Several sources reported that the 2012 Republican Platform would call for a commission to explore the possibility of the U.S. returning to a gold standard. However, the final document makes no mention of gold, and instead seems to have settled on a proposal that is unlikely to do any harm:

President Reagan, shortly after his inauguration,

established a commission to consider the feasibility

of a metallic basis for U.S. currency. The

commission advised against such a move. Now, three

decades later, as we face the task of cleaning up the

wreckage of the current Administration’s policies, we

propose a similar commission to investigate possible

ways to set a fixed value for the dollar.

I thought it would be worthwhile to review some of the reasons why we should be thankful that saner heads seem to have prevailed.

Here’s the core concern. In January of 2000, an average U.S. worker earned $13.75 an hour, and the price of gold was $283 an ounce. If you put in 100 hours of work at that wage, you would earn $1375, which would have been enough to buy a little less than 5 ounces of gold at the time:

Last month, the average U.S. wage was up to $19.77 an hour, but the price of gold had skyrocketed to $1623 an ounce. That means that for 100 hours of labor, the average worker today would only receive 1.2 ounces of gold. Here’s what average U.S. wages would look like if they were reported in units of ounces of gold earned per 100 hours instead of in the usual units of dollars earned.

|

But the essence of a gold standard is that the units used in the above graph would become the units in which wages and prices would get reported and negotiated. Under a gold standard, a dollar always means the same thing in terms of ounces of gold that it would buy. So for example, if the dollar price of gold today was the same as it was in January 2000 ($283/ounce), and if the real value of gold had changed as much as it has since then, the dollar wage that an average worker received would need to have fallen from $13.75/hour in 2000 to $3.45/hour in 2012.

And the problem with that is, for a host of reasons ranging from minimum wage legislation, bargaining agreements and contracts, institutions, and human nature, it is very, very hard to get workers to accept a cut in their wage from $13.75/hour to $3.45/hour. The only way it could possibly happen is with an enormously high unemployment rate for a very long period of time. This strikes most of us as a pretty crazy policy proposal.

To which the gold advocates respond with the claim that if the U.S. had been on a gold standard since 2000, then the huge change in the real value of gold that we observed over the last decade never would have happened in the first place.

The first strange thing about this claim is its supposition that events and policies within the U.S. are the most important determinants of the real value of gold. According to the World Gold Council, North America accounts for only 8% of global demand.

|

The surge in income from the emerging economies rather than U.S. monetary policy seems the most natural explanation for recent moves in the real value of gold.

|

Moreover, between 1929 and 1933, the U.S. and much of the rest of the world were on a gold standard. That did not prevent (indeed, I have argued it was an important cause of) a big increase in the real value of gold over that period. Because the price of gold was fixed at a dollar price of $20/ounce, the increase in the real value of gold required a huge drop in U.S. nominal wages over those years. The theoretical outcome described in the first figure above is exactly what was observed to occur in practice. The problem was solved immediately after the United States abandoned the idea of fixing the price of gold at $20/ounce.

|

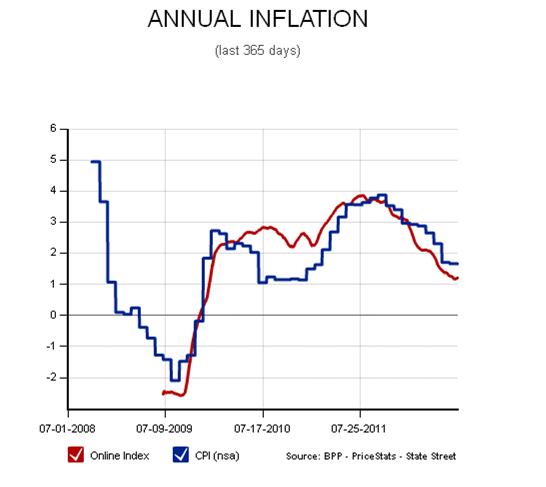

But the really odd thing about the current interest in returning to the gold standard is the timing. The proposals come after a decade in which U.S. inflation has been remarkably tame and stable. Here for example is the average U.S. price level as measured by the PCE deflator, shown on the same scale as gold prices.

|

Part of the explanation is perhaps that hardcore gold bugs further disbelieve published government inflation measures such as the PCE deflator or the consumer price index, and likewise disbelieve the objective averaging of posted internet prices reported by MIT’s Billion Prices Project.

|

For any of you who still believe that Shadowstats provides the only reliable U.S. inflation data, Paul Krugman supplies an amusing observation. The price of a 2012 subscription to Shadowstats is $175.

For comparison, six years ago the price was … $175.

It’s impossible to conduct a purely rational discussion about gold. You need to bring in the moral. So for example, many people are attracted to the gold standard because they see it as reflecting the natural order, as a way of honoring the intentions they read into the Bible. They see “fiat money” as fundamentally dishonest, to some even blasphemous. I’ve heard comparisons to the Tower of Babble, meaning fiat money is human hubris.

I think you might reference in that regard the history of bimetallism and particularly Bryan’s famous line, “I will not help to crucify mankind upon a cross of gold.” The silver bugs wanted to bring in silver because they saw the gold standard as immoral. Quite a turn over the last century plus from one condemnation to the next.

jonathan I’ve heard comparisons to the Tower of Babble

The Tower of Babble is what you find at a GOP convention. The Tower of Babel is what you find in the Bible.

CPI is mentioned but an omission is made, this CPI is whatever is the recognised basket,save food and energy.

No mention is made of the existing assets, Central banks would have to cover through gold holdings:

18 trillions USD are the assets amount in the books of the CBs (last BIS annual report).

This amount could be a good starter for setting the minimum gold reserves back up requirement.

Are the Central banks existing gold holdings lsrge enough:

Top Official Gold Holdings Tons Held

1. United States 8,133.5

2. Germany 3,401.0

3. IMF 2,814.0

4. Italy 2,451.8

5. France 2,435.4

6. China 1,054.1

7. Switzerland 1,040.1

8. Russia 792.3

9. Japan 765.2

10. Netherlands 612.5

11. India 557.7

12. ECB 502.1

Source: World Gold Council

What price for one once is needed to cover the 18 trillion USD assets through the existing CBs reserves?

How many more tons of gold, are available at whatever gold price is to be be set?

Would the eventual shortfall in gold reserves requirement be available through open market purchase?

How would the gold price settlement be made, printing more fiat money?

As for Shadowstats subscription price,it must be established in accordance with the GDP growth after netting off the Shadowstats GDP deflator.

JDH:”But the really odd thing about the current interest in returning to the gold standard is the timing.”

One theory here is that politics are driven by that class that has enjoyed the most recent financial success. Hard core gold bugs have surely enjoyed plenty of success over the last ten years, and are therefore capable of using their financial clout to get their favored policies onto the radar screen.

Note that the last Gold Commission was brought into law by Jessie Helms in October 1980. Gold had run up from $35 to $850. According to Anna Schwartz, that was the third bit of pro-gold legislation enacted by Helms:

“On his initiative, the right to include gold clauses in private contracts entered into on or after October 28, 1977, was enacted (P.L. 95-147). The program of Treasury medallion sales, in accordance with the American Arts Gold Medallion Act of November 10, 1978, was a second legislative initiative of the senator (P.L. 95-630). He was unsuccessful in subsequent efforts in 1980 to suspend Treasury gold sales and to provide for restitution of IMF gold.”

Rumour has it that that Helms was friendly with the gold lobby.

So like the late 70s, the gold lobby’s commodity of choice has risen in value, therefore their political agenda benefits from a large financial tailwind.

Just a theory, of course.

The US wage chart shows how inflation is simply masking lower wages.

“it is very, very hard to get workers to accept a cut in their wage from $13.75/hour to $3.45/hour. ”

so instead you lie to them and reduce the purchasing power of their money?

“U.S. inflation has been remarkably tame and stable.”

gas and food prices have climbed much higher the the quality of things we buy has gone down. You get smaller portions, the cattle are fed w/ corn not grass etc. Again, this is all hiding reality.

JP koning “One theory here is that politics are driven by that class that has enjoyed the most recent financial success. ”

the bankers are horrified by the prospect of a gold standard and so is washington. Between those two you have most of one percent.

The problem is human nature. When bureaucrats are given the power to counterfeit money and create purchasing power out of thin air they will take every opportunity to do so. A hard money standard protects savers and workers and prevents theft via inflation. A gold standard is not necessary. Just open up the system to competition by letting the private issuance of money and the market will pick the best medium of exchange.

” The only way it could possibly happen is with an enormously high unemployment rate for a very long period of time.”

Wow, we could have 8.3% unemployment for 48 months. Boy, am I gald we dodged that bullet.

One theory here is that politics are driven by that class that has enjoyed the most recent financial success. Hard core gold bugs have surely enjoyed plenty of success over the last ten years, and are therefore capable of using their financial clout to get their favored policies onto the radar screen.

If the theory is correct the class that has enjoyed the most success over the past three decades has been the financial sector. Its top five companies have a much bigger market cap than the entire gold mining sector. And if you added up all the gold in the world its value comes out to be around equal to what the annual US deficit plus the annual increase in unfunded liabilities come out. That makes the holders and miners of gold small players in this game and gives them no hope of influencing the political system.

Fortunately, in the end the market will decide what happens. And given the fact that all fiat money systems have failed miserably history is on the side of real money.

Debates about a gold standard are just proxies for justifiable dissatisfaction with the failings of discretionary monetary policy.

Playing make believe games such as what if we had been on a gold standard since 1980 but nothing else had changed are fairy tales. The entire reason for even considering any of this is the belief that discretionary monetary policy has altered the economy of the past 30 years in a bad way. That we would be in a different world had we had better monetary policy.

Put differently if you wish to discredit a gold standard you must falsify the assumption that our path would have been different.

But even accepting you claim that nothing would have changed – then nothing would have changed. Wages would be the same relative to other prices.

Sudden radical deflation MIGHT be disasterous, but slow deflation was the norm prior to the federal reserve – 19th century growth was nearly double that of the 20th century.

Is the price of gold really driven by its use value as jewelery ?

If as is often argued the price of gold is a reflection of its use as an inflation hedge, it is irelevant whether it is purchased by investors in the US or dollar denominated investors elsewhere.

I find it extremely difficult to believe that gold prices have shot up driven primarily by demand for jewelry. Didn’t Julian Simon demonstrate such presumptions false with other commodities ?

Like Fossil Fuels there might be some absolute limit to the amount of Gold – but for the moment we do not know it. And like similar commodities, normal demand increases cause compensating increases in supply. Oil as an example has not increased in price by a factor of 5 since 2000, or even 1980. But in the short run its price is highly volatile subject to small variations in supply and demand.

“[W]e should be thankful that saner heads seem to have prevailed.” It would be nice to see a surge in such sanity in those precincts.

America’s founding fathers has never liked the “gold standard” and instead went with a bi-metallic standard, even though they knew it was flawed. It was invented by the Rothchilds through their London investment houses to reap the winds of colonalization until the 20th century when it blew up in their faces. Central Banking and Securitizing also came from these “houses” think tanks roughly all at the same time.

The US basically was forced onto it 1873 and struggled to stay on it in its lifetime. The fascination with it, should lead people to figure out why these “sect” of persons want this type of monetary system. Maybe then, it would describe a situation.

why doesnt the govt sell a thousand tons to the Indians and Chinese?

As a good approximation when real interest rates are below about 1.8% the price of gold will rise. When real interest rates are above about 2.0% the price of gold will decline.

Check it out for yourselves over the past 40 years and then give us a theory about why this is so.

Note this does not say anything about what the price level of gold should be, but only why it goes up and down.

The current status quo re: monetary policy is not a good definition of sanity. rather the contrary

Professor,

I have great respect for you and so I am not going to assume that your ignorance is willful ignorance.

First your core concern –

Since 1913, about the time the FED was created, the CPI shows the dollar has lost 95% of its purchasing power. Since 1971, about the time Nixon took us off of gold, the dollar has lost 80% of its purchasing power. Comparing the commodity price index from 1792, about the time Alexander Hamilton put us back on gold, until 1933, about the time FDR broke the link to gold, the purchasing power of the dollar was essentially the same. Wages from 1792 until 1933 increased more than 4 fold so the purchasing power of the dollar exploded.

Even looking at more modern times your hypothetical analysis makes no sense. The National Average Wage Index reports that the wage in 1951 was $2,799.16, yet in 1971 the wage was $6,497.08. Using your logic it is absolutely impossible for wages to increase 2.3 times if we were on a gold standard with the dollar at $35/oz.

The spot price of gold does not change with the inflation rate or vice versa. This is a red herring inflationists throw at the gold standard. Those who make this assertion are foolish and shallow thinkers. Gold is a leading indicator.

Contracts lock prices in place for 30 and sometimes 40 years and these contracts do influence inflation but not the spot price of gold: consider mortgages, long-term leases, bonds, and a host of other such instruments. The inflation FDR caused when he debased the dollar from $20/oz to $35/oz in 1934 did not appear in price indexes until 15 to 20 years later. What your graph is showing is the lost purchasing power the dollar is going to experience over the next 15 years. Anyone saving dollars today is going to find them significantly debased when they retire. The FED is killing the savings of the elderly. Even your modest proposal of 2% per year means a 20% debasement in 10 years anyone planning to retire in 10 years would need to make a 20% return just to stay even.

Then concerning the gold standard and economic health, consider that the average price of gold in 1982 was $375.82 in 1995 it was $383.79; for almost 13 years the gold/dollar ratio essentially remained the same. Yet, the National Average Wage Index in 1982 was $14,531.34 while in 1995 it was $24,705.66. Then from 1995 until 1999 Greenspan allowed the average price of gold to fall almost 30% to $278.98. Greenspan understood the importance of the gold signal to inflation but he totally ignored the gold indicator of deflation. The result was the Greenspan 2000 deflationary recession.

Then you chase another red herring. Only 8% of the gold demand is in the US so 92% is in the rest of the world. So what? 90% of all the gold used in the world is for either jewelry or investment purposes and there is no way to know how much of the jewelry is actually investment. Only 10% is used in actual industrial use and most of that is recovered because of the inert chemical properties of gold. Over 85% of all the gold ever mined in history still exists. That is a phenomenal statistic.

Then you return to the period of the Great Depression to prove a point about gold as if the thousands of years gold has been used as a standard are meaningless. The Great Depression was an economic contraction because of horrible government policies it was not driven by monetary events, just as our problems today are caused by horrible government policies not by monetary events.

Then you reveal more of your lack of understanding of the monetary importance of gold by stating that since there is low inflation a gold standard does not matter. There was low inflation before the Greenspan deflationary recession but the gold standard was screaming its warning. When our economy was on a gold standard we did not have inflations and deflations that lasted only a matter of months. Robert Mundell has observed that the crash of 2008 was significantly caused by the Federal Reserve’s massive increase in the money supply followed by a massive reduction in the money supply all within a period of months. In today’s electronic world a change in the money supply is felt almost instantly in the markets. The contraction in the money supply in the summer of 2008 coupled with the massive stimulus passed by congress in October of 2008 sent markets reeling.

The gold standard is the only tool that has proven to give traders a stable unit of exchange. When traders are insecure in the unit of exchange they waste huge resources hedging against monetary losses. For a real world example a few years ago we purchased a large machine from Germany of almost $1,000,000. We normally give a 5% allowance to cover such things as currency exchange differences. By the time we received the machine 6 months after it was ordered the dollar lost purchasing power against the euro and cost us 9%. But as a company we were not allowed to take that as a loss. Today we realize some gains from dollar/euro exchange. Guess what? The Treasury makes us pay taxes on the phony gain.

The government does not want the gold standard because they have created a massive system built on inflation and windfall returns on taxes on exchange differences. Our monetary situation is awful today not because of inflation but because from month to month traders do not know what the dollar will be worth. It is an old example but it is a good one, imagine the havoc in the construction industry if every morning builders had to go to the Federal Reserve to find out the length of a foot. They over order for one job because after the material is received the builders find out that the unit of measure has changed and what they thought was correct is either too much or too little. This is what every trader in the world faces every day, conditions that did not exist in the 19th Century.

“Since 1913, about the time the FED was created, the CPI shows the dollar has lost 95% of its purchasing power. ”

So one hour of work buys just 5% of what it used to buy?

Steve

“Since 1913, about the time the FED was created, the CPI shows the dollar has lost 95% of its purchasing power.”

I’ve seen the claim above many times. The following from Robert Fogel makes for a very interesting contrast while also providing some evidence of why the claim above is a logic defying falsehood

“… Between 1875 and 1995, the share of family income spent on food, clothing, and shelter declined from 87 percent to just 30 percent, despite the fact that we eat more food, own more clothes, and have better and larger homes today than we had in 1875. All of this has been made possible by the growth in the productivity of traditional commodities. In the last quarter of the 19th century, it took 1,700 hours of labor to purchase the annual food supply for a family. Today it requires just 260 hours, and it is likely that by 2040, a family’s food supply will be purchased with about 160 hours of labor.”

Steve and Ray,

You do a cute slight of hand. We are not talking about commodities, or efficiency of labor, or innovation. We are talking about the stability and practical use of the currency. The fact is that a unit of labor today purchases about what it has always purchased. Also through technology and innovation we have greatly improved the world. But this has all been despite the debasement of the dollar not because of it.

Steve, does one hour of labor exchange for the same units of dollars today as in 1913? Is a unit of labor worth that much more today as in 1913?

Ray, does a loaf of bread cost today what it did in 1913? If the loaf of bread so much better today than in 1913 that it warrants the increase in the exchange value against the dollar?

The fact is that the dollar held its value during the 19th Century but in almost any terms crashed during the 20th Century. Do you know the difference in monetary policies?

pccm,

Respectfully, you don’t know what a gold standard is.

Consider this, you are a builder and you receive a contract to build a house. You receive architectural plans for the construction. You reference the Federal Reserve rate for board fee and calculate your need. You call your lumber supplier and place an order for 15,000 board feet. The following day the lumber supplier checks the Federal Reserve rate for board feet and pulls lumber to fill your order. You receive the order and begin to build.

The home buyer visits the site and is horrified to find that the rooms are all smaller than were originally intended. You and the buyer go to your office and reference the architectural plans. You have followed them exactly as shown, but the home buyer sees that the original unit of length is now 10% less than was intended at design. While correct at the time, the Federal Reserve determined that to increase economic activity they would change the unit of measure. As you are attempting to sooth the anger of the buyer your foreman enters the office and informs you that you are short lumber. It seems that from the time you place your order until the time the supplier shipped the lumber the Federal Reserve changed the length once again because the economy had not yet recovered.

So the now the question, does the federal government need to own a massive amount of board feet of lumber to establish a standard to define the length of lumber?

A gold standard is an established unit of measure for the dollar. The dollar today is totally unanchored to anything in reality and changes value just as our boards did in the our analogy above. The dollar only has value because of the institutional memory of traders back to when the dollar actually had an exchange value. Initially the Federal Reserve attempted to maintain the value of the dollar, but as we are seeing the exchange value of the dollar is rapidly eroding. The dollar is becoming less and less reliable as a unit of exchange and our architect, builder, and supplier are all hedging their business to try to cope with it.

Under a gold standard the dollar is simply standardized at an exchange value with gold, let’s say $1,600/oz today. That means that anyone can take 1,600 one dollar bills to the Treasury and receive one ounce of gold. The Treasury doesn’t have to hold that ounce in a vault. All they have to do is go to the open market and buy one ounce of gold and give it to the person exchanging 1,600 dollar bills. This means that the architectural plans will be drawn at an exchange ratio of 1,600:1, the builder will order at 1,600:1, and the supplier will deliver at 1,600:1. No one has to rely on which side of the bed “Helicopter” Ben got up on.

The price of gold is simply a reflection of the global fiat money supply. The amount of gold is increasing at a stable +/- 1.5% annually while fiat currencies are increasing at a much higher rate. The rate of change in the two create an ever decreasing ratio of Gold to global money supply thus pushing the price of gold up at approximately the same ratio over long time periods. Given this tread gold prices will continue to increase due to the anticipation of continued increases, inflation, of the fiat money supply. The amount of gold is a known and predictable standard whereas the quantity of fiat money supply is not and has never been without such a standard.

On the gold standard, all prices depend on what happens to the relative price of gold. Since that price is fixed, if the relative price of gold rises that means you will definitely have deflation. The gold standard is a nutty pernicious anachronism that needs to be re-killed every time this phoenix rises from the ashes. God help us.

Ricardo: The U.S. was not on a gold standard from 1951 to 1971. We supposedly would allow foreign central banks to exchange their dollars for gold at a rate of $35/ounce, but there was an implicit understanding that none of them would actually try to do that. Private U.S. citizens were actually prohibited by law from many forms of holding gold.

That this was not a true gold standard should also be obvious from your own numbers on inflation during 1951-1971.

Gold means open convertibility of dollars to gold at a fixed rate. Under a gold standard, if the value of other items (such as an hour of labor) changes relative to gold, that means that the value of labor in terms of dollars has to change.

And that is why a gold standard over the last decade would have been a disaster for the U.S. economy. The value of gold relative to labor changed very drastically, which would have required, under a gold standard, for the dollar compensation per hour of labor to change drastically.

For those of you serious about understanding this issue I encourage you to watch this video of the final hearing of the Domestic Monetary Policy Subcommittee of the House of Representatives August 2, 2012.

Member of the Domestic Monetary Policy Subcommittee – ron paul. Nuff said.

There was an interesting news segment on a week-long trade fair for gold standard folks. It was an entire tent city like Burning Man for gold bugs. They exchanged food, water, liquor, guns, trinkets, etc all for gold instead of cash. The funny part was that every trading booth had a calculator on the table so that they could determine the amount of gold for a loaf of bread, for example, by converting it to dollars. They knew the cost of a loaf of bread in dollars but had no idea what it was in gold. Further, every day of the fair they had to recalculate prices because, although the price of bread in dollars was the same, the price of bread in gold changed daily by significant amounts.

I have a question – how does the gold standard affect the government’s ability to go into debt?

I think a lot of the “gold bugs” would like to see less govt. debt and that is why they would like to return to the gold standard. I think they worry that the large amt of debt we are accumulating will be unsustainable (due to slowing population and technological growth, and perhaps usage of exhaustible resources) and therefore cause a decrease in welfare for some future generation(s).

Amy: The debt and the government’s fiscal operations are separate decisions from the gold standard. However, a given trajectory of the debt may be incompatible with continuing to be able to maintain a given fixed exchange rate between dollars and gold. This is one of the reasons that a gold standard can itself be destabilizing— investors correctly see that the fiscal policy and gold standard are on a collision course, and begin to speculate that gold parity will be the thing to go.

JDH- so basically people distrust the government so much that they think a gold standard won’t be respected. Yet we are supposed to trust this same entity with creating good policies?

If a governments fiscal policy is on a collision course with the gold standard change the government.

Thank you! 🙂

Ricardo:

How/why do you trust the government to set the fixed price of gold properly? If you are a proponent of free markets, what business does the government have setting a fixed dollar price for gold?

Shouldn’t the dollar price of gold be determined on the… free market?

You might be interested in my recent research paper The Golden Dilemma (free download). My coauthor Claude Erb and I analyze six views of gold.

“It is impossible to grasp the meaning of the idea of sound money if one does not realize that it was devised as an instrument for the protection of civil liberties against despotic inroads on the part of governments. Ideologically it belongs in the same class with political constitutions and bills of rights. The demand for constitutional guarantees and for bills of rights was a reaction against arbitrary rule and the nonobservance of old customs by kings. The postulate of sound money was first brought up as a response to the princely practice of debasing the coinage.”

–Ludwig von Mises. The Theory of Money and Credit

JDH wrote:

Ricardo: The U.S. was not on a gold standard from 1951 to 1971.

Professor,

We were on as much of a gold standard from 1951 to 1971 as we were during the Great Depression. We should be able to agree that the world left the gold standard to fight WWI and never returned. The standard that led to the Great Depression was a pound sterling/dollar standard, not a gold standard, and individuals were prevented from holding gold and gold clauses in contracts were outlawed. So my numbers about 1951 to 1971 are as valid as your number for the Great Depression.

I have to admit that the continued popularity of Gold Buggery is indeed baffling.

Those calling for a return should explain the following:

1. Why do you want the Chinese and Indians to become the wealthiest people in the world? Yes, the US leads the “official” holding but the unofficial holding are huge and the Indians and the Chinese possess the bulk of them. An inflation of the value of gold necessary to support the money supply will make a lot of these people into multi-millionaires.

2. If you don’t trust governments to print money, why do you trust them to tell you how much gold they have? If you know your gold history you are sure to be aware of the wide spread suspicions of French overstating their gold reserves in the 1920s. Even today the true amount of U.S. gold is a Classified Secret.

3. Following on number 2, the idea that there were past periods of price stability under the Gold Standard must have come from the pages of “The Gold Standard” comic book series. The rejoinder to this is always the “well there never really was a true gold standard”, which then makes me ask–Why in heaven’s name should we return to it then?

JDH wrote:

Gold means open convertibility of dollars to gold at a fixed rate. Under a gold standard, if the value of other items (such as an hour of labor) changes relative to gold, that means that the value of labor in terms of dollars has to change.

And that is why a gold standard over the last decade would have been a disaster for the U.S. economy.

Professor,

This great mechanism of the gold standard is that it does in fact allow goods and services to change in exchange value relative to gold. Gold is the most stable and the most monetary of all commodities.

It is quickly recognized that a price index is only as good as the basket of goods on which it is based. This is one reason the use of a price index to determine inflation or deflation is so faulty.

Any system that does not allow prices to adjust around a central anchor is very destructive. This is the problem with systems based on “price stability.” They inaccurately indicate the proper median price because they are distorted by exogenous influences on prices which cause distortions in the index.

What you see as a weakness of the gold standard is actually one of its strongest strengths in allowing the economy to breathe.

During a drought wheat should become more expensive. Under a gold standard the price will reflect the proper demand/supply ratio. Wheat becomes more expensive relative to other commodities but the only true measure of how much is to compare it to a commodity that will not be impacted by the drought, gold. The fact that 90% of gold useage is monetary gives gold an amazing stability.

Gold is not perfect but it is miles ahead of any other standard.

Nick,

Thanks for a very good question. It is claimed that a fiat monetary system is a market system but in all fiat systems the supply of money is determined by a central authority not the market. Like any market the supply of a good determines its exchange value with other goods. The same is true of money. So when the government changes the supply of money it changes the market price. The price is not really set by the marekt but the price tells us what impact the government has had on the exchange value.

In a gold system the object is to signal the optimal ratio of goods against one another in a common unit so that comparison is efficient. The best method is to find a very stable commodity and determine the exchange ratios of the less stable commodities to that stable commodity. That will essentially tell you the ratio of goods to one another in a common unit of exchange. Gold is by far the best and most stable commodity.

Now a monetary authority can set the exchange value of a money substitute to the dollar and it really doesn’t matter where as long as it does not change once it is set. For example the dollar, the euro, and the yen all exchange an significantly different values, but if they were all tied to gold at their market exchange rate at a point in time then all three currencies would exchange in different amounts in the currency but the same amount in gold. Essentially, if you were in New York City and a hamburger cost 5 dollars, it would cost about 4 euros, and about 390 yen, but the hamburger would actually cost the same in terms of the purchasing power of each of the currencies, and the same in units of gold. The price set by the monetary authority would simply be a standard, but the standard could be different as long as it was understood just as the English system of length is just as good as the metric system as long as you know which you are using and what the standard actually means.

Where the confusion of the price of gold comes in is during conversion from a fiat system back to gold anchor. Because traders have an exchange value in dollars built into their models a conversion price either too high or too low could cause economic dislocations for a period of time until the exchange ratio became common. For that reason you want the conversion ratio as close to the market as possible at the time of conversion.

Amy asked:

I have a question – how does the gold standard affect the government’s ability to go into debt?

Amy,

It doesn’t. But it does force the government into reporting the debt honestly and not using the printing press to steal value from the citizens. The reason the monetary authority under a gold standard is required to exchange its currency for its gold is to force it to be honest in its creation of currency as a representation of value. If they issue too much currency they will lose money when they go to the open market to buy gold to exchange for their currency. This forces them to exercise care in issuing the currency.

This is exactly the condition that those oppose to the gold standard scream about. It takes away their ability to steal by stealth, to counterfeit.

Randell wrote:

On the gold standard, all prices depend on what happens to the relative price of gold. Since that price is fixed, if the relative price of gold rises that means you will definitely have deflation. The gold standard is a nutty pernicious anachronism that needs to be re-killed every time this phoenix rises from the ashes.

Randell,

You engage in shallow thinking. What do you mean by “the relative price of gold rises?” How can the relative price of gold rise? If you have studied history, the best place for gold is the Golden Constant by Roy Jastram that gives the history of gold exchange values back almost 300 years. You will find that gold does not change in its exchange value, but the currencies change significantly. You confuse mismanagement of the currency with gold exchange value.

Dr. Morbius,

1. Why would the value of gold increase with a return to a gold standard?

2. Why does it matter how much gold the government holds on a gold standard if you can buy gold on the open market?

3. With the success of the gold standard for thousands of years why did we ever leave it? A hint, the sovereign always trys to debase the currency to make himself wealthy.

Ricardo: The U.S. minted a $20 gold coin through 1932, which was fully equivalent to the $20 green bill printed at the time (the one with the picture of Andrew Jackson). The $20 bill in fact described itself as a “gold certificate”, with a note on the bottom indicating it represented “twenty dollars in gold coin value payable to the bearer on demand.” For you to suggest that this system was comparable to the one from 1951-1971 is difficult to comprehend.

And as for your question to Randall Parker, whom you ask “What do you mean by ‘the relative price of gold rises?'”, the answer is exactly and accurately given in the first figure above. Over the last decade, the price of gold relative to one hour of labor rose by a factor of about five. This is indeed the central point of the entire discussion here.

You make a very good point about the difficulty the US might have had adjusting wages down if there was no inflation. But overall this piece is just carrying on the tradition of the pro- and anti- gold standard camps talking past each other without getting at the real issues where they disagree.

The absolutely crucial thing to understand about the gold standard is that it does not fix the broad money supply. Broad money is made up mainly of bank deposits which are not currency but claims to currency. The gold standard does not put any limits on the quantity of bank deposits, other than inflation, popular trust and the potential discipline of runs on bank deposits and the currency.

Moreover, because most gold standard implementations counted foreign currency reserves so long as they were gold-standard as equivalent to gold reserves, even the collective base money supplies of gold-standard countries were substantially greater than their collective gold reserves.

You’re telling only part of the story of the gold standard in the Great Depression. The other, crucial but ignored part is the rapid expansion of credit and broad money during the 1920s, while inflation remained low as the US was in a process of intensively bringing new resources to market (somewhat similar to the China effect in the 2000s).

The first stage of the depression was the massive liquidation of margin loans surrounding the 1929 crash, which kicked off a process of debt deflation somewhat similar to but more powerful in its time than the recent mortgage foreclosure crisis. That set off a self-reinforcing run on bank deposits and currency as deflation made it sensible to withdraw bank deposits and convert currency into gold, and the extinction of bank deposits and currency accelerated the deflation. This turned into a panic run on banks and currencies, in the US and Europe. Understanding that gold reserves were far fewer than bank deposits is essential to understanding the widespread collapses of banks in the early 1930s.

The gold standard folks have split into two camps over how to prevent such calamities from occurring again. The Hayekians eg Ron Paul want to eliminate central banks and introduce multiple, privately issued currencies. The Rothbardians want to require all bank deposits to be 100% reserved.

If you want to take on the contemporary gold bugs, you have to take on the proposals of one or both of their camps. I think they are both radical nuts, but not for the reasons you have given, which are a somewhat confused attack on the historical gold standard. You will only encourage gold bugs by convincing them that their critics don’t understand what actually went on in the 1930s.

Ricardo,

I’m still at a loss.

If the government says gold = $1000 per ounce, what happens when the demand for gold rises (let’s say there’s an imaginary shift in the demand curve because Apple has found a new industrial use for gold in iPads). Shouldn’t the price of gold rise?

As for the recent rise of real gold prices and what that would have been like if the world were on the gold standard – well, tough to sort out. Obviously you should start from 1971, not from 2000, which was the end of a period of falling gold prices that partly resulted from the end of the gold standard. You’re right though that rising demand for gold in Asia would have driven appreciation of gold-standard currencies. That would have weakened their exports to non-gold-standard countries, and driven some nominal deflation, but not nearly as radical of a nominal deflation as you’re suggesting. So long as nominal deflation is less than real growth, no cuts to average wages are necessary. It’s not obvious that the world would be worse off.

I am a huge fan of Econbrowser. However, this article is deeply, deeply flawed from the very beginning. The fact that your analysis begins in the year 2000 grossly exaggerates your reported findings. I would be interested to see adjusted results of your analysis if your measuring period began in 1971, or perhaps 1920. Until that information is presented, I cannot draw a single definitive conclusion from this article.

We’ll never be able to get a gold standard past the Wall Street – Washington powerful interests, but we all can go on our own personal gold standard: hold only the dollars you need for transactional purposes, and hold the bulk of your wealth in real assets including gold.

The dollar is a medium of exchange; it is not a store of wealth.

OL and Tom: I don’t understand your point. If a gold standard would have been a disaster if followed from 2000-2012, isn’t that reason enough not to try to go back on it?

Nick asked:

Ricardo,

I’m still at a loss.

If the government says gold = $1000 per ounce, what happens when the demand for gold rises (let’s say there’s an imaginary shift in the demand curve because Apple has found a new industrial use for gold in iPads). Shouldn’t the price of gold rise?

Nick,

Yes, and that is a good question. If something happened to cause gold to lose its amazing monetary characteristics, for example if the government learned how to print gold on printing presses, yes, gold would lose its monetary characteristics and another anchor would have to be found. There is nothing magic about gold other than that its monetary characteristics make it the best anchor for the currency and that has been true for thousands of years.

You show a better understanding of the gold standard that most because you understand this. But now you must ask not what could happen but what is true right now. In any system you can create an hypothetical condition that could cause it not to work, but better is to see what actually has and does work. With the currency losing 80% of its purchasing power and growth dropping from over 3% per year to right at 2% or less per year since Nixon broke the gold connection, you have to see that the system that replaced the gold standard has not worked.

JDH,

Allow me to clarify my point – I apologize for the confusion.

I am in no way advocating a return to a gold-backed currency. I agree that at today’s market price, reverting to a gold standard would be highly deflationary and destabilizing. With that being said, I would offer the following two thoughts:

1. The price of gold can be set at any price, including a price necessary to support M2 levels and avoid deflationary reactions to money supply/credit availability.

2. If governments around the world had never breached gold-currency convertibility, the massive expansion in money supply and credit that we have experienced over the past 25 years would not have been even remotely possible.

Please correct me if I’m wrong on either of these two thoughts.

JDH wrote:

Ricardo: The U.S. minted a $20 gold coin through 1932, which was fully equivalent to the $20 green bill printed at the time (the one with the picture of Andrew Jackson). The $20 bill in fact described itself as a “gold certificate”, with a note on the bottom indicating it represented “twenty dollars in gold coin value payable to the bearer on demand.” For you to suggest that this system was comparable to the one from 1951-1971 is difficult to comprehend.

Professor,

Thanks for the softball! 🙂

In April, 1933 Roosevelt signed an Executive Order requiring all holders of gold (with a few minor exceptions) to exchange their gold for that $20 gold certificate, that you mention you mention, on or before May 1. Then in the Gold Reserve Act of 1934 congress changed the exchange rate of the dollar from $20 to $35. Now couldn’t that gold certificate be exchanged for an ounce of gold? No, it could only exchange for .57 of an ounce of gold – that is if you wanted to pay a $10,000 and/or spend 5 to 10 years in prison – and still lose your gold.

Are you really prepared to call this a gold standard?

Granted Bretton Woods was not a gold standard, but $35 could exchange for an ounce of gold in 1971 just as it could in 1934. Foreign countries could legally make that exchange. The dollar was anchored at $35/ounce of gold. Because the dollar was anchored at $35/ounce and the supply of dollars was expanding the US gold reserves were flowing out of the country in a flood, but the dollar was still worth $35/ounce. The inflation was not in the value of the dollar but in the gold flows.

This is what Nixon understood. He had to either totally deplete the gold reserves or he had to default on his international commitment. His choice was to default.

The fact is that for normal exchange there was much less disruption in the Bretton Woods “gold standard” from 1951-1971 than in the FDR “gold standard” during the Great Depression. There were significant and severe interventions in the gold/dollar exchange system by FDR and so there was never as much stability as Bretton Woods. I will agree that neither system was a real gold standard as at the turn of the 20th Century.

JDH wrote:

And as for your question to Randall Parker, whom you ask “What do you mean by ‘the relative price of gold rises?'”, the answer is exactly and accurately given in the first figure above. Over the last decade, the price of gold relative to one hour of labor rose by a factor of about five. This is indeed the central point of the entire discussion here.

Professor,

I have already demonstrated why your one for one ratio makes no sense, but for the sake of argument lets do some comparison.

Henry Ford in 1914 began paying his workers the equivilant of 1.25 ounces of gold per day. Today with gold at $1,600/ounce that would mean that that his pay rate would be equal to $50/hour.

Today including all benefits – something Henry Ford did not pay – the auto workers make about $70/hour. Now if we reduce that for payments from workers to retirees we reduce the average wage to right around $50/hour.

You can play games with spot gold prices in an attempt to prove either over or under valuation of gold but the truth is that gold does not change its exchange value significantly but FED mismanagement of the dollar makes it fluctuate wildly.

In 2011 the price of gold went from went from a low of $1,319 to a high of $1,681. Will you seriously hold that a commodity that has actual use of its supply of only 10% saw a demand swing of 27% within 12 months?!! In truth the FED announcements and QE caused the dollar to go crazy. It was the dollar that changed 27% not gold.

In your zeal to discredit gold you forget that price is a ratio of dollars to commodity. If the demand for the commodity and the supply for the commodity is not moving then the problem is with the dollar.

Slightly off topic, but JDH’s paper on the role of the gold standard in propagating the Great Depression is very good.

Actually, it entirely applies to modern day Europe. From the conclusion of the paper:

“It sometimes is asserted that a gold standard introduces “discipline” into the conduct of monetary and fiscal policy where none existed

before. Indeed, this was the primary reason that the world returned to an international gold standard during the 1920s. I cannot think of a more naive and more dangerous notion. A government lacking discipline in monetary and fiscal policy in the absence of a gold standard likely also lacks the discipline and credibility necessary for successfully adhering to a gold standard. Substantial uncertainty about the future inevitably will result as speculators anticipate changes in the terms of gold convertibility. This institutionalizes a system susceptible to large and sudden inflows or outflows of capital and to destabilizing monetary policy if authorities must resort to great extremes to reestablish credibility”

Just substitute the word “gold” with the ECB’s Target2 settlement system. If gold convertibility can be doubted, so can Greek Euro convertibility into German Euro and vice versa (these parities enforced by Target2), the doubt spawning a 1931-type panic out of those euro-currencies most likely to suffer from an adjustment in their conversion ratio. That’s why the huge Target2 imbalances are there… more or less for the same reasons the US experienced huge gold outflows in 1931.

Professor,

If Nixon had not taken us off of gold we would not have had the OPEC oil crisis.

What happened in the “oil crisis” was not an oil crisis at all but a dollar crisis. What OPEC saw is that their resources were being priced in dollars that had lost value three fold. Gold in 1935 was at $35/ounce but in 1975 it hit $164/ounce. The OPEC price increases in 1973-74 simply brought the price of oil up to the level of the Nixon dollar debasement.

That counterfactual would have been a huge benefit to our economy in the 1970s.

Then in early 1980 gold surged to over $800/ounce and the economy was falling apart, inflation, interest rates, and unemployment all higher than double digits.

Gold has surged again here in the 2000s and we once again are seeing economic disaster. Rather than being manifest in interest rates and inflation it is showing up in deleveraging of assets, a real estate crash, a credit crunch, and once again high unemployment.

It is a counterfactual so it cannot be absolutely be proven but looking at times in the past such as when England returned to the gold standard after the Napoleonic Wars is a strong indication that a stable currency with a gold anchor leads to prosperity.

Our current problems are not totally a currency disaster but the currency problem sure aren’t helping anything.

Just as an aside, did you notice that when the FED started QE the economy began to crash (can you say TARP) then once the FED stopped QE and Twist the economy began to recover and with gold resting around $1,600 for months now the economy seems to be taking a breath? Just food for thought.

Interesting to our discussion is this article by my friend Nathan Lewis in Forbes.

Excerpt:

Thus, we find that what the Fed did during the crisis of 2008 was, in fact, much like what would have happened with a gold standard system. If anything, a gold standard system would have operated more quickly and more smoothly, supplying additional base money as soon as the dollar began to rise in value, an indicator of increased base money demand. Also, a gold standard system would have maintained the dollar at an even value, for example a parity of $1,000/oz., throughout the period, thus avoiding the additional turmoil of currency instability piled upon the existing problem of bank insolvency.

The Fed was created for exactly this purpose. It was always intended to operate alongside a gold standard system, and did so for 58 years, from 1913 to 1971. In the Federal Reserve Act of 1913, it states: “Nothing in this act … shall be considered to repeal the parity provisions contained in an act approved March 14, 1900,” which referred to the Gold Standard Act of 1900. It was only in later years that the Keynesians managed to turn the Fed into a supposed all-purpose economic Mr. Fixit via the magic of monetary distortion.

OL: (1) Yes, a gold standard could choose to fix the dollar value of gold at some particular price. The issue is not that the government would mistakenly choose too high or two low a price; let’s stipulate that the government in its wisdom chooses to set the dollar value of an ounce of gold at exactly the perfect price. Instead, the issue is what happens when conditions change after the government has set the price. For example, suppose we had set the price of gold in 2000 at $283/ounce, at a time when the dollar wage was $13.75/hour. Both the price of gold and the dollar wage would have been just fine at the time. However, if the real value of gold changed as it was observed to over the decade, and if we insisted that today an ounce of gold is still only worth $283/ounce, that would require a dollar wage today of $3.45/hour.

You could alternatively set the price of gold today at $1696/ounce. If you did that, everything would be fine today. But the concern I’m raising is what would happen if after you do that, the real value of gold changes again over the next decade in anything like the amount that it changed over the last decade.

The issue is that there is such a thing as the “real value of gold”– defined for example as how many hours a typical person would need to work to be able to afford one ounce of gold– and this is separate from the “dollar value of gold”– defined as how many dollars you need to pay to obtain one ounce of gold. The dollar value of gold is measured in units of dollars per ounce, while the real value of gold is measured in units of hours per ounce. Under a gold standard, the government can set the dollar value of gold, but it cannot set the real value of gold, because the latter is influenced to a very large degree by events completely outside the control of the United States.

In particular, the future path of U.S. M2 has essentially nothing to do with the number of tons of gold purchased for jewelry in India, and therefore the future path of U.S. M2 is largely irrelevant for the future path of the real value of gold.

(2) You are exactly correct that the big increase in U.S. M2 since 1971 would have been completely impossible if the U.S. had been committed to holding the price of gold in terms of dollars fixed.

Ricardo asks if I am prepared to describe Roosevelt’s actions in 1933 as a gold standard. My answer is, absolutely not. That’s why I’ve labeled the episode he refers to as “U.S. leaves gold” in the fourth graph above.

And please try once again to understand that the issue under discussion is how many hours a typical person has to work in order to afford one ounce of gold. That is what the rest of us are talking about when we refer to the real value of gold.

Ricardo: “In 2011 the price of gold went from went from a low of $1,319 to a high of $1,681. Will you seriously hold that a commodity that has actual use of its supply of only 10% saw a demand swing of 27% within 12 months?!! In truth the FED announcements and QE caused the dollar to go crazy. It was the dollar that changed 27% not gold.”

I know from physics that it is just as mathematically valid to choose a reference frame in which the sun revolves around the earth as a reference frame in which the earth revolves around the sun. One or the other may be more practical depending on what you are trying to calculate.

From where I stand, over the last 12 months, wages in dollars are unchanged, rent in dollars is unchanged, food in dollars is unchanged, etc. The only thing that has whipsawed drastically is gold priced in dollars.

In a practical sense, I find it much easier to keep track of wages and prices using the dollar as my reference rather than gold, just as I find it much easier to drive from New York to LA using the earth as my reference rather than the sun.

Thanks for your thorough response.

I have two follow up comments:

1. While I agree that US M2 is (somewhat) irrelevant to the current market price of gold, I would argue that global M2 is entirely relevant. In my opinion, there is no better metric to determine the “real” price of gold than global M2 levels. Please check the correlation over the past 10-15 years – it is quite staggering.

2. I understand that the purpose of this discussion is to value gold in terms of hours worked. However, my initial point was that picking the year 2000 (a year that gold was arguably extremely undervalued relative to global money stock) as your starting point may not be the most accurate reflection of the underlying relationship, which is why I am curious to see the same data set with a 1971 (Nixon Shock)or 1913 (creation of the Fed) starting point.

Thanks for your analysis and prompt responses – my only intention is to promote a logical and informative debate, not to diminish in any way the work that you have done.

In my 1:09 PM post I said that Henry Ford paid his workers 1.25 ounces of gold per day. That should have been per week.

JDH wrote:

And please try once again to understand that the issue under discussion is how many hours a typical person has to work in order to afford one ounce of gold. That is what the rest of us are talking about when we refer to the real value of gold.

I addressed this in my example of auto worker pay. An absolutism argument demonstrates the weakness of a theoretical argument.

Professor, until you can answer for the 80% loss of purchasing power under a fiat standard from 1971 to the present versus a 0% loss of purchasing power of the dollar under a gold standard in the 19th Century, your defense of an unanchored fiat system rings hollow.

Professor,

Thank you for admitting that there was no gold standard during the Great Depression. I hope that now you will also recognize that the world left the gold standard after WWI not in the 1930s. One of the primary reasons the US became the economic world leaders and the UK lost that position is because the US remained on the gold standard longer than other countries and so gold stocks flowed into the US. While the rest of the world faced economic decline and massive inflation during the 1920s the US experienced the Roarin’ 20s. Only the US, France, and Italy stabilized their currency relative to gold during the 20s and each experienced economic strength.

The only reason the UK did not fall into total ruin is because they robbed the rest of the world through the Gold Exchange Standard where they forced the pound on other countries in exchange for their gold and because Norman convinced Strong to manipulate the currency to slow the UK loss of gold.

Joseph,

Gold has not whipsawed. It is the dollar. Check out the money supply numbers.

What you have to realize is that traders desire stability in value so that they can calculate. For this reason prices and wages are “sticky.” Changes are at the margin and take time to flow through the economy. Gold is different. Because it is only important to traders as a monetary commodity its exchange ratio with the currency is quick and complete while other prices lag behind.

You may find it easier to deal with lagging indicators but you will always be driving from the back seat looking in the rearview mirror.

Ricardo: The U.S. and most of the rest of the world were on the gold standard from 1929-1932, which were the worst years of the Great Depression. The U.S. went off gold in 1933, which is when things in the U.S. started to improve. Countries that abandoned gold earlier than the United States started their recovery earlier than the United States. Countries that abandoned gold later than the United States started their recovery later than the United States.

You still have not understood the concept of the real value of gold.

The price of bread for one ounce of gold has been historically enough bread to feed one’s self daily for a year. That is a direct correlation. Calculating the amount of dollars an ounce of gold is worth (daily) to buy a loaf, as at the gold bug event, proves the value of the dollar. People have faith and are aculturated to its use. A return to the gold standard would be a step backwards.

JDH wrote:

Ricardo: The U.S. and most of the rest of the world were on the gold standard from 1929-1932, which were the worst years of the Great Depression. The U.S. went off gold in 1933, which is when things in the U.S. started to improve. Countries that abandoned gold earlier than the United States started their recovery earlier than the United States. Countries that abandoned gold later than the United States started their recovery later than the United States.

Professor,

We have been through this before so I will not beat a dead horse but your claims are based false assumptions. There claims form Eichengreen and Krugman have been refuted.

I hope you are not fallng under the spell of the currency shamans and see only money as the solution to all economic problems. The disasters of of the Hoover administration has been siginficantly detailed in many books. They were so horrible that long-time fiscal conservative of the time like Benjamin Anderson supported the election of Roosevelt. Hoover’s policies were so bad that Andrew Mellon refused to present his budgets even though he was Treasury Secretary.

Hoover was a Progressive right from the world of Woodrow Wilson and his administration was a Progressive administration. The world was starving for internatonsl trade and Hoover’s response was the Smoot-Hawley Tarriff.

I have more respect for you than to believe that you would engage is such narrow-minded analysis as to ignore the fiscal disaster of Hoover’s administration.

Finally, if you are going to blame the 1929-1932 period on the gold standard then you are going to have to explain why the gold standard did not distroy the economy of the 19th Century and how the UK could have such a huge recover after the Napoleonic Wars when they returned to the gold standard.

There are so many inconsistencies in your analysis I am surprised that you insist on it.

JDH wrote:

You still have not understood the concept of the real value of gold.

Can you demonstrate this absent the influence of mismanagement of the currency? If not I suggest you are being deluded in your analysis of the real value of gold by fiscal and monetary errors.

There are many who have pointed out the incomplete analysis such as this from Mark in your The gold standard and economic growth thread.

“If the banking laws and institutions drop required gold reserves from 40 to 20%, you’ll get a huge boom/ bust cycle under a ‘gold standard’; but don’t blame the problem on the watered down gold standard. There is no excuse to not understand this since the work of Hayek and others in the ’20’s.”

“From where I stand, over the last 12 months, wages in dollars are unchanged, rent in dollars is unchanged, food in dollars is unchanged, etc. The only thing that has whipsawed drastically is gold priced in dollars.”

What planet are you standing on? Rents have gone up, food has gone up. The intrinsic value of gold has NOT changed, since, almost ever. It is marginally more useful now than it was 100 years ago. The supply is increasing at a slow rate. What is changing is the amount of currency in circulation and the banking system’s ability (Fed AND all banks) ability to create (electronic) currency.

Vastly more currency + slightly more gold = much higher gold prices in dollars. Is gold priced in silver out of line with long term trends? Gold priced in oil? Now you get it, thanks for playing!