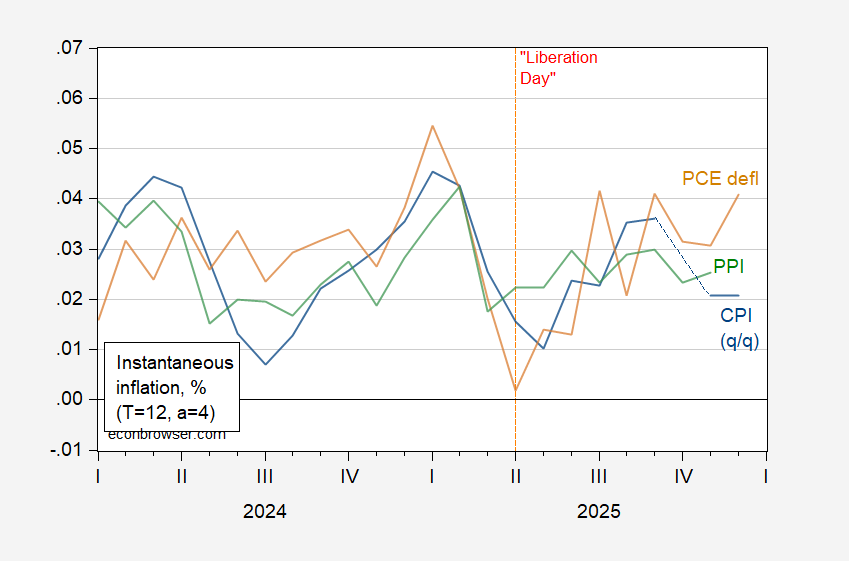

M/M PPI +0.5% vs.+ 0.2% Bloomberg consensus; m/m core PPI +0.7% vs. +0.2% consensus. Here’s instantaneous (per Eeckhout, 2023) PPI and PCE vs q/q CPI:

Figure 1: Instantaneous inflation (T=12,a=4) for PPI (green), PCE deflator (brown), q/q annualized CPI (blue), all in decimal form %. Calculations per Eeckhout (2023).Source: BLS, BEA, and author’s calculations.

I plot q/q for CPI because the missing October value prevents calculation of instantaneous CPI for the most recent observations. On the other hand, q/q inflation approximates ok for instantaneous for the CPI.

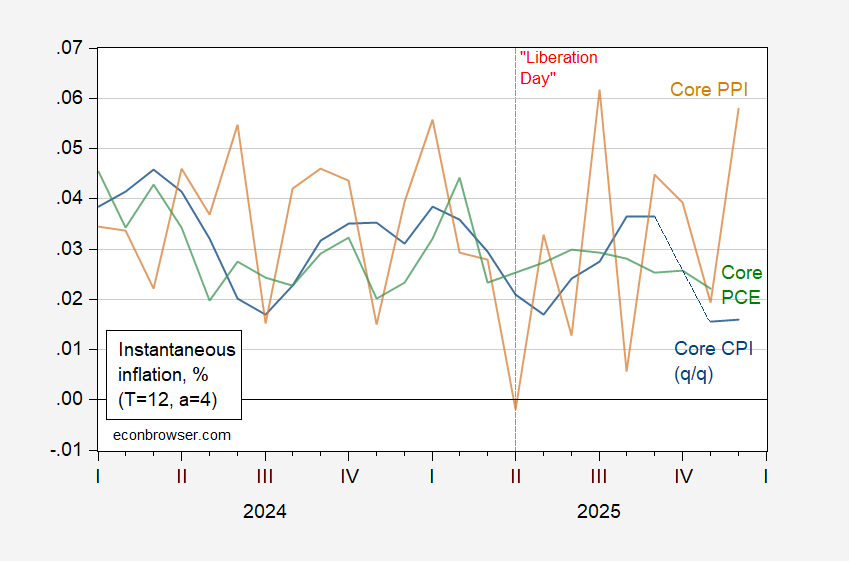

Figure 2: Instantaneous inflation (T=12,a=4) for core PPI (green), core PCE deflator (brown), q/q annualized core CPI (blue), all in decimal form %. Calculations per Eeckhout (2023).Source: BLS, BEA, and author’s calculations.

Cleveland Fed’s PCE deflator nowcast does not rely on the PPI. GS today predicts +0.37% m/m core PCE inflation in December, corresponding to an annualized rate of 2.98%, substantially over the target 2%. The Cleveland Fed’s core PCE nowcast is 0.24% m/m.

Looks like wholesalers boosted margins. In BLS terms, wholesalers provide a service when selling goods, so:

“The Bureau said over 40% of the increase in prices for final demand services was from a 4.5% rise in margins for machinery and equipment wholesaling.”

https://www.mdm.com/news/research/economic-trends/december-ppi-rises-sharply-as-machinery-wholesalers-expand-margins/

This is tariff passthrough on goods.

On a related topic, DXY rose 1% today, coincident with lower metals prices and the Warsh nomination. That’s despite a slight downward drift in expectations for the year-end funds rate and in Treasury rates; neither strong PPI nor Warsh news was enough to lift rates. Nominal Treasury rates fell more than TIPS break-evens – the drop in Treasury rates isn’t just an inflation-expectations thing. Not a very consistent message from market price movement.

This whole Bessent says “strong dollar”, felon-in-chief says a 4-year low for the dollar is dandy and also cut rates, just got even cloudier. Let’s hear how Warsh, seen as a hawk based on his own extensive statements, threads this needle.