Everybody’s waiting for it, but it’s still not here yet.

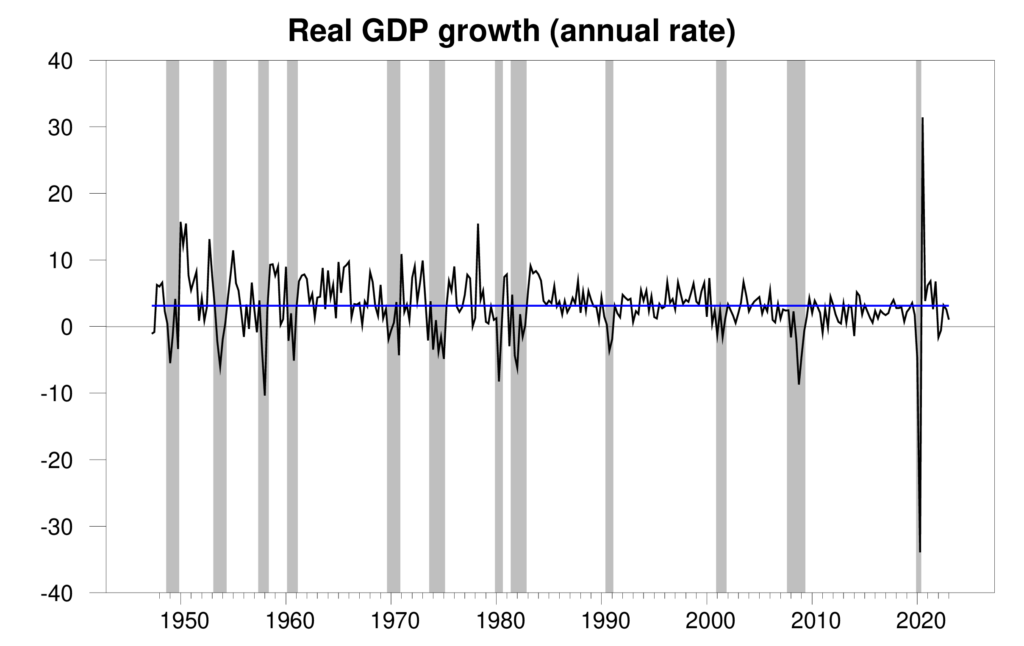

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 1.1% annual rate in the first quarter. The previous two quarters had been close to the historical average. Today’s numbers are much weaker.

Real GDP growth at an annual rate, 1947:Q2-2023:Q1, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of GDP from the previous quarter.

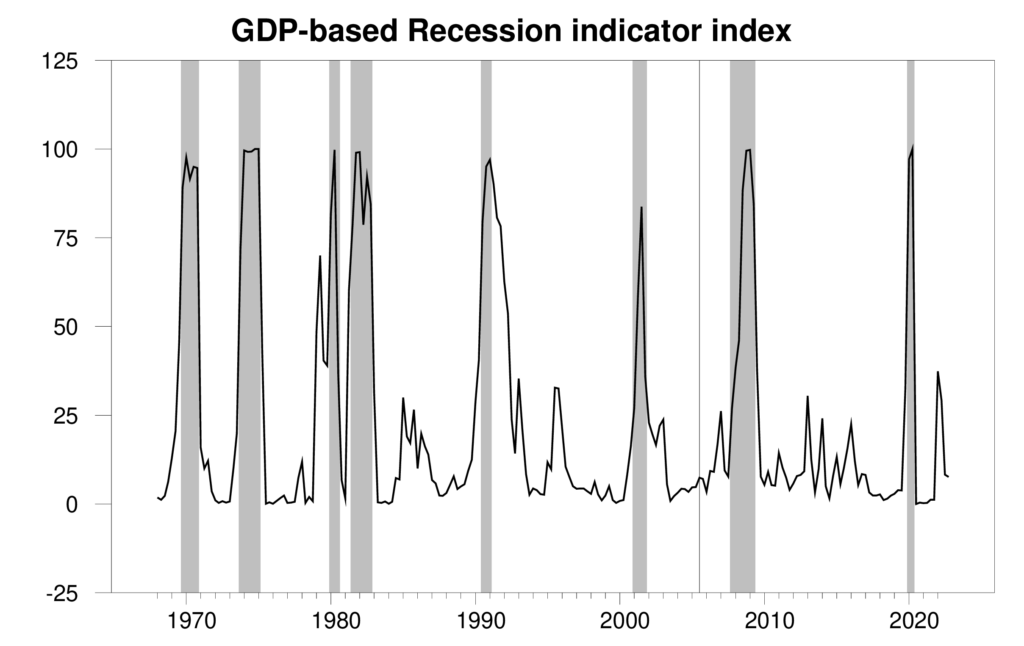

The new data put the Econbrowser recession indicator index at 7.6%, about where it had been three months ago, and well below the level that would signal that a new recession had started. Those who have been declaring for a year that a recession has already arrived will have to wait a little longer.

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2022:Q4 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.

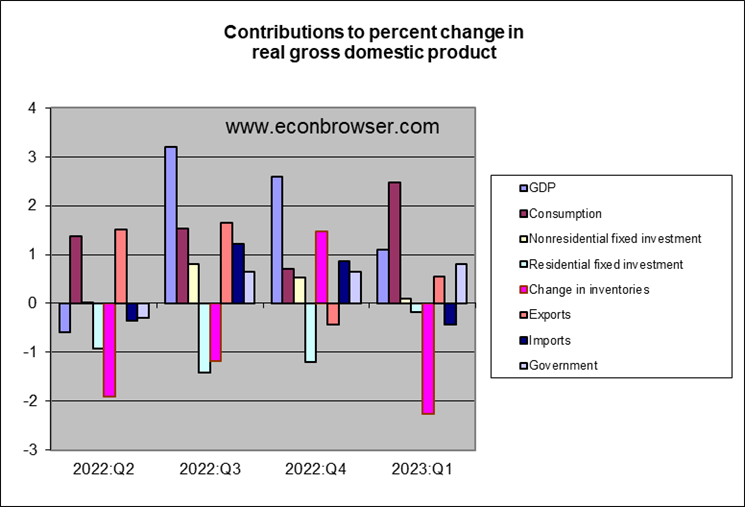

The Fed has been pushing the lever that it controls (interest rates) in the direction of trying to slow GDP growth. This shows up first in residential fixed investment, which fell in each of the last four quarters.

But by far the biggest drag on first-quarter GDP came from running down inventories. Inventory investment is one of the most volatile components of GDP and is subject to big data revisions. So this is unlikely to be the main factor holding GDP growth back in the coming quarters. But the effect of high interest rates on new home purchases and spillover from banking concerns to credit availability for small businesses will continue to be significant headwinds.

‘by far the biggest drag on first-quarter GDP came from running down inventories’

Taking this out and the BEA reports that final sales of domestic product rose by 3.4% (annualized).

Higher interest rates seems to be reducing overall investment but increases in consumption and government purchases has offset this.

The performance of final sales measures was stronger in Q1 this year than in the two quarters of real GDP decline last year, when inventories and trade induced a wide gap between real GDP and real final domestic sales. In fact, the strong pace of consumption was very likely a contributor to the inventory drawdown in Q1. Nothing in this report is particularly worrying, outside the fixed investment decline.

Real disposable income rose at an 8.0% pace in Q1 vs 5.0% in Q4. The saving rate was 4.8% in Q1 vs 4.0% in Q4. So households did pretty well in Q1. Real PCE rose at a 3.7% pace in Q1, the fastest rise since Q3 of 2021. Some of that was obviously borrowed from Q4 – always tricky. But anyhow, increase real income seems to be keeping spending growth strong. That’s a big positive in this report.

The Atlanta Fed will soon publish its first estimate of Q2 GDP growth, based on inputs from today’s release. Interesting to see what the inventory and spending estimates look like. The record on interest rates driving inventory holdings is wobbly. High interest rates tend to coincide with strong demand and inflation, which probably obscure the direct influence of cost of carry on inventory holdings. Screws up inventory forecasting.

The initial GDPNow for Q2 estimate is out; it’s 1.7%. The only projected drag is from residential investment. The median Blue Chip estimate is near zero.

what is not in stock cannot generate sales/revenue.

inventory is working capital, stock is turned to cash when sold, and that cost of stock cash is committed in ratio to replenish stocks…

what is interesting and pleasing in a masochist way is how managers decide what and how much to restock in a working capital constrained environment….

which if done badly causes a lot of empty shelves for things sold out and slow moving in stock assets tying up working capital of what does not sell. add to that supply chain issues!

i think there is a pending boom in roll-aids and aspirin sales among members of the council of supply chain managers (used to be inventory managers)!

those whose retail corps don’t go off like bed bath etc.

in the ’50’s invemntory busts seemed to cause a lot of worry….

Q2 2016 was another one. GDP supposedly had “anemic” growth but ex-inventories GDP was over 3%. The recession everybody waited for never happened. Its usually ex-inventory GDP that falls first, then inventories. Matter of fact, maybe inventories should be removed. Sorta like a mean trimmed GDP. Its a reason GDP isn’t even on my top 10 economic indicator list. Its hectic nature and backloaded revisions hurt credibility of the number. Why release it then?

In answer to your suggestion that the government not release GDP data, or exclude inventories from GDP:

GDP is gross domestic product, and leaving out inventory fluctuations would reduce GPD to final demand. There are measures of final demand in the GDP data, so all you are really suggesting is to leave out information. Do you really think leaving out information would make the data seem more credible? Do you really think that members of the public who are aware of the role inventories play in GDP fluctuations are unable to grasp the concept of final demand?

Aside from all of that, “credibility” is a silly issue. GDP data, economic data in general, are published to be informative. The issue of credibility is mostly raised by those who have an ax to grind, by quacks. If economic data suffer from a lack of credibility among the lay public, it’s because of quacks, not inventories.

And speaking of a lack of credibility, drop the Mary Rosh routine.

Kevin Drum often has insightful things to say but today all he gets out is:

‘The Q1 number clocked in at 1.1%, which is pretty anemic.’

No details. No awareness that final sales grew at a 3.4% rate which got dragged down by the inventory investment figure. Oh well his blog is not a substitute for Econbrowser.

https://news.cgtn.com/news/2023-04-26/China-takes-world-s-crown-in-nuclear-power-units-under-construction-1jjpfxcVtLi/index.html

April 26, 2023

China takes world’s crown in nuclear power units under construction

China continues to lead the world in the number of nuclear power units under construction, according to a blue book issued by the China Nuclear Energy Association (CNEA) on Wednesday.

The country has 24 nuclear power units under construction with a total installed capacity of 26.81 million kilowatts (kWs), said the blue book.

It demonstrates that China has operated its nuclear power units in a safe and stable manner over the long term, while making steady progress in their construction.

Since 2022, China has approved 10 new nuclear power units, putting three new units into commercial operation and starting the construction of six new ones.

Up till now, the country has 54 commercial nuclear power units with a total installed capacity of 56.82 million kWs, ranking third in the world.

At the same time, China has also operated its nuclear power with safety performance which has been maintained at international advanced level.

Boosting tech self-reliance for clean energy

According to the blue book, China has been steadily improving the self-developed key nuclear power equipment, promoting manufacturing capacity of nuclear power equipment and the ability to secure the related industrial chain. The country has developed the capacity to supply complete sets of nuclear power main equipment for pressurized water reactors with a capacity of one million kWs.

In 2022, a total of 54 sets of nuclear power main equipment were produced in China, reaching a new high in the past five years.

Zhang Tingke, secretary general of CNEA, told China Media Group (CMG) that “more than 90 percent of China’s major nuclear power reactors now are domestically produced, with key equipment of the No.1 demonstration fast reactor unit delivered to the site.”

“The technological level of China’s nuclear power engineering construction maintains international advanced ranks, with capability of building over 40 nuclear power units simultaneously.”

The ability of nuclear power equipment manufacturing has strongly supported the orderly development of nuclear power in China, said the blue book.

By 2030, the country is expected to lead the world in installed capacity of nuclear power. The country’s nuclear power generation is expected to account for 10 percent of total power generation in 2035, further increasing the importance of nuclear power in China’s energy structure to support the low-carbon transformation of the energy structure, according to the blue book.

Read More:

China opens advanced nuclear research reactor to worldwide scientists *

* https://news.cgtn.com/news/2023-04-03/China-opens-advanced-nuclear-research-reactor-to-worldwide-scientists-1iHdYDfOiIg/index.html

China is building six times more coal-fired power plants than the rest of the world combined:

https://energyandcleanair.org/publication/china-permits-two-new-coal-power-plants-per-week-in-2022/

As of 2020, 60% of China’s energy output came from coal, and China is adding coal capacity. In the U.S, only 11% of energy output is from coal, and that number is dropping.

If they can build more nuclear and less coal that would be better for everybody.

https://news.cgtn.com/news/2023-04-28/Non-fossil-fuels-exceed-50-of-China-s-energy-capacity-for-first-time-1jn0BNpGNZm/index.html

April 28, 2023

China’s non-fossil energy power generation installed capacity exceeds 50% for first time

The proportion of the installed capacity of non-fossil energy (e.g., solar, wind, hydropower, etc.) power generation stood at 50.5 percent by the end of the first quarter this year, according to the China Electricity Council on Thursday. This is the first time that it exceeded 50 percent of the total. The record-high proportion marks China’s important progress in the implementation of its “dual carbon” goal, which is to peak carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060.

https://www.chinadaily.com.cn/a/202304/03/WS642a8e5da31057c47ebb81de.html

April 4, 2023

China may meet solar, wind goals five years earlier

By Hou Liqiang

China may reach its 2030 target for wind and solar energy development five years earlier than planned.

Prefecture-level regions have planned to increase installed capacity for wind and solar energy by at least 800 million kilowatts during the 14th Five-Year Plan period (2021-25), according to research conducted by the Institute of Public and Environmental Affairs and the Chinese Research Academy of Environmental Sciences.

This means that China may be able to beat its target of increasing installed capacity for these two forms of renewable energy to 1.2 billion kW five years earlier than scheduled….

ltr, ” installed capacity ” seldom provides actual dispatchable capacity. ” installed capacity ” unless otherwise defined is usually the capacity figure shown on the name plate. For wind the actual dispatchable capacity is in the ~20-20% range. For solar it is in the <50% range.

These willfully false comparative claims are common when we see the public relations folks versus the engineers numbers. Quit drinking the Kool Aid.

She pours the Kool Aid.

http://www.chinadaily.com.cn/a/202304/24/WS64463f7ea310b6054facf774.html

April 24, 2023

PM2.5 density hits record low in major Chinese cities

By HOU LIQIANG

Following continuous decreases for almost 10 straight years, the concentration of PM2.5 particulate matter in China declined to below 30 micrograms per cubic meter in 2022, said Huang Runqiu, minister of ecology and environment.

The average PM2.5 density in major cities across the country stood at an unprecedented 29 mcg/cubic m last year, down 3.3 percent year-on-year, he said, as he reported to an ongoing session of the Standing Committee of the National People’s Congress on Monday.

The proportion of days with heavy air pollution in the country in 2022 dropped to 0.9 percent, compared with 1.3 percent in 2021.

“It’s the first time that the proportion decreased to below 1 percent,” the report said….

GDP is a trash indicator. Haven’t we learned that yet after last year. The so called drawdown in inventories is bogus.

Yes, this quarter is not the most firm “1.1%”. Get some 2014 feels with this release.

Mike Pence has testified to the Jack Smith Grand Jury!

https://www.cnn.com/2023/04/27/politics/mike-pence-grand-jury-testimony/index.html

Former Vice President Mike Pence testified on Thursday to a federal grand jury investigating the aftermath of the 2020 election and the actions of then-President Donald Trump and others, sources familiar with the matter told CNN. The testimony marks a momentous juncture in the criminal investigation and the first time in modern history a vice president has been compelled to testify about the president he served beside.

The NY Fed’s Macroblog has an article on retirement and retirement causes which sheds light on labor market dynamics:

https://www.atlantafed.org/blogs/macroblog/2023/02/20/retirement-and-its-impact-on-labor-supply

Covid seems to account for about 20% of retirements since 2020, aging of the workfor e for the rest. The second figure suggests that strong labor demand – with resulting wage gains – can hold retirement-age workers in the labor force.

One implications is that the labor market will remain tight for some time to come. Another is that anything which temporarily separates workers from jobs (recession, incarceration, supply disruption) will add to an already-rising dependency ratio.

would anyone who has had a US education understand the phrase?

Solid post. Thanks

Where can we find the rope to hang this economy? Maybe Kevin McCarthy has some in the trunk of his car.

I think Larry “the recession must occur to keep the working class in their place” Summers must be Gogo. – he never remembers anything.

I also find it interesting to what extreme ends the GOP will go to try and crash the economy when a Dem is President. The GOP debt ceiling bill cuts veteran’s benefits and SNAP for older adults and individuals with disabilities – I am hopeful that the CEO of Dollar General will give them a call and let them know that those cuts will hurt their sales especially in rural areas – https://www.ers.usda.gov/amber-waves/2019/july/quantifying-the-impact-of-snap-benefits-on-the-u-s-economy-and-jobs/

But as Rep Jeffries has said the GOP is about tax cuts for the wealthy and the US economy can crash https://www.huffpost.com/entry/hakeem-jeffries-criticizes-republicans-debt-ceiling_n_644a0075e4b011a819c597de

https://twitter.com/DeanBaker13/status/1651571525957603332

Dean Baker also noticed that 3.4% figure for final sales. And he is hopeful for a decent 2023QII.

Off topic, “the most important election of 2023” –

“ANKARA — With less than three weeks before Turkey’s elections on May 14, the race between Turkey’s President Recep Tayyip Erdogan and his top challenger, main opposition leader Kemal Kilicdaroglu, will be the closest in the country’s electoral history, according to an Al-Monitor/Premise poll.”

http://www.al-monitor.com/originals/2023/04/al-monitorpremise-poll-turkeys-election-dead-heat-erdogan-and-kilicdaroglu-tied#ixzz805qKowAL

I hear erdogan has been off the campaign trail, perhaps ill?

Hints that we’re slowly turning the corner on antitrust enforcement:

https://www.politico.com/news/2023/04/27/wall-street-gives-administration-earful-over-antitrust-enforcement-00093739

So, while economic conditions played a significant role in the slowdown in M&A, the approach taken by Biden’s appointees created additional hurdles for companies that would otherwise expand through acquisitions, U.S. Chamber of Commerce Executive Vice President and Chief Policy Officer Neil Bradley said in an interview. Publicly traded companies are increasingly identifying the FTC, which also enforces consumer protection standards, as a public policy risk, according to the Chamber’s research. There is “much greater uncertainty that [companies are] receiving from M&A attorneys about how long it will take — and the likelihood for — getting FTC sign off,” he said. Some chamber members have informed him that they’ve “walked away from deals because the uncertainty was too great.”

Leave it to fat cat lawyers and Wall Street bankers to whine their incomes will not be astronomical simply because the FTC did its job. Obama started this push for real anti-trust enforcement but Team Trump trashed those efforts. So good for Biden for getting this back on track.

https://www.law.columbia.edu/faculty/lina-khan

Lina Khan

Associate Professor of Law

Education

J.D., Yale Law School, 2017

B.A., Williams College, 2010

Lina Khan teaches and writes about antitrust law, infrastructure industries law, the antimonopoly tradition, and law and political economy. Several of her writings have focused on the ways that dominant digital platforms freshly reveal the shortcomings of the current approach to antitrust. In June 2021, Khan began serving a seven-year term as chair of the Federal Trade Commission.

Khan’s work has been published by the Columbia Law Review, Harvard Law Review, The University of Chicago Law Review, and The Yale Law Journal. The New York Times has described Khan’s scholarship as having “reframed decades of monopoly law,” and Politico has called her “a leader of a new school of antitrust thought.” Her article “Amazon’s Antitrust Paradox” was awarded the 2018 Antitrust Writing Award for Best Academic Unilateral Conduct Article, her article “The Separation of Platforms and Commerce” won the 2019 Jerry S. Cohen Memorial Fund’s Best Antitrust Article on Remedies, and her co-authored article “The Case for ‘Unfair Methods of Competition’ Rulemaking” received the 2020 Antitrust Writing Award for Best General Antitrust Academic Article.

Khan’s scholarship has also been profiled or discussed by The Atlantic, Bloomberg, The Economist, Financial Times, The New Yorker, The Wall Street Journal, and The Washington Post. She has been named to the Politico 50, Foreign Policy magazine’s Global Thinkers, Prospect magazine’s Top 50 Thinkers, WIRED25, National Journal 50, and Time magazine’s Next Generation Leaders.

Prior to joining Columbia Law in 2020, Khan served as counsel to the U.S. House Judiciary Committee’s Subcommittee on Antitrust, Commercial, and Administrative Law, where she helped lead the Committee’s investigation into digital markets and the publication of its landmark report. She has also served as legal adviser to Commissioner Rohit Chopra at the Federal Trade Commission and legal director at the Open Markets Institute.

https://www.bls.gov/news.release/pdf/eci.pdf

EMPLOYMENT COST INDEX – MARCH 2023

Compensation costs for civilian workers increased 1.2 percent, seasonally adjusted, for the 3-month period ending in March 2023, the U.S. Bureau of Labor Statistics reported today. Wages and salaries increased 1.2 percent and benefit costs increased 1.2 percent from December 2022.

This 1.2% increase is the nominal ECI. Over the same period, CPI rose by 0.94%. So real compensation (wages and fringes) rose by 0.25% over the past 3 months. Not a huge increase but at least moving in the right direction.

Professor Hamilton,

The recession also seems not to be “at hand” looking at the FRED Series, USPHCI which is the Federal Reserve Bank of Philadelphia coincident indicator described by FRED as, “The Coincident Economic Activity Index includes four indicators: nonfarm payroll employment, the unemployment rate, average hours worked in manufacturing and wages and salaries. The trend for each state’s index is set to match the trend for gross state product.”

Computing a probit model, the model seems to clearly indicate no recession. There seems to be some false positives since 1979, but no false negatives. The McFadden R-squared seems quite high at 0.59.

Do you have any comments about USPHCI regarding how much we should rely upon it as an indicator of recession for the future.

If or when the “Godot Recession” shows up, shouldn’t we rename it the “Powell Recession”?

Powell seems to have shifted from “soft landing” to “put wage earners in their place.”

Looks like First Republic will be under new ownership come Monday.

Let’s just hope the new owner is not JPMorgan. This bank is already too big.

JP Morgan acquired First Republic increasing its asset portfolio by $233 billion, which is a mere 6% of JPMorgan’s overall asset portfolio.