The drama began in Greece. Where is it going to end?

Let me begin with some observations on the basic mechanics of sovereign debt default. If you borrow $1 at a 5% interest rate, next year you’re going to owe $1.05. If you don’t pay any of it back and just roll over the debt, you’d then have to borrow $1.05 next year, meaning you’d owe $1.10 at the end of the following year. It’s hard to see how that game can go on forever, even if it’s a sovereign government doing the borrowing.

One critical parameter is the GDP growth rate. If the GDP growth rate is bigger than the interest rate (e.g., nominal GDP growing faster than 5% in the previous example), then the debt you owe, although growing, would still shrink as a percentage of GDP. A sovereign government might well continue to find lenders in such a situation, even if it’s just rolling over a growing amount of debt. But if GDP growth is below the interest cost, then debt that’s continually rolled over would grow to become an arbitrarily large multiple of GDP. Eventually you run into the logistical constraint that there simply aren’t enough funds in the world to buy that much debt. As soon as lenders recognize that’s where the process is headed, the government is going to find it suddenly much more difficult to borrow the necessary new sums.

To prevent that from happening, over the long haul any government is forced to run a primary budget surplus, meaning that tax receipts exceed expenditures other than interest costs, in order to be able to use some of that primary surplus to make interest payments. The higher the debt load, the higher the steady-state primary surplus needs to be.

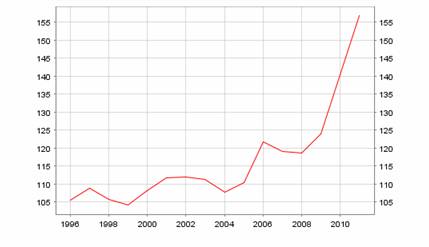

According to ECB data, Greek government debt was already 120% of GDP in 2008. The primary budget deficit was over 10% of GDP in 2009 and almost 5% in 2010. That plus the rapidly increasing interest rate facing Greece pushed their debt to 156% of GDP for 2010.

|

And from there it’s hard to tell a story with a happy ending. Even if the Greeks defaulted 100% on the outstanding debt, moving the primary budget back to balance requires significant contractionary moves. And default (or large “haircuts”) on the debt means huge capital losses for Greek banks and pensions. That kind of financial disruption can eliminate the extension of most credit and initiate a brutal economic contraction.

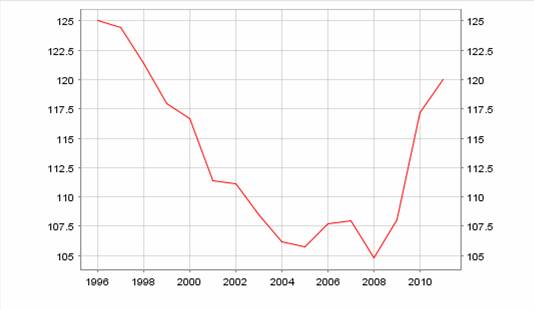

Nervous investors were speculating last week whether Italy might be next. The situation in Italy is different from Greece, with much more modest primary deficits, and a debt-to-GDP ratio that remains below what the country had in 1996.

|

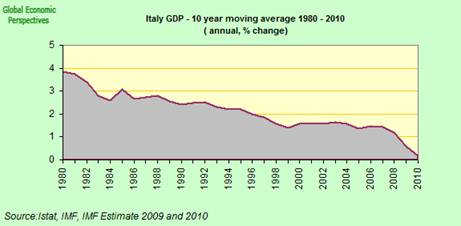

The pessimistic calculus in Italy has been a more slowly-unfolding drama, with a key development being the continuing slowing of the country’s growth rate. As the growth rate slid from 3% to 1%, being able to meet the interest burden of 120% debt-to-GDP becomes increasingly problematic.

|

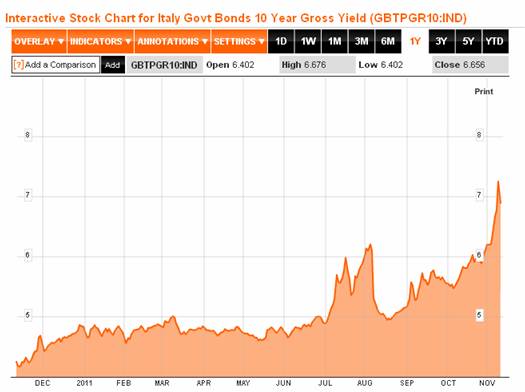

A year ago, the Italian government was able to issue 10-year bonds with an interest cost below 3.8%. Some might have argued that those low rates were a signal from the market that there was not much chance of Italy following Greece down the drain. At a visit to UCSD a few weeks ago, University of Maryland Professor Carmen Reinhart was asked whether that’s a correct inference to draw from a low government borrowing cost. Emphatically not, she said: “Yes, yields are low– until they’re not.” Historically, the changes can come pretty quickly, as the Italians discovered last week.

|

Italy has responded with a series of reforms described by the New York Times:

The legislation includes selling $21 billion of state assets and increasing the retirement age to 67 from 65 by 2026. It also sets the stage for a liberalization of closed professions and labor laws, a gradual reduction in government ownership of local services and tax breaks for companies that hire young workers.

Good ideas, which succeeded in bringing the Italian 10-year yield down 60 basis points by week end. But what is the downside in all of this?

Obviously the sentiment could shift again, and other countries could find themselves in the crosshairs next. That would likely mean significant contractions in the affected countries from the credit factors noted above. What would be the implications of that for countries like the United States?

A significant economic contraction in Europe will reduce demand for U.S. exports. But my bigger concern is with international financial linkages. Which financial institutions have made loans or entered into derivatives with exposure to these troubled debts? A recent assessment by the Congressional Research Service estimated that U.S. banks have $641 billion in loan exposure to Portugal, Ireland, Italy, Greece and Spain. But French and German banks themselves have considerable debt to those same countries, and U.S. banks have another $1.2 trillion in loan exposure to German and French banks.

And this is the heart of the problem. Who takes the losses, and if they fall, who do they then bring down in turn? If you’re somebody with funds to lend and don’t know the answer, in response to these fears what you do is cut back all kinds of lending. If that sounds familiar, it should, because it’s exactly this kind of ricocheting financial uncertainty that brought down the world economy in the fall of 2008.

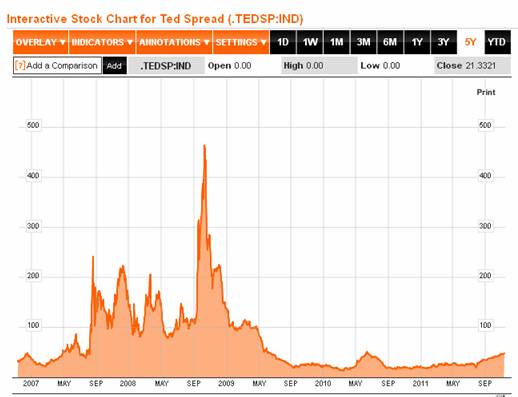

One key indicator to watch for whether we’re about to see a replay of those dynamics is the TED spread, which measures the gap between the rate at which banks can borrow Eurodollars from each other and the U.S. T-bill rate. This has been edging up, but is nowhere near signaling a crisis yet.

|

So, at this point the really scary fallout from the situation in Europe is perceived to be under control.

Until it isn’t.

It would seem that we are entering a period of “Revolving Door” politics in OECD countries, as voters periodically turn against the party in power, in effect hoping–without realizing it–that someone can figure out a way to maintain an infinite rate of increase in our consumption of a finite fossil fuel resource base (and bring back cheap oil), while Global Net Exports and Available Net Exports of oil will probably show an accelerating rate of decline.

As voters periodically change the makeup of the officers on the bridge of the Titanic, perhaps we should be focused on encouraging vocational and agricultural training in high schools and community colleges.

An article from the NYT:

http://www.nytimes.com/2011/11/13/us/young-farmers-face-huge-obstacles-to-getting-started.html

Young Farmers Find Huge Obstacles to Getting Started

Excerpt:

“Everyone wants young farmers to succeed — we all know that,” said Lindsey Lusher Shute, who oversaw the survey. “But no one was addressing this big elephant in the room, which was capital and land access.” Ms. Shute’s husband, Benjamin, runs Hearty Roots Community Farm in the Hudson Valley, which delivers seasonal produce to 500 families. Ms. Shute said she hoped that the survey results, released on Wednesday, would demonstrate to the United States Department of Agriculture and to Congress that young farmers, although passionate, have needs that must be addressed. The obstacles are formidable.

At Quincy Farm in upstate New York, Luke Deikis and Cara Fraver say they are living their dream, harvesting cabbage, sweet potatoes and carrots on a 49-acre property on the Hudson River. Still, even after three years of farming, Ms. Fraver, 30, waits tables, and Mr. Deikis, 31, moonlights as an engineer in the film industry, occasionally driving three and a half hours to Manhattan to pay the bills.

Dear Professor Hamilton,

Are there economic studies discussing known and unknown situations causing significant economic disruptions that could help with the risk analysis of a European meltdown? For example the European situation seems to be reported in the popular press and perhaps the general public has a degree of awareness of the situation. I wonder how much risk there is for a meltdown when the situation is well known and seemingly is being addressed even if in an unsteady fashion. Contrasting the current focus on European risk, the sub-prime crisis seemed to be based upon the commonly held assumption (Gorton, The Panic of 2007) that home prices would continue to rise. When home process collapsed, the panic of 2007 ensued. How many folks were focused on the risk of the sub-prime market as a potential catalyst for an economic panic compared to the number of folks concentrating on the European risk of causing an international meltdown?

http://www.energybulletin.net/stories/2011-06-13/world-limits-growth

In the world, at the limits to growth

by David Korowicz

Excerpt:

. . . across the political spectrum, people are claiming solutions for a predicament that cannot be solved. They are claiming a level of insight and dominion over systems they can barely intuit and over which they have little and declining control. The electorate assumes there must be a solution to get us out of recession, a way to reverse what we have come to call ‘austerity’. More than that, we demand the right to the realisation of their expectations- our pensions and purchasing power, jobs and savings, health and education services . . .

What everybody wants and needs is a sudden and explosive increase in the production of real goods and services (GDP) to make their continual debt requirements serviceable. But that, even were it remotely possible, would require a big increase in oil flows through the global economy, just as global oil production has peaked and begins its decline. It cannot happen. This means that the global financial system is essentially insolvent now.

Professor,

Good post.

It seems to me a large measure of global debt monetization is coming, along with some austerity measures.

A lot of what you write about Greece and Italy also applies to the U.S.

Aside from the impact of a Europe implosion on the U.S. economy, what are your thoughts on solutions for the unsustainable fiscal trajectory we are on? I don’t see austerity as politically realistic. It seems to me the path of least resistance is to keep running huge deficits and printing money until something blows up.

It seems this ends badly. Austerity measures will push the EU into recession. The ECB will become the lender of last resort for soverign debt casuing the euro to depreiate and food/energy prices to rise. Labor, anarchists and the like will create plenty of trouble given rising unemployment and rising food/energy prices, while at the same time, the EU is trying to force labor to take cuts in pay, pensions and other government services.

except that governments clearly do not run long-run fiscal surpluses! and they cannot, as their fiscal balance is necessarily the inverse of the private sector fiscal balance, unless the private sector were comitted to long-run deficits. the opposite is obviously true.

at some point, it will have to be admitted that in reality the euro members are suffering not because they are running too-large deficits but because they are not being allowed to run deficits large enough, backed by a lender of last resort to dictate sovereign interest rates, to sustain growth amid a reversal of the private sector leveraging of recent years – thanks to a destructive obsession with inflation enshrined in a deeply misguided treaty set.

Great post.

Prof. Hamilton,

Shouldn’t you have considered the difference between governments that issue their own money and borrow in their own money, such as the United States, the UK, Japan, and governments that use money issued by some other government or agency, such as Greece, Italy, and California?

I believe that your useful account of the need to run a primary budget surplus would apply only to governments using money issued by someone else.

Thanks James !

I appreciate your good work and look at the TED spread too.

“U.S. banks have $641 billion in loan exposure to Portugal, Ireland, Italy, Greece and Spain. But French and German banks themselves have considerable debt to those same countries, and U.S. banks have another $1.2 trillion in loan exposure to German and French banks”. I wonder about the Domino effect, as Greece will fall for sure ..

Echoing gaius marius, why is JDH assuming that governments running a surplus is a good thing at least in the context of economic growth of the last two hundred years. It has never been a good idea for as long as the U.S. has been around:

The United States has also experienced six periods of depression. The depressions began in 1819, 1837, 1857, 1873, 1893, and 1929. (Do you see any pattern? Take a look at the dates listed above.) With the exception of the Clinton surpluses, every significant reduction of the outstanding debt has been followed by a depression, and every depression has been preceded by significant debt reduction. The Clinton surplus was followed by the Bush recession, a speculative euphoria, and then the collapse in which we now find ourselves. The jury is still out on whether we might manage to work this up to yet another great depression. While we cannot rule out coincidences, seven surpluses followed by six and a half depressions (with some possibility for making it the perfect seven) should raise some eyebrows. And, by the way, our less serious downturns have almost always been preceded by reductions of federal budget deficits.

http://www.newdeal20.org/2010/02/10/the-federal-budget-is-not-like-a-household-budget-heres-why-8230/

JDH,others,

The FED used QE to pull impaired assets out of the banking system. The cash ended up in excess reserves so it wasn’t directly passed through to the economy.

Compare the U.S. QE to the situation the ECB faces. (1) There are impaired assets (potentially) in the global banking system in the form of Greek, Italian, Spanish, etc debt. The ECB appears ready to ‘solve’ that problem much like the FED did with direct purchases of impaired debt in the secondary market.

However, the underlying problem in the EU is the ability of Greece, Italy etc to issue NEW debt to make payments for public goods and services, (and pay off old debt). If the ECB wants to step into that mess, they will have to purchase new debt offerings in the primary market. In other words, money will flow directly from the ECB into the EU economies.

Conversely, if the ECB does not buy Greek, Italian, etc debt in the primary market, how will these counrties finance government spending and debt rollover? Can you provide a scenario where this all works out without the ECB backstop in the primary market for new Greek, Italian, etc debt?

Interesting how TED and European bank CDS (e.g. BNP) behave differently during the past 3 years.

The European union was born on a referendum for some countries and managed through axioms of dictatorship where the citizens had no word on who manage,who represent them at the European parliament.As of today the treaty of European union executed in 1992 exhibits a rotten content before ever being green,and yet legislators had foreseen and prevented through covenants,powers vested to European public bodies the occurrence of this decay.The next step is to enshrine the reforms, that is to ask non elected representatives to vouch for the status quo.

The growing current accounts deficits, may set an uneasiness in any new legislative act.Where will be the cap on primary deficits and current account deficits to GDP,when is the ECB deemed to have completed its sovereign bonds purchase (World Bank Quarterly External Debt Statistics)

The practicalities are financial since derivatives involve counter party risks of CDS.

A daunting task to navigate from BIS statement of cross countries exposure to the FDIC on USA banks exposure in Europe.

Source FDIC

Country Exposure Lending Survey /1: March 31,

2011

All U. S. Banks – Group A

(A)Cross-border Claims Excluding the Fair Value of Derivatives

(B)Cross-border Claims Resulting From the Fair Value of Derivative Products /2

(C)Cross-border Claims Including Derivative Products

US Banks exposure

G-10 and Switzerland C A B C

BELGIUM 39,177 4,052 43,229

A

CANADA 99,726 15,546 115,272

FRANCE 251,994 25,305

277,299

GERMANY 335,418 56,679 392,097

ITALY 40,723 18,600 59,323

JAPAN 142,556 25,734 168,290

LUXEMBOURG 26,225 4,595 30,820

NETHERLANDS 104,659 9,091 113,750

SWEDEN 27,890 1,582 29,472

SWITZERLAND 83,380 10,370 93,750

Total including UK 1,485,097 232,182 1,717,279

UNITED KINGDOM

333,349 60,628 393,977

Bloomberg is giving a realistic outlook of the insurance of sovereign risks or this time is not different.

U.S. Banks Sell More Insurance on Europe Debt By Yalman Onaran – Nov 1, 2011

“U.S. banks increased sales of insurance against credit losses to holders of Greek, Portuguese, Irish, Spanish and Italian debt in the first half of 2011, boosting the risk of payouts in the event of defaults”

I wouldn’t spend a lot of time looking at the TED spread. The LIBOR market is disfunctional and Treasuries are close to a zero bound, experiencing low rates due to fears about the global market and, to a lesser extent, central bank manipulation. If you’re looking at an index to track systemic financial risk, you should look elsewhere.

JDH wrote:

The drama began in Greece. Where is it going to end?

As interesting as it is the drama will probably end in Greece. Elections are scheduled in February 2012 and Anotonis Samaras is very likely to win. Samaras has already said that he will refuse any more bailouts from the EU.

I truth anyone who is elected in February will be overseeing the bankruptcy of Greece. So what is needed is someone who can force the holders of Greek bonds to have a very serious haircut and that includes EU sovereign nations as well as the IMF. Then that leader must institute pro growth policies to resuscitate the private sector. Right now it appears that Samaras is just the person who can do that.

But what then? If Italy, Spain, Portugal, and Ireland see that such a move will revive a dying economy they may decide to do the same. That is what strikes fear in the hearts of banks all across the EU, but actually makes the people smile. Samaras could actually begin an economic revolution that could sweep all of Europe into a roaring recovery.

“As the growth rate slid from 3% to 1%, being able to meet the interest burden of 120% debt-to-GDP becomes increasingly problematic.”

Now ask what the growth rate would have been had the euro not been forced into being overvalued by 10% to 20% after Ben’s QE and attendant fall in the renminbi versus the euro as China kept its currency locked to the dollar. Were there any effects but dollar carry trade and dollar depreciation? I argued Ben was being irresponsible. It’s true that the ECB shares blame by failing to inflate, as half a pair of scissors would for a cut. But that still doesn’t excuse Ben.

Some great comments today, tj and Ricardo.

Hints of contagion in the EU? Yields rose across the board yesterday, except for safe haven Germany. Capital flight? A story in the WSJ today about pensions and other institutional investors selling EU debt.

The EU has a cash flow problem and the economy is too weak to support much in the way of government spending cuts or increases in tax revenue, so the fundamental spending imbalances will remain. That leaves bondholders to refinance government debt.

Lots of credit default swaps written on EU debt. A big difference between Lehman and Greece is that rather than let Greece go, the EU is forcing ‘voluntary’ writedowns that technically avoid triggering a credit event which would cause the CDS’s to kick in. That might work for ‘tiny’ Greece, but will it work for Italy and Spain, if it comes to that?

It seems that without growth, it is going to be very difficult for the ECB to stay out of the primary market and avoid infusing trillions of euros directly into the EU money supply.

Lots of interesting similarities between Spain and the U.S. in this CNBC article, http://www.cnbc.com/id/45322644

Housing, unemployment, debt, social unrest, etc.

I am really surprised this thread isn’t more active. AS JDH points out, the EU debt problem/solution has the potential to be another huge systemic risk event.

The financial crisis exposed the flaws in the investment bank business model – borrow short term, buy risky assets, securitize, sell risky securities backed by risky assets (after attaching a CDS to creat a AAA security), rinse repeat. It all fell apart when the short term market for funds became illiquid, triggering credit events and CDS’s kicked in. Direct sytemic exposure to bad investment bank debt and indirect exposure through CDS’s increases the probability of systemic failure.

In comparison, the EU government spending model is to support spending by borrowing at all maturities. EU country debt is risky so a CDS market develops. The market for EU debt is becoming less liquid and borrowing rates are rising. If we continue on this path, a credit event will be triggered. Direct sytemic exposure to bad government debt and indirect systemic exposure through CDS’s increases the probability of systemic failure.

Do we also need to start thinking about U.S. states and potential default?

It is literally shocking to me that the mid-week fall in Italian yields is attributed to a promise to cut the retirement age by 2026. Are you certain that you are economists?