The Federal Reserve announced on Wednesday ([1], [2]) that it will sell some of its shorter-term assets in order to buy more longer-term assets. Here I assess some of the possible consequences of this move.

The maneuver is being referred to by some as “operation twist”, an expression that was originally used to describe a plan implemented by the Kennedy administration and the Federal Reserve in 1961, and given its moniker after a dance popular at the time. The idea then was that the Treasury would replace some of its longer-term debt with shorter-term obligations, and the Federal Reserve would simultaneously sell some of its shorter-term securities and buy longer-term Treasuries. Some of the early research (e.g., Modigliani and Sutch, 1966) concluded that the original Operation Twist was not terribly successful. However, Federal Reserve Bank of San Francisco economist Eric Swanson has a new paper recently presented at the Brookings Institution that makes a convincing case that Operation Twist did succeed in its goal of modestly lowering long-term interest rates.

The Fed announced on Wednesday that it is going to try something similar, intending over the course of the next 9 months to sell about $400B worth of its Treasuries that have maturity between 3 months and 3 years in order to buy securities with maturities of 6 years or longer. According to the latest H41 statement, the Fed currently only has $129B in Treasuries between 3 months and 1 year, meaning that much of what they plan to sell has to be in the 1-3 year range. The details of the plan released by the Federal Reserve Bank of New York indicate that about 2/3 of the securities purchased will be in the 6 year to 10 year range, and most of the rest will be over 20 years.

The idea behind this plan is that, in the current setting, dumping an increased supply of shorter-term Treasuries on the market should have little or no effect on the short-term interest rate. But by buying more of the existing supply of longer-term Treasuries, the intention is to nudge the price of those securities a little higher, or in other words, try to move the long-term interest rate a little lower. The hope is by lowering interest rates, there would be slightly more opportunity for households and firms to borrow or refinance and perhaps increase spending a bit. The new measure thus represents something the Fed could try, over and above what it already did in QE2, that might further stimulate the economy without expanding the overall size of its balance sheet any bigger than it already is.

In a research paper that I wrote with Cynthia Wu, which will soon be published in the Journal of Money, Credit, and Banking, we came up with a framework for evaluating the effects that policies like this might have. Our estimates are based on how changes in the relative supplies of publicly-held Treasury debt of different maturities correlated historically with changes in the basic factors determining interest rates on different securities, which factors we summarized by the level, slope, and curvature of the term structure of interest rates. We also built a simple model of how latent level, slope, and curvature factors have been influencing the evolution of interest rates in an environment like the current one in which the overnight interest rate is stuck near zero.

We decided to redo some of our earlier analysis in order to evaluate the potential effects of a policy like that just announced by the Fed. We conducted the following counterfactual experiment. Suppose that at some historical date t, the Federal Reserve were to have sold off its entire holdings of securities between 3 months and 3 years duration, and used the proceeds to buy an equiproportional amount of all outstanding Treasury securities between 6 years and 30 years duration. For example, if implemented in December 2006, this would have been an operation involving about $343 billion in securities. We calculated what this would have done to the level, slope and curvature factors, and what that would mean for interest rates of different maturities in the present setting where the overnight rate is stuck near zero. The result is plotted in the graph below. The horizontal axis reports the maturity of a given security (measured in weeks), and the vertical axis reports how the yield on that security (measured in annual percentage points) might change in response to operation twist.

|

We don’t claim to have very precise estimates for the outcome of this new counterfactual experiment– the values in the figure above are not statistically distinguishable from zero, according to our analysis. Nevertheless, they represent the best estimates I can give for the effects of operation twist. Our estimates suggests that a policy such as the newly announced operation twist might increase 1-3 year yields by 2 basis points and lower the yield on the longest term securities by a little less than 10 basis points.

In addition to the statistical accuracy, there’s another big caveat for these estimates, which is that we are analyzing the effects of Fed policy alone, assuming that there are no changes over the next 9 months coming from the Treasury. However, this assumption proved definitely not to be the case with QE2. There, while the Fed was trying to buy more long-term securities, the Treasury was preferentially issuing new long-term securities at an even faster rate, with the net result that the Treasury basically undid any stimulative effects of QE2. Thus, in contrast to the original Kennedy Operation Twist, in which the Treasury and Fed were working together, it’s quite possible that in the current environment, they will continue to be pulling the economy in opposite directions. So I expect the effects of the Fed’s latest measure could turn out to be significantly less than 10 basis points.

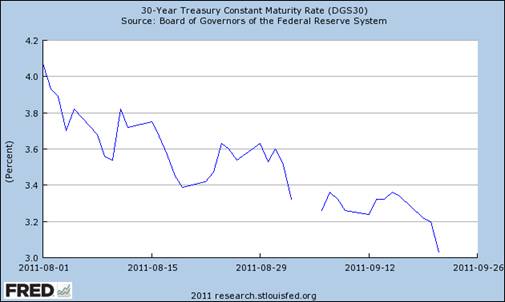

How then do I explain the fact that the 30-year Treasury yield fell 17 basis points on Wednesday? My answer is, this wasn’t just the Fed. News of a weakening European economy may have been more important. There also may have been some signaling effect with investors concluding, “Gee, if the Fed thinks they have to do this, the economy must be in even worse shape than I thought!” As evidence in support of such an interpretation, commodities and equities also fell significantly, moving in the opposite direction from what you would have expected if you believed new stimulus from the Fed was the key development driving markets.

|

The modest effects that one could reasonably anticipate for a measure like operation twist are easily swamped by other developments, and even a sizable effect on 30-year Treasury yields would not in my mind provide a major stimulus. I think the correct interpretation is that the Fed would like to bring some more stimulus, this was something they could do in that direction, so they did it.

But if you were about to drown, I wouldn’t want to count on operation twist as your lifeline to safety.

“It don’t mean a thing, if you ain’t got the swing (oil producer, that is.)”

It seems the biggest effect of Operation Twist is to make an eventual Fed exit more difficult. How do they sell long bonds in a rising rate environment? Who eats the loss?

China would be wise to take advantage of Operation Twist by doing a Reverse Twist and shortening the duration of its Treasury portfolio.

Very nice post. Thanks for this.

Steve Williamson has argued on his blog a number of times that it’s impossible for this type of action to have an effect, with the same argument applying to QE. It’d be very interesting to hear your views on his arguments, when you have the chance.

In my view, the effect on interest rates now is secondary. The main reason is that average maturity of government bonds is too low, which means that interest rate hikes filter through to the government bottom line too fast. With the debt load exploding, interest rates risk being constrained on the upside by this (i.e. if they go up, government defaults really quickly). A longer maturity would help.

Just my 2c

c: We address these issues on pages 10-11 of our paper.

Here’s another video. Chubby Checkers singing over video that will really bring a smile to your face. I promise. Having a bad day? Watch this.

http://www.youtube.com/watch?v=DZAtzcthSxM&feature=related

I had a fun model on my blog a while back, modeling the yield curve as a finite state Shannon channel. The points of the curve are the set i of -iLog(i); a finite precision channel that minimizes the redundancy of debt flow when the -iLog(i) are within an integer.

In my model, forcing the curve flatter makes the number of finite i want to drop by one element. You don’t get flatter, the banking network drops a rank.

Prior to Operation Twist, Fed officials discussed holding on to the entire asset portfolio and allowing it to decline in size as assets mature. The decision reached seems to have been that some assets should be sold before maturity. There is no guarantee that decision will stick after Operation Twist. There are other ways to reduce monetary accommodation than selling long-term assets.

I would be curious to see how many of the politically connected bought Treasuries immediately before the FED announced its operation twist. From attempts to impact the macroeconomy doing this in the past have been a huge yawn the one thing that would happen is that long-term Treasuries would increae in price. If you know in advance that the FED is going to buy $343 billion in securities getting there before their transaction could net a pretty return.

Crony capitalism always justifies itself as in the public interest and the killing the crony capitalist makes on the transaction is just a side issue, that is for everyone but the crony capitalist. How quickly we forget, the “Friends of Angelo” – 42 Fannie Mae CEOs, COO, and other executives including Franklin Raines and Jamie Gorelick. Yes, it happens, SOP for the political class.

As mentioned in the “oil” thread. The FED is trying to run a rade on the inflation hedge “inflaters”.

Since we can’t have any long standing inflation, inflation hedgers have to “create” that inflation to make you believe and boost up consumer prices, thus commodity prices. However, this is just not substainable. Since QE can’t spark a strong move in capital flows in the US economy, might as well try and boost it moving(mostly) commodities into investment. This will surge consumer spending and the economy will be on stable footing……..or so they hope. The EU problems may hurt Ben’s hopes.

I think the funny thing is, the economy was doing pretty good for this time last year……for what it was. Then came the correction. I do think if we can escape the EU crisis, “Twist” may become politically popular as a the economy regains more footing as the correction ends. Far from the truth. I think Republicans want to NGDP target so bad, they can barely stand it. But they have to put on a straight face for now.

Of course I am just a old fashioned nationalist, isolationist. I don’t believe in economics and find any form of it, a perversion of the intellect. To me, the government should just replace the credit, rebuild domestic industry and shake its fist at the world. That would end the need for these silly central banking games caused by fractional Reserve Banking. Reorganization is a necessity of the parent government, not plutocrats or intellectuals.

Refi anyone?

Instead of screwing around with this weak “signalling effect”, it would be better if the Fed simply announced that their new inflation target for the next 10 years is 4 percent. Stop using smoke signals and just make a clear announcement.

The Fed is derelict in fulfilling their dual mandate. They are dominated by the interests of rich bankers.

Bernanke starts to realize the critical solution to revive US economy by supporting mortgage market again. Next move would be deregulation of Fed and government to solve the property market. Fed should deregulate to ease the refinance and lending process. Government should consider to help the existing borrowers from deregulation and tax incentives to borrowers and lenders. Obama should implement the tax incentive for people and corporates to buy properties. Now property prices are very undervalued and the policy initiatives like tax incentives/no transaction tax or no property tax will support more demands and build expectation of property price appreciation.

Surely, more policies will be implemented but good sign is Fed see that the major problem is mortgage and I think the policies from Fed and Obama to help American to solve mortgage problems will gain support from public.

The action of operation twist with target zero intereat rate to at least mid-2013 will be more effective than QE2 becasue those action will target all yield curve-short/long at very low rate for longer periods. Action to support mortgage will also lagely affect positively the credit market especially the weakest part-mortgage.

The action of Fed is on the right track and sure more action will come to solve the real problem of US economy and far better than QE2 that is not targeting the real problem like mortgage and is less effective on yield curve after implement with high yield curve.

Really very thoughtful analysis–thanks.

The Fed’s announcement that they would keep rates low through at least mid-2013 seemed to have a larger effect than the twist. Would it be possible to do something similar to evaluate that policy? It would seem to have a different effect on the shape of the yield curve, perhaps pulling down medium-term rates more than long term rates. It would also be interesting to consider the effect of different kinds of policies on real rates and inflation expectations.

Does it ever bother you that the Fed is carrying 2.8T$ in assets with about 52G$ of capital or about 55:1 leverage?

Would you feel better if they wrote up their gold hoard from its 11G$ carrying number to its market value of about 430G$ which gives a 7:1 ratio?

Note: T$ = $1,000,000,000,000

G$ = $1,000,000,000

I am happy the latest Fed action is expected to have very limited impact. I suspect QE2 has been counter productive: it raised oil prices which was one of the major factors for the slowdown in the US economy in the spring; it also lowered income for retirees who have seen their CDs rolled into basically zero return savings and therefore are forced to cut their consumptions.

I wonder if Ben may be wondering if his policies have done anything more than bring doom to the euro and speed up real wage declines.

What makes the Swanson paper convincing that Operation Twist in the 60s succeeded? Can someone comment on that?

I remember reading a paper by Ken Kuttner (2006) titled “Can Central Banks Target Bond Prices,” and a point he made in the paper is that the effects of Operation Twist is small. More specifically, he looks at the relationship between “composition of privately-held debt in the aggregate” and term premia and find that the relationship is weak. The dataset he provides on his website ( https://www.sugarsync.com/pf/D64142_75919_698028) shows that over the 60s, the amount of privately held marketable US government securities greater than 10yr is virtually flat – that most of the Fed’s purchase is offset by the Treasury Department issuance.

Here is a link to a graph I made using the data showing privately held marketable US Government securities over the 60s, by length to maturity: http://i.imgur.com/DyXdh.png

In the Swanson paper (Table 2), he shows that the estimated cumulative effect for 10 and 30 year yields are 13 and 12.5 basis point. For the Swanson paper to be convincing, and to conclude that Operation Twist has an effect, then the effect must not be through supply or some sort of preferred habitat friction. So is Operation Twist’s effects in the 60s through a signal that the Fed is determine to keep long term rates low, and market expects them to be successful in whatever they ultimately decide to do? How (through what mechanism) does operation twist have an effect in the 60 on the long rates?

Any comments to increase my understanding will be much appreciated.

An Economics Student: Thanks for your thoughtful contribution.

Swanson’s claim is not that Operation Twist had an effect throughout the decade of the 60s. Instead, he claims to observe a response between February and April of 1961. The number he uses for the overall size of $8.8 B comes from Meulendyke (1998, p. 40) which is a comparison of December 1961 with December 1960. The figure you have prepared certainly seems to confirm the claim that during 1961, publicly held 1-10 yr securities did indeed fall and less than 1 yr securities rose by roughly this magnitude.

Your specific question may involve the apparent absence of change in the supply of greater than 10 yr bonds in your graph. In terms of the model that Cynthia Wu and I proposed, an increase in the supply of less than 1 yr and decrease in the supply of 1-10 yr would flatten the entire yield curve (and thus in particular affect 10-30 yr yields) through arbitrage. For example, the blue line in the second figure here gives our estimate of the effect on the yield curve of purchases concentrated in the 2-1/2 to 10 yr range when implemented at the zero lower bound.

It’s fairly obvious the ploy is create a bump in an election year by creating an atmosphere conducive to long term borrowing and leverage increases. WOW! That’s just what we need. more leverage and more debt! It may work! And our path to Greece continues as public employment increases and private employment decreases as a percentage of the workforce and most jobs go overseas.