The Census Bureau

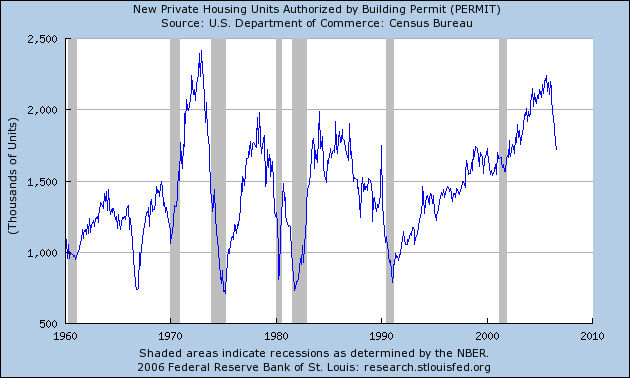

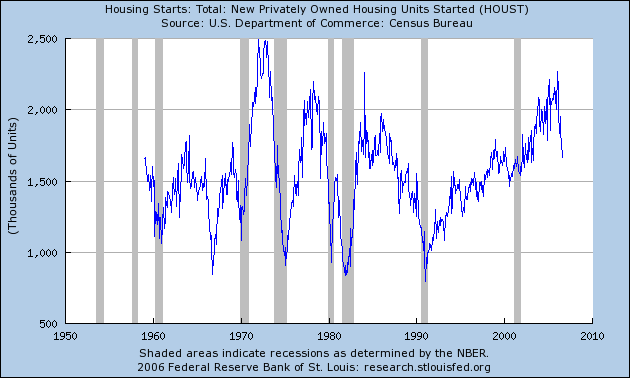

yesterday released August data for housing permits and new housing starts, both of which confirm that we are in the midst of a significant housing downturn.

|

Permits for new construction fell 2.4% (logarithmically, seasonally adjusted) at a monthly rate during August, which puts them 24.7% (logarithmically) lower than August 2005. Housing starts were down 6.2% for the month and 22.0% for the year.

|

The 2006 decline is already substantially worse than what we saw in either the 2001 recession or the 1994 “soft landing”, which the Fed was hoping to reproduce this year as a strategy for containing inflation. It is hard to find an example of a decline of this magnitude that wasn’t associated with a recession. We saw something comparable in 1987-88, though my view is that the 1987-88 housing downturn left the economy weak enough that the oil shock of 1990 then tipped us into a recession. For a really convincing example of declines of this year’s magnitude that did not produce a recession, I think you have to go back 40 years to 1966-67.

That also turns out to be how far back you have to go in order to find a negative yield spread (as measured by the 10-year minus 3-month Treasury rate) that wasn’t followed by recession.

|

And in case you’re looking for other reasons to be troubled by the housing data, see

Calculated Risk on the employment implications or the Big Picture on loan delinquencies.

My main question is how long it will take the same people who were sniping at Bernanke for not tightening enough now to start hollering that he went too far.

Technorati Tags: macroeconomics,

housing

And what about the people that argued that Bernanke was wrong in raising interest rates? What do you think about the decline in inflation and how it relates to commodity prices rather than to economy-wide inflationary pressures?

There was a time when useful information like that contained in this post was only available to subscribers to some overpriced investment letter. Now we get it free on the internet. Three cheers for the internet.

That said, I wonder whether there was a “just right” Goldilocks interest increase that would have lead to different results. If housing was a mania or bubble–it sure seemed as such in San Diego and many other places–then it seems as if any interest rate increase that had an effect of moderating housing would have lead to similar results. One the upward momentum or upward pressure of the mania is pricked, no matter how hard, it seems as if the air is let out irrespective of the specifics.

Finally, dumb question: what’s with all the references to logarithmic increase/decrease when discussing percentage changes. This comment seems to have appeared in the past few months (or I missed previous references to it).

T.R. Elliott, the August permits number is 1722 and the July value is 1763. One could either calculate the “percentage change” as

(1722 – 1763)/1763 = -0.023

or logarithmically as

ln(1722/1763) = -0.024

Since they are not quite the same number, I note when I’m quoting the percentage change logarithmically in case someone tries to reproduce the calculation and wonders why they get a different number.

Some of the advantages of using logarithms instead of the usual “percent change” measure are (1) a 10% decrease followed by a 10% increase puts you exactly where you started if you use logarithms, but puts you down 1% if you use the usual measure; (2) a 10% increase followed by a 10% increase puts you up exactly 20% if you use logarithms, but up 21% if you use the usual measure; (3) with the usual measure there is a potential ambiguity as to the base– do you want the change as a fraction of the previous value, or of the current value, or of something in between, whereas there is no ambiguity with logarithms– forward and backward calculations give you exactly the same answer; (4) there are a number of other theoretical calculations that work out more cleanly if you use logarithms.

For small changes (like 2.3%), the differences are inconsequential, whereas for big changes, the two measures will differ more. Even for big changes, my personal preference is to use logarithms.

I have seen daily headlines for about a year that look like this, “More Evidence that Housing is cooling (substitute in a slowdown, is softening, is carshing, is ….for “cooling”)

But, never a “therfore” attached to such stories.

(There is a reason for that)

Armed with such data, what are people supposed to do? *bet this one gets ignored*

Potpourri

Thai coup: Earlier this year Joshua Kurlantzick wrote a piece which provides background for what’s happening in Thailand. He notes how the (past?) prime minister’s strong-arm tactics have apparently backfired:Terrorism and insurgencies provide elected…

Larry Nusbaum asks, “what are people supposed to do?” That depends on who you are. If you’re Ben Bernanke, don’t raise rates any further. If you’re an investor, be cautious about long positions in equities or commodities. If you’re thinking about taking out a loan to buy a home whose monthly payments you can barely cover, don’t. If you’re a home-builder, batten down the hatches. And if you’re just a regular home-owner, ignore it all and get on with your life– those profits you made were only paper, anyway.

“those profits you made were only paper, anyway.”

LOL! They are all paper profits until they get cashed into fiat money, the worst investment of all: cash (the US $)

Logarithms: Thanks. I’m familiar with the convenience of logarithmic scales but given that the charts were not logarithmic, I hadn’t consider computing the percentages in logarithms.

Going back to my other point. I wonder if interest rates are like the volume control on a faulty radio (like the one our 1993 grand caravan) that, when turned up, does nothing, does nothing, does nothing–ouch, too LOUD. Or like trying to prick a small little hole in a balloon without it popping–“all I wanted was a small tiny little hole to let the air out, then KABOOM.”

I look at the housing starts dropping. And this leads me to better understand the oil and gas futures dropping. Voters right now are probably thinking “this is great, gas prices are down” without understanding, perhaps, what that really means.

“If you’re Ben Bernanke, don’t raise rates any further.” Sorry, James. I think that’s not enough. He must acknowledge it was a mistake to raise rates in response to increases in commodity prices and push for a quick reduction in rates to at least 3%. Most likely measured inflation will be close to 0 in the next few months and we know that if properly measured it would be close to 0 (or even negative) in the long run. He must also forget about the idea of inflation targeting.

I’m in Santiago, Chile, and I hope you can read about the poor performance of the Chilean economy (this is relative to the high growth predicted at the beginning of this year by most economists and by the Central Bank and the government). There are several reasons for this performance, but I think an important one has been the Fed’s policy aggravated by its imitation by Chile’s Central Bank. Inflation rates are now declining as the effect of higher oil prices has run its course, but GDP growth continues to weaken.

There was a time when useful information like that contained in this post was only available to subscribers to some overpriced investment letter. Now we get it free on the internet. Three cheers for the internet.

Amen to that, and three cheers for people like Profs. Hamilton, Mankiw, Lynne Kiesling, et. al. who put this stuff on the web for us.

Edgardo, I don’t share your opinion that the effect of higher oil prices has run its course. Oil is now in the $60 range, appreciably lower than its previous high. But recent declines probably largely attribute to seasonal fluctuations which, at this time of the year or thereabouts, have seen precipitous drops in oil prices. We’ve also had a spate of no-bad-news in the oil sector, but that won’t last. China’s oil consumption is up, India’s is up, North Sea output is significantly down over last year’s …. all these factors suggest we will see further price rises which will exacerbate “inflation,” particularly in the US which is particularly vulnerable to increased petro costs. Even without any near-term increase in oil price, I would place bets that inflation will continue to rise.

It appears to me that the decreases in building permits and housing starts that coincide with previous recessions were a function of the decrease in personal income that is associated with recessions. People who became unemployed or wound up in lower paying jobs became unable to afford to purchase a new home, hence the drop in supply of homes.

The fact that no recession accompanied the drop in housing starts in the late 1960’s is probably due to the “guns and butter” policies of President Johnson. Massive government spending in Vietnam and on social programs offset the reduced GDP generated by the drop in housing construction.

Thomas James, the longer oil prices remain over $60, the higher the probability of a large decline in demand. It happened in the 70s and the 80s (years in which I earned my money analyzing macro developments in USA and Latin America) and it will happen again. We don’t know the size of the decline and how long it will take to be completed, but as long as prices remain over $60 it will happen. Only if prices go down to less that $40-50, the decline in demand will not be significant. The probability of oil prices declining to the real level of 1986 in the next 5 years (around $30 today) may be less than 50% but it is not lower than 25%. You can bet that in both China and India high prices will also force at least a much lower growth rate in the demand for oil than in the past five years.

The only scenario in which oil prices increase over $75 (I assume that all price indexes have already adjusted to oil prices around $70) is a US strike on Iran’s nuclear facilities. Indeed I cannot predict the effects of this strike on oil markets and the world economy.

Anyway, the real question is what Bernanke should be doing in the next few months. I don’t think what may happen with oil prices in the next year (to ignore seasonal variations) will force a change in monetary policy.

As a keen observer of the USA housing starts fall, concentrated as it is, in those States where house prices rose hardest, FL, CA, Washington DC, the question for me is where is the bottom?

New orders for volume US home builders are down 40% year on year and yet inventories remain high. If there were 2 m starts in 2005 and maybe 1.8 m in 2006 what will we get in 2007? An on an annualised monthly basis will we get down as low as 1.4 m? I think its a possibility.

On logs I don’t think they are really appropriate for the questions the industry is interested in here. For instance if housing starts fall 10% (arithmetic) the point to me is that from the lower base a greater than 10% (arithmetic) rise is required to get back to zero. To my way of think the arithmetic view more accurately reflects the challenges of rises and falls in economic variables. Logarithmic changes are more useful for detrending nominal variables and comparing points that are a long way apart.

Well, let me think…

1) Housing overpricing leads to a recession. I refinance when mortgages crash to a couple of percent and spend less per month. Also wait for the Mcmansion of my choice to come down to my budget, and rent the former residence.

2) The federal deficit skyrockets as we attempt to inflate away our problems. my house, as a real thing appreciates in value, and my savings balloon with the extra interest gained through increased yields. (not to mention my foreign bonds held in other currencies, and I chortle with every mortgage payment at my current 5.5%)

3) whatever happens, my 30 year is fixed and affordable.

4) Inland properties have appreciated hugely, catching up with my CA. coastal digs, thus encouraging salivating hopefuls to migrate to better climes with their brilliant gains.

5) There is no correspondence between previous run-ups in housing to following busts. The key factor is loss of jobs in the local area…The rust belt of the 80’s, Job loss in CA. in the early 90’s, the NE coast bust…

81% of old people own thir own homes. Maybe I’m smart enough to trade out, then buy lower (as rents rise to accommodate such thinkers offering a counter incentive; not to mention the 20-30,000 needed to sell and rebuy), but modesty for my timing skills and prudence say I don’t sell.

I fail to see the sudden panic possibilities running toward divesting real assets, like shelter, in favor of hoping to outguess the increasing pressure on the dollar.

Summary; there is a floor under houses.

On recessions: yes, such housing declines usually coincide with recessions. Credit crunch of 1966 an exception, and don’t forget the nearly-as-bad-as-now decline in 1984, coming off the 1982 rebound. But correlation is not causation. I don’t believe that the housing declines caused recessions; the rise in interest rates that hurt housing hurt interest-sensitive consumer goods and business capital spending, too. We had recessionary forces that worked through housing and through other sectors as well. So the question is: is today’s housing downturn a housing-only event, or is it just one manifestation of generally recessionary causation going on somewhere. I think there’s a strong case to be made that housing is coming off of speculative excess, rather than an unduly tight Fed policy. After all, real Fed funds is near its long-run average. Thus, we may very well escape recession despite this housing downturn. My subjective estimate is only 25% probability of recession.

What to do? If you’re a business, make sure you’re doing contingency planning. Four basic steps are listed on my blog.

I’m not sure the Fed has really impacted the economy through reserve requirements. The monetary base spilling out from overheated home buying and equity cash-outs increased as Bernanke stepped up reserve requirements. Plus, it will take more time to fully realize all past tightening. We’re only touching upon areas of 3-4% neutral rates right now.

The housing market burned itself out before Bernanke could slow it down. One only has to look at supply and demand fundamentals and see how supply has overshot demand. The conclusion is simple. A retreat in reserve rates going forward will not save the housing market from a hard landing. If anything, it will simply reignite a commodity or emerging markets bubble.

But why is the stock market acting like nothing is happening? I mean the best case scenario is that there is going to be a moderate slowdown and the worst case is a recession. When there are slowdowns, stock prices fall. Why are they still going up? The stock market is telling everyone that there is not going to be a negative wealth effect from the housing slowdown at all.

Bonds are telling a different story. The Stock Market not getting the message, never!!!!

It’s going to have to get the message eventually if a slowdown is coming. I believe the probability of recession next year is around 40% but the probability of slowdown is pretty close to 100%. When the slowdown happens, corporate warnings will eventually start coming in and then the stock market will have to take notice. The only good thing about stocks right now is that the market only trades at 15 times earnings which is not too bad of a valuation.

Housing starts were up in the Northeast,Proves bubbles are created by greed and over capacity,as more inventory equals lower prices, and builders have not learned from past mistakes.

Edgardo, I disagree. There needs to be a time especially for a country growing as fast as Chile where the bad investments are weeded out from the good ones. I particularly think it’s appropriate as in the case of Chile when there’s been a period of abnormally high economic growth.

Similarly, the real estate market in the US created a lot of risky bets over the past few years. We need to weed out the bad bets. Also housing and rental costs are the largest component of the cost of living. Lowering the cost of residential real estate will lower the cost of living and decrease overall wage costs. My take is that making US labor more valuable will in the long term be a better deal than making real estate more valuable.

You guys CAN’T have your punch bowl back until you’ve sobered up.

The professor has explained that by one important measure, we’re still digesting the spiked punch.

Who amongst us still claims that the Fed can prevent business cycles? The best they can hope to do is moderate the effects.

RE: “My main question is how long it will take the same people who were sniping at Bernanke for not tightening enough now to start hollering that he went too far.”

really? THIS is your “main question” regarding these data? No feelings for the thousands of builders, brokers, mortgage bankers, construction workers, “home” retailers and home-owners who are being affected by the facts reflected in these data?

Wow, man ~ that’s COLD. But, you didn’t really mean that, did you? You were just, “being cute.” well, kinda.

Here’s MY QUESTION #1: Why Are We Looking At Housing Data for The United States = 48 States? is it like, you know ~ your weather maps on your American TeeVee, where “the weather” somehow STOPS at the Canadian and Mexican borders? As if, there is this thing called, “The U.S. Weather,” and it is entirely detached from, “The Climate”?

HERE’S MY QUESTION #2: There’s what, 12~20 (?) million “illegal aliens” in the greater 48 United States, let’s say ~10 million “illegal jobs”, thus (which is the real issue, n’est-ce pas?) So, how many “illegal residences” are there? IF you “solve” your illegal alien problem, either by securing your borders, or by perhaps driving a lot of them out (hey, it HAS been proposed), THEN what happens with housing? ie., is it like, a big hole in your housing heart, and SUPPLY city, man, places all over the place…

…or is it like New Orleans, you know ~ good riddance, now we can raze this mess of minorities and build something “clean” and “useful”?

HERE’S MY QUESTION #3: Why are we looking at the HOUSING INDUSTRY, isolated from TRANSPORTATION ~ when everyone can planly see that The road is our major architectural form?

So, what’s up with Fred at the Fed? Let’s just take a look now at a chart of “The Cost of Kapital” = 30Y LoanRate (since people don’t buy houses, anyway, they buy money, right?)

OK, now you guys here imply that if the Fed were to, say ~ lower interest rates by ~.50% wow, all kindsa people are gonna build and buy new houses. Somehow, i kinda doubt that. Sure, there were all kindsa loans made to folks who had no business buying money=houses/condos in the first place (that wretched excess really should be wrung out, don’t you think?)

But, looking at the 30Y conventional benchmark, the difference between 5.5% APR and 6.5% APR (just about the entire spread from 2001-2006), is peanuts to those truly credit worthy consumers of $330K mortgage loans.

in other words, the problem (reflected in your data) isn’t that the MONEY costs too much. Rather, the problem is that the HOUSING prices are too high.

And lowering the Debt Burden is no remedy to that, thus.

I am not looking for the housing market to suddenly turn back up on a dime. Too much inventory to work through. Some of that inventory will drop off as sellers cancel their listings (or they expire) as they were unable to sell at prices that are no longer available. These are the ones who didn’t have to sell, didn’t have to move, didn’t have a bad mortgage to refinance, but were willing to sell at inflated prices and didn’t pull it off.

Housing market peaked nationally in July 2005. From peak to trough, in selected markets ( Los Angeles, New Haven, etc. ), it takes 18 QUARTERS. So we will not see truly affordable houses until the late 2009 / early 2010 time frame.

Bernanke did EXACTLY the right thing by raising interest rates; I wish he’s raised rates again. We have been rewarding profligacy for TOO LONG in this country. I for one am sick of saving and investing diligently, only to see JOE NEIGHBOR go and borrow his way to fame and fortune, investing in dot-coms, flipping houses, etc. etc. I’d like to see joe neighbor taken out and SHOT, in an economic sense – he’s deserved his come-uppance for half at decade at least !! When we have 9% interest rates, then finally, Americans will start to behave responsibly and they will care about saving and deficits, after all these many, many, years wandering in the desert …

With home prices set to move even lower as inventory is reduced, and monthly payments set to rise as mortgage rate resets kick in, more and more homeowners are in danger of delinquency, suggesting more widespread foreclosures. As you can see in the chart below, housing affordability has been in a free fall.

Delinquencies lag affordability, but note the big subsequent surge in delinquencies after affordability sank in 20002001. Affordability is much worse today than it was during the last recession, in 2001, while household debt payments have jumped to nearly 14% of disposable income, an all-time record. With home prices and mortgage rates receding, there is hope for a bottom in affordability. But given the lagged effect, a rise in delinquencies may already be baked in the cake.

Banks may be at risk as well, as they have become steadily more dependent on residential real estate loans. As seen in the chart above, residential real estate loans as a percentage of total bank loans have surged from about 23% in 1999 to about 31% today.

“I believe the probability of recession next year is around 40% but the probability of slowdown is pretty close to 100%.”

Ryan makes an excellent point. Although there’s substantial disagreement about what the odds of recession are, there is a lot of agreement that growth rate is declining next year.

“Watching housing slide”

Econbrowser has a post up with some interesting charts on the current slide in the housing industry.

…

Watching Housing Slide: A Recession Is On The Way

Econobrowser provides The New Housing Building Permits Chart which shows a recession is on the way. The Census Bureau on 8-21-2006 released August…

‘The collapsing U.S. housing market crossed another milestone in August, as the median sales price of existing homes fell for the first time in 11 years and for just the sixth time in the past 38 years, the National Association of Realtors said Monday’

This is just the beginning:

http://globalhouseprices.blogspot.com/

“Bonds are telling a different story. The Stock Market not getting the message.” In response to Ryan’s post. The Dow Jones keeps flirting with all time highs, will the yeild curve is inverted, hence indicating different views of the future of the economy. One idea to explain these differences in views about the economy is the emergence of China and India providing vast amounts of labor to the world economy, shifting the labor to capital ratio, there increasing the return on investment for capital. The increased return on investment flow through to corporate profits,therefore higher stock prices; while China’s trade surplus flows through to buy more treasuries bonds, pushing down treasury yields.