The press account surrounding the Mid Session Review (MSR) (page 3-4) noted the preferred estimate of GNP response to the President’s tax proposals: real GNP might be 0.7 percent higher than steady state baseline. The Treasury’s Office of Tax Analysis has just released the underlying analysis.

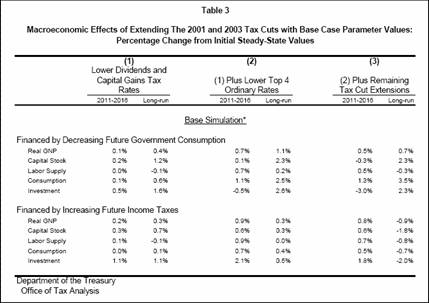

There are, of course, a variety of estimates which differ depending upon assumptions regarding the time horizon, parameter values, and most importantly, whether the tax cuts are accomodated by reductions in future government spending or increases in future income taxes. The report admirably lays out the range of results for many configurations. Some are laid out in Table 3. The 0.7 percent deviation from baseline cited in the 2007 MSR is in the top right hand corner element, under “Financed by Decreasing Future Government Spending” (recent history has not been too supportive of this possibility, though). This estimate is for the case where capital gains and dividend tax rates are reduced, reduce top 4 ordinary rates, and make permanent 2001 and 2003 tax reductions.

Table 3 from Office of Tax Analysis, “A Dynamic Analysis of Permanent Extension of the President’s Tax Relief,” U.S. Treasury, July 25, 2006.

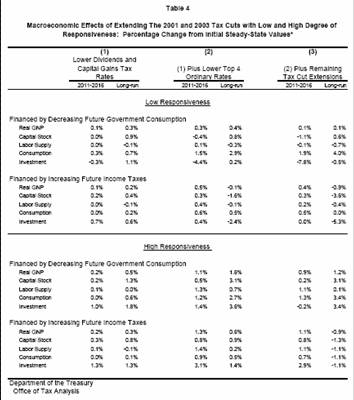

Of course, the astute reader will note that if taxes are raised in the future to finance the tax cut, then GNP will eventually be 0.9 percent lower than steady state baseline. Table 4 indicates that — for the future government spending reduction case — low and high responsiveness parameters lead to increases in GNP of between 0.1 and 1.2 percent relative to initial steady state, respectively. 0.7 percent is approximately in the mid-point of the range bracketed by these two estimates. The future tax increase estimate is unchanged across parameter value configurations.s

Table 4 from Office of Tax Analysis, “A Dynamic Analysis of Permanent Extension of the President’s Tax Relief,” U.S. Treasury, July 25, 2006.

Note a similar diversity of effects is recounted in the CBO’s analysis, How CBO Analyzed the Macroeconomic Effects of the President’s Budget, July 2003, (Table 9), cited in my previous post on this subject. (By the way, the “Division on Dynamic Analysis” is in the President’s budget proposal for FY2007.)

Late Addition: (7/26, 9:30am Pacific)

The media and the blogosphere are focused on this issue. The Washington Post has an article reporting on the study here.

Economist’s View has an excellent review of various media reports on the subject, and a query regarding the model. Greg Mankiw posts his WSJ oped co-authored with Treasury DAS Robert Carroll.

Older coverage of the estimate cited in the MSR can be found here.

Parting shot: It is important to understand that there is no welfare calculation undertaken, despite the fact that under certain conditions, GNP is higher than under baseline. That is because undertaking a welfare analysis would require taking a stand on the utility associated with government spending on goods and services. So even if one were to take the Treasury’s high end estimate for the long run steady state effect, the answer to the question of whether tax cuts are desirable depends upon the utility associated with spending on civil servant wages, bridges, and body armor.

Technorati Tags: dynamic analysis,

dynamic scoring, and tax cuts

Tax Cuts and Changes in Output

One more time: Tax cuts do not pay for themselves: Tax Cuts May Come At a Price, Study Says Treasury: Financing Must Be Found, by Nell Henderson, Washington Post: The federal government will need to either cut spending or raise

Ricardian Equivalence Rears Its Ugly Head

On his blog, Greg Mankiw reproduces his WSJ column with Robert Carroll about the growth effects of tax cuts. The overall conclusion is that if tax cuts induce more p…

So the conclusion is that tax cuts work, but only if you pay for them. What a surprise! And all these years the supply-siders have been telling us tax cuts pay for themselves.

This conclusion says that to stimulate growth, you can decrease taxes and decrease spending. What about the opposite possibility — increasing taxes and increasing public spending? Would the growth effect be larger or smaller.

Great point about dynamic analysis and social welfare, particularly given that the Treasury analysis does not include distributional effects. Given some degree of diminishing marginal utility of income, not all supply-side tax policy benefits are Pareto-improving from a welfare economics perspective. This seems rarely discussed as both sides of the policy debate are too busy arguing whether reduced rates on capital encourage growth (and surely they do — but at what cost and to whom).