Five year inflation breakeven shrinks, ten year – three month spread dives, TIPS and expected real rates rise above zero. The S&P500 and Bitcoin falls even as VIX remains at sub-Trump levels.

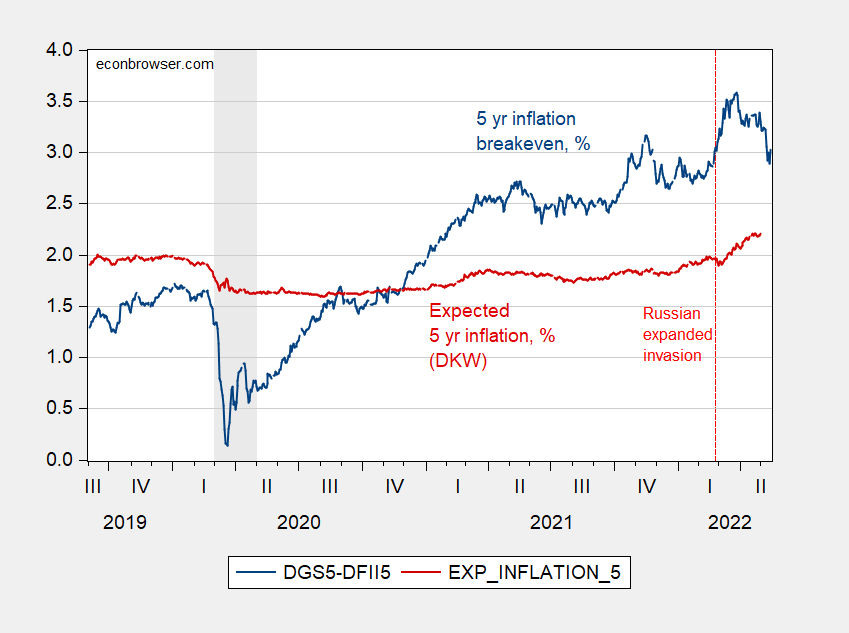

Figure 1: Five year inflation breakeven, 5 year Treasury minus 5 year TIPS (blue, left scale), 5 year breakeven adjusted for both inflation risk and liquidity premia, per DKW (red), both in %. NBER defined recession dates shaded gray. Source: Treasury via FRED, KWW per DKW, NBER, and author’s calculations.

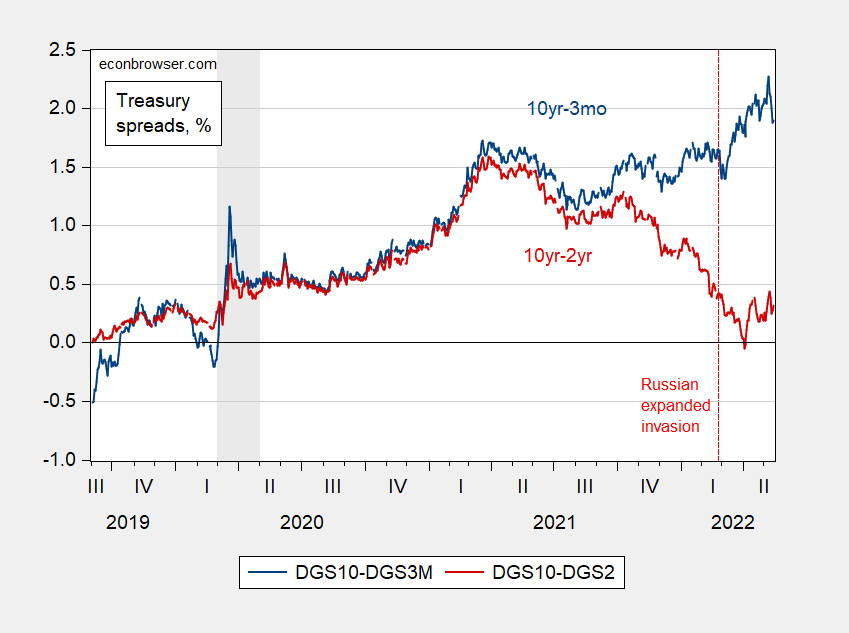

Figure 2: Ten year – three month Treasury spread (blue), ten year – two year spread (red), both in %. NBER defined recession dates shaded gray. Source: Treasury via FRED, NBER, and author’s calculations.

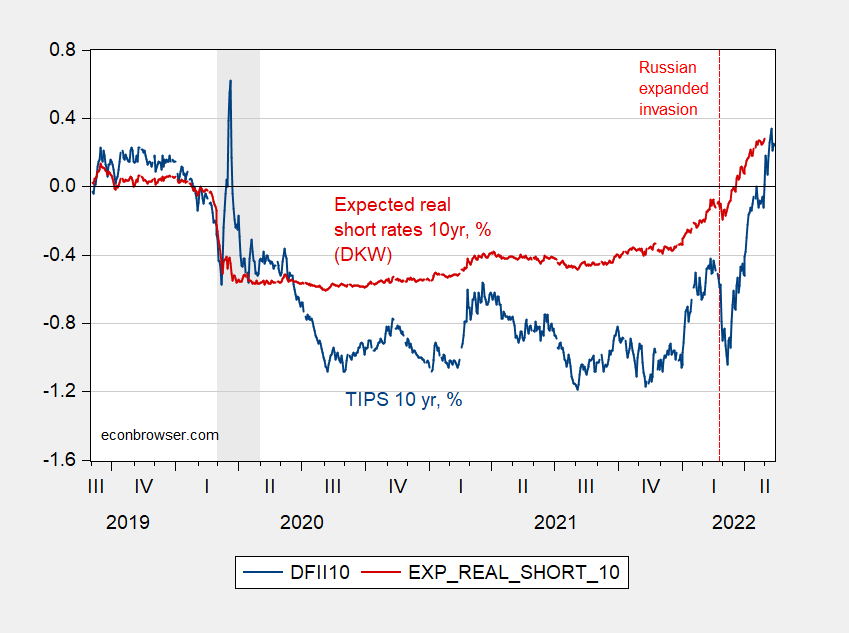

Figure 3: Ten year TIPS (blue), expected real short rates for ten years, per DKW (red), both in %. NBER defined recession dates shaded gray. Source: Treasury via FRED, KWW per DKW, NBER.

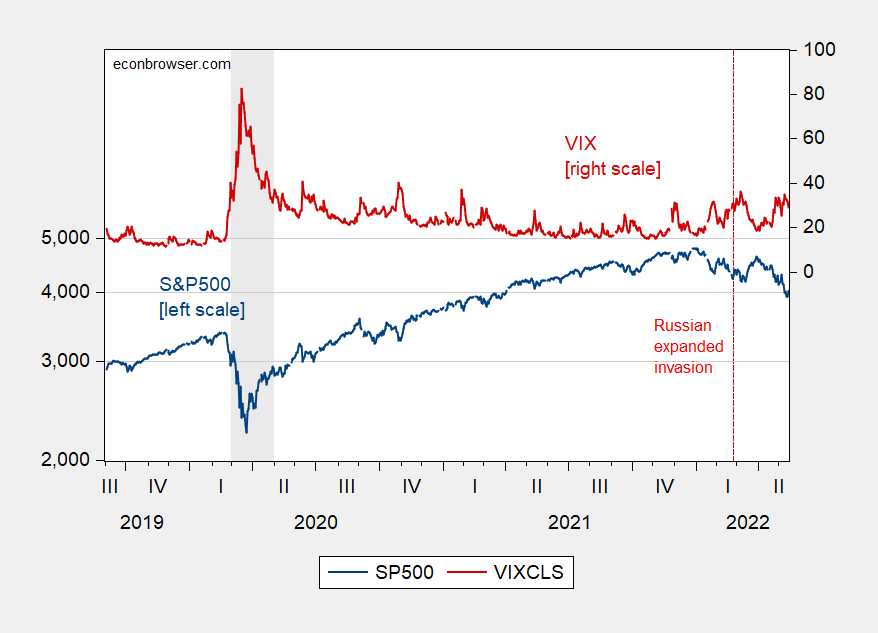

Figure 4: S&P 500 (blue, left log scale), VIX (red, right scale). NBER defined recession dates shaded gray. Source: FRED, NBER.

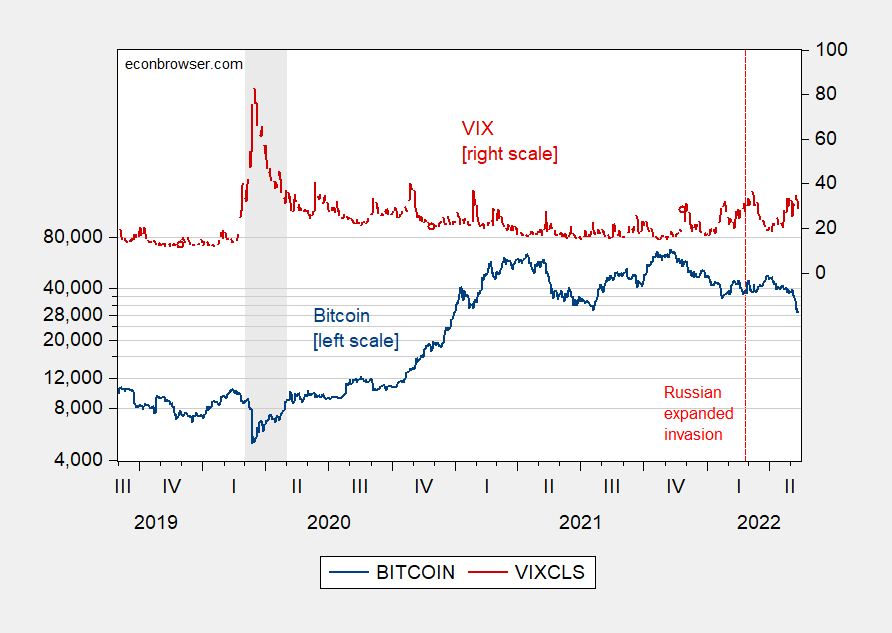

Figure 5: Coinbase Bitcoin (blue, left log scale), VIX (red, right scale). NBER defined recession dates shaded gray. Source: FRED, NBER.

The messages I take from this:

- Five year inflation expectations have not moved up substantially.

- Expectations for economic activity are positive, with the 10yr-3mo term spread and real rates up – the latter now above zero.

- Elevated VIX and real rates imply a declining stock market, as well as cryptocurrency valuations.

- The fact that crypto has taken a bigger dive than SP500 in the current episode, despite the same levels of the VIX experienced earlier indicates that other factors at work.

https://news.cgtn.com/news/2022-04-26/Xi-Jinping-calls-for-advancing-infrastructure-construction–19ybIMqBrzy/index.html

April 27, 2022

Xi Jinping calls for advancing infrastructure construction

Chinese President Xi Jinping, also head of the Central Committee for Financial and Economic Affairs (CCFEA), on Tuesday called for all-out efforts to strengthen infrastructure construction in the country’s building of a modern infrastructure system.

President Xi made the remarks at the 11th meeting of the CCFEA.

Infrastructure serves as a pillar for economic and social development, Xi said, urging the country to coordinate development and security, and optimize the layout, structure, functions and development models of infrastructure.

The work of several central government departments were reported at the meeting.

While giving credit to China’s achievements in major sci-tech facilities, water conservancy projects, transport hubs, information infrastructure and national strategic reserves, the meeting deemed the country’s infrastructure still incompatible with the demand for national development and security.

Strengthening infrastructure construction in an all-round way is of great significance to ensuring national security, smoothing domestic circulation, facilitating the “dual circulation” of domestic and overseas markets, expanding domestic demand and promoting high-quality development, according to the meeting.

Toward this end, the country needs to bolster the construction of network-based infrastructure in fields such as transport, energy and water conservancy, with efforts made to improve efficiency, the meeting said.

China should improve the planning of waterways and the building of coastal and inland ports, and upgrade water transport facilities nationwide, the meeting said, while a smart grid must be developed, a series of new green, low-carbon energy bases built, and the oil and gas pipeline network should be fine-tuned.

Efforts should also go into strengthening the infrastructure construction for industrial upgrades in information, sci-tech and logistics, as well as building facilities for a new generation of supercomputing, cloud computing, AI platforms and broadband networks, said the meeting….

https://english.news.cn/20220512/4cfc86f9773b42168d22df8e83e18b8a/c.html

May 12, 2022

China’s investment in water conservancy up 45.5 pct

BEIJING — China’s investment in water conservancy facilities totaled 195.8 billion yuan (about 29 billion U.S. dollars) in the first four months of 2022, jumping 45.5 percent year on year, data from the Ministry of Water Resources showed on Thursday.

According to the ministry’s targets, construction on a total of 30 new major water conservancy projects will start this year, and investment in water conservancy construction will hit 800 billion yuan….

https://english.news.cn/20220512/476bf442bb2543cba2642466e513a741/c.html

May 12, 2022

China’s FDI inflow up 20.5 pct in first four months

BEIJING — Foreign direct investment (FDI) into the Chinese mainland, in actual use, expanded 20.5 percent year on year to 478.61 billion yuan in the first four months of the year, the Ministry of Commerce (MOC) said Thursday.

In U.S. dollar terms, the inflow went up 26.1 percent year on year to 74.47 billion dollars, according to the ministry.

China’s FDI inflow recorded double-digit growth in the January-April period on the high base of 38.6-percent growth in the same period last year, said MOC spokesperson Shu Jueting.

Shu highlighted the important role of China’s high-quality economy in attracting foreign investment. FDI in China’s high-tech industry logged a sharp year-on-year increase of 45.6 percent during the period, up 25.1 percentage points from the average growth in all sectors….

https://www.msn.com/en-us/news/politics/the-list-of-anti-ukraine-republican-lawmakers-is-quickly-growing/ar-AAXgpTK?ocid=msedgdhp&pc=U531&cvid=f91cfc4da0a4467984a10d45578fa820

What’s up with Republicans. Their senior Senator (McConnell) leads a delegation to Ukraine to show there is bipartisan support for helping the citizens there to fight off Putin’s war crimes. But their junior Senator is blocking a critically needed aids package.

And then there is Thomas Massey who has opposed aid to Ukraine at every turn. OK he convinced dingbat Marjorie Taylor Greene to join his pro-Putin positions. Big deal But the number of House Republicans who have decided to just let Putin has his way has grown to 57.

When Trump told Putin he would be richly rewarded – he was not kidding.,

There was an interesting paper on Crypto that Krugman referenced on his Twitter recently that shouldn’t be terribly far down in his thread and easy to download. If Krugman says it’s worth a read that’s all I need to know~~I plan on reading it..

You do see a lot of connection to mainland Chinese citizens taking an interest in Crypto quite a bit (often as a tool to get around capital controls), I think a small part because Chinese tend to have a gambling itch to them, and so that part of their make-up, speaking broad generalities here, attracts them to crypto. So I’m wondering does the recent crash in crypto have any connection to activities in China right now?? I’d greatly appreciate Menzie’s thoughts or anyone else’s on this specific question I’d be lying if I stated I didn’t get a small kick out of the Crypto slaughter, because I still have an affection for traditional cash.

I am not making a “blanket statement” on Chinese loving to gamble. For example I am guessing I probably have a bigger proclivity to gamble than Menzie does. But generally you do see in the mainland Chinese culture that some Chinese really enjoy gambling and make it part of their recreational lives. I have less experience with American Chinese (believe it or not as strange as that statement sounds), so I can’t speak as well on their habits, I suspect American Chinese ALSO love gambling, but slightly less than mainland Chinese.

Perhaps the interest in crypto-currencies is another reflection of financial repression through interest rate caps on savings. Rate caps are certainly part of what drives distortion in the real estate industry.

I don’t follow the crypto market closely or even casually (MC is the go-to person for that) but there’s a huge factor there that is in the residuals (so to speak): ideology. That’s why I can’t just dismiss crypto as a scam. It’s only partly a series of scams. It’s mostly *ideological*. It’s an asset that seems to have no relationship to inflation (see January crypto crash), volatility (see above) or any real activity. I bet it’s even too volatile to be good for money laundering. Crypto is about a vague idea and a bunch of dumb people subscribing to that vague idea. And when the true believers’ attention goes elsewhere, so does the market.

Gita Gopinath and Chinn are “tied” at the finish line of the race for “go-to-person” on currencies. Just saying……

Noted!

The “Fed put” is no longer part of market participants’ thinking, at least for near-term market performance. The Fed went from a focus on stability and boosting average inflation to 2% to bringing inflation down. De-emphasizing stability means a lot in a market that has come to rely on the Fed for stability.

Market participants had also come to rely on the Fed for returns. If real rates are negative, then income generation depends on leverage. Capital gains are what you sell to clients, along with strategiesfor extracting income from capital gains. Conventional portfolio strategies performed worse in the first 4 months of this year than nearly any similar period on record, as correlation between asset class performance jumped.

I don’t blame current Fed policy for the damage being done. The Fed has a job to do. But the Fed’s response to past episodes of market stress made Fed policy a huge factor in driving risk-adjusted returns, and now the Fed is changing the rules.

I guess stock market stability is important until it isn’t. At better than full employment, they don’t have to worry about the consequences of Wall Street throwing a temper tantrum. The big important guys have actually learned how to make money on that – so its only the small guys getting hurt anyway.

This is a really superb comment and shows masterful observational skills. And guess what leader they (Fox, ZH, Breitbart etc) will blame the changing of the rules on??

Is there something in Michigan’s water that turns people into MAGA hat morons. Here we have Bruce Hall’s favorite Congresswoman:

https://www.msn.com/en-us/news/politics/biden-doesn-t-actually-care-about-americans-amid-inflation-surge-michigan-rep-lisa-mcclain-warns/ar-AAXgX9b?ocid=msedgdhp&pc=U531&cvid=cf93edb97d184edfaaac7ec998dc4c40

REP. LISA MCCLAIN: I have never met a man that is so out of touch, and if [Biden’s] really looking for solutions, I would be happy to meet with the president as well as I’m sure a lot of my Republican colleagues. And let me share with you maybe a solution. Why don’t we open up oil and gas leases here in America as opposed to restricting them? That would, A, help bring the cost of gas down. B, put more money in the hands of the Americans as opposed to the people overseas, and families wouldn’t have to be paying $4.35 at the pump.

OK she is a STUPID witch with a B. But Brucie did provide us an interesting Dallas FED discussion of the role of oil leases and current gasoline prices which obviously Bruce forgot to read. That stupid witch should read the concluding paragraphs, which clearly note why more leases with have ZERO impact on gasoline prices.

If this stupid witch wants “solutions” she should shut her toxic mouth and actually start learning a wee bit of economics. Something Bruce Hall is incapable of doing.

Agree. Maybe she should look up the number of already granted leases that are not even being used. We don’t need more leases, we need oil companies to start drilling where Trump already gave them permission. Biden tried to open leases in Alaska, but nobody wanted to bid.

Although oil prices at this time are quite high, everybody know that it takes several years to develop a project to where it actually pumps out oil. The people in the field are quite certain that prices by then will be back very low. So it doesn’t make business sense to lose even more money by exploring and developing the leases they already have. If you want US oil production to be increased within the next year, standard drilling will not do it.

Fracking is the only possible way, but it is not profitable unless oil is above $60. We need to guarantee that any oil from new fracking projects started in the next 6 months can sell to the government (strategic reserve) for $60 if it wants. Then we can empty our strategic reserve completely (to handle current supply problems). A strategic reserve is supposed to hold about 6 months of imports. You don’t need much of a “strategic reserve” of a product that you actually export.

If you want oil and gasoline prices to go down now give incentives for energy efficiency, home solar and EV purchases. Those can work very quickly – especially if they are time limited. How about a $2K refundable tax rebate (or up to 5K deduction) for certain home projects, if they are finished in 2022.

Dr. Chinn has undermined her claims in a new post using a Dallas FED discussion which we actually got from Bruce Hall. Never mind that Bruce never READ the discussion and so he thinks it supports their view.

I have to ask – has there been a dumber troll than Bruce Hall? Yea there are a LOT of really dumb trolls but Bruce Hall seems to be especially stupid.

A stubid witch?

https://www.msn.com/en-us/news/politics/bezos-vs-biden-amazon-founder-calls-out-president-over-inflation-and-corporate-taxes/ar-AAXfZTo?ocid=msedgdhp&pc=U531&cvid=a106b357c61e4b03a2244923a727f267

Poor little Jeff Bezos. Amazon might have to pay its fair share of taxes someday? Amazon’s price gouging under review? Amazon does not want unions as it cannot pay a fair wage? I guess a little responsibility for this fat cat was too much to suggest so Biden is a horrific human being. Poor little Jeff Bezos.

Doesn’t look like the markets really believe in a serious increased inflation lasting much past 2 years. Partly because they are certain the Fed will respond. It will be interesting to see when the markets begin to think that overreach by the Fed will drive us into deflation. Anyway I am glad I have 2/3 of my bonds in inflation protected. Maybe in a month or so I will begin moving back towards 50:50

“lasting much past 2 years”

That’s a long time. Biden’s approval is ~40%, and it’s basically all the economy.

Menzie, I know Natalie is “stealing” from her Dad with this song. Why does this song destroy my heart, Every time I listen to it???

https://www.youtube.com/watch?v=8XyaRC-F5Io&list=RDMM&index=1