic expansion of the past 12 years has been a leveraged bubble on the western spending bubble. Amazing that everyone accepts it as is.

easy call: coal-powered electric vehicles, then kiss the yangtze goodbye.

It’s easy to see the slope for China continuing similarly for the next 5-10 years based on demand alone. Indeed, it’s harder to figure out where this supply will come from even with other developed countries easing their use modestly. Even China would have severely blunted growth with $200/barrel oil, and it’s hard to imaging how they don’t run into some sort of price wall or significant drag within a few years.

Fission plants.

Electric cars.

Next?

China is a very non-egalitarian nation in terms of wealth and income. Most citizens are too poor to own a car, so an exponential extrapolation only works until you use up the part of the population capable of buying both cars and fuel.

China’s fuel subsidies are likely to be phased. A bus or a train will get you from the impoverished countryside to that city job, and back for occasional visits home to parents.

In a one child country, there are no cousins, aunts, uncles, or siblings. Much of the reason for non-commuting travel is eliminated in one fell swoop.

A central command economy is unlikely to thrive indefinitely, particularly when the rest of the world is unable to keep boosting China’s export income. Economic problems will be accompanied by popular unrest, with the ever-present possiblity of breakaway factions emerging.

The lifespan of Chinese construction is very brief, with premature collapse frequent. This is true for building construction, infrastructure construction (powerlines, tunnels, etc), and highway construction.

Empty apartments do not use a lot of utilities, once built. Cars that sit in the garage do not use a lot of fuel.

Yawn…..

Per capita oil consumption WW has not risen since 1982. It is still 4.6 barrels/day, despite vast WW economic growth during that period.

Demand destruction in the US, Japan, and Europe offsets the growth of India and China, and continues to do so.

China’s vehicles are growing 23%/year? In a country with 1% population growth and an average age higher than the US? Can anyone say bubble? There are only so many people who can buy their first-ever car.

“The only way this happens smoothly is if we plan to reduce our structural dependence, and soon.”

This sort of statement is commonly made, reflecting the notion that some sort of centralized, top-down decison-making body could ease the transition.

I have to admit a certain scepticism. The defining feature of the economy, with respect to fuel consumption, is its fixed asset stock–the country’s vehicle fleet. Personally, I question how fast this can be changed, and indeed, whether changing it would make a big difference.

Let’s assume that we could reduce consumption by 2.5% per year–pretty spectacular adaptation by historical standards, and worth about 0.5 mbpd / year. But global oil demand growth last year, according to BP, was 2.7 mbpd. So we could be on a strict oil diet and still choking on high oil prices.

In any event, I would welcome a rigorous, quantitative analysis of what a “plan to reduce structural dependence” might look like and what impact it might have.

Unless most people are seriously making arrangements to carpool to work, oil is not pinching the average American yet.

Period.

And we are not approaching crisis until most people are carpooling in groups of three, rather than two.

Until then, it is much ado about nothing.

Most likely, the peak acceleration phase of China consumption bubble has already passed, so either there will be a slowdown ( not -exponential growth) or even correction in yearly car sales numbers.

Oil shock will come from supply problems, not demand. And sooner than Chinese get to these 50 millions cars per year consumption. In 2011, H2.

Chinese car demand (and not its first derivative) has decreased in the first few months of this year compared to last year, although the role of subsidies and traffic measures distorts the actual picture.

How does the “shale revolution” fit into the petroleum supply analysis, as discussed in the 6-13-2011 WSJ by Robert Bryce, “America Needs the Shale Revolution”? Mr. Bryce, a senior fellow at the Manhattan Institute opines that both jobs and production will increase significantly with increased use of shale technology.

Fun Fact:

According to BP, China built the equivalent of 112 new 500 MW electrical power plants (mostly coal-burning) in just 2010 – a new one coming online every three days. The estimate is that they will use more than the rest of the world combined sometime this year – and burn more than the entire world did only 30 years ago. It’s impressive!

yes,this extrapolation is silly. Same silliness as the global warming hockeystick theory – btw where is Al Gore nowadays ? Seems he has cashed out …

Again, I emphasize that people are not really ‘troubled’ by oil prices until they actually start carpooling to work.

If $100 oil is not enough to get people to carpool, then we are still quite far from a crisis.

And yes, if a country of 1% population growth has seen its automobile fleet grow 23% a year….. that is far from a trend to extrapolate. A person can only buy their first ever car once. James should know better..

GK: Please note again that “the plot for 2015 would still leave the U.S. with 7 times as many vehicles per person as China”. That is number of vehicles owned, not the number sold.

An older post by Stuart on the subject:

http://earlywarn.blogspot.com/2011/01/chinese-oil-consumption-growth.html

A critical mistake often made with statements like “everyone should carpool” or “mass transit is the way forward” is that it fails to consider the value of time.

Consider a person who makes $75,000 per year, about $60 per hour or $1 per minute. Let’s assume the person could drive to work in five minutes at a cost of three dollars all in. And let’s assume this same person could take the bus free, but it would take only four minutes more. Would they take the bus?

If their time is worth $1 / minute, then they would prefer to drive, which costs them $3 in gasoline and vehicle use + $5 opportunity cost, or $8 in total.

The free bus equals $0 for the transport, but $9 in opportunity cost. Thus, by this analysis, the individual would rather pay $3 in cash than travel for free on the bus!

Now if the bus were $1 cheaper than gas, then it could be only 1 minute slower if it wants to be competitive!

Thus, when people call for carpooling or mass transit, they don’t realize how tight the tolerances really are. Half an hour–even for someone making a relatively modest $75,000–is worth $30!

That’s why HOV lanes are frustratingly empty and middle class people, by and large, do not take buses. Time is valuable, and any analysis which disregards that reality is likely to fail.

Here a little back of an envelope calc from a few years ago for fuel consumption at top cruising speeds: http://cumulativemodel.blogspot.com/2008/05/should-people-slow-down-maybe-envelope.html

Oh yeah, O/T:

Popular Mechanics did a quick test this year. Quick acceleration is indeed more fuel efficient than slow acceleration. And that’s just for an individual vehicle. I’m certain the benefits to traffic flow are much greater, should enough people pick up the pace.

https://www.facebook.com/photo.php?fbid=10150627275535527&set=a.10150354937755527.594021.857960526&type=1&theater

http://www.popularmechanics.com/cars/news/fuel-economy/6-driving-tactics-to-save-gas-this-weekend

Steve Kopits But you’re overlooking the fact that time spent riding the train or riding the bus is not necessarily dead time. Look at people riding the any metro rail system. They are checking their Blackberry, reading the paper, catching 40 winks, etc. What are they doing if driving? Probably listening to some local “Z-Man” on 97X FM or worse yet…listening to El Rushbo or Sean Insanity. And look at airplanes. Yes, a plane can get you there quickly, but the opportunity cost of flying is pretty high. Basically you’re stuck on a plane that’s so cramped it’s impossible to open up your laptop. And if you do manage to open it up, it’s only a matter of time before that overweight salesman in front of you reclines his seat and jams your laptop screen into the back of his seat.

Yes, time is expensive. And by and large driving is a huge time waster. The problem is that driving, and even being stuck in traffic listening to that morning Z-Man, is seen as “me time” rather than as wasted time.

Mr. Kopits: see my comments to your 6/30/2010 post on how to reduce U.S. oil consumption by 50 percent in 3 years. There were a lot of little pieces. It’s rather a grab-bag, and some of it is less sound than the rest. A major component is a revenue neutral gas-tax. This would actually be stimulative, since we’d capture some of the money leaving the country due to the trade deficit. The price of fuel is going to go up to reduce consumption anyway. A tax has the advantage that we can control it, unlike the global price of oil. If you distribute the revenue evenly you have a majority constituency formed of everyone who uses less than the mean amount of fuel. The other big piece is government capital expenditures on efficiency and fuel switching, people like free stuff and capital isn’t costing the feds much right now. Eliminate residential and commercial space heating with fuel oil and kerosene. Pay for the retrofits to improve the mpg of every OTR truck by 20%(you have to raise diesel fuel tax to keep this from increasing consumption). Ramp up biofuels some more, but change how the subsidies work (financing instead of production credit). Eliminate the ethanol tariff. Pay for railroad infrastructure and tax port traffic leaving by truck. More numbers in the other post.

Retail sales for the month were 16.9% above May 2010’s level, compared to 17.1% growth in April, and March’s 17.4% on-year rise.

Merrill said the weaker retail sales growth was attributable to easing auto sales, which fell 3.9% in May from a year earlier, according to monthly figures released by the China Association of Automobile Manufacturers.

Transit/carpooling: The median wage is about $0.25/min, not $1 (and 60/hr is 120K/yr which is top 5 percent personal income). Also, avoided cost is not taxed, unlike wages. Also, most people don’t have the ability to work more hours whenever they would like on demand to vary their income.

The main cost of flying is the TSA.

It used to be I could get dropped off 20 min before a flight, make it, and it still managed to take off early.

Following are what we show for Global Net Exports (GNE), using the updated data, with revisions, through 2010:

Global Net Export Data*

2002: 39.1 mbpd

2003: 41.6

2004: 44.8

2005: 45.5

2006: 45.5

2007: 44.6

2008: 44.5

2009: 42.3

2010: 42.6

*Top 33 net exporters with 100,000 bpd or more of net exports in 2005, BP + Minor EIA data (99% of global net oil exports)

Saudi net oil exports were down from 7.3 mbpd in 2009 to 7.2 in 2010. Note that Russian net exports have been at or below 7.1 mbpd since 2007. The (2005) top five (Saudi Arabia, Russia, Norway, Iran and the UAE) went from 23.7 mbpd in 2005 to 20.8 in 2010. So, the (2005) top five fell by about three mbpd over a five year period, while the bottom 28 showed basically no change from 2005 to 2010.

Chindia’s combined net oil imports went from 5.1 mbpd in 2005 to 7.5 mbpd (inclusive of the rather curious increase in reported Chinese production). In any case, their combined net oil imports, as a percentage of GNE, went from 11.2% in 2005 to 17.6% in 2010. At the 2005 to 2010 rate of increase in their net imports as a percentage of GNE, Chindia would consume 100% of GNE some time around 2030.

So Available Net Exports (ANE), i.e., GNE not consumed by Chindia, fell from 40.4 mbpd in 2005 to 35.1 mbpd in 2010. I’m projecting that ANE will be down to about 27 to 30 mbpd in 2015.

As Steve noted up the thread, the “swing” consumer is going to be the US and many other developed countries.

My view is that the US is well on its way to “freedom” from our dependence on foreign sources of oil, just not in the way that many people hoped.

The real fuel efficiency gains are there to be made on the roads. The mechanical low hanging fruit was picked.

Right now, our problems are the EPA and anti-driving groups (wishing to discourage driving by making our roads worse). Long ago, dynamo data for EPA reports was contracted out. This allowed the EPA to pay a contractor to collect data, but the company keeps the data as proprietary. It is sold for mechanical diagnostics and is very expensive. This data could be used to inform drivers of proper driving techniques that would improve efficiency much more than any mechanical improvment.

Another problem is traffic engineering. The field takes as given driving behavior. This is the one area where there are the most gains to be made, yet it is assumed that it cannot be changed. To our further detriment, they ignore affects of policy on driver behavior that will negatively affect the overall traffic system.

The public is being provided bad information. This information is making traffic worse, at a time when people also have never had more opportunity to tune out, further compounding the problem. We’re likely in a situation where fuel prices are actually making our fuel efficiency worse. Another problem is that I believe the stimulus has coincidentally biased our traffic data and hidden our declining efficiency (it doesn’t take a conspiracy or even a conscious effort for an essentially one time shot at 10s of billions of dollar to skew data).

benamery writes: “A tax has the advantage that we can control it, unlike the global price of oil.”

Lordy. Who is “we”? And why would a tax hike decouple US energy consumption from market prices for oil?

Aaron: good point that is often overlooked and somewhat counter-intuitive, but I would mention an important clarification. We are not talking about flooring the accelerator. You will see in the popular mechanic article that the acceleration used was not typical of full throttle acceleration for most cars. Fuel misers often use the “two-thirds of the available power” rule, as this seems to be optimal, which is compatible with the 15 seconds to 50 mph in the Popular Mechanics article.

http://www.nytimes.com/2001/06/07/technology/what-s-next-dashboard-miser-teaches-drivers-how-to-save-fuel.html?pagewanted=3&src=pm

Irrespective of what the real upward trends in non-renewable use are in the future, the basic fact that Chindia comprises almost 40% of the globe’s population means that they are not sustainable.

Something or a series of somethings is going to break the trend. And those events will come years before the theoretical endpoint.

My guess is that the next decade is going to be very tumultuous as the global economy is rocked by a series of basic material disruptions. We’re going to pop a series of ‘peak whetevers,’ including population growth.

Re: jult52

What the data show is that the US is being priced out of the global net oil export market. As in the movie “The Sixth Sense” (many ghosts don’t know they are dead and they only see what they want to see), for most of us our auto centric suburban way of life in the US is dead, but most of don’t know it yet and we only see what we want to see.

If I could dictate policy changes, I would abolish the highly regressive Payroll (Social Security + Medicare) Tax and replace it with a tax on energy consumption, at the retail level.

Tristan, good point. Most of us tend to oversimplify or take a point too far. I like using the words “Quick and Smooth”. General guidlines, ease off the accelerator at about 3500rpm and try to keep RPMs below 4000.

Also, accelerating too much is even more wastefull than too fast. A good guideline is, you can only go as fast as the car infront of you, unless of course you can safely go around.

I think on concerne about addressing this issue is a campaign might result in some fender benders and even pedestrian injuries initially (can easily imagine a driver staring down a red light and taking off without noticing a pedestrian who hasn’t cleared a cross-walk). I think this can be easily overcome though. One of the major ways to save fuel is looking ahead, keeping eyes moving, and being alert to avoid having to slow down. Stressing alertness should improve safety, speed, and safety.

Until the fusion revolution comes, we are dead in the water. Shale oil and coal? Forget about it. Not nearly cheap enough. Solar energy and wind? Ditto. There is a reason why first domestic crude oil and then foreign crude oil were the golden goose they were. People still don’t get it.

We are at a innovation standstill and have been since 2000. Couple that with worshipping capital and allowing them to offshore rather than “replace” the treasonous corps, you have the making of a American economic holocaust. One that will destroy the white middle class and set the stage for some ugly times to come.

Tristan, also glad to see other people are finding that all NYTimes article.

“It’s not what you know, it’s what you think you know that just ain’t so.”

The point about carpooling, once again, is that until people actually bother to coordinate carpooling to work (which is easier now in the Internet age than in the 1970s), they are not yet sufficiently pinched.

People can adapt to a life of lower oil consumption in many ways. Until they do, oil prices are not yet at ‘troubling’ levels.

Jeffrey, excellent information as always.

Well before Chindia consumes even 25-33% of ANE, US-China trade and diplomatic relations will be well on the way to collapse, and the US will have blockaded, embargoed, and seized Chinese holdings of resources in Central Asia, Africa, and South America and sent the Middle Kingdom back to the Mao era.

BTW, four times (White Lotus Rebellion, Opium Wars, Boxer Rebellion, and Mao’s revolution) since the late 18th century (about every 50-60 years, coincident with the timing of the Long-Wave Trough) westerners have descended upon the Middle Kingdom to get rich, and four times the results were the same: financial and economic crisis; social unrest; gov’t reaction; xenophobia against “western devils”; foreigners scapegoated, their assets seized, deported, and sometimes worse; and the Chinese leadership turned inward to deal with domestic social challenges.

History is rhyming yet again, and China is the greatest fixed investment and credit bubble in world history by far. China and India are 40-80 years too late to the oil- and auto-based economic model.

My bet is a collapse in China, a takeover by the PLA generals in Beijing, and war between the US and China within the next 8-10 years.

China is a four-letter word: Sell.

GK, how does your carpool work?

I don’t usually want to go the same place after work.

Bruce,

A small clarification. I am defining ANE (Available Net Exports) as GNE (Global Net Exports) less Chindia’s combined net oil imports.

My premise is that given China and India’s long term rate of increase in oil consumption (versus generally rising annual oil prices since 1998), what Chindia wants, Chindia gets.

So the developed OECD countries get what is left over, i.e., ANE, and ANE fell at an annual rate of about 3%/year from 2005 to 2010.

Jeffrey, yes, sorry about the confusion. Thanks for the clarification.

“What Chindia wants Chindia gets” might be another way of saying what the US supranational firms’ subsidiaries and Asian contract producers need to operate profitably in China-Asia they want, and what they want they intend to get, even at the expense of US domestic consumption and real GDP per capita.

China’s energy and imports situation is not unlike the situations in Germany and Italy in the 1910s-40s and Japan in the 1930s-40s. China’s hegemonic ascent is on a collision course with thermodynamics (net energy per capita) and Anglo-American oil empire. (Japan became an industrial powerhouse only after suffering humiliating defeat and late with lots of US FDI and the inflation-adjusted price of plentiful oil well below $20. China and India have the FDI but not the abundant supplies of cheap oil.)

Neither the US nor China can afford a last-man-standing military contest for the remaining oil reserves and shipping lanes; however, at peak global crude oil production and oil exports from oil-producing countries, neither can the US allow China’s oil consumption and oil imports to continue to converge with that of the US and reach parity by the early ’20s.

In this context, China represents an imminent national security threat to the US and Anglo-American empire which the so-called radical Islamists only wish they could be.

A look at the real China most of us westerners are not aware of, even those who travel frequently to the westernized coastal urban centers:

http://charleshughsmith.blogspot.com/2011/06/why-wheels-are-falling-off-chinas-boom.html

http://en.wikipedia.org/wiki/Energy_intensity

That site as the comparative energy efficiency of the main economies. India has the best efficiency, energy per dollar of GDP.