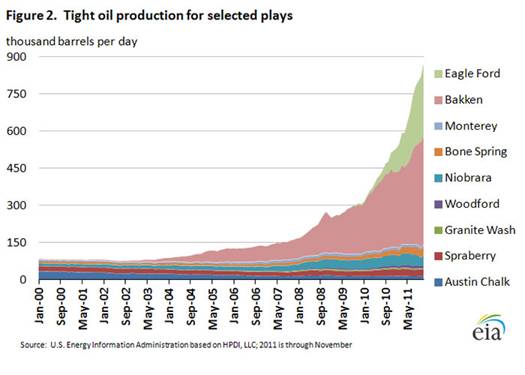

Since 2005, the “total oil supply” for the United States as reported by the Energy Information Administration increased by 2.2 million barrels per day. Of this, 1.3 mb/d, or 60%, has come from natural gas liquids and biofuels, which really shouldn’t be added to conventional crude production for purposes of calculating the available supply. Of the 800,000 b/d increase in actual field production of crude oil, almost all of the gain has come from shale and other tight formations that horizontal fracturing methods have only recently opened up. Here I offer some thoughts on how these new production methods change the overall outlook for U.S. oil production.

|

Let me begin by clarifying that “shale oil” and “oil shale” refer to two completely different resources. “Oil shale” is in fact not shale and does not contain oil, but is instead a rock that at great monetary and environmental cost can yield organic compounds that could eventually be made into oil. Although some people have long been optimistic about the potential amount of energy available in U.S. oil-shale deposits, I personally am pessimistic that oil shale will ever be a significant energy source.

By contrast, the expression “shale oil”, or the more accurate term “tight oil”, is often used to refer to rock formations that do contain oil and that sometimes might actually be shale. The defining characteristic is that the rock is not sufficiently porose or permeable to allow oil to flow out if all you do is drill a hole into the formation. However, enterprising drillers have discovered that if you create fissures in the rock by injecting water (along with sand and some chemicals to facilitate the process) at high pressure along horizontal pipes through the formation, oil can seep back through the cracks and be extracted.

As seen in the figure above, these horizontal fracturing methods have been the main factor behind recent increases in U.S. field production. The key question is how much more growth we should expect. Leonardo Maugeri, senior manager for the Italian oil company Eni, and Senior Fellow at Harvard University, has a new paper in which he predicts that the U.S. could get an additional 4.17 million barrels per day from shale/tight oil plays by 2020, though he notes that any such predictions are problematic:

the huge differences in permeability, porosity, and thickness of a shale/tight oil formation require many more exploration wells be drilled in different areas of the field before making it possible to have an idea of the effective recoverability rate from the whole formation…. it is impossible to make any reasonable evaluation of the future production from a shale/tight oil formation based on the analysis of a few wells data and such limited activity.

To put the 4.17 mb/d number in perspective, total U.S. field production of crude oil in 2011 was 5.68 mb/d. If 4.17 mb/d could be added to that, it would almost put us back to where we were in 1970. Alternatively, 4.17 mb/d represents 22% of the 18.8 mb/d currently consumed by the U.S. and 4.7% of total world consumption.

|

Maugeri describes the assumptions under which he arrived at his estimate for the Bakken tight formation in North Dakota and Montana as follows:

- A price of oil (WTI) equal to or greater than $70 per barrel through 2020;

- A constant 200 drilling rigs per week;

- An estimated ultimate recovery rate of 10 percent per individual producing well (which in most cases has already been exceeded) and for the overall formation;

- [original oil in place comes to 300 billion barrels];

- A combined average depletion rate for each producing well of 15 percent over the first five years, followed by a 7 percent depletion rate;

- A level of porosity and permeability of the Bakken/Three Forks formation derived from those experienced so far by oil companies engaged in the area.

The above assumptions detail the total quantities that Maugeri estimates can eventually be extracted (a stock variable), but they clearly are not enough to calculate an annual production rate for the year 2020 (a flow variable) which is the key number Maugeri is reporting. His analysis also makes use of a proprietary database of results for existing wells. What he evidently did was to calculate average well completion rates and flow rates per well from that database and extrapolate those forward, though he does not tell the reader what were the actual summary averages that he used for this calculation nor indicate in what way the $70 assumed price enters the calculations. His paper really just seems to provide his own summary judgment as to what his private database implies rather than specifics that other analysts could use to evaluate or reproduce his claims.

I recently attended an excellent conference on oil market fundamentals, whose proceedings can be viewed online if your budget allows for a hefty registration fee. One of the presentations was by Morningstar analyst Jason Stevens, who estimated the 2015 potential U.S. tight crude oil production using two different approaches. The first approach, which Stevens called a “top-down” approach, was to “use best-in play curves and assume repeatability and similar results in emerging plays,” which sounds identical to Maugeri’s methodology, and indeed, Stevens’ calculations used the identical 200 rigs per week assumption for Bakken as did Maugeri. But whereas Maugeri predicted we’d see 1.5 mb/d additional Bakken production by 2020, Stevens calculated that the area might only add 150,000 b/d or so by 2015. On the other hand, Stevens’ calculations suggested about a 900,000 b/d gain for the Eagle Ford in Texas by 2015, compared with 1.47 mb/d anticipated by Maugeri for 2020.

|

Stevens also calculated a forecast using a second method that he described as “bottom up”, which used specific production forecasts for 16 of the individual firms involved in these plays, and assumed that the fraction of each area’s total production represented by these particular firms would stay constant. This bottom-up calculation leads to an expected additional flow by the particular firms studied of almost 1 mb/d by 2015, implying perhaps 3 mb/d combined production from all drillers in the plays. Thus Stevens’ bottom line was similar to that of Maugeri’s, although the specifics differ.

|

In addition to the uncertainties noted above about extrapolating historical production rates, the rate at which production declines from a given well over time is another big unknown. Another key point to recognize is the added cost of extracting oil from tight formations. West Texas Intermediate is currently around $85/barrel. With the huge discount for Canadian and north-central U.S. producers, that means that producers of North Dakota sweet are only offered $61 a barrel. Tight oil is not going to be the reason that we return to an era of cheap oil, for the simple reason that if oil again fell below $50/barrel, it wouldn’t be profitable to produce with these methods. Nor is tight oil likely to get the U.S. back to the levels of field production that we saw in 1970. But tight oil will likely provide a source of significant new production over the next decade as long as the price does not fall too much.

It is a separate critical question how much additional production may come worldwide from other sources, and how far this new production will go toward offsetting declining production from existing mature fields. Maugeri is also quite optimistic about these issues as well. I hope to take up a discussion of these separate questions in a subsequent post.

We’re still learning about tight oil. Here is an interesting anecdote. At my refinery, we started getting some kind of North Dakota sweet crude that evidently had amines in it at maybe 250 ppm levels. They concentrated in the overheads from our atmospheric distillation tower, and completely fouled our overhead coolers, forcing us to cut rates and eventually replace exchanger bundles at great expense and lost production.

While amines are common in refineries, they’re part of downstream processes that get sulfur out of fuels. They are generally not seen by themselves in crude oil.

Our best guess is that the frackers use amines in their fracking fluids. They’re probably benign until they get concentrated at the top of a atmospheric distillation tower.

If tight oil in shale formations were economic the producers would show positive cash flows and stable debt loads in their SEC filings. But if you look at the companies you find exploding debt levels and negative cash flows even among mature companies in the sector that have been producing for many years. Speculation is nice but I would rather trust the actual numbers.

http://www.energybulletin.net/stories/2012-06-25/commentary-america%E2%80%99s-new-energy-reality-bidding-war-declining-global-net-oil-expo

America’s new energy reality – A bidding war for declining global net oil exports

Excerpt:

“Texas has seen a massive expansion of shale gas drilling efforts, especially in the Barnett Shale Play in North Texas. However, the RRC (Railroad Commission) data show that Texas natural gas well production showed a recent annual peak in 2008, with annual gas well production declining in 2009, 2010 and 2011. The monthly RRC data show that Texas natural gas well production in January, 2012 was down by 20% from the January, 2009 production rate*.

Note that the same RRC database shows a steady year over year increase in Barnett Shale gas production from 2004 to 2011. So, a common database shows increasing natural gas production from a large shale gas play, but declining overall total natural gas well production.

What I define as the shale play proponent’s model suggests that rising production from US shale plays and from new conventional discoveries will be sufficient to offset the underlying US production decline from existing production and to cause an ongoing and virtually indefinite net increase in US oil and gas production.

Furthermore, the suggestion is that we can apply the US shale play model to the world, so we are looking at an indefinite increase in global oil and gas production, as the shale play model is applied around the world.

However, the three year 20% decline* in monthly Texas natural gas well production—despite rising natural gas production from the Barnett Shale Play—directly contradicts the shale play proponent’s model.

In fact, if we use RRC Texas crude oil production data, instead of the EIA data for Texas (while using EIA data for other US producing regions), there was no increase in US crude oil production from 2010 to 2011, despite a huge increase in the number of rigs devoted to drilling for oil in the US . . .

Late on the evening of April 14th, 1912, at 11:40 P.M., the Titanic struck the iceberg. At around midnight, it seems likely that only about one-tenth of one percent of the people on the ship knew that the ship would sink, but that did not mean that the ship was not sinking. The ship’s pumps helped, but they were not sufficient to fully offset the flood of seawater coming into the ship.

I believe that the slow increase in US crude oil production is to the ongoing decline in global net exports of oil as the Titanic’s pumps were to the flood of seawater into the ship, and I suspect that perhaps one-tenth of one percent of the people in the world have some appreciation for the global net oil export situation, but that does not mean that global net exports are not declining, with the developing countries, led by China, so far consuming an increasing share of a declining volume of global net exports of oil.”

End Excerpt

*Revised data (as of July, 2012) show that Texas January, 2012 natural gas well production was down by 19% from January, 2009 rate.

Regarding the RRC/EIA discrepancy for Texas crude oil production, the RRC seems to be promptly updating the production reports at the following link:

http://www.rrc.state.tx.us/data/production/ogismcon.pdf

I am going to see what kind of updates we see through the year.

The June RRC update put 2011 annual Texas crude oil production at 1.13 mbpd, and January, 2012 as 1.21 mbpd.

The July RRC update puts 2011 annual at 1.14 mbpd, and January, 2012 at 1.23 mbpd.

Meanwhile, currently EIA puts 2011 annual Texas crude oil production at 1.47 mbpd, and January, 2012 at 1.77 mbpd.

Note that the RRC sums reports from Texas producers, while the EIA estimates Texas production, using a sampling approach. The RRC does tend to show higher production as late reports are received, but this tends to be a diminishing factor, since late reports would seem to be generally from smaller producers.

In any case, the EIA is, in effect, asserting that the Texas Railroad Commission, which has been tracking Texas crude oil production since the 1930’s, missing the equivalent of virtually the entire Bakken Play in North Dakota.

Problem with shale oil – it is not sustainable in the long run, as very expensive and not very friendly to the environment.

It provides a relief but we are not using the time wisely to solve main problem – how to reduce oil and gas consumption.

Once again, a very balanced, truly educational post.

Maugerie is considered somewhat woolly in the business. Jason Stevens, on the other hand, is a superb analyst, keeping in mind that he is an equity analyst, rather than geologist or supply-side expert. But from my perspective, Jason’s numbers are worth taking seriously.

I think there’s a good bit of optimism out to 2015, but caution thereafter. The decline rates on shale oil are quite high, as much as 75% in the first year. Therefore, to increase production over time, you have to drill more at the faster rate. It would seem likely that the results of shale drilling (at least for a given area) will come quickly, and plateau thereafter.

Thus, increasing US crude production to 2015 by 2 mbpd (Jason’s coverage universe, which is about half of production * 2) seems plausible. It’s less clear what happens after the middle of the decade.

I would add that Oil & Gas Journal has had some very good basin by basin analyses lately, and for hardcore oil devotees, their articles are well worth reading and largely accessible.

Available Net Exports of oil (ANE)

ANE are defined as Global Net Exports of oil* (GNE) less Chindia’s combined net oil imports (CNI).

The following graph shows the ratio of GNE to Chindia’s Net Imports (CNI):

http://i1095.photobucket.com/albums/i475/westexas/ECIPlots2.jpg

The 2008 to 2011 decline in the GNE/CNI ratio (9.5%/year) was faster than what the 2005 to 2008 rate of decline (7.7%/year) predicted we would see.

Based on the six year (2005 to 2011) rate of decline in the GNE/CNI ratio, estimated post-2005 Available CNE are about 168 Gb. Cumulative ANE for 2006 to 2011 inclusive were about 81 Gb, putting estimated post-2005 Available CNE about 48% depleted.

The 2005 to 2011 rate of decline in the GNE/CNI ratio, if extrapolated, suggests that China and India would be consuming 100% of Global Net Exports of oil in the year 2030, which is 18 years from now. I don’t think that will actually happen, but that is the trend line, and the rate of decline in the GNE/CNI ratio accelerated from 2008 to 2011, versus 2005 to 2008.

Of course, what appears to be a global slump in demand is having an effect on oil prices, with Brent currently at about $100, versus an average annual price of $111 in 2011.

However, the key point is that have not seen a positive net export supply response to the doubling in global annual crude oil prices from 2005 to 2011, so demand has had to accommodate declining supplies of exported oil.

*GNE = Net oil exports from top 33 net oil exporters in 2005, BP + Minor EIA data, total petroleum liquids

The author states:

Let me begin by clarifying that “shale oil” and “oil shale” refer to two completely different resources. “Oil shale” is in fact not shale and does not contain oil, but is instead a rock that at great monetary and environmental cost can yield organic compounds that could eventually be made into oil. Although some people have long been optimistic about the potential amount of energy available in U.S. oil-shale deposits, I personally am pessimistic that oil shale will ever be a significant energy source.

He is wrong on several accounts. Oil shale and shale oil have, for more than 100 years, referred to a generally fine-grained sedimentary rock rich in kerogen, the organic matter precursor to oil and gas, and to the product of heating that rock to temperatures that break down the kerogen into oil and gas. Although it is true the rock contains no oil, it is also true that wine grapes contain no wine.

Some oil shale fits any definition of shale, some does not. To say it is not shale is not accurate. Of course, the same definitions that exclude some oil shale also exclude nearly every formation of what are called gas shale as well as the new “shale oil” host rocks. If they were clay-rich enough to meet the traditional definition of shale, they would not be brittle enough to fracture.

The latest economic estimates published suggest economic recovery at $38-62/barrel. Production of shale oil in Utah may begin as early as 2014. The environmental impacts have been exaggerated to the same extent as those of hydraulic fracturing. The author should learn more about oil shale before he so casually dismisses it as a resource.

Jeremy Boak, Director

Center for Oil Shale technology and Research

Colorado School of Mines

Golden CO

Viewpoints expressed are mine, not positions of the Colorado School of Mines

Jeremy –

In the vernacular as I understand it, “shale oil” means “tight oil” accessed through horizontal drilling and hydrofracking; “oil shale” means the kerogen-laced shales.

Am I correct in understanding that oil shale–of the kerogen type–might be economical to produce at $38-62 / barrel? If so, that’s pretty interesting. I am on the phone most days talking to oil field service guys around the world. They tell me that conventional oil really needs $80 / barrel today on the margin.

A $38 cost, by comparison, is a big deal. And, of course, the oil shale resource is truly vast.

I would certainly welcome, and perhaps Jim would as well, a post on the promise of oil shale of the kerogen kind.

Re: Economic Shale Oil Recovery at $38 to 62 per barrel

Mr. Boak,

The average midpoint break even price, based on your estimate, is $50 per barrel. Given that annual WTI crude oil prices have exceeded $50 per barrel for seven years, and halfway into 2012, I guess my first question is what’s the holdup?

As an excerpt from the following link makes clear, it’s certainly possible to take leases on privately owned shale properties:

https://www.enefit.com/en/oil/projects/usa

Excerpt:

“Enefit has acquired one of the largest tracts of privately owned oil shale property in the USA. Enefit American Oil, a 100% owned subsidiary of Enefit,was established in 2011 to develop an integrated oil shale industry with a capacity of 50,000 barrels of shale oil per day at full production.”

End Excerpt

In any case, could you elaborate on who, using which method, “may begin” producing oil in Utah as early as 2014?

A good background article by Randy Udall and Steve Andrews from a few years ago:

http://www.solarblog.com/datas/users/1-OilShale.pdf

And a link to an Oil Drum post and discussion from 2010:

http://www.theoildrum.com/node/6212

Thanks for the response. I have been talking for several years now about the technical priority of these terms, and even within the industry, there is little acceptance. It seems to me that we need terms both for the rock and for the product. For immature kerogen rich rocks, I argue that oil shale and shale oil supply those terms.

I have suggested that for the Bakken and Eagle Ford, the terms oil-bearing shale and shale-hosted oil reflect traditional forms of geological terminology. However, they do require using three words to describe the deposit, and this seem intolerable to the press, the financial community and even the industry. This is where tight oil comes in. But I have never seen any oil that looked tight, so this is clearly an abbreviation for tight rock oil – three words again, and what would be the term for the rock body containing the oil? I jokingly suggest that if we could add one more word it would instantly be converted to an acronym, at least in Washington DC.

As to the word shale, it was a common word in Old German before it was a technical term, so there may be room for flexibility in its use. But the classic oil shale deposits are as much shale in the more technical definitions as all the new shales. In order to be fractured, they must be low in clay mineral content, just like some of the oil shales are.

The cost estimate I cited was published in Oil & Gas Journal in early 2009 by DOE and one of its contractors. The numbers are, like rig costs, affected by oil price. I have heard numbers as high as $80 recently, but also know that Red Leaf Resources and Enefit, the two companies moving ahead with plans to produce shale oil in 2014 and 2019 respectively, cite lower break-even prices than that. Total has just made a $200 million + commitment to move Red Leaf Resources’ system forward, and only a couple of permitting issues remain to be resolved.

Steve Kopits. the Green river Field is one of the most often mentioned. It is estimated as high as 3T barrels. It is undergoing successful exploratory experimentation, and one of the sites is as Jeremy says is ready for commercial: “Production of shale oil in Utah may begin as early as 2014.”

Shale oil has been commercially produced in Romania for a generation+. There much of it it is mined and then directly burned in power plants.

Mining may be the least expensive way for early production here in the US. To this novice it appears that shale oil may be conducive to coal mining technologies. Perhaps Jeremy Boak can comment here.

REdLeaf has completed a pilot test in Utah: http://redleafinc.com/index.php?option=com_content&view=article&id=14:pilot-test&catid=12:results-demonstrated&Itemid=16

On its FAQS page it claims production cost estimates to be $45. http://redleafinc.com/index.php?option=com_content&view=category&layout=blog&id=4&Itemid=5

As always cost determines when and why this resource will be developed. The last big oil shale development effort was shut down when oil prices plummeted. For that reason it is often discounted as too risky by analysts.

Could we also be facing “tight ethanol”? I’m not a big fan of ethanol, but the hot weather this summer has really hurt grain production in general and corn production in particular, which means tight ethanol supplies.

Following is an excerpt from the article (from a few years ago) by Udall & Andrews:

http://www.solarblog.com/datas/users/1-OilShale.pdf

“As a rule, nations don’t tap oil shale unless they are destitute. The world’s primary producer has been Estonia, a Baltic nation lacking

in coal, natural gas, oil, or hydropower. When Russian natural gas and nuclear power became available, Estonia began to phase out its

shale oil industry. Elsewhere, small amounts of shale have been mined in China, Brazil, and Russia. Most recently, a well-funded

and much-ballyhooed Australian oil shale experiment failed.

“Tellingly, one partner in that bankrupt project was Suncor, a successful developer of Canadian tar sands. After losing $100 million, Suncor now appreciates the critical distinctions between

tar sands and oil shales. There are two ways to produce shale oil. Typically, the rock is mined like coal. After being loaded and trucked

to a processing plant, the shale is crushed and fed into an enormous kiln (or “retort”), where it is roasted to 1,000 degrees F. The heat “cracks” the kerogen, whose distilled vapors can be refined into a liquid fuel. Retorting oil shale is capital intensive, messy, inefficient, and polluting. It consumes lots of energy and

water. The slag, swollen in volume and contaminated with arsenic, must be safely disposed. The entire process is so costly

and laborious that global production has never exceeded 25,000 barrels a day, compared to today’s 84,000,000 barrels of total

oil production.

Retorting a million barrels each day, as some propose, would entail mining and disposing of 700 million tons per year, digging the world’s deepest open pit mines, constructing a hundred retorts, and platting new cities to house tens of thousands of workers. In sum, it would be the largest mining operation in the world. In the last ten years, Royal/Dutch Shell has experimented with a new way to produce oil shale, a way that is, at first glance, less destructive and more promising.”

CoRev –

If the Romanians are burning kerogen-rich oil shales, then I presume they are using it functionally as coal, not oil. You can also convert coal to diesel–they do in China. But the economics are not convincing. To date, I am not aware that anyone has economically converted kerogen shales to an oil equivalent. That doesn’t mean it can’t be done in the future, but I think Jeffrey has outlined the challenges of the methodologies tried to date.

Jeffrey J. Brown & Steven Kopits I thought I read that “kerogen-rich” oil shale is also a problem to transport because it doesn’t move easily through a pipeline…even a heated pipeline.

Steve, I agree, other than Estonia there are few if any commercial applications of shale oil. As I and Jeffrey says it always depends on oil prices. But that is true for the peak oil argument. Whenever we pull the covers off that one, we find nearly all argument is based upon price.

I am watching this development, fracking, and LENR for a break through (economic and technological). Clearly fracking is moving forward faster than almost any other of the three at this time. The UK and much of W Europe are starting to consider it as a source of gas.

What Jeffrey described was just one of the ex-situ processes. I believe the Red Leaf is a hybrid in/ex-situ process. Regardless, there is little doubt that when prices dictate and technology allows (example fracking), these resources will be utilized.

2slugs, food for fuel has always been a questionable alternative.

What a tremendous resource provided by Prof. Hamilton by his posts and comments by him and others. It can be appreciated by the likes of myself without the technical knowledge to fully appreciate in depth.

But as anyone who lives in our economic system, I do have technical knowledge of living, producing and consuming. Similar to the discussion of the meaning of tight oil, oil shale, and the like, words have meaning, but their relevance can be fleeting. I would add ‘cheap oil’ to that category. It has little relevance to my economic life. All I need is a price, and unlike Goldilocks, I do not categorize. I am fully capable, in my own mind, of determining the best use of of my dollars in each transaction. All I ask is that others quit attempting to alter my choice through political – tax policy, regulation beyond the reasonable minimum, legalize monopoly, and subsidy in attempt to alter the natural competitiveness of different energy sources.

Just let me have a reasonably non-distorted competitive price from which I can choose my actions.

At one point the OP reads, “But whereas Maugeri predicted we’d see 1.5 mb/d additional Bakken production by 2010, Stevens calculated that the area might only add 150,000 b/d or so by 2015.” I believe the 2010 should actually read 2020, yes?

Michael Cain: Thanks much, I’ve now corrected the error.

http://www.bbc.co.uk/news/business-18828714

Shale will free US from oil imports, says ex-BP boss

Excerpt:

“The big growth in oil extracted from shale rock means the US will not need to import any crude within two decades, the former boss of BP has said.

Lord Browne told a conference in Oxford the US would be “completely independent of imported oil, probably by 2030”.

He also said the amount of shale gas in the US was “effectively infinite”.

End Excerpt

My comments:

If we extrapolate current data, I agree that the US will be independent of imported oil, probably by 2030*. My chart showing Global Net Exports of oil (GNE) divided by Chindia’s Net Imports (CNI), ironically enough, primarily using BP’s own data base:

http://i1095.photobucket.com/albums/i475/westexas/ECIPlots2.jpg

*Of course, I don’t think that the Chindia region will actually be consuming 100% of GNE in 2030, but that is the trend line, and the rate of decline in the GNE/CNI ratio accelerated from 2008 to 2011, versus 2005 to 2008.

“In the last ten years, Royal/Dutch Shell has experimented with a new way to produce oil shale, a way that is, at first glance, less destructive and more promising.”

I saw part of a presentation by Shell engineers at Colorado School of Mines. IIRC, the electricity required to support a million barrel per day operation was almost exactly equal to the current generation in the state of Colorado. *Lots* of new generating capacity would need to be brought on line. Not clear how much of it could be from intermittent sources such as solar or wind. Interruptions in the heating process would simply stretch out the time required to cook the kerogen, but it is less clear what happens if there are interruptions in the power used to refrigerate the screen of frozen ground water that prevents liquified kerogen from migrating to bad places.

Personally, I’m relatively sure that are better things we could do with that amount of renewable electricity than bake kerogen out of rocks…

Michael,

An additional excerpt from the Udall & Andrews paper (emphasis added):

The World’s Largest Utility Bill

“Although Shell’s method avoids many of the negative impacts of mining oil shale, it

requires a mind-boggling amount of electricity. To produce 100,000 barrels a day

would require raising the temperature of 700,000,000,000 pounds of shale by 700

degrees F. How much power would be needed? A gigabunch—in rough numbers, about $500,000,000 per year. The least expensive source for electricity is a coal-fired power plant. How much coal, how many power plants? To produce 100,000 barrels per day, the RAND Corporation recently estimated that Shell will need to construct

the largest power plant in Colorado history, large enough to serve a city of 500,000. This power plant, costing about $3 billion, would consume five million tons of coal each year, producing ten million tons of greenhouse gases, some of which would still be in the atmosphere a century from now. To double production, you’d need two power plants. One million

barrels a day would require ten new power plants, five new coal mines. How soon will we know whether any of this is feasible?

Shell plans to do more experiments, before making a go/no go decision by 2010. If the company pulls the trigger, it would be at least three or four years before first oil would flow, perhaps at a rate of 10,000 barrels a day. That’s less than

one-tenth of one percent of current U.S. consumption. In the near term, oil shale is not a silver bullet. It will not delay the imminent peak of world oil production. It will not reduce global oil prices. It will do little to enhance U.S. energy security.

By 2020, oil shale might yield 100,000 barrels a day, but that remains uncertain. Finally, if it turns out that Shell needs more energy to produce a barrel of oil than a barrel of oil contains, all bets are off. That is a fool’s bargain, the equivalent of burning the furniture to keep the house warm. Energy is the original currency, electricity its most valuable form.

Using coal-fired electricity to wring oil out of rocks is sort of like feeding steak to the dog and eating his Alpo.”

If it takes a power plant or two and it is economic viable, or at least private money is at stake by their own decision, then I am all for it. I am for all efficient creation of energy. I am very much of fan of coal for electricity. Modern coal power plants are amazingly clean with relevant pollution. They have done the responsible clean up of their process and deserve their place as one of the important large producers of energy.

Great post and discussion.

Similar to the confusion surrounding oil shale and shale oil, in the French language there is a somewhat similar state of confusion between gaz de shale and gaz de schiste. Specialists tend to prefer the former. Both the Canadian province of Québec and France have shale gas exploration and production moratoria in place.

It is a little disappointing to see that Drain America First! and cheap energy policies remain broadly popular. I have to assume to that Americans enjoy the economic volatility that comes with energy shocks. Or living in a nation that where in the incidence of chronic obesity continues to steadily grow and threatens epidemic proportions. Perhaps Americans enjoyed the recent wildfires in Colorado? Cheap energy contributes to low-density suburban neighbourhoods in semi-arid forests.

In the early 21st century, cheap energy strikes me as a particularly self-loathing social goal.

Jeremy Boak

“The latest economic estimates published suggest economic recovery at $38-62/barrel. Production of shale oil in Utah may begin as early as 2014. The environmental impacts have been exaggerated to the same extent as those of hydraulic fracturing. The author should learn more about oil shale before he so casually dismisses it as a resource.”

I am sorry but there is absolutely no evidence that these estimates are close to the truth. The simple fact is that if oil shale were economic at such a low price point you would have seen hundreds of projects that would seek to take advantage of the opportunity to make huge profits.

I know that as the Director of Center for Oil Shale technology and Research you have a story to sell and funding to apply for. But that does not change the economics and the reality of the market. From what I see in the SEC filings shale companies have a hard enough time staying alive by producing tight oil in shale formations. If they can’t generate positive cash flows or get the debt levels on their balance sheets under control after years of production why should we accept claims that have no real world support?