As President Obama and Governor Romney prepare for the first presidential debate this evening, I thought I would offer my vision of where our nation’s leaders should try to take the country.

Although there are many areas in which the American economic performance has been disappointing, one task we’ve been exceptionally good at is finding and producing more natural gas. In fact, America is currently just burning some of this potentially useful fuel as a waste product associated with oil production. On a dollar-per-BTU basis, natural gas and crude oil sold at a similar price 10 years ago. But today, energy from oil costs 6 times as much as natural gas. Any move to replace oil with natural gas would pay a big economic dividend.

|

One obvious strategy is to heat more homes with natural gas instead of heating oil. U.S. consumption of heating oil averaged 900,000 barrels/day in 2005 but has been about 400,000 b/d this year. New pipelines such as those recently approved serving New York City will help make further progress in this direction.

The biggest uses of oil are for transportation, where there are three main options for using natural gas. For heavy-duty trucks, it’s possible to use fuel tanks that keep the gas cold enough (-260o F) to be stored in liquid form. In 2010, nine million heavy-duty vehicles on U.S. roads consumed 2.2 mb/d of petroleum. Of these, 40,000 (or 0.4%) were using natural gas. Clean Energy Fuels Corp. is planning to complete 150 new LNG fueling stations by the end of next year to connect major trucking corridors across the country. Waste Management Inc. plans for 80% of the trucks it purchases during the next five years to be fueled by natural gas.

|

| Fuel | price per dge |

|---|---|

| gasoline | $3.93 |

| diesel | $3.75 |

| LNG | $3.35 |

| CNG | $2.28 |

A second option, available to any vehicle, is to compress the natural gas at sufficiently high pressure that it can be reasonably transported and stored. According to the Department of Energy, in July LNG was available at a retail price of $3.35 per diesel gallon equivalent, while compressed natural gas was $2.28. A recent study by MIT Professor Christopher Knittel estimated that a typical driver of a 30 mpg sedan would save almost $7,600 over the life of the car in fuel costs by switching to natural gas, but only pay an extra $5,500 for the vehicle. A 15 mpg pickup might save almost $4,200 net of the extra cost of the truck. When you take into account other benefits to society from using natural gas, such as lower pollution, fewer greenhouse emissions, and less dependence on imported oil, Knittel calculates that the net gains to society from a switch could be twice the savings to individuals.

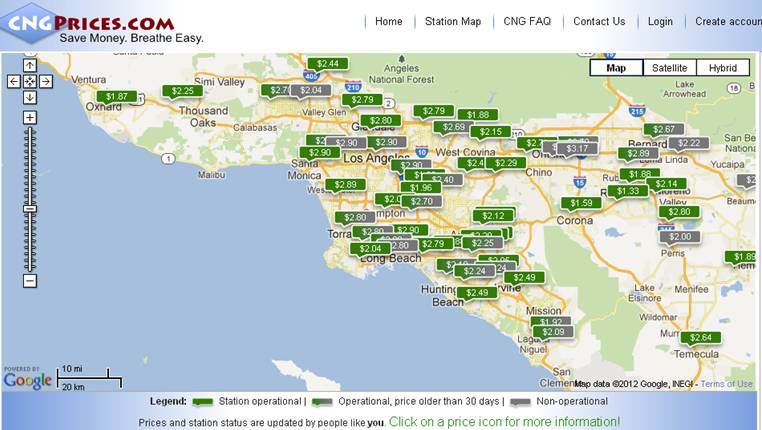

Why then aren’t more consumers switching to natural gas right now? According to the Department of Energy, as of May there were

1,047 CNG fueling stations in the U.S., compared with 157,000 stations selling gasoline. Of the CNG stations, fewer than half are open to the public, and more than a fifth are located in California.

|

Professor Knittel explains the main obstacle:

Large-scale adoption of natural gas vehicles requires coordination between vehicle manufacturers, consumers, and refueling stations– either existing gasoline stations or replacements. This creates a chicken-and-egg problem, or a network externality issue. Consumers are unwilling to purchase natural gas vehicles before a refueling infrastructure is built, but businesses will not invest in natural gas refueling stations until there is consumer demand. Each side would be better off if the other side acted first, but neither is willing to move without the other. Left alone, network externalities continue the dominance of the status quo technology when, from society’s perspective, it should be replaced with a new technology.

A third option for using natural gas as a transportation fuel is to convert the gas into methanol. Again this promising technology faces significant infrastructure switching costs.

Knittel suggests a number of policy proposals to try to help steer the private market in a better direction, including:

- Reform regulated pricing structures to allow natural gas utilities to sell to transportation users at closer to marginal cost instead of average cost.

- Facilitate and encourage private access to existing CNG and LNG stations.

- Establish an industry consortium to investigate and

coordinate on LNG refueling infrastructure. - Include methanol as a product satisfying renewable fuel standards.

- Subsidize natural-gas powered vehicles by an amount commensurate with their estimated external social benefits.

To these I would add the possibility of giving vehicle manufacturers credit toward Corporate Average Fuel Economy standards of any vehicles powered by natural gas or methanol. My idea is that if a manufacturer sells one car that gets 20 miles per gallon of gasoline, and a second vehicle that uses no gasoline at all, it gets credited for producing two cars with an average fuel efficiency of 40 miles per gallon. Another obvious idea is to streamline the EPA approval process for alternative fuel and engine designs. I would also add that a deficit-minded alternative to Knittel’s last suggestion of subsidizing natural gas vehicles would be to tax conventional gasoline vehicles, or gasoline itself, by an amount commensurate with their estimated external social costs.

I’m interested to hear if some of our readers have other suggestions.

central bank reflation will only hit the wall of higher energy prices, reducing oil usage is a must to improve growth.

I do not believe that New York should be allowed to import natural gas from surrounding states unless and until, NY allows drillers to use fracking to recover NG with in its borders.

Gov. Cuomo effectively killed fracking in NY last week by sending the issue back to the bureaucracy for a new study.

If fracking is environmentally harmful, and there is no evidence other than the fevered speculations of “environmentalists” that it is, then allowing it in neighboring states and using the product is the purest hypocrisy and snobbery. It should not be allowed.

Using NG directly as a transportation fuel has several difficulties that make it less than optimal.

NG is low in density. Fuel tanks to hold enough compressed NG to give a vehicle a reasonable range take up a lot of space and impair the utility of the vehicle. They also present an additional collision hazard (they would be hazardous if the held pure nitrogen). Because NG is ubiquitous, and can be used to refill vehicles at home stations, using it as a transportation fuel would slash gasoline tax revenue.

Liquid NG is also problematic as a fuel in consumer vehicles because of its low temperature — −162 °C (−260 °F), which makes it dangerous to handle.

Using NG as a feed stock is the best idea, but using methanol, which is toxic, hygroscopic and miscible with water, is not a great solution. It would be better to turn the NG into gasoline or diesel, which is done commercially in several places around the world. Wikipedia article: Gas_to_liquids

My guess is that permitting is what is preventing this from being done in the US, and is a problem that politicians can solve, if they want to.

Another fuel possibility is to dehydrate Methanol into di-methyl ether CH3-O-CH3. The compound is a gas at room temperature and pressure, but has boiling point of -24 °C -11 °F and can be kept as a liquid under moderate pressure. It can be used in diesel engines with minor modifications and produces less air pollution and particulates than liquid diesel.

This is funny, since it was an EPA lab that strongly pushed for methanol back in the 80s, but few people were interested. The researcher who was working the hardest for that was *just* shown the door last month! That whole group’s budget was just zeroed out. They even published a book, “Moving America to Methanol : A Plan to Replace Oil Imports, Reduce Acid Rain, and Revitalize Our Domestic Economy”. Depressing. But it still makes sense today.

Two points come to mind:

In regards to the net savings (excluding external benefits to society) from using compressed natural gas over conventional gasoline or diesel in vehicles, isn’t it true that as fuel efficiency increases the net savings from using natural gas decreases. Aren’t we moving towards greater fuel efficiency regardless of who will be President?

Also, these net savings are dependent on the assumption that the spread between conventional gasoline and compressed natural gas is maintained through the life of the vehicle. This seems like a pretty optimistic assumption over a 10-year period when you consider that in the power industry, capacity needs are being met increasingly (through new plants, or converting coal plants to natural gas) by natural gas.

Thanks,

Interestingly, none of the major oil companies or government agencies see natural gas as a major transportation fuel. Not Exxon, not Shell, not BP, not the EIA, not the IEA (although I spoke to the latter’s respective division head there recently, and they are becoming more optimistic on the matter).

But the economics are compelling. I’ll have more on this later…

You missed another way that natural gas could be used more extensively for vehicle transportation — electric cars.

Electric cars don’t care how the electricity is produced and there’s already a huge distribution network for electricity.

Yes, there are obstacles, particularly price and energy density, but there’s a lot of promising solutions in the pipeline — so much so that the the energy department is predicting an 70 percent reduction in price and significant increases in range in 2015.

http://www.ecogeek.org/power-storage/3679-secretary-chu-predicts-steep-decline-in-ev-battery

Forbes recently wrote that GM may have a “game-changer” in the works:

http://www.forbes.com/sites/eco-nomics/2012/08/17/the-scoop-behind-gms-new-electric-car/

But for the Kock Bros., we would becoming energy independent today by using natural gas as a transportation fuel: http://www.americanprogress.org/issues/green/news/2011/06/06/9746/conservatives-power-big-oil-stall-cleaner-natural-gas-vehicles/

I am the innovation manager for a company that owns 1500 heavy trucks operating in 7 states. We have concluded that the operating cost of a CNG truck verses a diesel truck is approximately $13,000 per year less to operate using current fuel costs. The incremental cost between diesel and CNG powered trucks is $40,000. Therefore the unit pays for this additional cost in 3 years and for about 60% of the entire truck in 10 years. This fact alone is compelling enough for my company and many other heavy fleet operators to switch to CNG not to mention the intangibles such as lower emissions, much lower emission control system maintenance, 30% lower noise levels and domestic fuel sourcing.

This is probably a stupid question, but is there any compelling technological reason why people wouldn’t be able to hook up their natural gas powered car to their home service in the same way that electric car owners can plug-in overnight?

One potential environmental problem with natural gas powered cars is the risk of gas leaks. If it can be contained, then it’s a big plus for the environment; but lax regulation and leaks could overturn that result. A manageable problem to be sure, but our politicians have a knack for turning perfectly manageable problems into disasters.

CNG is an awesome transportation fuel.

Although the CNG fuel cylinder’s intrusion in truck space in the Honda Civic GX/NGV reduces cargo area, a significant national commitment to CNG would encourage automakers to offer models in addition to the Civic and incorporate the storage cylinders into their designs without as much compromise.

State and national level programs to encourage homeowners to convert from heating oil to natural gas would create a significant number of construction jobs and lower winter heating bills. Win Win.

Gas hydrate clathrates are another means of storing hydrocarbon alkanes for distribution.

In addition to evolving LNG/CNG regimes, gas hydrate technologies suggest future benefits and higher energy densities.

Gas hydrates form when hydrocarbon “guest” molecules occupy water-ice crystal lattice voids within temperature and pressure stability zones.

One interesting side effect is that the ice crystal surrounding the gas molecule(s) is… pure water!

Imagine a seawater desalination plant which also produces methane for co-generation.

Oceanic deposits of methane clathrate produced by methanogenic archaea are an example of this process.

I believe the long-term costs of fracking far outweight the short-term “efficiency” gains.

ScottB, I believe monkeys will fly out of your…

2sb, you need to compress it somehow.

There is no way to make a profit from shale gas with a market price at less than $7.50 per Mcf and that number goes higher once a producer gets outside of the core areas in the better formations. Shale gas is the bottom of the barrel and has a depletion rate that demands massive amounts of drilling just to maintain production flat. This means that once demand is increased prices will have to explode or the investments in the new infrastructure and capital will have to be written down.

Natural gas is a solution for many nations that are large suppliers of oil because they have not looked for gas reserves that are present due to a lack of market in the past. It seems to me that the US would do better to encourage Mexico to develop the reserves that are in place and buy the production than to waste capital trying to extract gas out of tight shale formations.

Dave, air pollution too. We can sell more diesel abroad and have cleaner cities here.

2slug, regarding you question about home fueling for CNG vehicles, read the link at the end of this post:

http://hallofrecord.blogspot.com/2012/01/natural-solution-to-energy-needs.html

The only important factor in the adoption of CNG vehicles is the cost of the related vehicle infrastructure.

Can someone explain to me why a CNG Maruti in India is $200 more expensive than the gasoline version, while the difference in the US is $5-10k? In Argentina and Brazil, a retrofit is $2000–and retrofitting has to be more expensive than OEM.

So it comes down to the price of the tank. Get it under $1800 and adoption will be rapid. There is no particular need for large scale coordination with fuel suppliers–they have plenty of incentive to invest if the demand is there.

USGS releases damning EUR’s for shale:

http://energybulletin.net/stories/2012-09-04/usgs-releases-damning-eur%E2%80%99s-shale

Excerpt:

“The extraordinary hype surrounding this industry has been impressive to say the least. It has clearly been a public relations exercise of disproportionate scale compared to what the wells are actually producing. That should have been our first clue. Methinks they doth propound too much.

For instance, in July 2011 a giddy article on monetizing the Marcellus was published by E&P magazine, an industry publication. They had this to say:

“At press time, Cabot reported new whopper Marcellus wells…the newest wells suggest an EUR of at least 15 Bcf per well[emphasis mine].”

As I make clear in my presentations, such “monster wells” are the darlings of industry PR departments. There is nothing wrong with touting your best results provided you temper such statements. Unfortunately all too often these statements are taken out of context and the reader is left with the notion that every well is performing at these high standards. In reality, nothing could be further from the truth . . .

In an email sent to me by a senior Chesapeake executive, she claims an average EUR of 3.0 Bcf in the Barnett. The new USGS numbers, however, state the Barnett at 1 Bcf . . .

Southwestern Energy (SWN) and Chesapeake Energy (CHK) claim average EUR’s in the Fayetteville of 2.4-2.6 Bcf. The Powers Energy Investor, an industry publication stated:

“To put into perspective how ridiculous Chesapeake’s claims of 2.6 Bcf is, consider the following: of the company’s 742 operated wells completed on the Fayetteville, only 66 have produced more than one Bcf and none have produced more than 1.7 Bcf. Chesapeake’s average Fayetteville well has produced only 541 Mcf.”

The USGS confirms these numbers again with the average EUR for Fayetteville wells coming in at 1.1 Bcf, significantly lower than 2.4-2.6.

As you can see, yet another pattern is emerging in shale plays.”

End Excerpt

My comments:

Texas of course has longest experience with intensive exploitation of shale plays, using modern drilling and completion practices, and it’s interesting to look at Texas natural gas well production versus Barnett Shale natural gas production (using a common data source, the Texas RRC).

We have seen a steady year over year increase in Barnett Shale gas production, from 0.7 BCF/day in 2006 to 1.9 BCF/day in 2011, and total Texas natural gas well production increased at a rapid clip from 2006 to 2008, from 5.7 BCF/day in 2006 to 7.1 BCF/day in 2008, on track to increase to almost 10 BCF/day by 2011.

However, Texas natural gas well production started to decline in 2009, falling to 6.6 BCF/day in 2011 (based on most recent data). While it’s likely than a slow down in natural gas drilling contributed to the decline, note that the very large decline in natural gas drilling occurred only in the past year or so, and the Barnett Shale data show a steady year over year increase in Barnett Shale gas production, through 2011.

The bottom line is that rising natural gas production from the Barnett Shale (and from other shale plays) could not keep total Texas natural gas well production on an upward slope. As more and more US shale plays (both oil and gas) mature, the Texas shale gas model does not bode well for the shale play proponents’ assertions about the productive potential of these plays.

In any case, the estimates of what we will produce from our fossil fuel resource base will vary over time, as prices and technology change, but the bottom line remains the same: Our economy is based on the assumption of infinite energy, while the fact remains that we have a finite fossil fuel resource base, and an increase in the production rate, or more accurately the extraction rate, simply means that we are accelerating our rate of depletion of our remaining fossil fuel resource base.

USGS releases damning EUR’s for shale

http://energybulletin.net/stories/2012-09-04/usgs-releases-damning-eur%E2%80%99s-shale

Additional Excerpt:

“Chesapeake Energy (CHK) claims average EUR’s for the Marcellus at 4.2 Bcf. Range Resources (RRC) has claimed average EUR’s as high as 5.7 Bcf in investor presentations. According to the USGS, however, the average EUR for the Marcellus turns out to be about 1.1 Bcf.”

Arpra-E has funded at leas 13 projects that are aimed at the CNG infrastructure and in vehicle storage.

See this PDF

The hybrid electric car is the best option. Gas pipelines to every filling station is dangerous and costly, people filling cars with nat gas is dangerous, and cars flying around the highways with a tank of the explosive gas is dangerous. Better and safer to have a pipeline to a power plant and generate the electricity. Most of the infrastructure is already in place. This is also advantagous to the power plants. Most of the car charging would be at night which would balance demand between night and day. Currently many gas fired power plants cycle off every night because of lack of demand. This cycling greatly increases the cost of operating these plants; in fuel used to start and shutdown, and the increased maintenance cost from wear and tear due to cycling. It is definitely a fourth option you should have explored JDH

Nature Gas Distribution

“Moving Natural Gas Into the Home

Natural gas runs from the main into a home or business in what’s called a service line. Today, this line is likely to be a small-diameter plastic line an inch or less in diameter, with gas flowing at a pressure range of over 60 pounds to as low as ¼ pound. When the gas passes through a customer’s gas meter, it becomes the property of the customer. Once inside the home, gas travels to equipment and appliances through piping installed by the home-builder and owned by the customer, who is responsible for its upkeep.

Most gas meters are connected to an inner or outer wall of a home or business. In some instances, however, meters are located next to the point where the service line meets the main line. In this case, the piping from the meter to the structure is the customer’s property, not the gas company’s. These are called “customer-owned” lines and their maintenance is the responsibility of the customer.

When the gas reaches a customer’s meter, it passes through another regulator to reduce its pressure to under ¼ pound, if this is necessary. (Some services lines carry gas that is already at very low pressure.) This is the normal pressure for natural gas within a household piping system, and is less than the pressure created by a child blowing bubbles through a straw in a glass of milk. When a gas furnace or stove is turned on, the gas pressure is slightly higher than the air pressure, so the gas flows out of the burner and ignites in its familiar clean blue flame.”

A vehicle CNG tank is 3k-4k PSI.

Steve Levine write about a couple of charts of mine over at Quartz.

http://qz.com/#11808/how-thrifty-americans-feed-chinas-taste-for-oil/

Tim –

I think ARPA-E’s work is incredibly important. By the way, the Obama administration can take credit for commissioning the research.

Many larger installations are using recently-developed technology that mixes NG and diesel fuel by adjusting upstream and downstream control parameters. An issue with NG is its volatility — prices were 5X higher some years ago — so there is some aversion to going all-in on a NG-fuel supply chain.

“Hybrid” diesel-NG seems like a decent path to take, at one end not much worse than status quo, at best providing substantial fuel savings, as long as the capex isn’t significant. I expect if engine manufacturers figure out how to cheaply adjust the fuel controllers to allow different fuel mixtures you’ll see a big shift.

I have to preface my comments with my feeling that it is a disgrace that we haven’t made this switch yet, and I think it is hard to argue that we have a functioning economy given the $BBB left on the table over the past 4 years.

I blame Koch to some extent but more-so the basic economic theory and structure of our society where we just throw our hands up in the air whenever we’re presented with anything that looks like a prisoner’s “dilemma.” We need a punishment mechanism to move us to a more optimal situation in these sorts of dilemmas, and the bar needs to be a bit lower on what constitutes convincing evidence that the ends justify the means.

I would think that an attractive alternative would be to make it a huge government program like the Manhattan project…where the government acts as the provider of infrastructure instead of the private sector and recovers costs + interest by charging a monopolistic rate on CNG/LNG. Private stations providing CNG/LNG would be banned until government recouped cost.

Obviously this is not the best solution but it would be worth it because it would work in spite of itself and would piss off all the dogmatic “market-knows-best” lingam worshipers.

The better solution would be to go on the ol’ TV and explain to “the American public” that so long as we are importing a drop of foreign oil we’re pretty much going to be held economically hostage by a little thing called “peak oil” which is why we’re all paying $4/gallon in the middle of the great recession. So…because of this we’re jacking up taxes on gasoline to break the addiction (tough love baby, but it is for the sake of the TROOPS) and simultaneously going to offer some screamin’ deals on CNG cars, massive tax breaks to any companies that step up and install CNG infrastructure and a $25 million prize pool for the top 10 ideas (scientific or otherwise) on making it more efficient to use natural gas as a transportation fuel. Cue the propaganda machine, patriotic blather equating natural gas with supporting troops, etc. and cut some backroom deal with the Koch brothers and the big multi-national oil companies to make sure they have a seat at the natural gas table (which would just accelerate a process that is already underway).

@MarkG

Only problem with electric cars is that it depends on car companies to make them. We’re still stuck at 11 mile all-electric range on a dependable electric hybrid system last time I checked.

The hybrid electric car is the best option. Gas pipelines to every filling station is dangerous and costly, people filling cars with nat gas is dangerous, and cars flying around the highways with a tank of the explosive gas is dangerous. Better and safer to have a pipeline to a power plant and generate the electricity. Most of the infrastructure is already in place. This is also advantagous to the power plants. Most of the car charging would be at night which would balance demand between night and day. Currently many gas fired power plants cycle off every night because of lack of demand. This cycling greatly increases the cost of operating these plants; in fuel used to start and shutdown, and the increased maintenance cost from wear and tear due to cycling. It is definitely a fourth option you should have explored JDH

Re Davids comment: So this makes a lot of sense for fleets that come and go from depots on a daily basis. I suspect most are fueled today from a diesel pump at the depot, likely there is natural gas service, so you might have to upgrade it, and of course put in a compressor. No need to worry about public infrastructure for this. Ideal candidates are UPS and Fed Ex trucks, city buses, garbage vehicles, and the like. The next question is to look at regional delivery services, can you put in a big enough tank to handle most regional delivery services.

Note that Cat had just announce that they are going to make natural gas based mining trucks, and the like, which fit the depot model well.

Why is LNG dangerous? Liquid nitrogen is even colder and transported in large quantities on our streets, other chemicals more explosive! For larger vehicles like busses, trucks, lokomotives LNG is indeed an alternative. I as chemist have no objections.

CNG could also be used in larger quantities to fuel cars, in my hometown (Graz, Austria) there are many busses and taxis fuled with CNG, the smaller milage is only an issue on long-range routes. So at least second family cars can be converted.

The CNG fueling station near my house closed a couple of years ago.

Doesn’t Gas-to-liquids (GTL) diesel make more sense as a transportation fuel? Turn the natural gas into a premium diesel fuel (GTL diesel is much cleaner than “real” diesel, in fact it is crystal clear).

How about people just drive a lot less. No need to change fuels, get a new car or anything. Just drive less.

bmz,

Picken’s plans always involve taking money from taxpayers and putting it in his pocket.

Never understood why that bit corporate welfare seems to be popular.

Billionaire Boone Pickens can’t understand why the Billionaire Koch brothers don’t support the slimmed Pickens Plan

@Steven, “Interestingly, none of the major oil companies or government agencies see natural gas as a major transportation fuel.”

But the local oil companies and the government in India do see the point rather clearly. Together they actaully managed to two problems simultaneously – pollution and high oil prices

The problem for natural gas as a motor fuel for energy companies can be summed up in one sentence. It doesn’t need refining. For that reason, the price of natural gas cannot be fixed the way the price of gasoline is by collusion in major markets between refiners. (Remember how the original Standard Oil got it’s monopoly by taking over all the refineries by the early 20th Century?). Which helps explain why the price of natural gas is so volatile.