Reader Erik Poole suggests using the Hamilton filter instead of the Hodrick-Prescott filter, in assessing how much the CPI deviated from trend (recall, i noted that the CPI rose 2% vs trend at the same time as oil prices were elevated, before and after the expanded Russian invasion of Ukraine). I am (more than) happy to oblige.

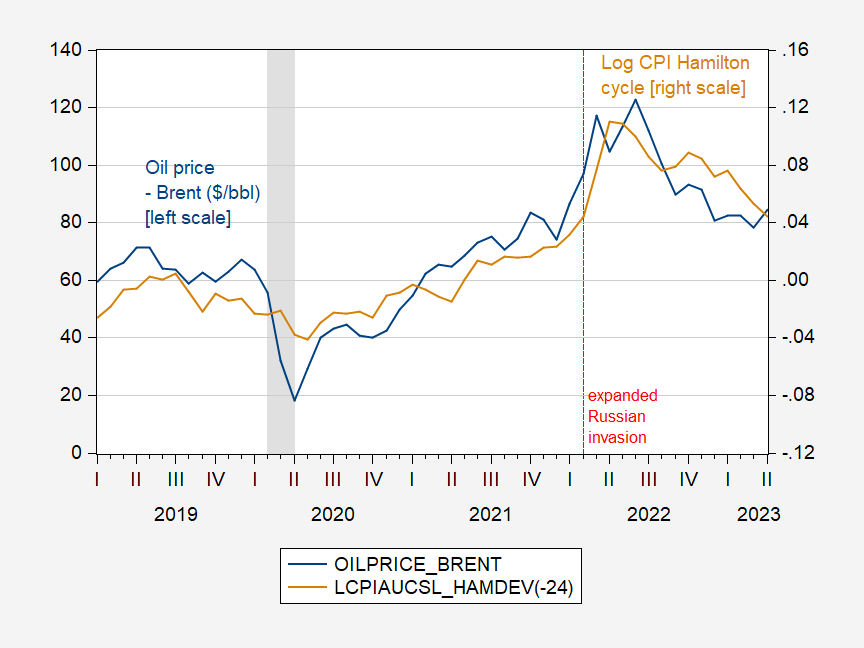

Figure 1: Oil price (Brent), $/bbl (blue, left scale), and CPI deviation from trend (Hamilton filter) (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: EIA, BLS via FRED, NBER, and author’s calculations.

I implemented the Hamilton filter with h=24, p=12. The HP cyclical component rose 2.1% from November 2011 to June 2022, while the Hamilton filter indicates a 7.7% increase. This is in line with my conjecture that in general, estimated cyclical components were larger for most typical US macro series.

Obviously, correlation is not causation; in particular, a joint factor is that increased oil prices are associated with increased aggregate demand, which itself (in the context of fixed or depressed aggregate supply) would raise prices via the simple Phillips Curve. However, I think all would agree at least a large share of the energy component of CPI-all is associated with cost-push inflationary pressures.

Personally I think “cost-push inflation” is not near as large as being portrayed. Can I say it has “nothing to do with increased inflation” of prior months?? NO, I can’t. But I’m dying on this hill (no joke). I’m dying on this hill, which says, “push-cost inflation” is much less than mainstream economists are portraying it these past months. Does this make me like a Kopits or a Ed Hanson in viewing facts?? I let others be the judge. But I feel strongly about it. How did it coincide with when manufacturers are telling everybody “supply chain problems”??? You decide, ‘cuz I’m just damned near tired of it.

Your cause of choice? (I think I know, and partly agree.)

@ Macroduck/ Bro

How dare you disagree with me!!!! (joke/sarcasm) /sarc I expected Menzie to chase after me at this point. Well, I don’t have a “supportive” link to be honest with you Macroduck, other than my adult drinks today (does that count??) uuuhm. Just my repeated, ad nauseam thoughts on the supply chain problems

If you or Menzoe. want to “take me to task” and disagree on me on this. I might be less argumentative or “bitchy” than you or Menzie imagine/

: )

NO worse than Eric Cartman. Just saying,

“I think all would agree at least a large share of the energy component of CPI-all is associated with cost-push inflationary pressures.”

Isabella Weber decided just this and wrote on the matter, only to be intemperately attacked by Paul Krugman. * Krugman apologized for being intemperate but not for being wrong. James Galbraith argued in support of Weber, but Krugman unfortunately seems to have decided the matter. The Chinese understood the cost-push nature of price increases in 2001 and successfully used price policy to limit the increases, but such Chinese policy is always discounted.

* https://news.cgtn.com/news/2022-01-22/The-case-for-strategic-price-policies-171AF24WDgk/index.html

https://twitter.com/paulkrugman/status/1477247341212184577

Paul Krugman @paulkrugman

Deleting, with extreme apologies, my tweet about Isabella Weber on price controls. No excuses. It’s always wrong to use that tone against anyone arguing in good faith, no matter how much you disagree — especially when there’s so much bad faith out there.

6:56 AM · Jan 1, 2022

https://news.cgtn.com/news/2022-01-22/The-case-for-strategic-price-policies-171AF24WDgk/index.html

January 22, 2022

The case for strategic price policies

By James K. Galbraith

With a single commentary * in The Guardian (and an unintended assist ** from New York Times columnist Paul Krugman), economist Isabella Weber of the University of Massachusetts injected clear thinking into a debate that had been suppressed for 40 years. Specifically, she has advanced the idea that rising prices call for a price policy. Imagine that.

The last vestige of a systematic price policy in America, the White House Council on Wage and Price Stability, was abolished on January 29, 1981, a week after Ronald Reagan took office. That put an end to a run of policies that had begun in April 1941 with the creation of Franklin D. Roosevelt’s Office of Price Administration and Civilian Supply – seven months before the Japanese attack on Pearl Harbor.

U.S. price policies took various forms over the next four decades. During World War II, selective price controls quickly gave way to a “general maximum price regulation” (with exceptions), followed by a full freeze with the “hold the line order” of April 1943.

In 1946, price controls were repealed (over objections from Paul Samuelson and other leading economists), only to be reinstated in 1950 for the Korean War and repealed again in 1953. In the 1960s, the Kennedy and Johnson administrations instituted pricing “guideposts,” which were breached by U.S. Steel, provoking an epic confrontation. In the following decade, Richard Nixon imposed price freezes in 1971 and 1973, with more flexible policies, called “stages,” thereafter.

Federal price policies during this period had a twofold purpose: to handle emergencies such as war (or, in the cynical 1971 case, Nixon’s re-election) and to coordinate key price and wage expectations in peacetime, so that the economy would reach full employment with real (inflation-adjusted) wages matching productivity gains. As America’s postwar record of growth, job creation, and productivity shows, these policies were highly effective, which is why mainstream economists considered them indispensable.

The case for eliminating price policies was advanced largely by business lobbies that opposed controls because they interfered with profits and the exercise of market power. Right-wing economists – chiefly Milton Friedman and Friedrich von Hayek – gave the lobbyists an academic imprimatur, conjuring visions of “perfectly competitive” firms whose prices adjusted freely to keep the economy in perpetual equilibrium at full employment.

Economists with such fantasies held no positions of public power before 1981….

* https://www.theguardian.com/business/commentisfree/2021/dec/29/inflation-price-controls-time-we-use-it

** https://twitter.com/paulkrugman/status/1477247341212184577

James K. Galbraith is chair in Government/Business Relations at the Lyndon B. Johnson School of Public Affairs at the University of Texas at Austin.

Speaking of Isabella Weber and Krugman, Krugman recently acknowledged something called price-price inflation:

“The International Monetary Fund has looked at data across several countries and found no evidence that wage-price spirals are developing. And in the United States I haven’t seen any evidence of one, either. Wage growth did accelerate, but this seems to have been mainly because workers were in demand in a very tight labor market. Indeed, wage growth has come down from its peak (although it’s still running unsustainably high) as indicators of labor-market tightness like the quits rate come down.

If anything, in the United States we have seen something like what Lael Brainard, the former second-in-command at the Fed and now the Biden administration’s chief economist, calls a “price-price spiral,” in which some firms raise prices more than their costs go up. At least some of this may have involved firms believing that they could get away with exceptional price hikes because customers wouldn’t notice in a time of widespread price hikes.”

https://www.nytimes.com/2023/04/28/opinion/inflation-wages-unemployment.html

I guess if Krugman acknowledges it, it must be tantamount to official! Yet I see few other mainstream economists publicly acknowledging that Corporate America has been one of the big drivers of inflation…heck, it was even hard to find an economist who would acknowledge that Corporate America contributed to inflation in any way!

Chinese claims of policy success are always discounted, and rightly so. Every time you copy/paste or link to a sel-congratulatory bit of cgtn Chinese propaganda, you confirm the need to discount these claims.

https://fred.stlouisfed.org/graph/?g=RqcN

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 1977-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=RqcV

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 1977-2021

(Indexed to 1977)

https://fred.stlouisfed.org/graph/?g=VbYC

August 4, 2014

Real per capita Gross Domestic Product for China, Indonesia, Brazil, United Kingdom and France, 1977-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=VbYG

August 4, 2014

Real per capita Gross Domestic Product for China, Indonesia, Brazil, United Kingdom and France, 1977-2021

(Indexed to 1977)

https://fred.stlouisfed.org/graph/?g=14Gs4

January 15, 2018

Life Expectancy at Birth for China, United States, India, Japan and Germany, 2007-2021

https://fred.stlouisfed.org/graph/?g=14GrN

January 30, 2018

Infant Mortality Rate for China, United States, India, Japan and Germany, 2007-2021

https://www.imf.org/en/Publications/WEO/weo-database/2022/October/weo-report?c=924,532,546,111,&s=PPPGDP,PPPSH,&sy=1980&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October 15, 2022

Gross Domestic Product and Share of World Total based on purchasing-power-parity (PPP) for China & United States, 1980-2022

1980

China ( 2.3)

United States ( 21.3)

1985

China ( 3.3)

United States ( 22.2)

1990

China ( 4.0)

United States ( 21.6)

1995

China ( 5.8)

United States ( 19.8)

2000

China ( 7.6)

United States ( 20.3)

2005

China ( 10.0)

United States ( 19.1)

2010

China ( 14.1)

United States ( 16.7)

2015

China ( 16.5)

United States ( 16.3)

2020

China ( 18.5)

United States ( 15.7)

2022

China ( 18.9)

United States ( 15.5)

NPR has gotten into the fray as well, offering a podcast featuring Isabella Weber, who has been all over what she calls “seller’s inflation” from early on. (Revenue = cost + profit…except that the profit part of the equation seems to have been overlooked when it came to inflation.) https://www.npr.org/2023/05/11/1175487806/corporate-profit-price-spiral-wage-debate

She recently released a paper on how it works: https://scholarworks.umass.edu/cgi/viewcontent.cgi?article=1348&context=econ_workingpaper

Claudia Sahm, who spent a good part of her career working on inflation at the Fed, has her take: “Price-price spirals take us for a spin…

What’s the real-world evidence for it? Reality played a role in bringing attention to price-price spirals. It might not fit neatly in our ‘standard models’ and was initially attacked as “very stupid.” But the evidence is piling up that it should receive serious consideration. Inflation reached its highest level in forty years, as well as an all-time high in profit margins.”

https://stayathomemacro.substack.com/p/price-price-spirals-take-us-for-a?utm_source=profile&utm_medium=reader2