As Niels Bohr (and others) observed, prediction is difficult, especially about the future. But if the challenge is predicting the number of 20-year-olds 5 years from now, you can get a pretty darn good start if you know the number of 15-year-olds right now.

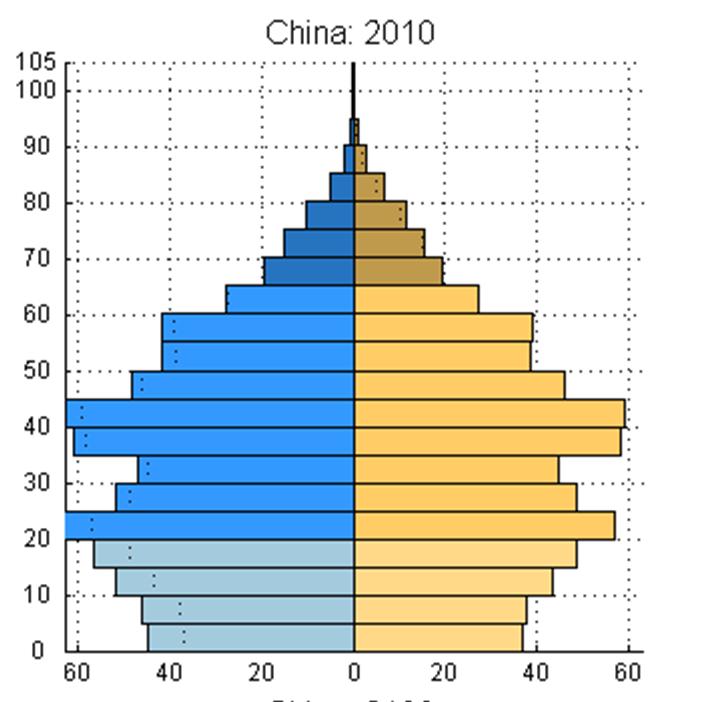

And China has more 45- to 50-year-olds today than it has 5- to 10-year olds. That means that in another decade or so, the number of people retiring will be greater than the number of new young people coming into the labor force. For the last ten years, the number of new 20-year-olds was greater in each succeeding year. For the next ten years, the number of new 20-year-olds is going to be fewer in each succeeding year.

|

A slower growth rate and eventual outright decline in the number of people working has to translate into a slower growth rate for total GDP. It also will lead to a number of other changes, such as an increase in wages as compensation to the scarcer factor is bid up. That in turn will undermine the current basis for Chinese competitive advantage, and could mean lots of changes for Chinese society. Perhaps we will be seeing more stories like this one from Monday’s Wall Street Journal:

Hon Hai’s Foxconn Technology Group arm said a fight among several employees in a dormitory late Sunday in the northern province of Shanxi triggered unrest among roughly 2,000 workers that lasted into Monday morning.

Taiwan-based Hon Hai, the world’s largest contract maker of electronics products for such clients as Apple Inc., said 40 people were hospitalized and an unspecified number were arrested….

“Some people are just not satisfied that Foxconn pays us so little and asks us to work long hours,” a female worker said.

Average wages in China’s manufacturing sector rose 18.9% last year, according to China’s National Bureau of Statistics.

“Younger workers are definitely more aware of their rights and more demanding,” said Geoff Crothall, a China Labour Bulletin spokesman. “They want more out of life than simply earning minimum wage.”

A traditional challenge for economies in which a phenomenal economic boom comes to an end is an overhang of investments that were made when it seemed the rapid growth would continue forever but which end up with limited social value. The subsequent sudden drop in spending can then pose significant challenges. Someone watching for this development might be concerned that investment as a percentage of Chinese GDP has been growing over the last decade, and now nears 50% of GDP. Accounts of newly constructed ghost cities with no inhabitants and inventories of unused raw materials also leave some outside observers concerned about whether the country will follow a smooth adjustment path to its inevitable new growth dynamics.

|

My quibble is this presumes the 20 years now are – and have been – used with any efficiency. Put aside productivity per worker, technology, etc. There are how many 20 year olds in China barely connected to the economy? How many are still in villages and working in a subsistence economy? The slow down in absolute number may yield more efficiency in connecting these people to real work. Again, not productivity but moving into the real workforce.

In a nation of forced abortions do you really see the elderly as an impediment? Euthanasia is simply the other end of the spectrum. Why not a new cultural revolution where the elderly are rounded up and worked to death. Isn’t this basically the communist way, Stalin, Mao, Castro.

And isn’t this essentially the direction that Obamacare is taking us with a board to determine health care based on cost of care rather than quality of care?

Aldous Huxley would not at all be surprised. Soma, anyone?

how long will it take to fill the ghost cities with 20 million chinese becoming urbanized each year?

how long does it take to get between cities 100 miles apart at 350 KPH?

Jonathan makes a good point. Also, Chinese consumer spending is only 1/3rd of GDP. Gradually increasing that to 50 or 60 percent will fuel China’s economy for a long time.

I’m not sure it’s the type of issue we might think. China really doesn’t have much in the way of what we call Social Security. Worse, the traditional Chinese reputation (at least as perceived among Westerners) of the children taking care of their parents is going away. My observations (which are similar to what the Chinese language papers report) is an erosion of the old ways. Sure, some children are devoted, but many see their elders as burdens, and don’t provide the support that was expected. I foresee lots of hungry Chinese seniors.

J. Hamilton is a first rate economist; if this is his analysis of the Chinese economy – we’re in trouble; and the comments? ‘nuf said.

I thought this post might be about current trends in China’s economy, as oil consumption is down and electricity consumption is up only 3.6% yoy and declining. If the country is not in recession, it certainly seems to be headed that way.

************

China might grow old before it grows rich, but I wouldn’t count on it. The Chinese work ethic is legendary, and I wouldn’t be surprised to see the Chinese working longer than expected.

************

“Average wages in China’s manufacturing sector rose 18.9% last year…” This exemplifies trickle down economics. Inititially, companies like Foxconn and their owners do well. Over time, the labor market tightens and workers do better. That’s what we’re seeing now.

Good timing! — I just finished going through population pyramids with my Japan economy class, then talked about the (two) potential demographic dividends of lower then higher dependency ratios and aggregate savings rates. Today I intend to talk about the slowdown in investment in Japan in the 1970s (if you read contemporary [Japanese-language] reports, and then go to the data, this was not in timing or detail a first oil crisis story), having just presented the open-economy savings-investment balances. And then we’ll look at the S-I data…initially the cavalry came to the rescue, Ronald Reagan with his (de facto) strong dollar-domestic stimulus policy, helped by domestic budget deficits. Then Japan tried the bubble route, while continuing the deficit spending route, not a happy ending.

I probably teach a China’s economy course next term (I’ve been doing it for 25 years, no content from the first iteration remains!). This theme will be present, a nice compendium edited by Loren Brandt and Thomas Rawski, China’s Great Economic Transformation (2008) in fact covers this approach in several places — among others Wang and Mason on demographics, including the content of this post, Perkins and Rawski on growth models.

The data are now old, but the analytics are sound and (as noted) that labor force growth will slow and the retired population will grow has been reflected by economists working on China for over a decade.

Read: “The Gray Dawn”, Peter G. Peterson

Chinese worker’s productivity is still only a fraction of German and Japanese workers, and has a significant room to grow.

There are many factors that shall help in Chinese productivity growth: the country’s investment rate is much higher than it is in the West; the state has huge foreign exchange reserves to assist in the quest to acquire best world technologies, know-hows and to grow domestic expertise, ….

Even if Chinese overall workforce is going to shrink at some point (as is intended by their communist party leaders), if the country can maintain high productivity growth, their GDP will still grow much faster than of the countries in the West for many years.

“A slower growth rate and eventual outright decline in the number of people working has to translate into a slower growth rate for total GDP.”

This sounds logical but why is it necessarily true so long as the population is still getting bigger?

Old people still spend money and still have wants and needs. They just have wants and needs that are different from young people.

The shortage of workers creates a problem of supply for those wants and needs but is it an insurmountable one if technology can increase the productivity of the remaining workers?

There’s also possibly a problem of purchasing power for the non-working population. But is this insurmountable if things like health care are provided by the state?

The statement may very well be true. Just raising a couple questions.

I wonder how many people get the distinction Neils Bohr was making and how many think he was engaging in a Yogi Berra-type observation.

I agree with the first comment. My (perhaps unenlightened) impression is that a large part of China’s population is not yet connected to the global economy.

I wonder how many people get the distinction Niels Bohr made and how many think it was a Yogi Berra-type observation.

I agree with the first comment. It is my (perhaps unenlightened) impression that a large part of the population in China is not yet connected to the global economy.

“A slower growth rate and eventual outright decline in the number of people working has to translate into a slower growth rate for total GDP.”

I’d go along with “…is likely to translate…,” especially in China’ case, where the rate of investment has already been very high, but the statement as phrased is clearly not true in general, unless this is ceteris paribus for changes in capital intensity and productivity. In many cases (and I doubt China is one of them, but it might be), an increase in capital intensity (effectively substituting capital for labor), or even a change in the Solow residual, could offset the decline in working population. In general, one might expect such forces to exist, since reduced labor supply would raise the incentive to substitute capital for labor.

I should have clicked on the first link before making my comment. And apologies for posting twice.

China must boost consumption to sustain economic growth. China is under the high and rising working age population for the next ten years that may be like US during 1990 or Japan in 1980. Government should start to relax consumption lending and support welfare program. The high working-age population will cause the high investment and saving and investment/GDP in China is already high. The way to sustain to economic growth is only consumption. Government should use monetary and fiscal policies to support high consumption growth and that will help reduce risk of overinvestment in China.

Sorry if I am late responding to this.

B Turnbull is correct. Productivity has much room to grow. Besides, should aggregate real GDP growth be the primary implicit goal as this article implies or should real per capita GDP and per capita wealth head the list of primary goals?

Even without these easy to forecast demographic changes, the profession should expect lower growth rates going forward. There has never been an economy that has maintained 7% to 10% real aggregate GDP growth rates for several sequential decades. The implicit and most unrealistic expectation is China can maintain these growth rates when precedents are completely absent and the economic growth literature abounds with different stories as to why aggregate growth rates are likely to decline.