I was doing a review of measured economic policy uncertainty, and found an interesting divergence between the US and Europe:

Category Archives: Uncategorized

“this [Covid-19] pandemic ain’t 1918–never was, never will be”

— Comment by rick stryker, August 19, 2020.

Term Spread and Inflation Breakeven Declining, and Real Rates Still Low

All suggesting slowing growth…maybe

“Do Central Banks Rebalance Their Currency Shares?”

Paper by me, Hiro Ito, and Robert McCauley. From the abstract.

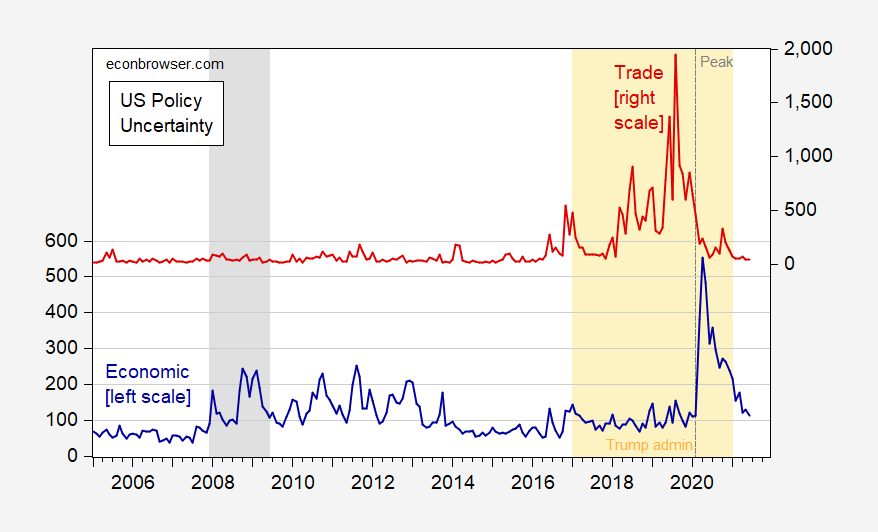

Policy Uncertainty Six Months, A.T.*

* “After Trump” .

Figure 1: US Economic Policy Uncertainty index (news) (blue, left scale), US Trade Policy Uncertainty categorical index (red, right scale), both monthly averages of daily data. NBER defined recession dates shaded gray, NBER peak at dashed line; orange denotes Trump administration. Source: policyuncertainty.com, and NBER.

Part of this decline in uncertainty could be attributable to the economic management team.

Macroeconomic Management in the Biden Administration

Here is an update to this post, on who’s where at the top of select agencies.

Baumeister, Leiva-León, and Sims: “Tracking Weekly State-Level Economic Conditions”

Section 232 Report on Automobiles Released (over 2 years after submission to Trump)

More Great Quotes from the Past

From a reader in 2018:

The people 2slugs disdains can overhaul an engine and cultivate a field way better than 2slugs, and have way more “common sense” than many university professors. The supposed nincompoop Trump voters in his 2 years have lead a national economic performance that Obama in his 8 years, lead by “elites” such as 2slugbaits, never did, and in fact said was impossible. Who is the expert here?

In 2017Q1-20Q1, GDP growth averaged 1.9%, and in Obama’s second term averaged 2.4%. (In Trump’s first two years, GDP growth averaged 2.6%. To be clear, what mainstream economists said was impossible was the 4% or 5% growth Trump promised.

Great Quotes from the Past

In order to judge the analytical abilities of an individual, it is sometimes useful to look back at their previous assessments. Consider this comment: