Friday’s jobs report was unquestionably a disappointment. But other recent U.S. economic indicators are more encouraging.

One of the big concerns of many analysts was that rising oil prices of the last 5 months might significantly slow down economic growth. My view is that the main mechanism by which oil prices can sometimes have a disproportionately disruptive effect on the economy is if they result in sudden shifts in the patterns of spending. One typical channel is a plunge in sales of the larger vehicles manufactured in the U.S., which then leads to further losses of income and jobs in the auto sector. But the evidence suggests that an oil price increase that just reverses a previous oil price decrease– and that is basically what we’ve experienced so far in 2012– is not nearly as disruptive as if the price were rocketing into uncharted territory. One reason for this is that recent consumers’ vehicle purchase plans were already taking into account the possibility that $4 gas could soon return.

The latest data confirm that sales of domestically manufactured light trucks (a category that includes SUVs) in March were still lower than they were in 2008, the first time we saw gasoline prices moving up to the values that now seem pretty normal. In 2008, sales at those levels came as a shock to Detroit. Today, they’re about the best anybody was expecting.

|

On the other hand, sales of the lighter cars manufactured in North America were at the highest level of any March over the last decade. The Wall Street Journal reported on Wednesday:

Last month, consumers’ thirst for small and fuel-efficient cars was a prime factor in driving light car and truck sales nearly 13% higher than a year ago. General Motors Co. GM said it sold more than 100,000 cars that get 30 or more miles on a gallon, its highest ever and nearly half of the 231,052 vehicles it sold.

|

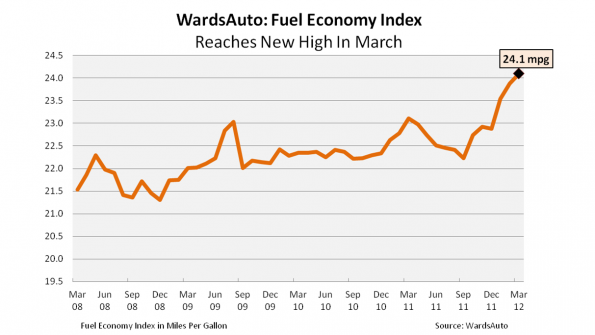

Thus despite rising gasoline prices, the auto sector should make a nice contribution to 2012:Q1 GDP growth, mainly because what’s happening now did not catch U.S. automakers or consumers by surprise. Mark Perry calls attention to this interesting graphic from Wards Auto showing that U.S. new light vehicles achieved record fuel-efficiency for the third month in a row in March.

|

Even if this spring’s high gasoline prices aren’t preventing Detroit from selling cars, they are still an undeniable drag on household budgets. However, improved fuel economy, low natural gas prices, and a mild U.S. winter have all helped cushion the effects of that, with spending on energy goods and services still only 5.8% of total consumer spending for February, lower than the values we saw this time last year.

|

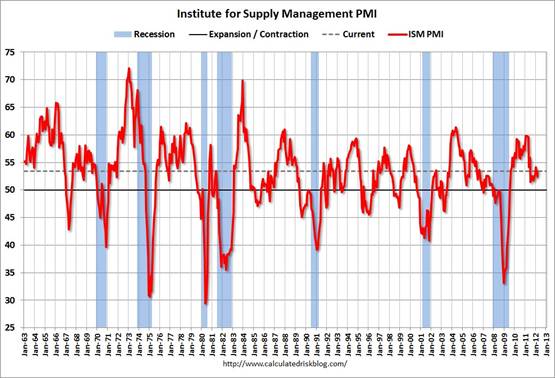

Some other recent U.S. economic data are also mildly encouraging. The latest national income accounts allow us to calculate a separate measure of real GDP growth based primarily on income data rather than purchases. The income-based measure suggests that U.S. real GDP grew at a 4.4% annual rate in 20011:Q4, compared with the 3.0% growth implied by the traditional GDP calculation. That discrepancy raises the possibility that when the 2011:Q4 GDP numbers are subsequently revised, they could well be revised upward from the current 3.0% estimate. Another favorable indicator was a modest improvement in the manufacturing PMI for March, consistent with a view that growth is accelerating.

|

The big disappointment (and unfortunately the single most important number) was Friday’s report from the BLS that the number of Americans on nonfarm payrolls only increased by a seasonally adjusted estimate of 120,000 workers in March, well below the 246,000 average gains over the preceding 3 months. The separate BLS survey of households actually recorded a seasonally adjusted drop in employment of 31,000 workers. There was an even greater drop in the number of working-age Americans looking for jobs, which produced the somewhat misleading impression of an improvement in the labor market in the form of a drop in the reported unemployment rate from 8.3% in February to 8.2% in March.

|

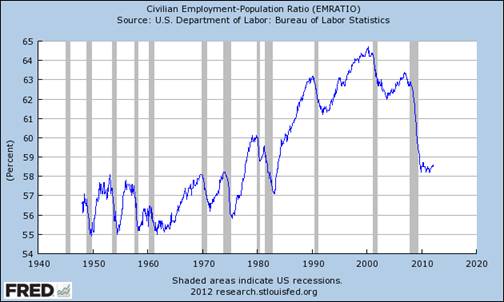

A steep decline in the employment-population ratio is very often seen during a recession, and usually it picks back up when the economy starts to grow again. This time it has not. As John Mauldin notes, partly this is due to long run trends of a falling labor participation rate for men and reversal of a previous trend of rising labor force participation by women. Notwithstanding, with a healthier economy, we expect to see at least some resurgence of this indicator. The fact that no such rebound is yet in sight confirms that while the economy undeniably continues to grow, the rate of that growth continues to disappoint.

I don’t think it’s just about vehicle sales.

Gasoline is a big percentage of the consumption basket for working families who are already living very close to the edge with saving rates very near 0%.

Another $10 or $20 to fill up the tank is $10 or $20 that can’t be spent on other discretionary items.

Given how the auto industry is much better prepared for high gas prices, they might see additional sales as the cost of filling the tank reaches the level of incentive to buy a vehicle that uses less gas. When the crisis hit, GM in particular relied on truck and big SUV’s for their profits. They now offer a wider range of cars and even their trucks and SUV’s are significantly higher mileage. Lots of people have cars that get less than 20mpg. They can see $4 gas as an incentive.

As for jobs growth, beats me. There could be a revision up. It could be one month of downer.

Given the tsunami of Cornucopian Disinformation about energy supplies out there, I think that the chances of any near term general recognition of resource limits are pretty low, and I have begun to conclude that perhaps those of us concerned about resource limits should focus on reaching common ground with people who may or may not agree with us regarding Peak Oil/Peak Exports.

I have often wondered when we were going to see the “Student Loan Protest Marches On Washington.” With the Occupy Movement, we have probably already seen it start to happen.

In any case, I wonder of we should try to focus on encouraging efforts to bring back vocational/apprenticeship and agricultural training in US high schools, together with the same type of training in community colleges.

A relevant item in the current issue of Time Magazine:

http://www.time.com/time/subscriber/article/0,33009,2111232,00.html

The Jobless Generation

Excerpt:

From Milan to Manila, Seattle to Santiago, the global economy is failing to provide good job opportunities for college graduates and others entering the workforce for the first time. After getting slammed during the 2008–09 financial crisis–when the global youth unemployment rate posted its largest increase on record–young people are discovering that their job prospects remain bleak three years later. Those in the world’s richest nations got hit the hardest. Persistent recession and budget cutting have brought the situation to crisis proportions in some developed countries–like debt-burdened Greece, where youth unemployment is more than 51%.

Over the past two years, the share of Americans ages 18 to 24 who are employed, at only 54%, is the lowest on record, according to a recent study by the Pew Research Center. In 2007, more than 62% were employed. The International Labor Organization (ILO) figures that 75 million people ages 15 to 24 are unemployed globally–or 2 out of every 5 jobless–and there is little hope of significant improvement. Without action, this army of young jobless could become “a lost generation,” warns Gianni Rosas, the Geneva-based coordinator of the ILO’s Youth Employment Programme. “We are in a situation where our kids are worse off than we were 20 years ago,” he says. “We are going backward.”

. . . In many countries, schools simply are not preparing students for the labor market. Too often, students choose courses of study that are mismatched with the needs of the economy, because of either personal choice (as in the U.S.) or the structure of an educational system that funnels top talent into certain sectors (as in Egypt). The result: a skills gap between what graduates are trained to do and what companies actually desire. One possible solution may be apprenticeship programs like those found in Germany, where youth unemployment is lower than in much of the rest of Europe. High-school-age students spend part of their time in classes and part on the job, absorbing the skills companies require.

The Nth Degree of Stupidity has been reached.

For those with investments, I can only say. “Good luck.”

All the numbers are coming in that say retail and industrial sales are dropping in all countries, including China and India. Unemployment is rising in Europe, with half the young people under 25 years of age, underemployed or without jobs.

The only country that seems to be immune, according to statistics, is the USA.

However, all the indicators say that the statistics are manipulated, because, for example; house prices are falling in America, which is the very opposite of what you would expect, if the economy is growing.

The economic growth over the last 50 years has been driven by borrowing against personal wealth, which resulted from increases in the real estate values of every family home.

The truth is that well paid, full time jobs have been replaced by low paying, part time jobs.

The oil companies are raising prices for gas, because they have a cartel that allows them to do so.

Big corporations are putting all the small farmers out of business, so they can monopolize the food production and raise prices by 10% every year.

Discretionary, disposable income is being squeezed dramatically. This puts pressure on retailers.

With all these brilliant people running the countries, how can they possibly think that cutting costs, through layoffs of public employees, would solve their problems. They now have more people collecting unemployment benefits instead of paying taxes.

They still think it is possible to run a country like a company.

The only thing they forgot about was the fact that countries are not allowed to lay-off any workers.

In a corporation, you can cut costs by laying off employees.

In a government, you increase costs, because the laid off workers are still paid, but now they are non productive.

The other anomaly, in their thinking, is the false belief that producing ‘more’ is the only way to get out of a recession. This is ‘old school economics’ shared by the political elite. I blame too much inbreeding.

Why do they think that producing more $1 dollar items, produced in China, that fall apart after one use and then end up in the garbage dump, only to be replaced by more useless products, is the answer to a recession?

America is Trillions of dollars in debt to China because the Chinese use the USA as a FREE garbage dump for their toxic waste and unsaleable products. The Germans don’t buy their junk.

We have reached the end of the ‘Consumer Driven Revolution’. It is time for a total rethink of our values.

Why do some people have too much money for producing nothing and others earn a dollar a day for 16 hours hard labour?

Why do some people have to work 80 hours a week, while others have no jobs?

Why do we spend less on education, job creation and healthcare because we spend too much money on police, army, weapons and jails to protect ourselves from uneducated, unemployed and mentally unstable people?

This system is broken and it cannot be fixed.

The whole thing is collapsing as you read this article.

The one good thing is that the collapse of this system will cause the creation of a new and better system.

Archie McLachlan

Archie McLachlan: “The oil companies are raising prices for gas (gasoline), because they have a cartel that allows them to do so.”

It’s curious that oil companies are “cutting” prices for natural gas, but “raising” prices for oil.

As I have previously noted, we have seen, since 2005, a material decline in the volume of Global Net Exports of oil (GNE), with developing countries, especially the Chindia region, so far consuming an increasing share of a declining volume of GNE.

While the US has shown some increase in production, it has not even come close to offsetting the decline in net exports from North & South America.

Global annual crude oil prices doubled from 2005 to 2011 in order to balance demand against a declining supply of GNE.

(We have seen a slight increase in total liquids production (+0.5%/year), inclusive of low net energy biofuels, but this is not really a relevant factor in oil exporting countries, where net exports are calculated in terms of total petroleum liquids.)

My new Buick gets 19/ 31 mpg city/ highway, replacing my BMW SUV that got 16/ 22. And it uses regular instead of premium, and is flex fuel to boot. I filled up with E85 at $3.65 a gallon when gas was $4.15. Mileage on E85 is not as bad as detractors make it out to be.

I have to agree that the US automakers are much better prepared for this round of gas prices than in ’08. Ford, in particular, has an impressive fleet of small cars, arguably the best in the business. GM also surprisingly has a decent fleet, and getting better quickly.

I think Chrysler is still a little lacking in the small cars arena, although it looks like they will release some new models soon. The biggest thing that drives car sales is new models, and pretty much every automaker that I can think of has new models in their showrooms. This bodes well for future sales regardless of gasoline prices or the age of the US automotive fleet.

Sometimes it is the hidden factors that drive costs. For example, a seemingly innocuous requirement for ethanol has driven up the cost of gasoline production, resulted in fines for refiners, and caused skyrocketing beef and dairy prices:

http://www.forbes.com/sites/christopherhelman/2012/04/03/ethanol-minus-the-corn-it-could-fuel-america-if-it-werent-illegal/

I’ve already written my congressman and suggest you do likewise. Just another example of the law of unintended consequences.

The disappointing one month numbers from the BLS is likely to be statistical flux, especially given that the unemployment rate went down anyway. Most importantly, it appears that the number of jobs that are part-time went down by 750,000, which means that 700,000 additional full-time jobs were added. Massive conversion of jobs from part to full time is a sign of some strength in the numbers.

Four numbers are important: new jobs reported by businesses, new jobs reported by households, unemployment rate, and part-time jobs vs full-time. Even this month, the last statistic showed a great improvement, a sign that statistical flux and not some downturn is responsible for the other numbers

The conventional wisdom crowd is once again ‘missing the forest for the trees’.

The deeper problem is that the US economy has become too dependent on its FIRE sector. This can be traced back to Triffin Dilemma dynamics and the paradox which resulted from reserve currency status. These issues are worsening and will continue to do so as the emerging nations gain strength and influence. Developing nations simply do not need cross-border capital in a fiat world… and, the availability of information is making ‘know-how’ less and less valuable, this then allowing nations to develop without sharing the profits which are gained from their ‘demographic dividends’.

The US and other nations which depend too heavily on global investment gains must accept that the ‘globalization’ plan was based on thinking that existed as part of a gold-standard mentality, but first of course, the citizens of wealthy nations must admit that they are exploitive.

Perhaps a good start toward an honest analysis would be to stop pretending that we are recovering as the number of people being made homeless is increasing.

Then, maybe we could begin to talk about our realtionship to the ROW, and how the recycling of dollars is directing the ROW’s surplus capital away from where it is most needed to … an economy with too much capital in relation to incomes (see asset bubbles).

Or, maybe we could open this conversation with something about our needing to incarcerate 25% of the world’s prison population even though we are only 4% of the world’s population.

But then of course the word recovery does imply that we only need to get back to normal, as if all was well? So nevermind, I was thinking of mentioning the global unemployment rate among young people but that probably doesn’t apply here.

As noted above natural gas prices are down in North America, as a result the increase in gasoline, may not mean as much of an increase in total energy expenditures as earlier. Consider that between the mild weather and low gas prices unless you are an unfortunate and have oil heat your heating bill is likley lower this winter than last. So perhaps more out for gasoline, less out for heating, perhaps close to a wash.

Al R — The hours worked data with the average work week falling directly contradicts your conclusion that those part time jobs were converted to full time jobs.

But the OTHER avenue that high gas prices impact the economy is through Fed-induced macroeconomic tightening, you forgot about that.

Back in Jan the market was pricing 60-40 odds of QE(n) coming by the 2nd quarter; now with high gas prices, the Fed has backed off. This is not surprising for a strictly inflation targeting Fed (which, lets face it, is what they are. There is no DUAL in the mandate).

the fact that the Fed has backed off and repriced the odds downward is a defacto tightening of macro policy.

The “long and variable lags” are neither as long nor as variable as they used to be in this age of 20-minute-delayed TIPS data on Bloomberg. Its more accurate to say that the market reacts in advance of any anticipated stimulus.

We seem to have forgotten that this recovery has been a few bright quarters punctuated by abysmal numbers, yet the Fed persists with the hope and pray method of macro policy.

“Not In Labor Force” At New All Time High

87.9 million removed from the labor force to get an 8.2% unemployment. At some point even those promoting the scam are going to have to get embarrassed.

Thanks for reporting this Professor.

There was an even greater drop in the number of working-age Americans looking for jobs, which produced the somewhat misleading impression of an improvement in the labor market in the form of a drop in the reported unemployment rate from 8.3% in February to 8.2% in March.

The 87.9 million people who are “Not in the Labor Force” (St. Louis Fed series ID LNS15000000) seems like a high number until viewed as a ratio to the “Working Age Population in the USA” (St. Louis Fed series ID USAWFPNA). The ratio of Not in Labor Force to Working Age Population was about 39% in 1975. The ratio fell to a low of about 33% from about 1994 to 2002 and has since increased to about 36% as of March 2012.

Did you include channel stuffing in your analysis?

GM has 713,000 vehicles in inventory channels up from 428,000 two years ago.

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2012/03/GM%20Channel%20Stuffing.jpg

AS,

Your point is without merit because women are now far more likely to have jobs than they were in 1975.

Think about what AS has written. In the middle of the Great Inflation with a high and growing unemployment rate the government was manipulating the unemployment number with 30% of the workforce. When unemployment declined in the boom years of the 1990s the government only manipulated the unemployment rate by 33%. Now that unemployment is once again becoming uncomfortable for the political class they are pumping up the number they are removing from the work force currently approaching Great Inflation numbers at 36% with the highest adjustment in history.

And he implies that this is not a high number. Oh really?

I notice that in 1975 there were 16.6 million Social Security Retirees and 2.5 million disabled compared to 35.9 million Social Security Retirees plus 8.6 million disabled workers as February 2012. Perhaps retirees are part of the analysis. http://www.ssa.gov/policy/docs/quickfacts/stat_snapshot/

“GM has 713,000 vehicles in inventory channels up from 428,000 two years ago.”

It would be nice if that chart showed us some inventory numbers from the pre-recession era–particularly since that’s also the pre-bankruptcy era. As it stands, noting that GM has seen steadily increasing inventory in the wake of the end of cash for clunkers, as well as the auto-bailout and its reorganization, is hardly telling of a an attempt at “stuffing” inventory down dealer’s throats.