A few years ago, most economic models presumed that interest rates were subject to a lower bound of zero. Why lend a dollar to someone who only promises to pay you back 99 cents, when you could just hold on to the dollar yourself? But we now have several years of experience from Sweden, Denmark, Switzerland, Japan, and the European Central Bank in which the central bank successfully induced negative interest rates in hopes of stimulating a greater level of spending on goods and services. We have enough data now to take a look at how much that seems to have accomplished, and update my earlier discussion of this topic.

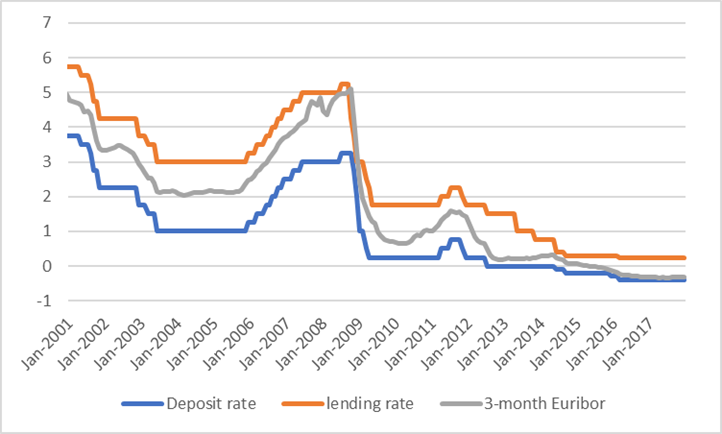

First, it’s useful to understand how the central bank could bring about negative interest rates. Consider for example the European Central Bank. Traditionally the ECB would set two interest rates: a deposit interest rate that the ECB pays to banks on excess reserves held overnight in the banks’ accounts with the ECB, and a marginal lending rate at which banks could borrow overnight from the ECB. The deposit rate would usually set a lower bound on the interest rate at which banks would offer to lend to each other– why would I lend to another bank at 2.5% if I can get 3% on my ECB deposits, which are in effect an overnight loan from my bank to the ECB? The borrowing rate likewise sets a ceiling– why borrow from another bank at 5.5% if the ECB will give me all I want at 5% through their lending facility? The graph below shows how this system worked historically, with the interest rate on 3-month loans between banks moving within the corridor specified by the ECB.

Average interest rate over the month on 3-month interbank loans (in gray) and end-of-month values for ECB deposit rate (in blue) and lending rate (in orange), January 2001 to December 2017.

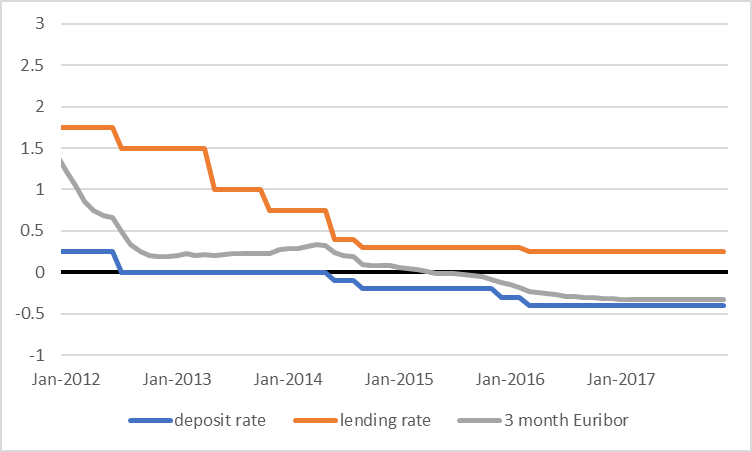

The ECB brought its deposit rate all the way to zero in July 2012. When that didn’t seem to be enough, they went to -0.1% in June of 2014, in other words, charging banks a fee (corresponding to a 0.1% annual rate) on their deposits held in excess of requirements. By March of 2016 the ECB had brought the deposit rate all the way down to -0.4%, where it still stands today. Here’s a more close-up view of the most recent data. It’s functioned just like the historical system, with banks lending to each other at a rate that is somewhere between the deposit rate (currently -0.4%) and lending rate (currently +0.25%). The average rate on interbank loans for December turned out to be -0.33%.

Average interest rate over the month on 3-month interbank loans (in gray) and end-of-month values for ECB deposit rate (in blue) and lending rate (in orange), January 2012 to December 2017.

Why would I pay another bank for the privilege of letting me lend money to them? It’s actually an easy call. If I keep the money myself, I’ll have to pay the ECB 40 basis points interest (at an annual rate). If I lend the funds to another bank, those deposits become their problem, not mine. Paying 33 bp to another bank to take the funds off my hands is obviously a better deal than paying 40 bp to the ECB. And hoarding cash would involve enough additional risk and cost that the banks just settle to pay another bank to take the funds from them.

But why would my counterparty agree to the deal? It’s actually the same reason that the interbank rate traded above the deposit rate in normal times. Whether I pay interest or receive interest on my deposits with the ECB, these accounts are useful in their own right for a number of other reasons. Banks use them to make or receive payments from other banks throughout the day, and I never know for sure whether I’m going to end up with more than I need. Another dollar in deposits could well end up costing me another 40 bp, but given other benefits of having the deposits, the true opportunity cost is more like 33 bp.

What are negative interest rates supposed to accomplish? Lending deposits overnight to another bank isn’t the only way I could try to get rid of them. Another strategy I could try is to buy a government security (another very low-risk option for my funds), paying for it by sending my ECB deposits to some other bank. That again would make the ECB deposit fee the other bank’s problem, not mine. If the government security pays positive interest and ECB deposits pay negative interest, the trade is again a no-brainer. But as all the banks try to buy the securities from each other, they will just pass the ECB deposits back and forth among themselves until they have bid the price of government securities above par. The result is that the effective interest rate on those government securities will go negative as well.

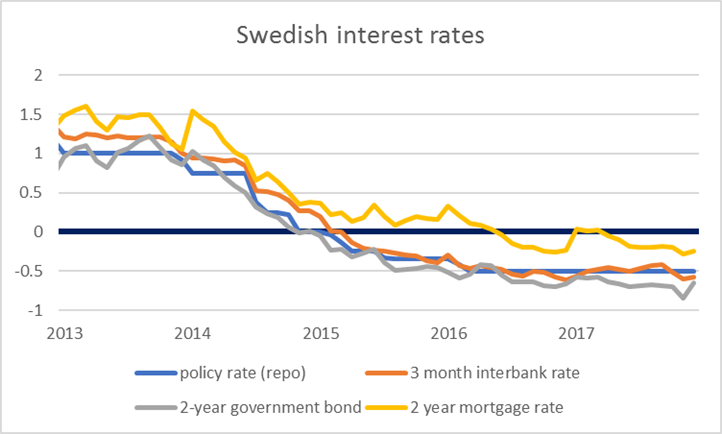

Here for example is an update of the analysis by Asterland et al. (2015) of various interest rates in Sweden, where the central bank has held its policy rate at -0.5% since March 2016. The interest rates on 2-year government bonds and even 2-year mortgages are now both negative.

Alternative interest rates in Sweden, Jan 2013 to Dec 2017. Data source: Riksbank.

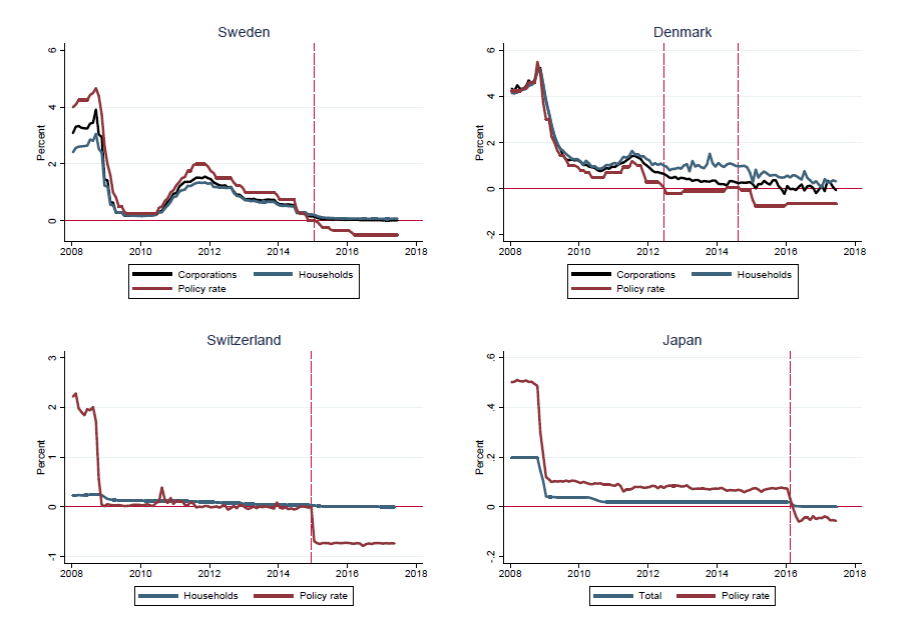

But some interest rates are harder to push into negative territory. The experience in these countries has been that banks are reluctant to start charging customers for the privilege of making deposits in the bank, for fear of losing those deposits as a future source of funding. Banks that don’t charge fees are then losing money on those accounts in the current environment. A negative interest rate policy may thus decapitalize the banks at a time when maintaining the health and stability of financial institutions could be an important policy goal.

Policy rates (in red) and household and corporate bank deposit rates (blue or black) for Sweden, Denmark, Switzerland, and Japan. The policy rates are defined as the Repo Rate (Sweden), the Certificates of Deposit Rate (Denmark), SARON (Switzerland), and the Uncollaterized Overnight Call Rate (Japan). The red vertical lines mark the month in which policy rates became negative. Source: Eggertsson, Juelsrud, and Wold (2017).

A recent paper by Eggertsson, Juelsrud, and Wold (2017) found that changes in the central bank’s policy rate have a much more limited pass-through onto customer deposit and lending rates once the policy rate becomes negative. Using detailed data from Sweden, for example, they found that banks that had historically depended more on customer deposits had significantly lower growth in loans extended after the policy rate became negative. Heider, Saidi, and Schepens (2017) found the same was true of Euro Area banks. Eggertsson, Juelsrud, and Wold (2017) developed a theoretical model in which reductions in the policy rate significantly below zero could actually be contractionary, leading to a decrease rather than an increase in overall spending.

Moreover, there are limits to how negative rates can go before cash hoarding begins to replace traditional banking. Maybe the central bank can get to -0.5%, but -1.5% could be more of a challenge. If all we could do is bring the policy rate from 0 down to about -0.5%, then even if there was 100% pass-through, the practical stimulus from bringing borrowing rates another 50 bp lower may be limited, particularly in an environment where pessimism rather than a perceived cost of borrowing is the biggest factor holding back investment spending. Indeed, a key goal of central banks in these situations is to try to contribute to expectations of a more robust economic recovery once interest rates go back to positive territory. It’s not clear that setting a negative interest rate today works well in practice for purposes of achieving that goal.

The Fed was understandably reluctant to use negative interest rates as a policy option during the recent episode of economic weakness.

While this is true: “The Fed was understandably reluctant to use negative interest rates as a policy option during the recent episode of economic weakness”, in contrast the Fed is paying banks 1.5% on their $2.2 trillion in excess reserves sitting with the central bank collecting dust and cobwebs.

If I did the math right, that’s $33 billion per year transferred from the central bank to the commercial depository institutions for . . . . . . what exactly?

I can’t see that as good public policy, or good monetary policy for that matter, and since I’m a taxpayer rather than a CEO of a large commercial bank, I don’t like it.

Commercial banks would lend the money if they believed they could earn more. I think, a more interesting question is who really pays for the Fed’s profits – about $100 billion a year – it remits to the Treasury? We know the Federal government and Fannie Mae pay interest on Treasury bonds and mortgage backed securities.

“Commercial banks would lend the money if they believed they could earn more.

What pray tell is holding this back? JPMorgan in 2016 had $34.5 billion in income before taxes which represented a 13.6% return to equity. I doubt their shareholders are complaining.

More bad loans would reduce profits.

Consumers often can get a better deal showing another bank the loan offer a bank gave you – the other bank may give a lower interest rate, a bigger loan, and/or reduce other costs.

Gee – you remind me of Ali Velshi. All the words are pronounced correctly and they do form a sentence. But the substance is vacuous. Maybe MSNBC should hire you to costar with him.

“Commercial banks would lend the money if they believed they could earn more.”

that assumes there is a demand for the money. the demand has been from those with weak credit history at times, and not sure they should be extended the credit. the trick is to entice those with a strong credit history to want more credit.

Baffling, you almost sound like a capitalist! 🙂

i am a capitalist. i am not a proponent of an aristocracy or other elitist construct.

Hamilton. Hamilton… Oh, yes, now I recall.

Jim –

I wonder if you might add some thoughts on the implications of rock-bottom interest rates on fiscal policy. Will it engender reckless borrowing? Are we all Japan now?

And in that vein, perhaps a word on interest rates and demographics. If working age population if falling rapidly, as it is in Japan, what are the implications for interest rates, and by extension, monetary policy? Is it possible for, say, mortgage rates to be 6% in a 2% inflation environment when the demand for housing is falling by 1.5% per year? Indeed, does it make sense to target 2% inflation when your economy is not expected to grow for the next fifty years and your workforce is expected to fall by a third to the middle of the century? How should we think about that?

To my point:

Republicans Scale Down Agenda for Safety-Net Programs, Health Law

“Republicans are scaling back their ambitions to overhaul safety-net programs and dismantle the Affordable Care Act following President Donald Trump’s weekend retreat with GOP leaders, due to concerns they can’t muster enough support ahead of the 2018 midterm elections.”

All predictable based on my Japan article. However, rising interest rates may be the tax deal’s unmaking, ultimately leading to a Kansas Scenario. Probably worth a Menzie post.

The “purpose” of the Danish central bank is different than for the ECB. Its primary goal is keeping the Danish currency peg to the Euro. Maintaining a 2% inflation is a secondary issue. So for Denmark the negative interest rate have “worked”.

The effect of easy monetary policy on asset prices is clear. For example, one is currently rewarded with an annual gain of about 2% for going long in the futures market on the DJIA if the index makes no progress at all for the year. In the usual state of affairs, interest arbitrage causes the futures price to be higher than the spot price, so you lose by going long if the index stays fixced.

how does the negative interest on the 2 year mortgage in sweden work? is the bank paying me interest each month as i pay off the prinicipal? fascinating. further, how have the home prices in sweden held up with the negative interest rates? are prices falling? are the mortgages limited to swedish nationals, or can this have an international market?

The Fed’s reluctance to adopt ZIRP seems to have been based on the damage this would do to the money market mutual fund business model. Not so much on decapitalizing banks.

See https://www.federalreserve.gov/monetarypolicy/files/FOMC20100805memo05.pdf

Many internet retailers and small businesses will give a 3% discount for cash. Visa/MasterCard charges fees to run your card. These are baked into the price of the good, unless you pay cash.

Despite that, a 3% discount is not enough of an incentive for a lot of consumers to switch to cash. Its a headache to send a cashiers check or money order through the mail, which itself may have a fee. I have paid for cars for “cash”… but really I use my debit card, I am not going to carry a bag full of cash to the dealership. If there is a 10% chance I get robbed, then the certainty equivalent discount I need is >10% before I’d rather pay with cash. I am also not storing a pallet of cash in my basement, its an invitation to be robbed.

Point is, the convenience “shoe leather” cost of cash – including the threat of robbery and violence – is much more than 3%. In addition, there are bank reporting requirements around large deposits (to monitor for money laundering and other financial crimes). Since the medical marijuana industry is all cash now due to federal regulation (see here: https://www.nytimes.com/2018/01/04/magazine/where-pot-entrepreneurs-go-when-the-banks-just-say-no.html?_r=0), it would be interesting to study the convenience value (cost) of cash in that industry. What would people pay to switch to electronic funds and be able to take debits cards?

Whether there are limits to how negative rates can go before cash hoarding begins to replace traditional banking… depends on whether banks would ever pay borrowers to borrow money. I.e. negative rates for actual borrowers not just other banks. The answer is: we see corporations and governments being charged negative interest rates on bonds. Rates are now not all that negative, so we do not see a lot of examples, but we do see them. I think its more than a mere possibility now that if deposit rates are -10% banks would offer -5% for mortgages. Both banks and the government have a very strong interest in making sure the economy does not run on cash. A cash-based economy makes it very hard to collect taxes.

dwb: Some state regulators have been encouraging legal marijuana businesses to open accounts with credit unions or small local banks in order to discourage the satchels of cash to pay fees and taxes.

re: negative interest rates.

From what I gather, low interest rates have done little or nothing for structural unemployment rates. Are negative interest rates better at resolving structural unemployment rates? Probably not.

Similarly, is a dual mandate better than a single mandate at lowering structural unemployment rates?

“Structural” unemployment, by definition, cannot be addressed with monetary or countercyclical policy (**). Negative rates or a dual mandate does not help structural unemployment directly.

If its due to technological change… people will need new skills for example. What to do about structural unemployment depends a lot on what you think causes it.

** A long period of very low unemployment and labor shortage will induce employers to offer higher compensation to re-train workers. So to some extent, inflationary monetary policy might reduce structural unemployment. But, this also creates inflationary conditions, so its not necessarily an optimal way to solve structural issues.

Could it be argued that if interest rates were lowered to around -1.5% then banks may eventually start charging customers for making deposits?

Does anybody have an explanation as to why when a nation has negative nominal target interest rates it often seems that the time horizon of government securities that end up having the most negative rates are often at the two years time horizon? Look at the Sweden case, where this has been the case, and it has also been in quite a few other nations as well. I have yet to see an explanation of this peculiarly non-monotonic yield curve in this situation so often.

dwb: True, by definition structural unemployment cannot be addressed by monetary policy, though I would like to think that low, near zero, stable inflation rates would encourage all kinds of investment in productive assets from human and social capital to infrastructure and M&E. Constantly adapting to new economic innovations is an expensive activity. The more stable inflation and ultimately the lower borrowing costs are, the lower the risk for both private and social investment.

In practice, distinguishing between structural and cyclical unemployment as the business cycle unfolds can be difficult. That is one argument in favour of single-mandate monetary policy.

Perhaps the question should be, do negative interest rates help labour markets better adjust during a period of negative or stagnant economic growth? Use other criteria than minimizing the unemployment rate, e.g., rates of re-training, return to college/university, rates of new business start-ups, early retirement.

The long-term is now.