Tim Iacono at The Mess That Greenspan Made had some interesting graphs this week.

Tim notes that immediately after the release of Thursday’s FOMC statement, the dollar plunged against foreign currencies,

|

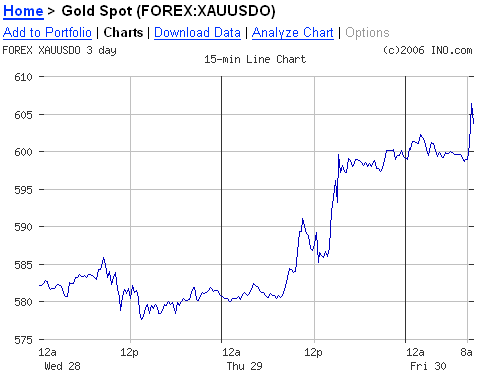

while gold shot up:

|

Tim interprets this as evidence that the “dovish” character of the Fed’s latest statement has markets worried that inflation is about to roar away. However, the same market responses might have been expected even if inflation expectations had not changed a bit. Further Fed tightening would have meant higher carrying costs for speculators, and slower real economic activity from higher interest rates would have meant lower commodity demand, both of which would be bearish for commodities, including gold. Likewise, if future Fed rate hikes would have increased the interest differential between the U.S. and other countries, that would tend to support a higher valuation of the dollar. If the latest FOMC statement convinced investors that those future rate hikes are less likely than they were perceived to have been last Wednesday, a higher gold price and lower value for the dollar would be warranted compared with the values that made sense on Wednesday, even if inflation expectations were unchanged by the news.

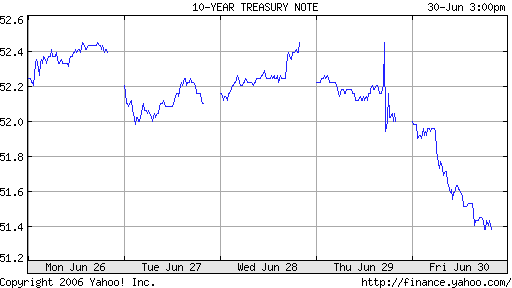

Another market indicator that is consistent with the latter interpretation, and casts doubt on Tim’s inflation story, is that long-term nominal bond yields also fell dramatically after the FOMC statement:

|

Notwithstanding, Tim is certainly correct that markets read the latest FOMC statement as indicating that the Fed is less anxious to raise rates further than many had previously been supposing. That’s also quite apparent from the fed funds option prices. On Wednesday, the market had viewed 5.5% as the most likely outcome with 5.75% even a possibility. Now, 5.75% looks pretty far-fetched, and 5.25% has become a more respectable prediction:

|

For once, I think the market is getting this right. The Fed really would prefer not to raise rates further. They can see the problems ahead for housing as well as any of us, and Bernanke has no desire to plunge the U.S. into a recession just to prove a point to financial markets. On the other hand, he’s not going to allow a higher rate of inflation to become established under his watch, and if that means further rate hikes, you can still count on seeing more rate hikes ahead.

Is it possible to keep inflation from rising without causing a recession? I’m not sure. But I remain of the opinion that if anybody can pull it off, Bernanke’s the man.

Technorati Tags: Federal Reserve,

inflation,

recession

The data indicate that there is still too much dollar liquidity in the system.

Falling US interest rates have not been a harbinger of a slowing economy for the last four years. Instead, they have been a signal that someone is priming the world market with currency – probably Japan.

The increase in commodity prices are consistent with an expectation of inflation and growth like Q1.

The Fed would love to stop. But the financial markets have a full head of steam and a bubble mentality and are not going to stop until it crashes or the Fed flinches. The post mortem on this one will be revealing and I suspect that one of the biggest mistakes will be the painless 25 bP pace of increase while inflation is on a 125 bP trajectory. It reminds me of the frog in the heated pot.

JH:

From what I can figure, you seem to be claiming that higher inflation would imply economic slowdown, which would reduce growth in a way that would be bearish on commodity prices.

There are a few problems I see with this. For one, what about commodities with low elasticity (e.g. grain, oil)? These are going to be very insensitive to general economic slowdown.

But even for those with high elasticity, if you introduce higher inflation expectations into the market, then the present value of the commodity will immediately price in the expected inflation. The price will thus go up, unless the market thinks that the resulting stagnation will be so severe it will overwhelm that inflation premium (given a particular commodity’s elasticity).

And oddly, you explicitly lump gold along with other commodities, even though gold is predominantly a value store and not consumable (hence not tied to economic growth). The claim that higher inflation expectations would be bearish on gold prices is just, well, bizarre.

Yin:

I agree. We needed a Volcker, not Greenspan and Bernanke. But now the financial markets are far too leveraged and cannot be “spooked”. Look what happened in the past couple months just because of Japan *preparing* to tighten.

An excellent post as always. The fed would like to stop — but consider this — perhaps they cant. We have housing starts at 1.9MM and the ISM is expected to come out at 55 tomorrow. Both numbers are very strong. No reason to stop yet.

I’m kind of thinking that we all got used to the low rate environment of the 90s and think that thats how things should be. But what about all the Asians getting rich now and competing for resources with the “developed world”. Inflation is a global phenomenon and it has nowhere to go but up.

Aaron, the claim that higher inflation expectations would be bearish for gold would indeed be bizarre, and that’s not remotely what I was suggesting. I am instead saying that higher real interest rates, that is, when the nominal rate goes up relative to expected inflation, that is bearish for gold, because it both increases the carrying cost and decreases real economic activity, with the latter important for industrial use, jewelry, as well as demand for gold as a store of value. The news was taken as implying lower real interest rates, and that is why gold rallied.

My whole point is that this news did not have the effect of increasing inflation expectations, but instead had the effect of lowering expected real interest rates, primarily by implying a lower nominal rate than would have resulted from the more aggressive future Fed tightening that some analysts were anticipating.

JDH-

Are you really hanging on to second order effects to make your point? “The whole market was bound to correct – it was just manifest in the things most analysts use as indicators” Aaron’s point is that the first order effects indicate market correction. Your second order putty knife is no match for Occam’s razor. Show us the broad-based “correction” and I’ll eat crow.

Sorry, stirthepot, but I’m not following your point. Why do lower interest rates come “second” in whatever way you’re choosing to order effects?

At the end of your analysis you ask “Is it possible to keep inflation from rising without causing a recession?” You ask the wrong question. You should have started your analysis by asking yourself how inflation will evolve in the next two or three years if the Fed keeps its rate fixed. If you want to justify changes in Fed’s policy you should provide evidence that inflation will be “high” (choose your target rate as you please but be ready to justify it) two or three years from now.

Now your answer to you question should be of great concern to any reasonable person. Why should we trust Bernanke? Why should we trust your judgement or anyone else’s judgement on Bernanke? I’m Argentinian and last week we lost at World Cup game against Germany. Most Argentinians trusted the coach would make the right adjustments during the game; he didn’t but it was only a soccer game. You and I should be worried that Bernanke has such a great responsibility when we both agree that there is no way to be sure about what to do, and at least in my case I don’t know why he has to do anything.

Interesting discussion but misses the point.

We all need to look at a chart showing CPI for the period 1973-present using the identical computational methodology in place at the beginning of the period, that is the 1973 method.

Can I hear you all say apples to apples. Good.

Now JDH should have access to the data and should be able to put up the chart here with a little work.

When you look at this chart I suspect that you will conclude that we are revisiting the experience of the mid 1970s. Whether we revisit the experience of the LATE 1970s probably simply depends on the ‘cojones factor’ over at the FED.

A young man wanted to become a firefighter. He learned that the academy requirements for height were 5’10” to 6’11”. Alas, he was 7’2″ and did not qualify. Now his father was a respected economist over at the United States Department of Labor. And the father decided to put his considerable intellectual skills to work to help his son. First, he obtained a measuring stick marked in inches with a top measure of 7′. Then, he obtained a small block of wood 4″ high. Placing the stick against the back of the boy showed him to be a little taller than the stick…no help here. The boy felt that nothing could help him, not even his esteemed father. But then the father got down on his knees and slid the block of wood under the stick. Then he made a pencil mark where the height of his son matched the stick. 6’10”. The boy was is pure ecstasy. “All in the way you measure,” said the father. And the next day the boy rushed down to the fire academy, stick and wood block in hand. The tester measured his height and reported 7’2″. “Too tall,” he said. “Use my stick,” said the boy. The tester compared the stick with his tape and found it accurate and then put it up to the back of the boy. “Not going to work, you are taller than the stick.” Then the boy said “slide the wood block under the stick,” which the tester did. And then the tester said “well NOW it reads 6’10”.”

The boy looked into the eyes of the tester and said, “so now do I get to be a firefighter?”

And the tester shook his head and looked into the eyes of the boy and replyed, “no son, you just get to be an idiot.”

And later that day the crying boy walked into his father’s den and related the story of his encounter with the tester. The father was totally perplexed and said to the boy, “don’t understand at all, this stuff always works back at the office.”

Esb, I put up the graph you requested here, though I’m not sure that I see in it the same thing you do.

JDH…thank you for this chart…it certainly is the one to watch…probably quarterly. You might consider making it a reqular feature on the site.

If the new kid in town (BB) has what it takes to bring along the rest of the Board and resist the natural tendencies of the political establishment to debase then he will beloved by me. The test will be if this graph flattens and then slowly falls rather than accelerates upward.

This is certainly one of the more interesting points in time that I can recall…and a little too early to judge the man.

The Bank of Japan recently reduced liquidity by 20 trillion yen, causing hedge funds to tremble about the security of their zero-interest leveraged status, thus to flee commodities, among other investments. Bernanke is only one and an ever less significant player in a large, complex monetary world.

JDH:

I feel like there are underlying models clashing here, big time. You’re assuming that there’s some “exogenous inflation” that is somehow distinct from interest rates, and hence the price of money, and the magnitude of money creation. But these things are clearly coupled. When the Fed indicates lower rates, they are saying they will make money cheaper, which is the same as increasing inflation expectations.

Yes, you can claim that broad commodities price increases are independent of this, but I would not call such a thing “inflation”. I’d call it “demand increasing over supply”. One cannot make heads or tails of the current macroeconomic environment unless real asset prices are disambiguated from financial asset prices and monetary base expansion.

Also, regarding that inflation chart–what was the CPI calculation regime in place at each point in the chart? I would hazard the guess that you did not really provide what esb asked for. I’d be curious to see it myself.

Aaron, I definitely am not assuming that inflation is exogenous. Instead, I am asking which hypothesis is consistent with all the data.

Hypothesis 1, which Tim, Esb, and you seem to maintain, is that inflationary expectations rose in response to the Fed’s statement. That hypothesis is consistent with the behavior of gold and the dollar, but it is inconsistent with the behavior of the 10-year nominal yield.

Hypothesis 2, which I am proposing, is that inflationary expectations did not respond to the Fed’s statement, but that expectations of future short-term rates were revised downwards. That hypothesis is consistent with the behavior of gold, the dollar, and the nominal yield.

As for what sense it can make for inflationary expectations not to change even while expectations of future short rates do change, I’m thinking of longer-term inflationary expectations as being grounded in one’s understanding of the nature of the Fed’s reaction function. If you believe (as I do) that the Fed is not going to allow the inflation rate to creep up, then you would not revise your expectation of the 5-year-ahead inflation rate in response to any news. But what you don’t know today is exactly what value that policy rule will end up requiring for the fed funds rate between August 2006 and August 2007. The Fed is behaving in such a way that, with incoming data, you would revise your expectation of that interest rate without revising your expectation of the inflation rate.

Again, that interpretation is not an assumption on my part, but rather is a conclusion I draw on the basis of what is consistent with the observed data.

JD:

Ok, I see your point more clearly. It is a curious dilemma. I feel, and many others have commented, that bonds seem to be behaving irrationally (i.e. having the yields bid down). If this were true, it could also resolve the dilemma. I don’t know enough technicals to justify this claim, however, but maybe foreign central bank behavior has something to do with it (i.e., hoping to control the decline of the dollar by buying more bonds than they otherwise would)?

Here’s another question that could perhaps shed some light: is it possible to estimate the amount gold and the dollar “should” have reacted to the change in the fed interest rate futures after the last FOMC meeting? If so, then one could determine whether changing inflation expectation factored in, and if so, in what direction.

In fact, I’ll make a primitive attempt at answering my own question. Using your above interest rate futures data, the FOMC shifted the weighted average top-three interest rate predictions from an overall projection of about 5.474% to 5.428%. This is -.84% delta. Not much; not even a percentage point.

However, gold immediately spiked and by the end of the day settled up 2.2%. The dollar immediately jumped down and settled at about -1.3%. So it appears the reaction of these two indicators were in excess of the reaction one would expect from a purely monetary-base/interest-rate analysis. How would you explain this? Or does my analysis have little or no merit?

Oh-oh, now I know I’m in trouble, if I have to defend the claims that (1) the dollar and gold were correctly valued on both Wednesday and Friday, and (2) I have an economic model that can accurately predict the magnitude of that correct valuation.

Frankel’s analysis might be taken to suggest that a 100 basis point decrease in the real interest rate would result in a 6% increase in real commodity prices. If we’re talking about a 10 basis point interest rate adjustment for Thursday’s news, that would warrant a 0.6% increase, rather short of the 2.2% gold adjustment observed, but confirming that potentially there could be reasonably large responses.

I confess that I’m open to the possibility that both the dollar and the price of gold often react a bit more strongly to each day’s news than could be justified by a completely rational valuation of the fundamentals.

I find the comment that the bond market behaved irrationally somewhat curious. The fed came out more dovish than expected so the market rallied. If the market thought that the news was inflationary it would have sold off — at least some steepening would have occurred. Instead the curve flattened. The bond market interpreted the news as meaning that fewer hikes are in store and that inflation expectations have not increased. It is a bit of a stretch to say that is not a rational interpretation.

I think that high liquidity is the problem exactly. An analysis I just finished links the price of oil to the transportation component of the CPI. The caveat is that there is an almost perfect 2 month lag.

I show a .97 correlation or .95 coefficient of determination between the price of oil for month X and the transportation CPI for X+2 months.

Since oil finished at almost $74 at the end of June, an increase of 6% over the previous month, the August CPI data that comes out in September should show a 1% increase because of the transportation component alone. My analysis shows that the CPI data by September will have the total CPI heading along at 6-8%.

Factor this in with increases because of the troubled “rental” component and some potential upticks in apparel and other global imports, and we could have a serious inflation problem on our hands.

To add to my last post, I looked at West Texas Crude prices since 12/31/99 and compared those to the transportation component of the CPI data beginning with 2/28/00 (a 2 month lag).

The relationship between these two data sets is tremendous. What this means for the CPI is quite disturbing in my view.

I started reading through the comments but then my head began to hurt, so I stopped.

The difference in opinion, if there is one, between JH and myself springs from the different interpretation of the words “inflation” and “inflation expectations”.

Not being formally trained in the dismal science, I don’t view inflation as being only comprised of selected prices paid by consumers that are then massaged and manipulated over the years to come up with something that is not too offensive.

For “inflation expectations” to be defined by the conundrum that is the bond market and consumer sentiment surveys that are better gauges of how badly consumers are smarting from high gasoline prices seems similarly dubious.

After looking at the reaction of gold and the dollar to the new Fed policy statement, my comment, “Maybe inflation expectations aren’t so well contained” had more to do with how the rest of the world views the prospect of a pause in the rate raising sequence for the world’s reserve currency.

That is, even with short term rates now over five percent, the rest of the world may feel that there is much more work to be done to maintain respectibiliy for the buck, regardless of what the formal measures of “inflation expectations” say.

Jenson, we are not so much seeing inflation, in my opinion, as cost increases from increasing oil prices. This type of “inflation” cannot be cured by monetary means. I mean, assume the Fed cools the economy. Oil demand will drop somewhat, dropping oil prices somewhat. China and India will then probably consume more oil, causing the price of oil to increase. Net result? GDP transfer to producing countries. Go Fed go!

My head also hurts from this thread.

We’ve had previous discussion as to the inflation/recession nexis which came to no consensus.

I would reiterate the position that increasing capital requirements for even the maintenance of enrgy supplies (not just transfer payments – “Petrodollars”) will suck money out of consumption and into energy investment. The need for new electrical generators will demand copper making hair dryers more expensive, for example. Massive new bonding for offshore oil rigs will raise interest rates for school bonds and home mortgages is another.

When infrastructure costs rise with no corresponding productivity increases, as we see energy doing, growth rates must suffer.

Monetary inflation is a political response to energy producer market power – ie printing more Petrodollars.

Look to the tides, not the ripples.