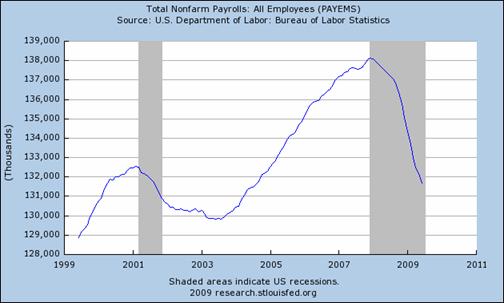

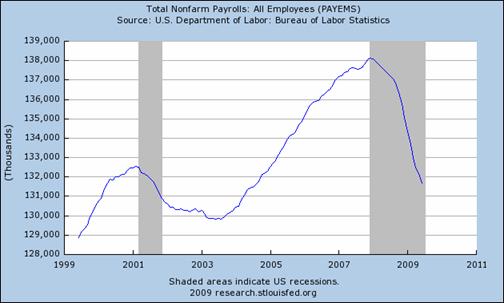

BLS reported that the total number of Americans employed in June on nonfarm payrolls came to 131.7 million workers on a seasonally adjusted basis. That’s below the June 2000 figure of 131.8 million with which we started the decade.

|

BLS reported that the total number of Americans employed in June on nonfarm payrolls came to 131.7 million workers on a seasonally adjusted basis. That’s below the June 2000 figure of 131.8 million with which we started the decade.

|

Maybe this helps ease the pain of that graph (in aggregate):

https://research.stlouisfed.org/fred2/graph/?chart_type=line&s%5B1%5D%5Bid%5D=OPHNFB&s%5B1%5D%5Brange%5D=10yrs

Per population, aggregate hours in private industry are back down to a level they first touched in 1964.

How well this instrument (AHWI/CNP16OV) measures work or how much total work there should be anyhow are open questions, true, but still: 1964!

Create more with less.

When the jobs headed off shore at the turn of the century many of us never found suitable employment, so apparently I was correct to call it the lost decade.

I seem to recall the S%P 500 being about 1500 also. So now we are a half. Little wonder the country has no appetite for more republican rule. No jobs, no pension, no health care, 401K decimated, that will do it.

All the data sure looks and reads like a depression, Professor.

I pray every night that President Obama wakes up and stops the idiotic, guaranteed-to-fail bailouts and proppings up. The U.S. will soon need all its cash and all its credit to feed its hungry and warm its cold.

This is a fine, quick daily read, of the WSJ from 79 years ago. Hilarious, the repeat of the foibles of human nature.

http://newsfrom1930.blogspot.com/

This is unprecedented, to have a decade with no job growth.

However, the retirement of Baby Boomers has only just started. That will lead to further contraction.

However, the retirement of Baby Boomers has only just started. That will lead to further contraction.

And what leads you to believe that the Boomers will actually be able to retire “on schedule”? Anecdotes are not data, but I’m a Boomer and it certainly feels like a significant number of my contemporaries have watched their pensions and 401(k)s evaporate over the last ten years.

Michael Cain,

Quite a few retirements will be involuntary. Plus, many corporations have mandatory retirements at age 65.

Plus, for those who are well off, even a 40% reduction in 401K may not necessarily delay retirement. They would instead buy a smaller condo, retire in a Tier II rather than prime location, etc.

Don’t just regurgitate something you heard someone else say. Think about all angles.

When the downturn will end is the big unknown. I have no interests in predictions. I do have an interest in indicators. When will unemployment cease growing and the level of income earned + savings, in aggregate, fit with the price of houses?

Wealth + earnings must match housing prices.

Despite all the anguish about declines in the stock market, the Federal Reserve Board caculates that private sector assets exceeded liabilities by 50 trillion as of the end of the first quarter of 2009. Perhaps it has declined another 3 trillion since then. 47 trillion is still large enough to get this economy off dead center.

My point is that spending will begin again when we all become convinced that the recession is over. And a lot of speculators are sniffing around, picking up bargains before the bottom is reached.

The problem, for me, is Obama’s rush to spend money when the times call for meeting human needs rather than trying to stimulate the economy. Too much stimulation helped create current problems.

I think the notion that retirement is part of some “natural” order of things, now and historically, in American society is a bit misleading.

For the bottom income quintile of workers, retirement is very rarely an option. The working poor work as long as their health holds out.

The second quintile, while marginally better off, still tends to keep working as long as possible; often in part time jobs.

It’s the upper three quintiles, what we would generally consider the middle and upper classes, where you see the bulk of retirees. However, even that set, there are a number of people who chose to continue to be employed if feasible. Think family businesses, professionals, and those who just want to get of the house and find working enjoyable.

While perhaps a majority of Americans go into a traditional retirement at some point in their lives, a substantial minority doesn’t, and never did.

By the way, the BLS definition of employment is rather broad, more so than many people are aware of. A person is considered employed if they did any work at all for pay or profit during the survey week. This includes all part-time and temporary work. The number of hours is irrelevant.

Also included are people who are”‘unpaid family workers,’ which includes any person who worked without pay for 15 hours or more per week in a family-owned enterprise operated by someone in their household.”

I suspect that there are a fair number of people who consider themselves retired that would be surprised to learn that by the standards of the BLS, they are actually still part of the workforce.

It’s the upper three quintiles, what we would generally consider the middle and upper classes, where you see the bulk of retirees. However, even that set, there are a number of people who chose to continue to be employed if feasible. Think family businesses, professionals, and those who just want to get of the house and find working enjoyable.

I say most of the top quintile keeps working as long as they are able. They like what they do, and get bored without going to work. I know several 70+ people who are wealthy and still continue their careers. Money is not the issue, but avoidance of boredom is.

The next entitlement to collapse IS retirement.

There is no historical precedent for people to be able to live without working for the final 20 years of their life. That too will prove to be a historical anomaly.

Anyone who wants to stop working should have to accumulate enough savings to do so. Those who cannot, should not expect to retire. Period.

Professor,

The figure is even worse if you adjust for working age population. According to the BLS, working age population was 211 million in January 2000 and is now 235 million. The Labor force level was 142 million in January of 2000 and is now 155 million.

We needed to add 13 million jobs just to keep up with demographics over the last decade. Look at the employment:population ratio figures that Calculated Risk put up for some scary and ugly figures on America’s employment situation.

http://www.calculatedriskblog.com/2009/07/employment-population-ratio-part-time.html

Pay people to grow vegetable gardens and count them as farmers. I’m a little bit serious, maybe you could give a couple dozens hours worth of benefits this way.

ReformerRay wrote: “When the downturn will end is the big unknown. I have no interests in predictions. I do have an interest in indicators. When will unemployment cease growing…”

The recession is ending now, according to the indicators. See my article at http://seekingalpha.com/article/147472-why-the-recession-is-over

Unemployment is a lagging indicator. It will not tell you when the downturn is ending. See the second article at http://seekingalpha.com/article/143237-bad-news-they-re-just-lagging-indicators

I don’t see how America can possibly survive as a country of any importance, able to protect what little value it still has on the world stage. Are there other countries we should begin looking at moving to, other than, of course, China, India and Brazil?

One of this day I’ll upgrade my inactive graph (currently 1948-2008):

http://fatknowledge.blogspot.com/2009/01/misleading-nature-of-unemployment.html

With inactive rising from 3% to 9% of men aged 25-54 over the period, I wonder where we are now.