The dollar weakens. Why? For how long? Against Whom?

Bloomberg reports that the dollar has weakened on reports of slowing U.S. growth:

“The dollar fell for a third day against the yen on speculation U.S. reports today will show slowing growth in the world’s biggest economy, supporting a decision by the Federal Reserve to keep interest rates on hold.

The U.S. currency slid against 15 of its 16 most actively traded counterparts before reports that may show manufacturing cooled and jobless claims rose, according to Bloomberg News surveys of economists. The Fed held its benchmark rate at 5.25 percent yesterday, saying inflation pressures will moderate.”

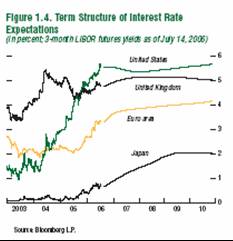

Is there evidence for a more rapid slowdown in the U.S. vis a vis the rest-of-the-world? From the IMF’s Global Financial Stability Report comes this graph of yield curves in several other major economies.

Figure 1.4: from IMF’s Global Financial Stability Report (Sept. 2006).

In short, the yield curves suggest a slowdown in US growth, while more rapid growth seems to be indicated for the euro area and Japan. Given that exchange rates are procyclical, this graph buttresses the case for near term dollar weakness, holding constant any possible “flight to safety” shocks (think Hungary or Thailand).

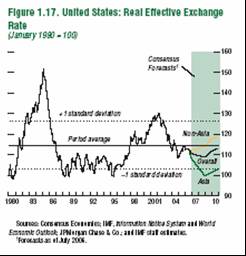

Another graph (Figure 1.17) presents some other interesting insights. The first is that Consensus Forecasts’ measures of expectations are for continued dollar depreciation. The second is that the dollar is viewed as having more scope for depreciation against Asian currencies than non-Asian.

Figure 1.17: from IMF’s Global Financial Stability Report (Sept. 2006).

Hence, in line with what I predicted back in June, the dollar seems set for decline. Deutsche Bank predicts a 6.1% (logarithmic) decline in the trade weighted nominal dollar in a year’s time, and a dollar/euro (yen/dollar) [yuan/dollar] exchange rate of $1.34, (1.01), and [7.68].

Technorati Tags: dollar,

exchange rate,

yield curve

Is the dollar falling against the yen and the euro or are the yen and the euro rising against the dollar? The problem with a world wide floating currency regime is that either could be the case and there is no way to actually measure the actual trend using only the FOREX.

Why should we assume that other currencies are stable and it is only the dollar that is moving?

I will say that using an independent constant we can see that the USD has fallen in value over the past two years and this is indicative of inflation, a loss of value in the dollar. While the yen has also been falling in value it has fallen at a slower rate than the USD. The euro has been relatively stable.

Recently the value of the USD has risen significantly against the constant and this should in time be reflected in its value against other currencies. I hate to disagree with the professor, but now that the FED appears to have ended its attacks on the economy I expect the dollar to gain value against both the yen and the euro, but if the FED renews its attacks on the economy all bets are off.

So Dick, any chance that the “attacks on the economy” -presumably the halt in interest rate hikes, will resume in order to attract that foreign interest in tbills, the paper that allows us to balance the CA? Seems to be a spate of countries whose CA balancing acts are producing some currency volatilities, yes?

Appreciate your work as always Menzie

The Gold-Silver ratio favors silver and it’s the only way to protect one’s wealth. The dollar will slide now that the Fed is done defending it.

Working for the Yuan-Keyed Dollar

Working with the USD as a value rather than a currency is revealing, and fun to explore. In more classical economics, the value of the dollar was imagined as that of a currency “linked” to a commodity; eg., Gold or silver = specie; or some (essentially arbitrary) basket of commodities, thus. There are many reasons why many post-modern (or radical 🙂 economists such as myself ~ no longer do so.

The conceit implicit of “linked” is “=” equivalence. When we say USD=GOLD, then the conceit is that IF USD can purchase X, THEN the =GOLD link also purchases X, for any T point in Time. QED for any T-p past or T+f future, the value of the USDollar is revealed, thus.

in my humble opinion, the commodity-linked concept of the value of the USDollar doesn’t work very well… That is to say, it fails to reveal what we really want to know, which is not so much “What can the present value of the dollar BUY=CONSUME?” rather: What value can the dollar presently PRODUCE?

GOLD isn’t “linked to” the USDollar today, so in a sense that whole old world is moot, anyway. What is fun to work with is “pegged to”, the FX financial world of Foreign Exchange, rather than the Commodity Exchange.

1 Chinese yuan = 0.126125672 U.S.Dollars

Strictly speaking, the Yuan is no longer “pegged to” the USD, but in reality the Yuan remains pegged to the USD +/- a bounded, managed float.

So, YUAN=USD where “=” means :PEG: pegged to, +/-fixed-float; and “fixed-float” is known, bounded ~ and for the sake of simplicity, let’s also say any variability of the “managed” :PEG: is Market-Driven = bounded random walk white noise, thus.

QED, IF “the dollar is falling against the yen and the euro”, apparent, THEN YUAN=USD is falling against the yen and the euro…

…but that’s just where the fun begins, mes amis. Consider ALL the currency “PEG’s to” the USD, the YUAN being the most influential; others, less so. Sort them out and we get something that resembles a regression expression…

USD = aA + bB +cC … +nN

of all these fixed and/or floating=bounded, managed PEG’s. The point is, The USDollar becomes an FX currency construct. Now if some nN currency:economy is “puny” {grin} then we could say it is “subordinate to” the USD, in a sense; ie., nN currency:economy has to work to maintain its PEG, most of the time.

On the other hand, if cC currency:economy is “mighty” relative to USD, then who is “moving” whom in value?

…is it cC currency:economy, or USD currency:economy, or both economies moving in the same direction or different directions, ah ~ you get the point, of that i am certain:

if the US FED monetary policy changes the USD Cost of Capital, and Yuan=USD, then to some extent the US FED has changed the Cost of Kapital in China; and, to some extent, vice-versa!

We used to say, “When the US sneezes, Europe catches a cold,” or something to that effect. Still true enough to some extent, certainly. But when it comes to the question (posed/posted above) “Why is the USD falling in value?” the radical economist’s response is: just what the hell is a USD?

The USD:economy is a construct, a composite of global PEG-like currency:economies. “globalisation”, changes everything. We can no longer just watch the local=US weather the way we used to, frankly ~ those models don’t work well any more :-/

We must become more aware, and accepting of the global economy climate reality : To make your econometric models work the way they used to, one “key” concept is “de-constructing the dollar” 😉

While governments try to make it more, a currency is simply nothing more than a medium of exchange. Implicit in this function is that the medium will hold its value neither appreciating nor depreciating because a depreciating currency will steal from the holder of currency while an appreciating currency will steal from the holder of assets.

It is easy to see that the USD from 1971 has lost most of its value today having an exchange value of less than 1/10 of its 1971 value. Something is seriously wrong with a currency system that will allow such a condition.

While the major currencies can exercise some semblance of independence, smaller currencies find themselves at the mercy of the major currencies. The inflation of the USD in the 1970s created huge problems in the US, but it destroyed economies and governments in the rest of the world. These smaller economies had no choice but to allow the US inflation to infect them.

Now concerning my insistence that the FED attacks the economy, I do not use these words lightly. If you have listened to Alan Greenspan and now Ben Bernanke you will hear them explicitly admitting that they are attacking various sectors of the economy. Greenspans irrational exuberance comment is a glaring example as he specifically attacked the stock market. Phillips Curve advocates specifically attack employment, and the media parrots the overheated mantra any time the economy begins robust growth. I do not at all believe that saying the FED attacks the economy is hyperbole.

Dick:

Although AG paid lip service to irrationality he then turned around and ran an experiment to see just how far irrationality could carry us. He found out soon enough.

Then he did it again…same irrationality, different asset class.

Look…the central bank in the United States has decided that its role in the economy is that of a con man…the creation of inflation accompanied by the pretense of protection against inflation. That is the reason that the dollar cannot function as a store of value. There will never again be periods actual price stability or deflation, only one long period of inflation. The only question is regarding the rate thereof.

Geeze I hate playing the straight man Dick (Can I call you Richard? Dick reminds me of Tracy). And you too esb.

Shoot.

“The Fed attacks the economy” is not hyperbole but “…terrorizes the economy” might be? Why would anyone use this expression if not to rattle noodles?

Do I care about castigating some former chairman of the Fed? Do I need to express my views about the eventual slide into The Great Inflation?

I just lack imagination and don’t appreciate a good digression when it plows over the thread. Which was ‘a weakening dollar –some interesting insights’, but not interesting for all it appears.

Where’s my Batman cape?

Calmo,

If you think that rattles noodles consider this. We can thank Milton Friedman and the monetarists for the attitude of perpetual inflation. It was only about a month ago that I heard an interview with Friedman where he recommended a constand increase in the money supply of 4%.

Too many comments here for me to respond individually. Hence, let me just say try to clarify my reasoning. I assume that exchange rates are determined by a multiplicity of forces, both in asset and goods markets. These forces work with different strengths, and with different directions, at different horizons. For a survey, see this survey, and for an empirical evaluation, see this paper.

In this post, I am pretty much using a sticky-price monetary model augmented with a risk-premium factor. The sticky-price monetary model posits a currency strengthens when either income rises (because it raises the transactions demand for money), or interest rates rise holding inflation constant, due to the Dornbusch overshooting effect (interest rate parity up to a risk premium holds, combined with sticky-price adjustment).

The currency’s value in this model is pinned down (up to a risk premium) by purchasing power parity. If you don’t like that, then one can allow in productivity-determined trends, although these are unlikely to have a big effect in a two or three year horizon.

The Dollar Weakens. Why? For how long? Against Whom?

Econobrowser in the 9-21-2006 article The dollar weakens. Why? For how long? Against Whom? relates: "Bloomberg reports that the dollar has weakened o …

Is It Time For The Canadian Investor To Sell Stocks And Use Those Canadian Dollars To Buy Gold?

A number of factors present the wisdom for the Canadian investor to invest in gold. 1) Gary Dorsch writes that "Robust base metals and energy price…