In addition to testifying before Congress, Federal Reserve Chair Ben Bernanke today tried to explain the Fed’s plans and options directly to the public through an op-ed in the Wall Street Journal. Here I provide some background on what Bernanke’s talking about in terms of an “exit strategy” for the Fed, and offer some thoughts on his remarks.

Author Archives: James_Hamilton

Natural gas and oil prices

Since the start of the year, the price of crude oil has risen about 40% while the price of natural gas has fallen by about 40%. Can that divergence be maintained?

Links for 2009-07-17

Some quick remarks about the evidence for economic recovery, central bank independence, and Goldman Sachs.

In the news

Concerns about the Fed’s New Balance Sheet

That’s the title of a chapter I contributed to a new book edited by John Ciorciari and John Taylor entitled The Road Ahead for the Fed. The book grew out of a conference held at Stanford University in March.

Links for 2009-07-12

A very neat interactive graphic from the NYT showing changes in same-store sales for different establishments. (Click on the store name at the left, and tip your hat to Economix).

Keith Hennessey, who used to have Larry Summers’ job in the Bush White House, on the challenges facing the White House in framing discussion of the effectiveness of the existing stimulus package. See Obama’s apparent answer here.

And a hilarious story via Calculated Risk on why Wells Fargo is suing itself.

Guest Contribution: Index Funds and Commodity Prices… Here We Go Again

By Scott Irwin

Econbrowser is pleased to host another contribution from Scott Irwin, who holds the Laurence J. Norton Chair of Agricultural Marketing at the University of Illinois, and today offers some insights from his research on the current debate concerning commodity speculation.

Back where we started

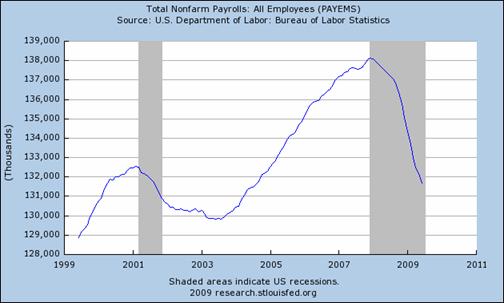

BLS reported that the total number of Americans employed in June on nonfarm payrolls came to 131.7 million workers on a seasonally adjusted basis. That’s below the June 2000 figure of 131.8 million with which we started the decade.

|

Off-balance-sheet federal liabilities

Just how much has the U.S. government promised to pay?

No rebound for autos

Autos are worth watching as one sector where economic growth could resume first. But despite what others are saying, I don’t believe that it’s happening yet.