It’s very clear that two things have to happen from here. First, Greece needs relief from its mountain of debt, and second, the country needs to find a way to become more competitive economically.

The traditional way these goals would be achieved is first, creditors would accept substantial haircuts and restructuring of the outstanding debt, and second, a big currency depreciation would give Greek exports a competitive international advantage to get the economy growing again without new borrowing.

The main complication preventing these steps in the current situation is Greece’s participation in the euro system. On the first issue, this meant that European governments, banks and the ECB extended substantial loans on the (mis)understanding that Greece’s membership in the European union meant default was impossible. On the second issue, devaluation would seem not to be an option because Greece does not have control over the value of its currency.

But the reality that everyone needs to recognize is that, one way or another, both changes are eventually going to happen. It’s just a question of when and how.

That Greece’s creditors are going to have to accept substantial restructuring of the sums they receive is simply an unavoidable consequence of the fact that, through a combination of a lack of tangible economic resources and the reality of Greek politics, Greece isn’t able to make the annual interest payments on its current load of debt. This reality has been quite evident for some time, though up to now Europe kept valiantly kicking this can down the road.

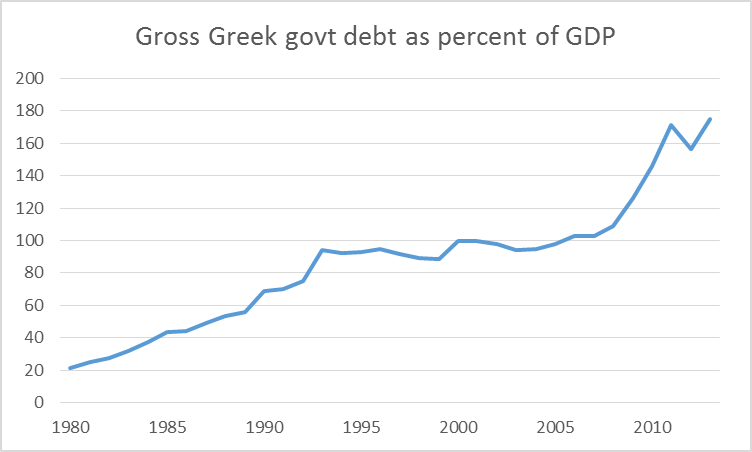

Gross debt of the Greek government as percent of GDP, 1980-2013. Data source: IMF World Economic Outlook Database.

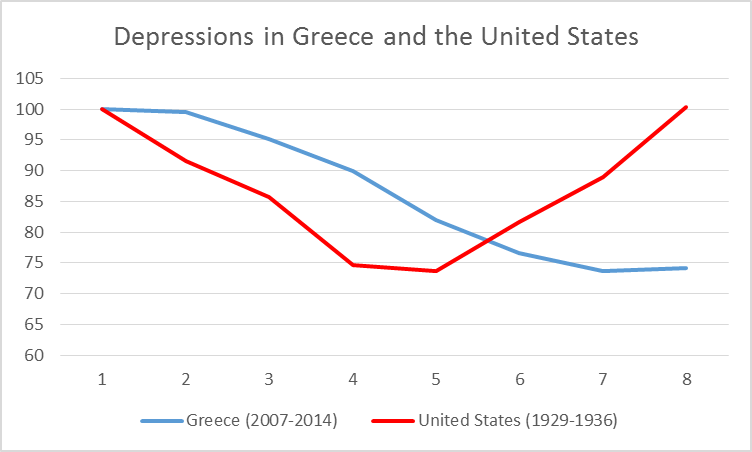

And if we do not get a real depreciation in the form of a change in the nominal exchange rate, the same goal can be achieved through a big drop in Greek wages and prices. The trouble is, this normally doesn’t happen unless there is a huge amount of unemployment. For example, it took the Great Depression of 1929-33 in the United States to bring prices and wages here down by a third. The New York Times has some eye-opening graphs demonstrating that the downturn in Greece has already become worse than what the U.S. saw in the Great Depression of the 1930s.

Red: U.S. real GDP, 1929-1936, as a percent of 1929, plotted as function of number of years since 1929 (data source: FRED). Blue: Greece real GDP, 2007-2014, as a percent of 2007, plotted as a function of number of years since 2007 (data source: IMF World Economic Outlook Database).

But it would have been so much easier if, rather than ask workers and pensioners to accept a 20% cut, Greece instead experienced a 60% increase in prices of imported goods with nominal wages and pensions unchanged. In the latter case, it would be clear to everyone that the painful adjustments were an unavoidable consequence of international developments and the country’s current circumstances, rather than a deliberate decision by some perceived political or economic adversary. Greece could become more competitive without having to go through a depression to get there.

Is there any better way to do this without leaving the euro? Here’s one idea that may sound a little crazy, but perhaps no less crazy than some of the wishful thinking that’s been calling the shots so far. Suppose the Greek government were to declare, we simply do not have the euros to make the payments we’ve promised to government workers, pensioners and suppliers of goods and services to the government. So we will make those payments 60% with euros and 40% with newly created Government Value Certificates. What are these certificates good for? Well, one thing you can do is pay up to 20% of any tax obligations you have with them, at par (one certificate discharges one euro in tax obligations), this year, or any time in the future. Greece might also consider a law specifying that a private firm could fulfill its legal obligations to employees by paying up to 20% of the euros owed with certificates.

Such certificates would have a direct market value. If you wanted, you could sell any certificates you have or buy any certificates you want from somebody else. The certificates would trade on the private market at a significant discount from par, based on factors such as how many new certificates people expect the government to issue next year and how useful they’re expected to be for paying future taxes. The size of the discount would determine how much of a de facto devaluation the program could achieve. In effect, this would amount to introducing a parallel currency.

Maybe you like that proposal, or maybe you don’t. But either way, some combination of debt forgiveness and real depreciation is going to occur, whether we like it or not.

And the sooner it happens, the better it will be for everyone.

You assume they need to stay in this system. 2nd world #Iceland proved they don’t have to and neither does the EU.

The idea of being in a single currency if there is no political union and solidarity is just insane. In order for rich people to consolidate their power and wealth (get rid of the risks of currency fluctuations) countries gave up the ability to adjust imbalances by currency depreciation (and inflation), and are instead forced to use the much slower and more painful deflation process (witch put almost all the pain on poor people). You can see why the conservative plutocrat sock puppets of previous Greek governments put them into this insane “union”. But it is beyond my wildest imagination why a so-called “socialist” government doesn’t have a quick plan for getting the hell out of this plutocrat trap called the Euro. This is the opportunity to get out and organize a society for the people rather than for the rich.

You assume that Merkel understands this.

Exactly. I recall a Paul Krugman post several years ago in which he described Merkel’s policy towards the Greek crisis by simply linking to a Youtube video of Wagner’s “Gotterdammerung.” It was the scene from the burning of Valhalla.

have you listened to the quotes from Wolfgang Schaeuble? this sounds like a personal vendetta against greece. rational economics are not in play at this time. the beatings will continue until morale improves.

The next time you hear economists talk about the necessity of politically isolated central banks, you should reflect on the policies of the ECB. Central bankers insist that they have no oversight from politicians, while at the same time are free to interfere at will in political issues.

The ECB is not addressing financial issues. It is executing a political agenda — privatization of public assets, elimination of union agreements, elimination of labor laws, reduction of pensions, tax cuts for the wealthy. The austerity rule is to let no crisis go to waste in the cause of neo-liberalism.

Too much political power has been ceded to bankers. They are not to be trusted. Bankers are the tyrants, dictators and despots of the 21st century.

My understanding is the lack of action by the ECB is in fact the result of it’s relative lack of independence.

Bankers are just people like anyone else. Bankers in the private sector face systemic temptation to use their size/influence to generate rents but this has nothing to do with *central* banks which are run by economists not financial products guys or traders or whatnot

I’ve been reading stories that argue that the private bankers are the only ones to get out of this with whole skins. The argument goes something like this: Greek got in deep deep trouble. The private bankers who loaned funds to Greece knowing Greece was in trouble were rescued by the ECB at no cost to themselves. Now the ECB and Greece argues about who is to pay and it looks like it is the people of Greece.

So the Banks skate again. And it is not reported in the news because it happened a couple of years ago.

Is this story true?

Here’s a key quote:

“But the bailout was primarily focused on saving the banks, not Greece: Rather than forgive a portion of the Greek debt and hand the banks a loss, Greece was to continue paying its bills. New money was lent by a variety of public sector entities (i.e.The European Commission, the IMF, and the European Central Bank) to pay off the old bills. The banks were consequently made whole, with most of the money from the new loans passing through Greece right back to the banks. For acting as a conduit to a northern European bank bailout, Greece was asked to change its ways—to spend less, tax more, and restructure the public sector.”

From: http://www.theatlantic.com/business/archive/2015/07/greece-crisis-banks-greedy/398603/

Professor Chinn,

As a non-expert, I for one, appreciate that you as an expert propose solutions.

Instead of printing certificates (that seem to be pseudo currency), as a non-expert, I wonder if Greece should just start printing or contracting to have Drachmas printed. Let the “devaluation times-roll”. Britain does not use the Euro along with some other European countries, so there seems to be a precedent.

AS: What I propose basically is printing drachmae along with a device that would give the created paper assets value and allow them to circulate side-by-side with euros. If Greece goes off the euro altogether, of course they could print their own currency without resorting to this contrivance.

JDH My understanding is that Greece cannot print drachmas and be a member of the euroregion. It would be grounds for expulsion. The alternative being bandied about is to have the govt issue IOUs denominated in euros. As a practical matter it would be a distinction without a difference, but printing IOUs would not be a prima facie case for expulsion.

Sorry meant to say Professor Hamilton.

They need a process akin to bankruptcy with powers like bankruptcy judge. The arbiter needs t o b e independent

With rules to apply

The problem is they have none. The European union should have defined the process fir s something foreseeable

1. A “write off ” is illegal in Euro treaties. It is not necessary, because the maturity are already extremely long and interest very low, and can be stretched some more, within the legal framework. Please see the numbers and details at https://econbrowser.com/archives/2015/06/anil-kashyap-on-the-greek-crisis#comment-190789

And the population in many other Euro countries know exactly that any formal write-off would just create a huge moral hazard of much more of this to come. This would be possibly the end of the Euro.

2. A huge depreciation would be very bad for Greece, a country which imports a lot of food, medicine, oil. It is a typical american viewpoint to just look at exports and ignore the imports. Why should their export prices be sticky?

3. Greece suffers from clientelism and patronage, since their independence in the early 1800s and that a large part of their intellligenzia is still stuck in marxism.

Change will only happen by force from the outside. Just read the IMF consultations for Greece, that just a little nagging and advice did not lead to the necessary change during all the years from 2000 on. This problem did not just start with the IMF rescue plan in 2010.

Some examples: Early retirement options at the age of 51, anti-business mindset of the government structures, massive overstaffing of government structures, the pharmacists already going on strike, because they loose their sales monopol for OTC drugs, like Aspirin

4. The deal which the EuroGroup reached now, provides what is needed. A Grexit would have been a social catastrophe for Greece

Genauer is correct but will be rubbished for saying this. Now there is a forecast that won’t need the old stats package to test, Prof Chinn.

Real issue is whether a country with a Middle Eastern culture can fit into a modern trading/currency bloc.

Unless you believe that all cultures and all people are interchangeable spare parts that respond to Krugman-think and macro-models in the same way, the jury remains out.

No, genauer is full of it. And as far as moral hazard goes, what about the moral hazard associated with bailing out German banks? When loans go bad we don’t ordinarily pin the moral hazard rose on the debtor, but rather to the creditor.

I don’t know about cultural stereotypes, but I do know the difference between aggregate demand and aggregate supply problems, which is more than I can say for most German economists. In the Teutonic brain economics is exclusively a supply side problem. When weak aggregate demand and deflation is the problem you really should not be peddling half-assed supply side prescriptions. Those only make the problem worse.

Again 2Slugs shows a lack of knowledge of European cultures. Hint: they are diverse. Some like Germany work much better than others. But 2Slugs knows more than those silly Germans and believes in good old American Krugman-think as the answer to every problem everywhere. After all, all people are not only equal; they are the same – just interchangeable spare parts who respond predictably to econ textbook macro-models.

Cultural traits are very persistent and hard to change. Juicing up demand inside the Eurozone is unlikely to help the Greeks over any meaningful period of time; Greek culture doesn’t work – it is Middle Eastern in the pejorative sense. Change will be forced on the Greeks by the EU or they will have to live on their own resources. I was all over Greece in the 1960s and have a good idea of what a drachma Greece would be like – pretty poor and pretty crummy for most Greeks. Some form of authoritarian rule would probably follow pretty soon.

c Thomson Cultural critiques are always the last refuge of a conservative who obviously does not understand the economic argument.

Suppose your cultural prejudices are right and Greeks really are lazy deadbeats. Suppose it’s as true today as it was half a century ago when you romped all over Greece. BTW, isn’t it a little weird to criticize a culture as lazy when you have enough leisure time yourself to romp around? But I digress. Even if we accept your subjective prejudices, wouldn’t all of those factors have been discounted when Greece entered the EU? What you don’t understand is that the problem isn’t just Greece’s long run structural problems. The immediate problem is insufficient aggregate demand. Why is this so difficult to understand? Is it because the only thing many conservatives feel comfortable discussing are subjective factors like cultural differences? Is macro too hard? The time to worry about Greece’s structural problems is when the output gap closes and inflation returns. Trying to focus on the long run supply curve while neglecting the short run AD curve is a recipe for failure. Then again, maybe failure is what Merkel wanted all along. It’s either that or she’s incredibly ignorant of economics.

And interestingly, the temporary Grexit, which would have allowed a write off, was rejected by Greece and some of the EZ members. And we have IIRC the issue that the now favoured construct needs approval of a few very pro-Grexit goovernments. The deal is not done.

As you say, Greece has had problems of clientelism, corruption and more since 1800, and probably prior to that also. This means these things are definitely not the cause of their current problems.

The extent of the current problems are due to cuts to government spending. If they truly do implement the automatic spending cuts required by the latest ageement so that there is a primary surplus this year, they will be chasing an always falling GDP until something really drastic happens to stop it.

The Greek economy is not able to finance the welfare the Greeks were used to during the first years of their membership in the euro. This welfare was only financed by capital transfers from outside. This source has run dry.

Therefore it’s obvious the government spending must be adjusted to a level the Greek economy can finance.

Greece has still the most expensive pension system in the euro zone (in relation to the GDP) and the highest proportion of the public workforce.

I am curious whether Tsipras can deliver parliament.

The Germans have managed to make a vote ostensibly about reform into one about sovereignty. You’ll recall, Genauer, that I said I knew the Germans ‘good and bad’. This is bad. Very German. Very bad. I’ll dwell on that below, but for, let me comment on the Greek parliamentary vote.

If I were a Greek politician, and since this vote is effectively about sovereignty (thank you, Angela and Wolfgang!), anyone signing up for this program is likely to appreciate that they may be making their last vote in Parliament and have their family labeled collaborators (yes, in that sense) for generations to come. If I’m in the opposition, I’ll pass.

If I’m on the left in Syriza, I’ll vote ‘no’ for obvious reasons. That’s leave the right of Syriza and maybe some conscientious guys elsewhere.

It is important to add that nowhere does this proposal appear to improve governance–of which many Greeks would approve–nor does it seems to improve the prospects for growth–which many Greeks would find desirable. Thus, it appears to be purely about debt collection. It does not appear to solve any fundamental problems. It is purely about demonstrating who is boss–and that’s very, very German.

@ Steven Kopits

1. Countries , which are in IMF Aid programs, get detailed obligations in exchange for financial help. Nothing specific “German” about that, just that the notorious Greek hate mongerers try to spin it as such.

2. Syriza is free to step away of this next 80 billion (25% of GDP) AID program, if they don’t like it. The hate mongering ( your “collaborators” ) against the sane 80% of the parliament (everybody but the die hard communists) is already ongoing there

3. In total contrast to your totally false claim this progam is very specific in many ways “to improve governance” (please see http://www.bbc.com/news/world-europe-33504487 and the link to the original http://news.bbc.co.uk/2/shared/bsp/hi/pdfs/13_07_15eurosummit.pdf)

-streamline pension system

– improve tax revenue

– liberalise labour market

– privatise electricity

– safeguard the independence of the statistical office ELSTAT against endless aggression to force them to cheat

– adoption of the code of civil procedure

– adopt more ambitious product market reforms with a clear timetable for implementation of all OECD toolkit I recommendations

– Privatization programme with improved governance

– Put in place a progamme for capacity building and de-politizing of the Greek administration

– Improve programme implementation and monitoring

Etc. etc, there is a lot longer list there, please read it

4. This is NOT about Germany , we just represent the vast majority of law abiding creditors, like Finland, Slovakia, Slovenia, Austria, Netherland, Estonia, Lithuania, etc.

The current agreement has no aid. There is no 80 billion. Greece is paying Europe 37.5 billion and having some repayments delayed. Also the use of the ECB ELA caps to “remind” Greece that it can be destroyed at any time will be suspended at the end of the week.

Sure many of the reforms are just common practice in other countries, but they aren’t things that can cause a quick recovery.

This is purely a case of Germany bossing Greece around for Germany’s advantage.

What should be Germany’s advantage?

Greece is repaying its debt, money it has already spent. Any other country has to account for its debts, too.

Greece has had a lot of time to implement these reforms. They could have already had a recovery, if they had done it before.

Fresh money from Germany is of course the easiest solution.

Genauer,

I’d like to answer your questions in two parts. The first deals with implementation.

Administration

Administering programs like improving tax collection, statistical data collection independence, adoption of civil code, and capacity building and de-politicizing of the Greek administration–all these require boots on the ground. Is the notion that the Troika will place dozens to hundreds of advisors into the Greek agencies? In fact, are they going to actually run the agencies? What rights will they have? What remedies will they have if the Greeks are not cooperative? What language will be used? Who will provide security? What if there are protests? What will the Troika do if one of their managers is beaten up outside his hotel by an irate Greek? What if they are beaten up by 30 irate Greeks?

Having been one of those advisors in Hungary (and one who spoke fluent Hungarian), I can assure you that bureaucracies are quite expert in circumventing foreign influence if they are so motivated. So, all these initiatives sound good on paper. In practice, they can be challenging to implement. And they are even harder to implement if they are viewed as the imposed policies of an army of occupation. I refer you to the US reconstruction post Civil War for an example of just how hard these things can be. We are 150 years since the end of the war and still arguing about the role of the Confederate flag.

Privatization

I know a good bit about privatization, and I would list a few particular considerations: prices, valuations, costs, investments, corruption and monopoly.

The selling prices from state-owned companies are often below, indeed, well below market prices. These are often set by company practice or under political influence. Thus, for example, if you look at Amtrak fares, on some of the long routes, you’ll see pretty easily that they must be set at a loss–a major loss. I need hardly mention fares on metropolitan buses. This will be even more so in Greece for things like the Greek railways. Therefore, price liberalization often precedes (or may succeed) privatization. The good citizens of Budapest, for example, can thank me for tripling their sewer fees. Now, when you’re living on $200 / month, an increase in fees like this by, say, $10 / month is a big deal. How will the Troika deal with this issue, both raising prices and dealing with the political fall-out?

Generally, SOE’s will see very different values based on discounted cash flow (DCF) or asset replacement cost valuations. Thus, the Greek railroads may be worth billions of euros on a replacement cost basis. On an DCF basis, their value is likely zero. Now, imagine these are sold to Deutsche Bahn for a fraction of replacement cost (but at a price DB still thinks is dear on a DCF basis). Will there be political fall-out? Who and how will it be handled? Do you expect the Greek politicians to be protecting the Troika or partaking in the protests?

Many of these state-owned assets are natural monopolies. This will include the electric grid, the airports, and the railroad, for example. Now, we know from the literature that a monopoly should provide better results than an SOE, but this improvement depends on a professional and disinterested regulator. Do you think the Greeks can create a professional and disinterested regulator?

And, of course, privatization provides fantastic opportunities for corruption, by selling state assets well below market value to favored insiders. I point you to the example of Russia, but I could pretty easily dig up some Hungarian examples as well. How would you rate this risk in Greece?

*****

I am all for these Troika programs. I think a privatized economy with a small, focused government is ideal. But the proposed Troika programs–absent domestic support–will be hard to implement, both from a technical and political perspective.

– improve tax revenue

– liberalise labour market

– privatise electricity

– safeguard the independence of the statistical office ELSTAT against endless aggression to force them to cheat

– adoption of the code of civil procedure

– adopt more ambitious product market reforms with a clear timetable for implementation of all OECD toolkit I recommendations

– Privatization programme with improved governance

“Push” versus “Pull” Systems”, Part II

“Push” in the Extreme

I’d like to comment on Wolfgang Schaeuble’s two proposals involving assets and Greek fiscal receivership from the incentive perspective.

First, I would like to assess the assumptions about Greek character made by German officials. The Greeks are considered shady, unreliable, sleazy dead-beats. In the German imagination, this is a failure of character and morality. It is genetic inferiority. Hence, there is no attempt to actually examine the incentive system under which the Greek political class operates and no attempt to try to modify this system. The only viable approach to fiscal order in Greece , in the German mind, is a direct takeover of governance, sequestering state-owned assets for sale by the Troika, and literally granting domestic fiscal powers to Troika representatives. This is a “push” system in the extreme. It is not about improving Greek governance, it is about either by-passing it entirely, or imposing a foreign coercive body atop the existing political regime. In this world, Greeks are inherently hopeless and need to be treated as a lesser race.

Well, I would refer the Germans to the last time they imposed German governance on the Balkan states and to consider the reaction of the local populations on that last occasion. Did it go smoothly? Did the locals immediately recognize the inherent superiority of German governance? Do you think they will this time around?

I have, I think, plainly laid out the Troika and EZ objectives in Greek as I see them, in order:

1. Improved governance (by the Greeks of themselves)

2. Economic growth

3. Debt repayment

Because the German proposal essentially ignores 1 and 2–which have legitimacy in Greece itself, and which are necessary both to bring Greek governance up to EU standards and to create a source of repayment–Germany has merely created the grounds for domestic resistance by focusing purely on the third element. It’s all about the Germans, and nothing to do with the Greeks, I think there is a very good chance that the Greek parliament will refuse to pass the proposed legislation, and then Germany will have gotten the worst of all worlds. A Grexit and default, and an enduring hatred of Germany. A three-fer!

Incredibly, incredibly stupid. And very German.

A “Pull” System

In the American imagination, people are pretty much assumed to be the same and to respond to their proximate incentives. (I think we still believe that. At least I seem to recall reading something like that in an economics textbook.) Therefore, we ascribe neither superiority nor inferiority to Germans or Greeks (since we can see that both seem to behave similarly after a few generations in the US), and instead focus on the incentive systems.

In this view, Greece will reform only if the Greeks themselves so desire it, and Greece will repay monies only if they themselves feel motivated to do so. Therefore, we would examine the current motivation system–and it clearly brings us to the deadbeat school. But the Greeks are not deadbeats because they are genetically impaired, but because the political system rewards them for behaving so. Therefore, we change incentive systems, and let that do the work. Again, this is so simple as to be banal, but it is a completely different approach than the one taken by Germany, which has successfully united guys like Krugman and me around a single point of view. Now that takes some real talent.

Here’s the right approach, again: http://www.prienga.com/blog/2015/2/19/a-program-for-greece

Please provide DIRECT evidence (not hearsay or other slanderers) for your totally false claim

“First, I would like to assess the assumptions about Greek character made by German officials. The Greeks are considered shady, unreliable, sleazy dead-beats. In the German imagination, this is a failure of character and morality. It is genetic inferiority.”

When did Wolfgang Schäuble or Angela Merkel or myself here say anything like that ?

When you are speaking of directly taking over another country’s assets or fiscal administration, as Schäuble did, then you are clearly implying that the Greeks, in this case, are incompetent, irresponsible or criminal in their behavior. However, if you were a technical consultant, as I am, you would not first ask whether the problem is one of moral character or inherent intelligence, but rather ask whether these people were motivated to produce the results that Schäuble would like. Put another way, do the Greeks share Schäuble’s objective function? That’s where you start, not with ‘ the Greeks are shiftless deadbeats.’

You don’t have to be a towering consultant to conclude that, in fact, Greek politicians are operating under a different set of incentives than are the Germans. If you have even the most minimal analytical skills, you would ask what these motivations are and how to counteract them. Well, clearly Schäuble doesn’t have even minimal consulting skills, because he clearly didn’t ask this question nor propose an answer.

Rather, he jumped right to “We Germans will run Greece because these incompetent Greeks are unable,” and proposed something as dimwitted as taking over Greek state monopolies and privatizing them seemingly without the least awareness of just what this entails as a practical matter. It all reeks of Übermensch. He is taking a ‘push’ system and making it an ‘uber push’ system.

Will this deliver long-term results? Look at Hungary, sitting right there on the border of the allegedly righteous Austrians. We had technical advisors everywhere in Hungary, for years. And what is the result today? We have a proto fascist government, favoring the very Russian government which enslaved the Hungarians for 45 years; a confiscation of savings; and unchecked clientelism. Did all those advisors in the 1990s set Hungary on the course for European convergence and prosperity twenty years hence? No. And yet you think an imposed system in Greece will make them better European citizens twenty years hence than the Hungarians are today? You are dreaming.

If you are the Troika, you emphatically do not want to be in the firing line of Greek reforms. If you have taken responsibility and control, you will also be held accountable. And most importantly, you will have done the work that the Greeks must do themselves if they truly want to be members of the Euro and European Union. You cannot do the kids’ homework for them at the end of the day. They have to do their own work and make their own mistakes. What the Troika can, and should, do is align the incentives.

I would have no qualms at all about championing my proposed program to the public in Greece. Indeed, I would go down the local pub every night and walk the citizenry though the day’s progress. And the message would be this: “Forward, Together: Governance, Growth and Credit” I would make clear that the big prize, the whole point of the exercise, is good governance. And by good governance, we mean primarily pro-growth policies. As the economy recovers, the Greeks need to understand that a share of that growth will go to repaying debt, but in fact, that growth alone also counts towards repaying debt. The whole point of EU and EZ membership is not the collection of debts, but the ultimate success of Greek society and its economy, in lifting it standard of governance and its prosperity toward northern European levels. If we can succeed with that, then we will find the money to repay at least some material portion of the debt. That’s the approach I would use.

Still the right program: http://www.prienga.com/blog/2015/2/19/a-program-for-greece

Of course Genauer didn’t say this anymore than I called the Greeks lazy, as 2Slugs claims.

Being a realist is taken as being evil – a denier of the truth and beauty of Krugmanian macro-economic analysis and that one size fits all.

Say that Haiti will always be a sick mess and you are instantly a racist. Say that mistrusting Iran is just common sense and you are an enemy of peace.

And so it goes.

Steve Kopits wrote:

“I think we still believe that. At least I seem to recall reading something like that in an economics textbook.”

That must be an old textbook.

It is.

Just an amateur (crackpot?) idea, but: I wonder if Greece could dollarize (as Argentina did) as practical transition back to its own currency — to give itself time design and distribute its new currency. Might fit (I don’t know how) with Greece’s number one import being crude oil and its number one export being refined petroleum — both being denominated in dollars. ???

Jim,

About as good an option as I have seen, call it a variation on the IOU option, de facto drachmas without actually pulling the plug. I long thought that there would be a muddle through in the past with wise people making a deal in the backroom, but it has not happened apparentliy because Schauble just really wants to crush the Greeks and any other uppity potential upstarts in the eurozone, even though the gaps between the final offers have been essentially miniscule.

Herr Genauer,

You are off on some of your points, as it appears much of the German population is as well., way off in some fantasy land that is really pretty nauseating to watch. Retirement age has already been raised, and the percentage of workers in the public sector in Greece is lower than in Germany. Oh, you did not know that? Boy, am I surprised. Furthermore, it is the Germans who are lazy, with much longer vacations than workers in Greece. Oh, you think that the 25& unemployment rate in Greece (over 50 for youth) shows they are lazy? Sorry, but massive cuts in government spending combined with tax increases as Greece has done have a tendency to get people laid off who would like to work.

Let me note something else that the readers of this blog should know (and its managers already do know). Not only has Germany gotten massive debt rwriteoffs, such as in 1953 for the debt run up by the Nazi regime, but in 2008 the US Fed bailed out German and French banks by taking on $600 billion of eurotrash obligations from the ECB, which was unable to save those banks, who were who also got saved by the 2010 arrangements with Greece, now being paid for by massive unemployment in Greece. Schauble may deserve respect for having been shot while overseeing the reunification of Germany for Kohl, but right now he is someone who is a total hypocrite who deserves noting but contempt and disgust.

@ Barkley Rosser

1. In contrast to your smug “Oh, you did not know that?” I do know that the official retirement age in Greece is now the same as Germany.

But I also know that the reality is different (e.g. http://uk.reuters.com/article/2015/06/16/uk-eurozone-greece-pensions-idUKKBN0OW20W20150616)

There are still many possibilities for retiring at 51, and that is the reason why pension payments in Greece are 17.5% of GDP, instead of 12% in Germany.

The classical Greek syndrome, on paper a decent number , and in reality endless exceptions , 14 instead of 12 monthly pensions, not just the main pension funds, but a myriad of extras, paid out of all kinds of special provisions on completely unrelated other budget items.

http://ec.europa.eu/eurostat/tgm/table.do?tab=table&init=1&language=en&pcode=tps00103&plugin=1

2. Where are your reliable data for “percentage of workers in the public sector in Greece is lower than in Germany”

3. your “for the debt run up by the Nazi regime“ please provide evidence for what loans went to Germany between 1993 and 1945

4. Schäuble is a Europhile, and enjoys historic record popularity, just not with people like you. And he was stabbed, not shot.

5. if the “the gaps between the final offers have been essentially miniscule.” as you claim, then what was all the drama and commotion over the weekend about ?

that was meant to be “between 1933 and 1945”

Herr Genauer,

Oh, sorry about getting what happened to Schauble wrong. Stabbed, not shot. Yes, his popularity is rising in Germany, but it is plunging elsewhere. This simply shows how badly deluded the German population is. They are completely misiniformed.

Only other item I shall note, beside the fact you admit the official retirement age in Greece has been raised, is to provide a source on the public sector employment matter, where you are just as deluded as most Germans.

http://www.business.insider.com/chart-of-the-day-government-sector-employment-2011-11

If that does not come up, just google it. Germany has a higher percentage of employed in public employment. It is a fact. Sorry to disillusion you from your fantasies.

And I do not know the exact time pattern of the accumulaton of the debt Germany had in 1953, but it was massively cancelled (not totally). The German position on this simply stinks to high heaven with hypocrisy, and I fear most Germans have no idea how awful they look right now as a nation, maybe worse than at any time since 1945. Indeed, that is definitely the case. Deal with it, Herr Genauer.

@ Barkley Rosser

In contrast to you I don’t make unsubstantiated false claims, like “debt run up by the Nazi regime”.

I also don’t insult people for “fantasies”, who were merely politely asking:

“2. Where are your reliable data for “percentage of workers in the public sector in Greece is lower than in Germany”

I did ask you for “reliable data”, and what I get from you is a BROKEN link to the YELLOW PRESS business insider http://www.businessinsider.com.au/chart-of-the-day-government-sector-employment-2011-11, the domain apparently for sale, which then just mentions some vague , unreferenced (Citi 2011) Where did the alleged Citi source get it from ? Own counting ? of course not.

This is where you get your inside from ?

That obscure graph by an obscure source is claiming a public employment fraction for Germany of over 31%

In stark constrast an OFFICIAL source http://dx.doi.org/10.1787/888932390557 puts the number of general + public for Germany at 13.6% and shrinking, a mere 44% of your claim. And Greece with 20.7% general + public corporation a whooping 52% higher than Germany

Now , whom do we believe, an official organization like the OECD with systematic data , or Barkley Rossers yellow press hearsay ?

But you, Mr Rosser prefer to routinely call people who look at official numbers and not your hearsay “deluded” and misinformed, hypocrisy.

I expect an unqualified apology.

One last thing for you, just google “BBC: Germany is the most popular nation in the world” , and the 2014 version “2014_Country Rating Poll_Global Release_Final_May30” , and deal with you being a tiny extremist minority with your hatred. Look at the rating of Germany vs the US , and look at the German ratings by the UK, France, and the US, all being higher than by ourselves, because we are modest people.

genauer, “3. your “for the debt run up by the Nazi regime“ please provide evidence for what loans went to Germany between 1993 and 1945”

“They estimate that 15 million to 20 million people died or were imprisoned in the sites.[28]”

https://en.wikipedia.org/wiki/Nazi_concentration_camps

the reference was to nazi concentration camps, and the millions who died or were imprisoned in them. even with payments made thus far, do you honestly believe the debt germany owed the victims of its actions was paid in full? not even close. this is why the world feels the hypocrisy of a germany who demands submission from the greeks, so that they pay their debts in full. germany could never repay its moral debt to the world. the world simply forgave them of their debt.

@ baffling

I strongly resent your blatant attempt to intimidate me with racist discrimination.

Your idea to silence me pointing out repeated false statement from Rosser and you by blaming me for stuff not even my grandfathers were responsible for, this is infamous.

And it will not work. I will not go silently into the night and forfeit my freedom.

genauer,

if you could kindly explain the racist discrimination i intimidated you with, it would be much appreciated. however, judging by your response, i do not think you understand what those words mean.

you may not be proud of that history, and I hope that you are not proud of that history, but it is a fact of history which did occur. now, you do not want blamed for the sins of your forefathers, and I certainly understand that as well.

i would imagine the youth of greece probably feel the same way about their current situation. the current austerity is going to destroy and demoralize an entire future generation of greece, for financial acts conducted by their forefathers. perhaps a little empathy is in order when you consider the economic measures imposed on greece today? you are punishing the wrong people with your views.

JDH wrote:

The traditional way these goals would be achieved is first, creditors would accept substantial haircuts and restructuring of the outstanding debt, and second, a big currency depreciation would give Greek exports a competitive international advantage to get the economy growing again without new borrowing.

Your first point is obvious but the current financial players want the money machine to keep pumping money their way as log as possible, lining their pockets. Everyone in the world knows Greece will never repay the debts, but the brokers get paid their commissions anyway, so they will keep it going until someone says stop.

Your second point is pure fantasy. Can you say Zimbabwe? Any form of a parallel currency would drive the euro out of circulation in Greece, bad money driving out good. But it would do nothing to exports. Anyone accepting the new currency would be a fool, so export contracts would still be in euros or dollars. Now what it would do is to continue to impoverish the Greek people because the parallel currency would face massive depreciation. Only Greeks would trade in the currency and they would try to get rid of their holdings as soon as possible. Wheelbarrows sales would undoubtedly increase.

The announced deal is the most cynical money grab I have ever seen. There is not one element that would increase production in Greece, the real way to increase exports, nor is there one element that would encourage international development in Greece. All the agreement does is create commissions for the new loan brokers.

Regarding the devaluation argument: I thought that Greek real wages have already fallen by ~30%, but that doesn’t seem to have helped. Why should we then expect further depreciation to help?

Lilly,

You make an important point. Greece has resisted austerity. Germany has attempted to force it on them. Because austerity is a consequence not a policy it needs no legislation. In the US the Forgotten Depression of 1920-21 was a consequence (falling wages and prices), the Great Depression was a consequence (falling wages and prices), the Great Recession of 2008-???? was a conquence (falling wages and prices). Bad central planning policies always end in consequences.

The Euros should stop sending any more cash to Greece. This is beyond silliness. This is not a problem of not being able to pay the old debts but of not being able to meet current accounts. (Total debt has steadily increased with the bailouts, if you include the haircuts.)

Whether Greece goes to a new currency is irrelevant (despite the macro economist desire to have some currency somewhere to inflate reflexively). The problems of Greece are not monetary, but not having enough cash and running a deficit. Inventing little pieces of paper won’t cover that up. Who will sell them a barrel of oil for scrip? And what is the point of devaluing a currency that you are trying to promote people to treat as real?

Actually, just continuing to use the Euro could be very practical. It is a sound currency. All the contracts are written in it. And there are still amounts left in the country (under mattresses and hidden offshore by residents, etc.) Kosovo and Montengro use the Euro, without getting to go to fancy meetings. There’s not even a transition needed! (In fact another advantage is the obviation of a transition.) Plus the Eurozone can handle the volume of offshore currency since it’s small and essentially no change.

Metering a new currency in with Euros might work (if there are any left in the country). But it’s kind of minutia. (and being half pregnant…the advantages and disadvantages scale with the ratio.) They could also introduce them by force by having the government exchange them with vendors (at controlled prices). And probably some element of command economy will be needed and will happen, given the political traits of the Greeks.

Whether the Euros “kick Greece out of the Euro” just means if they let them go to meetings and vote. So fine, kick them. But it’s orthogonal to what Greece’s currency decision is.

You’re seriously proposing a dual currency in which the new second currency has a dual exchange rate? Ugh. Awful idea. The purpose of any reform in Greece should be growth. Dual exchange rates are a disaster for growth.

A lot of people are saying “debt relief” and not understanding what one another means. When the IMF said “debt relief” in its July 2 report, it meant more official lending with privileged terms to roll over debts coming due in 2015-2018. Specifically that document foresaw €50b of gross new official lending, of which €30b would roll over maturing debts and €20b would rebuild cash balances, clear arrears and replenish bank recapitalization reserves. The only mention it made of possible write-offs was in a back section about how worse-than-expected future growth might be handled.

If Greece is politically incapable of sustaining a Troika program, then there will be a default and Grexit. Greece has been capable so far, but exasperation is building on both sides. Ultimately Greece needs Europe more than the other way around, and Merkel has played her hand very powerfully, biding her time while Tsipras alienated even the centrist European states with his foot-dragging and his referendum showmanship, and then confronting him with his near total lack of support. He may lose support in his own parliament soon.

But the Greeks very much want to keep the euro and the euro valuations of their financial assets. And a Troika program is the only way. I have no doubt that Greece could have been better off by now if it quit the euro back in 2008. But Greeks have a history that tells them not to go there, and as an outsider I’m not going to argue with that. I think that if Tsipras can’t implement a deal, the Greeks will eventually push him aside and elevate someone who can.

The reality is that Greece’s debt can relatively simply be kicked further down the road. The main bulk of debts to the EFSF have very low interest that’s currently added to the principal, not paid in cash. Another smaller chunk of debt to Euro Area central banks is refunded to Greece – not paid at all so long as Greece sticks to a reform program. For another mid-sized chunk pre-EFSF debt to Euro Area governments, Greece pays interest in cash but very little, about €300m a year. Greece also pays cash interest to the IMF, about €420m in the first half of this year. The program being worked out will increase the overall debt volume, but probably decrease the cash interest bill by rolling over higher-interest bonds into interest-deferred EFSF debt.

What’s more Greece didn’t had zero primary surplus last year, according to the July 2 IMF report, so it didn’t actually pay any interest from its own resources last year. And the primary surplus target for this year was last reported to be tentatively agreed at 1% of GDP, which is I think a bit less than the interest paid on locally owned debt. Some of that is to the Bank of Greece, which distributes much of it back to government. Some of that is basically a way that tax revenues go to recapitalize banks.

The real question for Greece is whether it can return to positive NGDP growth. Inflation remains low across Europe and negative in Greece, and without a radical helicopter money policy (which I don’t advocate) I don’t see Europe returning to 2% inflation anytime soon. Without NGDP growth, kicking the can really is only kicking the can.

http://www.globalizedblog.com/2015/07/merkel-shows-aces.html

There is a 50% unemployment rate for Greeks under age 30. So the German solution is to demand that older Greeks delay retirement and work longer. Brilliant.

This isn’t about economics. It is pure power politics. The Germans are getting their fascist groove on again. Demands for discipline and following orders. That has served them so well in the past.

Joseph,

This may be the first time I am in total agreement with you.

Greece interest payments have actually dropped a lot. In 2014 their intereset payment (% of GDP) was 2,6%. http://www.bruegel.org/nc/blog/detail/article/1551-greek-choices-after-the-elections/

Some authors calculate even lower numbers, like 2% http://www.voxeu.org/article/greece-solvent-illiquid-policy-implications

It is much lower than interest payment than in Italy, Ireland, Portugal etc. In recent decades Greece has never had such low interest payments as % of GDP.

@ baffling

July 15, 2015 at 9:46 am

1. the discussion with Rosser was about debt and not camps. That was your attempt to shift the topic to promote your racist hate mongering:

2. I do not owe you one cent of “moral debt, NEVER to be repayed”. With that You trying to make me, and all Germans , an ETERNAL second class citizen. That is “racist discrimination”

3. your “the world simply forgave them of their debt” is simply completely false. The London Debt Agreement 1953 regulated the payments, in conjunction with German payments to Israel, Germany contributing of 70 – 80 % of land troops to NATO to counter Russia, the “Stalin Notes” counter offers, and some other things.

And the last tranche was paid 3rd of October 2010, more than 65 years after WWII.

genauer, i am simply reminding you of the facts of history, specifically regarding actions of nazi germany. now, you are terrified of that history, and rightfully so. you do not want to be associated with that history. good for you. you would only be “an ETERNAL second class citizen” if you continued to defend past actions of the state. but if the world had demand reparations for the acts of WWII, like they did after WWI, germany would have collapsed. the world only extracted out of germany what it could and still allow the future of germany to grow. the rest of the debt from WWII was effectively written off. in fact, funds were even provided to germany to help it grow after the war. dispute that history all you want, it is true. i simply find it hypocritical for a nation which benefitted from the forgiveness of the world to appear so righteous towards a fellow european nation. too much pride leads to dangerous outcomes. again i reiterate, i don’t think you understand what “racist discrimination” means. you seem to think it means myself, or any other individual, is not allowed to raise issues of the past because it makes you feel uncomfortable. sorry, you are wrong.

you are NOT “reminding you of the facts of history”, you are just constantly making up false claims, like

a) what the ECB does,

b) the endless repetition of some hilarious claim between fed rate and inflation,

c) trying to switch from debt to camps

d) patently false claim “the world simply forgave them of their debt”

Every time you get caught red handed, you try to change the subject, no data, no RELEVANT links, no formulas, just baseless allegations

genauer, perhaps a little history lesson is in order

https://en.wikipedia.org/wiki/Axis_occupation_of_Greece

and you wonder why the greeks question the motives of the germans? you gripe about the past few decades of incompetence by greek politicians, but did you ever wonder why the country struggled so much over that period of time? you may want to blame it on the greek culture, but the chaos that ensued after the horrendous damage from the occupation of greece by nazi germany was a significant impediment on greece for years and years. the past does matter genauer.

your desperate attempts to blame Germany for everything under the sun and the opposite, now for the Grek civil war, after Germany left, and a Greek political culture of hatred, before and after that, are getting truly bizarre.

genauer, i do not blame germany for everything under the sun. germany has done some very good things over the years as well. i simply do not believe in the infallibility of germany, unlike yourself.

just to keep this comment short:

your latest blaming of Germany for

a) the Greeek civil war, strting before, and stoked by Tito, Churchill, America, and

b) te disfunctional greek politics cultures

is clearly totally bizzare. Typical for you.

gen,

i blamed nazi germany for world war II and the holocaust. that is the big picture. greek history is just a side show. just to be clear, you believe germany is infallible, and did not conduct those acts. now that is bizzare. but keep on coming back to try and defend your position. it is poor taste.