As efforts continue to impose sanctions on Iran ([1], [2]), I thought it would be helpful to discuss the possible implications of these developments for oil-consuming countries.

The most likely outcome of an embargo on oil purchased from Iran is that the countries participating in the embargo buy less oil from Iran while other countries not participating in the embargo buy more oil from Iran ([1], [2]). While this would produce some dislocations, if total world oil production doesn’t change, it would have little effect on either Iran or oil-consuming countries, and would basically be a symbolic gesture.

If instead the embargo is successful in reducing the total amount of oil sold by Iran, then the shortfall for global consumers would have to be met by some combination of increased production elsewhere and oil price increases sufficient to bring down global petroleum demand.

As for the first possibility, there appears to be only a limited amount of excess oil-producing capacity at the moment, and certainly far short of the 4.3 million barrels per day that Iran produced in the first three quarters of 2011.

And for the second possibility, it is useful to draw a comparison with previous episodes in which geopolitical events led to production shortfalls from key producing areas. The figure below summarizes world oil production (first column) and oil prices (second column) following 4 dramatic events: the embargo by the Arab members of OPEC following the Arab-Israeli War in September 1973, the Iranian Revolution beginning in November 1978, the Iran-Iraq War beginning in September 1980, and the First Persian Gulf War beginning in August 1990. The loss in production from the affected countries (as a percent of the pre-war world total) is indicated by the dashed line. In each case, there was some offsetting increase in production elsewhere to help make up some of the loss, with the net change in total global production indicated by the solid line. The second panel shows the change in the price of crude oil. At their peak disruptions, these events took out 4-7% of net world production and were associated with oil price increases of 25-70%.

|

And each of these events was also followed by a recession in the United States. The table below summarizes the average annual growth rate of U.S. real GDP in the 5 quarters following the above oil price increases. Instead of growing at the historical average of 3.2% per year, U.S. real GDP fell in each case.

|

The table below provides some perspective on some of the oil-producing regions currently in the news. Although Iran has been getting a lot of attention lately, it’s worth remembering that conflict could also easily flare up in either Kazakhstan or Nigeria. Kazakhstan represents about 2% of current world production, which would be about a third a size of any of the four events mentioned above, and similar to the contribution Libya had been making before last year’s disruption in that country, which was a key factor in last year’s 20% increase in the price of Brent. If all of Nigerian production were to be lost, that would be about half the size the events listed above or 1.5 times as big as Libya or Kazakhstan. By contrast, the loss of all Iranian production would be a comparable event to the four described earlier; indeed, Iran itself figured prominently in 2 of those 4 episodes.

| Location | Oil production | % of world total |

|---|---|---|

| Kazakhstan | 1.7 | 1.9 |

| Nigeria | 2.6 | 2.9 |

| Iran | 4.3 | 4.9 |

| Hormuz | 17.0 | 19.6 |

| World | 86.9 | 100.0 |

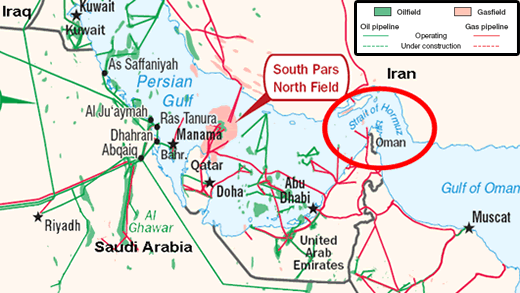

And if an embargo was successful, it is unreasonable to assume that Iran would not try to retaliate in some way. The country has threatened to close the Strait of Hormuz, through which 17 million barrels of oil, or about 20% of total world production, flow each day.

|

As for the likely consequences for oil prices of any supply disruption, the short-run price elasticity of gasoline demand appears to be quite low. Since crude oil represents about half the cost of the retail product, the elasticity of crude oil demand might be expected to be about half of that for gasoline. As a rough rule of thumb, I use a short-run price elasticity for crude oil of 10%. For example, if the lost production were confined to Iran alone, we might expect to see something like a 50% increase in the price of crude oil.

|

Some economists have claimed that the U.S. economy is less vulnerable to oil price shocks than it used to be. Close down the Strait of Hormuz, and you’ll get a good test of that theory.

And, a test of the admonition: Be very careful what you ask for, you might get it?

So, why would a presumed to be intelligent President of U.S. want to cause a 2nd Great Recession, when we have not recovered, yet, from the “L” shaped last one?

Does he/they think that the only way “they” can possibly get re-elected is to start another war, even before ending, completely the last two?

That’s a very nice, compact analysis of the issue.

Let’s hope cooler heads prevail.

I don’t think it’s right to just look at either oil’s share of US GDP or the “own” price elasticity of demand if you want to predict the impact on the US economy. The relevant elasticity is the elasticity of substitution, and since we’re talking about multiple factors we would want to look at the Morishima elasticities. And this is where things get a little scary. Over the years the US has definitely reduced its dependence on oil as measured by a declining percent of GDP; but we’ve also taken out a lot of the fat, so what’s left is hard demand. I don’t think the US can easily substitute away from oil. Public policy ought to concentrate more on findng alternative energy sources and alternative transportation venues.

JGBellHimself If you’re suggesting that the Administration wants a “wag the dog” episode, then you’re crazy. Aside from the obvious economic impact, there is a real risk to the 5th Fleet. And according to a NYT article the other day, a recent Navy wargaming study found that competent military leaders in Iran could inflict signficant harm on several ships including a carrier. It’s not a war that Iran would “win” but taking out something on the order of a dozen warships is in the range of the possible. And remember that Iran commandeered control of a drone aircraft by defeating the signal encryption, so electronic defense of the 5th Fleet is not a sure thing. And what might happen to the US Persian Gulf commands headquartered in Bahrain given the instability of the Bahrain government? It’s highly unlikely that an Iranian conflict would or could be contained to just Iran.

I don’t see what the thinking is behind an embargo of imports from Iran. Backing nutty people into a corner is a pretty risky business.

We tried an embargo of Japan and got Pearl Harbor. We might agree that’s a necessary risk, that Iran’s nuclear program needs to be stopped at all costs. But I think ought to have been presented that way to people.

We just seem to be sidling into this without any real debate.

Even a very temporary shock here could have very serious consequences. The PIIGS would be toast. The question of whether China can hit the gas pedal again would be settled. And consumer spending here is set back, even a little. It could be a world-wide recession in a few weeks.

I don’t see the embargo keeping much of Iran’s oil “off the market,” even if that means making a new market. China and India pledge to ignore the sanctions; Japan is hedging, Italy wants an exemption, the rest of the Euro countries are putting it off for 6 months if not longer. Can we just say the sanctions are a joke? If the US wants war they will probably have to incite it some other way.

When looking at the IMF data and forecast,advanced economies actual and forecast 2012 GDPs do not portend very positive growth.The world GDP growth is now revised at a precarious 4.3% where 4% is close to recession.

http://www.imf.org/external/pubs/ft/weo/2011/02/weodata/weoselgr.aspx

The oil price is not sensitive to forecast and hovering around the same price since long.A price convexity defying doubts.

Would the geopolitical events and threats derail price stability in oil and oil producing countries?.There is a repetitive pattern involving the Middle east and the oil producing countries more particularly.There is as well an historical pattern when meeting with domestic difficulties, that is to look for the dog s tail else where.

The script is a routine and the actual political developments do not deny it,make the war to the nations heads and do not make wars to the nations themselves.It has always ended with a war to the nations.It has always been triggering either faith based reaction,nationalism or both.As for oil,faith and the Middle east, all oil producing regions are predominantly populated with Chites and Iran is the cradle of the Islamic chasm.The East coast of Saudi Arabia is the oil producing land and separatism from the rest of the nation an endemic Chites faith based hidden hope.

My opinion is that the Iranian sanctions (NOT embargo) are political theatrics. It throws a bone to AIPAC in an election year; it fosters hope in the MICC that juicy new contracts are just over the horizon (as the defense budget is slashed); it humors the Sunni autocrats and tycoons in Arabia; and it complicates plans for export pipelines to China and India; Best of all, it increases the odds that the finance industry will make quick profits on their recent investment concentrations in oil… I’m with Robert Hurst. Without a navel embargo by the 5th Fleet, the US sanctions are bluster…a bluster applauded by the scallywags who want action for the bribes they pay.

Congress passed the legislation to do this, and Obama is afraid of being branded as insufficiently tough on Iran in a political environment where his opponents are calling for much more aggressive policies, and he is probably afraid of Israel bombing Iran if he does not apply increasing pressure. After all, Netanyahu has made it clear he views himself as more important than Obama and would like to see him defeated in the election.

As it is, there is no basis for the UN Security Council resolution demanding that Iran stop enriching uranium. It is doing so at a less than weapons grade level, and while headlines have made it sound otherwise, both the most recent NIE and IAEA official reports agree that Iran is not currently pursuing the building of nuclear weapons, and if they were to do so it would be easy to figure it out, along with the fact that Iran’s supreme leader, Ali Khamene’i has issued fatwas against obtaining nuclear weapons. This is a completely artificial and ridiculous crisis.

To reinforce the point about the lack of foundation for the UNSC resolution, Iran is and has been completely within their rights to enrich uranium to the level that they have been and are doing, including the new setup near Qom. They are fully in synch with the Nuclear Non-Proliferation Treaty, not that you will hear this from most of the US press or politicians.

Also, one hears the whine that they should trust the rest of the world to provide them with the appropriate enriched uranium for their medical uses, but their last supplier, Argentina, stopped doing so. Some basis for such trust. Their program is legitimate and reasonable. This is all just major hysteria, with serious potential consequences, as Jim is pointing out, even if he does not agree with what I have said here.

One issue which was not analyzed is whether the “spare capacity of Saudi Arabia” is of the right chemical composition to allow it to replace the Iranian oil – for if I remeber correctly most of this “spare” is very heavy oil, with excess Sulphur content. If the grade is different the refineries have to be re-ooptimized, which process may take too long for immediate replacement.

OK, I stay off the comment boards, but I have to weigh in here. I read every comment, and I am stunned at the lack of positive vision and action in this world. At first this may sound like a sales pitch, and maybe it is. But hey, if it helps solve some of the problems were facing, then so be it. Besides, its worth reading.

Every (Iranian conflict/oil supply issue) senario that can be thought of ultimately comes to one end point…everyone is screwed. We all know that, at least the ones that are not zoned in on Farmville and iTunes (I hate that crap). So what to do? The salesman in me says to tell you “my product can have a huge impact on global oil consumption without decreasing productivity, margin and GDP, and using it increases revenue, profits and has a positive impact on the environment and our national security”. I think Solynda said some of those things, too. But that joke is for another time.

Today, I saw a tweet from @mikehodge (energy and capital) about a Justin Beiber singing toothbrush. Now to most people, that is just laughable. But to me, it pisses me off to no end (all of this is related, you’ll see). Here I sit with a valid technology, the ERS Drive, and I can’t get this project funded to save my butt. Actually, it could save all our butts, but that comes later. Just hear me out on this. I own a huge, disruptive patent. 20 years ago I invented of a drive system that has both electric and hydraulic energy recovery and use. This drive system is emission free, will have good range, it fits within just about every place a gas or diesel engine fits, it would be pretty cheap, use less batteries than other electric drive systems and the batteries do not need to be high power, expensive chemistries. ERS is simple, easy to understand, and cheap to make.

Having said that, I spent 20 years chasing this dream. I knew I was right as rain on this. I started out life poor and troubled, and educated myself to a become a pretty smart guy and committed to trying to help save the world, at least as far as oil and pollution goes, anyways. So I wrote my first patent, and it was granted with zero objections or rejections…which is quite an accomplishment and a rare occurance (not bad for a 7th grade drop out). The patent examiner even gave me kudos on the inoovative use of existing technology. To see my video and read the supporting documentation, please go to the crowdfunding website “FundaGeek” and look at the ERS DRIVE. I hope you money guys can figure out the simple physics at play here.

So anyway, I have been trying to get the ERS funded for 7 years. Before the patent was granted, all I heard was “let’s wait and see what the patent office says…Mr. Inventor”. The patent gets granted, and then there were more excuses, my favorite being “you can’t change the car companies, are you crazy?”. So I explain how simple it is to retrofit vehicles like the class three truck. Now, this market is the largest in terms of units on the road, fewest miles driven, highest stop/start frequency (the ERS performs best in urban driving), gets the worst gas mileage and this market segment would benefit the most from ERS use. Its energy and dollars, not particle physics guys, come one! The ERS Drive is a machine, pure and simple. It recovers braking energy better than anyone else and uses that recovered energy very smartly, with inexpensive components. I graduated 6th grade, and I get it. My 12 year old gets it, for heavens sake.

So today, here is where we’re at (it’s almost over). I had to wait for technology to catch up with me. Well, technology and the business case for high efficiency inventions. Hydraulic hybrids are finally real, and they work great. Just look at Eaton’s HLA, Parker Hannifin’s RunWise system and the Bosch Rexroth HRB, and you’ll see the vaule add and ridiculous margins hydraulic hybrid systems earn. They are operating in UPS and trash trucks right now, and provide a rapid ROI (with rising energy costs, the ROI will be even faster). The EPA has video’s…go look at them on YouTube.

So, apply the same technology to electric vehicles, and Bing! You have a winner. Think about using this in school buses, that would change some things. And subway cars…you could shut off the third rail! Semi trailers would be a good retrofit market, as they make any semi tractor and instant hybrid when it attaches to an ERS equipped trailer. Elevators, commercial energy storage systems…the list of applications is endless.

And I am not the only one who sees the potential here. Navistar tried to patent the same thing, and the got rejected, citing my patent 40 times. Heck, the EPA has a patent application pending for the EXACT SAME THING, and they too will be rejected, due to me. I have date priority for electric hydraulic dual regenerative braking and pow use hybrids. Even the U of M is working on electric hydraulic test mules and they are wrting white papers on the optimization strategy of electric hydraulic hybrids, as are the Chinese. What don’t you investors get about this? The upside potential is stratispheric.

Now, since this whole ERS thing is pretty obvious, what could the problem be with getting funding for a prototype and moving forward with what would surely be an urgently needed, giant market success? Honestly, it’s you guys. Investors have their circles, and right now they only seem to care about the latest cell phone app that dumbs everyone down a little further. Or maybe it is the newest robot to sweep your floors, because hey, people need to get even more lazy, and you can profit from the demise of simple hard work and innovation. Wait, someone funded the Justin Beiber singing toothbrush…that will do wonders to further humanity (told ya it would be relevent). Wish I would of thought of that one. What was it Colbert said, “toasterer”? No wonder everyone hates us and we are falling behind.

So please, quit talking about “what we should do” about oil, Iran, how much you can make when oil hits 200 a barrel and renewable energy. Get off your collective butts and support an entrepreneur who is trying to make a difference…and provide jobs and a profit to everyone involved in the process. The world will not be saved by a 300% exit stategy, and it won’t be saved with a singing toothbrush or a bunch of angry birds. The problems are solved when innovative people like ME bring the new ideas to you, the investors. We are supposed to work together to solve things and make a buck or two. What happened to that?

I appreciate the space to ramble and your time. I have to go now. I have to work on the business case for a new venture for the idiot masses you created…faces on condomes. I’ll let you’re minds reel with the marketing opportunities for that one (is a Beiber condom coming to mind)? Ha!

Could the security of the Greenback as the international trading base have anything to do with it?

http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=114×14286

Even in the half century after Pearl Harbor, it is part of the theory of economic sanctions that action short of war is preferable to war, so economic sanctions are justified. Despite failures, the logic is incontrovertible, in such cases that it is decided some action against another state is necessary. Economic sanctions do not inevitably lead to war, though that certainly can be the outcome. War results in war 100% of the time.

The goal, of course, is not to starve the world of oil and get Iran hopping mad. The goal is to convince Iran to give up its nuclear ambitions. Domestic US politics have a big role in the outcome, just as domestic Iranian politics do. Nothing new about that. The whole issue, then, is not whether to starve the world of oil, but whether the threat of starving the world of oil is worth the risk in an effort to prevent the nuclearization of Iran.

I thought that was obvious, but comments here suggest it is not.

While it is true that in the short-run, elasticity for gasoline is low, there are substitutes coming but they will be unlikely to have a profound impact in the near-term. Cellulose from wood can produce up to 40 billion gallons of fuel per year if managed properly and a doubling of the fuel standard through innovation and technological advance could put wood and wood residues at 50% of the raw materials base for a domestic fuel supply. Such advances hold promise for the development of both cellulosic ethanol, butanol , jet fuels like JP-4 and JP-8 as well as other applications such as chemical building blocks. Both Iran and Nigeria present real problems to the fragile US recovery and another round of QE is not entirely out of the question at this time.

KHarris said “The whole issue… is…whether the threat of starving the world of oil is worth the risk in an effort to prevent the nuclearization of Iran.”

Some very fuzzy reasoning is going on here. “Nuclearization” is a hot button word, and not very precise. Iran is one of 31 countries with nuclear reactors. It is in compliance with IAEA regulations in the Non-proliferation Treaty it signed, but objects to the IAEA “additional protocols” Why? Probably because Israel has not signed the Nuclear Non-proliferation Treaty and will not allow IAEA inspections. Israel has nuclear weapons while Iran is in the infancy of developing civilian nuclear technology.

US military and foreign policy is hopelessly anarchic. The greatest risk from nuclear proliferation come from countries that have not joined, or have dropped out of the Non-proliferation treaty: Israel, India, Pakistan, and North Korea. The greatest risk of nuclear war comes from the weapons states, whose more than 22,000 nuclear bombs remain the greatest threat to global security.

The media and political discussion of this is even more factually messed up and wacko than the discussion of the nonexistent Iraqi WMDs prior to the US invading Iraq. At least then there was serious intel that thought Saddam still had chemical weapons and maybe bio research, if not nukes, which is what the public tends to think of and take seriously when they hear “WMD.” But France and Germany opposed the US invasion, even as they are now supporting these sanctions against Iran for a nuclear program that at worst may lead to having the capability to build a nuclear weapon.

kharris,

Aside from completely shutting down their civilian nuclear program, or at least their completely legal sub-weapons program of uranium enrichment, can you please explain exactly how Iran is supposed to prove that they they have “given up their nuclear ambitions”? Their supreme leader has issued religious injunction after religious injunction (fatwas) against nuclear weapons. Do you think he is lying about his theological views? This would be like a Pope lying about his real views in an encyclical.

Is it possible that monetary policy got somewhat misguided because the price signal distortions of the oil shocks resulting in an unnecessarily tight policy? If so, is there a way to quantify the effect on RGDP?

yargo: I discussed that issue here.

How on earth do our posters so confidently conclude that Iran isn’t really developing a nuclear weapons program, in light of the November 2011 I.A.E.A. report?

Your data and map says it all. Many Arab countries ship oil from their ports west of Iran. They seem to be in an arms race and are big buyers of US weapon systems. So why would the US be the policeman? Iran has big bucks from oil consumers around the world. They spend their money as they choose and trade with their oil customers. The world economy all connected and their spending affects all economies.

Conrad E.,

One can never prove a negative, but what the IAEA report showed was that a few years ago they had a few researchers doing things like running simulations of nuclear explosions and some theoretical work on triggers, but that these activities were no longer going on. No actual work at all found on an ongoing nuclear weapons program, and the IAEA inspectors are in there and able to see things. That is why they were able to report on these not terribly dramatic findings, although the press went hysterical over these findings. These all amount to that they may be interested in having the capability of having a nuclear weapons program, although those activities were some years ago and are reportedly not going on now.

There were changes in the latest NIE as well, but they amounted to similar sorts of things. No active nuclear weapons program, and keep in mind the NIE represents a consensus of all the US intel agencies, many of them very hawkish and skeptical of conduct of others, although this somehow keeps being ignored by the hysterical press and politicians.

When a country wants to actually build nukes, they throw the inspectors out, as in North Korea. Indeed, that was one of the reasons so many were suspicious about Saddam. He kept creating all kinds of obstacles for the inspectors, and apparently was stupidly trying to play some chicken game with his neighbors, particularly Iran, to make them think that maybe he still had some WMDs of some sort or other, even though he did not.

The problem we have is that Iran and many other countries will become net oil importers in the next 6-7 years. What we are experiencing is gradual and perhaps slightly sudden aggregate supply shock caused by an increase in quantity demanded and a decrease in overall production and export. This is why countries like Indonesia who became a net oil importer in 2004 are now using their NG reserves as a bargaining chip for oil while sending countries like Japan to search elsewhere for oil and consequently, natural gas. Add in that the Middle East is the third largest growth user of petroleum due to modernization and electrification and what we now have is a much greater demand than what was projected 20 years ago.

Good piece. It also helps remind us how Real Business Cycle Theory became so popular.

You miss though the real point of the oil embargo: to lessen the price that Iran receives for its oil by reducing the number of willing buyers. The hope appears to be that this will increase public dissatisfaction and help launch a Persian Spring.

But there’s a very high risk of some kind of military action, if Iran feels over-oppressed, or if Israel feels that Iran is under-oppressed. The potential economic fall-out of real output disruption, as you rightly point out, is huge. Want to stop Iran from getting the bomb, but don’t want to pay too high a price. This is what declining relative global power feels like.

For anyone not paying close enough attention, Juan Cole reports that Haaretz is reporting that Israeli military intel is handing Barak a report that agrees with the 16 US intel agencies in their NIE report: Iran is not currently actively pursuing a nuclear weapons program. Obama may be forced by Congress to pursue his sanctions effort, but it is time to cool off this budding US-Iran conflict over its non-existent nuclear weapons program.

Even if Iran did manufacture nuclear weapons would Iran have the vectors to accurately deliver these weapons? And, suppose Iran did have the vectors, would it dare use the weapons?

Canada, France and the USA have over the years gifted nuclear weapons to Israel, India and Pakistan. North Korea has nuclear weapons. Yet since the USA destroyed Hiroshima and Nagaski, no state or other organization has actually used nuclear weapons in an offensive capacity.

This nuclear peace will change once UAV transported ordinances become democratized and everybody from resource-poor states to NGOs including criminal organizations gets a hold of the technology. Concrete bunkers sunk 25 metres into the ground will be the only safe place to hide.

In the meantime, Iranian sanctions appear to be so much ‘cheap talk’, but also a strong reminder of on-going American support for the ethnic cleansing of territories taken in 1967 by Israel.

USA vs Iran (now, after Iraq, Libya, et al) is all about oil and regional hegemony.

Iraqi leadership was amongst the least religiously radical of all mid east countries. There were no weapons of mass destruction nor any active aid to Al Quaida; Saddam wanted to lead the region, increase oil prices and sell it in Euros, not USD. So… he had to go.

Gaddafi could not give a damn about US interests, wanted to ditch the US dollar in preference to gold, so he too took a dive.

Saudi Arabia is one of the most repressive regimes in the mid east – beheadings, stoning to death for sex outside marriage, decapitating hands for theft are acccepted routine punishments there. Take a drink in public and sense yourself whipped senseless in public and scarred for life. (Not so in Iraq, Libya, Egypt.) But do you see USA even murmuring about such barbarism and crimes against citizens by Saudi rulers? Oh no! Saudi gives USA/Europe all the oil they want at US accepted prices in USD, so why rock the boat?

Now Iran: Every country has a right to use nuclear energy for peaceful purposes/power generation. There is no proof (again, as in the case of Iraq) that Iran aims to build nuclear weapons. Iran too does not care a hoot for US interests. That is the problem.

USA has made a mess of Iraq, Afghanistan and left. Egypt and Libya are now even more economically and politically unstable. USA now working towards an encore with Syria, I suppose.

The aim is to make Israel ‘feel safe’ and happy, by rendering her neighbours in disarray and disorganised plus keep the oil flowing at cheap prices. Everything else emanting from USA/Europe is just propoganda to this send.

Let not anybody fool us otherwise, folks.