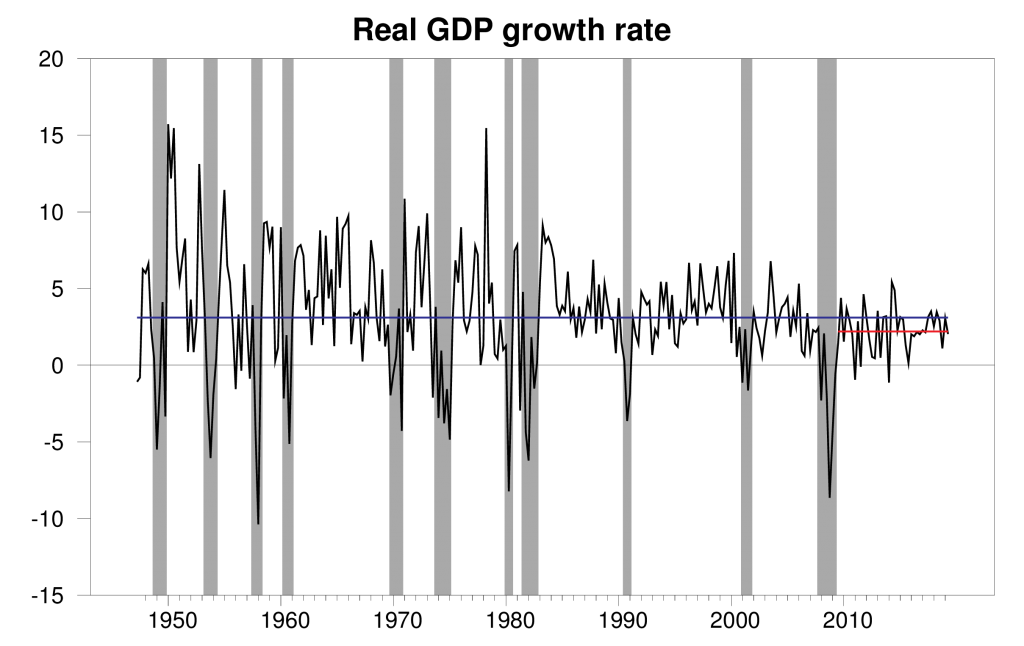

The Bureau of Economic Analysis announced today that U.S. real GDP grew at a 2.1% annual rate in the second quarter of 2019. That’s pretty near the 2.2% average rate since the recovery from the Great Recession began in 2009:Q3.

Real GDP growth at an annual rate, 1947:Q2-2019:Q2, with the 1947-2019 historical average (3.1%) in blue and post-Great-Recession average (2.2%) in red.

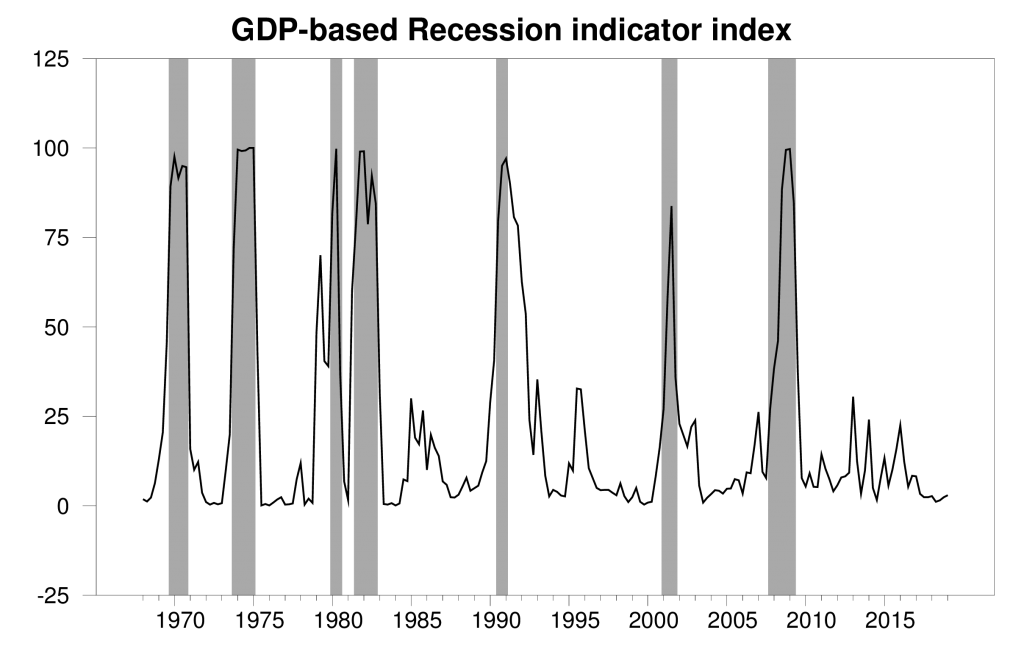

That brought the Econbrowser Recession Indicator Index to 2.9%, consistent with the favorable low levels we’ve seen over the last two years. The U.S. economic expansion has now been under way for 10 years (2009:Q3-2019:Q2), matching the previous record for the longest expansion on record (1991:Q2-2001:Q1).

GDP-based recession indicator index. The plotted value for each date is based solely on information as it would have been publicly available and reported as of one quarter after the indicated date, with 2019:Q1 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index, and which were sometimes not reported until two years after the date.

President Trump assessed these numbers with this tweet:

Q2 GDP Up 2.1% Not bad considering we have the very heavy weight of the Federal Reserve anchor wrapped around our neck. Almost no inflation. USA is set to Zoom!

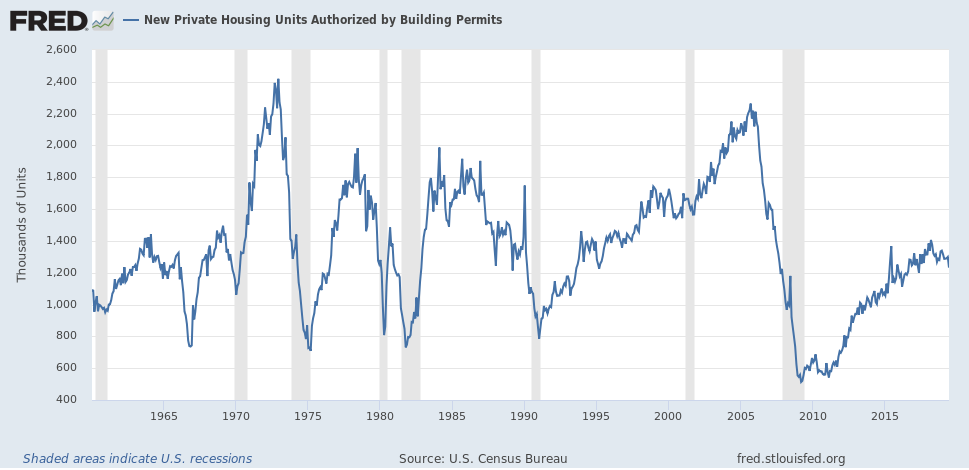

It is true that housing (in the form of anemic residential fixed investment) has been holding GDP growth back for several years.

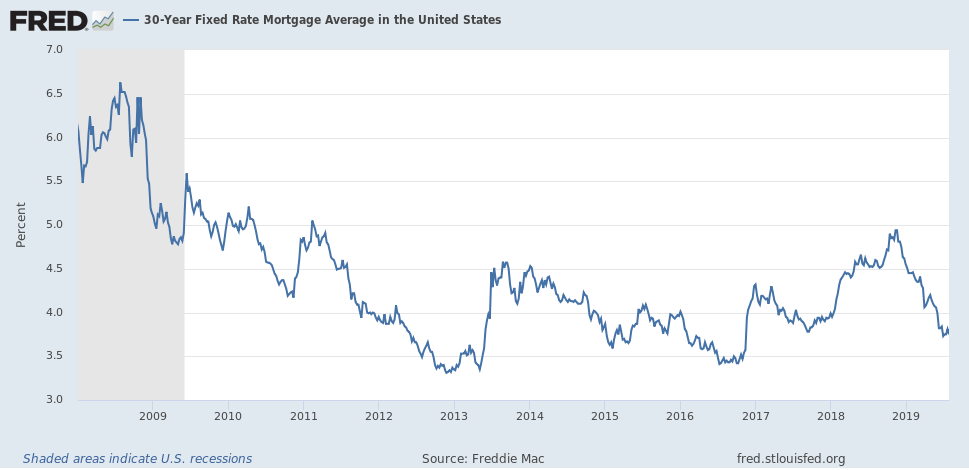

And rising interest rates during 2018 may have been one factor in that housing slowdown. But rates have come down significantly this year, and are now back essentially to the level before the run-up began.

It takes some time for lower interest rates to show up in new home sales. Some of my earlier research concluded that the biggest effects aren’t observed until 4 months after interest rates change.

Percent change in new home sales the indicated number of weeks after a 10-basis-point increase in the 30-year fixed mortgage rate. Source: Hamilton (2008).

If that was the whole story, I would have expected to see some rebound by now. And new building permits don’t give an encouraging sign looking ahead.

So I don’t think it’s fair to give the Fed all the blame for the current stagnation of residential fixed investment. Another hypothesis to consider is the role of increases in the after-tax cost of owning a home that resulted from the changes in tax laws implemented in December of 2017.

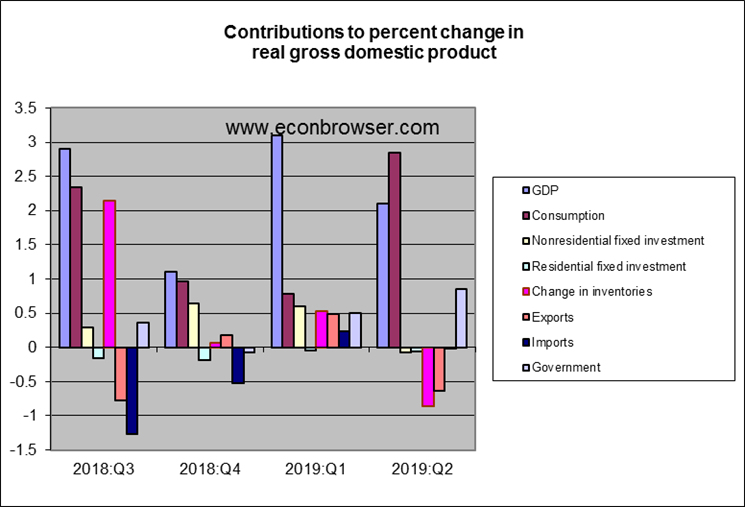

Returning to the chart above of contributions to GDP growth, a fall in exports subtracted 0.6% from the annual GDP growth rate.

Two-thirds of that drop came from civilian aircraft, engines and parts (see BEA Table 4.2.2), reflecting Boeing’s self-inflected wounds. The hit to GDP from those may get worse, and also contributed to the Q2 drop in nonresidential fixed investment, a category that had contributed 0.6% to the Q1 GDP growth. Also likely contributing to the Q2 decline in exports was tensions over world trade, another development high on many analysts’ list of factors to worry about in the current economic environment.

I agree with the President on this much– the numbers could have been better.

Bill McBride’s assessment seems to be pretty much the same. Given demographic realities, the 2.1% growth rate looks to be the new normal. Get used to it. The effects of the Trump tax cut have pretty much shot their wad, leaving us with a yawning structural deficit, which, as McBride says, any competent economist could have foreseen.

The only thing I would add to your post is that the spike in durable goods was due to motor vehicles, which probably explains the drop in inventory as well.

2slug,

There’s an area of relative weakness: motor vehicle sales (basically flat since 2015). I say “relative” because the levels are still good, but not trending upward.

• https://fred.stlouisfed.org/series/TOTALSA

Another area of relative weakness is home sales.

New home sales had appeared to stall for a couple of months, but rebounded in June (annual sales rate 646,000) and YTD comparison is up 2.2% versus 2018.

• https://www.marketwatch.com/story/new-home-sales-rebound-in-june-after-two-straight-declines-2019-07-24

Existing home sales fell 2.2% YTD (5.27-million seasonally adjusted annual rate) versus 2018, so overall we may be looking at a flat market.

• https://www.aier.org/article/existing-home-sales-fall-again-june

When those all go negative, then I’d say we have weakness in the economy.

So you are OK with slow and plodding growth. This is not what Trump promised. Be careful Brucie boy – Trump may have to fire you for once in your life talking about the real world.

I see where Bruce “not Robert” Hall thinks GDP growth is driven by the sales of existing homes. Which of course is really stupid. If I buy a used car from 2slug, that does not constitute production just a transfer. Same for sales of existing homes. Now if Bruce Hall had a clue, he would have provided this:

https://fred.stlouisfed.org/series/PRFIC1

Real Private Residential Fixed Investment

$620.4 billion as of 2017QIV. Down each quarter since to $589.1 billion.

Of course Bill McBride and James Hamilton both noted this so one would think Brucie boy would get this. But nope – as usual – clueless.

whoever, you can’t resist trying to be the class clown, can you. My points were about the economy, not specifically GDP. So, yes, wchile new vehicle sales and new home sales are part of the GDP calculation, only an idiot would say that a worsening of existing home sales was not an indicator of a weakening economy.

https://www.stlouisfed.org/publications/housing-market-perspectives/2018/housing-indicators-to-watch

KEY TAKEAWAYS

• Recent movements in several housing indicators resemble those seen in the late stages of past economic expansions.

• Not all housing indicators point to a slowdown.

• Key indicators to watch include mortgage rates, existing home sales, real house prices and the momentum of residential investment.

Now go back to watching CNN.

“My points were about the economy, not specifically GDP.”

The “economy” but not GDP? WTF? Lord – what a stupid statement even for you. You win Brucie – class clown will always be your crown!

“Not all housing indicators point to a slowdown.” This is sort of like saying not all days are warmer than others!

Your own St. Louis FED link:

“The cyclical momentum of home-sales activity reached its nadir near the onset of each of the previous three recessions. The current trajectory of existing home sales is consistent with this pattern, having recently fallen below its three-year average rate.”

This paints a very different picture than your little rosy view. C’mon Bruce – could actually READ this links before posting them? Or maybe you have no clue what these words even mean. So never mind me – keep embarrassing yourself this way. WHATEVER!

Leave to Bruce Hall to provide us with some data mining that Bruce Hall does not understand. Let’s unpack all of this and draw it in crayons so Bruce’s uneducated little brain might grasp. Two factors strike me as key issues in terms of predicting GDP growth. I’ll skip Bruce’s call to talk about the “economy” as he has no clue what he means by this term. Then again Bruce tosses out words he does not understand routinely.

The St. Louis FED does point to real residual investment which has declined over the past several quarters. That should be a concern but also note that the St. Louis FED smartly lists mortgage rates. Which has fallen a lot since the beginning of the year. Simply put – the fall in mortgage rates hopefully will reverse the recent decline in residual investment demand.

See basic economics is not that hard. Unless you are Bruce “no relationship to Robert” Hall!

whoever, I guess you’re berating the St. Louis Fed, eh?

whoever:GDP is the only measure of growth and anything not in the GDP metrics can’t be used as an indicator of economic weakness. You can’t have it both ways and then use the St. Louis Fed as a source for debate.

Come on, admit it. You love being the class clown.

—————-

https://www.stlouisfed.org/publications/housing-market-perspectives/2018/housing-indicators-to-watch

KEY TAKEAWAYS

• Recent movements in several housing indicators resemble those seen in the late stages of past economic expansions.

• Not all housing indicators point to a slowdown.

• Key indicators to watch include mortgage rates, existing home sales, real house prices and the momentum of residential investment.

Now go back to watching CNN since reading comprehension is not your strong suit.

“whoever, I guess you’re berating the St. Louis Fed, eh?”

From the village idiot who claims his name is Bruce Hall. Saying this village idiot does not understand some data mining is not berating anyone – except for perhaps the village idiot who claims his name is Bruce Hall. Fake name I guess.

But let’s repeat the incredibly simple statement that has our village idiot all angry. If Joe sells Fred a used car, automobile production does not rise. Same statement if Jill sells Susie her existing house – residual investment is not created so no new jobs, No new production. Oh yea Brucie whatever his last name is thinks it does because he is talking about the “economy” and not GDP.

Hey Brucie – you can keep this up if you want even if your own dog is now embarrassed at your incredible stupidity.

In a follow-up post, Bill McBride wrote:

“there was no investment boom following the tax changes. However, the tax changes did result in a large increase in the budget deficit (as predicted by all competent analysts).”

Yep!

Bruce Hall

Correction to what I said. Your comment caused me to relook the detailed GDP data. Motor vehicles appear to be a drag on GDP, although the value of light truck production was up a bit. It’s car sales that have been slipping. The economy right now seems to be meh. The wages and salaries component of personal income is growing, but decelerating (to use BEA’s description). Naturally, income from interest and dividends looks quite healthy. Personal savings as a percent of disposable income fell from 8.5% to 8.1%, which probably explains some of the strength in consumer spending. Personal saving is still okay and could support some more consumer spending, but it had been trending up since the tax cuts and the 0.4 percentage point drop would be a concern if that becomes a trend.

One thing that hasn’t gotten a lot of attention is the jump in non-defense federal spending. I didn’t think the Border Patrol bought THAT many tents and bars of soap!

Check out the difference between Bruce’s existing home sales (not part of GDP) and real private residential investment – the relevant series. Alas Bruce does not get the simple point here but I’m sure you do.

I wonder – do you think ‘fracking’ and the effective ceiling it put on oil prices contributed to the length or health of the current expansion?

It would be interesting if we could check investment demand in this sector. I haven’t check the incredible details on investment spending provided by BEA but this is a great homework assignment for someone.

https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2#reqid=19&step=2&isuri=1&1921=survey

Table 5.3.6. Real Private Fixed Investment by Type, Chained Dollars

Line 15 “other equipment” (Consists primarily of furniture and fixtures, agricultural machinery, construction machinery, mining and oilfield machinery, service industry machinery, and electrical equipment not elsewhere classified) is close as BEA gets. The broad sector has been basically flat since 2018QIV. I would suspect investment in agricultural machinery and oilfield machinery is dragging this down but we would have to go beyond this BEA information to know.

FRED to the rescue!

https://fred.stlouisfed.org/series/B270RA3A086NBEA

Real private fixed investment in equipment and software: Nonresidential: Mining and oilfield machinery (chain-type quantity index) (B270RA3A086NBEA)

Reported annually through 2017

Big drops in 2015 and 2016 with partial recovery in 2017

I guess we will have to wait for the 2018 figure and the 2019 figure is going to take longer.

” That’s pretty near the 2.2% average rate since the recovery from the Great Recession began in 2009:Q3.”

Channeling our Usual Suspects this must be FAKE NEWS. The economy sucked under Obama and has been the greatest ever since King Donald I took over. BEA is a socialist organization. So says Judy Shelton.

Now that I’ve had some coffee – interesting discussion of the residential investment market. Export demand and business investment fell but you note the Boeing woes which hopefully will soon be resolved.

Waste of time. They have no clue what GDP is and will never have a clue. They need to cut out these flawed quarterly reports. Just a waste of money

Are you saying BEA is clueless? When did you do a mind meld with Judy Shelton? The usual whining here is that BEA does not publish monthly data.

Excellent thread, Professor Hamilton! I personally do not place

to much stock in 90 day indexes since little can be projected from

such a short time period.

Housing construction is still quite dully. For most cities and villages,

production peak between 2000 and 2006, according to my observations.

Why America is now suffering from Peak Housing, I do not know, however,

its effects will become rather obvious, to home seekers, in the next decade.

There are more than likely a culmination of factors, which will create a large

shortage and crisis in America’s housing stock.

Demographics. If there are fewer young people overall, and those young people are saddled with debt or otherwise have poor prospects, they will create less demand for new housing. Single family construction, in particular, will likely be a diminished part of GDP in the future. That is my take on it.

Now if mom and dad decide that they need to finally get their own place, maybe that could serve as a temporary boost. Of course if we actually let more immigrants move here – one would think they would want a house and not those detention centers Trump is housing them in!

If you can get students underwater on education loans you have years of economic rents for the banks, why bother giving them a house?? You have them rent their living space also for zero equity. It’s a double win!!!!

That doesn’t create demand for new single family houses. Could create demand for new multi-family units. Those units are smaller, which means less furniture. Less room for tools, toys, hobbies. Less room for a family. The young people I know, meaning less than 40, are far less likely to have children as well. Which means less demand for all kinds of other things. Some can’t be bothered, but others just don’t feel like they have the economic resources to deal with raising children. Children will be something the very wealthy do, and the poor do, but not the middle class. That’s going to put a damper on things, because the very wealthy don’t spend the same percentage of income, and the poor don’t have the income to spend.

So, less demand for all kinds of things will follow from demographic and economic changes. Collecting student loan debt and then collecting an endless stream of rents will only save our feudal overlords. Those of us who are the great unwashed are increasingly up a creek.

First quarter I noted that rising inventories puffed the numbers and that they would probably go the other way helping to lower them in the second, which indeed happened. So they might go the other way for third quarter, providing some upswing for third quarter.

Real Final Sales of Domestic Product

https://fred.stlouisfed.org/series/A190RO1Q156NBEA

I think this series takes out the noise from volatile inventory accumulation. Its annualized growth rate for 2019QI was 2.3% and for 2019QII was 1.8%.

rising inventories puffed the numbers and that they would probably go the other way

Doesn’t speak well of some of these off-the-shelf commercial enterprise inventory systems.

A FOMC easing is appropriate to extend the longest expansion in U.S. history. Inflation isn’t accelerating, because the expansion has been weak. Less easing will be needed to preempt a recession or slower growth than to wait, because of lags in the adjustment process.

Also, there’s a debate whether inflation targeting or nominal GDP targeting is more appropriate.

Given Real GDP or the velocity of money is unstable, why is it better to target Nominal GDP?

Wouldn’t the instability of Real GDP in targeting Nominal GDP cause more policy adjustments by the Fed and wouldn’t the additional adjustments cause even more instability, because of lags in the adjustment process?

Anyway, this is my last posting, because too many of my relevant posts have been censored, while leftists attacks are allowed. It’s too political.

And remember as you ride off into the sunset: Sonny Bono is still dead. Has been for over two decades.

Don’t forget, O great California expert: the Sierra foothills are on the WEST side, not the east “near Reno”.

If Peaky is a “California expert” can we get him to provide his review of Once Upon A Time in Hollywood?

For the record, PT, I do not believe you. CoRev has been posting increasingly vicious lie after increasingly vicious lie on Menzie’s side, including lots of outrageous accusations against Menzie himself. And they have not been censored. JBH has posted completely wacko conspiracy theory garbage from Qanon, again over on Menzie’s side. Maybe some has been censored, but some was not. Sorry, but your posts have generally been stupider and more ignorant than theirs, but at the same time not filled with either the blatant outright lying or the outright insanity of JBH. I simply do not believe at least Menzie has been censoring you in any serious way, although, of course we do not know what we do not know, and maybe you have been trying repeatedly to post that Menzie is the giant spaghetti monster of the universe about to bring us all to eternal damnation, and he has censored those.

Now if you have been trying to post excessively aggressive and stupid stuff over here on the infrequently appearing Jim Hamilton side of this blog, well, then I cannot comment. It is my impression that he is much less tolerant of nonsense here, and here you are posting this not credible whine on his side while being careful to be very well behaved.

So, reallly, PT, how many times have you been censored by either JDH or MDC? I think you are exaggerating, just a bunch of fake news.

Peak, just wait until the 2020 elections to continue commenting. As the 2016 election caused this latest burst of anger, the 2020 version should drive these hermetically sealed minds deeper into insanity. What will be left is a diminishing group of unconnected vocal disbelievers wondering how they got there. All reactive emotion, mostly anger, and too little logic and rationality, is not a formula for learning

Watching the liberal circus clowns is an amazement.

“Watching the liberal circus clowns is an amazement.”

You and Peaky are liberals now? You two are certainly clowns but even the circus would not hire you!

IMO and FWIW, the very fact that the FOMC believes it needs to ease in order to extend an already-long expansion is pretty worrisome, and especially so in a hostile inverted yield-curve environment.

Sebastian

Peaky is baaaack writing his usual gibberish – “A FOMC easing is appropriate to extend the longest expansion in U.S. history. Inflation isn’t accelerating, because the expansion has been weak. ” The longest expansion ever but it is SO weak. It’s a floor wax and a desert topping!

Peaky’s contradictory messes remind me of this SNL classic!

https://www.nbc.com/saturday-night-live/video/shimmer-floor-wax/n8625

I think it was Drum who recently looked at the government contribution to GDP. If I recall correctly, when you take that away Trump’s economy is performing no better or worse than we had with Obama.

Steve

BEA is reporting that real government purchases are rising at annualized rate near 4% for the first half of 2019. But for the two-year period 2017/8, this growth rate was a mere 1.2% per year.

If you can find a link to what Kevin Drum wrote – that would be appreciated.

Real government purchases were flat in 2010 and fell for the next 4 years. Maybe that is what Kevin Drum was noting.

Remember, when Trump was first elected I said it would be easy to get 3% real GDP growth.

From the productivity data you could see that real nonfarm output was already growing at over a 2.5% rate.

So all he had to do to get 3.0 % real GDP growth was switch government from the negative growth imposed by the republican austerity budget policies to an expansionary policy. That is what he did and the tax cut was a flash in the pan that had essentially no impact on real GDP or business investment.

The number one rule of being an economic forecaster is that if you ever happen to be right, do not let anyone forget.