With new pressure on the Obama Administration to approve the Keystone Gulf Coast Expansion Pipeline, I thought it would be helpful to review some of the debate.

One issue that received a good deal of attention was the possibility that oil would spill from the new pipeline and contaminate water supplies in Nebraska and elsewhere. Let me begin with the report from the U.S. State Department:

Keystone has agreed to incorporate the 57

Project-specific Special Conditions developed by PMSA [the Pipeline and Hazardous Materials Safety

Administration] into the proposed Project….In consultation with PHMSA, DOS determined that incorporation of the Special Conditions would result in

a Project that would have a degree of safety greater

than any typically constructed domestic oil pipeline

system under current regulations and a degree of

safety along the entire length of the pipeline system

that would be similar to that required in high

consequence areas as defined in the regulations….DOS calculated that there could

be from 1.18 to 1.83 spills greater than 2,100 gallons

per year for the entire Project.

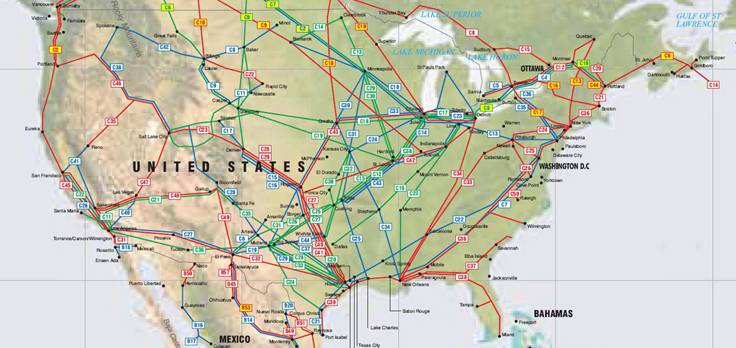

Although small spills will still occur, pipelines are by far the most efficient way to transport petroleum, and we could hardly do without them. The United States already has over a quarter million miles of oil and natural gas transmission lines, and millions more in gas distribution lines. TransCanada, the company that proposes to build the Keystone extension, claims:

There are currently 21,000 miles of pipelines crossing Nebraska, including 3,000 miles of hazardous liquid pipelines. Many of these pipelines co-exist within the Ogallala aquifer.

|

|

Although a significant portion of the oil transported through Keystone XL would be light sweet crude from North Dakota and Montana, a majority would come from Canada’s oil sands.

|

|

The most important issue for opponents of the pipeline is that getting a usable product out of the Canadian oil sands releases significantly more greenhouse gases than conventional oil resources. Charpentier, Bergerson and MacLean (2009) surveyed a number of different studies of the size of this effect, with each study’s estimate represented by a bar on the graph below. Whereas extracting one barrel of crude oil and delivering it to the refinery from conventional sources has been estimated to release 27 to 58 kilograms of CO2 per barrel, getting a barrel from surface-mined oil sands would emit 62 to 164, and estimated releases from in situ production range from 99 to 176.

|

However, this is much less alarming than it sounds, since far more CO2 is emitted when the final gasoline is combusted in the vehicle than in the production of the synthetic crude liquid itself. When one asks how much carbon dioxide is emitted when I drive a vehicle for one kilometer whose original energy source was oil sands rather than conventional crude oil, the differences are relatively modest.

|

In any case, U.S. production of oil from conventional sources has been declining for some time, and it’s simply not realistic to use conventional oil as the standard of comparison. Enhanced oil recovery and conversion of natural gas to liquid fuels are also associated with higher greenhouse gas emissions per kilometer driven than conventional petroleum; see for example Brandt and Farrell (2007). And if the end result of the U.S. refusing to buy the Canadian oil would be for them to build a pipeline westward to ship it to the Chinese or shipping the oil by rail or truck, there would be added greenhouse gas emissions associated with the transportation.

The extraction of the oil sands is also environmentally more destructive than conventional sources, though it would be an unusual step for the U.S. State Department to be the arbiter of what happens inside Canadian borders. And again perhaps a better standard of comparison is deep-sea or arctic production. It is quite possible that we’ll need these, and oil sands, and very significant U.S. conservation, to cope with the challenges over the next decade.

In terms of the potential impact on U.S. employment, TransCanada makes the following claim:

TransCanada is poised to put 13,000 Americans to work to construct the pipeline– pipefitters, welders, mechanics, electricians, heavy equipment operators, among other jobs– in addition to 7,000 manufacturing jobs that would be created across the U.S. Additionally, local businesses along the pipeline route will benefit from the 118,000 spin-off jobs Keystone XL will create through increased business for local goods and service providers.

The U.S. State Department estimates that the direct construction employment would be about half of TransCanada’s figure, which comes from a relatively small component of the total spending:

The construction work force

would consist of approximately 5,000 to

6,000 workers, including Keystone employees,

contractor employees, and construction and

environmental inspection staff. That would generate

from $349 million to $419 in total wages. An

estimated $6.58 to $6.65 billion would be spent on

materials and supplies, easements, engineering,

permitting, and other costs.

One should also emphasize that these are temporary jobs, as any construction work by definition must be. Once the infrastructure is constructed, the work of those who were employed in building it is finished. On the other hand, presumably the objective of any stimulus program is precisely to provide temporary employment opportunities. A recent report from Cornell University Global Labor Group came up with much more modest estimates of the short-term employment boost from the spending other than the direct construction would be 33,000 to 44,000 person-years.

In terms of “permanent” employment effects, I did not see either the State Department or the Cornell report mention TransCanada’s claim that the pipeline would generate a present value of $5.2 billion in property tax revenue over its lifetime. Even if the only jobs you counted were government workers, that should be enough loose change to buy you something.

And that brings me to a deeper issue here. The goal in my mind is not to “create jobs” in the sense of paying somebody to do nothing. Instead, the goal is to create new real income and wealth. I think a key measure to look at is not the cost of the project (how much is going to be spent on people and pipes), but instead its value added. And this has been the main reason that Keystone has always looked to me like it should be an easy decision. Light sweet crude in North Dakota is still selling for $20/barrel less that you could get for it if you could find a cheap way to transport it to the Gulf of Mexico. A quick calculation suggests that infrastructure that could move 500,000 barrels a day would generate $3.6 billion in annual value added. That benefit would go to the people who work to build the pipeline, motorists who buy the gasoline, workers and companies that produce the oil, and the government that collects taxes from all the rest.

JDH Although I am one of those who is concerned about the ecological effects of spills (both unintentional and intentional), let me chime in with something that helps make a stronger case for your position. As I’m sure you know, there is a new NBER study that finds the value of the Ogallala Aquifer has fallen fairly dramatically due to drought tolerant crops.

http://www.nber.org/papers/w17625

Of course, that may change with global warming and natural gas fracking as demand for fresh water increases.

I’ve yet to hear why adding a few extra pipeline miles to divert around the aquifer would have been such an outrageous consideration.

Finally, it looks like the Obama Administration played the Keystone Pipeline issue a lot smarter than I thought they were capable. Basically the Administration “gave up” something that they were probably going to do anyway except that they held it out as a concession for Republican support of a payroll tax holiday and unemployment benefit extensions. I think the Obama Administration played a clever version of the old Br’er Rabbit game. They played that card close to their vest.

This is a very interesting and useable post. Thanks.

James, you forgot about the tax revenue on the $10million per day of new wealth created in the US.

Then, of course, there is the reduced trade deficit (from US production, and value added from US refined products).

And, the strategic risk reduction of having local supply capacity we can use when there are global emergencies.

Excellent insight 2sb. I doubt they were that smart, but what’s it matter if that the outcome.

Dems got some tax cut cred, though for a cut that makes equality worse and has little (possibly negative) stimuls effect.

This cheer leading for oil companies is becoming amusing. The claims of benefits are all over the map.

First is the claim that it will produce 20,000 construction jobs. It turns out this this is actually 10,000 jobs for two years. This is quite amusing given that JDH excoriated people for adding up flows as stocks in the story about Fed lending. Remember he took everyone to task for, in his analogy, adding up $100 loans in consecutive months. Somehow this arithmetic is okay when counting jobs.

Even funnier is the later claim that Keystone will create 118,000 spin-off jobs. If you read the report, that number is 118,000 person years. Once again if you, say, add up 11,800 jobs for 10 years, you magically get 118,000 jobs. (Just make sure you don’t add up Fed loans that way, because that would be dishonest!)

But those numbers aren’t good enough. They can do much better. If you read the report, they claim ultimate gains of 250,000 to 553,000 permanent jobs! Really! While they are just making up numbers, why not a million jobs or two million jobs. It sounds just like a Republican primary TV debate where you can just make up anything. Gee, all we have to do is build a half dozen or so of these pipelines and we’ve completely solved the national unemployment problem.

This Perryman Group that authored the report is a pimp for the oil industry. It is so obviously over-optimistic that is is a joke. How can you tell if an oil man is lying? — his lips are moving.

Keystone says that other routes add up to 1/2 billion to the costs, and affect more people (the sand hills are basically at 2-4 people per square mile of population). However this shows some of the sort sightedness of folks deciding on routes, by not valuing near wild conditions more. The policy should in general be adopted that in the future routings should follow existing corridors where infrastructure exist rather than break new corridors, which would have meant running the line thru the Power River basin and then to UPRR route and east.

Joe, the $10million in wealth created each day is the equivalent of 72,000 jobs paying $50,000 each year during the operating life of the line. That’s before the multiplier.

Yes, more pipelines would help unemployment and growth greatly, but there are bottlenecks. We need the production capacity to expand fast enough to fill them and we need skilled workers.

Go for it. I just want to hear the estimation of the cost of fixing the Ogallala acquifier after it is totally destroyed. (That ought to be interesting.)

Great, useful commentary by Prof Hamilton.

Now, if we could just get his co-editor to lift his attention from leftish piffle and especially from what is trendy in Madison, Wisconsin. Please, Prof Chinn – trade and China.

Since you quoted the Cornell study, so will I.

“The industry’s US jobs claims are linked to a $7 billion KXL project budget. However, the budget for KXL that will have a bearing on US jobs figures is dramatically lower—only around $3 to $4 billion. A lower project budget means fewer jobs.

The project will create no more than 2,500-4,650 temporary direct construction jobs for two years, according to TransCanada’s own data supplied to the State Department.

The company’s claim that KXL will create 20,000 direct construction and

manufacturing jobs in the U.S is not substantiated.

There is strong evidence to suggest that a large portion of the primary material input for KXL—steel pipe—will not even be produced in the United States. A substantial amount of pipe has already been manufactured in advance of pipeline permit issuance.

The industry’s claim that KXL will create 119,000 total jobs (direct, indirect, and induced) is based on a flawed and poorly documented study commissioned by TransCanada (The Perryman Group study). Perryman wrongly includes over $1 billion in spending and over 10,000 person-years of employment for a section of the Keystone project in Kansas and Oklahoma that is not part of KXL and has

already been built.

KXL will not be a major source of US jobs, nor will it play any substantial role at all in putting Americans back to work. Even if the Perryman figures were accurate, and all of the workers for the next phase of the project were hired immediately, the US seasonally adjusted unemployment rate would remain at 9.1%—exactly where it is now.

KXL will divert Tar Sands oil now supplying Midwest refineries, so it can be sold at higher prices to the Gulf Coast and export markets. As a result, consumers in the Midwest could be paying 10 to 20 cents more per gallon for gasoline and diesel fuel. These additional costs (estimated to total $2–4 billion) will suppress other spending and will therefore cost jobs. main findinGsCorneLL university GLobaL Labor institute.

Pipeline spills incur costs and therefore kill jobs. Clean-up operations and permanent pipeline spill damage will divert public and private funds away from productive economic activity. In 2010 US pipeline spills and explosions killed 22 people, released over 170,000 barrels of petroleum into the environment, and caused $1 billion dollars worth of damage in the United States.”

http://www.ilr.cornell.edu/globallaborinstitute/research/upload/GLI_KeystoneXL_Reportpdf.pdf

Mark A. Sadowski: What is your scenario under which the Ogallala aquifer could be totally destroyed?

Light sweet crude in North Dakota is still selling for $20/barrel less that you could get for it if you could find a cheap way to transport it to the Gulf of Mexico.

Using some public choice economics, who is getting the benefit of that $20 a barrel differential? I know the inland refineries are making money hand over fist, for example. They are not looking forward to that differential going away.

It is highly unlikely that a major spill or any catastrophic environmental accident could take place along the proposed pipeline. This argument is made despite the two most destructive energy-related environmental mishaps within the past year — the Fukushima’s nuclear plants melt down and the BP’s Gulf oil spill. One has to wonder if the original cost-benefit analyses for these projects included the tail-end, low probability, immeasurably destructive events. Accidents, however unlikely, happen. How do we account for them as externality costs? Would the benefit outweigh the cost if proper cost analysis was done?

Right now, refiners in the central US are benefitting from the inability of oil producers to move oil to other markets. Remediating this will lower gas prices slightly and more equally distribute the wealth created to oil producers and consumers.

https://econbrowser.com/archives/2011/11/implications_of_1.html

“Because gasoline is transported using different infrastructure from the crude oil, the differences in the cost of crude did not translate into equally dramatic regional differences in the cost of gasoline. Whenever transportation facilities are adequate, we’d expect the law of one price to hold. If you can transport gasoline across U.S. states, the refined product should sell at a similar price as a result of physical arbitrage of the gasoline market. A big effect of the Brent-WTI spread was thus to raise refiners’ margins in the central U.S., with the price of gasoline in the U.S. tracking Brent more closely than WTI since the two prices diverged.

“It’s worth noting that despite the big run-up in WTI, the average retail price of gasoline has followed Brent down, being about 30 cents per gallon cheaper than at the start of September. What matters most for U.S. consumers at the moment is the cost of oil imported by tanker. Insofar as the latest developments put downward pressure on that, the seemingly paradoxical result is that a higher cost of WTI may actually mean lower costs of gasoline for U.S. consumers.”

It should be expected that if WTI, and oil from tar-sands and Bakken, is able to reach more markets,and hopefully the coast, the increased competition in the refining market will reduce Brent demand in the US and force refiners to pass some of their high margins to oil procuders and consumers.

JDH The proposed pipeline runs through a part of the aquifer that is highest in saturated thickness. The water table is, in some parts, literally inches from the surface. The heart of the aquifer is very near the path of the pipeline.

http://web.mit.edu/12.000/www/m2012/finalwebsite/problem/groundwater.shtml

A couple of terrorists working with an unemployed Russian hacker and a crop duster plane could, without much training or expense, effectively make the water from the aquifer undrinkable for generations. Remember, even though the aquifer itself is vast, the groundwater saturation is not uniform. As you pointed out, we have lots of miles of pipeline, so you might ask why we don’t worry about terrorists taking out other pipelines. The answer is pretty simple. With other pipelines the main target is at the end of the pipeline, and those are heavily defended against terrorists. In the case of the Keystone pipeline things are different because it represents an especially target rich environment that is, for all practical purposes, indefensible. Maybe it’s my background as an ORSA guy with the Army so I’m inclined to worry about these kinds of issues, but the proposed pipeline path has a big red bulls-eye written all over it. Rerouting the pipeline seems like a sensible compromise…and it would surely be cheaper than a new east/west pipeline across Canada.

Let me echo Jim here. I don’t see a plausible scenario in which the Ogallala acquifer is destroyed.

If you are going to argue that pipelines are inherently unsafe, then we should shut down all our oil and gas pipelines, no? No Trans Alaska pipeline, none of the vast network of pipes criss-crossing the seabed of the Gulf of Mexico. The East Coast, which obtains most of its gas from either the Gulf or from Canada (including TransCanada) literally has no source of gas.

What do you propose as the alternative? Trucking? Rail? Is that safer and cleaner than a pipeline? Or perhaps you prefer coal or nuclear to natural gas power plants?

Joseph,

The employment figures in general, are politically motivated in my view. What better way to get government officials behind your project than to offer jobs (especially now)?

The numbers are almost not worth looking at in my opinion, but if anything they help you visualize the size and time frame of a project.

Regardless of the numbers; the simple fact remains. The U.S. is reliant upon oil and until we curve our demand for oil; we need pipelines like the Keystone to help drive down costs here in the U.S.

If Barack Obama and the Democratic part were not every bit as beholden to the Automobile-Highway complex as the GOP, then we wouldn’t be bogged down in this novelty and nonsense. We’d be building trains. Or should I say, rebuilding trains–on the footprint of our historical rail system.

The XL pipeline has produced more hyperbole on all sides of the spectrum than any energy related issue I can recall. It is however a recapitulation of our dysfunction, as we fail once again to address our energy and transport challenges in terms of their proper scale. To wit: the primary avenue through which oil is subsidized in the US is not via direct incentives to the Oil and Gas industry but rather to the hundreds of billions spent each year on roads, highways, and the auto industry (which needs bailing out every couple of decades). The XL pipeline is sidebar, an amusement in this regard. It is a joke. It’s construction or its cancellation will mean nothing to global warming, environmental pollution, or policy because it’s dwarfed by the system we are already running: the number one source of US GHG is our transport. Not the power grid.

I’m happy to see the pipeline fail, however. I don’t mind that it’s merely a thematic win for climate and enviro groups. More broadly, I’m no longer convinced that oil from the Alberta tar sands provide a net benefit to society because once you calculate EROEI and damage to the landscape, the Tar Sands look more and more like a combined energy and climate sink.

The problem is that the disposition of the XL pipeline will have zero effect on future extraction of oil from the tar sands. That will require a much larger set of decisions which neither Washington nor Ottawa/Calgary are willing to make.

The key element here is the final paragraph, which is mostly nonsense. The “new real income and growth” that would come from relieving the Midwest tar sands glut wouldn’t in any way be evenly distributed. Essentially its only economic effect would be to transfer billions of dollars from Midwest motorists to Canadian oil producers, Texas refiners, and international commodity traders. It would exacerbate economic and political inequality, not improve it.

Re: Brad Johnson

Based on the recent WTI crack spreads, Mid-Continent refiners have been charging Brent based price for refined product, while paying WTI prices for crude.

2slug:And exactly how would these terrorist make the entire aquifer undrinkable for generations? This is certainly not the opinion of the OES:

In no spill incident scenario would the entire Northern High Plains Aquifer system be adversely affected

To answer one question, oil is moving out of ND the old fashioned way by rail, just as it did after Drake hit in PA. BNSF just build a 100k a day loading rack near Williston to handle the stuff. Of course if you look at the railroad map you find that a round about route is required, as in 1900 there was little need to ship stuff north south in the western parts of the plains states. You can either go via the power river basin and fight the coal traffic (the main line there has 4 tracks), or go east to the Red River/Missouri River valley.

Steve Kopits If you are going to argue that pipelines are inherently unsafe, then we should shut down all our oil and gas pipelines, no?

No one is arguing that pipelines are inherently unsafe. You’re making a strawman argument. The point is that while all pipelines might be vulnerable all along the length of the line, in general the consequences of leaking or dumped oil are manageable. The exception of course is at the end of the pipeline, and those points are in fact heavily guarded because of terrorist concerns. The Keystone pipeline is an exception because here the ground supporting the pipeline is more valuable than the oil & pipeline itself. We all recognize the obvious risk of terrorism at the pipeline terminal, so why the inability to recognize a special risk upstream?

Jeff The pipeline is supposed to be buried 48 inches below the surface. The pipeline over the Ogallala Aquifer will have a 30 inch diameter. That means the bottom of the pipeline will be 78 inches below the suface, which puts it very close to the water table. Rupturing the pipeline at critical points would be child’s play for anyone with minimal training in munitions. If an illiterate peasant living in a 7th century mud hut can make a homemade IED powerful enough to blow a hole through armor plate then that person can also make short work of a buried pipeline. And any decent Russian hacker should be able to defeat the shut-off procedures long enough to ensure a lot of oil contaminates the aquifer. Why take the risk when you can easily finesse the problem by rerouting the pipeline?

I am a little amused by the job estimates, since they make no attempt to measure the jobs lost resulting from reducing the quantity of oil flowing via the current means.

If it is more expensive to move things by truck, it takes about 5 seconds to conclude it takes more labor to do it as well. This loss of jobs is not estimated – which I doubt is an accident.

My guess is the pipeline is a net job destroyer – as most projects that reduce costs are. That doesn’t make it a bad idea – increasing efficiency is obviously one key to improving living standards.

But the attempt to create job estimates without measure the obvious jobs that will be lost is rather revealing of the motives behind these estimates.

It borders on intentionally misleading.

The best place for oil and coal is in the ground. It is the cheapest way to store excess carbon known. You do not even have to use energy to get it there.

If gas is cheaper, more is used, hence more carbon in the atmosphere. And this is offered as a reason for building the pipeline? Making the planet uninhabitable for future generations is a sweet trade off for more jobs now? Seen as an increase in wealth?

The impacts of a crude spill from the keystone pipeline is swamped by the ongoing damage to the Ogalla caused by ag subsidy driven over irrigation.

The best way to protect the Ogalla would be to end farm subsidies,especially the ethanol mandate.

Slug: I didn’t question the possibility that someone could cause a spill. I questioned your claim that a spill could render the entire aquifer undrinkable for generations.

When we consider ALL costs of Middle Eastern oil, the costs are $250/barrel or more.

Plus, the US only derives 30% of its total oil consumption from outside the North American continent.

That is right, 70% of US consumption is already from the US + Can + Mex.

It is absurd that Obama wants to block this in order to pursue some ‘green’ pork. It is even more absurd that this creature still has a decent chance at re-election.

This cheer leading for oil companies is becoming amusing. The claims of benefits are all over the map.

Yeah, all over the map on every road, rail, and highway, every day of every year.

If only we could extract your share of the benefits from you so you could remain guilt free for the rest of your life.

If you read the report, that number is 118,000 person years.

And person-years is precisely the correct way to measure the job gains and the Fed loans.

If you are looking at Fed loans, $1 billion due in one year and $1 billion due daily for 365 days is still 1 billion dollar-years of loans.

Idiot!

Reginald says: “If you read the report, that number is 118,000 person years.

And person-years is precisely the correct way to measure the job gains and the Fed loans.

If you are looking at Fed loans, $1 billion due in one year and $1 billion due daily for 365 days is still 1 billion dollar-years of loans.

Idiot!”

But JDH did not say 118,000 person-years. He said 118,000 jobs. That is a deliberate attempt to mislead by TransCanada. I was the one who pointed out the correct number was person-years. So who is the idiot?

If this was simply a pipeline across the USA it would not be an issue. There are already a massive number of pipelines in the area. The claims against damaging the ‘virgin’ aquifer in the area are just stupid. There should be no further bickering, this WILL create jobs and additional income for US workers. Sentiment improves when a jobs report shows a 10,000 job increase is shown. Please go look at the potential error in the numbers….

Nobody should minimize the risk of pipeline spills. Look at the Enbridge leak in Michigan.

What actually leaked was oil from the Canadian tar sands. It’s nasty stuff if it gets out of the pipe.

I’ve actually got a 12″ product pipeline not 40 feet from my back door. We had a big leak in the neighborhood 4 years ago, they filled up a retention pond with diesel. They had it cleaned up in a week. Another neighborhood on the same line had a leak that filled basements with product, that cleanup took 6 months. It evidently had been leaking underground for some time, and they had to remediate a large amount of soil.

Working in “the business”, I do think that the risk of a leak on a new pipeline is negligible for many, many decades. I think that technology has advanced quite a bit over the years, and a new pipeline is going to hold up a lot better than the stuff that was installed decades ago.

Here’s an interesting article:

Missing $4,155? It Went Into Your Gas Tank This Year

http://www.cnbc.com/id/45727242

Jim is quoted.

It’s interesting that the pipeline is being sold as a jobs generator when it is no different than the stimulus projects derided by the same people when Obama did. It’s also interesting the jobs number for this project is constantly inflated to maximize its impact while other projects were downgraded by the argument they didn’t really create jobs. If we apply the same logic to this pipeline, it would be more moving around of jobs than creating new ones and the same people pushing for it would be arguing it is a waste of money.

It is also very nearly the same kind of infrastructure project that highway work is: trucks and commerce that flows on roads are the lifeblood of the economy. Odd how doing that work was considered a waste of money.

I can’t address the environmental issues.

if you are using oil based products and oppose this project you are a fool and should have no voice

build it now and every other project on hold because of enviros, the useless hypocrites

Recommend also looking at the avoided risk of major scarcity in available fuel and consequent increase in unemployment and economic depression.

Lloyds of London and others are warning of global scarcity in the 2012-2015 time frame. e.g., Lloyd’s and Chatham House report:

“Sustainable energy security: strategic risks and opportunities for business”.

See Robert Hirsch The Impending World Energy Mess.

“The extraction of the oil sands is also environmentally more destructive than conventional sources, though it would be an unusual step for the U.S. State Department to be the arbiter of what happens inside Canadian borders.”

My recollection of the NAFTA negotiations in the 1990s was that precisely such environmental restraints were a key component in overcoming political resistance to the deal. The fear at the time was that weaker environmental standards in Canada and Mexico would give their industries an “unfair” advantage. As a result, the NAFTA accords were signed at the same time as a side accord on environmental protection and the creation of the CEC (www.cec.org.) Therefore, while the US State Dept. generally avoids overtly criticizing the internal affairs of its neighbours, it could have good justification to do so in this case.

“In any case, U.S. production of oil from conventional sources has been declining for some time, and it’s simply not realistic to use conventional oil as the standard of comparison.”

Good point. But the subsequent analysis ignored the possibility that some of the fall in domestic US production might by offset by increased energy conservation. To be fair, shouldn’t one also be looking at the environmental impact of that?

Simon –

You are joking a bit, no?

US oil consumption was down 1.6% in the three months ending November compared to the same period last year. US per capita oil consumption is down 15% since 2005. If we were addicted to oil, we’re pretty close to going cold turkey at present.

The normal pace of oil efficiency improvement (and this would include conservation) per unit of GDP is about 1.2% per year. Under stress (as we are now), it appears to be around 2.0% per year (maybe as high as 2.4%). But best I can tell, the US is just about maxed out today in terms of efficiency improvement and conservation, the balancing factor being therefore economic activity (eg, unemployment and restrained GDP growth).

As for the environment, the November UAH satellite temp anomaly is a lowly 0.1 deg C, sea level has been actually declining, and there’s no change in things like hurricanes or droughts. If you’re in the AGW crowd and are using satellite data (as opposed to anecdotes), what you’re left with is Arctic sea ice, which was, since 1979, at its second lowest level this summer–but that’s in a region exposed to winds and currents, and not just temperatures.

So it comes down to jobs or some relatively vaguely defined commitment to the environment. I know which one has my vote.

Steve, great points. But GDP is goosed by the fact that government spending is GDP growth by definition.

Kopits,

You’re an ignoramus. I don’t mean that as a pejorative but rather as a simple statement of the fact that you don’t know what you’re talking about on Climate Change and therefore your opinion should be evaluated in that light.

First, one month of satellite temp data is meaningless and everyone who follows this issue knows this is an El Nina year. Such years are typically cooler. However, this is the hottest El Nina year on record. And this year is shaping up to be among the top 10 hottest on record.

Here’s the trend, and the chart on this page puts El Nina years in blue to show the difference.

http://www.realclimate.org/index.php/archives/2011/12/global-temperature-news/

You’ll note that the temperature chart on this page includes satellite data as well as surface temperature data, and that’s because they don’t actually disagree that much.

The drop in sea level in a single year does not change the trend and was due to increased land flooding, which by the way is not good, and again due El Nina.

http://www.skepticalscience.com/sea-level-fall-2010.htm

The general trend in sea level is decades of up.

http://www.skepticalscience.com/Nils-Axel-Morner-wrong-about-sea-level-rise.html

AS for hurricanes and droughts, I would point out that the severe months-long drought that stretched from Texas through Oklahoma up into northern Kansas this summer was one of the longest and widespread on record. But of course, single events don’t mean much, so lets look at the trend of natural disasters, which has been rising and rising for decades now.

http://www.ritholtz.com/blog/2011/10/natural-disasters-in-the-united-states-1980-%E2%80%93-2011/

Could climate change theory be wrong. Of course, that’s science.

But to say the case on climate change is closed — that there’s nothing left to the argument but sea ice — is to say that you know absolutely nothing about the arguments in the debate. In short, you’re an ignoramus.

And I’m sick to death of listening to this kind of ignorance get treated with the same level of respect as the opinions of actual scientists who have Phds and have spents their lives researching this issue.

And I’m really sick of arguing against this kind of ignorance. So, let me provide you a shortcut to all your denialist fantasy arguments.

SkepticalScience.com provides a nice chart of denial arguments and the corresponding reason that they’re complete BS. You can find whatever BS is currently being touted by the people you like to listen to — because they tell you what you want to hear — at the link below and learn why it’s BS from actual scientists.

http://www.skepticalscience.com/argument.php

The pipe line is not needed. Research algal oil. Enough oil can be produced from 10% of the land mass in one of your southern sunny states. The current argument against it is cost. Producing algal oil is currently estimated to cost $300 per barrel. My 4 function calculator in 1973 cost me $100; five years later there are free in boxes of Tide. The first cell phones cost thousands; now they are free with a 3 year contract. They sooner the work begins on algal oil the sooner the costs will fall. It is also CARBON NEUTRAL.

Also re the previous comment on trusting scientists, I have two degrees in science and I wouldn’t trust people who have PhD behind their name just because they have a PhD behind their name. That’s the great thing about science, prove it.

“As for the environment, the November UAH satellite temp anomaly is a lowly 0.1 deg C, sea level has been actually declining, and there’s no change in things like hurricanes or droughts. If you’re in the AGW crowd and are using satellite data (as opposed to anecdotes), what you’re left with is Arctic sea ice, which was, since 1979, at its second lowest level this summer–but that’s in a region exposed to winds and currents, and not just temperatures.

So it comes down to jobs or some relatively vaguely defined commitment to the environment. I know which one has my vote.”

Thanks for this. Now I know you have no idea what you are talking about and can simply ignore everything else you say from now on.

Steve:

Not joking even a bit: just trying to be objective and logical.

Speaking of objective, I’d be interested if you have something more solid than “As best as I can tell…” on the potential for improving US energy efficiency.

SvN

The more I look at the tar sands the more I think that it is just a plain bad investment. The tar sands EROI is quite disappointing and the various projects require vast flows of natural gas when conventional gas supplies from the Western Canada sedimentary basin are in decline. As well it appears that the economically recoverable amount of gas from the shale plays look hugely overstated. So wasting natural gas to cook bitumen out of the tar sands looks questionable.

Add to that the present shale gas boom is looking to go bust because the reality is that fracked gas is expensive to produce, leaving aside the fact that the shale gas producers get to externalize the water pollution costs courtesy of the Cheney exemption.

The tar sands demand for natural gas and it’s disappointing EROI can’t be ignored. Add that together with the reality that we are leaving any efforts at climate change mitigation very very late make the tar sands a bad investment.

Our efforts and capital should be directed at ambitious reduction of energy demand. There are far more jobs to be had, in the communities that we live in, that would come out of “deep energy retrofits” of buildings and homes. Jobs that would add real wealth to communities.

The tar sands are a net loss. Building pipelines or working man camps in the Bakken and north of Fort McMurray may provide employment, but I wouldn’t call them ‘good’ jobs.

As for wealth creation, TCPL and the majors invested in the tar sands may make money, but the rest of us will be the poorer for it.

Andrew Henry

Re: “As for wealth creation, TCPL and the majors invested in the tar sands may make money, but the rest of us will be the poorer for it.”

Until you show how to provide other alternative fuels sufficient to replace current depletion of light crude plus growth, we will ALL be poorer if you stop oil sands – the economy will be forced to shut down in proportion to the growing shortages of transport fuels.

See Jeffrey Brown & Sam Foucher

Peak Net Exports—A Five Year

Retrospective and a Look Forward

Robert Hirsch Interim Observations

and other presentations at ASPO 2011

David,

First, exploiting the tar sands is a pretty good indication that we are scraping the barrel. Actually, in the tar sands case it’s more like picking up the dirt from around the barrel to cook out the stuff that spilled from it with methane and water. It’s a net loss.

Second, ignoring climate change isn’t going to make it go away! The tar sands are just going to speed up what is already a disconcertingly fast moving train. It’s got a lot of momentum and exploiting the tar sands is just going to ensure that we can’t stop it. (paper, presentation)

Exploiting the tar sands is ultimately a wealth destruction exercise!

As it is we are already paying more for food because of drought and severe weather impacts upon agriculture (and the boneheaded production of ethanol to fill SUV’s). But climate change imposes other costs, the small municipality I live in is looking at very large bills for road repairs from very heavy and unusual rain events. When it rains now, it, as expected, really pours.

Your worried about paying for transportation fuel but locally, and in many other places, the worry is how to fix the roads damaged by climate change. We have the wrong kind of transportation infrastructure for both climate change and the diminishing supply of a finite resource, oil!

It’s time to start leaving oil behind.

David,

In the end, the urgency of climate change will overwhelm the economics of the tar sands!

Andrew

Re: Peak Net Exports & the Global Calculator Shortage

I have concluded that there may be a global shortage of calculators, because most of the world seems either unable or unwilling to subtract domestic oil consumption numbers from domestic production numbers in oil exporting countries, in order to derive net export numbers, which are calculated in terms of total petroleum liquids.

While it is true that the EIA shows that total liquids production worldwide, inclusive of low net energy biofuels, increased at 0.5%/year from 2005 to 2010, the use of a calculator shows that the global supply of net oil exports available to importers other than China and India (what I call Available Net Exports, or ANE) fell at 2.8%/year from 2005 to 2010.

I estimate that the ANE decline rate will accelerate to between 5%/year and 8%/year in the 2010 to 2020 time frame. The lower end decline rate estimate, a 5%/year, suggests that the supply of global net exports available to importers other than China & India will be down by about half in 2020, versus 2005.

Incidentally, the BP data base shows that the combined net oil exports from Canada, Mexico, Venezuela, Argentina, Colombia and Brazil* fell from 5.1 mbpd in 2005 to 4.0 mbpd in 2010.

*Brazil is a net importer of petroleum liquids, showing increasing net petroleum imports, but the MSM seems to believe otherwise (another sign of the calculator shortage), so I added Brazil to this list.

Thanks JDH. I knew it was only a question of time before you covered this. A few comments.

Blocking pipeline projects is not a substitute for high excise taxes on dirty fossil fuels, nor does it solve a common global perception that Americans will without hesitation kill children and grandparents for oil. That perception works against national security and wealth maximizing objectives.

The Northern Gateway Pipeline that would transport upgraded oilsands synthetic crude or diluted bitumen from northern Alberta to tankers waiting at Kitimat, British Columbia, is unlikely to flow any oil before a decade is out. The local opposition is ferocious. If the Harper government decides to ram through the project, violent civil disobedience will result. I see at least 1/2 decade of jawing before any progress is made.

Kinder Morgan may have more success increasing the capacity of the existing pipeline transporting synthetic crude to a terminal in Burnaby near Vancouver, BC. There are also plans a foot to dredge Burrard Inlet so it can accommodate larger oil tankers. Otherwise, options are minimal. Shipping oil through the Arctic Ocean or Hudson Bay is unlikely to occur. Greater pipeline capacity to eastern Canada is uneconomic at the present time. American anti-oilsands activists can indeed effectively strand Canadian oil in Canada.

Elsewhere Brazil is threatening massive fines for Chevron because of a tiny 3,000 barrel spill. Brazil is also threatening to permanently ban Chevron from Brazil. Hyper-vigilant hysteria reigns in the aftermath of the BP Macondo well disaster, and are making a whole series of fossil fuel projects–pipelines, shale natural gas, oilsands bitumen–tough sells. By contrast the support in North America for killing and taking remains high.

I really don’t understand how Professor Hamilton feels he has the knowledge or expertise to decide what pollution is harmful and which “is no big deal” (paraphrase). I thought Mr. Hamilton is an economist, not a climate scientist?

I think the main concern people have with the tar sands is it contributes to adding concentrations of CO2 in the atmosphere. James Hansen calculates that the 350ppm is the maximum amount of CO2 in the atmosphere that the earth can handle without the climate severely heating up and getting out of balance.

We are already at 391ppm. If we were to cut emissions to 0 today it would take 50 years for the atmosphere to return to less than 350ppm as Hansen recommends. At around 500ppm, climate change becomes irreversible.

And the effects of climate change — melting sea and polar ice caps release methane which creates even more greenhouse gases which trap even more heat which melt even more ice — it’s a positive feedback loop of destruction. Huge masses of land will be swallowed by rising seas. And areas that were once inhabitable will become deserts while other areas will be plagued with floods.

This is the long-term disaster that is climate change. And the tar sands contributes to it, and more so than conventional oil. We need to be moving away from all of this stuff, but digging into those tar sands represents kicking the can down the road on climate change, and we can’t afford to do that. It’s saying, lets take the short term benefits of more oil and forget about the long term costs.

And you talk about cost savings related to this oil — the only reason the oil would have any cost benefit is because the cost of pollution would not be incorporated into the price of the oil. That is the situation we want to get away from. Allowing the Keystone pipeline to be built would move us in the wrong direction.