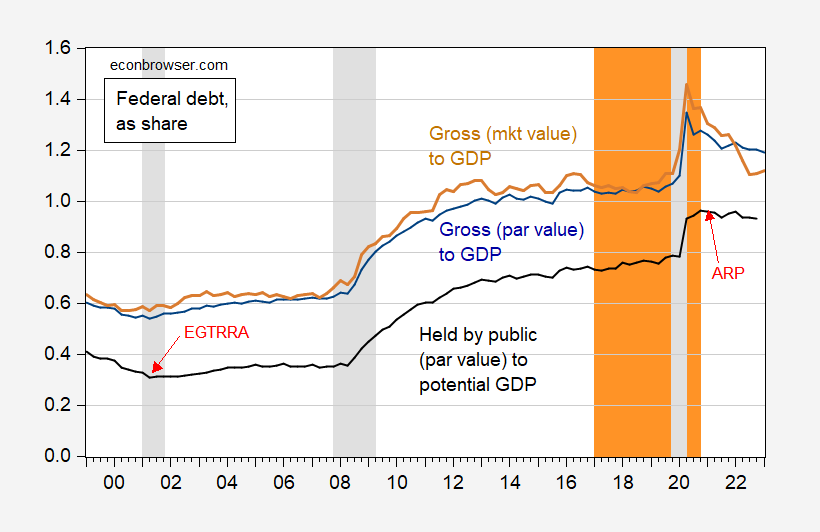

Regardless of gross or net, at par or market value, as a ratio to GDP or potential GDP, the answer is pretty obvious.

Figure 1: Gross Federal debt at par value as ratio of GDP (blue), at market value as ratio to GDP (tan), Federal debt held by public at par value as ratio to CBO potential GDP (black). NBER defined peak-to-trough recession dates shaded gray. Trump administration shaded orange. Source: Treasury via FRED, Dallas Fed, CBO (February 2023), NBER, and author’s calculations.

Publicly held debt as a share of potential GDP rose by 15 percentage points going from 2020Q1 to 2020Q2. The 25 ppts increase using actual GDP is in some sense misleading because it’s largely by the sharp drop in output in Q2.

The market value of debt has dropped substantially more than the par value, and in some ways the market value is more representative of the burden posed by the outstanding stock of debt (see discussion here).

None of this should detract from the argument that the path of debt is not sustainable. I would say that it is impossible, given the consensus to maintain defense and Social Security, to meaningfully address this problem without raising additional revenue. (Productivity and output enhancing measures, like increased immigration, wouldn’t hurt either.)

(Side Note: Japan’s net debt to GDP in 2021 was about 170%).

The discussion of productivity improvement has been tainted by repeated, mistaken claims that tax cuts and deregulation boost productivity. The record is quite mixed for both, and if a large deficit or debt is bad for productivity, then the mixed record isn’t enough to keep the debate legitimate. If a large debt/deficit is bad for growth, and Social Security and military spending are untouchable, then well-designed tax increases are unambiguously good for growth.

‘well-designed tax increases are unambiguously good for growth’

Standard economic theory tells us that tax increases raise the national savings rate which lowers real interest rates encouraging investment. Martin Feldstein taught his students that and he knew how to do well designed. But of course the modern Republican Party probably thinks Feldstein is some deep state socialist.

Menzie Chinn,

Is “the answer is pretty obvious” to where federal debt to GDP is going now? And over which (relevant) time period is it “pretty obvious”? Let us know!

I’m kind-uh a dumb guy. Often a kind-uh dumb guy Drinking makes it exponential. I’m drinking, which makes me exponentially dumb [ clears throat ]

I think Menzie is trying to tell us…………………………….. TAXES = U.S. GOVERNMENT REVENUE Who knew???

Increased immigration is not going to increase productivity. Technological growth is simply not there to increase productivity like going from horses to metal boxes that move. The system is sustained by global wealth schemes aimed on keeping the pyramid growing. Debt is the only game in town. Once the system liquidates, it’s over.

“Increased immigration is not going to increase productivity.”

Dude – Dr. Chinn did not say it would. He did say more workers would increase aggregate output. And other measures that might increase output per worker could help too.

Yea – it could have been written more eloquently but come on – your writing SUCKS. Oh wait – you are a bot. Never mind.

Menzie didn’t claim immigration increases productivity.

Productivity gains on a steady, modest path are well worth having. Revolutionary technology transformation isn’t necessary for steady, modest gains.

Increased immigration is the easy way to increase GDP. It is also one way to make the debt more sustainable. More shoulders to carry the same (or even a slightly bigger) load. Social security desperately need more young productive immigrants to fill the hole left by an increasing number of people retiring.

“I would say that it is impossible, given the consensus to maintain defense and Social Security, to meaningfully address this problem without raising additional revenue.”

This should be obvious. Now CoRev has spewing a new lie – that Biden’s policies reduced tax revenues by 26%. Yea – CoRev is one dumb liar.

Yea – Ole Bark, bark is one dumb liar. The 26% was from a Mquack referrence. He should actually try reading instead of emoting.

The angry, desperately denying liberal mind is an amazement.

Macroduck may have had a typo but at least he linked to the CBO report. I read it and it is clear little CoRev was too lazy and stupid to do so. Thanks for admitting you are a lazy moron.

“The 26% was from a Mquack referrence.”

If CoRev thinks he is referring to some document Macroduck provided – he just LIED. I read the documents and clearly CoRev did not. OK let me amend what I said. CoRev is still lazy and stupid but he also lies a lot. Who knew?

BTW CoRev – learn to spell reference.

Wow! Ole Bark, bark scores another WEAK point by REFERENCING a typo.

Living in these weak liberal minds is an amazement.

How effing stupid are you? Macroduck provided the links and you are too lazy to READ them? You are truly the most worthless little troll ever.

https://news.cgtn.com/news/2023-05-18/Over-1-6-mil-excess-deaths-among-Black-Americans-over-20-years-study-1jTXOO7lCEM/index.html

May 18, 2023

New study finds over 1.6 million excess deaths among Black Americans over 2 decades

Black population in the U.S. experienced more than 1.63 million excess deaths and more than 80 million excess years of life lost, when compared with the White population over the last two decades, according to a new study published on Tuesday.

After a period of progress in reducing disparities, improvements stalled, and differences between the Black population and the White population worsened in 2020, according to the study * published in the medical journal JAMA.

From 1999 to 2020, the disproportionately higher mortality rates in Black males and females resulted in 997,623 and 628,464 excess deaths, respectively, representing a loss of more than 80 million years of life, according to the study.

Heart disease had the highest excess mortality rates, and the excess years of potential life lost rates were largest among infants and middle-aged adults, according to the study.

Amid efforts in the U.S. to promote health equity, there is a need to assess recent progress in reducing excess deaths and years of potential life lost among the Black population compared with the White population, the study said.

* https://jamanetwork.com/journals/jama/article-abstract/2804822

Sad that China’s propaganda outlets never look at problems within China. Neither cgtn not ltr ever look into the terrible treatment of Uyghurs and other Muslim and Turkic populations:

https://www.hrw.org/report/2021/04/19/break-their-lineage-break-their-roots/chinas-crimes-against-humanity-targeting

Human Rights Watch is not so blinkered.

https://jamanetwork.com/journals/jama/article-abstract/2804822

May 16, 2023

Excess Mortality and Years of Potential Life Lost Among the Black Population in the US, 1999-2020

By César Caraballo, Daisy S. Massey, Chima D. Ndumele, et al.

Abstract

Results

From 1999 to 2011, the age-adjusted excess mortality rate declined from 404 to 211 excess deaths per 100 000 individuals among Black males (P for trend <.001). However, the rate plateaued from 2011 through 2019 (P for trend = .98) and increased in 2020 to 395—rates not seen since 2000. Among Black females, the rate declined from 224 excess deaths per 100 000 individuals in 1999 to 87 in 2015 (P for trend <.001). There was no significant change between 2016 and 2019 (P for trend = .71) and in 2020 rates increased to 192—levels not seen since 2005. The trends in rates of excess years of potential life lost followed a similar pattern. From 1999 to 2020, the disproportionately higher mortality rates in Black males and females resulted in 997 623 and 628 464 excess deaths, respectively, representing a loss of more than 80 million years of life. Heart disease had the highest excess mortality rates, and the excess years of potential life lost rates were largest among infants and middle-aged adults.

Conclusions and relevance

Over a recent 22-year period, the Black population in the US experienced more than 1.63 million excess deaths and more than 80 million excess years of life lost when compared with the White population. After a period of progress in reducing disparities, improvements stalled, and differences between the Black population and the White population worsened in 2020.

https://fred.stlouisfed.org/graph/?g=14Jvy

January 15, 2018

Life Expectancy at Birth for United States, United Kingdom, France, Germany, Italy and Japan, 2017-2021

https://fred.stlouisfed.org/graph/?g=12f10

January 30, 2018

Infant Mortality Rate for United States, United Kingdom, France, Germany, Italy and Japan, 2017-2021

When thinking of national debt, I’ve always been laser focused on one thing: ability to repay.

Do the government and economy have the wherewithal to meet the interest and principle payments, and if so, how heavy is that burden.

(Admittedly, my work was primarily with developing economies.)

As a proxy for debt service, let’s look at federal interest payments.

[[https://fred.stlouisfed.org/series/FYOIGDA188S]]

Big surge: 1942-46, mild drop through the 1950s.

Big surge: 1980-91, followed by a big drop, 1996-2003.

Between 1948 and 1980, federal outlays for interest averaged 1.31% of GDP.

2006-22? A whopping 1.49%.

Frankly, I’m not worried in the least, particularly given (a) it’s entirely domestically denominated; and (b) the US Constitution has something to say on the subject.

“Russia’s oil revenues in March were down 43 percent from a year earlier, the International Energy Agency reported last month, even though its total export sales volume had grown”

https://www.nytimes.com/2023/05/18/business/g7-biden-oil-price-cap-russia.html

Another spectacular success for the Biden administration. This in spite of Saudi Arabia having cut its production by 2 million bpd. Competence matters.

Princeton Stevie pooh was trying to tell us that Biden’s policies on this have been a big failure. Of course the data from the real world shows Princeton Stevie pooh is one dishonest “consultant”,

Menzie made a small error too. He remembered to chart debt under donald but forgot to chart debt under Ronald. No, not the McDonalds Ronald. The “hurry up and go get killed in WWII kids” Ronald and the hiring freeze Ronald.

I get Ronald McDonald confused with St. Reagan too. Remember how Carter was guilty of tax and tax and spend and spend. St. Reagan changed all of that to “spend & spend and borrow & borrow”.

No wonder Milton Friedman refused to serve on St. Reagan’s CEA.

https://www.barrons.com/news/russian-oil-revenues-tumble-due-to-price-cap-treasury-aab95168

Russia’s oil revenues have suffered a marked decline since Western countries slapped a price cap on Russian crude as punishment for the invasion of Ukraine, the US Treasury said Thursday. “Despite widespread initial market skepticism around the price cap, market participants and geopolitical analysts have now acknowledged that the price cap is accomplishing both of its goals,” according to the Treasury report.

The $60-a-barrel cap levied by the G7 group of advanced economies, the European Union and Australia caused oil revenues to shrink from as much as 35 percent of the total Russian budget before the war to 23 percent this year, the Treasury said.

The Treasury, citing Russian Ministry of Finance figures, said federal government oil revenues were down over 40 percent between January and March this year compared to a year earlier. The decline in revenues comes despite an increase in overall Russian oil exports to countries including India over the last year.

Let’s give Princeton Steve the Oil Markets for Dummies version. Russia may be selling more barrels but that nasty Ural discount means less revenues. Of course the world’s worst consultant will never figure out Price times Quantity.

This would be an excellent time to talk about the Pentagon’s failure to pass a an audit. Why should they get more when they don’t know how the money already received got spent?

“ Insanity Continues as Pentagon Spending Moves Ever Closer to $1 Trillion…

The Pentagon doesn’t need more spending. It needs more spending discipline, tied to a realistic strategy that sets clear priorities and acknowledges that some of the greatest risks we face are not military in nature.” https://www.commondreams.org/opinion/1-trillion-pentagon-budget

It would also be a good time to audit and carefully control the money sent to the Ukrainian kleptocracy. And maybe learn some lessons from the last fiasco in Afghanistan? (Perish the thought!) https://www.militarytimes.com/flashpoints/afghanistan/2021/08/17/final-inspector-general-report-details-all-the-ways-the-us-failed-in-afghanistan/

And it would be a good time to talk about tax avoidance and evasion.

https://eml.berkeley.edu/~saez/CSZ2021.pdf

Unfortunately these debt ceiling discussions always seem to deteriorate into what social programs to cut

I would have said a decent comment for a change but you had to include this garbage:

‘the Ukrainian kleptocracy’

Excuse me Jonny boy but watching film of Russian soldiers raping Ukrainian women is immoral. Even if that is what you do at night.

I guess pgl missed this from Seymour Hersh: “ What also is unknown is that Zelensky has been buying the fuel from Russia, the country with which it, and Washington, are at war, and the Ukrainian president and many in his entourage have been skimming untold millions from the American dollars earmarked for diesel fuel payments. One estimate by analysts from the Central Intelligence Agency put the embezzled funds at $400 million last year, at least; another expert compared the level of corruption in Kiev as approaching that of the Afghan war, “although there will be no professional audit reports emerging from the Ukraine.” https://seymourhersh.substack.com/p/trading-with-the-enemy

We know that pgl and the Democrats oppose audits on Ukraine aid…and even suggest that Ukraine is not a kleptocracy. Do they have their fingers in the pie?

You can be excused for missing this news…it was reported by news outlets around the world…but apparently deemed “not fit to print” in the mainstream media. Who decided that?

Seymour Hersh has been certified to have lost it. No one trusts him anymore.

And to say I oppose audits – dude? Your lies are pathetically stupid.

pgl thinks that Ukraine has become a model of financial integrity and transparency…just because the US anointed Zelenskyy as their proxy. Well, here’s one pgl will love: “ Head of Ukraine’s supreme court held in anti-corruption investigation” https://www.theguardian.com/world/2023/may/16/head-of-ukraine-supreme-court-held-in-anti-corruption-investigation

Corruption has deep roots in Ukraine, and Hersh’s piece merely shows how little things have changed in the leptocracy.

And pgl thinks it’s brilliant to pour money down a rathole with no audit and no accountability! Is he getting kickbacks for his lame attempt at being an influencer?

JohnH

May 20, 2023 at 1:26 pm

pgl thinks that Ukraine has become a model of financial integrity and transparency

Of course I never said that but dude – you just polluted your already polluted diatribe even more. This is why NO ONE likes you. You are incapable of an adult conversation.

“Zelensky’s been buying discount diesel from the Russians,” one knowledgeable American intelligence official told me. “And who’s paying for the gas and oil? We are. Putin and his oligarchs are making millions” on it.

Even if this unverified charge were true, it would be a smart move by Ukraine to buy needed fuel at a discount. Now one would think Putin could put a stop to this to help his soldiers but I guess he is even dumber than little Jonny boy. Or maybe Putin does not care if Russian soldiers die.

Hersch claims Putin and his oligarch buddies are making “millions” on selling oil at a deep discount. Come on – Hersch and Jonny boy think one does better by selling oil at $60 a barrel as opposed to selling oil at $80 a barrel? Yea – it is this kind of world class stupidity that little Jonny boy excels at!

What’s Wrong with Seymour Hersh’s Conspiracy Theory

https://historynewsnetwork.org/article/159377

In his 10,000 word expose titled “The Killing of Osama Bin Laden” which appears in the London Review of Books, Hersh makes several stunning claims that would seem to indicate that the Obama administration is involved in the greatest cover up since the Nixon era. In a nutshell, Hersh tells us that just about everything the world knows about the May 1/2, 2011 raid that killed Bin Laden is a government-orchestrated lie. A recap of Hersh’s story, which is far too long and filled with far too many complex “War on Terror” accusations for the average internet-era reader’s patience, will show just how explosive his findings are.

Only problem is that Hersch made up this elaborate lie. And this is the person who Jonny boy relies on for news about Putin’s war crimes. Yea – Jonny boy went insane a long time ago.

Shortchanged: Seymour Hersh’s Claim Zelenskyy Embezzled $400M in US Aid Lacks Evidence

The entirety of the claim apparently comes from what Hersh describes as “one knowledgeable American intelligence official.”

https://www.snopes.com/news/2023/04/19/400-million-embezzled/

As Snopes explained in a story discussing those claims, Hersh’s later career has been controversial and widely panned by journalists for promoting conspiratorial claims that hinge on dubious anonymous sources or speculation. This later work is often sympathetic to Russian talking points, and his work is widely covered there. Hersh’s present claim fits plainly within that genre. Characteristically, it has been promoted by Russian media. Hours after publishing his piece, the Russian news agency TASS promoted Hersh’s claims

And now we know why Jonny boy peddles these lies. Putin’s pet poodle is now working for TASS.

;Regardless, in its simplest form, collecting the tax deficit of multinationals involves taxing the foreign earnings of US multinationals at some minimum rate (21 percent in the case of Biden’s proposal), with credits given to offset foreign taxes paid. For example, imagine that Apple books $10 billion in profits in Ireland—taxed in Ireland at 5 percent—and $3 billion in Jersey—taxed in Jersey at 0 percent. The United States would tax Apple’s Irish income at 16 percent and Apple’s Jersey income at 21 percent. More broadly, the United States would impose country-by-country taxes such that Apple’s effective tax rate, in each of the countries where it operates, equals at least 21 percent. In other words, the United States would, for its own multinationals, play the role of tax collector of last resort: it would collect the taxes that foreign countries chose not to collect.’

Biden wants a 21% global minimum tax. Joseph Stiglitz said he wanted this to be 21% but decided what Biden suggested would be a bare minimum compromise. Fair enough but the OECD’s Pillar Two is setting this at only 15% and Republicans are going nuts that it is not their 10.5% GILTI garbage ala Trump’s stupid tax cut for the rich. Yea Republicans were never serious about combatting profit shifting.

Kimberly Clausing, Emmanuel Saez, and Gabriel Zucman admitted that estimating the extent of profit shifting using those CbC reports prepared by multinationals may be problematic. They would be happy to see what this analysis found:

https://www.taxobservatory.eu/wp-content/uploads/2023/05/EUTO_WP17_Benchmarking_CbCRs_May2023pdf

Benchmarking Country-by-Country Reports∗

Giulia Aliprandi and Gerrit von Zedlitz

May 10, 2023

Abstract

Country-by-Country Reports (CbCRs) have emerged as a unique public source of information to track the country-by-country activities of multinational corporations. However, concerns about double counting and comparability have raised

questions about the reliability of these reports for economic analyses. In this paper, we conduct a benchmark analysis focusing on publicly available CbCRs to assess the reliability of CbCR information compared to respective consolidated financial information. Our findings suggest only limited double counting issues. Most CbCR information matches well with the consolidated information, with only a few exceptions. Nonetheless, we document differences in the definition of variables and in the scope of the reports that may complicate comparisons across multinational corporations. We subsequently discuss the implications of our findings for the use of CbCRs as a source of information in economic analyses. In addition, we provide recommendations for improving the reliability and comparability of CbCR information.

Unfortunately, the political process is notoriously pro-cyclical. When times are good, politicians cannot resist the imperative to spend or cut taxes to get elected. When a recession looms, people blame past profligacy and politicians are pressured into budgetary restraint. Both outcomes the exact opposite of what is needed. Government debt ratchets up with each boom and bust cycle.

There is, of course, a well known solution. Years ago, many governments relinquished control of monetary policy to central banks. An even older idea is to allow a fiscal authority to control fiscal stance to ensure the appropriate counter-cyclical policy. For example, an authority could be mandated to guarantee the fiscal responsibility of every budget. If a budget is too expansionary the authority can reject it with options for spending cuts and/or tax increases, too contractionary and it is returned with options for greater expenditure and/or tax cuts. In the US, the CBO is the obvious choice for that expanded role as it already provides budgetary advice. Obviously, any such body would have to be completely transparent and open in its decisions.

Advantages are clear; a single body can make forward projections knowing targets will be met. The authority can apply a strong fiscal stimulus in the face of a recession knowing it can dictate the timing and scale of fiscal consolidation in the outyears. As an additional benefit, the cost of borrowing may be permanently lowered as bond markets are reassured any debt will be repaid. Maybe even politicians will come to enjoy the loss of control – they can blame the fiscal authority if an election promise fails to be delivered. Then again, yes I know, dreaming again.

Wow! What as monstrously meaningful graph is Figure 2. It clearly shows the economic impact of the Covid 19, while simultaneously showing the hatred of the Trump administration. Why does it ignore, by NOT highlighting, the rise in the prior administrations?

Yup! Another illustration of the hateful liberal mind. At least it didn’t use hateful terms, y’ano like subhuman, yet.

The liberal mind is an amazement.

CoRev: There is no Figure 2.

Figure 2? Dude – we get you are stupid. We get you are a liar. We get you are a pointless little troll. But DAMN!

Why does it ignore, by NOT highlighting, the rise in the prior administrations?

I wish Dr. Chinn took this graph back further as the debt/GDP ratio was falling before Trump took office.

Hey CoRev – we know you lie about everything. So take the rest of the month off.

“Why does it ignore, by NOT highlighting, the rise in the prior administrations?”

Prior administrationS – OK!

St. Reagan and Bush43 did let the debt/GDP ratio rise. I guess CoRev was supporting Democrats back then?

Seriously CoRev – do you ever have a clue what you are barking at? Didn’t think so.

In self induced frenzy the fool sees what doesn’t exist. His mind—what’s left of it—repeats: Biden Biden, Biden! It’s BDS, and the fool is powerless to resist its grip.

https://www.forbes.com/sites/saradorn/2023/05/19/trump-ad-claims-desantis-wants-to-raise-taxes-ron-desalestax/?sh=22cbf7c8664b

Trump is saying DeSantis wants a massive tax increase because Congressman DeSantis supported the so called Fair Tax. Never mind this proposal wanted to get rid of the income tax which would have lowered taxes. DeSantis is a right wing creep whereas Trump is a serial liar.

What Kevin McCarthy is doing right now, amounts to extortion. And on top of it, McCarthy’s position right now, is weak. And he’s in no place to make demands, unless McCarthy thinks self-destruct of U.S. economic power is going to make Republicans look good to U.S. voters and nearly as importantly, U.S. allies.

BTW, McCarthy has NO PLAN and doesn’t even currently know the number of votes he could carry in his own party.

Menzie, then the rational author would have assumed the comment referred to the only figure in the article and was a typo. Instead of wasting time by providing a response unrelated to the meat of the comment.

The ego of the liberal mind is an amazement.

The fool always has a ready excuse for his errors. His mistakes are the fault of others, never his.

How many points must you folks ignore to feel so arrogant? Where’s that list of Biden’s successful policies?

😉 another mind in which to live. What an amazement.

If there was a vaccine for BDS (Biden Derangement Syndrome) , the fool would likely refuse it.

Me thinks CoRev is still ingesting bleach.

“How many points must you folks ignore to feel so arrogant?”

This from the moronic troll who keeps telling us that tax revenues fell by 26% under Biden. Address that lie before you spout out another stupid bark.

CoRev fails writing 101 and decides it was Dr. Chinn’s fault? Taking responsibility has never been CoRev’s style.

Fair Tax?

Fair for who?

In FY23, the federals are expected to collect around $2,632 billion in individual income taxes. That’s a lot of revenue to replace, so let’s see how we might do it.

Consumption: Impose a 15.2% tax national tax on $17.4 trillion in private consumption.

Bear in mind that billionaires will pay exactly the same tax rate as those living hand-to-mouth.

Import duties; Impose an 81% tax on $3.25 trillion in imports.

See rich / poor caveat above.

Poll tax: Impose a $9.8 million tax on each of the 333.6 million citizens.

See rich / poor caveat above.

Any other ideas?

Nicely done! The Fair Tax is not only unfair – it is bad arithmetic.