Today, students in my Master’s level Public Affairs course in macroeconomics had the good fortune to receive a guest lecture from Steven Kamin, resident scholar at AEI, formerly Director of the International Finance Division of the Federal Reserve Board (sponsored by UW’s International Division). In his lecture, he covered the centrality of the dollar in the global financial system, monetary “spillovers” of Fed policy to other economies with special reference to the pandemic response, the macro challenges posed by the most recent fiscal relief package, and implications for emerging market economies. The entire lecture is here.

I wanted to focus on six graphs which summarize the impact of the Fed’s actions on emerging market economies (EME’s).

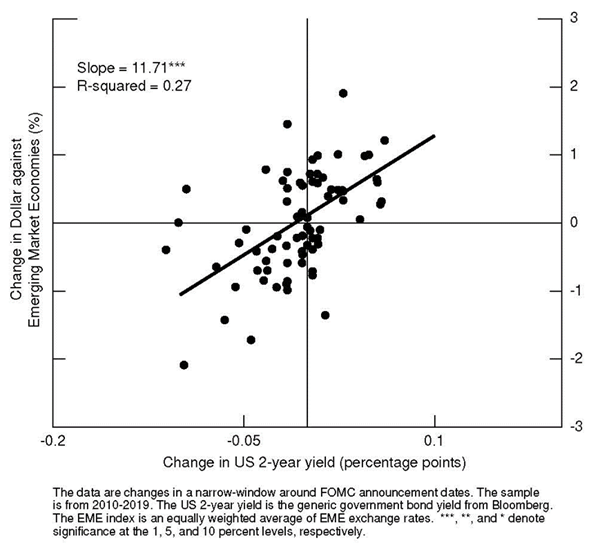

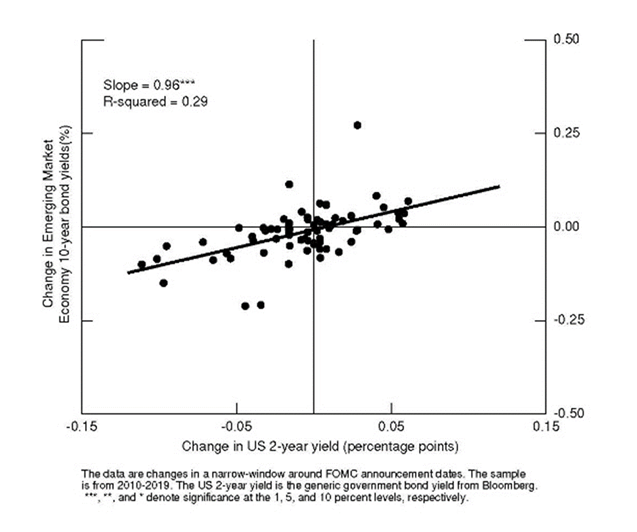

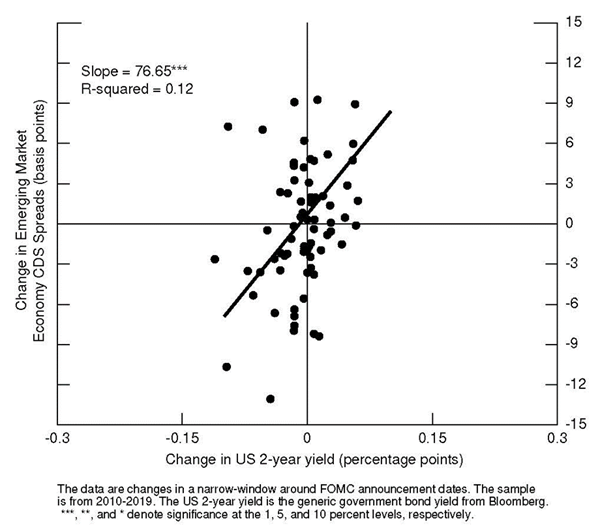

The first three quantify the impact of US 2 year yield changes at FOMC announcement dates on changes in (1) EME exchange rates, (2) EME government bond yields, and (3) EME CDS spreads.

Source: Kamin (2021).

Source: Kamin (2021).

Source: Kamin (2021).

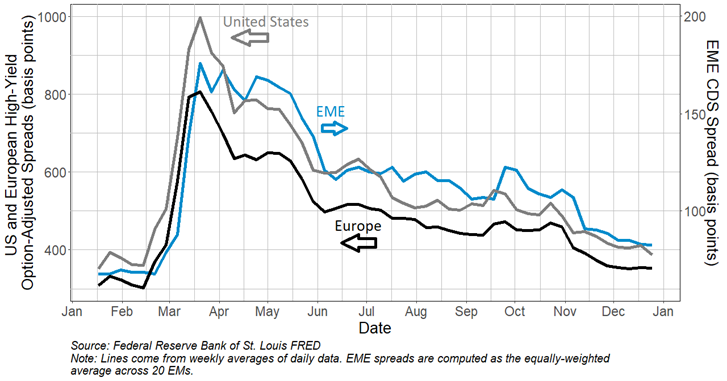

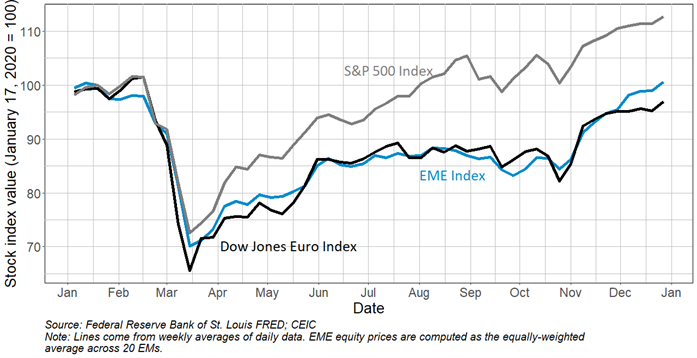

The second set of three figures concerns the evolution of key EME variables over the pandemic’s course.

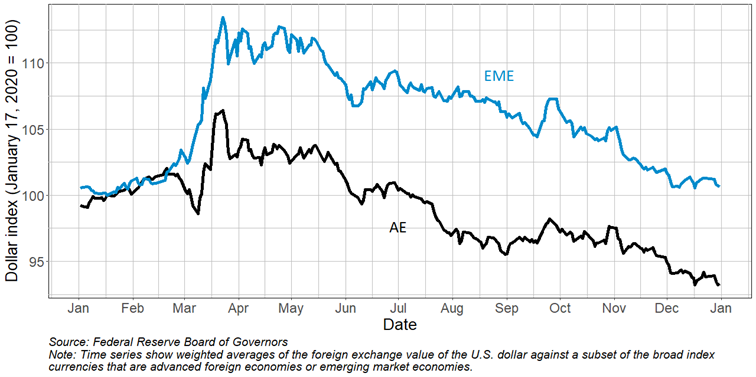

Using the above relationships, one can consider the effect of the Fed’s policy response at the outset of the pandemic in the United States. Initially, the dollar strengthened against EME currencies (Figure 4, blue line), EME CDS spreads widened (Figure 5, blue line right scale) and EME stock market plunged about 30% (Figure 6, blue line).

Source: Kamin (2021).

Source: Kamin (2021).

Source: Kamin (2021).

With the Fed funds rate return to the zero lower bound and the restart of credit easing, we see EME rates (on average) and stock markets return to pre-pandemic levels. Credit spreads have also fallen, although not back to pre-pandemic levels.

Dr. Kamin concludes with a discussion of the implications of three scenarios for inflation and Fed policy. For that discussion, see the entire presentation here.

Thanks for this, Menzie.

I have two questions and a comment.

The first is why did we see EME markets acting in Feb. and March last year act as if the Fed had tightened policy when in fact the Fed did not tighten. Of course after the Fed announced much more expansionary policy at the end of March we got a response as expected.

A rather minor question is why he labels the possible future scenario of a temporary spike in inflation “ugly” when a permanent spike of inflation is somehow merely “bad.” Is not “ugly” supposedly worse than “bad” in usual discourse? Assuming that is the meaning here, why does he think the temporary spike in inflation is somehow worse than a permanent spike?

My comment is to find it interesting that he highlighted so much at the end of his lecture the role of the swap arrengements that played such an important role back in 2008 but that not many people have been aware of.

Barkley Rosser: (1) While the Fed loosened, it was against a backdrop of rising perceived risk as illustrated by rising CDS spreads. (2) “Ugly” is less bad than “Bad” mirroring the typology in “The Good, The Bad, and the Ugly”, where Lee Van Cleef’s character is *really* bad, and Tucco (sp?) is merely opportunistic/slightly bad.

“Credit spreads have also fallen, although not back to pre-pandemic levels.”

The spike in credit spreads was almost as dramatic as what happened in late 2008 and early 2009. Credit spreads back then moderated over the rest of 2009. The moderation of credit spreads this time came sooner.

Naturally I would not expect someone from AEI to address the distributional consequences of monetary policy. For that we are fortunate to have a new study authored by several European economists.

https://www.nakedcapitalism.com/2021/04/softer-monetary-policy-increases-inequality.html

They found–surprise, surprise!–that monetary policy as it is currently implemented functions as a get richer scheme for the wealthy, who rarely let a disaster go to waste. The trickle down nature of this policy has been known for quite a while. Stiglitz published “The Price of Inequality” almost a decade ago. He later published a book detailing how to fix the problem. Saez and Zucman repeatedly published research that showed that the wealthiest received most of the gains in the early 2010s, years of historically low rates.

Nonetheless, the problem never seems to have emerged as much of an issue, Democrats and Republicans both being quite comfortable with monetary policy it is currently designed and with how it benefits their paymasters.

Question is, how much has this recent research affected how monetary policy is taught is the classsroom and how economists explain it to the public in the media?

JohnH: You could refer e.g., to Coibion et al. published in 2017 in an obscure (!) journal, Journal of Monetary Economics, for an example of examining income distribution effects of monetary policy. So, I’d say we think about this issue, research this issue, etc.

But he did not publish it in the NYTimes so JME does not count.

And this:

“Saez and Zucman repeatedly published research that showed that the wealthiest received most of the gains in the early 2010s, years of historically low rates.”

These authors were not blaming monetary policy or low interest rates. I would love someone to compare real interest rates over this period of time to real rates now as I bet they were not as low as JohnH wants us to believe. In fact wasn’t one of their conditions r > g (even if Greg Mankiw declared so what)?

I have to look for another source as the earliest interest rates FRED publishes go back to 1919. But notice the nominal interest rate on AAA corporate bonds was around 5%:

https://fred.stlouisfed.org/series/AAA

Monetary policy before the Great Depression was not exactly the ZIRP tried to tell us.

“We study the effects and historical contribution of monetary policy shocks to consumption and income inequality in the United States since 1980. Contractionary monetary policy actions systematically increase inequality in labor earnings, total income, consumption and total expenditures.”

Just the opposite of what JohnH routinely preaches. But if we are going back generations like he has, maybe we should remind him of Tobin’s debt deflation reasoning or even the economic logic in the Cross of Gold speech.

Yes JohnH failed monetary theory as well as the history of economic thought.

pgl: My impression is that JohnH has only a very cursory acquaintance with actual academic (i.e., peer reviewed) research, and analytical interpretation thereof.

I agree. I’m mostly concerned with how economic policy gets explained to the public in the media that they pay attention to as well as the distortions conveyed by economists assuming the role of public intellectuals, either by commission or omission. So, far example, Kamin relished saying that monetary policy saved the economy but never bothered to mention that it is also helping make fat cats obese.

JohnH: That’s why Fed policymakers who are allowed to speak publicly from Bernanke onward (despite your contention to the contrary) have argued for additional fiscal stimulus. In the medium run, money is a veil, so in order to affect *real* variables to a first order degree, you need *real* things (taxes, spending) to change.

But remember – he thinks we are all corrupt as we got paid by someone at some point in time. I just wish he would bother to provide reliable sources for his rather bizarre data claims as in how interest rates during the 1910’s were historically low (they weren’t).

Menzie: ten years ago, part of Bernanke’s justification for low rates was the “wealth effect.” It’s pretty clear whose side The Fed is on, and it isn’t those segments of the population that have a high propensity to spend and increase aggregate demand in the process.

The study by the European economists only proves what we already knew…and should raise our concerns if not our alarm.

There are several transmission mechanisms for how monetary policy impacts aggregate demand. But leave it to a know nothing like you to confuse basic modeling with political motivations.

More on “wealth effects” from a class ala Paul Krugman who reminds us that it was Irving Fisher that wrote the book on how debt deflation leads to Great Depressions:

https://www.masterclass.com/articles/what-is-debt-deflation-and-how-does-it-affect-the-economy#:~:text=The%20theory%20of%20debt%20deflation%20is%20a%20macroeconomics,financial%20instability%20results%2C%20eventually%20leading%20to%20a%20recession.

OK we know JohnH really hates Krugman for some bizarre reason and so he will be too cheap to pay for this. But Barkley did a nice job of explaining the hypothesis for us for free. Essentially unexpected tight money increased the real value of debt held by farmers which led to less aggregate demand from this sector.

Now JohnH may be too stupid to know this but we are talking about a wealth effect as real wealth = real asset value – real debt. Then again that is basic accounting so I’m sure JohnH does not understand this either.

Uh, no. Stating a fact is not the same as stating an allegiance. Interest rates affect asset prices – that’s a fact. The Fed’s most powerful monetary policy tool is interest rates – that’s a fact. Rising asset prices induce consumption – that’s a fact. Rising consumption induces hiring and upward pressure on wages – facts. (Not currently interested in fussy arguments about the definition of “fact”.) Bernanke had reason to hope that lowering rates would help the economy – boost hiring and wages – in part because of the wealth effect. In light of these facts, it is not at all clear whose side Bernanke is on when he says “wealth effect”.

By the way, evidence on the distributional impact of the wealth effect are not all that clear: https://onlinelibrary.wiley.com/doi/abs/10.1111/infi.12108. Housing is the most widely held asset. Access to residential real estate and the value of residential real estate are both quite sensitive to rates. Ignore that fact and you might come to the mistaken conclusion that the wealth effect only works for richie’s. It is true that minority households generally benefit less from low rates because of low home ownership rates. That’s more the result of housing discrimination than interest rate policy.

Claiming interest in how economics and economic policy are transmitted through the popular press is not an excuse for getting the facts wrong.

JohnH,

There is a great irony about monetary policy now regarding income distribution. It is unclear what they can do to push equalization.

Traditionally, and this is going back before the fed even existed to the days of the gold standard and William Jennings Bryan’s populist “Cross of Gold” speech, tight money supplies with deflation or disinflation and high interest rates were favored the rich as creditors who saw the value of their loans gaining, while looser money supply such as allowing silver money as advocated by Bryan with more inflation and lower inflation rates was viewed as favoring the poor who were debtors. This view has long held, with the political parties in the US taking these opposite sides: GOP tending to favor tighter high interest rate anti-inflationary policies and Dems the opposite.

But now we have this mechansm that has developed over the last couple of decades where the policy that supposedly favors poor debtors of low interest rates halps spur asset markets that favor the wealthy. And to the extent that inflation does not rise with such policies the old gain that poor debtors got from having the real vvalue of their debts decline no longer operates. So the old populist mechanisms have broken down. It looks like the rich gain no matter what.

It’s probably true that the rich gain no matter what, as long as they accurately read the tea leaves from the Fed and move their funds from bonds to cash to stocks as Fed policy would indicate. I think that a lot of investors are doing precisely that, with gains practically guaranteed…which basically begs the question: shouldn’t there be a windfalll profits tax on gains caused by predictable government action?

Stiglitz has been all over the Fed and its limitations for years, including his claim that Small and Medium Enterprises had difficulty accessing credit in the aftermath of the financial crisis. Personally, I noted that the Fed’s drop in rates never get passed along to credit card holders and it took a long time for rates on student loans to drop. The usual suspects wouldn’t even acknowledge that it ever happened.

Two possibilities:

1) The Fed (intentionally or incidentally) acts in a way that will benefit the rich more than the rest.

B) The Fed uses it’s monetary tools in accordance with it’s legislated mandate in an economic structure which tends to enrich the rich, with the result that Fed policy inevitably helps the rich more than the rest.

While the two options are not mutually exclusive, it use likely that one case dominates. Since there have been rich and poor for as long as human civilization has been around, I kinda think there is better evidence for B. The Fed operates within a rigged system and the effects of Fed policy reflect that system. Vote for better legislators if you want a better system.

The Fed needs to hire more minorities, hire more women, hire more non-technocrats to help lift the blinders once in a while. The Fed might benefit from giving non-financial sector folks a role as large as that of bankers in oversight and board positions. Even if all of that were to happen, Fed policy would still operate within a rigged system.

“hire more women” like Janet Yellen but please no to Judy Shelton.

“shouldn’t there be a windfalll profits tax on gains caused by predictable government action?”

Do you have any clue how easy this would be to evade? Gee the client got a windfall but it was not from a PREDICTABLE government action. Never mind the Efficient Markets Hypothesis that if something is predictable – no one gets any windfall profit at the end of the day. Yea I’m speaking financial economics which of course you will never get.

But an easier tax code to enforce would tax windfall profits regardless of whether they came from predictable or unforeseen events.

Please do not do tax law as in everything else in the world – it is WAY over your head.

Dean Baker recommends taxing stock returns.

https://cepr.net/tax-stock-returns-if-biden-really-wants-to-close-corporate-income-tax-loopholes/

The easy way to enforce a tax on windfalls would be to increase the tax rate when the Fed is lowering rates, lower it when the Fed is raising rates.

But that’s heresy!!! Faux progressive liberals like pgl can’t imagine doing anything—absolutely nothing—to address a Fed policy that helps drives

inequality. In fact, for most of the 2010s he couldn’t acknowledge that Fed policy was basically trickle down

JohnH

April 23, 2021 at 2:58 pm

Wait – you claim I cannot imagine taxing the well to do right after you note this Dean Baker proposal which I have endorsed MANY times.

Come on dude – we know you are stupid. We know you write pointless lies over and over. But damn – make it too obvious next time.

Kevin Drum applauds Biden’s proposal to double the capital gains tax:

https://jabberwocking.com/whos-afraid-of-a-high-capital-gains-rate/

I applauded this too yesterday. But of course JohnH later writes I could never imagine any proposal to tax the rich this way. Yes – he is that much of a liar. Pointless lies on the order of Sarah Palin.

“his is going back before the fed even existed to the days of the gold standard and William Jennings Bryan’s populist “Cross of Gold” speech”

Bryan’s 1896 speech was the most spot on populist declaration ever but JohnH has no clue what he was saying. Thank you for this eloquent reminder.

Then again JohnH started his parade of utter nonsense over at EV by telling us that growth was great during the gold standard days. He moved on to praising Cameron’s fiscal austerity as it some how was good for real wages as it kept inflation down. Never mind the fact that UK real wages plummeted during this period.

“Democrats and Republicans both being quite comfortable with monetary policy it is currently designed and with how it benefits their paymasters.”

Johnh, this is not an isolated topic. fiscal policy has an impact on how monetary policy works through the system. how one rates monetary policy today would be different if a large fiscal stimulus is implemented or denied. and that difference occurs between the democrats and republicans.

“the early 2010s, years of historically low rates”.

Before making statements like this maybe you could check the data. 10-year US government bond rates dating back over 200 years:

https://advisor.visualcapitalist.com/us-interest-rates/

Rates were not double digit but they were far above your ZIRP claims. Any more totally inaccurate babble today?

Isn’t Kamin also associated with Brooking? He’s not so much an AEI guy as a guy even AEI realizes they should listen to.

macroduck: To my knowledge, no. He’s a research fellow at AEI. He shows up on the Brookings website because he has a paper coauthored with Brahima Coulibaly.

Ah. Thanks.

Maybe someone should warn him about reputational issues?

He does have this impressive resume:

https://www.csis.org/people/steven-b-kamin

The anti-hate act designed to protect Asian Americans for MAGA hat wearing racists passed the Senate 94-1!

Who voted no? If you guess Josh Hawley, you’d be correct.

CNN provides a good summary of the total melt down from uber-racist Tucker Carlson and his ilk over the Chauvin guilty verdict. Carlson was actually laughing over the death of George Floyd. His melt down was so bad that even Stephen A. Smith had to spend First Take time to call it out.

https://www.cnn.com/videos/media/2021/04/22/brian-stelter-tucker-carlson-derek-chauvin-verdict-ctn-vpx.cnn/video/playlists/business-media/

As it is, there is a fairly clear bottom line on this matter of Fed policy impacts on distribution, with the link Menzie provided from the J. of Monetary Economics. Regarding income distribution the traditional view dating back at least to W.J. Bryan is that stimulative monetary policy tends to be more equalizing, stimulating income of lower and middle income groups more than those in higher levels.

However, we have the opposite outcome when we look at wealth distribution, which is what has people like JohnH upset. Thos lower real interest rates of stimulative monetary policy tend to boost the asset markets and so boost wealth, as we have indeed seen. So monetary policy affects income and wealth distributions differently.

People at AEI tend to be more intelletually serious than those at Heritage and some of the other conservative economics think tanks, with a long history of people there coauthoring and running projects jointly with people at Brookings.

As much as I strongly strongly dislike Hoover, I’ve always thought of Hoover as the conservative “counterpart” (for lack of a better term) to Brookings. I don’t think your AEI pairing is apropos.

Moses Herzog: Having worked and been a guest scholar at Brookings, and having visited AEI and known people who were resident scholars there, I look at AEI as being more a counterpart to Brookings than Hoover (although I don’t know a single person at Hoover personally, I have looked at their list of scholars).

@ Menzie

Fair enough, I stand corrected.

It is kind of interesting to think about. I like Brookings quite a bit (anyone would expect, since I’m a bleeding heart lefty for the most part). But so many people who pretty much make me seethe with anger are at AEI, whereas guys like Milton Friedman (in the past obviously) and your cerebral blogging partner Prof Hamilton have done things at Hoover, so yeah I “go at” Hoover sometimes, but actually find Hoover (yes, with my limited knowledge of the two institutions) less “annoying” or ethically bothersome, if that makes any sense.

Moses,

I have never been “at” either of them (or Hoover), but I have given several talks at Brookings and I know a lot of people at all three of those places. As pgl notes at AEI there is a range of good, bad, and ugly, which I think also holds at Hoover. Something important in terms of AEI versus Hoover in terms of interacting with people at Brookings is that Hoover is on the west coast while Brookings and AEI are both in Washington not all that far apart. Such things do make a difference. It is a lot easier for people from each place to get together for lunch at the Cosmos Club to discuss joint projects of interest. All three have substantial serious scholars.

All three also have a certain number of people who are really politicians or even journalists, with the politicians often using these places as resting spots for when their party is not in power for getting back into some office when their party gets back into the WH. For AEI in particular I do not think this worked for them when Trump came in because most of these folks were people who had been in one or both of the Bush administrations, and were often a bit too established and reasonable for the looney bin that the Trump advisers were. A bit of the same problem for Hoover, although Judy Shelton was there for awhile who Trump tried to put on the Fed Board. He got some people out of Heritage, which is more political and less scholarly.

https://www.aei.org/our-scholars/

AEI provides us a list of their scholars – the good, the bad, and the ugly. I will leave it to you to categorize each scholar per the title of my favorite Spagetti Western.

Ooops, just put this one on wrong thread. Here it is where it belongs.

AEI is probably the most intellectually substantial conservative economics think tank in Washington. There has been a history of people there coauthoring with and running joint projects with people at Brookings.

Financial economists realize that their profession owes a huge debt to the papers co-authored by Merton Miller and Franco Modigliani. Now we know the latter was a leading Keynesian.

It turns out that Miller co-authored a macroeconomics text with Charles Upton who was a died in the wool new classical type.

Then again Miller-Upton Journal of Finance 1976 was THE seminal article on the economics of leasing so hey!

I have copied much of macroduck’s reply to JohnH’s bitching about Bernanke noting a wealth effect. Well said but of course JohnH never bothers to sit down and read such stuff preferring to just continue his pathetically stupid pitching.

But we can define wealth or net worth for any person rich or poor as the value of assets minus the value of debt. Simply put lower interest rates are supposed to increase the value of assets. Now some have more assets than others. And farmers over 100 years ago had a lot of debt so the kind of tight money that JohnH seems to endorse at every turn lowered the net worth of these farmers. That was the point of Irving Fisher’s Debt Deflation hypothesis that I, Barkley, and Krugman talked about. Which is a form of wealth effects.

Of course JohnH could care less about real economics. After all – understanding such stuff gets in the way of his incessant bitching.

macroduck

April 23, 2021 at 11:52 am

Uh, no. Stating a fact is not the same as stating an allegiance. Interest rates affect asset prices – that’s a fact. The Fed’s most powerful monetary policy tool is interest rates – that’s a fact. Rising asset prices induce consumption – that’s a fact. Rising consumption induces hiring and upward pressure on wages – facts. (Not currently interested in fussy arguments about the definition of “fact”.) Bernanke had reason to hope that lowering rates would help the economy – boost hiring and wages – in part because of the wealth effect. In light of these facts, it is not at all clear whose side Bernanke is on when he says “wealth effect”.

Changing a couple words from what you just said: “[Trump’s tax cuts] induce consumption – that’s a fact. Rising consumption induces hiring and upward pressure on wages – facts. (Not currently interested in fussy arguments about the definition of “fact”.) [Trump] had reason to hope that [cutting taxes] would help the economy – boost hiring and wages – in part because of the wealth effect [the wealthy keeping more of their wealth.].”

Liberals like trickle down via low rates; conservatives love trickle down via tax cuts, though they too have come to love low interest rates.

And it’s not just the effect on wealth. Per the study I cited, “Our first set of results concern the effects of monetary policy on disposable income. We show that softer monetary policy increases disposable income at all income levels, but that the gains are highly heterogeneous and monotonically increasing in the income level. As shown in Figure 1, a decrease in the policy rate of one percentage point raises disposable income by less than 0.5% at the bottom of the income distribution, by around 1.5% at the median income level, and by more than 5% for the top 1% over a two-year horizon.” In addition, “The results suggest that softer monetary policy unambiguously increases income inequality by raising the income shares at the top of the income distribution and lowering them at the bottom. ”

While the disparity of impact on disposable income is pretty dramatic, “the effects of softer monetary policy through appreciation of assets are generally much larger than the effects through higher disposable income. “But it’s not just assets, but the impact on debt: “Notably, the top-1% stands out with larger gains from softer monetary policy than any other income group at each level of leverage.”

Now why, exactly is the Fed’s trickle down monetary policy a subject of wide public interest and debate? Shouldn’t economists doubling as public intellectuals be flogging this issue? Where is the outrage?

Correction: Why exactly is the Fed’s trickle down monetary policy NOT a subject of wide public interest and debate?

“the Fed’s trickle down monetary policy”

JohnH uses a lot of words he does not understand. Trickle down is right wing word salad for the following nonsense economic hypothesis: cut taxes (for the rich so they can go on shopping sprees on Rodeo Drive, which drives the national savings curve in but I’m already going off their script) and this somehow leads to more investment and long-term growth (even though any economist with a brain would not this raises real interest rates and lowers investment and long-term growth – but I just went off their stupid script again).

But leave it to an economic know nothing like JohnH not to get the difference between long-term growth and short-term Keynesian aggregate demand management. Yes – JohnH is THAT INCREDIBLY STUPID.

Johnh,

First of all I looked at the study you linked to. I note it uses data from Denmark where income and wealth are both much more equally distributed than in the US. I am suspicious about carrying over anything from there to the US. I also remain quite certain that even if somehow a more stimulative monetary policy actually does increase higher incomes more that in it increases lower ones, there is a bigger disparity in terms on wealth inequaiity than on income inequality, or at least that would hold in the US.

However, I must ask what you think the Fed should do. You seem to think that the “wide publid” should be shocked and outraged by Fed policy. But do you think they would support a hiking of intetest rates that would slow growth and might lead to an increase in unemployment? Yes, during the pandemic fiscal policy has been used to mitigate the impact on the unemployed, but do you really think the “wider public” is going to get all excited for having higher unemployment because it might reduce the wealth or even incomes of those at the top?

Or do you think other monetary policy tools should be used? On this I doubt you are going to find too many that will clearly target raising low incomes while not doing so for higher ones. Quantitative easing? To the extent this involves the Fed buying mortgage-backed securities it might help lower mortgage rates, which might make it easier to buy homes, but it also puffs up the value of existing homes, and the poor are mostly renters. Got any other Fed policy tools up the sleeve? Or maybe you want to join the Austrian free banking crowd and call for shutting down the Fed. Oh yeah, those folks also want to bring back the gold standard. Do you want to crucify us upon a Cross of Gold?

I note that the main reason the Fed raises interest rates is to slow inflation. But at the moment they are trying to get it up a bit, possibly unwisely. This is indeed the core of the old Phillips Curve, the supposed unemployment-inflation tradeoff, which is sometimes there and sometimes not, although not so much now with inflation not doing much. Anyway, when it operates you get that tradeoff, so the efforts to raise interest rates slow inflation but raise unemployment, whatever that does to income increases at different levels.

Anyway, you have yet to say what the supposedly no-good rotten Fed should be doing.

All this babbling and word salad but you cannot bother to respond in any substantive way to the point he was making. Oh wait – you do not understand the point he was making as you are an utter babbling moron. Babble on dude. It is what you have been doing for over 6 years. BORING!