The latest U.S. economic indicators have taken a favorable turn.

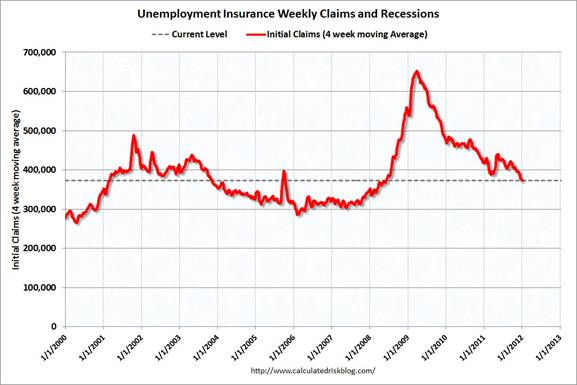

A variety of data suggest an improving labor market. For example, new claims for unemployment insurance continue to exhibit a steady decline.

|

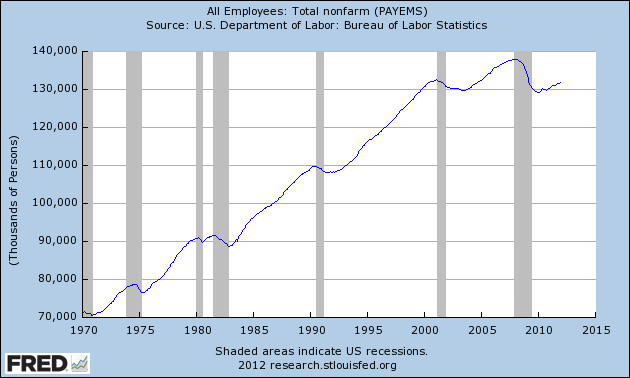

And on Friday the Bureau of Labor Statistics reported that seasonally adjusted nonfarm payroll employment increased by 200,000 in December, bringing the average monthly gain for the year to 136,000. The December strength was confirmed by estimates of an increase of 176,000 jobs reported by the separate BLS survey of households and 325,000 according to ADP’s direct payroll calculations. Even so, we’d need 30 more months just like December to get the number of workers on nonfarm payrolls back up to where it was on January 2008, let alone to catch up with population growth over what by then would have been 6-1/2 years.

|

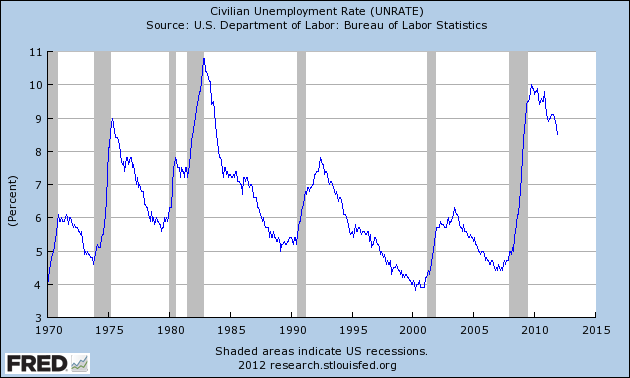

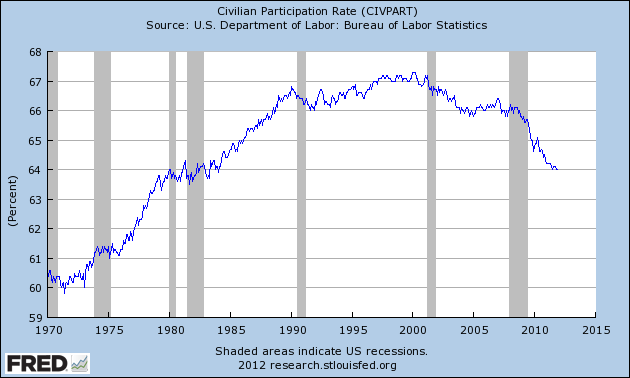

One of the surprising things about 2011 was that the unemployment rate has now fallen by 1.5 percentage points from its peak, despite the relatively weak growth in employment and GDP since the recession ended. The key explanation appears to be a declining labor force participation rate, which can’t be read as an encouraging development.

|

|

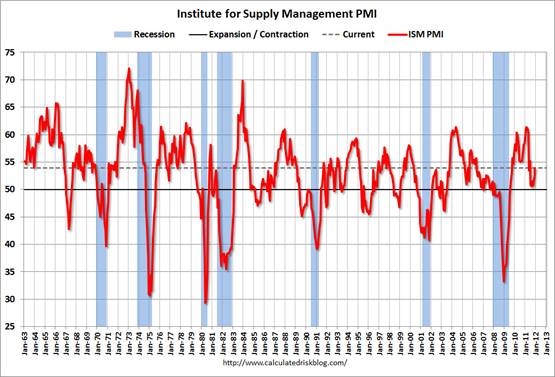

The PMI based on the ISM survey of manufacturers rose to 53.9 in December. A value above 50 indicates overall economic expansion. The December reading is the best in the second half of 2011 and slightly above the long-term historical average of 52.7. But again, one would hope to see better than that given how much below capacity we’ve been.

|

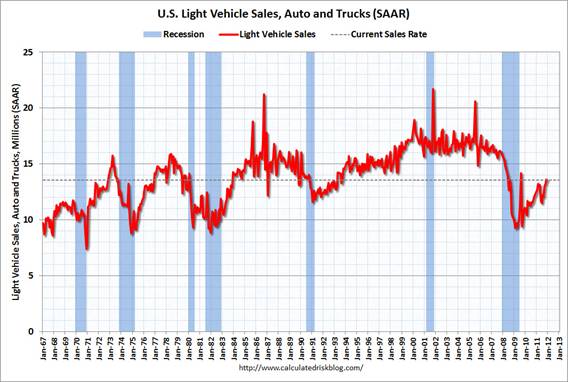

Auto sales also continue at levels well above the recession lows but well below what we used to consider normal.

|

Overall, U.S. economic growth appears to have picked up over the last few months. But while Tim Duy acknowledges the positive incoming data, he nonetheless still worries about a possible repeat of this summer’s U.S. budget fiasco and the separate financial situation in Europe. On the latter, borrowing costs for Italy are once again back up to levels at which their budget deficits are likely unsustainable.

|

The spread between 3-month and overnight interbank euro borrowing rates remains elevated, another indicator that concerns about the soundness of European banks have not gone away.

To Tim’s worries I would add possible disruptions in world oil supplies. If sanctions on Iran’s oil sales prove to be successful, that would of course increase oil prices for buyers as well as raise the risk of escalation into military conflict. And even if Iranian production and Middle East shipments remain unaffected, the situation in other important oil-producing countries such as Kazakhstan [1], [2] or Nigeria could easily become more unstable.

So for now the rocky U.S. economic recovery continues, but there are storm clouds on the horizon.

Tim Duy also drops pregnant hints about a kind of perverse Lucas critique effect concerning possible Fed actions. I think there’s a general consensus that the Fed’s 2 percent inflation target is now acting more like a ceiling than a central tendency and that, at least in the current environment, we need a higher target if we’re to avoid deflation. But the improving economic news is likely to act as a constraint on the Fed’s ability to do what’s really needed to get the economy out of first gear. In other words, the political economy’s reaction to improving economic news is to take actions that will ultimately frustrate continued improvement.

It looks like the economic recovery is taking hold… except for people, of course.

Imagine, unemployment rate declines if you don’t count all of those people who have given up hope.

How’s that for changing hope?

UE isn’t falling because of lack of parcip, it is falling because job growth has gotten strong enough, as usual, the bls is lagging, expect some impressive upward revisions over the years. Basically the slowdown came and went. We survived this one, will we be so lucky next time?

Still hoping that central banks will solve the structural bottlenecks of unemployment,when none of their mandates provide for such blind faith power.

Elected and accountable politicians may have more bearings towards this end.

And while you seem to have a somewhat optimistic view on the US economy, Hussman sees the economic data that are coming in, put into a larger context and evaluated with respect to their predictive power, still strongly indicating a recession in United States within the next months (as does the ECRI).

http://www.hussmanfunds.com/wmc/wmc120109.htm

Any thoughts by other economists here about the reasoning by Hussman and his methodological approach?

rootless, there is a very good story on various recession indicators and their implications at AdvisorPerspectives (http://advisorperspectives.com/newsletters12/US_Recession-An_Opposing_View.php). Only two of nine indicators (one being the ECRI) are in recession territory. The other seven are well below that. The author does say this recovery is atypically weak.

Is oil over $100 a barrel because of “geopolitical risk”, or is it because of fundamentals? If it is the later, then any economic growth whatsoever will spike gasoline prices, and sink economic growth.

Some of that happened last year. Expect it to happen with a vengeance this year.

Rich,

Thanks for the link to this interesting article. It would have been great, if they had included Hussman’s index in the analysis. It would have been an independent test of the index. Hussman has done backtesting of the index, and this testing shows a high forecast skill, although this doesn’t guarantees it won’t fail this time. Time will tell.

Ah, always gotta include car sales in the economic indicators! I almost thought you might have forgotten to do it this time!

Silas Barta: You’ll be happy to hear that I plan on no longer running the detailed auto sales graphs, for the reason that Wards Auto is no longer publicly posting the data behind those. One of the reasons I always put those up was that this was the only source on the web for seeing the raw data with seasonality depicted in that form. Now, you won’t be able to find graphs like those anywhere on the web!

It is too bad that Ward’s has decided to firewall the sales data.