Here’s my suggestion for how to become rich: buy low and sell high.

It’s a strategy that works for individuals, and can work for the entire nation as well. If you can figure out a way to find resources whose value in their current use is not very great– in other words, if you buy low– and redeploy them somewhere else where their value is much greater– in other words, sell high– then you will not only add to your personal wealth, you will be creating new wealth for society as a whole. The process of allocating resources to their most efficient use is the heart of what drives economic growth. The fact that individuals have a strong personal incentive always to be looking for better ways to do that is the primary factor responsible for the standard of living that we enjoy today.

Let me give a concrete example of what I’m talking about. On Friday, you could buy a barrel of light, sweet crude oil produced in North Dakota for less than $81. On that same day, oil refiners in Port Arthur on the coast of Texas were paying around $110 to import a similar grade of oil produced in Nigeria. That’s $30 worth of incentive to you to try to figure out a way to transport oil from North Dakota to Port Arthur in order to replace a barrel of imported Nigerian oil with Williston sweet. As a nation, if we could divert some of the resources we are currently devoting to pay for oil imported from Nigeria, and use them instead to enable the Port Arthur refinery to get its oil from North Dakota, we will become richer.

Buy low, sell high.

So there’s a very concrete mission. How can you go about implementing it? You could try to ship the oil from North Dakota to Port Arthur by truck, but that would eat up most of your profits in transportation alone– the combined resources we’d use to produce the oil and then truck it to Texas are not much less than the resources we’re currently surrendering to get the oil from Nigeria. Rail is a much better way to get the oil from North Dakota to Texas, and rail is being used more and more, but it’s still pretty expensive. And America doesn’t have enough of the specialized rail infrastructure to handle the volumes that are needed.

|

A far better idea is to transport the oil by pipeline. We could get the product where it needs to go with a fraction of the resources currently used up trying to move the product by rail, permitting us as a nation to produce more of everything else.

Wealth creation.

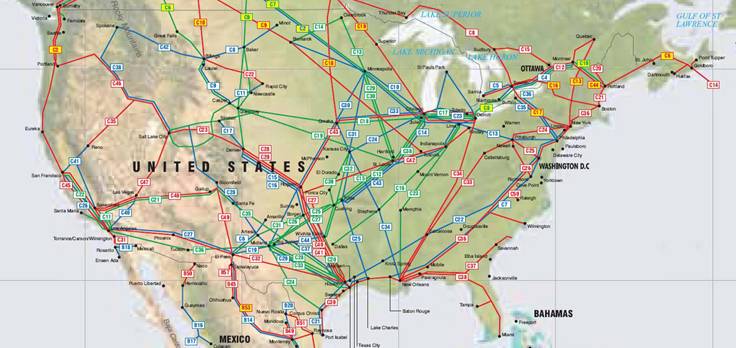

Of course, this is not a new idea, but has been the obvious solution from the industry’s beginning. The first pipeline for transporting oil was built in 1865, only 6 years after the start of the industry. In the years since, America has laid a half million miles of oil and natural gas transmission pipelines, and millions more in gas distribution lines.

|

|

But now we need some more, to make best use of the growth in new oil production from places like Canada and North Dakota. What we need, for example, is the proposed BakkenLink system to connect North Dakota to the bigger proposed Keystone pipeline expansion.

|

|

That obvious solution was proposed some time ago by TransCanada, a private company that’s offered to build and pay for the pipeline, and has been waiting now for more than 3 years for the U.S. State Department to do nothing more than say, “OK.”

On Wednesday, President Obama announced that he needed more time to study the proposal.

For 150 years, Americans understood perfectly well that pipelines are the rational way to transport oil. We’ve reached a new and very troubling paralysis if we can’t even agree on such an obvious fact at this point.

In addition to the question of how to make the best use of productive resources, another issue that has been raised in the debate is whether projects like the Keystone Expansion Project might also be helpful in terms of putting unemployed Americans back to work. Certainly laying more than a thousand miles of new pipe ought to cover a few paychecks. Critics say that these would only be temporary jobs, lasting only as long as it takes to build the pipeline. That’s a valid point. But many of those same critics seem to think that America would be well served by other government-funded, temporary stimulus spending, as a good plan for getting people to work.

But here’s the problem– how shall we choose the projects worthy of this government funding? One of the key drawbacks to having elected officials choose which projects get funded is that they are likely to favor the projects that reward their political allies and consolidate their power. For example, U.S. taxpayers might find themselves committed to pay a half-billion dollars to a solar company that ceased operations shortly after receiving the money.

Which is the better strategy for creating new wealth, Keystone or Solyndra? Maybe we need a few more years to study that question.

Which is the better strategy for creating new wealth, Keystone or Solyndra?

A bit tendentious, aren’t we?

What are the total costs of the pipeline, including environmental damage? How much are we already subsidizing oil and gas related projects, including the value of roads, parking regulation, tax subsidies, etc., etc.

Do we look at one failed loan and decide that all lending is overly expensive? The implications of such a policy for the financial sector (an obvious recipient of massive government support) would be staggering.

Good suggestions and good principle “buy low, sell high”, but really too much work involved,when compared to “receive low and sell high” and “O fortuna” mad Hof coincident factors.

Econbrowser (More on those secret Federal Reserve loans to banks)

Theoretical and actual Federal Reserve lending by category (billions of dollars)

Category GSEMBS fed loans

potential Actual maximum Date of maximum

1,000 1129 23juin 2010

Bloomberg Credit Suisse Toxic Bonuses Provide 75% Returns

“Credit Suisse employees who got $5.05 billion of junk-grade loans and commercial-mortgage-backed bonds in late 2008 as part of annual bonuses have reaped gains of 75 percent on the payouts since the end of that year through Nov. 30, people with knowledge of the results said. Gold futures returned 98 percent in the period, while Credit Suisse’s shares declined 23 percent.”

Bradley Keoun in New York at bkeoun@bloomberg.net (one may remember B Keoun steadfast participation in the comments of the above post)

Good work is always rewarded isn it?

The North Dakota oil boom does have its own litany of setbacks…just ask ND farmers.

http://www.governing.com/topics/energy-env/north-dakotas-oil-boom-blessing-curse.html

Wealth creation for whom? But I digress. TransCanada said they will have a new route and plan to submit “in a matter of a very few weeks.” Maybe if we could stop this decision from being held hostage for a country’s budget process…

JDH You may be looking at the wrong model. The Administration has conspicuously left the door open for eventual approval of the pipeline. I think it’s pretty obvious that the Administration has started to learn how to negotiate with the GOP. Instead of revealing the secret to wealth creation, a better analogy would be the secret to negotiating. The Administration knows that it controls a bargaining chip that the GOP values very highly. It’s a good idea to pocket that chip until needed in future negotiations with the GOP. The Administration showed its willingness to put the pipeline on the negotiating table when it allowed the pipeline “decision” to become part of the FICA holiday extension. Another big fight with the GOP is coming in a few weeks and Obama knows it. Eventually the pipeline will be approved conditional upon a slight rerouting around the more sensitive parts of the aquifier.

As to Solyndra, you shouldn’t forget that part of the problem is that the company executives flat out lied about critical facts that went into the loan guarantee. In any event, didn’t the govt also subsidize North Dakota tar sands research and development back in the 1970s…the same resource that today’s Big Oil conservatives are today championing as our economic salvation?

It’s strange to see someone write nearly 1,000 words without using the words “climate change” or “global warming” or “greenhouse” or “carbon”.

No one opposes the Keystone pipeline because they don’t think it’s an efficient way of getting the oil from point A to point B, or because they don’t believe it will make somebody rich.

The reason that the pipeline “needs more study” because climate scientists like James Hansen say that if we fully utilize the world’s fossil fuels, we are likely to trigger a runaway greenhouse effect that will boil the oceans and leave the earth uninhabitable. (Yes, that’s what he says.) Getting rich, even getting really, really rich, isn’t that important compared with leaving a habitable planet for our grandchildren. That’s why Obama blocked the pipeline.

Now, you may think Hansen is wrong. You may not believe in anthropogenic climate change, I don’t know. You may think that if we get rich enough in the meantime, there will be a technological solution. Or you may think that blocking one pipeline is a pretty poor substitute for a carbon tax or system of carbon permits. But that’s where the debate is.

Mr. Hamilton:

Why should the pipeline be approved when one of the main beneficiaries of said pipeline is the Koch Brothers? And what if plenty of us don’t want to live in the Rand-ian “paradise” that the Koch Brothers want to turn the USA into?

Whatever the benefits of Keystone are, I have to ask:

1. Why is it being pitched as a massive job creator? No doubt any job, temporary or not, funded by the government or not, is good, especially in a time like this, but was it really going to create any substantial number of jobs?

2. Are the concerns of those who oppose it at all legitimate, in your opinion? (For what it’s worth, I don’t really come down one way or the other on this.)

3. There’s a legitimate question as far as how the government should be involved in alternative energy production, but was Solyndra the exception or the rule? From what I remember, most if not all of the other involvement has turned out okay. And it looks like Solyndra, as bad as it was, was more of a case of poor decision making and bad luck that horrendous corruption. Notice how we haven’t heard much about it lately–it’s more smoke than fire, perhaps?

Hahaha The same BS as off shoring jobs! We all know the oil from Trans Canada is going to China, and China Companies now owns most of the refineries in Texas! Not only are we going to ruin the headwaters of fresh clean drinkable waters that comes from Canada, if we allow them to continue pulling that poison out of the ground up there, we would foul the air in Texas and the gulf as they process it more down there!

Then there is the real question, which is why doesn’t the other provinces in Canada want to ship it to the west coast? Why isn’t the pipeline being built in Canada, which would save thousands of miles in travel for supply ships alone?

Because, Canada really doesn’t want the Pipeline itself! it is a unnatural disater waiting to happen! You have been hanging out with greedy bastards for to long my friend!

Based on crack spreads in 2011, it would appear that refiners nationwide were generally pricing refined product based on the Brent price, but Mid-continent refiners are paying Canadian and Mid-continent producers based on the WTI price, and simply pocketing the difference as refining profits.

Note that we have seen two Brent annual price doublings in recent years, as annual Brent prices went from $25 in 2002 to $55 in 2005, and then went from $55 in 2005 to $111 in 2011 (versus $97 in 2008).

But one way or the other, Canadian crude oil exports will find their way to a global market. Mid-continent refiners have just been providing a multibillion dollar incentive for Canada to accelerate their plans to ship their oil elsewhere.

Note that only two major exporters in the Western Hemisphere (100,000 bpd or more of net oil exports in 2005) showed increasing net oil exports from 2005 to 2010, Canada & Colombia.

The dominant trend that the US is facing is that we will, in my opinion, be forced to continue to consume a declining share of a declining volume of Global Net Exports of oil.

Harsh. Funny, but harsh.

Speaking of buying low, nat gas front month is at $2.34. Even the most bullish shale gas guys say we need $5.00-5.50 to produce shale gas. At some point, this has to reverse.

Seems worth wondering why it took TransCanada 3+ years to figure out one of the states it was passing through was unhappy with the route and that it might speed things up to come up with a different route.

I agree with what this post says, but it seems to miss the heart of the issue. Very few people are arguing against pipelines as a good way to transport oil.

The arguments are: is this the best route, and various screeching over the source of the oil. But very few are making the argument that this post tries to tackle.

Throwing in Solyndra is a bit of a non sequitur here. Someone is getting a bit emotional over this pipeline.

ComradeAnon: Wealth creation, for example, for state and local governments, who could have collected $5 billion in new property taxes from the pipeline.

And if your position is, “yes, it is wasteful to transport oil by rail rather than pipeline, but it is not wasting my money,” please permit me to suggest that you are mistaken.

JW Mason: I discussed Keystone and global warming here. But the specific topic I wanted to take up today is whether it is better to transport oil by pipeline or by rail. I do not think you can make a case for the latter on the basis of any argument about the climate.

As someone who lives and works in Alberta let me point out a few things. First, the tar sands are a relatively new animal in the world of oil production. Are there bugs to be worked out and a learning curve? Yes. Are we making improvements on a constant basis and monitoring the process closely with the help of environmentalists? Yes, again.

Now, let’s look at this from a business perspective from the Canadian side. We have a resource that is in high demand around the world so who should we market our product to? Well, our neighbors to the south are relying heavily on overseas imports from countries with questionable political practices where civil unrest and terrorism seem to be the norm. If we sell it to them, we can transport it in a much safer manner than oil tankers, and rail cars. If we use a pipeline, we also cut down significantly on the pollution that tanker trucks would create. Our neighbors would have a much needed product from a country that is in line with their political stances and general system of values and ethics. Building the pipeline will create jobs that will continue long after the pipeline begins operating as it needs to be monitored and maintained. It will even provide jobs for all the environmentalists that are opposing it. Considering their current needs and economy, it seems like a no brainer. We’ll offer our product to the US first.

What’s that? You don’t want it? You’d rather do business and financially support the same people that funded the attacks against you in 2001? You want to have to kiss the asses of these manipulators of the industry that control the price you pay at the pumps? Doesn’t make much sense, but if that’s what you want, we’ll sell to China instead.

And yes, that pipeline will go through, because unlike your government, ours can’t be bought by lobbyists and votes.

Enjoy funding the oppressive countries that want nothing more than to destroy you.

We’re taking our ball now and going home.

“The process of allocating resources to their most efficient use is the heart of what drives economic growth.”

Really? And here I thought population growth and capital accumulation also played a role….

Steven,

As you know lots of shale players have been booking proven and proven undeveloped gas reserves as BOE, using the six to one BTU ratio. It’s entirely possible that on a cash flow basis, the ratio could be in the range of sixty to one this summer.

Methinks that there are going to be some sizable reserve writedowns, especially in the proven undeveloped category.

Sure — the oil companies want to transport the oil from ND and Canada to the Gulf Coast so Americans can pay less for oil. That’s it.

Michelle Anderson Are we making improvements on a constant basis and monitoring the process closely with the help of environmentalists? Yes, again.

You may have misunderstood the point about tar sands. The point is that improvements are not happening just with the help of environmentalists, but with the not inconsiderable help of government subsidies. If you support govt subsidies for tar sands, then it’s hard to argue against govt support for green energy as well.

If we use a pipeline, we also cut down significantly on the pollution that tanker trucks would create.

I don’t think you can make that claim without a lot more information. The pipeline would reduce pollution from tanker trucks hauling the oil south; but if it could also increase the total amount of oil consumed because of lower prices and greater demand (thanks to increased wealth!), then pollution might increase.

Now, let’s look at this from a business perspective from the Canadian side. We have a resource that is in high demand around the world so who should we market our product to?

From a strictly business perspective, shouldn’t you also look at the intertemporal sale? Oil is an exhaustible resource, so it matters when you extract that resource from the ground. With interest costs very low and the future price of oil likely to accelerate, why would you want to sell oil today? What continually surprises me is how low oil is priced and just how eager those sheiks and mullahs are to sell oil at bargain basement prices so they can invest the revenues at 3% US Treasuries.

We’re taking our ball now and going home.

What happened to that famous Canadian sense of politeness? Been too long since you won a Stanley Cup? ;->

Michelle Anderson: “We’re taking our ball and going home.”

It’s not your ball, Canada. The resource is privately owned by international oil companies. (The part that’s not already owned by the Chinese govt. through Petrochina.)

JDH, you are obviously correct. It’s too bad the issue is so emotion filled and not based upon economic logic.

Of the $30 spread between Williston and Port Arthur, half of it is between Cushing and Port Arthur, and yet Conoco held up reversal of Seaway until they got an elevated price for sale of half interest in the pipeline. That bears regulatory investigation in my view. They were using their role as a common carrier to create rents for themself.

More efficient, with net global economic benefits is an easy proof, net American jobs is highly debatable. I’m pretty confident trucking oil requires more labor than moving it by pipeline.

“Rail is a much better way to get the oil from North Dakota to Texas, and rail is being used more and more, but it’s still pretty expensive.”

That’s not a very compelling argument for pipeline over rail. Rail is infrastructure that benefits the entire country. People like trains, and the rights of way are already established. Go rail!

Does anyone really think that the Canadian oil will not find a way to world markets and be consumed perhaps in countries that may have weak or no pollution controls? Just because the current administration senses a temporary negotiating advantage over the GOP does not seem to be an earth friendly strategy.

Alternately, we could drill deep holes in the ground and bring up geothermal heat. No energy storage required (unlike solar), every place has it (unlike wind), pollution is minimal (unlike nuclear or burned carbon) and it will take a long, long time to cool down the earth.

Why doesn’t the pipeline go to Chicago? Or Michigan? The US industrial heartland? Instead it goes all the way across the United States.

Hard to believe it’s for our benefit.

i think we can assume that every drop of oil from the alberta tar sands will eventually be exploited, and this pipeline &/or others from alberta will be built, & that the oil will be more valuable at that time…

so what is the point of a “drain america first” energy policy? our future energy security is best served by leaving what oil we have in the ground…since oil will become scarcer & more difficult & expensive to extract over time, as long as this country can get relatively cheap oil shipped to us from overseas in exchange for our fiat currency we should do so; the oil we have within our borders is better than money in the bank, because it will only become more valuable as the easy to exploit fields are depleted…

Michel Levi of the Council of Foreign Relations seems to have provided the most complete answer.

It can be found in the January 18 issue of the Wshington Post under the title “Five Myths about the Keystone XL Pipeline.”

His conlsusion is rather simple.

The fate of the pipeline will be of limited consequence to long-term U.S. energy security or climate change (though the decision to reject it will probably be ugly for U.S.-Canada relations). But the Keystone decision ultimately became far more about symbolism than substance. It’s a shame that so much attention was diverted from things that matter more.

As readers may remember, I called for a recession back in April. Jim felt a slowdown more likely.

Europe is indeed in recession. The US has experienced only a slowdown, even though the two regions were tracking similarly to the summer.

So what’s the difference? It was during this period that shale oils really started making an impact. Now, our oil is cheaper, and is creating jobs throughout the center of the country. (The rig count drilling for oil increased from 180 in Q1 2009, its nadir, to 1223 in Baker Hughes last report.) Our natural gas is much, much cheaper, about 1/4 the price of European gas. The net benefit per household is on the order of $1800 per year (not of all it captured by households, to be sure). That’s about 3% of GDP.

I have elsewhere commented that the economic multiplier for oil could be on the order of 10-12. Thus, the shale gas and oil activity could have an appreciable affect on our economic health. Put another way, one could argue that one reason the US is not in recession–as I had forecast–is that comparatively low energy prices have played a material role in sustaining our economy.

Keep in mind that the pipelines DO go from North Dakota to Cushing, Oklahoma, and from there to various refineries around the midwest. Those refineries process that “underpriced” crude and sell into global markets at global prices. Guess which refineries are making money now? Not the ones in Port Arthur.

I’m note sure that the Keystone Decision was only driven by environmentalists. Which refiners have a presence in the midwest but not in the Gulf?

“Buy Low, Sell High”: Wow, what profundity!

“Carney” types like P.T. Barnum were advocating that old saw over a century ago; and it’s what allow our Jewish Diaspora to emerge from being limited to operating Junk Yards!

But we can agree that our nation’s once pristine, & still very fragile, natural surface is now Criss-crossed with not only pipelines, but all kinds of other lines as well. And thereby, with the distinct – and rediculously ignorant – exception of our power grid, those “Capitalists” that truly understood the concepts of “economies of scale” and “efficiency”, quickly learned to tie-in, interconnect & share. So why can’t, now, our very “deep pockets” Petroleum industry learn – & apply – those self-same “Econ 1010” lessons? Vs. insisting on continued violation of Nature, our Environmental & Ecological balance! How about hiring some of our indigenous “Native Americans” as your new production planners? They’ve got more “natural” sense in their little fingers than you seem to have in your “Ivory Tower” tomes.

Supporters of additional regulation say that regulations are necessary to ensure safety. The US is great today because we found projects and built them. There is also a cry about manufacturing leaving the US for other countries. Consider that it takes 3 years and millions spent on studies to only be told we need more study for a pipeline. Or consider that after 3 years developers could not get a permit to deepen Charleston harbor by 5 feet to accommodate the new generation of shipping, longer than it took to build the Panama Canal. And statists wonder why we are losing major company expansion to other countries.

Canada is already courting China as a buyer of its oil. With Bretton Woods it took us about 15 years to run all the excess gold out of the country so we had to float the dollar. I wonder how long it will take us to run off all the major businesses out.

I’m doing this from memory, but I seem to recall that the oil business is the largest employer of Native Americans in Alaska.

Re: Buzzcut

I don’t know if it’s true or not, but it wouldn’t surprise me in the least if Mid-continent refiners were financially supporting anti-Keystone efforts, since Mid-continent refiners are the only real winners regarding the spread between WTI and global crude oil prices.

Perhaps you should build a refinery in Chicago greg. It is absolutely not for your benefit greg, but, only the benefit of greedy oil companies and those greedy people they serve. I know you ride a bike to work and heat your home with hand cut wood from the back forty, right? Besides, Mr. Buffet stands to profit handsomely from rail. He owns it. Those pesky things criss cross the country as well and don’t benefit me at all that I can tell. I don’t need to understand these things, however, since Obama will make sure I stay warm and give me my daily bread and that is all I need to know.

And what’s the cost of potentially contaminating the Ogallala aquifer? That’s where the bipartisan opposition is coming from.

“but if that’s what you want, we’ll sell to China instead”

Except that there is currently no way to do that in significant quantities. The proposed Northern Gateway pipeline that would allow oilsands crude to be loaded onto tankers and shipped to China is years away from being approved let alone built. It is opposed by virtually every First Nations community along the route and In British Columbia those First Nations are VERY powerful. My prediction is that it never gets built unless the Canadian government declares martial law in northern BC.

From my perspective as a Canadian concerned about global warming it would be better to have a coherent climate policy that put a high price on carbon. But lacking that policy any decisions that might slow down the rate of oilsands extraction are on balance a good thing

meh, too much work, try: borrow cheap lend dear, it’s good enough for the bankers.

A societal economic analysis needs to consider not just short term profits, but also ‘externalities’ — at the national level, health and long-term economic costs from loss of environmental business services are not “external.”

The use of tar sands petroleum releases much more greenhouse gas per BTU than other available energy sources (possibly excluding coal). The national-level cost-benefit calculation is fundamentally different than from the private companies who can unquestionably enrich their short-term bottom line by imposing disproportionate costs on population health present and future, and future general economic disruption.

Macroeconomics cost-benefit analysis is not complete without full consideration of both immediate costs such as those of poisoning populations’ air and water and long-term economic damage from climate change, especially if a tipping point is reached in melting methane in the far north or in ocean acidification.

No one has explained how the atmosphere can continue to absorb 70 million tons of greenhouse gasses a day and have it not change the climate. To make these costs concrete and immediate, an unprecedented $50B was spent on recovering from an unprecedented spate of “natural” disasters in 2011.

Even micro businesses responsibly achieve long-term profitability by investing now so as to contain future risk and cost.

you are thinking the wrong way around :

instead of more and more oil consumption and new pipelines, better buy fuel efficient diesel cars, as they need only 5 LITERS per 100 km.

http://www.audi.de/de/brand/de/neuwagen/a4.html

The article implies the $30/bbl price differential will persist after the pipe is built. I don’t think it will. Oil in the Dakotas is $81 because it is relatively non-transportable. Once the pipeline is built then the Dakota price should rise as more buyers bid on the now moveable oil and the $110 Pt Arthur TX price should fall due to increased supply, resulting in a narrowing of the $30 spread.

James: Of course adequate pipeline capacity would make the differential disappear. That’s my point!

As long as the differential persists, it’s an indication that we’re not using resources efficiently.

JDH, now that you’ve gotten that rant off your chest, go run some numbers on the multi-year economic losses to most of central Nebraska’s farmers if a major oil spill (there have been some, right?) pollutes their only secure water source. That’s what economists do – when they’re not ranting – right? The pipeline will get built. You know its not a question of whether, its a question of what route. Can you be productive about the real issue?

I am a strong environmentalist who supports subsidies for solar and other non-fossil fuel energy sources (the problem with Solyndra was not corruption but Chinese subsidies to their solar companies, driving down the price). However, I agree largely with JDH and also with 2slugbaits and Philip Verleger. Obama is largely holding this back as a political chip, and both the envirnomental costs but also the economic gains, particularly in employment, have been wildly exaggerated. This has turned into a dumb symbolic issue, and blocking the pipeline will not slow global warming one iota. That oil will get out one way or another. All we are doing is annoying the Canadians and having a very stupid fight in our political arena.

Keystone or Solyndra? That’s a no brainer. We’d do much better dumping money into alternative energy sources rather than stop-gap arbitrage on fossil fuels.

Arbitrage might make an individual rich, but it can’t work for an entire society. Eventually, the tar sands are going to be played out, and we’ll be back at square one. If we spend on a range of start ups, even if they fail, we’ll get the technologies we need to ditch fossil fuels. Right now, they might not look very valuable, but that’s what buy low and sell high is all about.

Barkley,

[b]”This has turned into a dumb symbolic issue, and blocking the pipeline will not slow global warming one iota. That oil will get out one way or another. All we are doing is annoying the Canadians and having a very stupid fight in our political arena.[/b]

A wonderful bit of candor and reason. There is hope.

Sure, it all makes sense if you’re looking into the wrong end of the telescope, and only looking into making just a few people wealthy, which up until a very few years ago has been the pet rock upon which our economy has been built. This policy, in case no one has noticed, has somewhat backfired, so maybe something with so many foreseeable environmental and economic costs that could potentially outweigh the benefits SHOULD be studied further, actually studied, not buried in some arcane committee, instead of being slammed through under pressure from Big Money. (Can you say Deepwater Horizon, boys and girls? I knew ya could. Or did everyone forget that one?) Or is Big Money surprised that Small Money won this round? I can’t speak for it, not having enough to even qualify for that much, but I bet Small Money is, too.

No comment necessary.

Buffett’s Burlington Northern Among Winners From Keystone Denial

On Levi’s comment: If the issue is symbolic, then the symbolism is that the environmental benefit is worth 20,000 jobs.

On the other hand, Alaksan oil is not symbolic. It represents an incremental 1.4 mbpd at peak (about the same as Gulf of Mexico production), and products valued at $2.4 trn (yes, trillion) to the middle of the century. It maintains the viability of the TransAlaska Pipeline and underpins with Alaskan economy. Will Shell be allowed to drill in 2012? And if so, then what exactly was the symbolism of killing the Keystone XL pipeline?

And Mike Laird, regarding the cost of a spill. You can do the analysis yourself…the numbers are reasonably available. However, we have at least one example: The Exxon Yellowstone spill of last year.

It took Exxon about one hour to shut down the pipe (the pipes are monitoried, by the way). For a 500 kbpd pipe, that might equal about 20,000 barrels or 3,000 cubic meters. Allow that it coats the surface (or leaches in) about 10 cm in any given spot. That would limit the affected area to about 3 hectares (in reality, probably less). Clean-up would probably cost on the order of $200 million, based on Exxon’s Yellowstone experience.

So, what we are most likely talking about is six acres in Nebraska, with 3 inches of oil on top of it. Is the risk of such an event and its magnitidue sufficiently compelling that we should kill the project?

http://www.huffingtonpost.com/2010/07/27/michigan-oil-spill-among_n_661196.html

Enbridge dumped 20,000 barrels from a monitored pipeline in Michigan recently. Except it ended up in a creek, which polluted a major river. I think if we had it to do over again, we would have re-routed the pipeline to avoid the problem.

No one’s talking about killing the project. The President nixed the current proposal because Congress forced him to approve it or nix it. They’re making changes to the proposal and resubmitting.

This is a naive, but serious question (and similar to the one asked by Greg). Why doesn’t it make sense to create a refining plant in the middle of the US, from which to ship the refined oil, rather than shipping the crude oil all the way down to Texas to be refined and then reshipping it back up to the rest of the US.

Re: the Michigan spill: “U.S. Rep. Mark Schauer called the [20,000 barrel] spill the ‘largest oil spill in the history of the Midwest.'” So this is the largest in the region ever, at least according to a politician with no vested interest in hyperbole.

In any event, this would suggest my 20,000 barrel estimate might be pretty fair number to use for the Keystone XL, too.

Kaleberg,

I could be wrong, but it is my understanding that Keystone does not involve any US taxpayer money, whereas Solyndra did. Thus they are not directly comparable.

The case for doing tar sands now is that sure they are going to run out, but hopefully as time passes we will have more tech improvement of sustainable alternatives and will be able to bring them in better, preferably with fewer questionable subsidies (Solyndra did not actually involve corruption, eeeeek! the president visited the plant! and some of its owners were his contributors, eeeek!), but most voters think it was a case of corruption unfortunately.

And, again, the tar sands will get done one way or the other despite Keystone, although I certainly think care should be taken to route the pipeline to minimize potential problems from spills. But, hey folks. Go look at JDH’s map. The country is covered with pipelines, and we have relatively few spills. Pipeline spills are not like supertankers breaking up a la Exxon Valdez.

Mark K:

You could build a refinery if you wanted to. However, the US is almost certainly post-peak in oil consumption, and we believe this will continue to decline at around 1.5% (250 kbpd) / year virtually indefinitely. Thus, it’s questionable whether we need more refining capacity.

And if a simple pipeline is proving so controversial, imagine the comments Econbrower would receive if a refinery were proposed!

Jim –

Might you consider to a bit on the economic impacts of a closure of the Strait of Hormuz?

Steven K.,

Looks like a closure of the Straits is now pretty much out of the question. Israel has agreed that Iran is not pursuing nuclear weapons and will not bomb in the near future, and the Iranian vice president has specifically denied/withdrawn threats to close the Straits. Not a serious issue anymore, crisis over.

Steven Kopits On the other hand, Alaksan oil is not symbolic. It represents an incremental 1.4 mbpd at peak (about the same as Gulf of Mexico production), and products valued at $2.4 trn (yes, trillion) to the middle of the century. It maintains the viability of the TransAlaska Pipeline and underpins with Alaskan economy.

I think this is actually an argument against building the pipeline. The last thing we want is an endowment like the Alaska pipeline that could end up becoming a white elephant. We already see this with the owners of the Alaska pipeline making the same lame case. A few months ago JDH had a post on how the owners of the pipeline want the US to open up more Alaskan reserves in order to protect the profitability of their asset. There may or may not be good economic reasons for opening up Alaskan reserves, but doing so for the sake of the politically well-heeled is certainly not one of them. The desire of the pipeline owners to squeeze out more rents from an already fully depreciated asset should not be confused with an economic argument for the pipeline. We don’t want public policy to become captured by white elephants.

this would suggest my 20,000 barrel estimate might be pretty fair number to use for the Keystone XL, too.

If the pipeline is rerouted around the most sensitive parts of the aquifer, then a 20K spill might be tolerable. But at critical points the proposed pipeline is literally only a few feet and inches above the water table. A leak would go directly into the water. Most pipelines are vulnerable to terrorist attacks, but they are not particularly attractive targets because the damage can be contained and while a spill may instill a sense of disgust and anger in people, it does not instill a sense of terror. Not true with the Ogallala aquifer. It would not be all that difficult for skilled hackers (especially those working for foreign govts) to defeat the shut down valves after an “accident” along the pipeline. That would cause panic and terror for those living between the Mississippi and the Rockies. Again, it’s easy to fix. Just reroute he pipeline, which is what the Administration is forcing TransCanada to do despite the company’s earlier refusal to even consider rerouting. This is one issue that the Administration is managing quite nicely. The Administration has deftly outmaneuvered the GOP and TransCanada.

everyone has their own definition of reasonable.

For me

if you want to live in a suburb or rural environment, you have to pay 100% of the cost of support, including full enviromental remediation. Probably add 10$/gallon to oil, and everyone moves to NYC CHI etc where they have mass transit

zoning laws that, in effect,make it very $ to build new jobs (offices, mfr plants, what have you) away from real mass transit (not the BS bus systems that allow hispanic cleaning people to get to office parks; no white guy ever takes those)

I am amazed you managed to write an entire article about the Keystone Pipeline, without ever using the word “environment” which is the SOLE reason the pipeline is being reviewed.

Now you may not agree that the environmental costs are great enough to offset the other benefits (and I am potentially with you on that) but you simply cannot ignore the fundamental (and only) reasoning why it hasnt been approved yet while complaining about it not being approved yet.

As some have noted, not one mention of global warming. Which is the ‘Mother’ of all wealth destroyers.

Andrew

Two points. First, I think you’d be betetr served taking up your point on whether, the real truth here is that there is no anthropogenic warming of any significance, there never has been and it is extremely unlikely that there ever will be, with all of the national academies of sciences or perhaps the 98% of all climate and atmospheric scientists who work on this topic and who disagree with your basic premise. I’ll follow the peer-reviewed literature in terms of forming my impressions of the severity of the climate change problem, and the conclusions there, while not consistent on the magnitude of impacts, are very consistent on the best estimate not being zero impact.Second, you seem to ignore that the proponents of this pipeline have significant commercial interest in getting it built it’s not just the environmental groups which have a financial gain in play from their opposition. As such, they present numbers which maximize the probability of the pipeline getting built. I doubt that TransCanada would sign a guarantee to employ agreement based on the numbers in the Perryman report. I agree that there are significant economic benefits from the pipeline, but the pipeline is not a social program. As long as proponents continue insisting on promoting it as such, people will not take their positions as genuine. I would hazard a guess that most environmental groups involved in this debate are more concerned with minimizing environmental impact than TRP is with maximizing employment.Andrew