Henry Paulson has been nominated to the position of Secretary of Treasury. Will it matter?

Most of the commentary has been fairly upbeat, focusing on his Wall Street credentials. Bloomberg writes

He would be the first of Bush’s Treasury secretaries to hail from Wall Street. Paul O’Neill, who served from 2001 to December 2002 was chairman of Alcoa Inc. when he came aboard. Snow ran railroad company CSX Corp. Neither was able to win a place in the president’s inner circle and became mainly promoters of policies set in the White House.

They also note the conditions under which he has arrived.

Paulson is bequeathed an economy that expanded 5.3 percent last quarter, the most in more than two years, while the jobless rate, at 4.7 percent, hasn’t been lower in four years. A surge in tax receipts means the fiscal deficit, which widened to a record on Bush’s watch, will narrow faster than expected, according to the Congressional Budget Office.

Last quarter’s vigor may give way to a more moderate pace of growth for the remainder of 2006. Rising gasoline prices and a softening housing market are eroding the confidence of consumers, whose spending accounts for more than half of gross domestic product. At the same time, a surge in energy and commodity prices has fanned fears about inflation pressures.

I think it has to be remembered that GDP is only one metric, and that the economy has both underperformed along a number of dimensions, and faces serious challenges in the future.

Regarding the past and present:

- Real compensation has been stagnant.

- Job creation has been lackluster.

- Income inequality has been increasing.

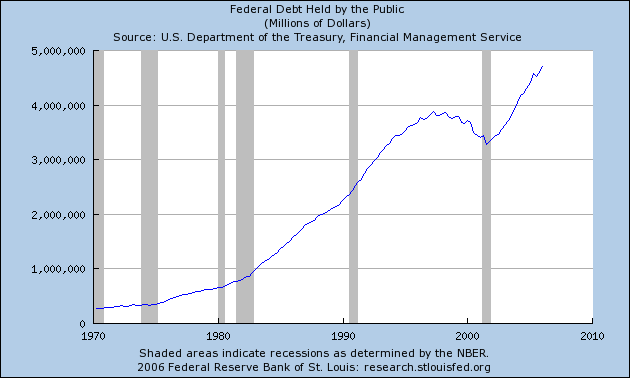

- Federal debt has been exploding and is set to explode further, as the 2001 and 2003 tax cuts are extended.

- Federal government entitlements-based liabiities have been expanded tremendously by the Bush Administration and Congress(Medicare Part D) even as the Bush Administration attempted to modify Social Security.

- Tradable sector output share has been declining.

Regarding future challenges:

- The trade and current account deficits are increasing without seeming end.

- The determination of interest rates on government debt in the US are ever more in the hands of foreign governments and other actors.

- The net income account in the balance of payments is set to go into the negative range.

- High energy dependence exacerbates the problems reserve accumulation in oil exporting countries.

- The possibility of a “hard landing” for the dollar.

None of these trends will likely change, so beware the hype about a new economic team. Unless the process changes substantially, policymaking will remain centralized within the White House agencies. That’s not necessarily a knock against centralization, but it isn’t apparent to me that centralization in the last six years has led to particularly sensible economic policies.

Since I have not heard of any substantive changes in the policies themselves, expect more of the same. More tax cuts, more talk of spending restraint without actual implementation, more pro-production subsidies for energy, more deregulation. On the other hand, Paulson is known as a person who is adept at managing crises, although not necessarily financial crises. So in this sense, I welcome his nomination as bringing in much needed expertise, especially as we are likely to see more financial crises abroad as interest rates rise and US growth slows — just think about Turkey and Iceland.

Here’s one picture that I think sums up the Bush Administration economic legacy thus far. Just think about whether — despite Paulson’s reputation as a deficit hawk — you believe the current trajectory will alter as a consequence of this change.

Technorati Tags: budget deficits,

current account deficits,

Henry Paulson,

tax cuts,

entitlements,

Federal debt, and

Secretary of Treasury

As the article referenced by “is adept at managing crises” makes clear, the crises he has supposedly manaed so well have been in organizations where he had been in a position to have prevented their ever occurring had he been on the ball.

Somewhere else in the blogosphere a commenter opined that he is being brought in to lead a renewed offensive in the administration’s attempt to destroy Social Security by creating private accounts that will allow the Wall Street sharpies to vacuum up that remaining fraction of the citizenry’s retirement funds still protected from their predations.

Why don’t you post the Federal Debt held by the public as a % of GDP? The nominal aggegrate display is misleading.

Following a theme by jm, I saw a report that Paulson previously rejected the offer and wonder what could have changed his mind.

Did it involve some lucrative place in the privatization of SSTF?

More plausibly (given the polls) did it involve some privatization of Fannie whose story is not getting nearly the press coverage it deserves?

Last thing, what factors worked against his close and trusted friend, Evans? Who exactly is shaping w’s selection with Snow’s replacement?

Thanks for focusing on the issues rather than the personalities. When Brad DeLong heralded this appointment, I asked a simple question – will the new Treas. Sec. convince the President to either raise taxes or to massively reduce Federal spending? I suspect the answer will remain no until after the November elections.

Yes, last quarters real gdp growth was strong.

but over the last three years real gdp growth only averaged 3.5% — the same as the long term trend. So the Bush boom has been to achieve average growth. We all get so taken in with the “spin” that it is very hard to put things in their proper perspective.

For the 5 years under Bush real gdp growth has been 2.5% — when this happened before JFK ran on a platform of let’s get the economy moving again and Clinton said it’s the economy stupid.

The incompetent Henry Paulson

The blogospheric response to the appointment of Henry Paulson to replace John Snow has been generally, if not uniformly, positive. Max Sawicky

begs to disagree:

All this swooning over the new Bush appointee for Treasury Secretary, not least from lead…

What I find curious is that both Clinton and Bush Jr. had chairmen of Goldman as Treasury Secretaries. Just shows that Wall Street can play both sides of the street. Just so they get the business they don’t care who’s in office.

RD: I plotted the nominal debt held by public series because it was easily downloaded from St. Louis Fed. I have posted the picture you wanted with likely trajectories for the future many times — it is much scarier. See this post. Remember the red line in that graph is “current law”, so assumes no further legislative initiatives (and doesn’t include the extension of the 2001 and 2003 tax cuts). I’d say the black line labeled “tax fixes” is more likely, at the very minimum.

Weekend Reading: Econobrowser and the Ethanol Challenge in the US

Econbrowser’s Menzie Chinn

Menzie Chinn, while discussing the new appointed Sec. Treasurer Henry Paulson, puts out to a laundry lists of major and mounumental challenges the U.S. economy is facing. His full article, “Does a new economic t…

One important aspect of Paulson’s appointment is that he will be fifth in the line of succession to the Presidency. If Bush and Cheney have to resign, and Hastert is tied up with shall we say, “legal issues” and Ted Stevens declines, then Condi Rice (if she isn’t indicted as well) and he will be next in line. Rice/Paulson 2008?