This week’s data paint a picture of slowing growth.

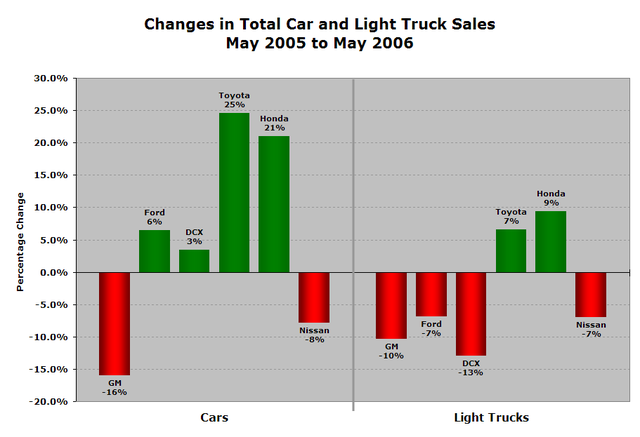

Autos. GM continues to bleed, but otherwise auto sales overall do not show further deterioration from April’s levels. Comparing May 2006 with the previous year, GM’s light-vehicle sales were down 12.5%, while Ford lost 2.0% and DaimlerChrysler 8.4%. On the other hand, Toyota gained 17.0% and Honda 16.1%.

The moderate move away from SUVs continues at what I would describe as a healthy pace rather than something that will create severe dislocations. I’m expecting autos to be a drag on 2006:Q2 GDP growth, but nothing like the dominating factor that they were for 2005:Q4.

|

Employment. The Bureau of Labor Statistics reported that only 75,000 new jobs were added to American payrolls in May, a figure that Barry Ritholtz, never at a loss for words, observes “stunk the joint up.” And yet the BLS announced at the same time that the unemployment rate fell to 4.6%, its lowest value in five years.

|

The divergent impression of the two statistics reflects in part the very different indications that are currently being given by the BLS survey of establishment payrolls and the Current Population Survey, which interviews a sample of individual households as to their current employment status. The household survey claims that 288,000 net new jobs were created in May, with an average rate of 240,000 per month so far this year, in contrast to the 75,000 May figure (and 146,000 monthly average for 2006) from the payroll survey. Some economists are inclined to disregard the household survey altogether. Personally, I put some weight on it, and infer that the employment situation may not be quite as bad as the payroll data suggest. Still, I take away a clear indication of a slowing growth rate. Economic Policy Institute has more.

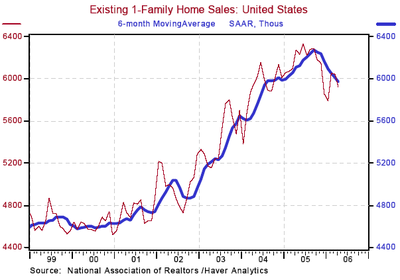

Housing. The Fed wanted a slowdown in housing, and now it seems to be here. Perhaps they’ll get what they wanted, and no more. The Big Picture has a couple of interesting graphs, showing a broad trend down in home sales,

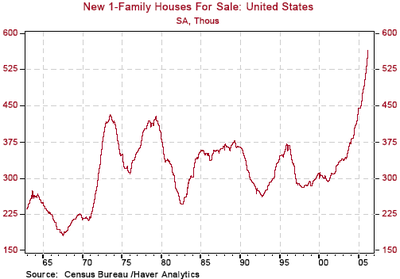

and attendant accumulation of inventory of houses intended to be sold:

My conclusion? GDP 2006:Q2 growth will surely be weaker than Q1. But so far it’s looking like slower growth rather than an actual decline.

Technorati Tags: employment,

autos,

housing,

macroeconomics

If you look at the year-over-year percent change in the two employment series you find that are almost identical — 1.7% for the household survey and 1.6% for the payroll data.

I would think this is a much better way to judge the two series then comparing the raw numbers.

On this basis the two series are telling similiar stories.

It has been my belief for so time that the Fed’s attempt to combat inflation by reducing domestic demand ignores the main sources of inflation, namely cost push on commodities, and exchange rate impact on imports.

Since the increase in global marginal demand for commodities over the past couple of years is almost all external to the U.S. it will take a big (recession sized at least) drop in domestic demand to make much impression. As for the weak dollar, this should at some point lead to a slow down in non commodity imports all by itself without any help from higher interest rates.

It seems evident that the combination of higher energy costs and higher interest rates is choking off demand, and that this is showing up in the big ticket areas first, autos and housing. When we start to see significant fall off in sales of non-durables it will be too late.

I suppose that when a country has a growth rate in externally held debt of historic levels the credibility of the central bank will at some point trump domestic concerns like jobs and GDP growth. This was the view that the Bank of Canada took fifteen years ago when Canada’s debt to GDP and deficit to GDP starting getting out of control. The diffence between that case and this is that the Canadian Federal Government pitched in by raising taxes and cutting spending. At some point the Fed won’t be able to convince the rest of the world alone.

As little weight as I put on the Household Survey generally (its home to an awful lot of “self-employed independent contractors”), I hasten to remind folks that one data point does not make a trend — and as far as the establishment survey is concerned, we should focus less on any one month and more on the overall trend. Of course, that trend has been pretty soft for a while.

Note that Unemployment fell to 4.6 percent largely because more adults chose to not participate in the job market. The adult labor force participation rate remains significantly lower than it was 6 years ago. If adults were participating in the job market at 2000 levels, 2.7 million more people would be looking for work and unemployment would exceed 6 percent.

I would think the Fed knows it cannot appreciably impact oil and other commodity prices without manufacturing a world-wide recession. I have read several papers by various Fed authors discussing the relationship between an oil price spike and recession, even by Bernanke himself. These papers indicate current awareness of oil price concerns.

I’d guess the housing situation was more of a concern to the Fed, as the oil and commodity situations are practically untouchable.

Relax Barry, now that everybody knows they are “massaging” the unemployment rate, they will “move” it back to 5.1% to appease yourself lol…….

“Note that Unemployment fell to 4.6 percent largely because more adults chose to not participate in the job market. The adult labor force participation rate remains significantly lower than it was 6 years ago. If adults were participating in the job market at 2000 levels, 2.7 million more people would be looking for work and unemployment would exceed 6 percent.”

This begs the question as to how these people are paying their bills. It also looks as if there is a chance that the Fed holds off on tightening the next time the FOMC meet.

If you want to see another indicator, take a look at the retail employment trend at BLS. It’s headed down. Usually this is a harbinger of recession.

And, also this week, the ISM Manufacturing survey declined from 57.3 to 54.4, with key components like new orders and production declining particularly much. Interestingly though, the price component rose, something which would suggest stagflation.

It has been my belief for so time that the Fed’s attempt to combat inflation by reducing domestic demand ignores the main sources of inflation, namely cost push on commodities, and exchange rate impact on imports.

Everything that I have ever read says that the main source of inflation is the increase of the money supply.

Seems to me the Feds “battle” to reduce inflation is all smoke and mirrors. They make money easily available (Debt), while at the same time claiming their number one goal is “battling inflation”.

The economic imbalances underpinning the economy for the past four years are unsustainable in the long run. The printing press economy has resulted in series of asset bubbles that last only as long as cheap credit can sustain them or until inflation destroys the currency. Choose your poison.

The idea that the Fed is causing a slowdown is silly. The Fed is responding to the implosion of the bubble economy as the predictable inflationary consequences of the last few years take root.

It is ironic that, initially, the US bubble economy grew out of policy actions taken to prevent the spread of deflation from Japan, which itself was caused by the Japanese bubble economy they created through the printing press. The irony is that Japan didn’t export deflation, they exported the pre-deflationary bubble economy.

The Fed has been far too timid, jawboning up, and sustaining, inflationary pressures. A pause in interest rate hikes at this juncture will stimulate the budding inflation into a full blown episode.

Japan has to stop feeding the world wide inflation and stimulate their own domestic demand. They will take the rest of us down with them, eventually.

David B,

You claim the Fed is ignoring the main source of inflation, then make the argument for pursuing the very policy the Fed has adopted. The Fed doesn’t ignore commodities and the exchange rate. They simply recognize where they have leverage and where they don’t. The Fed cannot stabilized commodity prices, so they look at core inflation as well as at all items inflation. If they were to weight all-items too heavily, they’d end up forcing deflation among core items to control headline inflation.

They also recognized that exchange rates matter, and that, all else equal, higher overnight rates will help reduce inflation through a number of paths, including a stronger dollar. They do not, however, have direct control over the dollar. If the dollar falls in the face of higher overnight rates, then a falling dollar has to be taken into account, and may mean higher overnight rates still.

You may be right about the eventual direction of the economy. Anybody’s guess. But we should recognize that the Fed has a limited number of tools and that those tools are not always perfectly matched to the sources of inflationary pressure, or the sources of weakness, in the domestic economy. They have to rely on those tools, nonetheless.

Note that today’s ISM non-factory survey data were quite strong – unlike the past two readings on service sector employment. All sectors but legal services reported growth. The inconsistency of data cannot make the job any easier for the Fed.

Kharris:

I think we are in agreement that the Fed cannot do the job alone in the present circumstances. My point in the last paragraph is that absent a rational fiscal policy, Fed over-tightening may end up producing progressively more difficult conditions.

Obviously Ben and the boys can’t make Congress do what it should to control the federal deficit monster. But since the rest of the world can read numbers, how high must rates go to induce net exporters to keep holding US$, and at what cost to the US economy? It may be a choice of the frying pan or the fire.

I don’t agree the ISM’s looked strong, they looked weak to me.

The only thing strong about the ISM was the price index, which indicated that inflationary pressures remain strong -or even accelerating- despite slower real growth.

I Want to GET GOOD INFORMATION ON MACRO ECONOMICS

SO PLZ SEND ME SOME GOOD INFORMATION ON GLOBAL WORLD,