There is a curious difference between the EPA report on boutique fuels that was actually released by the EPA and the account in the mainstream press.

The EPA on Friday released its report to President Bush on “boutique fuels”, an expression used to refer to the proliferation of different fuel requirements in different communities across the United States. Someone evidently delivered a “draft” version of this report to AP correspondent H. Josef Hebert, whose account of the study was carried by many of the nation’s media outlets on Friday. The Barking Dingo has a version of the AP account that is perhaps a more permanent link than someplace like the Washington Post. Hebert wrote:

The review “did not reveal any studies or empirical data confirming that boutique fuels presently contribute to higher fuel prices or present unusual distribution problems,” said the draft report.

The curious thing is that neither the above statement nor any facts or analysis to support it appear in the final report that was actually released by the EPA.

Now, some may imagine that in the 24 hours between the time that Hebert received his advance copy and the time the EPA released the final version, there was some massive re-editing of the report to eliminate anything that might have been seen as potentially embarrassing to the Bush administration. I’m inclined to guess instead that any such editing would have been in the works well before Thursday, that the EPA staff member who originally wrote the words was miffed that they were taken out of the final report, and that said staff member therefore chose to circulate a “draft” version of the report to the press on the eve of the release of the final report.

In any case, the statement that there are no studies claiming that boutique fuels contribute to higher prices is patently false. For example, a 2005 analysis by Ujjayant Chakravorty and Celine Nauges concluded:

These fuels are costly to produce, but they also segment the market and increase the market power of refiners…. we find that both cost and market segmentation significantly affect wholesale gasoline prices.

The EPA report as publicly released in fact notes the beneficial effect on prices of temporarily waiving requirements last fall:

Recent use of this authority occurred as a result of hurricanes Katrina and Rita, in the late summer and early fall of 2005 when EPA, in consultation with DOE, successfully issued a series of limited fuel waivers for specific gasoline and diesel quality standards. These waivers were authorized and approved based on supply concerns. EPA’s waiver authority and decisions were universally supported by the affected stakeholders.

Presumably the EPA is also aware of the alarms raised by Governor Edward Rendell (D-PA) in his

request last April for a temporary waiver of requirements:

We have information indicating that a major gasoline supplier in the Philadelphia area is reporting more than 160 delivery-needed alarms, and many more fuel outlets reporting that supplies are nearly exhausted.

Cambridge Energy Research Associates advocates further waivers to ease gasoline prices this summer, and the EPA final report acknowledges hearing a “unified message” from those involved in gasoline distribution and marketing that “boutique fuels impact supply and price even in normal market situations.”

|

It would be pretty surprising to me if the huge differences in the price that consumers pay for gasoline across different parts of the country have nothing at all to do with the fact that different kinds of gasoline are required in different communities. I am nevertheless open to reviewing evidence as to the extent to which that is the case. The ultimate decision of where we stand on the tradeoff between clean air and the cost of gasoline is appropriately one that should be debated in the political arena, and for which different U.S. residents may have different opinions. But a necessary input to that discussion should be an objective, scientific effort to measure exactly what the magnitudes of the tradeoff may be.

|

Technorati Tags: gas prices,

gasoline prices,

boutique fuels

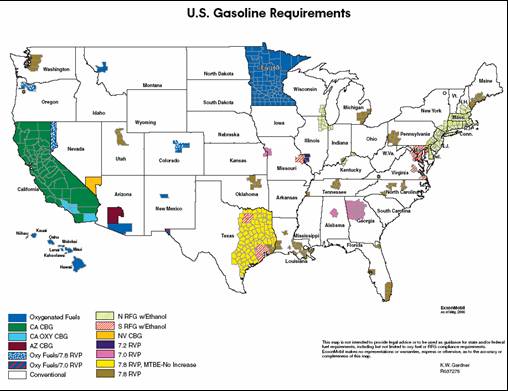

Thanks for posting the fascinating maps. It’s not obvious to me that the gasoline requirements are the main explanation of the fuel price differences. For example, consider Minnesota, which requires different fuel than the conventional fuel required by neighboring Wisconsin, Illionois or South Dakota. Yet is has similar prices.

Or look at the pattern in Arizona where the two counties with special requirements have either the same or cheaper gas than surrounding counties with conventional requirements. Ditto in Washington where the special requirement in Seattle goes along with slightly cheaper gas than surrounding rural counties.

However, clearly *something* is disturbing the peace of efficient market operations in retail gasoline. There are obvious state effects – eg Nebraska is systematically more expensive than Kansas, South Dakota is systematically more expensive than North Dakota, and so on. Those might be tax based?

However, taxes can’t be all of it: I used to live in Humboldt County, CA (second from the top coming down the coast). There were persistent complaints in the newspaper that we had to pay more for gas than other places. I see from this map that in fact that county has the most expensive gas in the nation. It is of course remote, but not more so than counties in north eastern California with cheaper gas. I never did manage to figure out what was going on, but my suspicious looking at this map is there are some anticompetitive things happening at the distributor level. I just can’t think of a good reason for prices to vary county-to-county like this (modulo higher costs at the retail level, eg for rents in urban areas).

I just quickly skimmed that Chakravorty and Nauges paper and it looks very dubious to me. The problem is that the distribution of fuels that they look at is extremely regionally specific and it’s not at all obvious that the correlations they find aren’t due to some other regional effects that aren’t in their regression and aren’t being controlled for. Eg. the RFG fuels almost all occur in a cluster of east coast states. How do we know the price fluctuation there isn’t due to something other than the boutique fuel? Also I thought looking at refinery capacity per state was very odd given that many states are small and won’t have their own refinery (as opposed to, say, distance to nearest refinery, or inbound pipeline utilization).

Given the large number of closely similar fuel types shown on the map, how much of the tradeoff is really a tradeoff, and how much is just the same old political corruption and protectionism that also leads, for example, to our outlandish farm subsidies?

Are there really umpteen different kinds of smog, or are there really only one or two? And if there aren’t umpteen kinds, then why, except for the behavior our sleazy Congresscritters, must we make the tradeoff much less favorable than it needs to be, by so fragmenting the market? (Gasoline, after all, is clearly a national commodity subject to the interstate commerce clause, so Congress has the right to override this nonsense any time they feel like it.)

Do any of the reports address how easy it is for a refiner to switch from output to another? Or how easy it is for a refiner to be “multi-fuel?”

I’ve mentioned before that I see it as a difference in small volume additives, and something that would be easy to blend to customer requirements.

If the guys at Home Depot can mix 100 colors of paint …

It is really a mystery to me why gas prices have such huge regional differences. Little of the difference is taxes as this report from the American Petroleum Institute shows http://api-ec.api.org/filelibrary/2006-gasoline-diesel-taxes-summary.pdf

It can’t be proximity to refineries. I was in Washington state recently only a few miles from the refineries and docks of Alaskan tankers. The prices were 20% higher than on the remote backroads of Idaho hundreds of miles away from the nearest refinery, pipeline or freeway (or competing gas stations for that matter).

Is the wholesale gas market that inefficient?

For that matter, what’s keeping some enterprising trucker from driving 10,000 gallons of gas from Boise to Spokane and making $3000 for an afternoon’s work? A bunch of regulations, I suppose.

It would be interesting to know what goes into the price paid by the consumer. How much is fuel? How much is the dealer’s markup? How much is taxes? How much is the retailer’s markup? Gasoline is heavily taxed and there are considerable differences from state to state. How much represents the cost of doing business? Rural areas seem cheaper than urban areas. Does this reflect a higher cost of doing business in an urban area? OTOH there would be less competition in rural areas so one would think rural prices would be higher. It would be nice to see a map of price variations by area of other commodities such as milk or bread. If the president has the power to waive boutique fuel requirements in order to control prices, how important can those requirements be?

The price-by-county map is misleading. What is mostly reflects is the differences among state and local gas taxes around the country. Check Missouri, for example. It has lower gas taxes than most states.

The price-by-county map is misleading. What is mostly reflects is the differences among state and local gas taxes around the country. Check Missouri, for example. It has lower gas taxes than most states.

Copy what Dave said.

Is there any way to redo the maps with the taxes pulled out? That would be far more enlightening. Dr. Hamilton, do you have a few grad students with nothing to do this summer? Just a little hint.

I used to work in the ethanol biz & blended gasoline & ethanol. If by ’boutique fuel’ they mean taking already produced generic blends of gasoline & adding additives to them then it shouldn’t effect the price much at all. It is done in small batches at the point of transit & sent out to the stations – not unlike mixing a specific shade of paint at Home Depot.

On the other hand if they have to actually run the refineries differently to produce the blends (and then set-up special tanks in the tank farms & keep it all seperate)… then ‘yes’ boutiques of this type could certainly have a significant effect on cost.

As for the pricing issues resulting from market segmentation… I’d bet the lack of local competition has a bigger role than the boutique formulations themselves.

If the boutique blend increases the cross boundary hurdles to competition that make it possible to create a near monopolies in an isolated locality possible – thinking west coat here – then maybe the boutique itself adds to the problem. To know for sure one would have to look at how easy it is to make/blend that particular boutique blend & their distribution across boundaries.

My guess is if that were done ‘honestly’ – the reason the west coast is so expensive will be (1) lack of adequate local refining capacity & feedstock supply and (2) taxes. Eliminating the reformulation reg’s will probably have little effect unless there was more supply & capacity & probably more competitors in that market. On the other hand, keeping the regs in place & brining in more competition to the market would – in my opinion – have a far greater impact.

But we all know oil companies HATE competition.

From Joseph’s API link taxes in California are 25 cents per gallon higher than Missouri, but the price differential is over 60 cents per gallon for most counties.

Stuart and others make remarks as if they see the role of competition as separate from the boutique fuel question. In my mind, they are one and the same issue.

JDH:

I’m just observing that there seems to be a lot of structure in the map that is not well explained by the boutique fuels. Until I had a clear understanding of what caused most of it, it would be hard to say whether or not the boutique fuel requirements were material or not.

Off the top of my head, I can think of a bunch of factors that might reasonably cause differences in gas prices:

At the wholesale level:

* distance from refineries, transport costs to distributor facilities

* adequacy of competition amongst refiners

* adequacy of competition amongst distributors

At the retail level:

* cost of land and construction for service stations

* cost of labor for running service stations

* price sensitivity of consumers (wealthy consumers will be more likely to pay whatever the price is at the most convenient station, poorer consumers will more likely accept more inconvenience to find the lowest price, forcing prices down).

* cost of transport to the service station (more spread out in rural areas)

* adequacy of competition amongst service stations (generally good except in isolated areas)

It seems to me that only by having a tolerably good understanding of how these factors play together would one be in a reasonable position to assess the effects of the boutique fuels requirements.

It is worth noting that the contents of the various formulations are not an major cost factor. The API says the direct costs vary by only about a nickel a gallon. If boutique fuels are an issue, it is a supply and demand problem, not a material cost problem.

Carnival of the Capitalists

There are many great posts for this week’s Carnival of the Capitalists. I particularly enjoyed:Breakeven Point Before Real Returns at The Real Returns Circumventing Late Fee Anger at BusinesspunditCreative Job – Commute Helper at Personal Finance Advic…

I drive back and forth between a house in NJ and one in NE PA and buy gas in both states. During the winter, regular gas was consistently 10 cents a gallon cheaper in NJ. Now it has flipped to 5 cents cheaper in PA. There has been no change in taxes in either state. I think the switch is due to fragmentation of the market.

For those wanting to do the math themselves, Gas Price Watch has a list of state-by-state gas taxes. Here’s a quick comparison between “lowest-cost” Missouri and “highest-cost” California:

Missouri = $2.47 – $.17 = $2.30/gal

California = $3.34 – $.18 = $3.16/gal

Stuart Staniford’s post above does a good job describing the various reasons for differences in cost.

JDH – you wouldn’t happen to have a map showing the location of refineries and pipeline distribution nodes, would you? I’m wondering if Humboldt County’s place at the high end of the scale may be accounted for by a lack of close proximity to both.

It’s more complicated than that, Ironman. Here in Illinois for example in addition to the state gas tax there are local gas taxes that vary by county and municipality.

Where are the real crude oil and refined product pricing experts?

Did anyone read the 26 page EPA Boutique Fuels Task Force final report? Or the 15 page technical report? Or visit the Boutique Fuels Task Force web page? If interested, start here and not at the link that JDH posted:

EPA – Boutique Fuels Task Force

U.S. refineries and product pricing knowledge? Clue: Try starting with the following links.

EIA DOE

Petroleum Refining and Processing

Refinery Capacity Report 2006

Operable Petroleum Refineries by State – named individually by location

Operable Petroleum Refineries by PAD District (PADD) and State

What is a PADD? Short for Petroleum Administration for Defense (PAD) Districts (PADD) which represent geographic aggregations of the 50 States and the District of Columbia into five districts by the Petroleum Administration for Defense in 1950. These districts were originally defined during World War II for purposes of administering oil allocation.

PADD Map

Refinery & Blender Net Production – by Petroleum Products

Refinery & Blender Net Production – Total Finished Petroleum Products

Refinery Net Production – Finished Motor Gasoline (by area and PADD)

Refinery Net Production – Motor Gasoline Terminal Blenders Net Production

Refinery Net Production – Oxygenate Production

Total Refinery Sales Volume by PADD and State – Refiner Motor Gasoline Sales Volume

Reformulated Gas Sales to End Users

Total Refinery Sales Volume by PADD and State – Refiner Motor Gasoline Sales Volume

For the West Coasters…

California Energy Commission – Gasoline

California Oil Refineries

Banacek, I can do no better than to answer your questions with more questions. Why do you think it is better to read a one-page press release rather than the 26-page report? Why do you refer to the slide show as a “technical report?” What in any of the materials you linked do you think lends additional insight into what’s been said? What makes you think I did not read the 26-page report (3 times, because I was astonished that the AP could possibly be talking about the same report that I read)? Please spell out whatever point you are making, because I am missing it.

JDH,

You should again review the task force link that I provided to all readers. It’s certainly not limited to a one-page press release. There are links that take readers to the Stakeholder Comments, for example, as well as other links.

If you do not see the value of readers developing a broader base of knowledge regarding U.S. refinery operations and finished product mix, that’s unfortunate based on their subsequent questions and remarks in the comment section of this post.

For those readers who review the refinery links, the benefit of such knowledge should be obvious, now and for future reference.

The ability to pull together key pieces of information from the EIA refinery, production, and import data is critical to addressing the issues discussed during the past year.

Banacek:

I think your attempt to convince us that your knowledge is overwhelmingly superior is so far a little lacking. Providing us with a brilliant pithy insightful summary of what is really going on with gasoline price variations would be a lot more impressive than a bunch of links to raw data, sprinkled with snide comments.

Links and Minifeatures 06 26 Monday

Carnival of Personal Finance

Carnival …

I realize that I am entering into this discussion kind of late, but:

Generally, I agree with the list of factors Stuart mentioned above. The only thing I would add is that over the long term, prices will be set by the marginal barrel of product – So a region could be directly connected to refineries by pipeline, but if the pipeline is full and the marginal mechanism is barges up the river, that will set the price. This makes prices even harder to understand…

My other comment is that an important element of competition is time. The pipelines and refineries typically work on a 2 week schedule – so if Atlanta gasoline is scheduled twice in the cycle and something goes wrong on the front half of the cycle, its a minimum of a week and more likely 2 before it can be fixed. There is no easy way to shift gasoline from say North Carolina to Atlanta, because the specs are different.

Another example is movement of gasoline across the

Atlantic – When the US and Europe had more common gasoline specs, there was gasoline sitting in tanks in Rotterdam which met US specs. Traders were very agressive about watching the relative prices and whenever the arb opened, they were very good at chartering a product ship, purchasing gasoline on the spot market, hedging the deal on the futures market, and getting the bbls moving towards NY harbor. Now that the Europeans have gasoline with MTBE and the east coast needs a gasoline blendstock to be mixed with ethanol. Its not that the European refineries can’t make it, or that its incredibly expensive to make it, but the time requierd to respond to market incentives gets longer.

I would expect the fragmented market specs to increase the size and duration of a spike, and for any snapshot in time to show greater variation in prices…