Today we’re pleased to feature a guest contribution from Michael Dueker, chief economist at Russell Investments and formerly an assistant vice president in the Research Department at the Federal Reserve Bank of St. Louis. Dueker is also a member of the Blue Chip forecasting panel. Econbrowser readers may remember that in February 2008 Dueker correctly predicted the onset of the current recession, using a model-based forecast. In a depths-of-recession piece from December 2008, he predicted in this forum that the recession would last until July or August of 2009, but that employment growth would not resume until March of 2010. We asked Mike to share the latest macroeconomic predictions from the Dueker Business Cycle Index model, subject to the disclaimer that the content does not constitute investment advice or projections of the stock market or any specific investment.

Is a U.S. recession a ‘done deal’ or would future shocks, such as European conflagration, be necessary to tip the U.S. toward recession?

that are posted monthly on Russell.com.

Before even looking at model output, I start with the observation that the measures of financial market concern about the state of the economy that go into the Qual VAR model are not showing acute stress at present, especially relative to their values in late 2007 and and early 2008. For example, the TED spread between 3-month LIBOR and the 3-month T-bill rate has to consider that, since December 2008, the LIBOR yield has had a floor under it equal to the 25 basis point interest rate the Fed has been paying on excess reserves. Viewed this way, the current 3-month LIBOR yield of about 32 basis points in September 2011 does not represent much stress in interbank lending markets at all. Similarly, the Baa-Aaa corporate bond spread averaged about 120 basis points in September 2011, which is elevated, but still slightly below levels seen during the recession scare in June and July 2010. As a signal, the slope of the yield curve between ten years and three months is also distorted by the present near-zero interest-rate policy, which prevents yield-curve inversions. For this reason, the model also includes the level of the ten-year Treasury yield and core inflation to reflect the Japan-like near-zero long-term real return expectations on the Treasury bond.

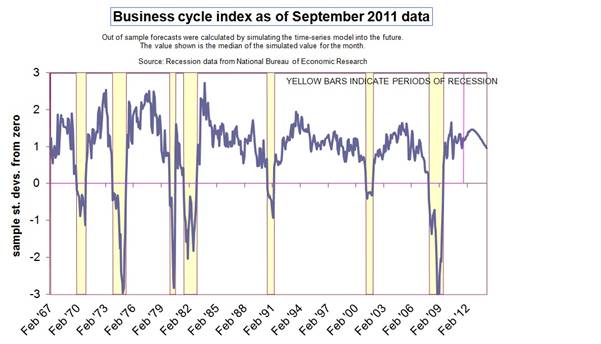

The figure below shows the model-implied business cycle index, where its distance from zero indicates either the depth of a recession

or the strength of an expansion. The history of the business cycle index illustrates the so-called Great Moderation in the U.S. economy after 1984. The out-of-sample forecasts in the chart suggest that the central-tendency forecast is a muddle-through scenario, with gradual, achingly-slow improvement in business cycle conditions that never reach anything beyond what could be called mediocre.

|

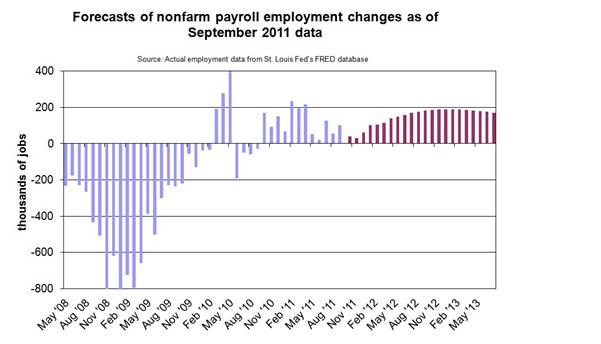

As part of his recession call, Lakshman Achuthan of the Economic Cycle Research Institute has said that he would not be surprised at all if the U.S. unemployment rate were to go back above 10 percent, presumably as part of its current trajectory without requiring fresh shocks to push it there. The central-tendency forecasts of nonfarm payroll employment from the Qual VAR model, in contrast, do not project the declines in employment that would be part and parcel of a new U.S. recession. In particular, the path of employment shown here is not consistent with a rise in unemployment back to 10 percent. Instead, the projection is for U.S. jobs gains to remain moribund for several months, not reaching 150,000 jobs per month on a sustained basis until June 2012. Thus, it will be hard to distinguish in coming months between a stalling economic expansion and an economic expansion that is slowly rebuilding momentum from scratch. Nevertheless, the key difference in message between the Qual VAR model and ECRI concerns whether new negative shocks are needed to drive the U.S. economy into recession or not.

|

I emphasize that a U.S. recession is certainly possible, given that a Eurozone recession looks very likely. It is entirely conceivable that European policymakers will fail to gather the necessary resources in time to prevent financial-market contagion to peripheral countries, such as Italy and Spain, or to recapitalize their banks sufficiently quickly in the face of or, better yet, in advance of a Greek default. Such a financial shock, if it occurs, could be transmitted to the United States with sufficient severity to lead to recession here. This would be a new negative shock, however, and does not appear to be built into current early-warning financial indicators in the United States to a sufficient degree to make a U.S. recession the base case at this time. My current reading of the financial market indicators of the U.S. business cycle is that investors are more concerned about Japan-style economic stagnation right now than about a traditional recession.

A traditional recession is not likely if Europe doesn’t implode. Even a garden variety “recession” in Europe wouldn’t hit the US as much as people think. Considering the acceleration in the US during September, I suspect this train of thought will die by Demember…….if Europe doesn’t implode. To me, this recession is early 90’s/00’s type from just a greater trough. Even when “recovery” begins in earnest, we won’t hit the levels of the past. That is just something people will have to come to grips with.

If Europe implodes, then all bets are off as that would be the resumption of the financial crisis.

Thanks for the analysis. Very concise and well written.

One thing that puzzles me is how a default by Greece, contagion to others and an impact on banks can be called a shock given:

– the interest rates, CDS levels etc for the PIIGS and

– the equity prices of various European banks (Dexia etc).

You’d have to put this “shock” as something that the relevant markets have priced in as being highly possible in the next 6-12 months rather than some “shock” – wow that was totally unexpected and came out of nowhere. What is the “shock” in this context?

It seems worth mentioning that Europe’s woes are putting upward pressure on the dollar and thereby constraining US exports… and that of course affects the job shortage. This strikes me as more important than the exposure of US banks to issues in the PIIGS nations???

ray

ECRI says recession. They have never issued a false alarm in decades of analysis.

Dueker will come around to that, possibly in a month or two.

The only reason that there might not be a recession, is that we have not really had recovery.

100%:

1)DJIA to 6000-6500 in q1 2012 in nominal USD, howering around that level ( up to 7500, than down again) for at least till the end of 2014. That corresponds to 2-4% yearly recession over 3 years.

2) USD being world reserve currency, USA will not default even with recession in 2012-2014 earlier than 2016- both the USA will need increased debt to finance anything as tax receipts fall even more, and domestic environment is debt deflationary

3) creditors will support this to be able to continue selling goods and avoid losing value of USD reserves as long as USD maintains/INCREASES its value against most other currencies. However , I strongly suspect China will move to silver standard in October 2012, when also Eurozone will shed a bunch of its weak members- to protect themselves from inflation caused by strong USD and commodities prices in USD.

4) What ever politicians do, who ever is presidents, which ever party controls House and senate, USD debt has passed sustainability limit in 2006, and default is imminent.

My analysis here:

http://saposjoint.net/Forum/viewtopic.php?f=14&t=2626&start=620#p34423

Suggest that default will happen in end of 2015- early 2016, USA debt will stand at 21 trillion USD, and the haircut within next 2 years ( 2017-2018) will be in the range of 50-75%. Hence inflation in the USA will be on average 25% in 2017-2018..

Once USA default ( Europe would have defaulted by parts starting from q4 2011-q12012 and until q4 2012 would have cleared EUROZONE up, Eurozone ( what is left)will start to recover in 2017, and reduce inflation ( as USD will devaluate,resources will cause less)

Still, given the coming economical circumstances I predict Tea Party or other Nationalist conservative movement or alliance to make huge gains in 2014 HOUSE/SENATE diminishing both GOP and DEM representation and their representative WIN 2016 presidency.

So , in the meantime, Tea Party etc will become a true party. As will its nemesis, communists, though they stand no chance in the USA.

I think Sarah Palin will work hard to make 3rd party a real force before 2014 elections. Economy will help ( pain in economy, sorry about that).

Interestingly, Great RECESSION vs. Great Depression spells it out very well unwittingly ( wrong name, perhaps):

What is ongoing and coming will be the longest recession (Great) since 1913 in the USA, but not the deepest (Great depression).

The one thing this discussion omits is the significant tightening of fiscal policy in FY2012(I’m assuming that the 200 bp reduction in the payroll tax will not be reinstated). That’s a pretty significant blow to incomes in an already weak environment — not, apparently, the sort of factor incorporated in this model, but still something that contributes to the risk of recession.

What I find interesting in the graphs, that no one seems to be talking about in any real way, is: why the lackluster jobs recoveries in the last recessions? There is a clear trend towards jobs not coming back, or taking a very long time to come back as we come out of “technical” recessions. Or has the definition of “recession” reached an inflection point?

I have my own hypothesis about this, and also about income inequality and distribution, but I don’t see any serious attention on it. I believe that, much like we’re focused on the wrong thing with the deficit, we’re focused on the wrong thing with this trend and jobs (globalization). The giant question in my mind is, as we pull further into an age of technology and further mechanization, where are the average middle class, middle educated jobs? Each time we shed layers in an recession, less seem to come back. What takes their place? Where do the people now find work? At Walmart or other service sector jobs for low wage? Where are the well-paying assembly jobs? Ever go into a modern car plant? How many people do you need these days? You don’t even need people to deliver parts, it’s done by robot drones running the floor. Secretaries/personal assistants? Now done by electronic software on your iPhone. So we keep saying “it’s the demand stupid” but is it, or is this component the real story here and we’re just not talking about it?

I think this is very, very important and akin to the disruptions that occurred in the industrial revolution. Except now we’re living in the last phases of the “technology revolution” and ignoring the displacement because it’s hard to talk about because, well, there really isn’t an answer.

The problem as I see it is that most of the data that is being used here are data points that are manipulated by the Fed’s and as a result may be masking turmoil elsewhere … like under the surface.

Personally … I’m seeing a lot of businesses that were either competition or vendors going out of business.

Throwing macro money at the banksters … is preventing micro price discovery from happening on Main Street.

Excellent post.

Some questions:

– the slowdown in growth from Q2 was unexpected by most economists, ie, virtually the all major forecasting agencies or companies (Macroec Advisors, IMF, GS, etc.) have downgraded growth forecasts throughout the year. Is this also true of the Qual Var model? If so, what drives the downgrades? Government spending and deficits in Europe are straight-forward to forecast and therefore should have been incorporated into expectations ex-ante.

– How does the Qual Var model differ from an ECRI model? Why is ECRI so confident and Deuker so skeptical? (Jim, do you suppose you might ping Achuthan for a rebuttal?)

– Why not a word on oil prices? The Saudis are in the press today stating that they do not need to increase capacity. GS notes that physical capacity is quite tight in Europe. If Brent is at $100 now, with a recession looming, what will happen to oil prices if there are glimmers of economic hope? What will be the effect on the OECD economies?

econimonium,

I agree. I think too that a misguided belief in the Marginal Utility Theory has created a false sense of security in regards to a service based economy. Economists seem to believe that growth can be driven by lending indefinately. This assumption though ignores the fact that any nation with a banking system can create capital ex nihilo and thereby eliminate cross-border interest payments. Why nations would continue to share their progress with opposing forces once they no longer need technolgical expertise from the advanced nations is seemingly an inescapable flaw in the ‘globalization plan’. But of course, as you suggested, our leaders are in denial about some rather obvious problems with the ‘master plan’, we seem to be relying on the plan of no plan?

Mike,

Good post. Is it possible to make the BCI historical data available on your Russell website?

As if there isn’t enough to worry about already, shouldn’t we start to get a little nervous about the contagion from a Canadian recession? Second quarter Canadian GDP fell at an ~4% annualized rate. Canada is just as a big a trading partner as Europe.

I wonder if the worry of the next 2008-like shock is over done? Not that there isn’t a real likelihood of trouble in Europe, but given that financial markets are still pretty tranquilized, and what would have been a shock in 2007 wouldn’t budge the needle much now, I’m not sure that’s what would push us over the edge.

On the other hand, obviously we’ll have another recession sooner or later. Robert Schiller said he would consider it a double-dip if we still had high unemployment, deleveraging, etc. That seems a no-brainer to me.

Steven Kopits,

But what of the oil log-jam creating a surplus here in the US? What will it take to move this to Europe? Is there a government obstacle in the way?

Again it appears that economic conditions are driving the price of oil rather that oil driving the economy.

Just because Washington declares a recession to be over doesn’t mean there is a recovery beyond the Beltway.

http://www.nytimes.com/2011/10/10/us/recession-officially-over-us-incomes-kept-falling.html?_r=1&nl=todaysheadlines&emc=tha2&pagewanted=all

Back in 2008, I speculated that the growing recession was different. It certainly has been for Michigan.

http://hallofrecord.blogspot.com/2008/11/what-were-causes-of-japans-lost-decade.html

Ricardo –

Basically, the government just has to get the permits in line in timely fashion. Jim’s already written on this topic; I don’t have much to add.

But keep in mind, the shales are maybe going to give us an incremental 400 kbpd/year on total consumption are 88 mbpd, and required growth (by our count) of around 2400 kbpd / year. So it’s helpful, but WTI should be more influenced by Brent than vice-versa. It’s not going to save the European’s bacon all by itself.

On the other hand, there are shales in France (now prohibited), shales in Poland (coming along), and I’d bet you a good bit that we’ll find some interesting stuff underneath the oil Russian oil fields in western Siberia. And expect the Chinese to start pouring into this topic. They have plenty of mature fields, too, and I would guess you’ll find something like shale oils under a number of them. However, this will not affect Europe in the next 12-18 months.

In short, there are a number of issues: diffusion of techonology, basic geology, logistics and infrastructure, industy capacity, NOC vcs IOC, and also, government regulation and policy. It’s not just policy or regulation.

Though technically, the U.S. Economy has had a slight recovery. The folks out here paying their bills, taking care of their kin and paying down debt, have not. So… we are not worried about a second recession. We will look back in maybe 10 to 15 years and see that we are were in the midst of a second and “Greater Depression”. There has been a generational shift, which our political leadership has missed. It is a good thing, that they cannot see it, however. The new norm is, low or no debt. Ownership, not rent to banks via mortgages, is taking hold. Those who do not choose to do this will maintain low to no debt, via renting. In addition, it is a time when people are actually opting out of the work force. Maybe, at first, unwillingly, but once they find out that freedom from the bondage of low paying multiple jobs can be navigated by doing work in a multiple generational household is more rewarding, it becomes easy.

So we are going back to the things which gave us our great country, LIFE, LIBERTY and THE PURSUIT of HAPPINESS!

It was the politicians, acting against the best interests of the People, who abdicated to the monied interests of Wall Street. So you see the Tea Partiers and the Wall Street protesters do have something in common. The Dems and the Reps were screwing them both.

O/T, major gas and oil find in Ohio and Penn:

http://energy.aol.com/2011/10/07/utica-shale-may-be-its-own-energy-game-changer/?icid=maing-grid7%7Chp-desktop%7Cdl3%7Csec1_lnk2%7C103029

Ricardo,

If we had a surplus of oil then a barrel at Cushings wouldn’t be over $80. Cheap oil is below $30.